Professional Coffee Machine Market Outlook:

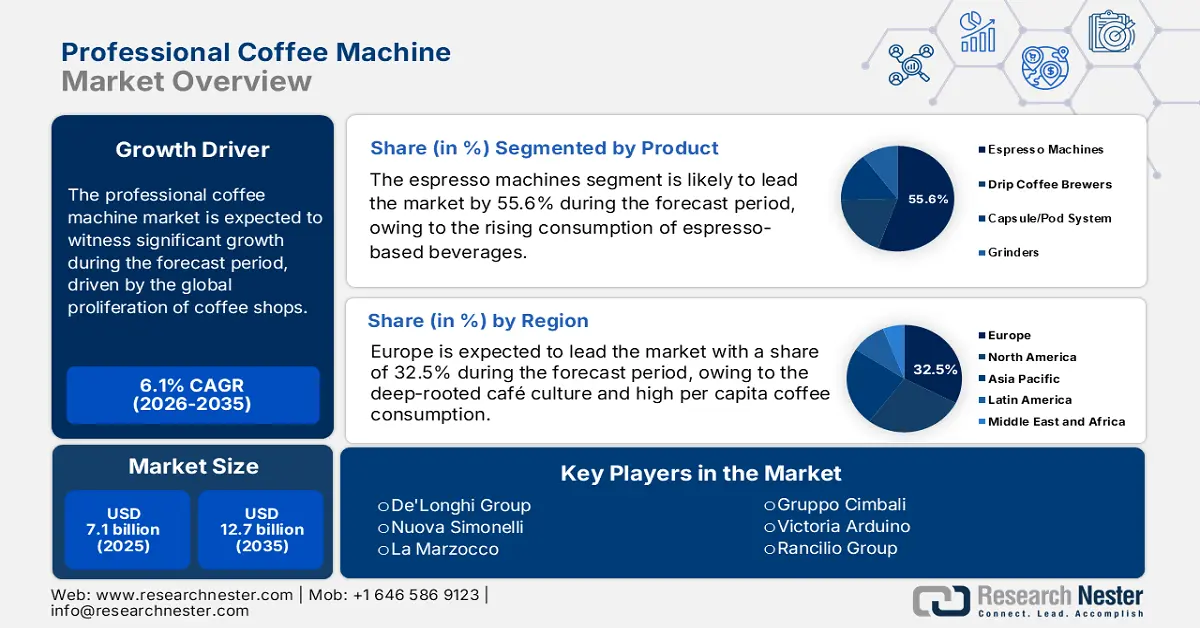

Professional Coffee Machine Market size was valued at USD 7.1 billion in 2025 and is projected to reach USD 12.7 billion by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of professional coffee machine is assessed at USD 7.5 billion.

The global professional coffee machine market is a significant segment of the commercial food service equipment industry and is directly correlated with the health and expansion of the hospitality sector. The demand of the market is primarily driven by the global proliferation of coffee shops and specialty cafes. As per the International Trade Administration data, the coffee shop chains represent a major growth segment for the U.S. consumer brands abroad, indicating a sustained international investment in café infrastructure and the high-grade equipment required for the operation. Further, the consistent consumer demand for coffee, as tracked by organizations such as the National Coffee Association, reported in August 2025, has indicated that 66% of U.S. adults drink coffee daily. This data provides a stable foundation for the commercial equipment sales and surging market demand. This consumption trend necessitates reliable high-volume machinery for businesses.

The professional coffee machine market evolution is increasingly influenced by technological integration and the demands on operational efficiency. The equipment is transitioning from standalone mechanical units to connected components within a commercial kitchen ecosystem. This shift is partly a response to the documented labor market. The data from the U.S. Bureau of Labor Statistics consistently shows a high turnover rate within the accommodation and food services sector, creating operational pressure that favors automated and consistent equipment. This drives the adoption of the super-automatic machines that reduce the dependency on highly skilled labor. Additionally, operational cost management is a key purchaser criterion leading to heightened focus on equipment, energy, and water efficiency. Compliance with international electrical and safety standards (e.g., UL, CE) remains a non-negotiable market entry requirement, influencing design and production.

Key Professional Coffee Machine Market Insights Summary:

Regional Highlights:

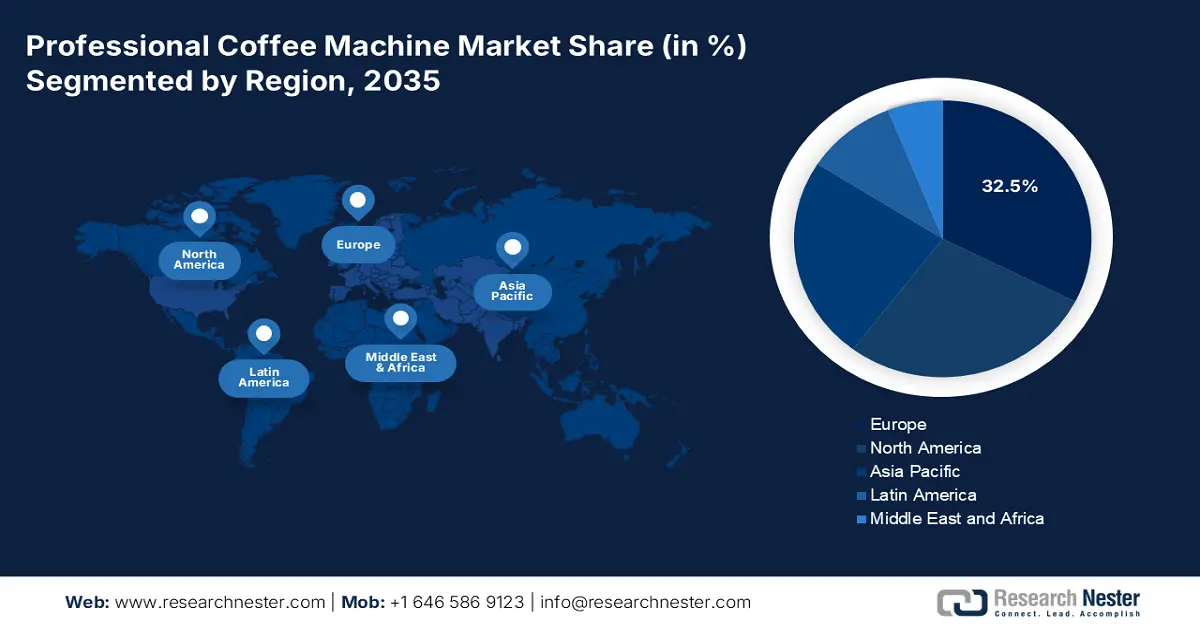

- By 2035, Europe is projected to command a 32.5% share of the professional coffee machine market, owing to stringent EU energy-efficiency mandates and a deeply rooted café culture.

- North America is expected to witness significant growth during 2026-2035, impelled by premiumization in specialty cafés and the rising adoption of energy-efficient connected equipment.

Segment Insights:

- By 2035, the espresso machines segment of the professional coffee machine market is forecast to capture a 55.6% share, propelled by advanced pressure-profiling technologies and IoT-enabled innovation.

- The direct sales segment is set to retain the leading distribution share by 2035, supported by bespoke high-value installations and long-term service integrations for large hospitality operators.

Key Growth Trends:

- Infrastructure investment in food service and tourism

- Global expansion of coffee shop chains and franchises

Major Challenges:

- Stringent certification and compliance requirements

- Complex, service intensive distribution and after sales networks

Key Players: De'Longhi Group (Italy), Nuova Simonelli (Italy), La Marzocco (Italy), Gruppo Cimbali (Italy) - (includes Faema, Cimbali), Electrolux Professional (Sweden) - (includes Wega), Victoria Arduino (Italy), Rancilio Group (Italy), Melitta (Germany), Miele (Germany), Franke Coffee Systems (Switzerland), JURA (Switzerland), Schaerer (Switzerland), WMF (Germany), Bravilor Bonamat (Netherlands), Curtis (USA), FETCO (USA), Poursteady (USA), Slayer Espresso (USA), La Spaziale (Italy), Tiger (Japan).

Global Professional Coffee Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.1 billion

- 2026 Market Size: USD 7.5 billion

- Projected Market Size: USD 12.7 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, United Arab Emirates

Last updated on : 9 December, 2025

Professional Coffee Machine Market - Growth Drivers and Challenges

Growth Drivers

- Infrastructure investment in food service and tourism: Government-led infrastructure and tourism development are direct demand drivers. State investments in airports, convention centers, and urban renewal projects create new commercial venues requiring professional food service equipment. For instance, the European Union’s Recovery and Resilience Facility allocates substantial funding for green and digital transactions, which includes modernizing hospitality infrastructure. In the U.S., the Economic Development Administration data in November 2022 it is reports that the government has awarded USD 510 million in targeted grants for tourism to invest in infrastructure, marketing, and other projects to revive safe leisure, business, and international travel, thereby expanding the addressable professional coffee machine market for manufacturers.

- Global expansion of coffee shop chains and franchises: The international trade promotion fuels the professional coffee machine market growth. The government trade bodies actively assist domestic coffee chains in expanding abroad, which standardizes the equipment procurement globally. A prime example is the support from the export agencies, such as the U.S. Commercial Services, that helps the brands in the U.S. to navigate the foreign markets. This institutional support facilitates the replication of café formats, creating a predictable, large-scale demand for specific machine brands and models favored by these expanding chains, thereby shaping a global supply and service network. Further, the rising demand reinforces this expansion as past-day consumption of espresso-based beverages increased by 17%, strengthening the business case for chains to scale internationally and replicate standardized café formats, as stated in the NCA April 2025 report.

- Regulatory push for energy efficiency: The strict energy efficiency regulations are a powerful driver in the professional coffee machine market. Mandates such as the EU’s Eco-design Directive and various state-level regulations in the U.S. compel manufacturers to redesign the products and incentivize end users to replace outdated, energy-intensive equipment. The public procurement policies often prioritize Energy Star-rated appliances. This regulatory environment creates a replacement cycle and advantages for manufacturers investing in R&D for more efficient boilers, standby modes, and heat recovery systems, directly influencing the product development roadmaps.

Challenges

- Stringent certification and compliance requirements: Machines must meet the diverse international safety standards, such as the FDA compliance for food contact parts. Navigating this regulatory maze is costly and time-consuming, varying by target region. For example, a company entering both the North America and Europe markets must budget for the dual certification processes that can add months and incur significant expense to the product launch timeline, a major hurdle for resource-constrained startups.

- Complex, service intensive distribution and after sales networks: Professional machines require installation, regular maintenance, and urgent repair services. A lack of a localized certified technician network is a deal breaker for commercial buyers. For example, large groups such as the De’Longhi or Gruppo Cimbali succeed via vast consolidated global service networks. New entrants often fail by underestimating this logistical and training burden, which is as important as the product itself.

Professional Coffee Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 7.1 billion |

|

Forecast Year Market Size (2035) |

USD 12.7 billion |

|

Regional Scope |

|

Professional Coffee Machine Market Segmentation:

Product Segment Analysis

Within the professional coffee machine market, the product segment is led decisively by espresso machines and is projected to hold the share of 55.6% by 2035. The segment dominance is due to the global café economy, where espresso-based beverages such as lattes and cappuccinos are the primary high-margin offerings. The high Average Selling Price of commercial espresso systems is high disproportionately drives the total market value compared to the lower cost drip brewers or grinders. The key driver is the relentless innovation focused on this category, including pressure profiling boiler technology and IoT connectivity, which justify premium pricing and frequent upgrades by specialty cafes. Statistics data from the OEC 2023 reports that the U.S. imports of commercial equipment, hot drinking, cooking, and heating food were USD 1.4 billion, which includes espresso machines. This data indicates a sustained investment and import demand for the advanced equipment, outstripping growth in the simpler beverage preparation machinery.

Distribution Channel Segment Analysis

The professional coffee machine market distribution is defined by a strong preference for direct sales from the manufacturers to the business to end user, which commands the largest channel share. This model thrives because it facilitates high-value, customized solutions and bundles equipment with indispensable long-term service and maintenance contracts. Direct ties with major hotel chains, restaurant groups, and increasing coffee franchises provide bespoke solutions, bundles of equipment requirements, simple integration into current operations, and dedicated technical support. It locks in recurring revenue for manufacturers beyond the initial sale. The government data on wholesale trade indirectly supports this trend. The U.S. Census Bureau’s Annual Wholesale Trade Survey indicates that sales in the commercial equipment merchant wholesales indirectly rise the market.

Type Segment Analysis

The fully automatic or super automatic machines are leading the type segment in the professional coffee machine market. The segment is fueled by the critical industry-wide need to optimize labor, ensure unwavering product consistency, and integrate data-driven management. In environments from quick service restaurants to office pantries, these machines reduce the reliance on highly skilled and often scarce baristas, automating the entire process from bean grinding to milk frothing at the touch of a button. This addresses persistent labor challenges documented by the federal agencies. For instance, the U.S. Bureau of Labor Statistics in September 2025 on Job Openings and Labor Turnover Survey consistently shows a high rate of hires and separations in the accommodation and food service sector, with a separation rate of 4.8% as of August 2025, underscoring the volatility that makes automation a strategic investment. By guaranteeing identical beverage quality every time and offering remote diagnostics, fully automatic systems provide a hedge against labor instability and operational inefficiency, making them the growth engine of the type segment.

Our in-depth analysis of the professional coffee machine market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

|

Product |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Professional Coffee Machine Market - Regional Analysis

Europe Market Insights

The Europe professional coffee machine market is well defined by natural demand, a strong heritage in manufacturing, and robust regulatory drivers. The market is expected to hold the share of 32.5% by 2035. The growth is indicated by the continent’s deep-rooted café culture and high per capita coffee consumption, creating a consistent replacement and upgrade demand. A primary driver is the regulatory push for energy efficiency under the EU Ecodesign Directive, pushing the replacement of older, less efficient models. Further, the EU-level funding mechanisms, such as the Recovery and Resilience Facility, allocate capital for modernizing the hospital sector, indirectly accelerating the equipment investment. The key trends include the rapid adoption of connected IoT-enabled machines for data-driven operations and preventive maintenance, and a strong focus on sustainability, influencing both the manufacturing materials and machine energy consumption.

Germany is leading the professional coffee machine market in Europe and is defined by engineering excellence and a strong regulatory environment that drives demand for high-quality, efficient equipment. The country’s leadership is reinforced by its dense network of bakeries, cafés, and institutional food service operations, all of which prioritize durable and reliable machinery. A significant trend is the integration of Industry 4.0 principles with the connected machines, offering predictive maintenance and operational data analytics, becoming standard in new procurement. Further, the data from the GTAI 2025 indicates that investment in machinery and equipment within the accommodation and food service sector in Germany was nearly EUR 14 billion in 2023. Moreover, Germany ranks third in the German machinery industry. This data highlights the demand and growth of the coffee machine market.

The UK professional coffee machine market is defined by a dynamic specialty coffee culture and a significant capital investment from large-scale institutional procurement. The demand is highly influenced by the commercial hospitality sector’s need to enhance productivity and manage the high operational costs, mainly labor costs. A key trend is the strategic investment in automation and super-automatic machines to ensure consistency and reduce the reliance on skilled baristas. The government spending directly surges the market via large public projects. The professional coffee machine market is further shaped by a strong emphasis on enhancing the service efficiency across hotels, cafés, and corporate food service providers. Increasing consumer expectations for premium, consistent coffee quality push operators to upgrade the machines more frequently. Further, sustainability-focused purchasing policies are influencing the equipment selection, hence driving demand for energy-efficient and low-waste coffee systems.

APAC Market Insights

The Asia Pacific is the fastest-growing professional coffee machine market and is experiencing a strong growth driven by the rapid café expansion and the institutional adoption of automated brewing technologies. China and Japan remain the largest contributors, supported by high café density and the increasing penetration of international specialty coffee chains. Japan reports that workplace cafeterias and corporate canteens are increasingly modernizing their beverage service industry grew steadily post 2022, strengthening procurement of professional coffee equipment. On the other hand, South Korea remains a highly mature professional coffee machine market with the world's highest per capita café density, mainly in Seoul, driving the consistent adoption of super automatic machines to reduce the labor reliance.

China remains the largest and fastest scaling market for professional coffee machines in the Asia Pacific region and is driven by the high café density growth and rapid adoption of automated brewing systems. The urban centers such as Shanghai, Beijing, and Chengdu are showing a strong demand from specialty cafes, convenience chains, and corporate food service operators are upgrading to high-capacity machines. A key contributor is the expansion of domestic chains supported by government-backed commercial activity zones. The number of coffee shops in China has increased by 58% to 49,691 stores in the past 12 months, surpassing the U.S. coffee shops, as per the Food Talks report in June 2025. This directly increases machine procurement cycles and replacement demand across cafés, hotels, and modern retail segments that standardize beverage equipment to manage workflow efficiency.

The professional coffee machine market in India represents a high growth opportunity and is driven by increasing urbanization, a young demographic, and the rapid expansion of international and local coffee shop chains. The demand is diversified among the premium espresso machines for the specialty café segment in the tier 1 cities and more affordable, high-capacity automatic machines for the growing quick service restaurant and office coffee service channels. A major trend is the focus on equipment suited for high ambient temperatures and voltage fluctuations, requiring durable engineering. Further, the rising consumption of coffee also surges the market demand. The report from the Coffee Board data in 2023 depicts that coffee consumption has increased from 84,000 tonnes in 2012 to 91,000 tonnes in 2023. This increased consumption rate provides a sustained investment in both retail and commercial brewing infrastructure across the country.

North America Market Insights

North America is experiencing a rapid growth in the professional coffee machine market and is driven by the high coffee consumption premiumization in specialty cafes and replacement demand for the energy-efficient connected equipment. The expansion of quick service restaurants and coffee chains investing in automation to counter labor shortages and ensure consistency is a key trend. The federal and state-level tourism infrastructure grants, such as the U.S. Economic Development Administration, also support new venue development. A key trend is the shift towards the IoT-enabled machines to operate remotely. Sustainability is a growing focus with the demand for machines compliant with energy standards. The after-sales service network remains a critical competitive factor for manufacturers.

The U.S. professional coffee machine market is defined by a strong specialty coffee sector and a high rate of technological adoption. A primary trend is the integration of the Internet of Things capabilities in machines for remote monitoring, predictive maintenance, and recipe management, driven by the need for operational efficiency in a tight labor market. The data from the U.S. Bureau of Labor Statistics consistently shows a high separation rate in accommodation and food services, incentivizing investment in automated, consistent equipment. Manufacturers focus on Energy Star-compliant design to meet the evolving state-level regulations and the corporate sustainability goals. On the trade side, the U.S. is the leading importer of commercial equipment, hot drinks, and cooking or heating food, and China is the key nation in exporting these products. In 2023, China exported worth USD 329 million on the commercial equipment including professional coffee machines, as per the OEC 2023 report.

U.S. Imports on the Commercial Equipment Including Professional Coffee Machine

|

Country |

Export Value (USD million) |

|

Germany |

211 |

|

China |

329 |

|

Italy |

102 |

|

Switzerland |

114 |

Source: OEC 2023

The professional coffee machine market in Canada emphasizes energy efficiency and bilingual service support within a strong institutional sector. The growth of the market is supported by the federal initiatives such as the Canadian Tourism Growth Strategy that invests in infrastructure, creating a demand in he new and renovated hospitality venues. The Public Services and Procurement Canada manages substantial equipment purchases for federal buildings, healthcare, and educational institutions, representing a stable B2B segment. Statistics Canada data indicate that there is a steady growth in the foodservice sales underpinning the equipment demand. A significant trend is the alignment with the stringent provincial energy standards, pushing the manufacturers to offer high-efficiency models. Further, various funding programs for SMEs, including the café’s are expanding the market growth. For example, the program Buy Canada Policy has allocated a budget of USD 186 to support Canadian small and medium businesses.

Government Led Investment to Small Business Cafes and Micro Roasters

|

Funding/Investment Program |

Description |

Amount / Year |

Notes |

|

2025 Buy Canadian Policy |

Budget 2025 includes $186 million funding to support Canadian small and medium businesses |

USD 186 million from 2026+ |

Helps SMEs, including cafés, access federal procurement and increase competitiveness |

|

Canada Small Business Financing Program (CSBFP) |

Provides loans to Canadian small businesses, including cafés and roasters |

USD 1.8 billion loans (2023-24) |

Has supported over 50,000 Canadian small companies expanding operations |

|

Innovation, Science and Economic Development Canada (ISED) Support |

Proposed funding for SME procurement programs and technological adoption |

USD 79.9 million over 5 years starting 2026-27 |

Supports SMEs in increasing capacity and accessing procurement opportunities |

Source: Government of Canada November 2025, BIZFUND November 2025

Key Professional Coffee Machine Market Players:

- De'Longhi Group (Italy)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nuova Simonelli (Italy)

- La Marzocco (Italy)

- Gruppo Cimbali (Italy) - (includes Faema, Cimbali)

- Electrolux Professional (Sweden) - (includes Wega)

- Victoria Arduino (Italy)

- Rancilio Group (Italy)

- Melitta (Germany)

- Miele (Germany)

- Franke Coffee Systems (Switzerland)

- JURA (Switzerland)

- Schaerer (Switzerland)

- WMF (Germany)

- Bravilor Bonamat (Netherlands)

- Curtis (USA)

- FETCO (USA)

- Poursteady (USA)

- Slayer Espresso (USA)

- La Spaziale (Italy)

- Tiger (Japan)

- De’Longhi Group is dominating the market by integrating a smart user-friendly technology from its consumer division into professional-grade machines. Their strategy mainly focuses on providing a seamless bridge for the cafes seeking reliable branded equipment with advanced digital interfaces for easier operation and consistency. In 2024, the company earned 3.5 billion euros with a strong presence in professional and domestic segments.

- Nuova Simonelli, via its Black Eagle series, is a leader in the professional coffee machine market by pioneering data-driven extraction. Their strategic initiative relies on integrating precision technology such as gravimetric dosing and Bluetooth connectivity by providing baristas with real-time brew analytics to achieve unparalleled repeatability and quality control.

- La Marzocco holds its iconic position in the market by blending artisanal craftsmanship with strategic technological partnerships. Key initiatives include developing connected machines that offer remote monitoring and preventive maintenance catering to the high volume specialty cafes where machine uptime and performance data are critical.

- Gruppo Cimbali competes aggressively in the global professional coffee machines market via a multi-brand portfolio strategy. Their key initiative is offering tiered solutions from the accessible Cimbali to the premium Faema, coupled with a strong focus on sustainable design, energy-saving modes, and global service networks to capture diverse customer segments from hotels to specialty roasters.

- Electrolux Professional competes in the global professional coffee machine market by using its vast expertise in large-scale food service and hospitality solutions. Their core strategy focuses on the integration and reliability for high-volume environments such as hotel chains, fast casual restaurants, and cafeterias. A key initiative is the development of robust, easy-to-maintain espresso and automatic machines designed for durability and consistency. The company has made a net sales of 12,583 MSEK in 2024.

Here is a list of key players operating in the global professional coffee machine market:

The global professional coffee machine market is very competitive and is dominated by the long-established Italian and Swiss engineering firms, renowned for innovation and quality. The landscape features a clear segmentation high high-volume, durable machines for chain cafes versus precision artisan-focused equipment for specialty coffee shops. The key strategic initiatives include heavy investment in connectivity for remote and data-driven maintenance sustainability via energy and water efficiency, and modular design for easier service. The companies are also expanding via acquisitions to broaden their portfolios. For instance, De'Longhi SpA in 2023, has acquired the shares of La Marzocco International LLC for approximately 41.2% of the capital to broaden the market leadership. This strategy intensifies direct service networks to build brand loyalty in a market where reliability and support are paramount.

Corporate Landscape of the Professional Coffee Machine Market:

Recent Developments

- In August 2025, Keurig Dr Pepper announced the acquisition of JDE Peet's in an all-cash deal, aiming to create a global coffee giant via the combination of Keurig's single-serve platform with JDE Peet's brands. The acquisition is expected to close in the first half of 2026 after regulatory approval.

- In December 2024, Simonelli Group acquired a stake in Swedish coffee filter machine company 3TEMP to expand its portfolio in specialty coffee technology and accelerate global growth of advanced filter coffee machines

- Report ID: 8293

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Professional Coffee Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.