Household Flour Milling Machines Market Outlook:

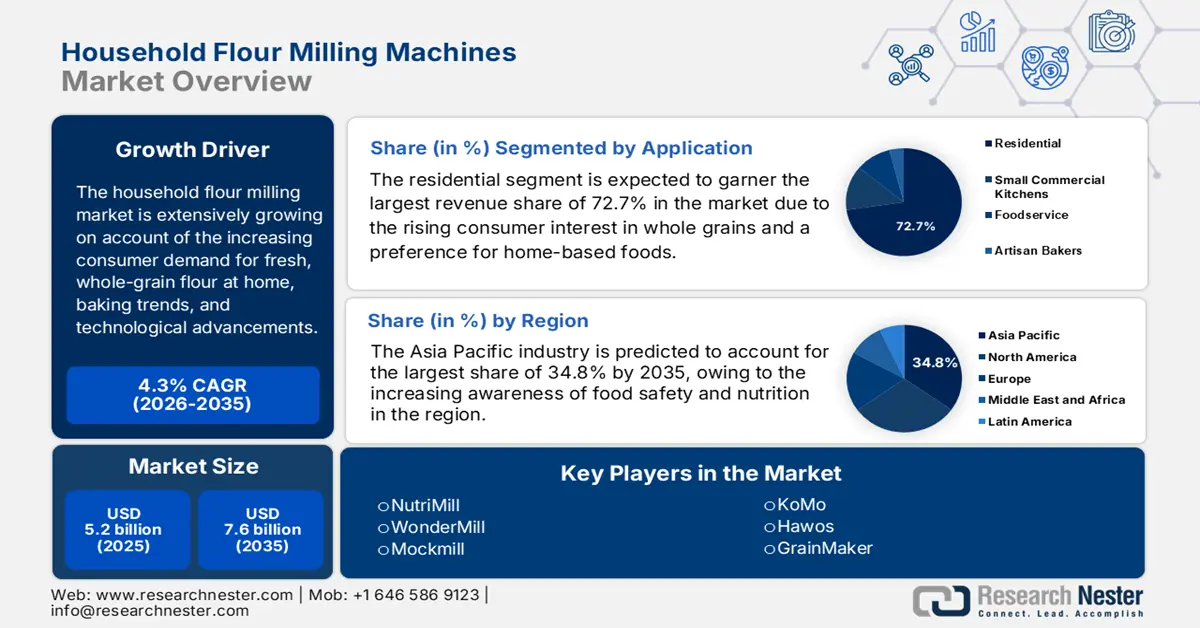

Household Flour Milling Machines Market size was valued at USD 5.2 billion in 2025 and is projected to reach USD 7.6 billion by the end of 2035, rising at a CAGR of 4.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of household flour milling machines is estimated at USD 5.4 billion.

The household flour milling machines market is extensively growing on account of the increasing consumer demand for fresh, whole-grain flour at home. According to the report published by NAAS USDA in May 2024, in the U.S., wheat flour production reached 425 million hundredweight in 2024, wherein whole wheat flour reported at 18.2 million hundredweight, reflecting a slight annual growth. It also stated that all wheat ground for flour totaled around 916 million bushels, which was supported by robust milling capacity in different states. Hence, there is a stable domestic demand for flour and an increasing consumer preference for whole-grain options at home. Simultaneously, millfeed production is 6.49 million tons, which indicates efficient byproduct utilization, whereas daily milling capacity crossed 6.48 million hundredweight, thereby ensuring a consistent supply to meet both household and commercial needs.

Quarterly U.S. Flour Milling Statistics for 2024 in the U.S.

|

Item |

January -March |

April- June |

July - September |

October- December |

Total 2024 |

|

Wheat ground for flour (1,000 bushels) |

226,545 |

226,006 |

232,391 |

230,786 |

915,728 |

|

Flour production (1,000 cwt) |

105,532 |

104,908 |

107,408 |

107,331 |

425,179 |

|

Whole wheat flour production (1,000 cwt) |

4,686 |

4,315 |

4,681 |

4,548 |

18,230 |

|

Millfeed production (tons) |

1,606,401 |

1,605,149 |

1,641,584 |

1,636,755 |

6,489,889 |

|

Daily 24-hour capacity (cwt) |

1,608,042 |

1,600,442 |

1,600,442 |

1,601,217 |

(X) |

Source: NASS USDA

Furthermore, the global household flour milling machines market is being positively influenced by pricing trends, which are showcasing steady growth, reflecting rising demand and evolving industry dynamics. Testifying the same, FRED reported that the producer price index for the flour milling industry, with the most recent observation for August 2025, at 214.553. Therefore, the existence of this upward trend in pricing, combined with expanding global consumption of flour-based products, indicates there is a strong potential for market growth. On the other hand, since there is a heightened demand for processed flour in both commercial and industrial sectors, it encourages manufacturers to invest further in milling capacity and operational efficiency. Consequently, these factors are expected to drive sustained expansion in the global flour milling machine industry, thereby supporting higher production volumes and broader penetration on a global scale.

Key Household Flour Milling Machines Market Insights Summary:

Regional Highlights:

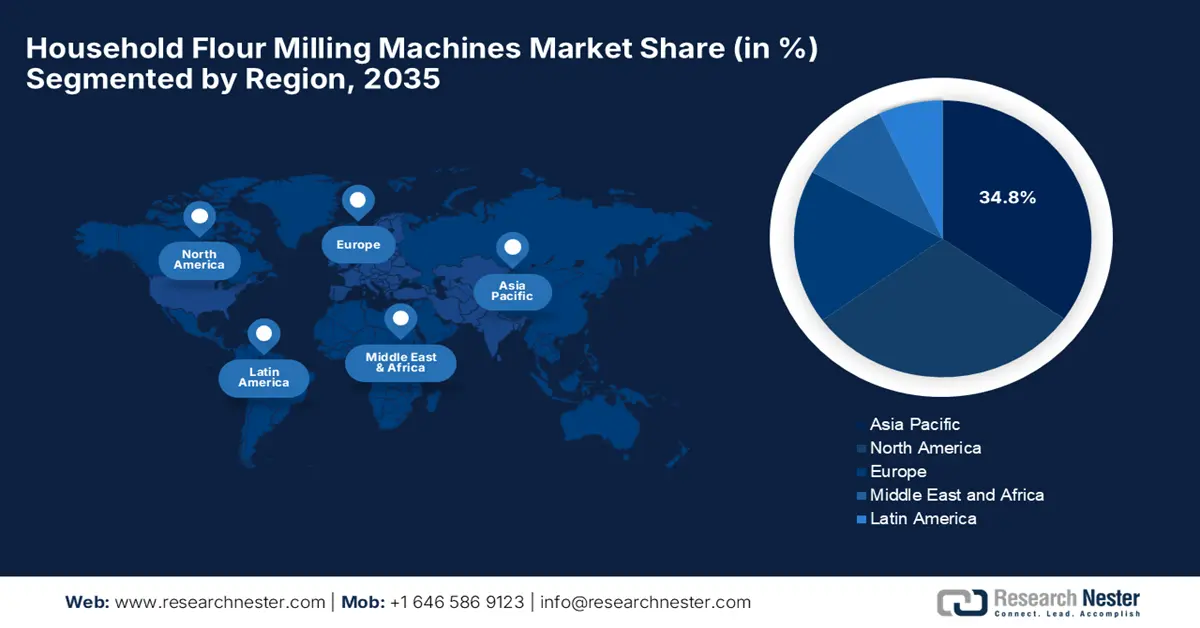

- Across 2026–2035, the Asia Pacific region is anticipated to secure a 34.8% share in the household flour milling machines market, upheld by expanding middle-class populations and heightened awareness of food safety.

- By 2035, North America is expected to advance significantly in share, supported by rising demand for freshly milled flour and multifunctional milling solutions.

Segment Insights:

- By 2035, the residential segment is projected to hold a 72.7% share in the household flour milling machines market, propelled by intensifying consumer interest in whole grains and fresh milled flour.

- The home flour mill machine type segment is expected to capture a 58.4% share by 2035, encouraged by the growing adoption of countertop appliances and home baking.

Key Growth Trends:

- Rise in home baking

- Technological advancements

Major Challenges:

- Maintenance, durability

- Energy consumption and infrastructure constraints

Key Players:NutriMill - U.S.,WonderMill - U.S.,Mockmill - Austria,KoMo - Austria,Hawos - Germany,GrainMaker - U.S.,KitchenAid - U.S.,Marcato - Italy,Country Living - U.S.,Retsel - U.S.,Blendtec - U.S.,Milan - India

Global Household Flour Milling Machines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.2 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 7.6 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: – United States, China, India, Germany, Japan

- Emerging Countries: – South Korea, Brazil, Indonesia, Italy, Canada

Last updated on : 21 November, 2025

Household Flour Milling Machines Market - Growth Drivers and Challenges

Growth Drivers:

- Rise in home baking: This, coupled with rising cooking trends after the pandemic, has pushed consumers to make investments in kitchen appliances such as flour mills. Also, home-based milling enables both convenience and cost‑effectiveness, enabling people to produce flour on demand for specific recipes or preferences. In January 2021 stated that in China, the bakery sector is growing exponentially, on account of the rising middle-class incomes, Westernized lifestyles, and increasing demand for convenient food options. The report also mentioned that retail sales of baked goods surpassed USD 34 billion in 2020 and are and are expected to reach USD 53 billion by the end of 2025, reflecting strong untapped potential and the country’s relatively low per capita consumption, thereby positively impacting household flour milling machines market expansion.

- Technological advancements: Innovation in milling technology is a key growth driver for the household flour milling machines market. Therefore, manufacturers are introducing smart, compact machines with automation, noise reduction, and energy-efficient designs which users to control grinding settings, monitor flour quality, and even schedule operations. On the other hand, the emergence of modern designs also focuses on energy efficiency, reducing power consumption while maintaining high performance, and includes noise-reduction technologies to make home use more convenient and comfortable. Furthermore, advancements in terms of more durable materials and precision engineering improve the lifespan and consistency of flour output, thereby meeting the growing demand for high-quality, home-milled flour.

- Health awareness & demand for fresh flour: The concern about nutrition and food purity is a major demand factor for the household flour milling machines market. People believe freshly ground flour retains more nutrients, especially when using whole grains, since it's free from additives, which aligns with growing trends of organic and additive-free foods. In December 2024, Bühler announced that it had joined the Millers for Nutrition coalition to help millers fortify staple foods in eight countries, aiming to improve nutrition for 1 billion people. It has its advanced grain-processing technology, training capacities, and expertise, where the company will support wheat, maize, rice, and edible oil fortification while enhancing operational efficiency and food safety as well. Hence, such collaborations expand demand for advanced, smaller-scale milling equipment suitable for fortified flour.

Challenges:

- Maintenance, durability: These factors, along with technical complexity, are creating a major barrier for the expansion of the household flour milling machines market. Utilization of these machines can frequently lead to wear on motors, grinding stones, and bearings, which might necessitate regular servicing. Most of the consumers do not have access to spare parts or skilled technicians, particularly in rural or underdeveloped regions. Also, there are advanced models with multiple settings or automation features that can be challenging for less tech-savvy users, hence restricting widespread adoption in this field. Hence, these instances force manufacturers to design durable, user-friendly machines and establish accessible service networks to maintain long-term adoption.

- Energy consumption and infrastructure constraints: Electric household mills consume considerable amounts of power, making them expensive to operate in areas where there are high electricity costs or unstable supply, hence causing a major obstacle to the household flour milling machines market. Meanwhile, in terms of rural or semi-urban markets, the inconsistent electricity access can reduce usability, thereby discouraging adoption. For regions where energy costs are rising, the cost-effectiveness of using a home flour mill when compared to buying commercial flour becomes questionable. Additionally, households without proper electrical infrastructure may face safety concerns or limited options. Therefore, manufacturers must develop energy-efficient designs and alternative power solutions for economies with infrastructure limitations.

Household Flour Milling Machines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 5.2 billion |

|

Forecast Year Market Size (2035) |

USD 7.6 billion |

|

Regional Scope |

|

Household Flour Milling Machines Market Segmentation:

Application Segment Analysis

By the end of 2035, the residential segment based on application is expected to garner the largest revenue share of 72.7% in the household flour milling machines market. This dominance is due to the rising consumer interest in whole grains and fresh milled flour. On the other hand, consumers are increasingly preferring home-based foods, which promotes the usage of these milling machines since whole grains are a part of disease prevention guidelines. Moreover, the shift toward personalized nutrition is encouraging households to mill flour which are tailored to specific dietary needs. On the other hand, the growing concerns over food purity and additives are also boosting the preference for at-home milling. The rising popularity of home baking as well as culinary experimentation further supports this trend. Furthermore, increased product availability through e-commerce platforms is making household milling machines more accessible to consumers.

Machine Type Segment Analysis

In terms of machine type home flour mill machine type segment is likely to gain a revenue share of 58.4% in the household flour milling machines market. The rise of home baking and the growing preference for countertop appliances are the key factors driving the leadership of this subtype. In this context, firms such as Mycrofine are offering domestic flour mills to households, which is the most convenient way to enjoy fresh, chemical-free, and nutrient-rich flour, preserving essential fibers, vitamins, and minerals while allowing custom grinding for various grains. The firm also leverages ISI-certified energy-saving motor, stainless steel grinding chamber, and air-cooled filtration system to ensure efficient, hygienic, and high-quality flour production. Furthermore, with durable construction, mess-free cleaning, and versatile grinding capabilities, the products are readily enhancing home cooking by delivering healthier, flavorful, and protein-rich flour for foods, hence denoting a positive market outlook.

Technology Segment Analysis

The steel milling technology segment, expected to hold 44.5% in the household flour milling machines market during the analyzed timeframe. The subtype benefits from faster throughput and lower heat generation when compared to stone milling. Therefore, most of the manufacturers prefer them. This can be exemplified by Heavytech’s domestic stainless-steel flour mill, which features a 1 to 1.5 HP copper-wound motor, consuming about 1 to 2 units of electricity per hour while producing 14–16 kg of flour with adjustable thickness settings. Its stainless-steel body, automatic cleaning system, and suitability for various applications make it an extremely versatile appliance. The firm also has products such as a 12-stone flour mill and a 7.5 hp flour mill, which offer a variety of highlights. Heavytech’s focus on serving diverse home-milling needs with durable and efficient designs, thus positioning the sub-type as the key revenue generator in this field.

Our in-depth analysis of the household flour milling machines market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Machine Type |

|

|

Technology |

|

|

Capacity |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Household Flour Milling Machines Market - Regional Analysis

APAC Market Insights

The household flour milling machines market in the Asia Pacific is expected to lead the entire global dynamics, capturing the highest share of 34.8% by the end of 2035. The rising urbanization, expanding middle-class populations, and increasing awareness of food safety and nutrition are key factors behind this leadership. Simultaneously, cultural factors, which include the continued importance of traditional breads, noodles, and pastries, support demand for reliable milling solutions. In January 2024, Shakti Pumps Limited reported that it had been granted its 9th patent for the innovative solar flour mill, which is a technology designed to operate independently on solar power, addressing the concerns of electricity shortages in rural areas and reducing infrastructure costs. Further, the mill helps farmers to generate additional income by supporting sustainable rural development, and aligns with national initiatives such as Make in India and Vocal for Local, hence making it suitable for overall market development.

China is the leader in the regional household flour milling machines market is efficiently backed by increasing consumer focus on home cooking, healthy diets, as well as traditional grain-based recipes. The country also benefits from the growing interest in dietary customization, which includes gluten-free and whole-grain options, and is fueling demand for flour mills. Additionally, factors such as e-commerce platforms and strong domestic production capabilities are raising awareness and adoption. IAOM in 2023 disclosed that the country’s flour milling industry is a global powerhouse, which has an annual wheat milling capacity of 86 million tons processed by approximately 1,500 factories. It also underscored that the sector is dominated by a few major players, including Wudeli, Yihai, and COFCO, which collectively process over 55 million tons of wheat annually. Furthermore, the key industry focus is on advanced milling technology to produce flour with low ash content, bright color, and minimal damaged starch, for the domestic consumption of steamed, boiled, and frozen flour foods.

India has a huge potential to capitalize on the global landscape of household flour milling machines market, primarily driven by the country’s deep-rooted tradition of preparing fresh flour at home, particularly for staples. There has been an influence of cooking shows and social media content is boosting market penetration since consumers are preferring traditional food preparation practices. In this regard, MSME states that the mini flour mill project focuses on processing staple grains, with locally available raw materials to meet growing domestic demand. It uses a roller milling technology, high-quality, with a capacity of 1,435 MT of atta and significant outputs of suji, maida, and besan, by following BIS standards. The project reported a total investment of ₹1.23 crore (USD 165,000), and it promises a net profit of over ₹51 lakh (USD 68,400) on a yearly basis.

North America Market Insights

North America is portraying extensive growth in the international household flour milling machines market due to the rising interest in home-cooked, artisanal foods, as well as health-consciousness. Consumers in the region are preferring freshly milled flours for baking, gluten-free diets, and organic cooking, which has created demand for more reliable milling solutions. In this context, manufacturers are making investments in multifunctional machines that are capable of grinding various grains while maintaining nutritional integrity. Besides, the trends such as smart kitchens and connected appliances resulted in the development of milling devices that offer automation and remote operation, enhancing widespread adoption. Furthermore, the presence of educational campaigns underscores the health benefits of whole-grain flour is also encouraging adoption, encouraging both national and international players to operate in this field.

In the U.S., the household flour milling machines market is expanding due to the increasing popularity of DIY food preparation, amplified by a shift toward organic and unprocessed foods. The market is also influenced by government incentive programs that help small-scale manufacturers. In this regard, USFA reported that its rural microentrepreneur assistance program provides loans and grants to microenterprise development organizations to support the startup and growth of rural microenterprises. It also underscored that funding can be used for technical assistance, working capital, equipment purchases, debt refinancing, and others, wherein the loans range from USD 50,000 to USD 500,000 and grants up to USD 100,000 annually. Furthermore, by providing loans, grants, and technical support to rural microenterprises, the program enables small businesses such as household flour milling ventures to expand operations, driving overall market growth.

Canada in the household flour milling machines market is gaining enhanced traction as there has been a strong focus on convenience, with compact, low-noise machines that are designed for small kitchens and urban living spaces. Manufacturers are also capitalizing on digital platforms and e-commerce to reach consumers, thereby attracting more players to make investments in this field. In September 2024, P&H Milling Group announced a USD 241 million flour mill in Red Deer County, Alberta, which is set to process 750 metric tonnes of local wheat on a daily basis. Moreover, the facility, supported by the Government of Alberta, is expected, supply high-quality flour to commercial and export markets, with long-term growth in the country’s food sector. Furthermore, its advanced, energy-efficient design and government-supported investment demonstrate a strong commitment to sustainable growth and strengthening the overall flour milling machines market.

Europe Market Insights

Europe’s household flour milling machines market is poised for notable growth in the upcoming years due to rising health organic food consumption and the demand for specialty flours, such as spelt, rye, and gluten-free options. The region’s market also benefits from a huge emphasis on sustainable and locally sourced food supplies encourages households to adopt home milling, creating encouraging opportunities for manufacturers. For instance, in June 2025, GoodMills Group announced that officially inaugurated its expanded mill in Poland, doubling annual production capacity from 140,000 to 280,000 tons and thus reinforcing its leadership in the regional industry. It made a total investment of €25 million, which represents a major technological upgrade and delivers economic benefits to the milling industry and local community. Furthermore, this expansion is part of the company’s strategic plan to increase its market share in Poland, with a fifth mill already planned to reach a total capacity of 1 million tons.

Germany is the pivotal growth engine for the household flour milling machines market, efficiently backed by increasing investments from health-conscious households in machines that allow them to grind a variety of grains at home, preserving nutrients and flavor. The emerging product designs are gaining huge popularity among the urban citizens, whereas the manufacturers are also concentrated on developing multifunctional mills that are capable of producing fine, coarse, and specialty flours to meet diverse culinary needs. The trend is also being reinforced by Germany’s strong bakery culture, emphasis on sustainability, and awareness campaigns promoting home preparation of staple foods. Furthermore, online culinary communities are readily driving adoption, providing manufacturers with a platform to reach a wider audience group.

In the UK, the household flour milling machines market is one of the strongest and is fueled by increasing demand for machines that allow them to mill fresh, unprocessed flours at home, supporting whole-grain diets as well as dietary customization. The sustainability movement and desire to reduce packaging waste further encourage adoption, creating a favorable environment for manufacturers. As per an article published by the UK. Flour millers in February 2025, the country’s flour milling industry is one of the most productive sectors in the country, which is generating £2 billion (≈ $2.5 billion USD) in turnover, creating £700 million (≈ $875 million USD) in added value. It also stated that with over £250 million (≈ $312 million USD) invested in modernizing mills across the country, the sector operates 24/7, wherein flour contributes significantly to national nutrition, providing a third of the fibre, calcium, and 30% of the iron consumed, while the industry continues to focus on innovation, workforce development, and food security.

Key Household Flour Milling Machines Market Players:

- NutriMill - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- WonderMill - U.S.

- Mockmill - Austria

- KoMo - Austria

- Hawos - Germany

- GrainMaker - U.S.

- KitchenAid - U.S.

- Marcato - Italy

- Country Living - U.S.

- Retsel - U.S.

- Blendtec - U.S.

- Milan - India

- WonderMill is one of the most recognized brands in the home grain-milling industry, which is best known for its high-speed electric mills that emphasize power, durability, and quiet performance. The company leverages flagship WonderMill Electric model remains a category benchmark for both reliability and ultra-fine flour output. The firm has an extremely strong distribution network across North America and Europe, and it continues to lead the market through consistent product upgrades, user-friendly designs, and a customer base.

- NutriMill stands out as a prominent player for blending performance with affordability, which is offering a wide range of impact and stone mills designed for modern home bakers. The brand is readily enhancing its product portfolio, which has positioned it as one of the most accessible high-speed electric mills on the market. NutriMill products are well known for ease of use, clean milling, and efficient flour production, supported by strong online engagement, more than two decades of brand value.

- Mockmill is a global leader in precision stone milling for home kitchens. The company specializes in natural granite milling stones, compact designs, as well as attachment models that integrate with popular stand mixers. The company is widely recognized for producing exceptionally fine whole-grain flour with minimal heat, whereas its devices appeal strongly to artisanal bakers, sourdough enthusiasts, and health-focused consumers.

- KoMo is a prominent manufacturer based in Europe and is known for its elegant wooden-housing grain mills that combine craftsmanship with high-performance stone milling technology. Its products, ranging from compact home mills to multi-functional grain-and-flake systems, are valued for their quiet operation, longevity, as well as beautiful beechwood designs, thus allowing a widespread adoption in this field.

- Hawos is a strongly respected German-based manufacturer of stone grain mills, focusing on robust construction, natural granite milling stones, and long-lasting motor performance. The company offers a variety of models, which are aimed at home users who want consistency in flour texture and dependable day-to-day milling. Also, the brand is the most preferred choice for households that value traditional craftsmanship combined with modern milling efficiency.

Below is the list of some prominent players operating in the global market:

The global household flour milling machines market is highly fragmented, and is a combination of legacy kitchen appliance brands along with specialized mill manufacturers. U.S.-based companies such as NutriMill, KitchenAid, WonderMill, and Blendtec are dominating with a strong consumer appliance footprint, whereas firms such as Mockmill and KoMo bring premium stone milling among artisanal bakers. In October 2025, The Mennel Milling Company announced that it had acquired the historic Toledo Flour Mill from Mondelez International to strengthen its long-standing presence in the U.S. flour milling sector. Hence, this strategic move will expand Mennel’s production capacity and support its broader supply chain, while ensuring Mondelez continues to receive flour through a supply agreement, hence making it suitable for overall market growth.

Corporate Landscape of the Household Flour Milling Machines Market:

Recent Developments

- In November 2025, Tietjen Verfahrenstechnik GmbH expanded its hammer mill portfolio with the launch of the FD24 Pro, which is a model engineered for fine grinding fat- and protein-rich recipes in fish feed and pet food production.

- In May 2025, NutriMill announced the launch of the Impact Grain Mill, which is a high-speed electric grain mill, making fresh-milled flour more accessible than ever. The mill delivers fast, fine flour without overheating grains, gaining widespread attention from baking and wellness influencers.

- Report ID: 8259

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.