Coffee Machine Market Outlook:

Coffee Machine Market size was valued at USD 12.4 billion in 2025 and is projected to reach USD 19.4 billion by 2035, growing at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of coffee machine is evaluated at USD 13 billion.

The coffee machine market is set for extensive growth over the years ahead, primarily fueled by increasing global coffee consumption and evolving consumer preferences toward specialty coffee experiences at home and in workplaces. In this context, the NCA data in June 2025 revealed that in 2025, specialty coffee consumption in the U.S. reached a 14-year high, wherein 46% of adults drank specialty coffee in the past day, surpassing traditional coffee consumption. In addition, the report also highlighted that 74% of specialty coffee consumed was prepared at home, reflecting growing demand for home brewing equipment such as espresso and drip coffee machines. Therefore, this trend demonstrates how evolving consumer preferences toward specialty coffee experiences are directly supporting growth in the coffee machine industry, thereby encouraging more players to establish their footprint in this field.

Global Coffee Consumption by Region (2022-2023)

|

Category / Region |

2022 (Million 60-kg Bags) |

2023 Million 60-kg Bags) |

|

Total |

173.1 |

177.0 |

|

Producers |

55.1 |

56.5 |

|

Non-Producers |

118.1 |

120.5 |

|

Africa |

12.2 |

12.5 |

|

Caribbean, Central America & Mexico |

6.0 |

6.1 |

|

South America |

27.5 |

28.0 |

|

North America |

29.8 |

30.9 |

|

Asia Pacific |

44.5 |

45.7 |

|

Europe |

53.1 |

53.7 |

Source: International Coffee Organization

Furthermore, the coffee machine shipments have steadily increased in recent years, driven by rising consumer demand. This, coupled with increasing prices, also stimulates consistent growth in the worldwide coffee machine market. In this context, the U.K. Office for National Statistics reported that in the UK Consumer Price Index for coffee machines, tea makers, and similar appliances represented 119.6 in August 2024 (with 2015=100 as the base). This increase indicates a growing consumer interest in making investments in high-quality brewing equipment, which is extremely crucial for sustaining industry expansion. Therefore, to capitalize on this momentum, market players need to focus on enhancing product innovation, optimizing cost structures, and expanding manufacturing capabilities. Hence, this in turn allows manufacturers to better meet continuously evolving consumer preferences and position themselves competitively in this growing coffee machine market segment.

Key Coffee Machine Market Insights Summary:

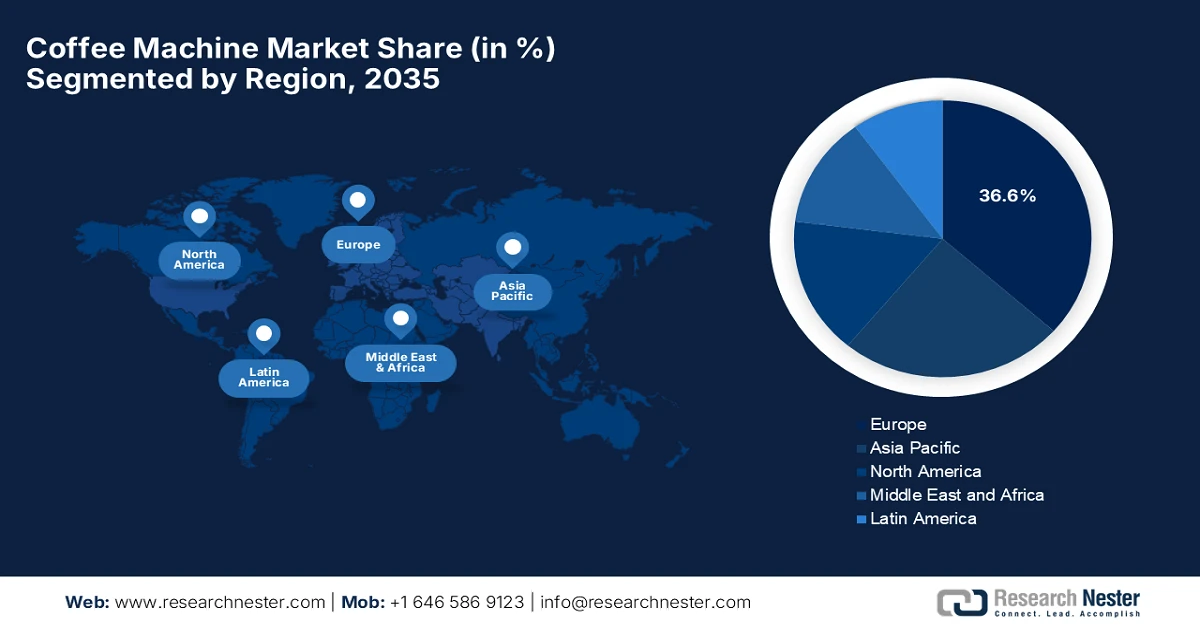

Regional Highlights:

- Europe is projected to command a 36.6% revenue share by 2035 in the coffee machine market, underpinned by high per capita coffee consumption and robust demand for specialty coffee.

- Asia Pacific is anticipated to emerge as the fastest-growing region during 2026–2035, stimulated by rapid urbanization, rising disposable incomes, and the expanding specialty coffee culture.

Segment Insights:

- The fully automatic machines segment is forecast to capture a dominant 64.7% revenue share by 2035 in the coffee machine market, supported by rising disposable incomes and a strong consumer inclination toward convenience and automation.

- The residential segment is expected to secure a substantial revenue share by 2035, reinforced by increased household spending on premium appliances and the growing work-from-home trend.

Key Growth Trends:

- Expansion of café culture

- Growing disposable income & premiumization

Major Challenges:

- Growing disposable income & premiumization

- Environmental concerns and sustainability issues

Key Players: Keurig Dr Pepper Inc. (U.S.), Nestlé Nespresso S.A. (Switzerland), De’Longhi Group S.p.A. (Italy), Breville Group Limited (Australia), JURA Elektroapparate AG (Switzerland), WMF Group GmbH (Germany), Koninklijke Philips N.V. (Netherlands), Panasonic Holdings Corporation (Japan), Hamilton Beach Brands Holding Company (U.S.), Melitta Group (Germany), La Marzocco International LLC (Italy), Rancilio Group S.p.A. (Italy), Electrolux AB (Sweden), Morphy Richards Ltd. (UK), TTK Prestige Limited (India).

Global Coffee Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.4 billion

- 2026 Market Size: USD 13 billion

- Projected Market Size: USD 19.4 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (36.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Italy, Japan, France

- Emerging Countries: China, India, South Korea, Brazil, Vietnam

Last updated on : 21 January, 2026

Coffee Machine Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of café culture: The global proliferation of cafés, quick‑service restaurants, boutique coffee shops, and workplace coffee solutions drives sales of the commercial coffee machines. These sectors require machines that are capable of high throughput and variety from espressos to cold brews, fueling the progress of the coffee machine market. In October 2025, JURA announced that it had launched the fifth-generation E8 fully automatic coffee machine, by combining 27 specialty coffees across three worlds of indulgence, i.e., hot brew, light brew, and sweet foam, that are programmable through the J.O.E. app for personalized brewing and scheduling. The company also mentioned that the E8 features a P.A.G.2 precision grinder, a 3.5-inch color display, and the quality assistant to ensure consistent coffee quality, easy maintenance, and long machine life, hence denoting a positive coffee machine market outlook.

- Growing disposable income & premiumization: The rise in disposable income results in more consumers being willing to invest in higher-end coffee machines, which consist of superior build quality and features. Premium equipment, such as fully automatic espresso machines are expanding rapidly, prompting a profitable business environment for the coffee machine market. Based on the government data from India, the country’s economy is showing signs of stabilization, with the CPI inflation easing to 2.10% in June 2025, which marks the lowest since January 2019, providing relief to households and thereby boosting purchasing power. Strong export growth, rising agricultural production, and policy measures such as tax exemptions and supply management have also supported income and consumption, whereas the aspect of rural surveys indicates higher household spending and income. In addition, the GDP is projected to reach USD 7.3 trillion by the end of 2030, and trade deficits are narrowing; these developments reflect a strengthening and resilient economic environment.

- Shift to home brewing & specialty coffee culture: There has been an increased preference towards this, leading to a booming sale of espresso machines, bean-to-cup models, and specialty brewers. Most of the consumers prefer customizing flavor, strength, and style preferences that standard drip machines can’t satisfy. As per the article published by the government of India in November 2025, India’s coffee sector spans 4.91 lakh hectares across major and emerging regions, and it supports over two million livelihoods, with smallholder farmers accounting for 99 % of holdings. Besides, it is recognized globally for premium and specialty varieties such as monsooned malabar and mysore nuggets, whereas the country’s coffee exports reached a record USD 1.8 billion in FY 2024-25, driven by quality cultivation, GI certifications, and value-added products. In addition, policy measures such as the GST reduction on coffee and the India-UK CETA also boost domestic consumption and global trade, enhancing income for growers and strengthening India’s position in the international coffee machine market.

Challenges

- Competition from alternative methods: The rise of alternative preparation methods, such as instant coffee, cold brew concentrates, and coffee pods that do not require machines, is a major obstacle for sales in the coffee machine market. Also, the instant coffee appeals to consumers who prioritize speed when compared to quality, thereby limiting the market share for this brewing equipment. In addition, trends such as coffee subscription services and ready-to-drink coffee products offer consumers alternative ways to enjoy coffee without making any investments in advanced machines. Therefore, this forces coffee machine manufacturers to innovate continuously by focusing on features that enhance both brewing quality and convenience.

- Environmental concerns and sustainability issues: This is yet another factor that is negatively impacting the coffee machine market, especially due to the increasing use of single-serve pods and capsules, which generate considerable amounts of plastic and aluminum waste. Meanwhile, the growing consumer awareness about sustainability pressures manufacturers to consider packaging and develop eco-friendly alternatives. Furthermore, energy consumption during machine operation contributes to the environmental footprint, which in turn compels companies to design more energy-efficient appliances. Compliance with government regulations on waste and emissions adds operational complexity and cost, making it challenging for firms from price-sensitive regions.

Coffee Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 12.4 billion |

|

Forecast Year Market Size (2035) |

USD 19.4 billion |

|

Regional Scope |

|

Coffee Machine Market Segmentation:

Technology Segment Analysis

In the technology segment, the fully automatic machines will lead by capturing the largest revenue share of 64.7% in the coffee machine market over the analyzed timeframe. The rising disposable income and consumer preference for convenience and automation are the key factors behind this dominance. Also, the specialty coffee culture efficiently encourages experimentation with diverse brewing methods that these machines better facilitate. In May 2024, Bosch announced that it had launched a new line of fully automatic espresso machines in the 300 and 800 series, thereby offering barista-quality coffee and customizable beverage options for home use. It also mentioned that these machines feature advanced technologies such as ceramic grinders, smart water pumps, and integrated milk systems, delivering convenience, variety, and consistent quality with minimal effort. Therefore, this launch highlights the growing consumer preference for automation, premium home brewing, and specialty coffee experiences, reinforcing the subtype’s coffee machine market potential.

End use Segment Analysis

By the conclusion of 2035, the residential segment is expected to attain a significant revenue share in the coffee machine market. There has been an increase in purchases of durable goods in household expenditure, such as appliances and lifestyle products, which supports the long-term adoption of premium coffee machines for home use. Simultaneously, the growing trend of work from home also signals the residential demand for high-end brewing equipment, drawing the interest of more players to make investments in this field. In addition, the rise of smart homes and connected kitchen appliances is encouraging consumers to invest in IoT-enabled coffee machines. Premium residential machines are seen as a lifestyle statement, enhancing the overall at-home café experience. Moreover, the influence of social media and home-based content creation has popularized specialty coffee preparation, thereby motivating more households to purchase high-end brewing equipment, hence denoting a wider segment scope.

Product Type Segment Analysis

In terms of product type, the drip coffee machines will capture a considerable revenue share in the coffee machine market over the forecasted years. The growth of the segment is highly attributable to its affordability, ease of use, and suitability for households and small offices, making it a very popular choice for daily coffee consumption. In addition, the subtype’s ability to brew multiple cups at once efficiently caters to families and workplaces with heightened coffee demand. The segment benefits from widespread availability, low maintenance requirements, and compatibility with a variety of coffee blends, including ground and filter coffee. Rising awareness of coffee culture and the increasing adoption of home-brewing practices also solidify its appeal, as consumers seek reliable and convenient options for everyday use. Moreover, drip machines are often positioned as an entry-level or mid-range option, allowing brands to reach a broader consumer base while supporting incremental upgrades to premium appliances in the long term.

Our in-depth analysis of the coffee machine market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

End use |

|

|

Product Type |

|

|

Brewing Capacity |

|

|

Price Range |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coffee Machine Market - Regional Analysis

Europe Market Insights

Europe coffee machine market is anticipated to command the largest revenue stake of 36.6% by the end of 2035. The region’s prominence in this field is effectively propelled by the per capita coffee consumption and the heightened demand for specialty coffee. The presence of key coffee machine market players and their strategic activities is also propelling continued growth in the region’s market. In April 2025, Evoca announced that its Wittenborg W100 coffee machine won the prestigious red dot design award in the product category, which marks the company’s third consecutive design recognition. The company also stated that this award follows previous honors from the European Product Design Award and the iF Design Award, thereby emphasizing Evoca’s focus on innovation and excellence in product design. Furthermore, the W100 consists of a contemporary aesthetic with sleek, modular lines and soft corners, combining modern style with functional usability, hence creating coffee machines that are both visually attractive and technologically advanced.

Germany coffee machine market is growing on account of high consumer preference for fully automatic and capsule machines. The country’s market also benefits from a strong culture of specialty coffee consumption, technological innovation, and environmentally conscious purchasing decisions. In this context, in June 2025, Mahlkönig, which is a part of the Hemro Group, announced that it had acquired the Germany-based espresso machine startup Zenia, strengthening its presence in the high-end coffee machine segment. The acquisition allows Mahlkönig to expand its product portfolio with Zenia’s innovative espresso technology and design by targeting specialty coffee enthusiasts and premium home brewing sectors. In addition, this move also highlights the trend of established coffee equipment manufacturers investing in startups to drive innovation and capture growing demand for automated and specialty brewing solutions in this region.

The UK coffee machine market is witnessing interest in terms of convenience and specialty coffee at home, driving the adoption of these machines. Besides the trends such as smart home integration, energy efficiency, and customizable brewing profiles, influence consumer choices, fostering increased uptake. In this context, Majestic Coffee Ltd in January 2026 became a corporate partner of the UK Golf Federation, with a prime focus on enhancing hospitality experiences at golf clubs across the country. Also, the partnership leverages Majestic Coffee’s range of espresso machines, which includes fresh-milk bean-to-cup models, to improve beverage quality, member satisfaction, and profitability. In addition, by integrating high-quality coffee solutions into more than 1,500 venues, the collaboration supports golf clubs in boosting revenue, footfall, and overall visitor experience. Therefore, such initiatives will boost the country’s market by increasing demand for premium and specialty machines across commercial and leisure venues, expanding overall sales and consumer exposure.

APAC Market Insights

The Asia Pacific coffee machine market is expected to represent the fastest growth from 2026 to 2035. The region’s growth in this field is effectively propelled by urbanization, rising disposable incomes, and specialty coffee culture that is driving adoption. The aspect of international coffee trends, coupled with continued investments in modern brewing methods and fully automatic machines, is also positively influencing market expansion. In September 2025, Nescafé Dolce Gusto announced that it had launched its next-generation NEO coffee system in Japan and Korea, that is featuring SmartBrew technology, home-compostable pods, and smartphone connectivity for personalized brewing. This expansion targets the growing at-home café trend, offering seven coffee styles in one machine and introducing environmentally friendly pods to these industries, making it suitable for overall coffee machine market growth.

China coffee machine market is efficiently growing owing to the rising middle-class incomes and increasing exposure to Western coffee culture. Coffee chains and specialty cafés in the country are also promoting consumption, consistently stimulating household adoption. In this regard, Jetinno in October 2025 announced that it had inaugurated its new intelligent R&D and manufacturing base in Guangzhou, China, investing USD 40 million in a 68,000-square-meter facility. The plant features automated production lines, AI-based inspection systems, and in-house brewing and grinding component manufacturing, boosting capacity by more than 200% and ensuring high-quality output. Furthermore, it is equipped with a smart warehouse and advanced logistics; the facility supports worldwide delivery to more than 90 countries, reinforcing Jetinno’s position as a leader in innovative coffee equipment for both commercial as well as home use.

India coffee machine market is growing exponentially, facilitated by the growing trend of home brewing and the rising popularity of specialty coffee. Consumers in the country are shifting from traditional filter coffee makers to modern drip and automatic machines, attracting more investments from pioneers. The country’s market also benefits from work-from-home trends, smart home tech adoption, and exposure to global coffee culture, fueling demand for both basic drip machines and high-end automatic espresso makers. In February 2025, Kaapi Machines announced that it had launched the WMF Espresso NEXT, which is designed to deliver barista-quality espresso and a variety of specialty coffee beverages with precision and consistency. Furthermore, the launch showcases the company’s focus on enhancing the coffee experience and supporting the country’s growing café culture by bringing world-class equipment to the domestic businesses and homes.

North America Market Insights

The North America coffee machine market is mainly driven by strong consumer demand for convenience, premium home brewing experiences, and the growing café culture. Innovation in terms of smart and IoT-enabled coffee machines, along with rising interest in specialty coffee, encourages both residential and commercial adoption. In this regard, Keurig Dr Pepper, in March 2024, unveiled its next-generation Keurig coffee system, introducing K-Rounds plastic- and aluminum-free pods and the new Keurig Alta brewer to redefine home coffee brewing. Besides, the innovation enables consumers to prepare espresso, hot, and cold coffee using a single machine while eliminating traditional pod waste through plant-based, compostable materials. In addition, this multi-year initiative underscores the company’s focus on sustainability, convenience, and barista-style quality, shaping the future of single-serve coffee in North America.

The U.S. coffee machine market is mainly propelled by busy lifestyles and a growing preference for at-home café-quality coffee. The country’s market also benefits from the proliferation of specialty coffee culture and subscription services for beans and pods, which efficiently boost the demand for premium machines. In June 2024, Olympia Express partnered with Siemens Digital Industries Software to modernize the design and production of its handcrafted espresso machines, utilizing the Siemens Xcelerator portfolio. The company also stated that by adopting Solid Edge, Teamcenter, and NX CAM, the company reduced prototyping efforts by around 50% and increased productivity by up to 30%, thereby freeing resources for innovation. Hence, this digital transformation supports both the development of new products, such as the Mina portable espresso machine, and the servicing of legacy machines, solidifying the company’s blend of Swiss precision, sustainability, and long-term product durability.

Canada coffee machine market is also growing continuously, facilitated by the trend of work-from-home setups and the adoption of smart kitchen appliances, which is accelerating the uptake of high-end coffee machines. Local retailers and manufacturers in the country are focused mainly on machines that combine automation with sustainable features. This shift is also supported by the rising preference for in-home café experiences, as consumers are opting for professional-grade brewing without visiting cafés. Manufacturers are integrating connected features, programmable settings, and energy-efficient designs with a prime focus on aligning with smart home ecosystems. In addition, sustainability initiatives, such as recyclable brewing formats, are also gaining prominence in product offerings. Therefore, the presence of all of these factors is reinforcing long-term demand for premium and technologically advanced coffee machines across households in Canada.

Key Coffee Machine Market Players:

- Keurig Dr Pepper Inc. (U.S.)

- Nestlé Nespresso S.A. (Switzerland)

- De’Longhi Group S.p.A. (Italy)

- Breville Group Limited (Australia)

- JURA Elektroapparate AG (Switzerland)

- WMF Group GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Holdings Corporation (Japan)

- Hamilton Beach Brands Holding Company (U.S.)

- Melitta Group (Germany)

- La Marzocco International LLC (Italy)

- Rancilio Group S.p.A. (Italy)

- Electrolux AB (Sweden)

- Morphy Richards Ltd. (UK)

- TTK Prestige Limited (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Keurig Dr Pepper Inc. is identified as a leading player in the coffee machine market through its Keurig single-serve brewing systems, supported by a strong installed base across North America. The company’s main focus lies in ecosystem control by combining proprietary machines with compatible pods and licensed coffee brands. In addition, Keurig is prioritizing portfolio expansion, operational scale, and long-term value creation through strategic transactions, which positions the company as a central force in at-home and office coffee consumption.

- Nestlé Nespresso S.A. operates at the premium end in this field by leveraging a vertically integrated model that combines machines, capsules, retail boutiques, and direct-to-consumer channels. The company is concentrated mainly on brand experience, sustainability, and international expansion, particularly in emerging markets. Furthermore, strategic priorities include boutique-led retail growth, responsible sourcing programs, and continued innovation in portioned coffee systems to strengthen recurring revenue.

- De’Longhi Group S.p.A. is yet another leading player in this sector that has a strong presence in fully automatic, manual espresso, and professional-grade equipment. The company’s corporate strategy emphasizes premiumization, design-led innovation, and expansion in both household and professional segments. Besides, the company has strengthened its position through strategic investments and business combinations across price tiers by maintaining brand autonomy, enabling it to compete effectively.

- Koninklijke Philips N.V. is considered to be the frontrunner in the market that leverages domestic espresso and automatic coffee systems that are focused on technology, ease of use, and connected features. The company also consists of broader appliance and consumer technology expertise to differentiate through digital integration, energy efficiency, and ergonomic design. Moreover, Philips prioritizes innovation-driven growth and worldwide distribution, particularly in Europe and the Asia Pacific, aligning coffee machines with its wider smart home and lifestyle appliance ecosystem.

- Breville Group Limited is a central player in this market and has established itself as a premium home coffee machine manufacturer, making it appealing to consumers who are seeking café-quality coffee at home. The company emphasizes precision engineering, intuitive controls, and functionality that is supported by strong brand positioning in developed markets. Further, Breville’s corporate approach revolves around continuous product innovation, selective geographic expansion, and premium brand building.

Below is the list of some prominent players operating in the global coffee machine market:

The global coffee machine market is witnessing huge competition among multinational appliance manufacturers and coffee equipment brands across various regions. Pioneers in this field, such as Keurig Dr Pepper and Nestlé Nespresso, leverage strong brand ecosystems, whereas Europe-based players such as De’Longhi, JURA, and La Marzocco compete in terms of exclusive designs, automation, and professional-grade performance. In December 2023, De’Longhi S.p.A. announced that it entered into a strategic business combination with Eversys and La Marzocco to establish a global hub in the coffee machine segment. The move aims to accelerate innovation and growth by combining expertise across professional and consumer markets, while also keeping the companies independent under unified control. In addition, this initiative supports De’Longhi’s plan to strengthen its leadership by expanding its portfolio with a wide range of coffee machines, thereby including automatic, traditional, and household appliances.

Corporate Landscape of the Coffee Machine Market:

Recent Developments

- In October 2025, Dr.Coffee reported that it showcased its fully automatic coffee machines at Host Milano 2025 by highlighting over ten flagship models across Coffee Shop, CVS & Ho.Re.Ca, and OCS lines. The brand demonstrated versatility, high output efficiency, and premium quality.

- In August 2025, Keurig Dr Pepper announced an all-cash acquisition of JDE Peet’s to create a global coffee leader which is operating in over 100 countries. Following the deal, the company plans to separate into two independent public companies focused on refreshment beverages and pure-play coffee.

- In March 2025, Nespresso announced the opening of its first boutique in India in New Delhi, which offers an immersive experience featuring Nespresso’s premium coffee range, advanced coffee machines, and personalized guidance from trained specialists. Nespresso also confirmed Thakral Innovations Pvt. Ltd. as its official distribution partner in the country.

- Report ID: 6002

- Published Date: Jan 21, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coffee Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.