Respiratory Drugs Market Outlook:

Respiratory Drugs Market size was valued at USD 18.38 billion in 2025 and is likely to cross USD 33.86 billion by 2035, registering more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of respiratory drugs is assessed at USD 19.42 billion.

This market growth is set to be dominated by growing consumption of tobacco.

Further, the prevalence of second-hand smoke is also surging. For instance, as per the estimation of the World Health Organization, over 1.3 million non-smokers are killed due to the exposure of second-hand smoking across the globe. Second-hand smoking is the major driver for the rise in respiratory infection. As a result, the market is predicted to gather highest revenue.

Moreover, another main reasons for the rise in respiratory disease is upper respiratory infection. Upper respiratory tract infection occurs in a higher part of the respiratory tract. Nasal passages, sinuses, pharynx, and trachea are the specific areas that are most affected by the infection. The respiratory drugs are one of the common treatment available in the market. Hence, the market is poised to observe growth.

Key Respiratory Drugs Market Insights Summary:

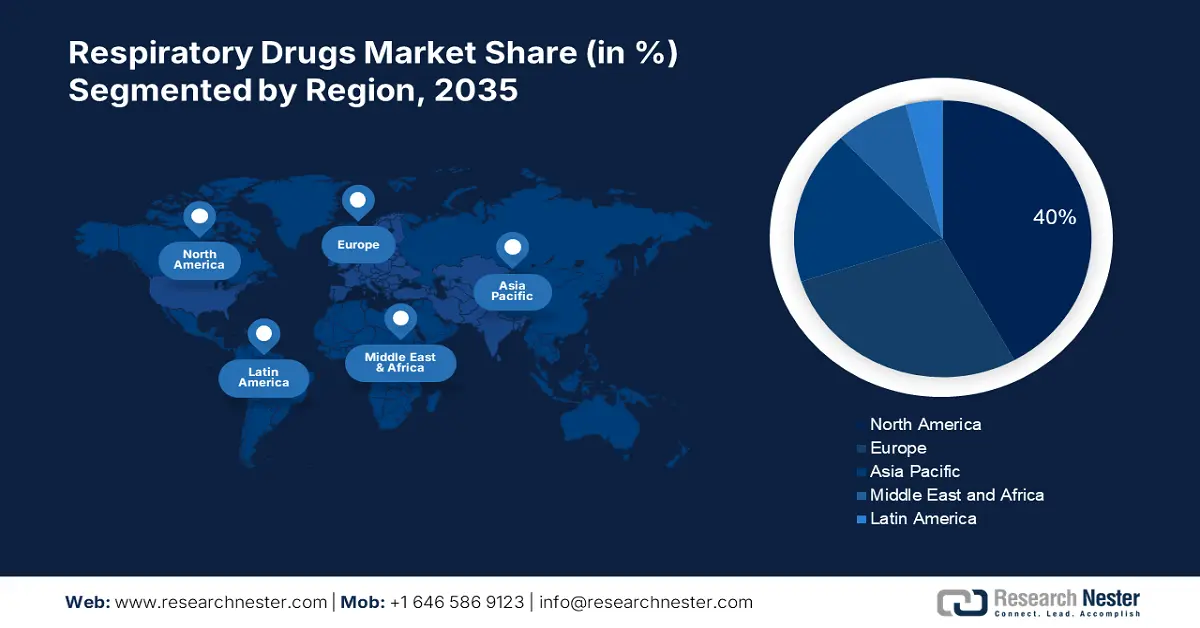

Regional Highlights:

- North America respiratory drugs market will hold more than 35% share by 2035, driven by rising respiratory diseases and obesity rates in the region.

Segment Insights:

- The oral segment in the respiratory drugs market is projected to achieve substantial growth through 2035, driven by the convenience and compliance offered by oral drug delivery, alongside the trend of self-administration and home healthcare.

- The hospital segment segment in the respiratory drugs market is projected to achieve a 40% share by 2035, driven by the increasing number of hospitals and enhanced patient education for respiratory drug use.

Key Growth Trends:

- Growing product launches and R&D

- High incidence of common cold

Major Challenges:

- Growing product launches and R&D

- High incidence of common cold

Key Players: of GlaxoSmithKline plc, Verona Pharma Plc, Teva Pharmaceuticals, Sandoz Inc., Hospira Inc., Novacyt Group.

Global Respiratory Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.38 billion

- 2026 Market Size: USD 19.42 billion

- Projected Market Size: USD 33.86 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Respiratory Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Growing product launches and R&D - New manufacturers are expected to be attracted to the market for nonprescription upper respiratory drugs by a lenient regulatory regime in the US Food and Drug Administration on OTC medicinal products. Thus, product launches, research, and developments from key manufacturers in the respiratory drugs market are evolving into product segments.

For instance, the launch of Otrivin nasal spray by Novartis has led to similar product launches by other key players in the market. As a result, the market is poised to have notable growth over the coming years. - High incidence of common cold - The prevalence of common cold is surging significantly. Even though it is slated to be mild lack of proper treatment could cause severity. Moreover, it is predicted that over 21 million students lose school days annually in the United States due to common cold. Furthermore, seasonal changes are also set to boost the prevalence of colds.

The major factor causing common cold is lack of sufficient humidity is low-the colder months of the year. Further, cold weather may additionally lead inside lining of your nose to dry hence making it greatly vulnerable to viral infection. Therefore, the market is estimated to grow over the forecast timeframe. - Growing advancement of technology - There has been surging advancement of technology across the world which includes, PCR-based tests, molecular diagnostics and more. These advancements have made detection of respiratory drugs effective. Moreover, the importance of nanotechnology is also surging.

Along with it, the integration of AI and machine learning has also proved importance in analyzing data to recommend efficient treatment. Hence, the market is estimated to rise between 2026 and 2035. - Surging Cases of Sleep Apnea - Obstructive sleep apnea has been commonly found among adult population. However, this has further given scope for the rise of respiratory drugs. Hence, the market is estimated to gather the highest market revenue.

Challenges

- Strict regulatory standards and lack of resources - The growth of the respiratory drugs market in the projection period is projected to be hampered by a stringent regulatory framework, together with unfavorable reimbursement policies. Furthermore, the insurance claim is declining rapidly worldwide.

Also, the awareness among population regarding the treatment and spread of respiratory infection is low. As a result, key players find it challenging to invest in the production of medicines related to respiratory drugs. Furthermore, lack of availability of resources significantly restrains market demand in the market. - Cost and time complexities associated are expected to hamper the market growth in the upcoming period.

- Lack of effective vaccines for some respiratory viruses are estimated to pose limitation on the market growth in the projected period.

Respiratory Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 18.38 billion |

|

Forecast Year Market Size (2035) |

USD 33.86 billion |

|

Regional Scope |

|

Respiratory Drugs Market Segmentation:

Distribution Channel Segment Analysis

In respiratory drugs market, hospital segment is likely to capture around 40% share by the end of 2035. The growth in number of hospitals in set to boost the segment share. In the year 2021, across the globe there were over 164000 hospitals. The purchase of medicines needed to treat the upper respiratory tract is carried out by hospital pharmacies in close cooperation with suppliers and pharmaceutical companies. They're stored in pharmaceutical warehouses after that.

The inventory management systems help to keep stock levels under control and ensure that an adequate supply of medicinal products for patients with breathing difficulties is available. In addition, hospital pharmacies frequently teach patients how to use their respiratory medicines properly. Better patient compliance and more efficient distribution of medicines are a result of this education. These factors will contribute to the growth of hospital pharmacies, which are expected to be a driving factor for market development in the projection period. Therefore, the market is projected to capture the highest share over the years to come.

However, the drug store segment is also anticipated to account for a significant share by the end of the 2035. The mounting competition within the non-prescription respiratory drugs advertise is profoundly unstable and the nearness of major worldwide key players has revolutionized the research and improvement within the fabricating industry. The penetration of medicate dispersion channel is broadly established within the supply of respiratory drugs drugs, expeditiously satisfying the request from medicate stores.

Route of Administration Segment Analysis

In respiratory drugs market, oral segment is predicted to capture around 50% revenue share by the end of 2035. This is owing to the fact that oral drug delivery provides excellent compliance and convivence to the patients. Also, the growing trend of self-administration and home healthcare is additionally offering scope for the growth of oral drug delivery. Consequently, with the growth in this segment, the market is also estimated to experience boost.

Our in-depth analysis of the global market includes the following segments:

|

Drug Class |

|

|

Form |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Respiratory Drugs Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 35% by 2035. The development in the region can be dominated by developing burden of respiratory maladies. Also, the prevalence of obesity is also rising in this region. In 2023, over 18 states in America were poised to have obesity rates approximately 34 percent, which indicates a rise from about 15 states in 2022.

Consequently, these variables are expected to drive the development of the showcase within the estimated period. The selection of quick diagnostics tests for quicker determination of respiratory irresistible illnesses is another key factor expected to expand the respiratory irresistible infection diagnostics advertise within the locale.

APAC Market Insights

The respiratory drugs market in the Asia Pacific region is set to grow significantly during the projected period. The Asia-Pacific region is a residence for huge heterogeneous population whose respiratory health is encouraged by diverse social, environmental and economical factor.

Moreover, the healthcare infrastructure in many countries in the region is enhancing, making it easier for people to access diagnosis and treatment for regulatory diseases. Additionally, huge investment has been made by government to enhance the treatment outcome. Therefore, the market is set to rise in this region.

Respiratory Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alcon, Inc.

- Collegium Pharmaceutical Inc.

- Merck & Co. Inc.

- GlaxoSmithKline plc

- Verona Pharma Plc

- Teva Pharmaceuticals

- Sandoz Inc.

- Hospira Inc.

- Novacyt Group

Recent Developments

- Novacyt, an international specialist in clinical diagnostics, announces the launch in August 2020 of its CEMark approved PCR respiratory test panel, Winterplex. The test panel is intended for use on any open PCR platform and, in particular, the Company's rapidly transportable Q32 device.

- Pfizer Inc. reported that the U.S. Food and Drug Administration has endorsed ABRYSVO, the company's bivalent RSV prefusion F immunization, for the anticipation of LRTD and serious LRTD caused by RSV in newborn children from birth up to six months of age by dynamic immunization of pregnant people at 32 through 36 weeks gestational age. ABRYSVO is unadjuvanted and composed of two preF proteins chosen to optimize assurance against RSV A and B strains and was watched to be secure and viable. The FDA's choice is based on the information from the significant Stage 3 clinical trial MATISSE, a randomized, double-blinded, placebo-controlled Stage 3 consider outlined to assess the adequacy, security, and immunogenicity of the antibody against LRTD and extreme LRTD due to RSV in newborn children born to solid people immunized amid pregnancy.

- Report ID: 5753

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Respiratory Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.