Respiratory Pathogen Testing Kits Market Outlook:

Respiratory Pathogen Testing Kits Market size was valued at USD 4.8 billion in 2025 and is projected to reach USD 7.8 billion by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of respiratory pathogen testing kits is assessed at USD 4.9 billion.

The global market is growing due to the enhanced consciousness about the diagnostic value, surge testing needs during pandemics, and early detection in susceptible population sections. As per a report by the WHO in March 2024, every year, due to the respiratory syncytial virus, more than 3.6 million hospitalization cases and more than 100000 deaths occur in children under 5 years of age. The highest pediatric deaths (almost 97%) happen in low-income and middle-income countries. This increased pool of patients comprises healthcare workers, the elderly, disadvantaged communities, and institutional settings. Critical supply chain shocks from worldwide dependency on swabs, reagents, and lab equipment to insufficient surge capacity have illustrated the need for resilience.

The market supply chain pathways are complex and globalized, involving multiple reagent suppliers, swab suppliers, assay component suppliers, and suppliers of specialized diagnostic equipment. The upstream API and component sourcing are disrupted, mainly out of Asia, lead times and prices flying skyward. The producer price indices have experienced increased volatility because of raw material inflationary pressures and logistic constraints being imposed on margins at various channels.

Key Respiratory Pathogen Testing Kits Market Insights Summary:

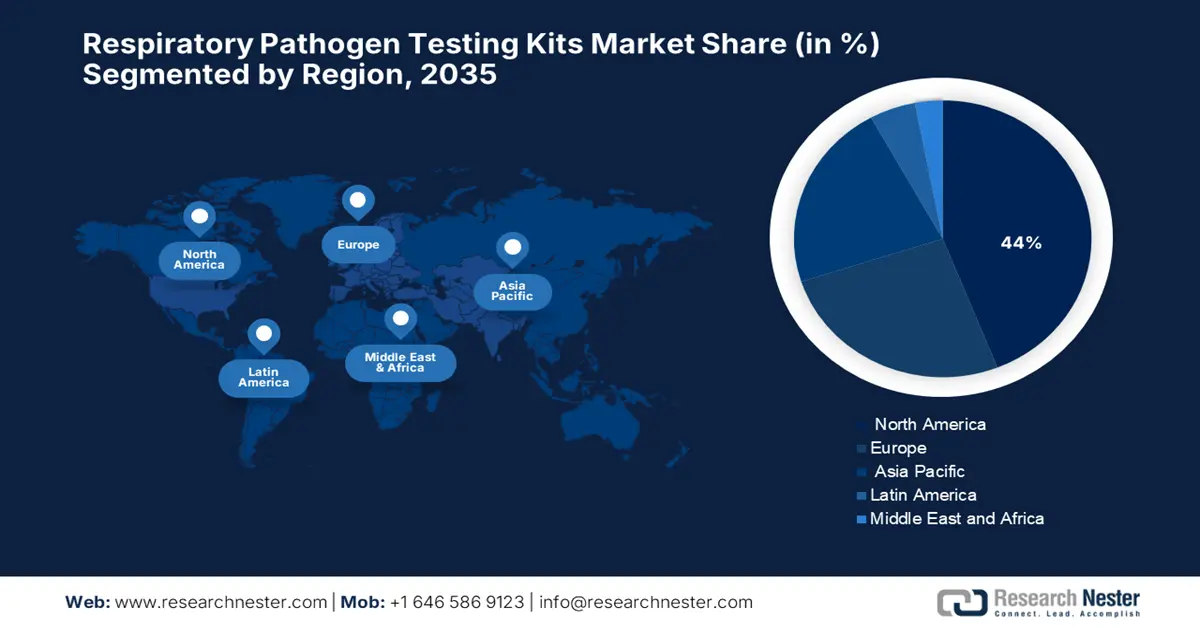

Regional Highlights:

- North America is projected to command a 44% share of the Respiratory Pathogen Testing Kits Market by 2035, spurred by the rapid adoption of molecular diagnostic technologies such as PCR for influenza detection.

- Asia Pacific is anticipated to exhibit the fastest expansion through 2026–2035, underpinned by increasing government and donor investments in multiplex-ready diagnostic platforms for outbreak preparedness.

Segment Insights:

- The Influenza Virus Infection segment is projected to account for 65% of the market by 2035, propelled by persistent seasonal epidemics and heightened public health initiatives.

- The NAAT subsegment is expected to lead the technology category through 2026–2035, owing to its superior sensitivity, specificity, and advancements in RT-PCR and isothermal amplification methods enhancing decentralized testing access

Key Growth Trends:

- Diagnostic equity and patient access expansion

- Combatting AMR with advanced respiratory diagnostics in LMICs

Major Challenges:

- Complex Multiplex Panel Validation

- Limited Adoption in Low-Resource Settings

Key Players: Thermo Fisher Scientific, bioMérieux SA, Roche Diagnostics, QuidelOrtho Corporation, Siemens Healthineers, Hologic Inc., Becton Dickinson and Company, Cepheid (Danaher), Luminex Corporation (DiaSorin), Danaher Corporation, Altona Diagnostics, Qiagen NV, Bio-Rad Laboratories, DiaSorin.

Global Respiratory Pathogen Testing Kits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.8 billion

- 2026 Market Size: USD 4.9 billion

- Projected Market Size: USD 7.8 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 8 September, 2025

Respiratory Pathogen Testing Kits Market - Growth Drivers and Challenges

Growth Drivers

- Diagnostic equity and patient access expansion: There is growing demand in the market due to expanded testing accessibility into underserved populations. According to the NLM January 2022 report, ZIP code accounted for 79% of the variance in positive test results. Patients from below the poverty line were hospitalized at rates 3.8 times higher than their wealthier counterparts, showing systemic disparities in health. This highlights the need for an equal distribution of diagnostic resources to ensure proper early detection and treatment. Enhancing proper access in vulnerable communities can improve individual health with mitigate broader public health risks.

- Combatting AMR with advanced respiratory diagnostics in LMICs: The rising threat of antimicrobial resistance (AMR) has created a demand for newer solutions for respiratory pathogen testing kits. The diagnostics, including Dx2, identifying bacteria causing disease and their susceptibility to drugs, fill critical gaps in the care of pneumonia. As per a report published by FIND in June 2023, this rapid near POC diagnostic is a high-impact opportunity for market growth and improved global health outcomes, with about 24 million eligible hospitalized patients in LMICs and a target market of 12 million tests per year.

- Financial resilience via global supply chain expansion: An efficient supply chain enables manufacturers to respond quickly to fluctuating demands and prevent shortages during peak respiratory illness seasons in the market. As per a report by OEC August 2024, the United States accounted for 20.9% of the total exports of medical instruments in 2023, facilitating faster diagnosis and treatment of infections such as influenza and RSV. Such an advanced and internationalized supply chain provides the possibilities for manufacturers to diversify sources and enlarge production capacity and resiliency against disruptions so as to speed up the response to markets and raise the standards of healthcare.

Medical Devices Export and Import Value in 2023

|

Export Destinations (2023) |

Value (USD) |

Import Origins (2023) |

Value (USD) |

|

Netherlands |

5.9 billion |

Mexico |

11.8 billion |

|

Germany |

3.1 billion |

Germany |

3.9 billion |

|

China |

3.2 billion |

Ireland |

2.7 billion |

|

Japan |

2.8 billion |

China |

2.2 billion |

|

Mexico |

3.1 billion |

Japan |

1.9 billion |

|

Canada |

1.8 billion |

Israel |

1.0 billion |

Source: OEC, August 2024

Challenges

- Complex Multiplex Panel Validation: Respiratory infection test kits offer the simultaneous identification of multiple diseases, which demands rigorous validation to ensure superior sensitivity and specificity against a panel of pathogens. Such complexity limits the establishment of reliable multiplex kits and also causes marketing approval to be delayed, thereby increasing the development and review time. In addition, these kits need to be updated repeatedly by the manufacturer to handle new pathogen variants that appear over time, thus causing additional development cost and time. Regulatory bodies usually call for extensive clinical trials to validate performance, which may be region- and pathogen-difference-dependent.

- Limited Adoption in Low-Resource Settings: Even though these kits are in demand, their availability in decentralized or low-resource environments is barred by cost and test simplicity, denying the regions minimal and frequently belated detection of respiratory illness, impacting the market's overall development. Furthermore, a lack of trained healthcare experts and suboptimal laboratory conditions are also hindering the multiplex testing solutions. Supply chain disruptions and uneven reagent and consumable availability are other reasons for getting much delay in the adoption process. Overcoming these hurdles through low-cost, easy-to-deploy platforms and training initiatives is critical to expanding market penetration in underserved areas.

Respiratory Pathogen Testing Kits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2026) |

USD 4.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.8 billion |

|

Regional Scope |

|

Respiratory Pathogen Testing Kits Market Segmentation:

Application Segment Analysis

Influenza virus infection is projected to dominate the application segment with a 65% market share by 2035 in the market. This is fueled by ongoing seasonal epidemics and increased public health activities. As per a report by the WHO, April 2024, over the last few years, a total of 889 cases and 463 deaths have been reported globally from 23 nations due to the influenza A(H5N1) virus. The need for multiplex diagnostic tests that can detect influenza in combination with other respiratory viruses continues to increase, particularly in clinical and point-of-care applications.

Technology Segment Analysis

NAAT is supposed to be the highest subsegment in the technology segment in the respiratory pathogen testing kits market. Being highly sensitive and specific, especially in scenarios having low viral loads, it is most preferable for diagnostic procedures of respiratory pathogens. Innovations in the RT-PCR and isothermal amplification approaches will further dominate the subsegment worldwide. Such techniques are also being explored to fit into rapid, decentralized testing setups. These advancements not only enhance the accuracy and speed of the testing but also expand accessibility while making the NAAT-based kits increasingly vital in managing respiratory disease outbreaks globally.

End user Segment Analysis

Hospitals are estimated to dominate the end user segment in the respiratory pathogen testing kits market. The testing setup procedures are determined depending on clinical assessment, such as CURB-65, and on the immune levels of patients. Multiplex respiratory panels are being adopted by hospitals more for reducing diagnostic turnaround time and cost, and improving pathogen detection for moderate-to-severe cases of CAP. These panels also bring down the general usage of antibiotics by disallowing prescriptions for antibiotics that are not pathogen-specific. Additionally, the integration of these testing kits in hospital settings supports better patient management and infection control practice, which ultimately improves the clinical outcome.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Specimen Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Respiratory Pathogen Testing Kits Market - Regional Analysis

North America Market Insights

North America is expected to lead the respiratory pathogen testing kits market with the highest market share of 44% within the forecast period, driven by rapid molecular tests such as PCR targeting the conserved matrix (M) gene for influenza diagnosis. However, according to a NLM 2025 report, testing for respiratory pathogens in children witnessed considerable growth in North America, recording 13.6% in the last 10 years and rising to 62.2% in 2022, with a huge impetus from the COVID-19 pandemic. Testing costs steeply rose from USD 34.2 per encounter in the last 8 years to USD 128.2 by 2022, reflecting greater use of large-panel tests and sophisticated platforms. Some studies observe reduced sensitivity on the part of some tests in detecting novel strains, underlining the need for continued assessment of diagnostic tools to keep them effective in this dynamic landscape.

The respiratory testing kits market in the U.S. is growing due to government initiatives and an increasing patient pool. The U.S. respiratory testing kits market is influenced by government initiatives such as Medicare coverage for FDA-authorized tests and the CDC's National Strategy to Combat Antibiotic-Resistant Bacteria, which result in more than millions of disease incidences and deaths every year. It is essential to use rapid and precise testing to optimize antibiotic treatment in line with the CDC, which has underlined the fact that antibiotics are improperly used in nearly half the cases. Such demand passed on to the manufacturers also has downstream repercussions on pricing and reimbursement policies.

The respiratory testing kits market in Canada is growing due to post-pandemic demand, combined with enhanced diagnostic ability in the past couple of years. The government-sponsored initiatives, such as Choosing Wisely, set forth recommendations for limited use in low-acuity pediatric cases, sending testing in the direction of the high-risk population. Testing volumes saw a surge in all periods, affecting payer pricing and acting as a stimulus for panel development investments. Strategic funding aligned with standardized CPT coding is ensuring greater uptake in healthcare organizations and diagnostic laboratories.

North America 2022 Imports of Medical Test Kits from the U.S.

|

Country |

Import Value (USD 1000) |

Quantity (Kg) |

|

Mexico |

12,517.8 |

246,808 |

|

Costa Rica |

45,681.2 |

318,089 |

|

Panama |

36,702.9 |

167,415 |

|

El Salvador |

9,139.2 |

106,024 |

|

Belize |

3,431.3 |

80,380 |

|

Cuba |

5,138.5 |

12,248 |

|

Jamaica |

3,827.3 |

63,277 |

Source: World Integrated Trade Solutions, April 2025

Asia Pacific Market Insights

Asia Pacific is expected to be the fastest-growing respiratory pathogen testing kits market by 2035. In a typical low-resource setting, the current genomic infrastructure of surveillance creates a need for flexible kits to detect respiratory pathogens. Governments and funders are increasingly investing in diagnostics that are ready for multiplexing to be able to prepare for outbreaks. Yet, with limited funds, advanced sequencing facilities promote regional adoption of complex respiratory panels. These create opportunities in terms of kit volume and price models that are geared toward the constraints faced by economies, thus being profitable for companies that deliver scalable and cost-efficient test platforms.

The respiratory testing kits market in China is growing due to the population, high colonization rates, and government initiatives. In China, according to the NLM June 2024 report, healthcare workers were found to have high colonization rates of respiratory pathogens, 67.1%, especially Streptococcus pneumoniae and Haemophilus influenzae, implying an urgent requirement for rapid multiplex PCR test kits. Training on IPC and hand hygiene programs initiated by the government decreases the infection risk, hence other factors that could encourage the market. Further funding in infection control as well as COVID-19 response initiatives will promote growth, along with the lower prices of PCR kits manufactured locally for great accessibility in different healthcare institutions.

The respiratory pathogen testing kits market in India is growing due to the need for rapid diagnostics, on a limited clinical pathology setup. Budgetary constraints, coupled with reimbursement issues at public health settings, represent a threat. Funding keeps coming from both government and private institutions, such as through the PPPs that the Bill & Melinda Gates Foundation has supported in the spirit of affordable access to public facilities, while private sales maintain a level of profitability. As per a report by India Fellow, June 2022, India has spent approximately 1% of its GDP on health for over 15 years, compared to nations such as Japan with 9% or even comparable economic nations such as Brazil, which spends 3-4% of its GDP.

Europe Market Insights

Europe is expected to hold a considerable share of the respiratory pathogen testing kits market during the forecast period. According to a June 2023 report by NLM, the Europe respiratory pathogen testing market is growing, owing to the use of high-throughput PCR respiratory panels promoting diagnostic accuracy and shortening the turnaround time to 5.5 hours. Government healthcare systems support the panels for their cost-effectiveness, as they streamline workflows and drive down the cost per test to €23.88. Funding centers on optimizing care pathways in hospital settings, negotiating up-front expenditures with long-term savings, and improving patient outcomes in light of rising CAP incidence.

The respiratory pathogen testing market in the UK is developing with the NHS initiatives to prioritize rapid diagnosis of CAP and other respiratory infections. The use of Multiplex PCR panels is expected to be in line with national guidelines and also aid antimicrobial stewardship. Low-cost diagnostics are being introduced into public hospitals to streamline workflows and improve clinical results. Government-funded investments in lab modernization and pandemic preparedness continue to champion the sustained demand for high-throughput respiratory testing technologies in the United Kingdom.

The respiratory pathogen testing market in Germany is growing due to public funds and with a particular focus on infectious disease surveillance. The advanced technique of PCR-based respiratory panels is finding increasing use in university hospitals and diagnostic laboratories. Reimbursements by way of statutory health insurance would support the introduction of kits that are cost-effective, while digital health reforms in Germany also aid interoperability for laboratory data. The stable regulatory environment, coupled with the ever-growing need for scalable and accurate diagnostic solutions, puts market players in a very advantageous position.

Key Respiratory Pathogen Testing Kits Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific

- bioMérieux SA

- Roche Diagnostics

- QuidelOrtho Corporation

- Siemens Healthineers

- Hologic, Inc.

- Becton, Dickinson and Company

- Cepheid (Danaher)

- Luminex Corporation (DiaSorin)

- Danaher Corporation

- Altona Diagnostics

- Qiagen NV

- Bio-Rad Laboratories

- DiaSorin

The respiratory pathogen testing kits market is highly fragmented, with the dominance of top global diagnostic players such as Abbott, Thermo Fisher, Roche, and bioMérieux, which together control a large chunk of the market. These giants innovate through PCR, multiplex, AI-based systems, and rapid antigen testing. Mid-tier players such as Cepheid, Siemens Healthineers, and Hologic fill in the gaps with molecular diagnostics and automation. Asian companies such as Sysmex and Horiba provide regional strength. These collaboration agreements, acquisitions, and expanded portfolios continue to contribute to market growth and global technological uplift.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Roche launched the powered by TAGS technology received FDA clearance for SARS-CoV-2, Influenza A, Influenza B, and RSV, making respiratory diagnostic processes easier by enabling multiplex PCR identification of up to 15 viruses. CE-marked and compatible with existing Cobas platforms.

- In September 2024, Roche launched their first test kit to use its breakthrough TAGS technology for high throughput, while easy detection of 12 respiratory viruses. It can detect up to 15 targets in a single patient due to high-throughput molecular diagnostic analysers, cobas 5800, 6800, and 8800.

- Report ID: 8071

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.