Pneumonia Testing Market Outlook:

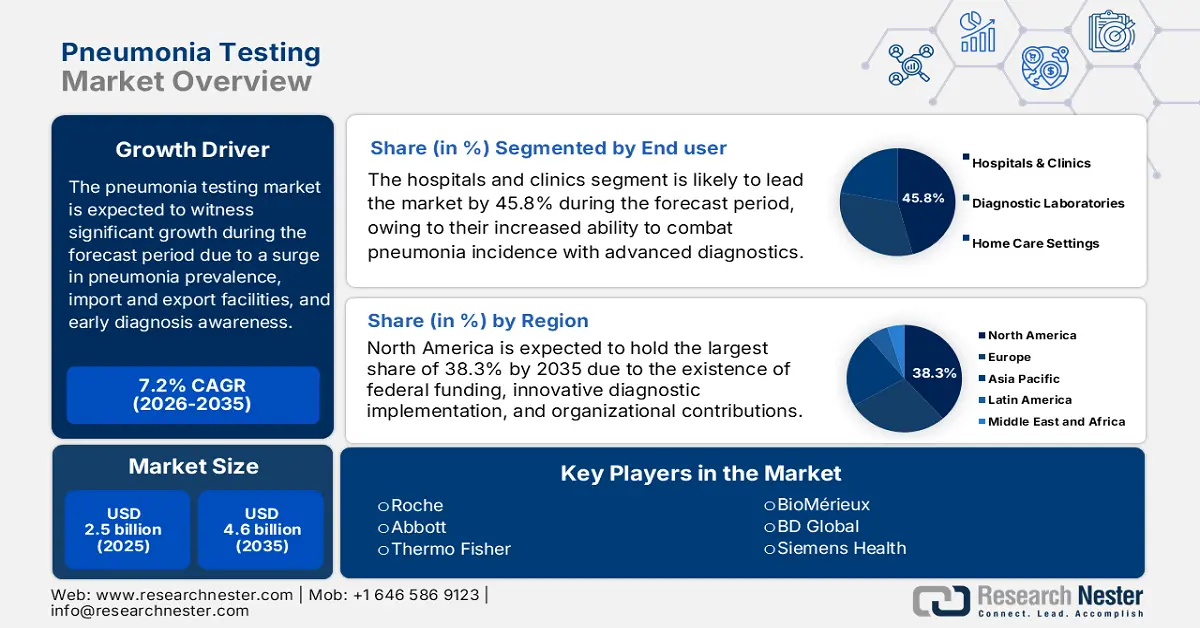

Pneumonia Testing Market size was USD 2.5 billion in 2025 and is anticipated to reach USD 4.6 billion by the end of 2035, increasing at a CAGR of 7.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pneumonia testing is assessed at USD 2.6 billion.

Globally, the market is witnessing growth, majorly due to a surge in pneumonia incidence. According to the 2025 World Health Organization (WHO) report, pneumonia has readily affected more than 808,000 children within the age of 5 years, which accounted for 15% of overall deaths globally. In addition, adults more than 65 years of age are also at risk for pneumonia, which is also driving the market’s demand. Besides, the overall market’s growth is also driven by other interconnected factors, including an increase in awareness for early diagnosis, a surge in governmental strategies, the presence of accurate and rapid testing methods, and advancements in diagnostic technologies.

Moreover, chest x-ray as a diagnostic tool is readily sourced across nations through import and export facilities, which is positively impacting the market. According to the 2023 OEC report, the global export valuation of this tool is USD 9.3 million, and the import valuation is USD 123 million. In addition, India’s share in global exports is 0.1%, and it is ranked 21 out of 103, along with the global import share accounting for 2.4%, with a rank of 9 out of 181. Besides, as per the October 2023 NLM report, only 5% to 12% of adults suffering from pneumonia are diagnosed, with symptoms lower respiratory tract infection. Additionally, 22% to 42% are admitted to hospitals, with a mortality rate of 5% and 14%, thereby denoting an increase in the demand for the market.

Key Pneumonia Testing Market Insights Summary:

Regional Highlights:

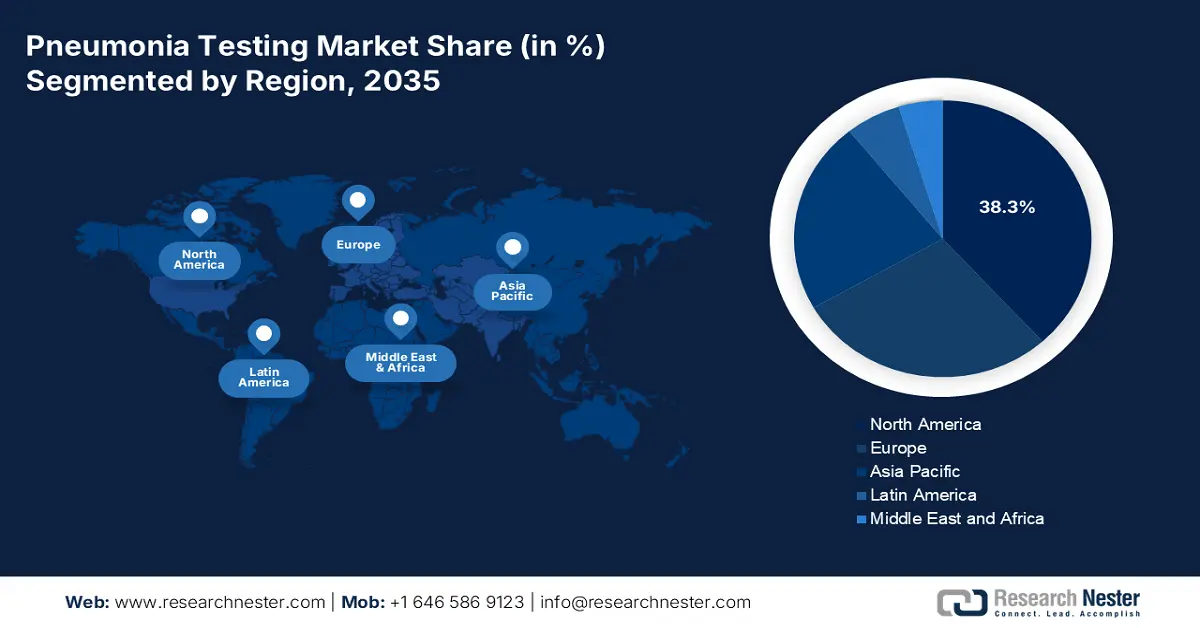

- North America in the pneumonia testing market is forecast to hold a 38.3% share by 2035, sustained by innovative diagnostic integration, the presence of federal funding, and a surge in the incidence rate.

- Asia Pacific is anticipated to secure a 22.5% share by 2035, strengthened by a surge in the disease burden, governmental strategies, and private sector funding.

Segment Insights:

- The hospitals and clinics segment in the pneumonia testing market is expected to capture a 45.8% share by 2035, impelled by the latest advancements integrated in hospital and clinic facilities to combat diseases.

- The molecular diagnostics (PCR-based) segment is estimated to achieve a 35.7% share by 2035, supported by its increased accuracy for initiating differentiation in viral and bacterial pneumonia, which is essential for target-specific treatment.

Key Growth Trends:

- Automation in diagnostics

- Air pollution impact

Major Challenges:

- Increased out-of-pocket expenses

- Disruptions in the supply chain

Key Players: Roche Diagnostics (Switzerland), Abbott Laboratories (U.S.), Thermo Fisher Scientific (U.S.), BioMérieux (France), BD (Becton Dickinson) (U.S.), Siemens Healthineers (Germany), QuidelOrtho (U.S.), Danaher (U.S.), Qiagen (Germany), Bio-Rad Laboratories (U.S.), Sysmex (South Korea), Trivitron Healthcare (India), SD Biosensor (South Korea), Tulip Diagnostics (India), ACON Laboratories (U.S.).

Global Pneumonia Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 19 August, 2025

Pneumonia Testing Market - Growth Drivers and Challenges

Growth Drivers

-

Automation in diagnostics: The integration of artificial intelligence in health diagnostics tends to reduce the overall treatment duration, which is suitable for augmenting the pneumonia testing market globally. According to an article published by NLM in September 2023, the aspect of machine learning-deep learning algorithm demonstrated a characteristic curve of 95%, along with 77.3% specificity, and 87% of sensitivity. Besides, the utilization of AI systems in healthcare has been suitable for 101 radiologists, showcasing 86.4% sensitivity and 87.5% specificity, thus positively impacting the overall market.

-

Air pollution impact: An increase in pneumonia cases is highly denoted by a surge in air pollution internationally, which has bolstered the pneumonia testing market demand. As per the 2025 WHO report, 99% of the global population breathe air that comprises harmful pollutants, with developing countries suffering the most from high exposures. Besides, the April 2025 NIH report stated that over 6.5 million deaths take place every year, denoting an increase over the past two decades. From vehicle emissions to natural gas, fuel oils, and power generation, especially from coal-based power facilities, are creating increased pollution, which in turn is increasing pneumonia, and hence an increase in the market demand.

-

Expansion in travel medicine: Travelers returning from international destinations are possible carriers of respiratory illness, leading to pneumonia cases, which in turn is driving the pneumonia testing market. As stated in the April 2025 NLM article, 36% infections are caused during travelling, which has resulted in the increased need for travel medicines. Besides, the March 2023 Medscape report indicated that over 1.4 billion travelers have crossed international borders, in comparison to 25 million in previous years, thereby denoting the requirement for travel health clinics, which is positively impacting the market.

X-Ray (including CT-Scan) Sourcing for the Pneumonia Testing Market

X-Ray Import and Export Global Data

|

Countries |

Export |

Import |

|

U.S. |

USD 3.5 million |

USD 33.9 million |

|

Germany |

USD 1.0 million |

USD 11.8 million |

|

Bangladesh |

USD 763,000 |

- |

|

Brazil |

USD 650,000 |

- |

|

Egypt |

USD 603,000 |

- |

|

China |

- |

USD 49.1 million |

|

Japan |

- |

USD 20.1 million |

|

Israel |

- |

USD 3.4 million |

Source: OEC, 2023

Severity Scoring Systems Impacting the Pneumonia Testing Market

CRB65 and CURB65 Scoring Systems Comparison

|

Component |

CRB65 Score (Community Setting) |

CURB65 Score (Hospital Setting) |

|

Confusion |

Abbreviated Mental Test ≤8 or new disorientation |

Same as community |

|

Raised Respiratory Rate |

≥30 breaths/min |

Same as community |

|

Low Blood Pressure |

Diastolic ≤60 mmHg or Systolic <90 mmHg |

Same as community |

|

Age |

≥65 years |

Same as community |

|

Blood Urea Nitrogen (BUN) |

Not applicable |

>7 mmol/L |

|

Total Possible Points |

4 |

5 |

Source: NLM, October 2023

Challenges

-

Increased out-of-pocket expenses: Pneumonia testing costs are creating financial gaps, particularly for underinsured and uninsured patients. For instance, the cash price range for molecular tests denotes a crippling expense for the majority of uninsured patients in America. Besides, the situation is even worse in developing nations, where tests are usually more than a week’s wage. This has resulted in diagnostic and treatment delays, thereby increasing the mortality rate. However, rapid test adoption, partnership with government organizations are probable solutions for this issue, which is suitable for the pneumonia testing market’s upliftment.

-

Disruptions in the supply chain: The pneumonia testing market continues to remain vulnerable to critical bottlenecks in the supply chain that can affect the production process. Severe components, such as specialized plastics, nitrocellulose membranes for rapid tests, and PCR reagents, are sourced from other nations, including the U.S., Germany, and China. Therefore, this concentration has created huge risks, leading to delays in test manufacturers, particularly to produce molecular tests that usually require specialized components from different suppliers, thus causing a hindrance in the market’s growth.

Pneumonia Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Pneumonia Testing Market Segmentation:

End user Segment Analysis

The hospitals and clinics segment in the pneumonia testing market is projected to account for the highest share of 45.8% by the end of 2035. The segment’s growth is highly propelled by the latest advancements integrated in hospital and clinic facilities to combat diseases. According to an article published by the CDC in December 2024, 85% of acute care hospitals have readily implemented the Core Elements, in comparison to 41% over the past 10 years. Besides, the consumption of antibiotics, which are prescribed by medical professionals in hospitals and clinics, is also driving the market. However, 30% of suggested antibiotics in the U.S.-based hospitals are sub-optimal, thereby generating ineffective restrictions.

Product Segment Analysis

The molecular diagnostics (PCR-based) segment in the pneumonia testing market is anticipated to hold the second-highest share of 35.7% by the end of the forecast duration. The segment’s upliftment is effectively uplifted, owing to its increased accuracy for initiating differentiation in viral and bacterial pneumonia, which is essential for target-specific treatment. Additionally, the segment’s development is also attributed to a surge in the need for rapid diagnostic solutions, especially in reference labs and hospitals, wherein the PCR implementation has enhanced since 2022. Besides, government initiatives and progressions are also boosting the segment internationally.

Method Segment Analysis

The rapid antigen testing segment in the pneumonia testing market is expected to hold the third-highest share of 30.5% during the projected timeline. The segment’s development is highly driven by the ability to detect and evaluate asymptomatic and symptomatic SARS-CoV-2 infection. In this regard, a clinical study was conducted, which was published by NLM in July 2024. The study included 7,361 participants, of which 5,353 were asymptomatic, and with the utilization of the testing methods, the sensitivity rate was 93.4% for the symptomatic group and 62.7% for the remaining asymptomatic group, which later on improved by 79.0%, thus denoting the usefulness of the test.

Our in-depth analysis of the pneumonia testing market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product |

|

|

Method |

|

|

Technology |

|

|

Pathogen |

|

|

Test Setting |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pneumonia Testing Market - Regional Analysis

North America Market Insights

North America in the pneumonia testing market is projected to be the dominant region, grabbing the largest share of 38.3% by the end of 2035. The market’s growth in the region is effectively fueled by innovative diagnostic integration, the presence of federal funding, and a surge in the incidence rate. According to the December 2024 ASPE Organization report, Illumina, within the past 7 years, unveiled the iSeq Sequencing system, which is a benchtop sequencer, for an estimated USD 20,000. In addition to this, the organization also introduced high-throughput sequencers, with a valuation of USD 1 million, thereby focusing on a diagnostic approach, which is suitable for the market’s growth in the overall region.

The pneumonia testing market in the U.S. is significantly growing, owing to the expansion in POC testing, artificial intelligence-based diagnostic tools, and Medicare and Medicaid reimbursement policies. As per an article published by Frontiers Organization in May 2024, the overall North America region represented itself as the top frontrunner in the POC testing industry, accounting for a market share of 43.2% as of 2022, which is readily driving the pneumonia testing market in the country. Besides, as per the June 2025 CDC Government report, the Health Care and Education Reconciliation Act (HCERA), along with the Patient Protection and Affordable Care Act (ACA) made effective modifications in the Medicaid reimbursement policies, which is also positively impacting the market in the country.

The pneumonia testing market in Canada is also growing due to federal provisions, as well as an increase in Ontario’s expenditure. Besides, the February 2022 NLM article has put forward the antimicrobial activity for bacterial CAP pathogens, including 98% to 100% of S pneumoniae strains, 94% for cefuroxime, 85% for doxycycline, and 78% for macrolide, all of which develop outside hospital settings. However, Ontario has provided generous investment for hospital facilities, suitable for overcoming the pneumonia incidence. According to the April 2025 Ontario government report, the government has supported more than 50 hospitals and 3,000 beds in the past 10 years. Additionally, there has been an investment of USD 50 billion for the coming 10 years for hospital infrastructure, which is suitable for the overall market.

Recommended Plans for Pneu-C-15 or Pneu-C-20 Vaccine for Children in Both the U.S. and Canada

|

Age at presentation for immunization |

Number of pneumococcal conjugate vaccine doses previously received |

Suggested schedule for Pneu-C-15 or Pneu-C-20 |

|

2 to less than 7 months |

0 doses |

2 or 3 doses + 1 dose at 12 to 15 months of age |

|

1 dose |

1 or 2 doses + 1 dose at 12 to 15 months of age |

|

|

2 doses |

0 or 1 dose + 1 dose at 12 to 15 months of age |

|

|

7 to less than 12 months |

0 doses |

2 doses + 1 dose at 12 to 15 months of age |

|

1 dose |

1 dose + 1 dose at 12 to 15 months of age |

|

|

2 doses |

1 dose at 12 to 15 months of age |

|

|

12 to less than 24 months |

0 doses |

2 doses |

|

1 dose at less than 12 months of age |

||

|

2 or more doses at less than 12 months of age |

1 dose |

|

|

0 or 1 dose at less than 12 months of age AND 1 dose at 12 months of age or older |

||

|

24 to less than 60 months (5 years) |

0 doses or incomplete vaccination schedule |

1 dose |

|

5 to less than 18 years |

0 doses |

0 doses |

Source: Government of Canada, May 2024

APAC Market Insights

Asia Pacific in the pneumonia testing market is anticipated to be the fastest-growing region, garnering a share of 22.5% during the forecast timeline. The market’s upliftment in the region is highly driven by a surge in the disease burden, governmental strategies, and private sector funding. According to the November 2024 Observer Research Foundation Organization report, the death toll for pneumonia in India was over 127,000 children under 5 years of age, accounting for 14% of deaths in this particular age group. However, to combat this, treatment expenses constitute USD 25.6 per episode, especially for elderly patients. Therefore, all these factors are responsible for uplifting the market in the overall region.

The pneumonia testing market in China is gaining increased exposure, owing to an increase in the aging population, governmental funding, and technology-based diagnostic solutions. As per an article published by NLM in October 2024, the digital healthcare market in the country has reached CNY 195.4 billion, as of 2022, with a growth rate of 30% over the past 5 years. In addition, there has been the establishment of 125 regional medical facilities, particularly in Tier-2 and Tier-3 cities. Furthermore, the electronic medical record (EMR) coverage accounted for 90% of hospitals, followed by 60% secondary hospitals, and 40% primary hospitals, thus denoting a huge opportunity for the market’s development.

The pneumonia testing market in India is steadily growing since there has been an expansion in governmental initiatives, development in telemedicine services, and a boost in local manufacturing. As per the December 2024 PIB Government report, Nafithromycin has been specifically designed, with a fund provision of ₹8 Crore (USD 913,371), to aid community-acquired bacterial pneumonia (CABP). This has been possible by conducting Phase III clinical trials under the Biotechnology Industry Research Assistance Council (BIRAC) Biotech Industry Program supervision, which is a huge growth opportunity for the market in the country.

Total Deaths and Years of Full Health (YFH) in Asia

|

Pathogens |

Total deaths averted (till 2024) |

Total YFH gained (till 2024) |

||

|

|

All Ages |

Under 5 years |

All Ages |

Under 5 years |

|

Diphtheria |

81,000 |

73,000 |

5,430,000 |

4,900,000 |

|

Haemophilus influenzae type B |

601,000 |

601,000 |

43,365,000 |

43,365,000 |

|

Hepatitis B |

73,000 |

57,000 |

10,486,000 |

8,158,000 |

|

Measles |

20,517,000 |

20,194,000 |

1,264,122,000 |

1,244,255,000 |

|

Pertussis |

4,428,000 |

3,910,000 |

366,568,000 |

323,138,000 |

|

Poliomyelitis |

347,000 |

196,000 |

168,577,000 |

95,333,000 |

Source: NLM, November 2024

Europe Market Insights

Europe in the pneumonia testing market is projected to account for a considerable share of 28.4% by the end of the forecast period. The market’s upliftment in the region is propelled by the presence of health policies, effective import and export facilities, POCT integration, and stringent monitoring facilities. According to the 2023 OEC data report, France is one of the top exporters of oxygen, with a valuation of USD 26.5 million. This is followed by Belgium, accounting for USD 22.1 million, USD 17.9 million in the Netherlands, and USD 14.3 million in Slovakia. Besides, primary as well as hospital care are provided to patients with no cost, which is an optimistic outlook for the overall market in the region.

The pneumonia testing market in Germany is steadily growing, owing to an increase in healthcare expenditure, automation in hospitals, continuous research and development activities, and Europe Union funding. As indicated in the 2025 World Bank Group data report, the country’s gross domestic product (GDP) rate for healthcare spending is 11.8% as of the financial year 2022. Besides, the 2023 OECD Organization report stated that the health expenditure in the country amounted to EUR 159 per capita, along with an upsurge in public funding by 85.5% for the healthcare system, denoting an increase from 81.1%. Additionally, the out-of-pocket aspect is lower by 12% in the country, thereby effectively bolstering the market.

The pneumonia testing market in the UK is also propelling due to the presence of NHS investment, an expansion in telemedicine, localized production, and public-private collaborations. As per an article published by Informatics and Health in March 2025, the NHS reported that there has been an increase in telemedicine usability in the country by 67%, particularly in rural locations. For instance, Cumbria witnessed a surge by 45% since pandemic days, which has permitted patients to achieve consultations within the required duration. Therefore, the availability of this facility has developed a positive outlook for the overall market in the country.

Key Pneumonia Testing Market Players:

- Roche Diagnostics (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories (U.S.)

- Thermo Fisher Scientific (U.S.)

- BioMérieux (France)

- BD (Becton Dickinson) (U.S.)

- Siemens Healthineers (Germany)

- QuidelOrtho (U.S.)

- Danaher (U.S.)

- Qiagen (Germany)

- Bio-Rad Laboratories (U.S.)

- Sysmex (South Korea)

- Trivitron Healthcare (India)

- SD Biosensor (South Korea)

- Tulip Diagnostics (India)

- ACON Laboratories (U.S.)

The international pneumonia testing market is extremely dominated with key players, including Thermo Fisher, Abbott, and Roche, combinedly leveraging POC and PCR advancements to effectively maintain a joint market share. In addition, diagnostic investment, rapid test implementation are suitable strategies that these organizations have integrated for boosting the overall market. Besides, Fujirebio and Sysmex are successfully leading automation, along with ELISA testing, to deliberately focus on the regional aging population. Besides, Siemens, BioMérieux, and QuidelOrtho have readily integrated AI, multiple panels, and telemedicine to uplift the market across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2024, Merck declared that the U.S. FDA has cleared CAPVAXIVE, which is considered a pneumococcal 21-valent conjugate vaccine, for active immunization to overcome pneumonia and invasive diseases.

- In June 2022, Royal Philips notified that has partnered with Biodesix, Inc. to implement Biodesix’s Nodify Lung blood-based lung nodule risk assessment testing results into Philips Lung Cancer Orchestrator lung cancer patient management system.

- Report ID: 4457

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pneumonia Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.