Premium Cosmetics Market Outlook:

Premium Cosmetics Market size was valued at USD 178.4 billion in 2025 and is projected to reach USD 341.2 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of premium cosmetics is estimated at USD 190.3 billion.

The global premium cosmetics market represents a significant growth in the personal care and beauty industry and is defined by higher price points, specialized formulations, and targeted distribution. The trade and regulatory data indicate that the demand for higher-value cosmetics continues to expand due to safety and ingredient transparency and international trade integration requirements. According to the Personal Care Council report in 2025, consumers invest heavily in beauty products, especially in cosmetics, fragrances, and hair care products. These products accounted for the sales of USD 210.6 billion in 2022, which signals sustained international interest in the premium performance-focused product categories. The regulatory filing from the U.S. FDA highlights the continuous update on permissible cosmetic ingredients and color additives under the Federal Food, Drug, and Cosmetic Act, requiring manufacturers to maintain a compliance program and invest in safety documentation that increases the cost per formulation and indirectly supports premium price positioning.

The government-linked consumer expenditure research suggests that people are willing to spend more per cosmetic item, mainly in segments with scientific evaluation and safety substantiation. The U.S. BLS December 2024 data highlights that spending on personal care products and services increased by 9.7% respectively in 2023. On the other hand, the Organizations, including the WHO, have reported that the global trend of population aging is directly related to increased R&D investment in premium skincare solutions targeting efficacy and longevity. Further, the trade data from the OEC 2023 shows an ongoing activity in the import of essential oils and cosmetic preparations, indicating the scale of the underlying supply chain. Success in the premium cosmetics market is based on the confluence of demographic trends, stringent and varying international regulations, and a supply chain under pressure to demonstrate transparency and sustainability.

Essential Oils Trade Flow (2023)

|

Country |

Import (USD millions) |

Export (USD millions) |

|

France |

423 |

472 |

|

India |

253 |

744 |

|

U.S. |

1.16 billion |

744 |

|

South Africa |

26.4 |

52 |

Source: OEC 2023

Key Premium Cosmetics Market Insights Summary:

Regional Highlights:

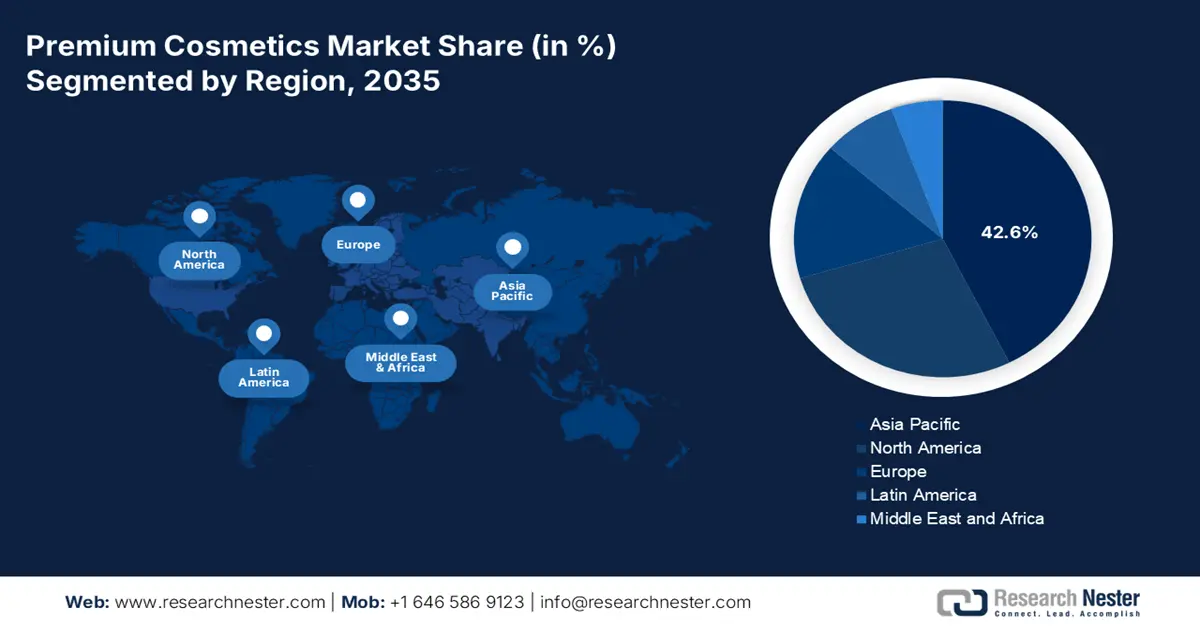

- By 2035, the Asia Pacific region is set to command a 42.6% revenue share in the premium cosmetics market, attributed to rapid digitalization.

- North America is expected to grow at a 5.6% CAGR during 2026–2035, owing to rising consumer purchasing power.

Segment Insights:

- By 2035, the female sub-segment is projected to hold a 72.5% share in the premium cosmetics market, supported by entrenched cultural beauty norms.

- By 2035, the online or e-commerce sub-segment is anticipated to secure a major share, propelled by social commerce and DTC ecosystems.

Key Growth Trends:

- Public expenditure on organic and chemical free with advanced cosmetic formulations

- Continuous innovation and R&D investment

Major Challenges:

- The greenwashing trap and authentic sustainability

- The innovation to duplication speed cycle

Key Players: L'Oréal Luxe (France), The Estée Lauder Companies Inc. (U.S.), Shiseido Company, Limited (Japan), Chanel (Beauté) (France), LVMH (France), Coty (U.S.), Puig (Spain), Amorepacific (South Korea), Kao (Japan), KOSÉ Corporation (Japan), LG Household & Health Care (South Korea), Beiersdorf (Germany/Switzerland), Clarins Group (France), L'Occitane Group (Luxembourg/France), Natura &Co (Brazil/Australia), Procter & Gamble (U.S.), Unilever (UK/Netherlands), Coty (U.S.), Hindustan Unilever (India), Sephora (France).

Global Premium Cosmetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 178.4 billion

- 2026 Market Size: USD 190.3 billion

- Projected Market Size: USD 341.2 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, France

- Emerging Countries: India, Brazil, Indonesia, United Arab Emirates, Mexico

Last updated on : 11 December, 2025

Premium Cosmetics Market - Growth Drivers and Challenges

Growth Drivers

- Public expenditure on organic and chemical free with advanced cosmetic formulations: Government investment in chemical safety research indirectly supports the demand for the organic cosmetic sector and utilizes natural sources as ingredients. The report from the International Trade Association in September 2023 has depicted that South Africa is on a rising stage in the use of organic products in the cosmetics sector. Moreover, nearly 74% of consumers prefer organic ingredients in personal care products, based on the NSF data in March 2025. Public environmental health programs in the EU and OECD also continue to promote exposure reduction to synthetic chemicals and preservatives, indirectly supporting the demand for organic alternatives. Further, various sustainability frameworks highlight the ongoing policy development aimed at reducing the harmful substances across the cosmetic supply chain, reinforcing long-term momentum toward organic formulations.

- Continuous innovation and R&D investment: This is the fundamental driver in the premium cosmetics market to maintain competitiveness and drive the growth in the market. Leading companies allocate significant resources to develop novel formulations, proprietary actives, and advanced delivery systems that offer clinically verifiable efficacy, differentiating their products in the crowded landscape. To justify this, leading players in the market, such as the Loreal has invested €1 billion each year and 4,000 researchers for research and innovation in the beauty industry. This strategic focus translates immediately into a strong intellectual property portfolio and a competitive edge in high-growth markets such as derma-cosmetics and environmental research. Consequently, R&D intensity becomes a key metric for investor confidence and a primary barrier to entry for smaller competitors.

- Government procurement standards in institutional personal care categories: Institutional procurement increasingly references cosmetic compliance standards, evolving ingredient disclosure, and microbial control. The U.S. government procurement documentation includes the requirement for allergen transparency and regulated preservative profiles in personal care goods supplied under the federal contracts. These technical conditions, although not explicitly cosmetic premiumization, create procurement barriers that favor validated formulations and disincentivize low-cost chemical substitutions. The personal care agents under the procurement standards require validated ingredients, indirectly supporting the broader adoption of premium-grade cosmetic materials. The presence of institutional procurement standards, even in non-retail segments, signals a system-wide demand trend that transfers into the high-end consumer cosmetics segment, where compliance documentation already exists and can be leveraged for B2B and B2C propositions.

Challenges

- The greenwashing trap and authentic sustainability: Consumer demand genuine sustainability, making superficial green claims a reputational risk. Building verifiable circular practices requires significant investment in R&D. Many key players focus on accessible refills for their core products to build credible sustainability. According to the Federal Trade Commission’s Green Guides, marketers must have reliable evidence to back environmental claims. The FTC has increased the scrutiny with a review aiming to modernize the guidelines against deceptive marketing, raising the compliance bar.

- The innovation to duplication speed cycle: The rapid pace at which the large incumbents can reverse engineer and launch similar products threatens small brands. A unique formula or technology can be copied quickly. The ordinary disrupted with transparent single ingredient formulations, but within years, major retailers launched their own skincare staple lines. Protecting IP is difficult in the cosmetics sector. Various reports have shown that the cosmetic patent filings remain high, and the legal cost of defending them can be prohibitive for small companies against the large competitors.

Premium Cosmetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 178.4 billion |

|

Forecast Year Market Size (2035) |

USD 341.2 billion |

|

Regional Scope |

|

Premium Cosmetics Market Segmentation:

Consumer Group Segment Analysis

Under the consumer group, the female sub-segment remains the undisputed core of the premium cosmetics market and is projected to hold the share value of 72.5% by 2035. The segment is driven by its deep roots in historical market development, extensive product portfolios specially formulated and marketed for the female consumers, and persistent cultural beauty norms. However, the male consumer is the fastest-growing driver; female consumption is higher. The shift is quantifiable, for example, the Bio Web of Conference study in 2024 has reported that the female consumers account for 80% to 90% of the usage of the beauty products in the total beauty market of USD 500 billion. This data clearly depicts that females spend more on personal care products and are growing consistently, with notable contributions from male-targeted goods. This expansion is forcing brands to rethink traditional gender-based marketing and product development to capture this high-growth demographic.

Distribution Channel Segment Analysis

The online or e-commerce sub-segment is leading the distribution channel segment in the premium cosmetics market and is poised to capture a significant share by 2035. The segment is powered by the seamless integration of discovery, education, and purchase with social commerce and DTC models acting as the primary growth engines. The platforms, such as Instagram, TikTok, and brand-owned sites, use influencers' content, live streaming, and advanced digital marketing to surge sales. The vital enablers are the use of augmented reality for virtual try-ons, which reduces the traditional barrier of being unable to test products online. This digital migration is a permanent behavior shift stimulated by the pandemic. Further, the Invest India report in April 2024 states that cosmetics is the second largest e-commerce sales, with 11% of the total sales being in beauty and cosmetics. Brands are therefore increasing investment in online-first product development and fulfilment infrastructure to secure long-term digital advantage.

Product Type Segment Analysis

By 2035, skincare is forecasted to be the leading product segment in the premium cosmetics market, and is driven by the decorative color cosmetics to health-focused preventative wellness. This skinification trend is fueled by the aging population seeking scientifically backed anti-aging solutions, the profound influence of multi-step K-beauty and J-beauty regimens, and the rising consumer literacy demanding proven activities such as retinoids and vitamin C. The super premium serum and treatment sub-segment is the key revenue driver within the segment, as consumers invest in high efficacy concentrated formulas. Further, the government data highlights this focus on ingredient safety and claims. The U.S. FDA maintains a database and issues reports on the sunscreen ingredients and anti-aging product regulations, their activities, and consumer updates for a sustained regulatory and public interest in skincare product safety and efficacy that shapes the premium product development and marketing claims.

Our in-depth analysis of the premium cosmetics market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Consumer Group |

|

|

Distribution Channel |

|

|

Age Group |

|

|

Pricing Tier |

|

|

Ingredient Focus |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Premium Cosmetics Market - Regional Analysis

APAC Market Insights

The Asia Pacific is dominating the premium cosmetics market and is poised to hold the revenue share of 42.6% by 2035. This dominance is driven by a massive aspirational middle class with deep cultural emphasis on skincare and beauty rituals, and rapid digitalization. The key trends include the pervasive influence of K-beauty and J-beauty, which set global benchmarks for the multi-step regimens and innovative textures, and the rise of the skintellectual consumers who seek clinically proven ingredient-focused products. The e-commerce and social commerce, mainly via platforms such as Douyin and Little Red Book in China, are the primary sales channels. The regulatory landscape is intensifying with China’s National Medical Products Administration imposing strict oversight on efficacy claims and ingredient safety that redefines the premium cosmetics market entry strategies for international brands.

India’s premium cosmetics market is expanding rapidly and is defined by the growth potential fueled by a massive young population and rapid urbanization, leading to premiumization. The primary trend is the fusion of international prestige with clean heritage beauty, where consumers seek advanced formulations that also integrate trusted Ayurvedic efficacy with cultural resonance. The Bio Web of Conferences 2024 depicts that the cosmetic industry in India has two main sections of population, such as the teenagers and women, with teenagers contributing 65% of the overall market share. This demographic dominance positions the marketing focused on teenagers and product innovation as vital for market capture. Further, as incomes rise, monthly household expenditure on cosmetics and personal care products is becoming a more significant and prioritized line item within discretionary spending.

Monthly Expenditure on Cosmetics and Personal Care Products

|

Expenditure |

Share of respondents |

|

Upto Rs 700/- |

43.88% |

|

Rs 701-1700 |

18.92% |

|

Rs. 1701-3500 |

8.57% |

|

Rs. 3501-7000 |

3.4% |

|

Rs. 7001-10000 |

1.24% |

|

> Rs. 10000 |

0.93% |

Source: Bio Web of Conferences 2024

China’s premium cosmetics market remains the indispensable global engine for premium cosmetics and is driven by its vast digitally native consumer base and advanced e-commerce ecosystem. The dominant trend is Guochao or China-chic where domestic brands leverage cultural storytelling luxury giants. This shift is underpinned by a rapidly evolving and strict regulatory landscape enforced by the National Medical Products Administration which mandates rigorous safety and claim substantiation. Concrete trade data underscores the market’s scale and demand for international brands according to the China’s General Administration of Customs the total import value of beauty cosmetics and skincare preparations reached USD 4.37 billion in October 2025, reflecting the sustained consumer appetite for foreign prestige labels alongside the rise of local players.

North America Market Insights

North America is the fastest-growing region in the premium cosmetics market and is expected to grow at a CAGR of 5.6% during the forecast period 2026 to 2035. The growth is driven by the rising consumer purchasing power, intense digitalization, and a strong culture of wellness and skincare. The key trends include the dominance of science-backed cosmeceuticals, clean beauty formulations adhering to the regulatory shifts such as the U.S. MoCRA, and the seamless integration of DTC e-commerce with omnichannel retail. The demand is increasingly shaped by demographic aging, which fuels the anti-aging solutions among the aging population. This positions the region as a critical hub for clinical-grade innovation and regulatory-compliant product development. Consequently, success in North America requires a dual focus on advanced scientific substantiation and a superior, integrated digital-to-physical consumer experience.

The U.S. premium cosmetics market is defined by the regulatory evolution and demand for clinical efficacy. The implementation of the modernization of cosmetics regulation act by the FDA is redefining the landscape, mandating a robust facility registration, ingredient safety substantiation, and fragrance allergen disclosure. The regulatory shift prioritizes the brands with strong R&D and transparent supply chains. The data from the Maine April 2025 states that the U.S. spent nearly USD 74 billion on personal care products, and the largest share is accounted towards the cosmetics, holding 47% such as perfumes, skincare, and nail care. Further, in 2024, the average annual household spending in the United States on cosmetics, perfume, bath, skincare, and nail care will be USD 264. This data indicates increased household expenditure on cosmetics, indicating a growing consumer propensity to invest larger amounts in beauty items, which drives demand for premium formulation.

Average Annual Household Spending by Product (2024)

|

Factor |

Spending (USD) |

|

Personal Care Products |

560 |

|

Cosmetics/Perfume/Bath/Skincare/Nail |

264 |

|

Hair Care |

107 |

|

Deodorant/Fem Hygiene/Misc Personal Care |

61 |

|

Oral Hygiene |

58 |

|

Wigs/Hairpieces |

10 |

Source: Maine April 2025

In Canada, the premium cosmetics market is defined by a strong consumer preference for clean, sustainable, and ethically sourced products influenced by a robust regulatory framework. The Health Canada regulation for cosmetics under the Food and Drugs Act requires pre-market notification of all products with a particular focus on ingredient prohibitions and bilingual labeling. This aligns with and reinforces the consumer-driven clean at Sephora trend. The market growth is further fueled by a culturally diverse population, mainly in major urban centers, driving the demand for inclusive shade ranges and specialized products. According to the International Trade Administration report, the Canada beauty products premium cosmetics market in 2021 reached USD 1.24 billion in revenue. This focus is improved by the proactive environmental policies, which further mandate sustainable packaging innovation.

Europe Market Insights

Europe’s premium cosmetics market is evolving rapidly and is well defined by a strong regulation high baseline of consumer advancements, and a strong cultural emphasis on skincare and luxury. The growth is mainly driven by the consumer demand for clinically proven cosmeceuticals, sustainable and natural formulations, and omnichannel retail experiences. The region’s regulatory framework is governed by the European Commission’s Cosmetic Products Regulations, which are a key driver for the introduction of new products and reinforce the customer’s trust and mandate strong safety assessments and ingredient transparency. A primary trend is the integration of digital beauty tech, such as AI-powered skin diagnostics, with physical retail. Demographic shifts, including an aging population, continue to fuel the investment in the premium anti-aging and dermo-cosmetic products.

The UK is projected to retain the highest revenue share in Europe in the premium cosmetics market by 2035. The growth is based on its status as a global beauty and retail hub, attracting international brands and investment. The primary factor is the robust e-commerce and digital adoption rate, with consumers seamlessly blending the online research with the in-store experiences. The trend towards wellness beauty, where cosmetics are viewed as part of a holistic health regimen, is strong. According to the Government of the UK data in December 2023, UK companies that are the leaders and innovators in the natural and organic beauty have exported nearly £4 billion of beauty and personal care products across the world. Consequently, domestic market growth is further amplified by strong international demand for British beauty brands.

Germany is forecasted to hold the second-largest share in the premium cosmetics market and is driven by its powerful economy and a consumer base that prioritizes scientific credibility and environmental sustainability. The demand for cosmeceuticals and dermatologist-recommended brands is the dominant trend. The regulatory influence is significant; the German Federal Environment Agency actively promotes green chemistry and circular economy principles, pushing the brands towards sustainable formulations and packaging. The report from the various official sources has indicated that the high and stable consumer spending is mainly on personal care goods. The growth is further supported by Germany’s strong manufacturing base in green chemistry, as highlighted in the government sustainability reports, allowing it to lead in the production of high-performance eco-compliant premium ingredients.

Key Premium Cosmetics Market Players:

- L'Oréal Luxe (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Estée Lauder Companies Inc. (U.S.)

- Shiseido Company, Limited (Japan)

- Chanel (Beauté) (France)

- LVMH (France)

- Coty (U.S.)

- Puig (Spain)

- Amorepacific (South Korea)

- Kao (Japan)

- KOSÉ Corporation (Japan)

- LG Household & Health Care (South Korea)

- Beiersdorf (Germany/Switzerland)

- Clarins Group (France)

- L'Occitane Group (Luxembourg/France)

- Natura &Co (Brazil/Australia)

- Procter & Gamble (U.S.)

- Unilever (UK/Netherlands)

- Coty (U.S.)

- Hindustan Unilever (India)

- Sephora (France)

- L'Oréal Luxe is a titan in the premium cosmetics market and is using its portfolio of powerhouse brands such as Lancôme and Yves Saint Laurent. Its key strategy is the integration of augmented reality and AI via apps to offer virtual try on personalizing the digital luxury experience and driving the online conversion. The company has registered a 4.5% rise in the global beauty market growth.

- The Estee Launder Companies Inc. dominates the premium cosmetics market via a strategic house of brands model, acquiring and nurturing iconic names such as Tom Ford and La Mer. Its focus is on creating ultra-exclusive, high-margin products and immersive brand-specific retail environments that cultivate a deep consumer loyalty and prestige. The company has witnessed a rise in sales of skin products by 29% in 2025, which is an increase of 1% from 2024.

- Shiseido Company Limited competes globally in the premium cosmetics market by integrating the advanced Japan skincare science with the timeless aesthetics in brands such as Cle de Peau Beaute. Its strategic initiative centers on skin beauty, utilizing the biometric data research to develop products that target skin health at a cellular level, blending science with the luxury.

- Chanel is another leading player in the premium cosmetics market via an unbending narrative of heritage and exclusivity, epitomized by its iconic No.5 fragrance and Sublimage skincare. Its strategy is meticulous control over the distribution, limited points of sale, and marketing that highlights the art and timeless elegance over the trends.

- LVMH exerts immense influence in the premium cosmetics market with the star brands such as Dior and Guerlain. Its strategy combines the cosmetics with its fashion houses, creating a compelling lifestyle universe. The company heavily invests in innovative retail markets and sustainable ingredient sourcing, hence positing luxury as both experiential and responsible.

Here is a list of key players operating in the global premium cosmetics market:

The global premium cosmetics market is highly competitive and is dominated by European and U.S. players such as L'Oréal and Estée Lauder. These player leverages extensive portfolios and global distribution. The key strategies include mergers and acquisitions of niche brands, heavy investment in digital marketing and DTC e-commerce, and a strong focus on sustainability and clean beauty to meet the ethical consumer demands. For example, e.l.f. Beauty has announced that it has signed a definitive agreement to acquire Rhode in May 2025, which is the fast-growing, multi-category lifestyle beauty brand founded by Hailey Bieber and is known for its collection of high-performance, skin-focused products. The players in Asia, including Shiseido and Amorepacific, are driving the innovation in skincare and expanding globally, while all the players are utilizing AI for personalization and experiential retail to build loyalty in an increasingly crowded and digitally driven marketplace.

Corporate Landscape of the Premium Cosmetics Market:

Recent Developments

- In October 2025, Estée Lauder announced its official launch in the Amazon.com.mx Premium Beauty store. This launch expands the access to Estée Lauder’s high-performance skin care, best-in-class makeup and iconic fragrances for customers.

- In January 2025, Hindustan Unilever Limited (HUL) has announced it has signed a definitive agreement to acquire the premium actives-led beauty brand Minimalist. This acquisition marks another step in the Beauty & Wellbeing portfolio towards evolving and higher-growth demand spaces.

- In January 2024, Puig, a global leader in premium beauty, has announced the acquisition of a majority stake in the Dr.Barbara Sturm. Puig is committed to driving the brand’s international expansion and development.

- Report ID: 8309

- Published Date: Dec 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Premium Cosmetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.