Organic Skin Care Market Outlook:

Organic Skin Care Market size was valued at USD 14.1 billion in 2025 and is projected to reach USD 34.2 billion by the end of 2035, rising at a CAGR of 9.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of organic skin care is assessed at USD 15.4 billion.

The organic skin care market is expanding significantly within the personal care industry and is defined by the formulations that use organically farmed ingredients. The market growth is driven by the rising consumer awareness on ingredient safety and environmental sustainability. The NSF data in March 2025 has depicted that nearly 74% of consumers prefer organic ingredients in personal care products. Moreover, 65% of people ask for the complete ingredient list to identify any harmful ingredients that have been added to the product. Further, regulatory bodies like the U.S. FDA provide a framework for cosmetic safety via a unified global standard for organic cosmetics.

The major concern for the transition towards the organic product is the increasing skin diseases. As per the NLM study in July 2025, 90% of the skin damage is due to solar exposure. This rising awareness is surging the adoption of natural sunscreen, botanical antioxidants, and reef-safe formulations in the organic skincare segment. Further, dermatologists are also recommending on use of mineral filters, hence driving the demand for clean-label sun protection products. This shift is aided by the regulatory emphasis on safer ingredients, promoting the brands to innovate and launch organic products for sensitive and photo-damaged skin.

Key Organic Skin Care Market Insights Summary:

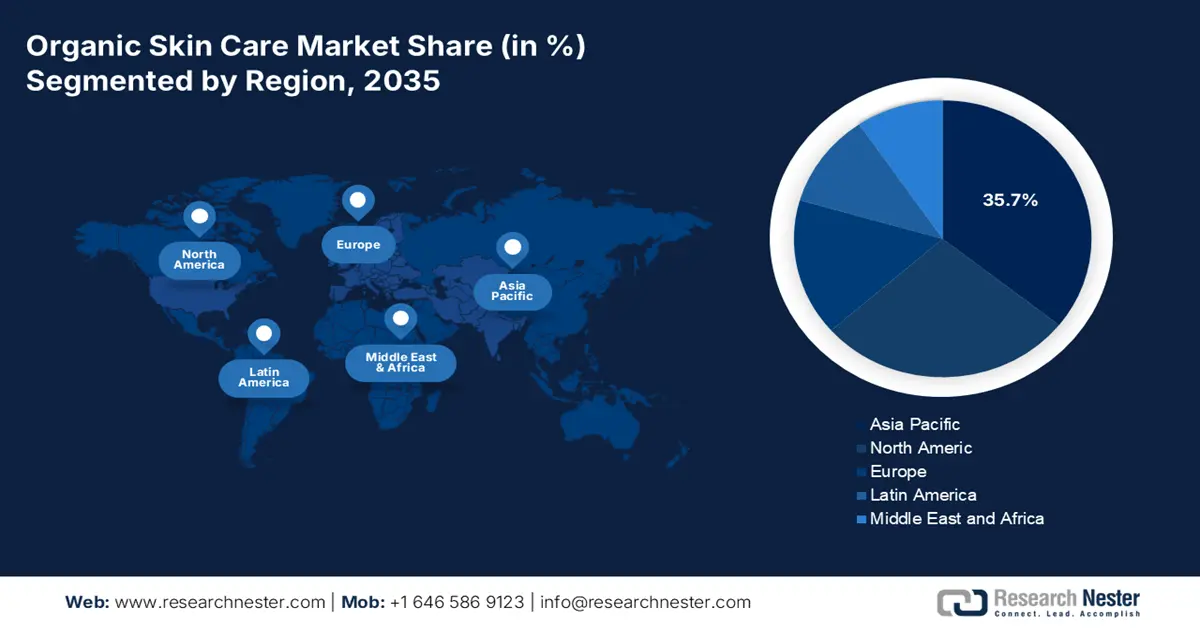

Regional Insights:

- Asia Pacific is predicted to hold 35.7% share by 2035, driven by rising disposable incomes, a growing middle class, and deep-rooted cultural traditions of using herbal and natural ingredients.

- North America is forecasted to grow at a CAGR of 6% during 2026–2035, impelled by high disposable income, advanced retail infrastructure, and strong demand for ingredient transparency.

Segment Insights:

- Individuals or consumers segment is projected to account for 88.4% share by 2035, owing to personal use for daily wellness and beauty routines.

- Women sub-segment is expected to hold a significant share by 2035, propelled by long-established beauty and self-care routines and higher spending power.

Key Growth Trends:

- Expansion of premium and masstige segments

- Regulatory support for the traditional medicine system

Major Challenges:

- High cost of certified organic ingredients

- Supply chain instability for botanicals

Key Players: Procter & Gamble Co. (U.S.), Johnson & Johnson Services, Inc. (U.S.), The Clorox Company (Burt's Bees) (U.S.), Edgewell Personal Care (Jack Black) (U.S.), L'Oréal Groupe (France), Beiersdorf AG (Germany) (NIVEA), L'Occitane Group (France), Weleda AG (Switzerland), Dr. Hauschka (Germany), Amorepacific Corporation (South Korea), LG Household & Health Care (South Korea), Shiseido Company Limited (Japan), Kao Corporation (Japan), Jurlique International Pty. Ltd. (Australia), Aesop Pty Ltd (Australia), Forest Essentials (India), Himalaya Wellness Company (India), SimplySiti Sdn. Bhd. (Malaysia).

Global Organic Skin Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.1 billion

- 2026 Market Size: USD 15.4 billion

- Projected Market Size: USD 34.2 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 4 November, 2025

Organic Skin Care Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of premium and masstige segments: Rising disposable incomes, mainly in the APAC, are fueling the growth in premium organic skincare. People are trading up from the huge organic skin care market products to high efficacy, branded organic solutions, which offer a luxury experience. As per the NSF data in March 2025, nearly 45% of people are willing to pay premium prices for organic skin care products as well as for personally certified products. This trend is expected to accelerate the beauty consciousness among millennials and Gen Z customers, who are the leading consumers of beauty products.

- Regulatory support for the traditional medicine system: The government in India is actively promoting traditional medicine via the Ministry of AYUSH by providing a powerful demand for the organic skincare market. With the standard manufacturing codes and quality control for Ayurvedic products, the Ministry creates a regulatory framework that boosts consumer confidence. This official endorsement validates the use of ancient ingredients such as turmeric, neem, and more in modern formulations as used by the Gen Z population. These organic formulations enable brands to stay ahead in the competitive edge and use government-backed, culturally significant ingredients for authentic market expansion and crowded global organic skin care market growth.

- Increased investment and strategic initiatives: With a clear focus on expansion via strategic initiatives and increased investments, companies are aiming for mergers and acquisitions to expand their footprint. For example, L'Oréal grabbed a significant stake in Medik8 in July 2025, signaling the expansion and innovation of the market. The company's 2024 growth increased by 5.6% and nearly 33% of the sales were made in the European market. These cross-border strategic partnerships and portfolio expansion into organic categories are expected to surge further.

Challenges

- High cost of certified organic ingredients: Sourcing for certified raw materials is more expensive than the chemical alternatives. This rising cost is due to the robust farming practices, supply chain complexities, and lower yields. This high input cost is passed to the customers, creating a huge pricing barrier that limits the adoption of the organic skin care products. For government and payer consideration of organic products, this cost is a premium, making the organic option less viable compared with cheaper and synthetic-based medical creams. Further, many companies prioritize regenerative organic agriculture, absorbing high sourcing costs to ensure the purity, a model that is not scalable for all brands and contributes to a premium price point.

- Supply chain instability for botanicals: Organic skincare are often relied on the botanical harvests that are vulnerable to climate change, pests, and geopolitical issues. These issues lead to supply volatility and price fluctuations. Further, the WHO states that climate change is a major threat to medicinal plants. This instability jeopardizes consistent product formulation and availability, hence making it a risky long-term investment for suppliers and an unreliable option for government health programs.

Organic Skin Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 14.1 billion |

|

Forecast Year Market Size (2035) |

USD 34.2 billion |

|

Regional Scope |

|

Organic Skin Care Market Segmentation:

End user Segment Analysis

Individuals or consumers dominate the segment of organic skin care market and are expected to hold the share value of 88.4% by the end of 2035. The segment is driven by personal use for daily wellness and beauty routines. This transition is towards the ingredient consciousness and a clean lifestyle for beauty routines. Consumers nowadays are aware on the formulations and are seeking products that align with their personal health values and ethical standards related to animal welfare and sourcing. Further, the purchasing behavior driven by the cultural move and digital content move towards holistic living, and ensures that major market revenue is generated by individual customers.

Consumer Demographics Segment Analysis

The women sub-segment is leading the segment and is projected to hold a considerable share value by 2035. The segment is driven by the long-established beauty and self-care routines, and higher spending power. The Information Sciences Letters Journal has published an article on factors affecting female green purchasing behavior of green cosmetics in Bahrain in September 2023, and stated that nearly 58% of the women in the U.S. prefer utilizing natural and organic cosmetic products. Further, 69% women depend on green cosmetics products. This data highlights the purchase of certified organic brands, which aligns with the wellness and health values.

Price Point Segment Analysis

The premium sub segment leads the price point segment due to the high quality, and consumers equate cost with efficiency and organic ingredients. Shoppers invest in products that offer clinical-grade results from natural sources and prefer for sustainable and aesthetically pleasing packaging. The NLM study in January 2025 depicts that men are willing to pay more than women for plant-extracted skin care products. Further, consumers are conscious about the premium cost of organic skincare, as they believe that these brands are not used for luxury but for long-term skin health.

Our in-depth analysis of the organic skin care market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

Consumer Demographics |

|

|

Packing |

|

|

Price Point |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Skin Care Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the organic skin care market and is poised to hold the market share of 35.7% by 2035. The market is driven by the rising disposable incomes, a burgeoning middle class, and deep-seated cultural traditions of using herbal and natural ingredients. The market is in demand due to the high pollution in urban areas, which surges the requirement for protective and detoxifying formulations. The main trend is the fusion of advanced biotechnology with ancient botanical wisdom, such as integrating natural and organic products, such as turmeric, ginseng, and green tea, into essences and serums in skin care products.

China is dominating the APAC organic skin care market and is fueled by the clean beauty trends and rising awareness on health and beauty. According to the NLM study in November 2022, the cosmetic market in China reached USD 60 billion in 2021, and this rise is due to the social media influence and awareness of the risks related to using harmful chemicals in cosmetics. Further, the OEC data depicts that China’s export of beauty products accounted for USD 70.4 billion in 2023, including organic skin care products. This data highlights the nation’s strong manufacturing system and demand for naturally derived beauty products.

India is a high-growth market and is defined by the rising young population and cultural affinity for Ayurveda. People are actively seeking chemical free products that use traditional-based ingredients such as sandalwood and turmeric in modern formulations. This rising demand is aided by the government initiatives via the Ministry of Ayush that promote standardization and acceptance of Ayush products globally. As per the OEC data in 2023, India beauty products export reached USD 347 million. The market is fragmented with various brands and many new digital native startups that are competing in a space where natural provenance and authenticity are the key purchase drivers.

Trade Flow of Beauty Products in 2023

|

Country |

Export (USD billion) |

Import (USD billion) |

|

South Korea |

8.03 |

2.49 |

|

Japan |

4.9 |

1.53 |

|

Singapore |

2.29 |

2.82 |

Source: OEC 2023

North America Market Insights

North America is the fastest-growing market in the organic skin care and is expected to grow at a CAGR of 6% during the forecast period, 2026 to 2035. The region is driven by the high consumer disposable income, advanced retail infrastructure, and stringent demand for ingredient transparency and product efficacy. The market is defined by the strong clean beauty movement, where customers avoid using sulfates, parabens, and synthetic fragrances. The key trend includes the rise of organic ingredients and waterless formulations. Further, direct to consumers and digital marketing are playing a key role in educating the customers and are steadily expanding the market.

The U.S. organic skin care market is driven by the rising consumer demand for scientific validation. The market witnesses a functional growth in multifunctional products with proven efficacy that educate on chemical safety. The NLM study in September 2022 depicts that the FDA has approved many formulas with honey as the main ingredient in L-Mesitran ointment that consists of 48% medical-grade honey, calendula, aloe vera, zinc oxide, lanolin, cod liver oil, sunflower oil, and vitamins C and E. This growing preference is clinically backed by a natural formulation that demands bioactive skincare, supporting the expansion of the market.

The organic skin care market in Canada is highly influenced by the rising consumer preference for sustainable and authentically certified products. Cosmetic brands in Canada are mainly sourced from bio-based ingredients and are eco-friendly. The International Trade Administration report in May 2022 has depicted that the cosmetic market in Canada reached USD 1.24 billion in 2021. Further, the report has stated that 40% of the skin care market in Canada is organic and ethically sourced products. Further, trends such as buyers' age, gender, use of technology, and ethnicity are contributing to the market growth.

Trade Flow of Beauty Products in 2023

|

Country |

Export (USD billion) |

Import (USD billion) |

|

U.S.a |

6.86 |

6.58 |

|

Canada |

1.94 |

1.86 |

Source: OEC 2023

Europe Market Insights

The organic skin care market in Europe is defined by robust regulations, strong cultural affinity, and high consumer awareness for natural and sustainable products. The growth of the market is mainly driven by the restrictions or bans on harmful chemicals. The AXA data in October 2022 depicts that more than 1,300 harmful chemicals were banned in the cosmetic industry. This builds a significant trust in product safety. The key trends include the rise of high-quality products and demand for locally sourced botanicals. On the other hand, the digital influence and wellness of skin are viewed as part of a holistic health regimen are also vital drivers. The market is further competitive and features a mix of established pharmacies, digital native startups, and luxury brands.

The organic skin care market in Germany is fueled by the ingrained culture of health consciousness and unparalleled consumer trust in certifications such as the stringent BDIH Controlled Natural Cosmetics label. Further, consumers actively seek ingredient safety. German consumers are seeking scientific proof for the ingredients added and their efficiency. Supportive government policies, such as the Federal Environment Ministry funding for sustainable industry practices, are boosting the market further by incentivizing green innovation and supply chain transparency, hence making Germany a hub for advanced organic skin care product manufacturing.

The UK is the top organic skin care market player in Europe and is driven by the powerful wellness beauty convergence and advanced digital retail landscape. British consumers are influenced by the demand for the brands and are highly influenced by social media, with strong ethical consideration for sustainability and cruelty-free practices. For example, Paiskincare player in the UK, provides 100% skin care products that are 100% made with natural ingredients. The growth of independent, organic brands that use e-commerce and direct-to-consumer models is a key trend prompting companies to respond to the market demands.

Trade Flow of Beauty Products in 2023

|

Country |

Export (USD billion) |

Import (USD billion) |

|

France |

13.1 |

2.55 |

|

Italy |

3.84 |

1.56 |

|

UK |

2.63 |

2.69 |

Source: OEC 2023

Key Organic Skin Care Market Players:

- Estee Lauder Companies Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procter & Gamble Co. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- The Clorox Company (Burt's Bees) (U.S.)

- Edgewell Personal Care (Jack Black) (U.S.)

- L'Oréal Groupe (France)

- Beiersdorf AG (Germany) (NIVEA)

- L'Occitane Group (France)

- Weleda AG (Switzerland)

- Dr. Hauschka (Germany)

- Amorepacific Corporation (South Korea)

- LG Household & Health Care (South Korea)

- Shiseido Company Limited (Japan)

- Kao Corporation (Japan)

- Jurlique International Pty. Ltd. (Australia)

- Aesop Pty Ltd (Australia)

- Forest Essentials (India)

- Himalaya Wellness Company (India)

- SimplySiti Sdn. Bhd. (Malaysia)

- In the organic skin care market, Estee Lauder’s is leading the market with an innovative strategy on prestige and acquisition. The company acquires top organic brands such as Dr. Jart+ and Aveda to expand its portfolio and capture a huge consumer base. This is complemented by focusing on research to infuse scientifically backed, potent organic ingredients into its formulations. The net sales of skin care products in 2024 reached USD 7,908 million.

- Procter & Gamble uses its immense scale to mainstream the organic skin care market. The brands such as Native and Herbal Essences Bio Renewals integrate organic ingredients into accessible, high-volume products. Further, P&G performs significant investment in R&D to create proprietary, sustainable formulations that meet ethical sourcing standards and efficacy. The company has achieved USD 84 billion in sales in 2024, with the operating cash flow of USD 19.8 billion.

- Johnson & Johnson’s approach in the organic skin care market is rooted in its legacy of dermatological science and safety. The company focuses on cleanical beauty merging certified natural and organic ingredients with clinically proven efficiency mainly for sensitive skin. J&J invests more in testing to evaluate the performance and mildness of its organic-infused products.

- The Clorox Company is the best player in the organic skin care market. The company's core strategy is the commitment to its Natural Origins promise, where a high percentage of the products are certified as natural. The company's subsidiary Burt’s Bees focuses mainly on sustainable and ethical sourcing of key ingredients such as beeswax and botanical oils. To maintain the dominant position, the company fosters deep consumer loyalty.

- Edgewell Personal Care targets a specific consumer within the organic skin care market via its premium Jack Black brand. The strategy aims for performance-driven men’s grooming, incorporating high-quality ingredients that are organic, such as shea butter and blue algae, into advanced multifunctional products. This approach is aided by a strong direct-to-consumer e-commerce model and selective retail partnership.

Below is the list of some prominent players operating in the organic skin care market:

The global organic skin care market is very competitive and fragmented, including a dynamic mix of multinational conglomerates and agile niche brands. Some key players are dominating the market, such as L'Oréal and Estée Lauder use a huge distribution network and marketing to achieve sales. Top brands are actively adopting strategic initiatives to secure and dominate their market. These initiatives focus on scientific innovation with clinical formulations, strategic acquisitions of indie brands to gain more consumer bases. For example, Unilever acquired men’s personal care brand Dr. Squatch in June 2025. Further, these brands make significant investments in influencer collaborations and digital marketing.

Corporate Landscape of the Organic Skin Care Market:

Recent Developments

- In October 2024, Evonik partners with Kolmar to innovate the Chinese beauty industry. This collaboration fuels innovation in raw materials, including sustainable ingredients, color cosmetics solutions, sun care, and efficient active ingredients.

- In July 2024, American Exchange Group acquired Indie Lee. Indie Lee's portfolio includes eye balm, toner, cleanser, and body scrub. The acquisition aims to expand the brand beyond skincare and leverage American Exchange's retail distribution.

- In July 2024, CORE Industrial Partners acquired cosmetics and skincare brand Winky Lux to scale operations, expand digital and retail channels such as Target and Ulta, and boost product innovation.

- Report ID: 8216

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Skin Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.