Skin Care Market Outlook:

Skin Care Market size was valued at USD 199.1 billion in 2025 and is projected to reach USD 418 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of skin care is assessed at USD 214.4 billion.

The market is expanding rapidly and is driven by the increasing consumer interest in skin-conscious and environmentally aware products, as documented in government sources. The skin care sector continues to demonstrate consistent growth, supported by aging populations, increased consumer health literacy, and evolving public health priorities. Dermatological disorders continue to rank among the most common health issues worldwide, according to the National Institutes of Health, which has led to a persistent need for therapeutic and preventive skin care products. The American Academy of Dermatology Association data in 2025 depicts that acne is the most common skin condition in the U.S., and it affects more than 50 million people, contributing to a robust domestic market for both prescription and over-the-counter products.

On the trade side, the global trade value in beauty products reached USD 70.4 billion, based on the OEC 2023, highlighting the rising demand for prominent skin care products internationally. Countries such as China, Germany, and the UK are the top export markets, indicating a high demand for top brands and formulations. The data also provides evidence that China is the top importer and France is the top exporter of beauty products with exports valued at USD 13.1 billion. Further, the organic skin care ingredients, demand for sustainable packaging, and digital retail channels. The organic skin care market is driven by the rising consumer awareness of ingredient safety and environmental sustainability.

Key Skin Care Market Insights Summary:

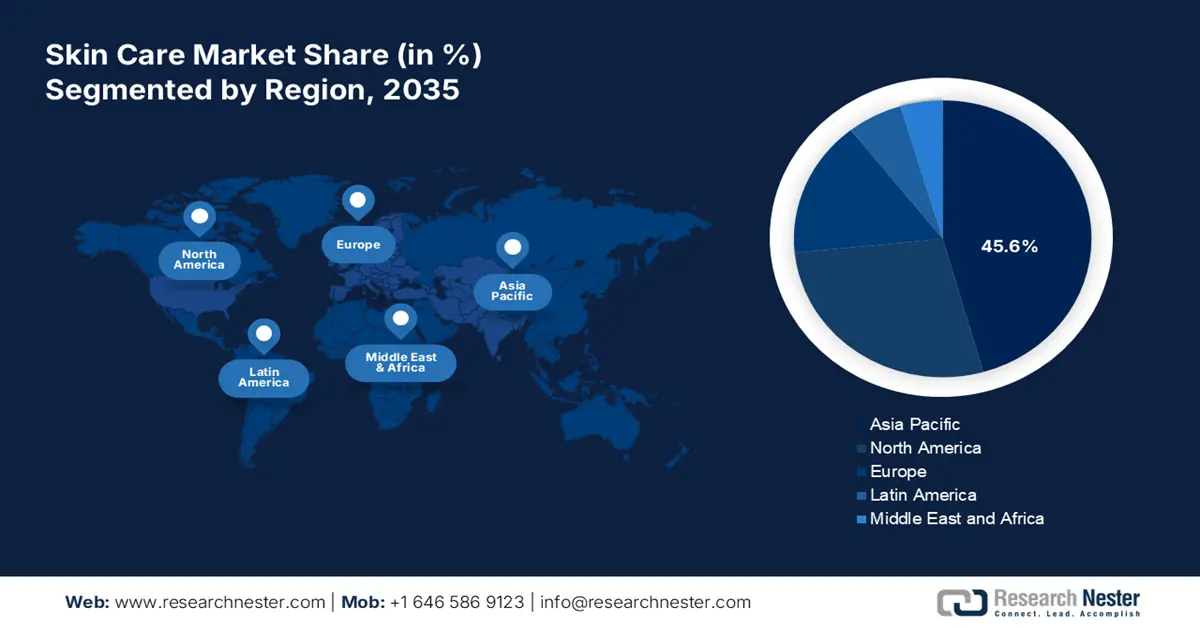

Regional Insights:

- By 2035, APAC is set to command a 45.6% share of the skin care market, underpinned by deep-rooted skincare knowledge and the strong impact of digital and social-media–driven trends.

- North America is anticipated to be the fastest-growing region through 2026–2035 in the skin care market, supported by rising demand for advanced anti-aging solutions and clinically driven clean-beauty innovations.

Segment Insights:

- By 2035, the adults segment in the skin care market is estimated to hold an 89.5% share, sustained by higher purchasing power and varied age-specific skin concerns that necessitate continuous demand for targeted solutions.

- Women are expected to capture a substantial share by 2035, fueled by established multi-step routines and marketing strategies that prioritize female-centric skincare preferences.

Key Growth Trends:

- Digitalization and data driven personalization

- Aging population and male grooming

Major Challenges:

- Robust and fragmented regulatory constraints

- Supply chain and ingredient bans

Key Players: L'Oréal (France),Estée Lauder Companies (USA),Procter & Gamble (USA),Johnson & Johnson (USA),Shiseido (Japan),Unilever (UK/Netherlands),Beiersdorf (Germany),LVMH (France),Chanel (France),Kao Corporation (Japan),Amorepacific (South Korea),LG Household & Health Care (South Korea),Natura &Co (Brazil),Coty Inc. (USA),L'Occitane Group (Luxembourg/France),Pola Orbis Holdings (Japan),KOSÉ Corporation (Japan),Edgewell Personal Care (USA),The Jala Group (China),Galderma (Switzerland)Company Overview.

Global Skin Care Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 199.1 billion

- 2026 Market Size: USD 214.4 billion

- Projected Market Size: USD 418 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (45.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Key Players: Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 13 November, 2025

Skin Care Market - Growth Drivers and Challenges

Growth Drivers

- Digitalization and data driven personalization: E-commerce and social media have transformed purchasing behavior. The rise of AI and augmented reality has made online sales hyper-personalized. Brands use AI algorithms to create custom blended products based on individual customer surveys, which include skin type, environment, and lifestyle. The NLM study in December 2023 depicts that 51% of females are familiar with the skin product via social media. This data highlights the permanent shift to digital-first consumer engagement, pushing brands to invest in direct consumer channels and personalized digital experiences to capture market share. Due to this change, brands use data analytics not only for marketing but also to completely redefine the inventory control and product creation to better meet the needs of individual customers.

- Aging population and male grooming: Two different demographics are expanding the consumer base, which are the growing aging population seeking anti-aging solutions and the rapid rise of the male grooming market. The NCOA data in July 2024 has reported that 31.9 million women and 25.9 million men were aged above 65 in 2022. These demographic bases are a rising demand for anti-aging skin care solutions. Governments, like Statistics Canada, project a significant increase in the senior demographic, creating a sustained demand for products targeting wrinkles and age spots.

- Economic growth in the emerging markets: Rising disposable income in developing markets is the primary driver for the global skin care growth, particularly in the APAC. As the middle class expands, the spending on non-essential goods also rises, including premium personal care. The World Bank data on GDP per capita growth in countries like India and Indonesia directly correlates with increased market penetration for both mass and prestige skin care brands. In order to attract new first-time users, big firms are making significant investments in marketing and distribution networks in these high-growth countries, which is changing their worldwide strategy.

Challenges

- Robust and fragmented regulatory constraints: Manufacturers face complex web of regulations such as prohibition of animal testing in EU and China’s historical requirement for it. This fragmentation raises the compliance cost and maximizes the time period for the market entry. The WHO states that this regulatory harmonization is the vital challenge to create region-specific formulations and dossiers, an important burden for smaller entrants lacking large legal and regulatory affairs departments, hence stifling innovation and reducing the global flow of products.

- Supply chain and ingredient bans: With the sudden regulatory changes, such as the ban of microplastics or restrictions on particular chemicals that are harmful, it instantly disrupts the product lines and invalidates inventory. The European Chemicals Agency highlights that these bans protect the environment and human health. Manufacturers must monitor the global regulatory standards and reformulate the products. This makes the product price costlier and time-consuming for market entry. This barrier for companies that directly rely on a complex supply chain for the sourcing of the ingredient from one country and may be deemed non-compliant in another, creating instability and increasing the cost.

Skin Care Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 199.1 billion |

|

Forecast Year Market Size (2035) |

USD 418 billion |

|

Regional Scope |

|

Skin Care Market Segmentation:

Demographic Segment Analysis

Adults lead the segment and are poised to hold the share value of 89.5% by 2035. The segment is driven by the highest purchasing power and faces a wide spectrum of skin concerns from acne in young adulthood to intensive anti-aging treatment in later years. This drives a continuous demand for varied targeted solution which includes serums, moisturizers, and preventive care such as sunscreen. According to the U.S. Bureau of Labor Statistics data in September 2024 states that the annual average expenditure of personal care products in the U.S. is USD 950K, highlighting the significant market contribution. This high expenditure states the segment's resilience and its vital role as the key revenue engine for the entire market.

Gender Segment Analysis

Women are leading the gender segment and are expected to have a reasonable share value by 2035 due to the targeted marketing and deeply established skincare routines. Women are considered the primary consumers of multi-step regimens, and they are often the decision-makers for household purchases. The demand for these skin care products is fueled among specific females due to their health-related skin changes and a strong focus on anti-aging. According to the FDA's 2023 Voluntary Cosmetic Registration Program, the vast majority of submissions were for products targeted mostly at women, such as foundations and moisturizers for the face, which reflects their dominating market share.

Ingredient Segment Analysis

Synthetics lead the segment and they are driven due to their stability, efficacy and specific clinically proven results, which are difficult to replace with the natural alternatives. As per the Frontiers study published in October 2024, it is identified that there are nearly 10,000 ingredients in cosmetic products, and most of them are synthetic. Ingredients, such as retinoids, peptides, and hyaluronic acid, form the backbone of clinically effective anti-aging and targeted treatment products. The targeted production delivers reliable results to enhance the consumer's trust and ensure consistent purity and potency. Further, ongoing scientific research is creating new, more advanced synthetic substances that push the limits of cosmetic efficacy and maintain their market dominance.

Our in-depth analysis of the skin care market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Demographic |

|

|

Category |

|

|

Distribution Channel |

|

|

Ingredient |

|

|

Gender |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Skin Care Market - Regional Analysis

APAC Market Insights

APAC is dominating the skin care market and is poised to hold the market share of 45.6% by 2035. The market is defined by its huge size, rapid innovation and diverse consumer preferences. The main drivers are deep knowledge of skin care routines and the strong influence of digital marketing and social media. South Korea and Japan are leading the APAC market by their advanced multi-step regimens and novel ingredients such as snail mucin and galactomyces. The market is also witnessing a surge in demand for functional, clean beauty products and dermacosmetics, driven by growing skin health awareness. For example, the China-specific Guochao trend, which sees consumers opting for the domestic brands that incorporate traditional ingredients, is a major growth vector.

China market is the largest in the APAC and is expected to hold a considerable share during the forecast period, 2026 to 2035. The market is driven by the clean beauty trends and increasing awareness of health and beauty. The NLM study in November 2022 provided evidence stating that the cosmetic market in China accounted for USD 60 billion in 2021. The main reason for this surge is the rising social media influence and awareness of the risks related to using harmful chemicals in cosmetics. The National Medical Products Administration (NMPA) regulates the sector, and its stringent filing process for imported cosmetics ensures product safety. Further, the OEC data depicts that China’s export of beauty products accounted for USD 4.41 billion in 2023. This value reports the nation’s strong manufacturing base and demand for traditionally derived beauty products.

South Korea is the second largest leader in the APAC market and is driven by the relentless innovation, fast-paced product cycles, and cult like international following for K-Beauty. The market is defined by the dedicated focus on achieving glass skin, multi-step routines, and revolutionary product formats like cushion compacts and highly concentrated serums. As per the International Trade Administration data published in December 2023, South Korea is one of the top ten beauty markets globally. the report states that in 2021, the nation production value of cosmetics was nearly USD 14.5 billion, which is a rise of 21.3% compared to the previous year. Further, South Korea’s cosmetic products are mainly exported to the U.S. and France. The industry consistently generates billions in annual exports, highlighting the nation's status as a dominant and influential beauty innovation hub on the world stage.

South Korea’s Total Market Size for Cosmetics

|

Factors |

2019 |

2020 |

2021 |

|

Total Local Production |

13,959 |

12,853 |

14,549 |

|

Total Exports |

6,554 |

7,572 |

9,182 |

|

Total Imports |

1,637 |

1,168 |

1,305 |

|

Imports from the US |

309 |

279 |

300 |

|

Total Market Size |

9,042 |

6,449 |

6,672 |

|

Exchange Rate 1USD |

1,165 |

1,179.6 |

1,144.6 |

Source: ITA December 2023

North America Market Insights

North America is considered to be the fastest-growing skin care market and is expected to grow at a CAGR of 6.9% by 2035. The market is driven by a strong focus on anti-aging solutions and advanced ingredient innovation. The dominance of e-commerce, demand for clinical and clean-beauty products with transparent labeling, and personalization via AI and technology are the key drivers for the market growth. According to the Personal Care Council's data for 2024, the personal care products sector's influence included a USD 2.6 billion trade surplus and a significant contribution to the country's GDP, which reached USD 308.7 billion, underscoring its leadership in the national economy. On the other hand, digital marketing and direct-to-consumer are enhancing their role in educating the customers, which expands the market steadily.

The U.S. market is defined by strong demand for science-backed and preventive solutions. The key trend for the market growth is the consumers actively seeking multi-functional products containing clinically proven active ingredients. According to the NLM study in August 2024, 90% of the people in the U.S. use personal care products daily. These personal products enhance the attractiveness and boost self-confidence among the well-being, which is the primary driver of the demanding market. Additionally, a digitally engaged consumer base that uses online tools to investigate ingredients and verify marketing claims amplifies this wellness-focused demand. This has compelled brands to invest heavily in clinical testing and transparent communication to build trust and loyalty in a competitive marketplace.

The skin care market in Canada is driven mainly by the strong consumer base prioritizing natural and sustainable beauty products. The harsh climates and diverse multicultural skin types are the key trends driving the market growth. As per the International Trade Administration data in May 2022, the cosmetic market in Canada accounted for USD 1.24 billion in 2021. Nearly 40% of the market in Canada is ethically sourced products that are organic. Further, trends such as gender, use of technology, buyers' age, and ethnicity are contributing to the market growth. The nation's growing immigrant population influences demand for inclusive shade ranges and specific cultural beauty solutions. People nowadays are seeking certifications for cruelty-free, vegan, and organic attributes.

Europe Market Insights

Europe’s skin care market is set to grow with the strong consumer preference for premium, sustainable, and efficacious products. The key drivers are the rising aging population seeking advanced anti-aging solutions and the rising awareness of skin health, which accelerates the self-care trends. The strict regulatory framework managed by the European Medicines Agency (EMA) and the European Commission's Health and Digital Executive Agency (HaDEA), which promotes consumer trust through strict safety requirements, is a major market trend. E-commerce and social media are influencing purchasing decisions and enabling direct-to-consumer brands to gain attention in the premium brands market.

UK holds the highest revenue share in the Europe skin care market, and the growth is backed by the high consumer base opting for premium and digital-first brands. The UK government enforces strict safety regulations on skin care products that build trust and demand high ingredient transparency from brands. As per the OEC 2023 data, the UK has exported USD 2.63 billion worth of beauty products around the world. This data highlights the high demand for skin care products in the nation. Further, the key trend is the demand for sustainable and vegan products, which is supported by various organizations. The market is also characterized by robust e-commerce penetration and the influence of beauty influencers, making digital marketing a critical growth factor.

Germany is the second-largest market in Europe and is expected to hold a significant revenue share by 2035. The market is driven by the well-established dermocosmetics sector and a consumer preference for clinically proven, high-efficacy products. People in the country prefer high brand loyalty to pharmaceutical-grade brands available in pharmacies. The Federal Institute for Risk Assessment provides extensive research and consumer guidance on product ingredients, reinforcing the demand for safety and scientific validation. The natural cosmetics movement is a major trend, with companies following stringent certifications from organizations like BDIH. This guarantees ongoing growth for medicalized and sustainable skin care products, especially when coupled with an aging population that actively manages skin health.

Key Skin Care Market Players:

- L'Oréal (France)

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Estée Lauder Companies (USA)

- Procter & Gamble (USA)

- Johnson & Johnson (USA)

- Shiseido (Japan)

- Unilever (UK/Netherlands)

- Beiersdorf (Germany)

- LVMH (France)

- Chanel (France)

- Kao Corporation (Japan)

- Amorepacific (South Korea)

- LG Household & Health Care (South Korea)

- Natura &Co (Brazil)

- Coty Inc. (USA)

- L'Occitane Group (Luxembourg/France)

- Pola Orbis Holdings (Japan)

- KOSÉ Corporation (Japan)

- Edgewell Personal Care (USA)

- The Jala Group (China)

- Galderma (Switzerland)Company Overview

- L’Oreal is a global skin care company, uses advanced technology to personalize beauty. Its strategic initiatives highly focus on acquiring augmented reality and AI startups to power the virtual try-on tools and develop diagnostic devices, such as Perso, to create custom serum formulas at home. In 2024, the total sales reached €43.48 billion.

- Estee Lauder Companies is a dominant player in the market via a strong brand portfolio and direct-to-consumer strategy. The key initiatives such as highlighting the high-margin hero product from brands, including La Mer and Estee Lauder, while strategically acquiring niche, high-growth brands like Dr. Jart+ to capture the K-Beauty trend. The net sales of the company’s skin care products reached USD 7,908 million in 2024.

- Procter & Gamble leads the skin care market with its flagship brand, Olay. The company's key strategy revolves in offering prestige-quality technology at an accessible price point.P&G makes significant investments in scientific research, which results in improvements like as its peptide complex-based Olay Regenerist range.

- Johnson & Johnson's strategy is witnessed as a leading player in the skin care market. Its iconic brands, Neutrogena and Aveeno, are positioned at the intersection of beauty and wellness. J&J is reformulating to be gentler and more inclusive, and is focusing on ingredient transparency and expanding its service to cater to sensitive skin conditions.

- Shiseido is a leading skin care market player in Japan and differentiates itself via cutting-edge research, mainly in skin biology and bioavailability. Its strategic initiatives are centered on developing products that aim to prevent signs of aging before they appear. This is supported by innovations like its proprietary technology for sustained-release formulations.

Here is a list of key players operating in the global market:

Of the countless skin care companies, a select group of giants and dynamic specialists lead the market. Relentless innovation, strategic acquisitions of promising independent companies, and a strong shift towards digital marketing and clean, sustainable formulations characterize the intensely fragmented competitive scene. For example, in July 2024, Givaudan completed its acquisition of b.kolormakeup & skincare. Key players are actively expanding their footprint in emerging markets with advanced technologies like AI for personalized product recommendations. Agile K-Beauty powerhouses and digitally native businesses that connect directly with customers via social media constantly challenge the supremacy of major giants like L'Oréal and Estée Lauder.

Corporate Landscape of the Skin Care Market:

Recent Developments

- In August 2025, Beiersdorf has introduced its first-ever epigenetic serum to the mass market under its iconic NIVEA brand, which makes a breakthrough age-reversing skin care more accessible. EPICELLINE is the epigenetic ingredient that reverses skin age and activates skin longevity.

- In January 2025, Hindustan Unilever Limited (HUL) announced that the company has signed a definitive agreement to acquire the premium actives-led beauty brand Minimalist. This acquisition marks another step in the transformation journey of its Beauty & Wellbeing portfolio towards evolving and higher growth demand spaces.

- In December 2024, L’Oréal Groupe announced that the company has signed an agreement with Swiss retail group Migros to acquire its subsidiary Gowoonsesang Cosmetics Co, Ltd, including the Korean skincare brand Dr.G, which is founded by dermatologist Dr. Gun Young Ahn.

- Report ID: 8234

- Published Date: Nov 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Skin Care Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.