Baby Care Products Market Outlook:

Baby Care Products Market size was valued at USD 254.8 billion in 2025 and is projected to reach USD 256.6 billion by the end of 2035, rising at a CAGR of 8.1% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of baby care products is evaluated at USD 255.0 billion.

The market witnesses a significant growth owing to the higher birth rates in developing regions, enhanced spending by parents on infant health and hygiene, and the increase in the number of retail and e-commerce distribution channels. Customers for baby care products broadly cover newborns, infants, and toddlers, with dependency periods running into months or even years. As per a report by NLM in July 2025, according to the World Health Organization (WHO) 2024 report, approximately 2.3 million newborns died in their first month of life in 2022, with neonatal infections, congenital anomalies, premature birth, and birth complications being the leading causes of neonatal death. Addressing these challenges involves a complex chain of supply that spans sourcing raw materials, manufacturing components, assembling devices (feeding bottles, monitors), quality control, and distribution.

Polymers and specialty additives are sometimes imported by producers from chemical hubs, while the final assembly is done in regional clusters close to the market demand.

Exports and imports exhibit rising volume trends. As per a report by the U.S. Bureau of Labor Statistics in September 2025, producer prices for medical equipment, half of which overlap with baby care devices, rose at a rate of 0.6% for 12 months. In niche subsegments such as smart monitors and advanced formulas, R&D and deployment investments remain modest and are typically driven only by leading multinational firms; grant approvals or funding from nonprofit organizations remain rare in the market.

Key Baby Care Products Market Insights Summary:

Regional Highlights:

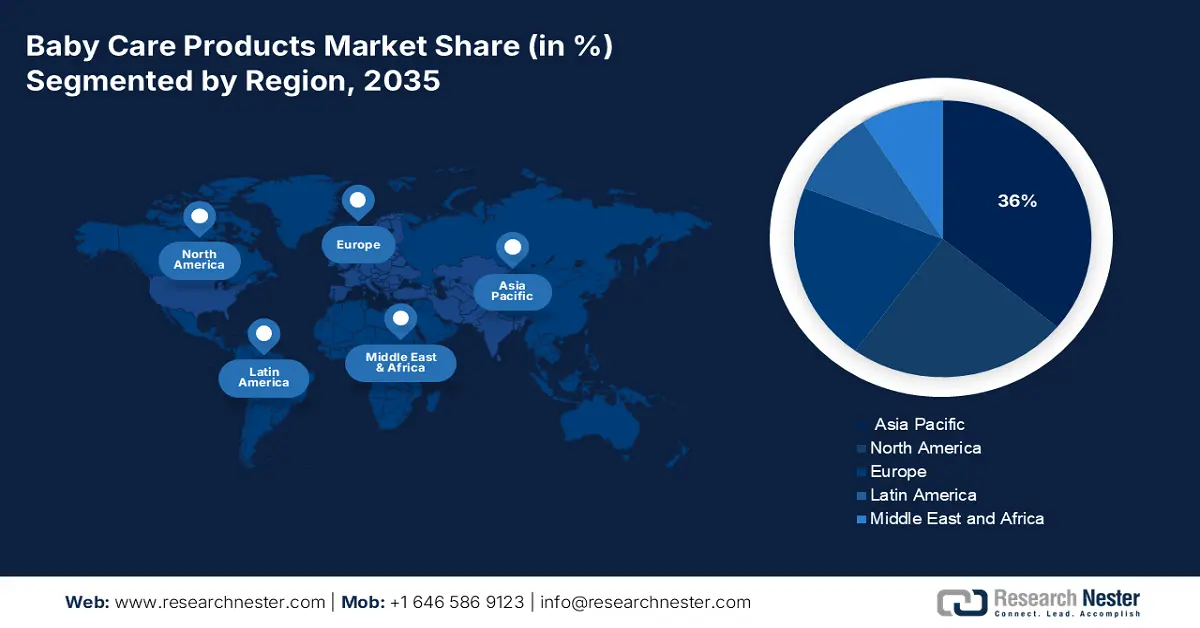

- The Asia Pacific baby care products market is projected to command a 36% share by 2035 owing to the rising number of working mothers and increasing urbanization.

- Europe is anticipated to be the fastest-growing region for the baby care products market through 2026–2035, spurred by growing awareness of baby hygiene and a shift toward sustainable product preferences.

Segment Insights:

- Conventional formulations are expected to capture a 61% share by 2035 in the Baby Care Products Market, propelled by lower production costs and longer shelf life compared to organic alternatives.

- The mid-range price tier segment is projected to hold the largest revenue share by 2035, driven by affordability, product accessibility, and consistent repeat purchases.

Key Growth Trends:

- Rising demand from premature and medically fragile infants

- Increasing focus on improving early infant health outcomes

Major Challenges:

- Maintaining quality and safety standards

- Managing complex supply chains

Key Players: Johnson & Johnson, Procter & Gamble (P&G), Kimberly-Clark Corporation, Nestlé S.A., Unilever plc, Beiersdorf AG, The Himalaya Drug Company, Honasa Consumer Pvt. Ltd. (Mamaearth), Sebapharma GmbH & Co. KG, Essity AB, Dorel Industries, Frida, FirstCry, Cotton On Group, Goodbaby International Holdings Limited.

Global Baby Care Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 254.8 billion

- 2026 Market Size: USD 255.0 billion

- Projected Market Size: USD 256.6 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Indonesia, Brazil, South Korea, Mexico

Last updated on : 13 October, 2025

Baby Care Products Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand from premature and medically fragile infants: The growth of the market is propelled by the growth in demand for premature and medically vulnerable newborns. As per a report by the Karnataka Paediatric Journal in January 2025, around 3.5 million babies in India are born far too early, and around 1 million newborns are discharged from Special Newborn Care Units (SNCUs) every year. These babies require continuous, specialized care following their discharge, which builds up the demand for safe, quality baby hygiene and health care products.

- Increasing focus on improving early infant health outcomes: Another key driver of the market is the growing recognition of gaps in the practice of infant health and healthcare in early life. As per a report by the Karnataka Paediatric Journal in January 2025, only 41% of newborns in India are breastfeeding. Early initiation of breastfeeding is vital to child survival and immunity. Stillbirths or late abortions constitute a very high proportion at 4 per 1,000 births, and many of the neonatal deaths in the special newborn care units (SNCUs) are supposed to be due to asphyxia, reflecting the weaknesses in the system. These issues are pushing demand for supportive baby care products that assist in postnatal care, hygiene, and feeding.

- Shifting demographics and targeted product demand: Changing population dynamics have been playing a prominent role in the baby care product market. As per a report by PIB in September 2025, while the birth rates in India have been showing a generally downward trend, increasing at least in the rural areas, the decline in urban areas attains the lower rates: For the year 2023, the all-India birth rate was 18.4, whereas the rate was at 20.3 for the rural population and 14.9 for the urban population. This unfair distribution pattern is forcing companies to target the rural markets that have limited access to quality neonatal care. Thus, targeted distribution and local product development methods are crucial to ensure that the demand in these places with high birth rates is met.

Top Exporters of Infant Foods (Cereals, Flour, Starch, or Milk) in 2023

|

Country |

Export Value (Million or Billion USD) |

Country |

Export Value (Million or Billion USD) |

|

Netherlands |

2.4 billion USD |

Ireland |

1.3 billion USD |

|

France |

1.0 billion USD |

Germany |

1.0 billion USD |

|

China |

3.9 billion USD |

Saudi Arabia |

347 million USD |

|

Malaysia |

281 million USD |

Vietnam |

194 million USD |

|

Mexico |

413 million USD |

U.S. |

356 million USD |

|

Dominican Republic |

116 million USD |

Canada |

287 million USD |

|

Algeria |

213 million USD |

South Africa |

66.9 million USD |

Source: OEC

Challenges

- Maintaining quality and safety standards: Ensuring high-quality and safety standards across the market remains a huge challenge, especially in those markets that have varying degrees of regulatory enforcement. Counterfeiting and selling inferior-quality products pose a potential hazard to the health of infants and to the reputations of the established names of the market. The responsibilities of the manufacturers breed huge needs for quality control, product testing, and checks for compliance with different sets of regulations. It is even harder for smaller producers without adequate resources. Further, since the manufacturers have to devote significant resources to educating the consumer on authentication and safety issues, this situation worsens.

- Managing complex supply chains: The market faces many hurdles in maintaining the intricacies of its supply chain. Sourcing of raw materials, APIs, and specialized packaging components occurs globally, posing risks to manufacturers from geopolitical tension or logistical barriers. Such interruptions cause project delays and competing costs. Additionally, the erratic availability of critical ingredients can also affect formulation and quality. If the supply chain wants to stay resilient, the supply chain has to collaborate strategically or consider alternative sourcing. Otherwise, they will be running out of stock, experiencing price volatility, and losing their competitiveness.

Baby Care Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 254.8 billion |

|

Forecast Year Market Size (2035) |

USD 256.6 billion |

|

Regional Scope |

|

Baby Care Products Market Segmentation:

Formulation Type Segment Analysis

The highest‑share subsegment for formulation type remains conventional formulations with a 61% market share. Conventional formulation means lotions, washes, and creams with synthetic preservatives or emulsifiers. Price is the biggest advantage; conventional formulations tend to be cheaper to produce and have longer shelf lives compared to natural or organic alternatives. According to the U.S. National Sanitation Foundation in March 2025, as much as 74% of consumer preference leans toward organic ingredients in personal care products. Another 65% of consumers would prefer to have transparency of the ingredient list to spot potentially hazardous ones, with price, availability, and performance following close behind. Manufacturers aligned with synthetic formulations currently enjoy functioning supply chains as well as regulatory acceptance.

Price Tier Segment Analysis

The mid-range price tier is expected to hold the highest revenue share in the price tier segment by 2035, serving the broadest base of consumers. It is the subsegment that strikes a balance between affordability and somewhat competent quality, which naturally leads to repeat purchases of basic products, including diapers, wipes, and basic skincare. According to the U.S. National Sanitation Foundation in March 2025, 45% of respondents said that they would pay a higher price for certified personal care products stated to be organic. Players in this subsegment therefore pay close attention to cheap ingredients, economies of scale, and strong distribution channels. Fancy packaging, private labels, and promotions stand as their tools.

Distribution Channel Segment Analysis

Brick-and-Mortar subsegment is anticipated to have the maximum share in the distribution channel segment by 2035. Consumer trust, instant availability, and equally strong presence in urban as well as rural areas benefit these channels. For baby care, especially hygiene types and frequently used products, consumers prefer visiting a physical store to examine the product before purchase. Therefore, retail stores are investing in the shopping experience and shelf visibility. E-commerce is growing, but will be seen more for niche, premium, or convenience buys, while supermarkets and pharmacies will retain the greatest revenue share. This long-set preference for in-store buys, therefore, requires strategic product placement and in-person brand engagement.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-Segments |

|

Product Type |

|

|

Distribution Channel |

|

|

Formulation Type |

|

|

End user |

|

|

Price Tier |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Baby Care Products Market - Regional Analysis

Asia Pacific Market Insights

The baby care products market in the Asia Pacific is expected to hold the largest market share of 36% during the forecast period due to the rise in working mothers. The demand for convenient and dependable baby care solutions has surged. As per a report by the International Labour Organization in 2022, the employment-to-population ratio for females was 42.3%, leading to an increase in the demand for convenient baby care products. With the rise of a middle-class population in the region, disposable incomes have increased, thus the spending capacity on premium baby care products has also increased. Another contributing factor to this growth is the trend of urbanization, as more parents in urban areas want the best products for their kids.

The baby care products market in China is growing due to increasing factors such as urbanization, rising disposable incomes, and an awakening among parents on the need to use baby care products that are safe and effective. The market expansion has also been assisted by government policies that are aimed at raising the birth rate. As per a report by the International Labour Organization in 2022, employment in manufacturing has hovered around 20% of total employment in China for the last three decades, which has helped the country develop strong production capabilities, thus allowing the growth of the market.

The baby care products market in India is growing due to a combination of demographic and socio-economic factors. According to a report by the World Health Organization in 2024, life expectancy at birth increased by 4.1 years in India. The country's young population, rising with an increasing number of working mothers, has created more demand for baby care products, which assure convenience and safety. Middle-income families are producing more disposable income to commit to top-notch baby care products. Additionally, rising online retail platforms have provided a huge listing of products to satisfy divergent consumer preferences.

Europe Market Insights

The baby care products market in Europe was forecasted to be the fastest-growing region worldwide during the forecast period. Such growth is attributable to growing urbanization, rising disposable incomes, and increasing consciousness about baby hygiene and safety. Increasing demand boils down to preference in the trend of healthier and more sustainable options. As per a report by Eurostat in July 2024, for the second consecutive year, the population in Europe has increased from 447.6 million in January 2023 to 449.2 million people in January 2024, which also drives the market of baby care products. Furthermore, advancements in technology and innovation in baby care solutions continue to enhance product offerings, meeting the evolving needs of consumers.

The baby-care market in the UK is witnessing immense growth owing to factors such as a growing preference for a natural and organic-minded range of consumers, an upward thrust in the number of working parents, as well as increasing awareness relating to infant hygiene and safety. These factors together drive the demand for premium baby-care products in the country. As per a report by ONS in July 2025, in 2024, there were 594,677 births in England and Wales. This level of steady birth rate continuously supports the demand for baby-care essentials. In addition, growth in the online retail sector gives parents the ease of access to a wide variety of items.

The baby care products market in Europe in Germany, is experiencing a growth that is attributed to the working mothers' population increasing, along with an increase in disposable income; baby hygiene and baby safety are increasingly gaining attention. Innovations in baby care are unfolding, with sustainability and organic variants now joining the fray. In addition, the government promotes parental leave and childcare, which incentivizes increased spending on baby care. Now the consumer demands sustainable and chemical-free products, thus driving the manufacturers to go green with their formulas.

Exporters and Importers of Baby Carriages and Parts in 2023

|

Exporters of Baby carriages and parts in 2023 |

Amount (in USD millions) |

Importers of Baby carriages and parts in 2023 |

Amount (in USD millions) |

|

Germany |

118 |

Germany |

202 |

|

Poland |

87 |

UK |

137 |

|

Netherlands |

69.6 |

Netherlands |

117 |

|

Italy |

41.7 |

Russia |

102 |

|

Sweden |

20.5 |

Spain |

80.4 |

|

France |

14.7 |

Poland |

73.7 |

Source: OEC

North America Market Insights

The baby care market in North America is steadily increasing as parents become increasingly aware of the need to use safe, natural products for their babies. This has resulted in a surge in demand for organic, hypoallergenic baby care products such as diapers, lotions, and shampoos. As per a report by CMS in December 2024, U.S. health care expenditure increased by 7.5% in 2023 at USD 4.9 trillion or USD 14,570 per individual, thereby boosting the baby care product market. Additionally, growth in disposable income and lifestyle changes have also become more viable for parents to spend on high-end baby care products.

The baby care products market in the U.S. is expanding due to the growing rate of birth rate in some areas, resulting in increased demand for baby care products. Additionally, the rising awareness about the potential hazards of chemicals in traditional baby products has prompted parents to seek safer alternatives. As per a report by CMS in December 2024, a larger percentage is being employed in health and wellness compared to any other consumer, with health expenditure forming 17.6% of the gross domestic product of the country. This paradigm shift has helped the rise in preference for organic and eco-friendly baby care products as parents begin to become truly conscious of the ingredients and safety involved in whatever items they use for their babies.

The baby care products market in Canada is expanding on account of the rising focus on health and wellness among parents in Canada, resulting in a shift towards organic product requirements. The trend is fostered by the fact that a large variety of such products is available in the market to meet the demand for safer products. Additionally, the increasing percentage of working parents has increased the demand for easy and time-efficient baby care products. The rise in e-commerce websites has also made it easier for consumers to access a range of products, enabling them to make educated decisions from their homes. The growth of retail channels, both physical and digital, has facilitated the access of consumers to a wide variety of baby care products.

Key Baby Care Products Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procter & Gamble (P&G)

- Kimberly-Clark Corporation

- Nestlé S.A.

- Unilever plc

- Beiersdorf AG

- The Himalaya Drug Company

- Honasa Consumer Pvt. Ltd. (Mamaearth)

- Sebapharma GmbH & Co. KG

- Essity AB

- Dorel Industries

- Frida

- FirstCry

- Cotton On Group

- Goodbaby International Holdings Limited

With established brands with a few new entrants, and a slew of smaller entities in the baby care products market, competition is actually fierce. But with their vast product portfolios and brand names, the large corporations of yore, of course, Johnson & Johnson, Procter & Gamble, and Nestlé, would still be dominating the market. However, with great days for a few eco-friendly and health-conscious brands such as Mamaearth and Frida, buying preferences are now changing, forcing an element of creativity and adaptation on the established ones.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, Pfizer announced that the U.S. FDA approved their RSV vaccine called ABRYSVO for higher risk of getting serious lung infections caused by the Respiratory Syncytial Virus (RSV). This vaccine was already approved for older adults and pregnant women to protect both the mothers and their babies.

- In November 2022, Janssen, part of Johnson & Johnson, announced that they would present new research at the American Society of Hematology (ASH) Annual Meeting in New Orleans. The company will share results from over 50 of its own studies, plus more than 20 studies started by outside researchers.

- Report ID: 8185

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Baby Care Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.