Organic Baby Food Market Outlook:

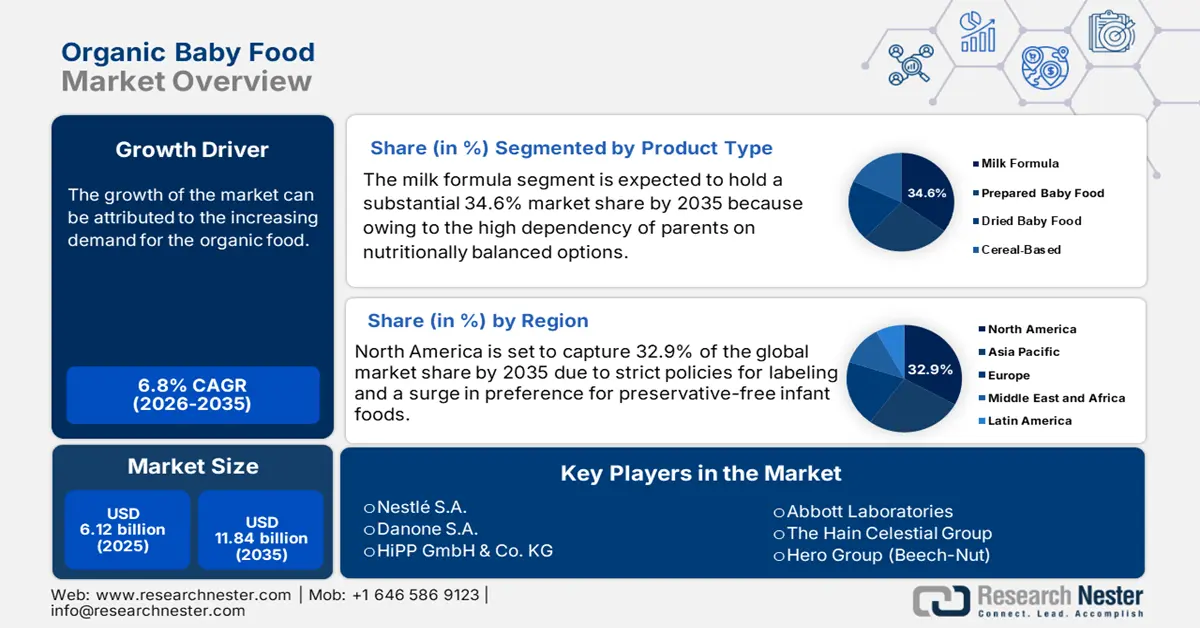

Organic Baby Food Market size was valued at approximately USD 6.12 billion in 2025 and is projected to reach around USD 11.84 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period 2026-2035. In 2026, the industry size of organic baby food is assessed at USD 6.54 billion.

Over the last decade, the market has garnered a significant consumer base. The investment in research and development has also remained substantial and falls under the broad governmental research budget. Research and development in the organic baby food market is primarily focused on clean-label formulations and enriching nutrients. Various market players are focusing on incorporating superfoods and maintaining minimal processing. Another priority area is safety testing, with various companies implementing stringent protocols for detecting heavy metals.

The supply chain of the organic baby food market originates from certified organic farming. in which fruits, grains, etc., are sourced under stringent standards to eliminate the chance of the presence of any synthetic inputs. The structure of the supply chain hugely affects the growth of the market. Market players are trying to make resilient traceability systems and trustworthy cold chain logistics. Also, diversification of the raw material procurement can overcome the challenges in the supply chain. The efficient and transparent supply chain allows brands to consistently deliver high-quality, safe, and certified products, which directly strengthens consumer confidence.

Key Organic Baby Food Market Insights Summary:

Regional Highlights:

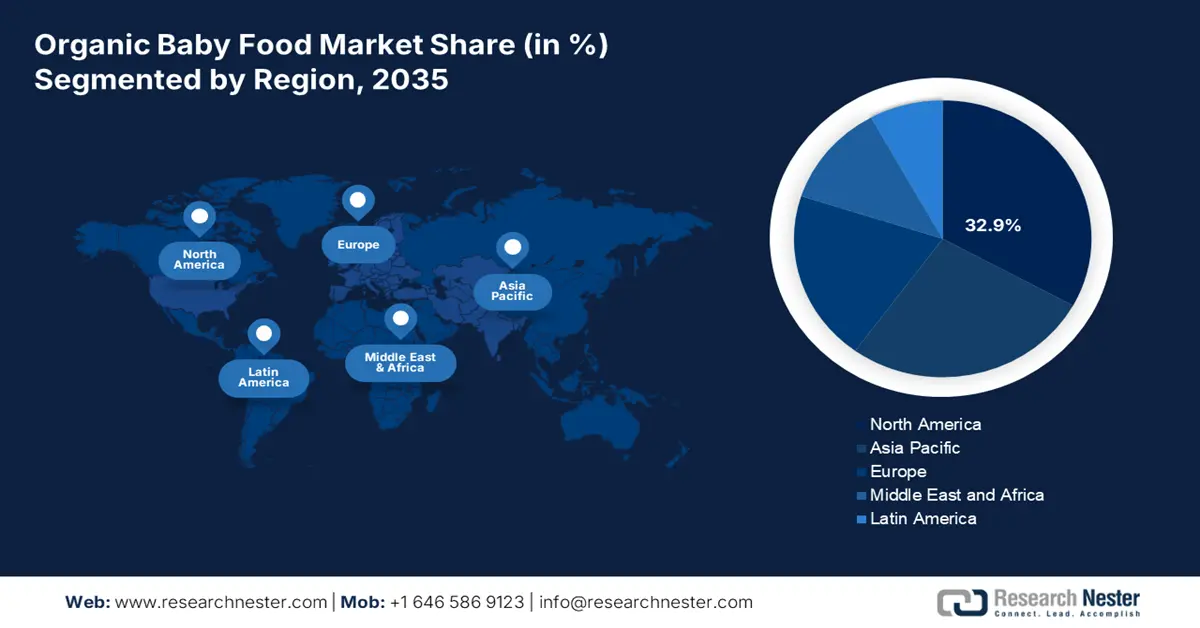

- North America is projected to hold a 32.9% share by 2035 in the organic baby food market, driven by strict labeling policies, rising preference for preservative-free products, and growing parental concerns about food quality.

- Asia Pacific is expected to register the highest CAGR of 8.5% during 2025–2035, fueled by rising disposable income, urbanization, government support, and expanding e-commerce penetration.

Segment Insights:

- The Infant Milk Formula segment is projected to hold a 34.6% share by 2035 in the organic baby food market, driven by parental preference for nutritionally balanced, minimally processed dairy options supporting infant gut health.

- The Pouches segment is expected to capture a 27.5% share by 2035, owing to rising demand for lightweight, portable, recyclable packaging that aligns with eco-conscious consumer trends.

Key Growth Trends:

- Increase in health-conscious parenting and clean-label demand

- Fortification and nutrient innovation

Major Challenges:

- High production and certification costs

- Limited and inconsistent raw material supply

Key Players: Nestlé S.A., Danone S.A., HiPP GmbH & Co. KG, Abbott Laboratories, The Hain Celestial Group, Hero Group (Beech-Nut), Mead Johnson Nutrition, Bellamy’s Organic, Ella’s Kitchen, Organix Brands Ltd., Little Freddie, Baby Gourmet Foods Inc., Morinaga Milk Industry Co., Meiji Holdings Co., Ltd., Arla Foods (Baby&Me)

Global Organic Baby Food Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.12 billion

- 2026 Market Size: USD 6.54 billion

- Projected Market Size: USD 11.84 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: China, India, South Korea, Brazil, United Arab Emirates

Last updated on : 17 September, 2025

Organic Baby Food Market - Growth Drivers and Challenges

Growth Drivers

- Increase in health-conscious parenting and clean-label demand: The escalation in awareness regarding the presence of unhealthy artificial additives is compelling parents to opt for organic baby food. People are preferring clean-label products with a simple and transparent ingredient list, which is free from the inclusion of any synthetic enhancers. Today’s parents, mainly millennials and Gen Z, are keenly researching the labels carefully and are highly selective about the food for their infants. There has been surging concern about artificial additives with long-term health repercussions. Various digital platforms are amplifying the transition by spreading awareness about the detrimental ingredients and advocating the practices that include organic feeding.

- Fortification and nutrient innovation: The innovation of nutrient inclusion made through fortification has emerged as a crucial factor in the organic baby food market. The shift has strengthened market players' focus on ingredient innovation, backed by nutrition science. Market players are also planning to introduce plant-based protein sources such as chickpeas and quinoa, which provide crucial amino acids and are adequate for the allergy-prone household. The adoption of naturally nutrient-rich raw materials supports the development of infants, as recommended by academic institutions and pediatricians. According to data published by Business Fights Poverty in 2020, every USD 1 invested in the fortification of food generates USD 27 in economic return by averting diseases and enhancing earnings.

- Expansion of the organized retail and e-commerce channels: The swift growth of modern retail, such as hypermarkets and the advent of online platforms, has increased the accessibility of organic baby food to a wide range of the audience. Earlier, the availability was just confined to the health stores, but today these are mainly showcased in mainstream retail aisles and various popular online platforms. According to the International Trade Administration, the worldwide B2C e-commerce revenue is anticipated to reach USD 5.5 trillion by the year 2027. Parents are opting for digital platforms as they allow them to compare various products and research nutritional claims.

Challenges

- High production and certification costs: The primary challenges in the production of organic baby food are the exorbitant costs related to organic farming and certification. Organic farming needs compliance with the stringent practices for the cultivation and constant audits by the certification bodies. Such a requirement raises the operational costs in comparison with traditional farming.

- Limited and inconsistent raw material supply: The yield of organic farming is usually lower and more dependent on the seasonal agriculture. This results in the limited availability of the raw materials. Also, the fragmented small-scale organic farms lead to the complexity, as manufacturers often need to source from multiple suppliers to meet their volume requirements.

Organic Baby Food Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 6.12 billion |

|

Forecast Year Market Size (2035) |

USD 11.84 billion |

|

Regional Scope |

|

Organic Baby Food Market Segmentation

Product Type Segment

The infant milk formula is anticipated to hold 34.6% of the market share by 2035, owing to the high dependency of parents on nutritionally balanced options. There has been a surge in awareness of the gut health of infants. Also, dieticians are suggesting that calcium and protein from milk are appropriate for the infants. The data published by the U.S. National Library of Medicine corroborates that newborn babies show more absorption of the nutrients from the dairy-based nutrition, especially for vitamin D and calcium. There is a preference given to the purchase of minimally processed food by parents across the world.

Packaging Segment Analysis

The pouches segment is projected to garner 27.5% of the market share by 2035. The growth of the segment is mainly driven by the rising demand from consumers for lightweight and portable packaging solutions. Pouches allow for mess-free consumption of the products and are mainly popular among people living in cities. These pouches are also mainly recyclable and align with the need for the burgeoning eco-conscious population, who are looking for organic and sustainable food products. Additionally, there high compatibility of the pouches with advanced techniques for sterilization, making the segment highly growing.

Distribution Channel Segment

The hypermarkets/supermarkets segment is predicted to garner 33.8% of the market share by 2035. The growth of the sub-segment is mainly driven by the presence of a myriad of product assortments and the ability to give bulk discounts on the products. These avenues serve as a single point of destination, fostering the parents to scrutinize the packaging and ensure the freshness of the products. The USDA Economic Research Service report states that the allocation of shelf space for organic products has mushroomed significantly in retail chains. The sub-segment is anticipated to pioneer the sale of organic baby food.

Our in-depth analysis of the global organic baby food market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Packaging |

|

|

Distribution Channel |

|

|

Ingredient Source |

|

|

Age Group |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Baby Food Market - Regional Analysis

North America Market Insights

North America is expected to register 32.9% of the market share by 2035. The growth of the market in the region is driven by strict policies for labeling and a surge in preference for preservative-free infant foods. The market in the U.S. is rapidly expanding owing to escalating parental concerns about food quality. The country’s National Organic Program ensures strict standards for certification, making products more reliable to use for the babies. The American Medical Association has endorsed more advanced research on the efficacy of organic food. The confluence of consumer trends is projected to bolster the growth of the market in the country.

The market in Canada is also witnessing staggering growth, aided by burgeoning public health awareness and rigorous regulations related to food development. According to a report published by the Organic Market British Columbia in 2021, organic acreage in the country has reached 3.4 million acres and showcases a projected 3.1% of the Canadian farmland. Additionally, the Healthcare Association in Canada supports indigenous research and development for the formulation of clean labels. Also, the robust support from the public and private cooperation ensures a significant growth in the country for the organic baby food sector by 2035.

Asia Pacific Market Insights

The Asia Pacific market is set to register the highest CAGR of 8.5% during 2025-2035. The market growth is driven by surging disposable income and urbanization. The market in China is rapidly expanding, with humongous support from the government in recent years. In addition, progressive e-commerce penetration via platforms such as JD.com and Tmall has remarkably enhanced product accessibility, allowing both domestic and international organic baby food brands to reach consumers directly. The country is not only the largest market but also one of the most dynamic global players and fostering innovation in product variety, packaging, and digital marketing strategies.

The market in India is also witnessing a significant transformation, fueled by a growing middle-class strata and strong government support for infant nutrition. The launch of POSHAN Abhiyan by the government under the national nutrition strategy aims to lower the rate of child malnutrition with the safe consumption of food. According to the data published by the government of India in December 2024, out of the 85 million surveyed children, 37% were found to be stunted. Hence, the country has a large pool of consumer, and companies are expanding their product portfolio.

Europe Market Insights

The organic baby food market in Europe is also positioned for significant growth, driven by substantial support from the government. The market in Germany the country is supported by national initiatives to promote the eco-label certifications. The government programs are subsidizing on purchase of nutritional food via public health schemes. Retail infrastructures are key drivers offering significant organic baby food sections. The country is also focusing on normalizing the consumption of cereals and purees based on the organic formulae. Major German retailers and supermarkets are expanding their dedicated organic aisles, while online platforms are increasingly becoming a preferred channel for young parents.

In the UK, the growth of the market is on the rise, driven by the surging awareness of the gut health of babies. The brands such as Ella Kitchen are dominating the supermarket channels, and products are in high demand. Such brands are expanding on the online platform to reach wider audiences. Additionally, the country is witnessing innovation in the recyclable pouch packaging that has fueled the demand for organic products. The British Nutrition Foundation has also launched educational campaigns to increase public awareness about the benefits.

Key Organic Baby Food Market Players:

- Nestlé S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danone S.A.

- HiPP GmbH & Co. KG

- Abbott Laboratories

- The Hain Celestial Group

- Hero Group (Beech-Nut)

- Mead Johnson Nutrition

- Bellamy’s Organic

- Ella’s Kitchen

- Organix Brands Ltd.

- Little Freddie

- Baby Gourmet Foods Inc.

- Morinaga Milk Industry Co.

- Meiji Holdings Co., Ltd.

- Arla Foods (Baby&Me)

The global market is witnessing aggressive competition led by giant companies, dominated via a wide range of product availability. Emerging players are leveraging social media platforms to cater the niche market. Key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position. Various cross-border collaborations and humongous investments are also reinforcing brand positioning. Moreover, private-label partnerships with retail giants are redefining accessibility and affordability.

Here is a list of key players operating in the market:

Recent Developments

- In April 2025, Bobbie Baby launched the 1st and only USDA organic whole milk infant formula in the US market. The formula features naturally occurring milk fat globule membrane (MFGM) from organic whole milk, choline, and industry-leading levels of DHA, aiming to support infant brain development.

- In March 2025, Nestlé India unveils a new CEREGROW variant with no refined sugar. The company is reinforcing its commitment to offering nutritious choices to its consumers through meaningful innovations. Designed for toddlers aged 2 to 6 years, CEREGROW multigrain cereal with the goodness of wheat, rice, oats, milk, and fruits.

- Report ID: 8112

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Baby Food Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.