Food Grade Alcohol Market Outlook:

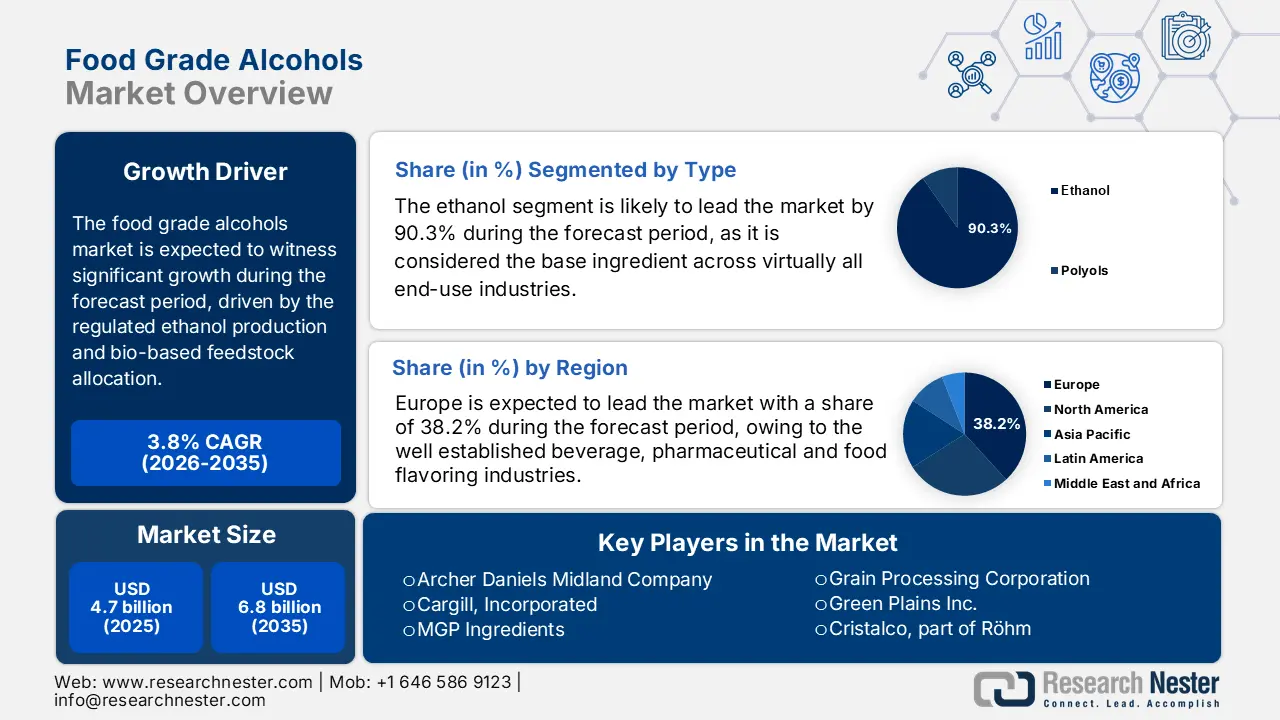

Food Grade Alcohol Market size was valued at USD 4.7 billion in 2025 and is projected to reach USD 6.8 billion by the end of 2035, rising at a CAGR of 3.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of food grade alcohol is estimated at USD 4.8 billion.

The food grade alcohol market continues to reflect shifts in regulated ethanol production bio-based feedstock allocation, and beverage input requirements. As per the EIA January 2024 data, the U.S. fuel and industrial ethanol production in 2022 was over 15.4 billion gallons, a portion of which is directed toward beverage, pharmaceutical, and food processing use. The NASS report in 2025 notes that corn remains the dominant commercial feedstock in North America over 95.2 million acres of corn planted in the U.S. for 2025 and continuing diversion into ethanol, including industrial grades that are further processed under the food and beverage specifications. Countries in Brazil continue to expand the ethanol capacity, reinforced by the federal programs such as RenovaBio, helping maintain the large-scale supply into global markets, while Europe focuses on certification and sustainability verification.

The growth trajectories are influenced by several key factors, including the agricultural feedstock availability and pricing, which are subject to climate variability and biofuel policy. For instance, the corn, being the primary feedstock for domestic production, experienced a notable price volatility, impacting the input costs for manufacturers. Further, the long-term demand is aided by stable consumption in the core sectors and incremental growth in adjacent applications such as hand sanitizers, where specifications align with the food-grade standards. The WHO has also documented the sustained global use of alcohol based formulations in hygiene, creating a consistent ancillary demand stream. The market expansion is contingent on navigating the complex international trade environments where tariffs and non-tariff barriers can affect the export volumes for producing nations.

Key Food Grade Alcohols Market Insights Summary:

Regional Insights:

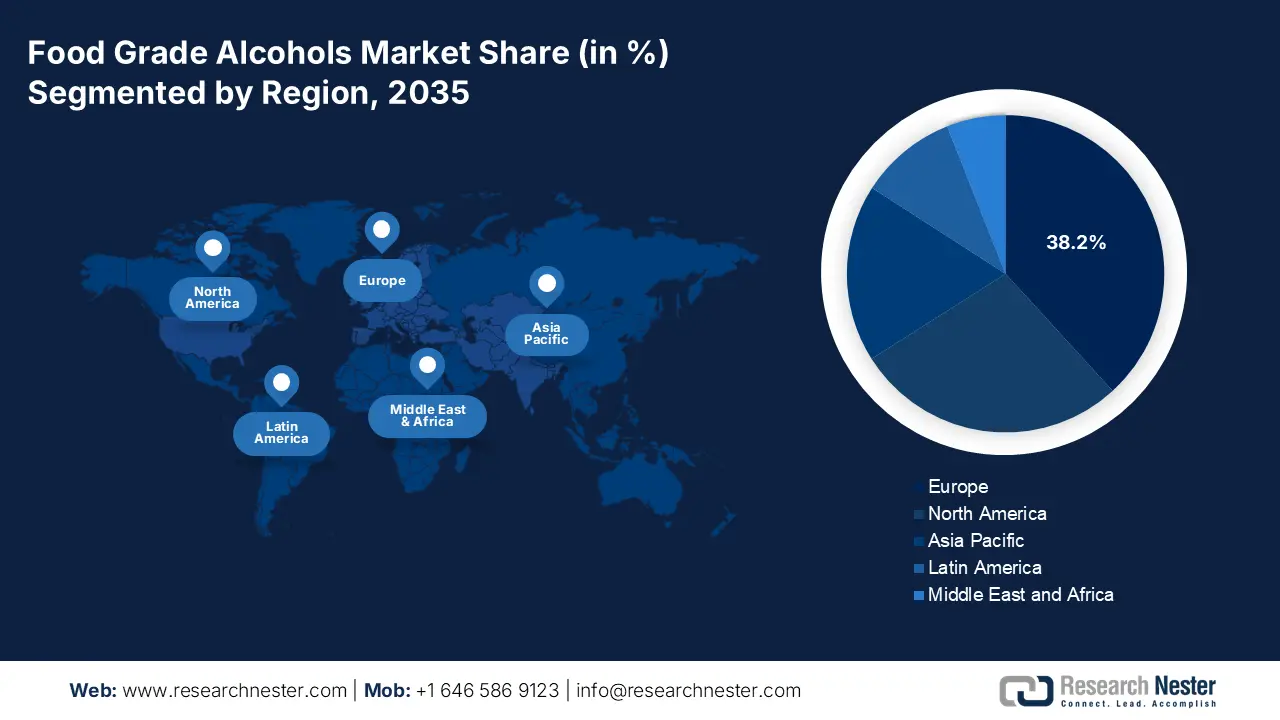

- Europe is anticipated to secure a 38.2% share in the food grade alcohols market by 2035, upheld by stringent EU pharmacopoeial quality standards and sustainability-led production mandates.

- By 2035, Asia Pacific emerges as the fastest-advancing region with a 5.4% CAGR during 2026–2035, supported by rapid urbanization, expanding beverage and pharmaceutical industries, and biofuel-linked distillation growth.

Segment Insights:

- By 2035, ethanol in the food grade alcohols market is projected to capture 90.3% share, sustained by its broad functional versatility and its expansive production base and GRAS status.

- The undenatured alcohol sub-segment is set to hold a dominant purity-based majority share by 2035, reinforced by rising demand for toxin-free inputs and the clean-label shift favoring additive-free formulations.

Key Growth Trends:

- Agriculture budget allocations influencing raw material availability

- Government bioethanol expansion and feedstock allocation

Major Challenges:

- Capital intensive production and high entry costs

- Volatile and geopolitically sensitive feedstock pricing

Key Players: Archer Daniels Midland Company (ADM) (U.S.), Cargill, Incorporated (U.S.), MGP Ingredients (U.S.), Grain Processing Corporation (GPC) (U.S.), Green Plains Inc. (U.S.), Cristalco, part of Röhm (France), CropEnergies AG (Germany), Tereos (France), Südzucker AG (Germany), Roquette Frères (France), Manildra Group (Australia), Wilmar International Ltd. (Singapore) [Key production in Malaysia], BSG CraftBrewing / Main Street Ingredients (U.S.), Glacial Grain Spirits (U.S.), Kalsnava Distillery / Alco (Latvia), Sasmac Ltd. (Japan), Ruder (South Korea), Pure Alcohol Solutions (Australia), Fangchenggang Zhongyuan Sugar Industry (China), Jiangsu Huating Biotechnology Co., Ltd. (China)

Global Food Grade Alcohols Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.7 billion

- 2026 Market Size: USD 4.8 billion

- Projected Market Size: USD 6.8 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.2% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, United Kingdom

- Emerging Countries: Brazil, Indonesia, Mexico, Vietnam, South Korea

Last updated on : 11 December, 2025

Food Grade Alcohol Market - Growth Drivers and Challenges

Growth Drivers

- Agriculture budget allocations influencing raw material availability: The government crop support programs materially influence the availability and pricing of the feedstocks used in the fermentation. The U.S. Department of Agriculture reported over 91.5 million acres of U.S. corn were planted in 2024, demonstrating a sustained federal support acreage tied to domestic industrial ethanol availability. The National Agriculture Allocations in India continue backing grain procurement and ethanol plant expansion under the centrally financed biofuel schemes. The EU Common Agriculture Policy funding supports the sustainability-linked farm incentives indirectly impacting the sugar beet and cereal availability for industrial alcohol. For food-grade producers, this supports a consistent supply pipeline used for beverage-grade and processing alcohols. Further, the market is expected to expand procurement from countries with government-supported grain investments, enabling food ingredient manufacturers to negotiate more predictable supply contracts.

- Government bioethanol expansion and feedstock allocation: Government-led ethanol programs continue to redirect the grain and sugar feedstocks into the industrial alcohol, improving the infrastructure that also supplies the food-grade streams. Various reports have indicated the rising production of ethanol in the U.S., which is supplied to beverage, extraction, and processing industries. The government in India has fixed the target of 20% blending of ethanol with petrol by 2025 under the Ethanol Blended with Petrol program, based on the PIB December 2023 report. This expands the fermentation capacity used for the food-grade alcohol. On the other hand, Brazil’s RenovaBio policy supports decarbonization credits and large-scale ethanol availability via state-regulated pathways. This sustains public availability, supporting the cost-effective raw material availability for beverages and food processing alcohols.

- National food safety purity standards and regulated beverage inputs: The food grade alcohol market conforms to national purity labeling and allowable residue requirements. The U.S. FDA lists ethyl alcohol used in food under substance categories requiring GMP compliance, purity criteria, and recordkeeping. The EU authorities apply harmonized purity and traceability rules under commission-aligned food safety frameworks. Further, India’s FSSAI supervises labeling and alcohol use standards for beverages and food processing via centrally notified norms. These rules drive higher-grade sourcing of certified suppliers and validated production parameters, directly shaping the corporate procurement. Beverage manufacturers allocate higher budgets toward compliant ingredients, mainly for spirits flavoring carriers and extraction uses, raising the specification-driven demand.

Challenges

- Capital intensive production and high entry costs: Establishing a compliant production facility for the food-grade alcohol needs a huge initial investment in specialized distillation, purification, and quality control systems in the market. Economies of scale are vital, making it difficult for new entrants to compete on price with incumbents. For example, a new state-of-the-art biorefinery can cost hundreds of millions of dollars. Various leading companies navigate this strategy by repurposing and upgrading the existing fuel ethanol facilities to produce the higher purity alcohols, thereby leveraging sunk capital and reducing the cost of new market entry.

- Volatile and geopolitically sensitive feedstock pricing: Profitability is directly tied to the cost of agricultural feedstocks such as corn, sugarcane, and wheat, whose prices are subject to extreme volatility due to the weather, trade policies, and competing demand. Top players in the food grade alcohol market overcome this risk through vertical integration, owning and controlling grain origination, transportation, and processing assets that provide a buffer against market swings. A new entrant without this integration faces unpredictable and often unsustainable input costs.

Food Grade Alcohol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 4.7 billion |

|

Forecast Year Market Size (2035) |

USD 6.8 billion |

|

Regional Scope |

|

Food Grade Alcohol Market Segmentation:

Type Segment Analysis

Ethanol is the dominating subsegment in the market and will maintain an overwhelming dominance, projected to hold the share value of 90.3% by 2035. The segment is driven by the unparalleled versatility as the foundational solvent preservative and base ingredient across virtually all end-use industries, from the potable spirits to pharmaceuticals. The key driver is its established scale; for instance, the EIA January 2024 report states that the U.S. total production capacity rose from 13.6 billion gallons per year in 2011 to 17.7 billion gallons per year by 2022. This massive production base, combined with its Generally Recognized as Safe regulatory status worldwide, makes ethanol the indispensable and economically efficient workhorse of the industry, leaving specialized polyols such as sorbitol to serve distinct functional niches in sugar-free products.

Purity Segment Analysis

The undenatured alcohol sub-segment is forecast to command a decisive majority share in the purity segment in the food grade alcohol market. The segment is non-negotiable in the core alcoholic beverages sector and is increasingly vital in food, personal care, and pharmaceuticals, where consumers and regulators demand ingredients free of toxic denaturing additives. The statistical demand is reflected in the production. The TTB September 2025 report depicts that the distilled production in June 2025 was 2,013,002,342, representing the primary manufacturing stage for producing high-purity consumable-grade alcohol, and a portion of this total volume is directly contributing to the supply of undernatured alcohol used in food, beverage, and pharmaceutical applications. Further, the requirement for purity in the largest application segments, coupled with the clean-label movement rejecting chemical additives in foods and cosmetics, solidifies undenatured alcohol's essential and growing market position.

Application Segment Analysis

Within the application segment, the food and beverages segment is leading, specifically, the alcoholic beverages are dominating within the segment in the food grade alcohol market. This application is the traditional volume anchor and a consistent source of premium value, especially for high-purity spirit grades. This is reinforced by the rising excise reporting and production disclosures that indicate steady utilization of undenatured grades within the beverage distillation supply chains. Continuous brewery and distillery capacity additions in the market, such as India and the U.S., further support long-term demand visibility for the food-grade ethanol. Moreover, the regulated purity specifications and analytical testing guidance reinforce the preference for high-grade alcohol inputs, mainly in the premium beverage formulations. As a result, alcoholic beverages remain a structurally strong downstream demand driver across both established and emerging markets.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Source |

|

|

Purity |

|

|

Function |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Grade Alcohol Market - Regional Analysis

Europe Market Insights

Europe is dominating the food grade alcohol market and is expected to hold the market share of 38.2% by 2035. The market is characterized by robust regulatory standards, a strong focus on sustainability, and diverse feedstock sources, including sugar beet, grains, and wine. The demand is fueled by the well-established beverage, pharmaceutical, and food flavoring industries. A key driver is the EU’s regulatory mainly the European Pharmacopoeia monographs, which set mandatory quality standards for alcohol used in medicines, creating a consistent high-value demand stream from the pharmaceutical sector. A significant trend is the push for sustainable production, mainly influenced by the EU’s Renewable Energy directive that incentivizes the production of biofuels and bioliquids from waste and residue feedstocks.

Germany is projected to hold the highest revenue share in 2035, driven by its entrenched industrial and pharmaceutical dominance. The critical demand side factor is the binding quality standard of the European Pharmacopoeia maintained by the European Directorate for the Quality of Medicines & HealthCare. Various extraction techniques are used for detecting or quantifying compounds in alcohol-containing samples. In food-grade alcohol markets, extraction and analytical methods are a vital part of quality assessment, impurity detection, flavor compound analysis, and regulatory compliance testing, especially when alcohol functions as a solvent, carrier, or flavoring input. Techniques such as the SPE drive market expansion via high-throughput automation and compliance with pharmacopoeia standards, fueling demand in Germany's pharmaceutical sector amid bioeconomy investments.

Extraction Techniques Comparison Table

|

Metric |

LLE |

SPE |

SPME |

SBSE |

HSSE |

|

Detected compounds (/24) |

23 |

22 |

21 |

22 |

22 |

|

Handling time * |

3 h |

1 h |

0.2 h |

0.2 h |

- |

|

Sample amount |

50 mL |

13 mL |

3 mL |

3 mL |

- |

|

Solvent amount |

200 mL |

10 mL |

- |

- |

- |

|

Quantitative analysis |

+++ |

+++ |

+ |

+ |

- |

|

Automation |

Low |

High |

High |

Moderate |

- |

|

Cost per analysis |

Low |

Low |

Moderate |

Moderate |

- |

|

Cost of instrumentation |

Low |

High |

Moderate |

High |

- |

Source: NLM October 2022

In France, the market is a major producer in Euroope and is distinguished by its reliance on domestic agricultural feedstocks such as sugar beet and wine industry by products. The primary growth driver is the strategic France 2030 investment plan that allocates significant capital of €54 billion nationally for decarbonizing industry and developing a competitive bioeconomy directly funding the advancements in the sustaianble alcohol production, as per the ANR 2021 report. The French Environment and Energy Management Agency reported that biofuel consumption including ethanol was high demonstrating the scale of the underlyng fermentation industry that supplies food grade streams. The demand is further supported by a robust national standards trnasposing EU regualtions for pharmaceuticals and sanitizers ensueing a consistent high value demand from the healthcare and premium beverage sectors.

APAC Market Insights

Asia Pacific is the fastest-growing food-grade alcohol market and is expected to grow at a CAGR of 5.4% during the forecast period 2026 to 2035. The growth is driven by the massive population's rapid urbanization. The key drivers of the market are the robust expansion of the alcoholic beverage sector, mainly in China and India, the booming pharmaceutical manufacturing industry, and the increasing use of alcohol as a solvent in food flavor extracts and personal care products. The regional drivers are the government biofuel policy, such as India’s ambitious Ethanol Blended Petrol program, which is scaling up the sugarcane and grain-based distillation capacity, increasing the supply base for food-grade purification. The trend toward premiumization in beverages and a growing middle class demanding processed foods with natural ingredients further propel the demand. The market remains fragmented with varying regulatory standards, and competition from low-cost producers is intense.

China is the undisputed regional leader in the food grade alcohol market in APAC, with its massive production capacity from both the grain-based and cassava sugarcane-based ethanol plants. Its market size is propelled by the enormous domestic consumption of beverages, traditional medicine, and as a chemical feedstock. Government policy is a vital driver; the National Development and Reform Commission has outlined the plans for the biofuel and biochemical industry, influencing the production scales. According to the USDA August 2025 report the China’s fuel ethanol production in 2025 is estimated to be 4.3 billion liters, showcasing the vast industrial base that supports the food-grade sector. Further, the Made in China 2025 initiative promotes the advanced biomanufacturing that includes high-purity alcohol production.

Production Capacity of Licensed Fuel Ethanol Plants

|

Producers |

Production Capacity |

Feedstock |

|

SDIC Jilin Alcohol |

887 million liters |

Corn |

|

Henan Tianguan |

887 million liters |

Wheat, Corn, Cassava |

|

COFCO Biochemical (Anhui) |

798 million liters |

Corn, Cassava |

|

COFCO Bioenergy (Zhaodong) |

507 million liters |

Corn, Cellulosic |

Source: USD August 2025

India’s market is experiencing a transformative growth and is almost entirely driven by the government’s Ethanol Blended Petrol Programme. This policy is aimed at energy security, and supporting sugarcane farmers has led to a massive expansion of ethanol distillation capacity. According to the PIB January 2025 report, the government implements the Ethanol Blended Petrol (EBP) Programme wherein the oil marketing companies sell petrol blended with ethanol up to 20%. When government policies increase fermentation and distillery capacity for fuel, the same infrastructure also produces industrial ethanol streams that can be purified into food-grade, beverage, pharmaceutical, and personal-care grades. Consequently, India is rapidly evolving from a constrained market into a major global supplier, with its food-grade sector poised for sustained, policy-backed expansion.

North America Market Insights

The North America food grade alcohol market is defined by the mature integrated production and stable demand from the core sectors such as beverages, flavors, and healthcare. Its primary driver is the synergy with the federal Renewable Fuel Standard that supports massive corn-based ethanol production capacity, and a significant portion of this output is refined into high-purity grades. The U.S. Energy Information Administration data in October 2025 notes fuel ethanol production per day is 1,126 Mbbl in November 2025, underpinning the supply. The key trends include strategic investments in sustainable production to meet the corporate carbon goals and the rising demand for specialty alcohols such as organic and non-GMO verified products, driven by the consumer packaged goods and premium beverage brands. The regulatory frameworks from the FDA and TTB provide a stable market governance.

The U.S. market is defined by high production integration and stable demand from the established end-use sector. The key driver is the synergy with federal biofuel policy under the Renewable Fuel Standard that maintains large-scale corn-based ethanol production capacity, a portion is continuously upgraded to food and pharmaceutical grades. The U.S. EIA report in September 2025 notes that the U.S. has 191 fuel ethanol plants with a total capacity of 18,477 MMgal per year. This data highlights the underlying fermentation infrastructure that can be diverted or upgraded toward food-grade production, influencing the supply availability and long-term sourcing stability. Key trends include investment in sustainable production methods to meet corporate carbon goals and growing demand for organic and non-GMO verified alcohols, driven by consumer packaged goods companies.

U.S. Fuel Ethanol Plant Production Capacity (January 2025)

|

PAD District |

Number of Plants |

Production Capacity (MMgal/yr) |

Production Capacity (Mb/d) |

|

PADD 1 |

2 |

190 |

12 |

|

PADD 2 |

177 |

17,463 |

1,139 |

|

PADD 3 |

4 |

430 |

28 |

|

PADD 4 |

4 |

226 |

15 |

|

PADD 5 |

4 |

168 |

11 |

|

U.S. Total |

191 |

18,477 |

1,205 |

Source: U.S. EIA September 2025

The food grade alcohol market in Canada is shaped by its agricultural profile and alignment with the U.S. trade and regulatory frameworks. A significant portion of domestic demand is supplied by imports, but the domestic production leverages gain feedstocks mainly wheat, as noted in Agriculture and Agri-Food Canada reports on crop use. A key trend is the growth in the premium beverage alcohol production, including the craft spirits and non alcoholic distilled alternatives that require high-purity food-grade ethanol. The regulatory oversight for food additives and the Canadian Food Inspection Agency’s standards govern the market. The Statistique Canada report in June 2024 states that 2.4 million cubic meters of ethanol were imported in 2023. This trade reliance highlights upstream supply conditions that influence domestic availability of fermentation alcohol streams that may be diverted toward food and pharmaceutical grade processing.

Key Food Grade Alcohol Market Players:

- Archer Daniels Midland Company (ADM) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated (U.S.)

- MGP Ingredients (U.S.)

- Grain Processing Corporation (GPC) (U.S.)

- Green Plains Inc. (U.S.)

- Cristalco, part of Röhm (France)

- CropEnergies AG (Germany)

- Tereos (France)

- Südzucker AG (Germany)

- Roquette Frères (France)

- Manildra Group (Australia)

- Wilmar International Ltd. (Singapore) [Key production in Malaysia]

- BSG CraftBrewing / Main Street Ingredients (U.S.)

- Glacial Grain Spirits (U.S.)

- Kalsnava Distillery / Alco (Latvia)

- Sasmac Ltd. (Japan)

- Ruder (South Korea)

- Pure Alcohol Solutions (Australia)

- Fangchenggang Zhongyuan Sugar Industry (China)

- Jiangsu Huating Biotechnology Co., Ltd. (China)

- Archer Daniels Midland Company is a global agricultural processing giant player in the market, leveraging its massive grain origination network. The company utilizes its integrated supply chain to produce high-purity alcohol from corn and other feedstocks, supplying the beverage, food flavoring, and pharmaceutical industries. The ADM’s strategy focuses on product diversification and sustainability initiatives to serve the growing demand for clean-label and organic alcohol variants. The company has made a revenue of USD 85.5 billion in 2024.

- Cargill Incorporated operates as a key global provider in the food grade alcohol market via its extensive bioindustrial segment. The company produces a wide range of grain-based alcohols, highlighting the supply chain reliability and consistency for its food, beverage, and personal care customers. Cargill’s strategic initiatives include significant investment in fermentation technology and expanding the production capacity to secure its position as a low-cost cost high-volume supplier in the global market. The company has recorded USD 160 billion in revenues in the year 2024.

- MGP Ingredients is a leading specialist in the premium segment of the market, renowned for its high-quality grain neutral spirits. The company’s expertise lies in producing ultra-pure alcohol that is vital for the distilled spirits, food extract, and specialty beverage industries. The MGP’s strategy centers on innovation in the distillation techniques and a strong focus on the craft beverage sector, allowing it to command a premium in the market for the superior purity products.

- Grain Processing Corporation subsidiary of Kent Corporation, is a major and specialized player in the food grade alcohol market. The company produces pure food-grade alcohols from corn with a strong emphasis on applications in the food, beverage, and healthcare sectors. The GPC’s competitive advantage stems from its vertically integrated operations, from the grain processing to advanced purification, ensuring robust quality control for sensitive end uses.

- Green Plains Inc. has strategically transformed into a leading biorefining company with a significant footprint in the market. Moving beyond the traditional fuel ethanol, the company now focuses on producing high-purity alcohols for human consumption and industrial uses via its ultra-high protein and specialty alcohol division. This pivot is an important strategic endeavor for diversifying income streams and capturing high value along the alcohol supply chain.

Here is a list of key players operating in the global market:

The food grade alcohol market is fragmented with competition among the integrated agricultural giants and specialized producers. The key strategies revolve around the vertical integration for feedstock security and cost control, and diversification into high-value premium segments such as organic, non-GMO, and craft beverage alcohols. Sustainability has become a core differentiator driving the investments in low-carbon production and traceability initiatives. Further, the capacity development in the emerging regions, strategic distribution, and technology alliances are key strategies for boosting the global footprint and meeting changing regulatory and consumer demands for purity and responsible sourcing. For example, in September 2025, Greenfield Global announced its expansion in the UK with new distribution capabilities for high-purity and industrial-grade alcohol.

Corporate Landscape of the Food Grade Alcohol Market:

Recent Developments

- In October 2025, Frugalpac partnered with Rhea Distilleries and ITC and introduced the Frugal Bottle for Fidalgo Premium Cashew Feni. This collaboration aims to minimize the glass and plastic waste in India’s F&B industry, with plans to scale up production.

- In January 2025, Alto Ingredients, Inc. has acquired CO2 processing plant adjacent to the Columbia facility for USD 7.25 million in cash plus working capital, bolstering economics and increasing asset valuation.

- In December 2024, Godavari Biorefineries Limited announced that it has invested ₹130 Crore in a new corn/grain-based distillery to enhance ethanol production with dual-feedstock flexibility, aligning with India’s Green Energy Goals.

- Report ID: 8307

- Published Date: Dec 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Grade Alcohols Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.