Food Recycler Market Outlook:

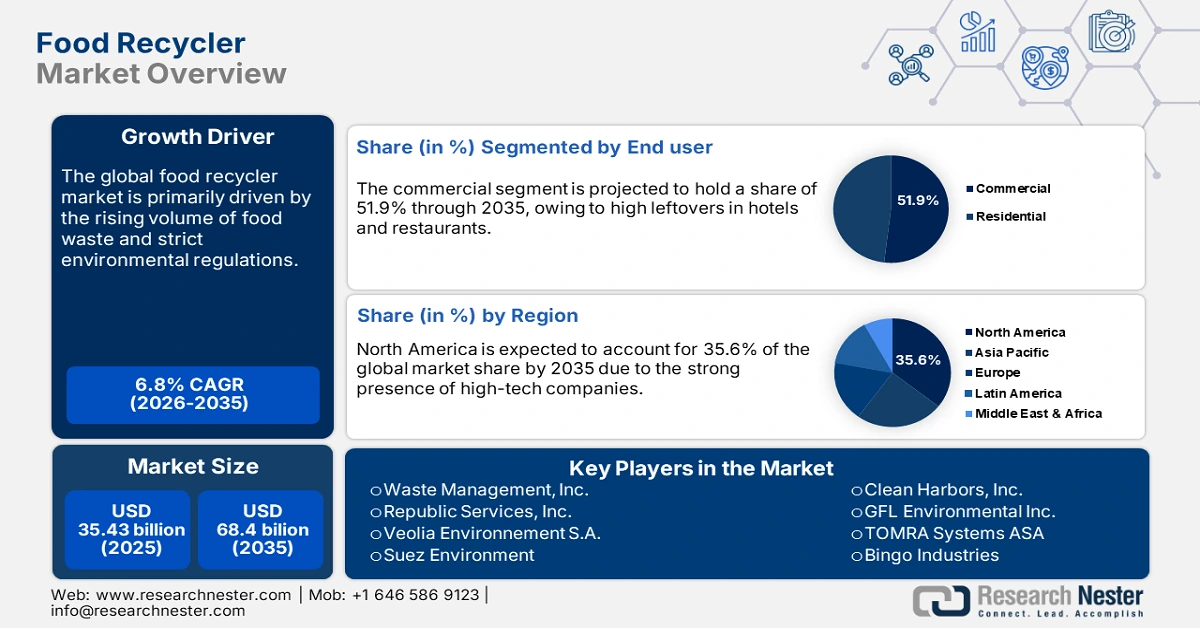

Food Recycler Market size was valued at USD 35.43 billion in 2025 and is expected to reach USD 68.4 billion by 2035, expanding at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food recycler is evaluated at USD 37.6 billion.

The sales of food recyclers are expected to increase at a high rate during the projected timeframe, as the trade policies, supply chain dynamics, and technological investments are expected to influence the sales. The raw materials and components used in the production of food recyclers are mainly sourced from China, Germany, and Japan. The International Trade Commission (ITC) study reveals that the U.S. imports of food waste processing machinery were calculated at USD 287.0 million in 2022. This underscores that the raw materials are mainly sourced from other countries in the U.S. for the domestic assembling of food recyclers.

The food waste processing machinery shipments in China accounted for 42.0% during the same period. According to the same source, 35% of U.S. manufacturers import critical parts from overseas. In 2022, the export demand for fully assembled food recyclers rose by 12.4% YoY, mainly due to strict sustainability regulations of the EU and APAC. Furthermore, the Bureau of Labor Statistics reveals that the producer price index for recycling equipment grew by 6.5% in 2023. This was mainly due to rising metal costs. Also, the consumer price index for commercial-grade recyclers registered a 4.5% uptick during the same year, owing to high production and logistics expenses.

Key Food Recycler Market Insights Summary:

Regional Highlights:

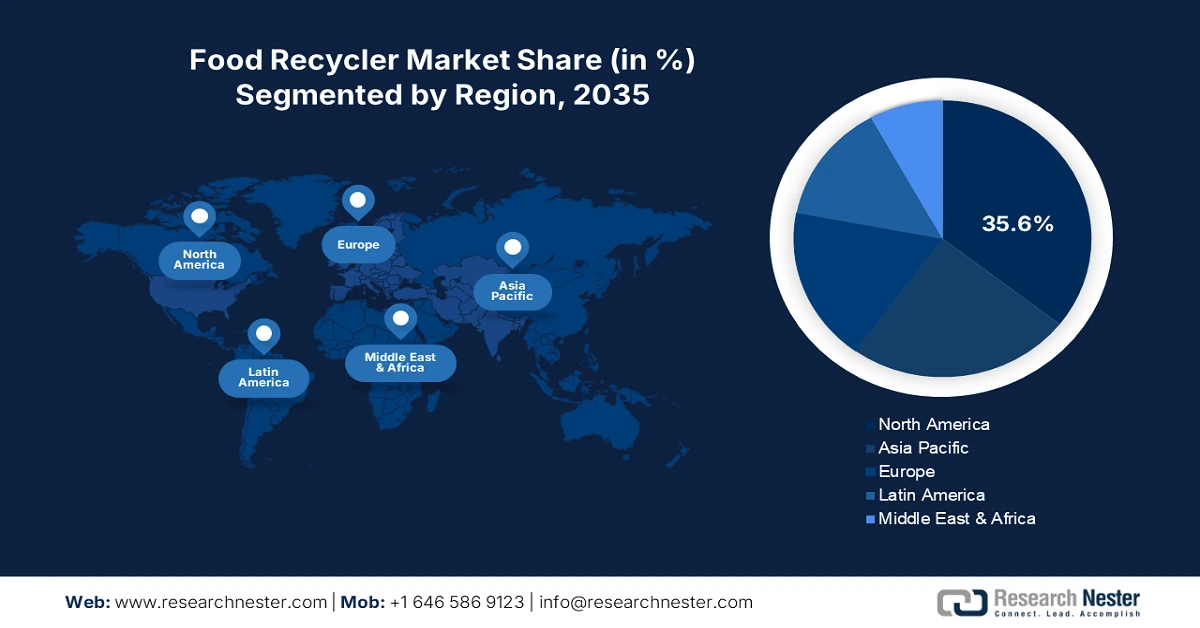

- North America leads the Food Recycler Market with a 35.6% share, fueled by high awareness of food waste and government-backed sustainability programs, driving strong growth prospects through 2035.

- The Asia Pacific Food Recycler Market is projected to experience significant growth through 2026–2035, driven by rapid urbanization and government-led food waste management reforms.

Segment Insights:

- The Commercial segment is projected to hold 51.9% market share by 2035, driven by high food waste volumes and regulatory mandates promoting food recycler adoption in restaurants.

- The Small (0-50 kg/day) segment is expected to hold a 38.5% market share by 2035, driven by its suitability for households and small commercial settings.

Key Growth Trends:

- Regulatory pressure

- Rising food waste volumes

Major Challenges:

- Infrastructure readiness gaps

- High cost of compliance and certification

Key Players: Waste Management, Inc., Republic Services, Inc., Veolia Environnement S.A., and Suez Environment.

Global Food Recycler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.43 billion

- 2026 Market Size: USD 37.6 billion

- Projected Market Size: USD 68.4 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Food Recycler Market Growth Drivers and Challenges:

Growth Drivers

- Regulatory pressure: The strict environmental regulations and waste management policies are fueling the sales of food recyclers. The EU’s Circular Economy Action Plan requires member states to halve food waste by 2030, which is anticipated to report a 15.4% YoY rise in food recycler installations across Germany and France. In the U.S., the EPA’s Food Recovery Challenge drove a 22.4% rise in commercial adoption since 2021. The tax incentives covering 31% to 51% of capital costs for businesses are boosting the adoption of food recyclers. The manufacturers are expected to earn lucrative gains use to favorable polices and schemes in the years ahead.

- Rising food waste volumes: The increasing volumes of food waste are increasing the adoption of recycling technologies. The Food and Agriculture Organization (FAO) reveals that the global food waste exceeds 1.7 billion tons annually. More than 59.5% originates from commercial sectors. This is fueling a high demand for industrial-scale recyclers, particularly in the U.S. and China, which account for 35.5% of global waste. The hospitality and retail sectors are also expected to capture a high chunk of global food waste. This directly accelerates the deployment of food recyclers in these industries.

Technological Innovations in the Food Recycler Market

The technological advancements are set to double the revenues of food recycler manufacturers during the projected period. The robust rise in food waste is propelling the demand for advanced recycling technologies. Moreover, the green innovations and strict environmental regulatory mandates are set to boost the adoption of food recycler systems. The sustainable initiatives, such as zero waste targets and the circular economy, are augmenting the demand for food recycling technologies. The table below reveals the current technological trends and their outcomes.

|

Technology |

Key Statistic |

Sector Adoption |

|

AI Sorting |

Mitigates contamination by 40.3% |

Retail (Walmart) – Employed AI recyclers, cutting waste costs by $2.1M/year |

|

IoT Monitoring |

Cuts maintenance costs by 25.5% |

Hospitality (Marriott) – IoT-tracked recyclers decreased downtime by 30.4% |

|

Blockchain |

30.3% of food processors use it for traceability |

Manufacturing (Nestlé) – Piloted blockchain for recyclable packaging tracking |

Sustainability Trends in the Food Recycler Market

|

Company |

Sustainability Initiatives |

Goals & Vision (2030) |

Impact on Business |

|

Whirlpool Corp. |

Achieved 33.4% mitigation in CO₂ emissions (2023) through solar-powered U.S. plants |

Net-zero emissions by 2030; 99.9% renewable energy use by 2028 |

Operating cost savings of $6.5M/year; increased ESG rating |

|

Electrolux Group |

Reached 45.4% renewable energy share globally (2022); optimized transport emissions |

80.3% renewables by 2030; 50.5% CO₂ reduction across operations |

Decreased logistics emissions by 21.4%; enhanced investor confidence |

|

Panasonic Corp. |

Fall in industrial waste by 38.4% (2020-2023) via circular economy production redesign |

Achieve 99.9% recyclable packaging; net-zero factories in Asia by 2030 |

Enhanced brand value (+12.3% YoY); reduced material costs |

Challenges

- Infrastructure readiness gaps: The unavailability of advanced infrastructure, such as digital technologies and a reliable connectivity network, hampers the sales of food recyclers. As per the analysis by the International Telecommunication Union (ITU), internet penetration in Sub-Saharan Africa and Southeast Asia was below 35.4% in 2023. The same source also estimates that more than 42.4% of households in these regions lack uninterrupted power. This directly hampers the adoption of Wi-Fi-enabled or app-connected recyclers.

- High cost of compliance and certification: The high cost of food recyclers is expected to limit their sales to some extent in price-sensitive markets. The strict complex regulations drive manufacturers to meet certification standards such as FCC, CE, and BIS. Obtaining multi-country compliance hampers the pockets of food recycler manufacturers. These certification hurdles make it financially infeasible for small or medium-sized manufacturers to scale globally without strategic licensing or local partnerships.

Food Recycler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 35.43 billion |

|

Forecast Year Market Size (2035) |

USD 68.4 billion |

|

Regional Scope |

|

Food Recycler Market Segmentation:

Capacity Segment Analysis

The small (0-50 kg/day) segment is estimated to account for 38.5% of the global food recycler market share throughout the forecast period. The 0-50 kg/day capacity food recycler is gaining traction owing to its suitability for small-scale operations. The households, small restaurants, and cafes are prime application areas of small food recyclers. Growing consumer awareness is expected to fuel the demand for compact recyclers for residential and small commercial use. Furthermore, the cost-effectiveness and ease of installation are fueling the adoption of small-capacity food recyclers.

End user Segment Analysis

The commercial segment is projected to capture 51.9% of the global market share by 2037. The high food waste volumes from bulk preparation and customer leftovers in restaurants and hotels are boosting the demand for food recyclers. The Environmental Protection Agency’s (EPA) goal to decrease food waste by 50.4% by 2030 is set to accelerate the sales of food recyclers. The strict regulatory mandates are also propelling the adoption of food recyclers in restaurants. Furthermore, the hospitality sector’s focus on corporate social responsibility and cost savings through waste-to-energy solutions is contributing to the overall trade of food recyclers.

Our in-depth analysis of the food recycler market includes the following segments:

|

Segment |

Subsegment |

|

Capacity |

|

|

Component |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Recycler Market Regional Analysis:

North America Market Insights

The North America market is anticipated to hold 35.6% of the global revenue share through 2037. The high awareness of food waste and government-backed sustainability programs is expected to boost the sales of food recyclers in the years ahead. The strict environmental regulations are likely to fuel the use of food recyclers in restaurants and hotels. In addition, the widespread availability of robust wireless connectivity networks and the digital shift are set to increase the efficiency and productivity of food recyclers. The key players in the region are focusing on the production of IoT and AI-integrated food recyclers.

The U.S. market is expected to increase at a rapid pace owing to the strong federal and state-level environmental policies. The EPA’s 2030 Food Loss and Waste Reduction Goal is estimated to fuel the demand for household and commercial food recycling solutions. National Telecommunications and Information Administration's (NTIA) BEAD Program, with a USD 42.6 billion investment plan, is contributing to the expansion of smart kitchen appliances through improved digital infrastructure. Furthermore, over 2.1 million U.S. households employed smart food recyclers in 2023, due to connectivity expansions and targeted grants.

The digital transformation and circular economy principles are projected to boost the sales of food recyclers in Canada. The government programs led by Innovation, Science, and Economic Development (ISED) are expected to promote R&D in smart kitchens and waste technologies. The Telecommunications Alliance Canada reveals that more than 510,000 households employed food recycler technologies in 2023. The supportive government policies and positive funding are anticipated to drive the adoption of food recyclers in the coming years.

APAC Market Insights

The Asia Pacific market is anticipated to record significant growth during the period 2025-2037. The rapid urbanization and government-led food waste management reforms are creating a profitable environment for key market players. Increasing investments in ICT and digital infrastructure projects are likely to drive innovations in food recycler technologies. China, India, Japan, and South Korea are expected to be the most opportunistic marketplaces for food recycler companies. Continuous technological advancements are projected to fuel the sales of smart waste solutions in the coming years.

China is estimated to register high sales of smart waste solutions, including food recyclers, during the foreseeable period. Massive smart city rollouts and government-enforced food waste regulations. The Ministry of Industry and Information Technology (MIIT) estimates that the government investment in food recycling technologies crossed ¥12.7 billion in 2023. The favorable regulations and public spending are drawing the attention of international food recycler companies.

The India market is estimated to increase at the fastest CAGR throughout the study period. The rise in digitization and growth in public-private investments in smart waste technology production are expected to drive the sales of food recyclers in the coming years. As per the analysis by the Ministry of Electronics and Information Technology (MeitY), the food recycler-related tech investments rose by 240.5% between 2015 and 2023. More than 4.3 million businesses are employing food recycling systems, especially in tier-1 and tier-2 cities. Overall, India is the most profitable market for food recycling system producers.

Country Specific Statistical Highlights

|

Country |

Gov. Spending/Adoption |

|

Japan |

In 2024, 2.3% of METI’s tech innovation budget (~¥98.4B) supported smart waste and food recycler projects. MHLW partnered with AMED to pilot 27 food waste AI monitoring systems. |

|

Malaysia |

Between 2013–2023, gov. funding rose 130%, with company adoption doubling. MDEC supports digital waste start-ups with RM350M through its #MyDigital programme. |

|

South Korea |

MSIT-backed NIPA allocated ₩270B in 2023 toward smart kitchen AI and recycling IoT; 720K+ homes adopted food recyclers since 2021. |

|

Australia |

DTA invested AUD 96M (2023) for circular tech pilots across Sydney and Melbourne smart cities. |

|

Indonesia |

Kominfo’s ICT stimulus fund supported 7 smart waste zone implementations (2022–2024) across Jakarta and Surabaya. |

|

Singapore |

IMDA and NEA launched the Smart Waste Management System, resulting in 200+ residential zones adopting food recyclers (2023–2024). |

Key Food Recycler Market Players:

- Waste Management, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Republic Services, Inc.

- Veolia Environnement S.A.

- Suez Environment

- Clean Harbors, Inc.

- GFL Environmental Inc.

- TOMRA Systems ASA

- Bingo Industries

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Biffa Group Limited

- Renewi plc

- Godrej & Boyce Mfg. Co. Ltd.

- Ecofast Malaysia Sdn Bhd

- Cleanaway Waste Management Limited

The key players in the global market are employing several organic and inorganic strategies to increase their reach and revenue shares. Leading companies are leveraging technological innovation tactics to attract a wider consumer base. They are also entering into strategic partnerships with other players to introduce advanced solutions. Collaborations with raw material suppliers are expected to offer a stable supply chain. The industry giants are also expanding their operations in developing economies to earn high gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2024, Tero announced the upgradation of its award-winning countertop food recycler, originally launched in 2021. This expansion led to a 25.4% rise in user adoption among eco-conscious households in North America in Q3 2024.

- In March 2024, Xsense Ltd announced the expansion of its Xsense System, an IoT-based cold chain monitoring solution. The system’s deployment in North American food processing facilities reported a 12.4% reduction in food spoilage rates in Q2 2024.

- Report ID: 7805

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Recycler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.