Food Processing Market Outlook:

Food Processing Market size was over USD 183.5 billion in 2025 and is estimated to reach USD 521.2 billion by the end of 2035, expanding at a CAGR of 12.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of food processing is estimated at USD 206 billion.

The international food processing market is emerging as one of the most severe industries in the global consumer goods industry, readily underpinned by food innovation, convenience, and security. Moreover, the market’s growth is highly driven by technological advancements, sustainability strategies, and a rise in the demand for packaged foods. According to official statistics published by Sustainable Production and Consumption in September 2024, the packaging sector tends to generate an estimated 2% of the gross national product across developed nations. In addition, with an international 5% yearly growth rate, the packaged food consumption is projected to increase from USD 1.9 trillion to USD 3.4 trillion by the end of 2030. Besides, the aspect of packaging is one of the main end use application industries of plastics, constituting a volume of more than 150 million tons per year, thereby denoting a huge growth opportunity for the food processing market.

Furthermore, the aspects of green and sustainability packaging, functional and plant-based foods, automation and digitalization, cold chain expansion, along with convenience and premiumization, are other drivers proliferating the food processing market’s growth. As per an article published by the GFI Organization in 2026, the plant-based food sector in the U.S. is evolving and growing, amounting to USD 3.9 billion, along with an increase to USD 8.1 billion in 2024. In addition, 6 in 10, which is 59% of households, readily purchased plant-based foods as of 2024. Meanwhile, this particular food category made up of 1.1% of the overall retail food and beverage industry, and 96% of households purchased plant-based seafood and meat in 2024. Therefore, based on these growth and evolution, there is a huge growth opportunity for the overall market.

Key Food Processing Market Insights Summary:

Regional Highlights:

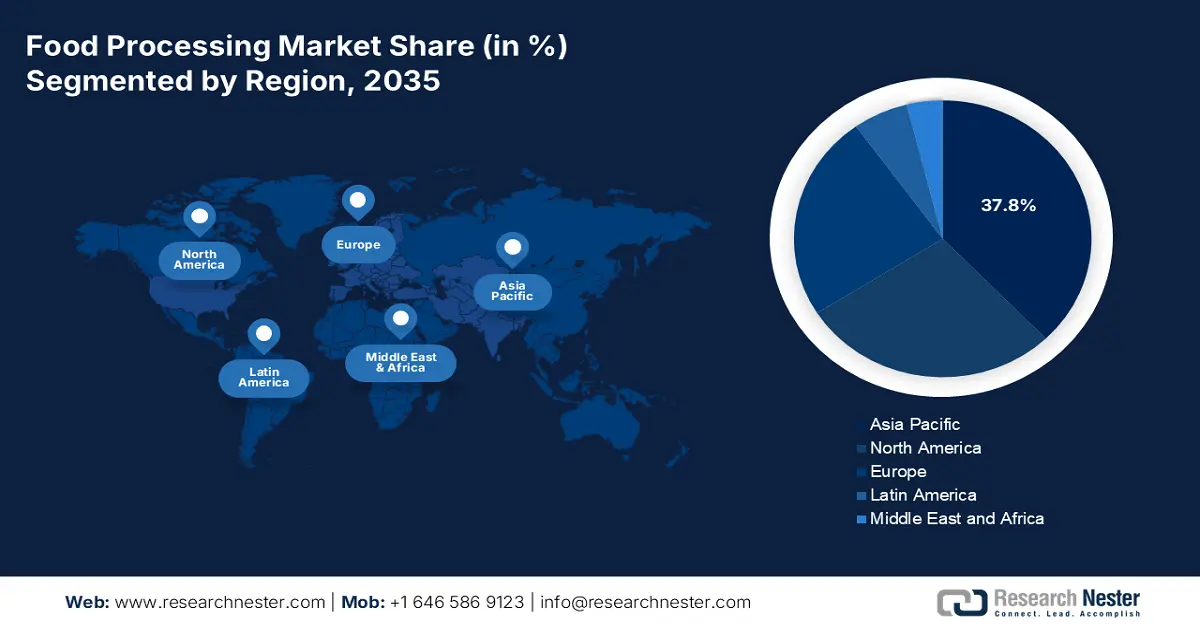

- Asia Pacific is projected to command the largest 37.8% share of the food processing market by 2035, supported by rapid retail modernization, accelerating urbanization, and rising private consumption.

- Europe is anticipated to emerge as the fastest-growing region by the end of the forecast period, strengthened by digitalized traceability systems, hygienic processing standards, and substantial investment in sustainable packaging.

Segment Insights:

- The dairy products sub-segment is forecast to capture a dominant 35.8% share of the food processing market by 2035, reinforced by its high nutritional value and functional attributes that enable diversification and processing enhancement.

- The frozen fruits and vegetables sub-segment is expected to register the second-highest share by 2035, stimulated by its ability to extend shelf life, ensure year-round availability, and preserve nutritional integrity.

Key Growth Trends:

- Rise in urban consumption

- Increase in government spending

Major Challenges:

- Regulatory compliance and food safety standards

- Sustainability and environmental pressures

Key Players: Nestlé (Switzerland), Unilever (UK), Danone (France), Mondelez International (U.S.), PepsiCo (U.S.), The Hershey Company (U.S.), Mars, Incorporated (U.S.), General Mills (U.S.), Kellogg Company (U.S.), Lactalis (France), Ferrero (Italy), Dr. Oetker (Germany), Ajinomoto (Japan), Meiji Holdings (Japan), CJ CheilJedang (South Korea), Yili Group (China), China Mengniu Dairy (China), Fonterra (New Zealand), Britannia Industries (India), Arnott’s Group (Australia).

Global Food Processing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 183.5 billion

- 2026 Market Size: USD 206 billion

- Projected Market Size: USD 521.2 billion by 2035

- Growth Forecasts: 12.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 15 January, 2026

Food Processing Market - Growth Drivers and Challenges

Growth Drivers

- Rise in urban consumption: There is a continuous growth in packaged foods across urban locations, with an increase in processed food penetration, which is positively impacting the food processing market. According to official statistics published by the Gain Health Organization in 2025, the expenses of a sustainable and healthy diet significantly exceeded the overall income of 57% of the total population in sub-Sahara Africa, along with 38% of the population in South Asia. Besides, 70% of households in Nairobi witness food insecurity, denoting a quarter of which are critically food insecure. Therefore, there is a huge growth opportunity for the market to flourish and expand across urban locations, especially in developed countries.

- Increase in government spending: The presence of governmental reforms significantly promotes sustainable packaging, research and development for biotechnology, and promotes food safety. As per an article published by the U.S. Department of State in August 2025, the U.S. provides an additional USD 93 million to treat almost 1 million children that usually suffer from malnutrition across 13 countries. These countries include Chad, Kenya, Djibouti, Democratic Republic of Congo, Central Africa, Madagascar, Nigeria, South Sudan, Ethiopia, Niger, Mali, and Haiti. Besides, UNICEF has decided to utilize this funding opportunity for distributing and transporting the government’s prepositioned stock. Moreover, the fund is also utilized for producing an additional 11,285 metric tons of RUTF, thus driving the market’s exposure.

- Focus on technological advancements: The aspect of innovation in homogenization equipment, extrusion, and thermal processing is optimizing product quality and efficiency, which is also fueling the food processing market globally. As per official statistics published by NLM in July 2025, the international population is projected to exceed 9.7 billion by the end of 2050. This is essential for requiring resource production and management to offer sustainable, healthy, and safe food globally. Besides, vegetable oils, refined sugar, cereals, and dairy products significantly contributed 72.1% of the total energy intake in the U.S. Moreover, the continuous food preparation supply chain focuses on advanced technologies, which also denotes an optimistic outlook for the overall market’s growth and expansion.

2023 Food Preparation Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

U.S. |

6.2 billion |

7 billion |

|

Singapore |

5.5 billion |

- |

|

Germany |

5.3 billion |

3.0 billion |

|

China |

- |

3.5 billion |

|

Global Trade Valuation |

57.8 billion |

|

|

Global Trade Share |

0.2% |

|

|

Export Growth |

2.5% |

|

Source: OEC

Challenges

- Regulatory compliance and food safety standards: Food safety regulations in the food processing market are becoming increasingly stringent worldwide, with agencies such as the FDA (U.S.), EFSA (Europe), and FSSAI (India) enforcing strict guidelines on chemical use, labeling, and hygiene. Compliance requires significant investment in testing, traceability, and certification, which can be burdensome for small and mid-sized processors. The complexity of global supply chains further complicates adherence, as companies must navigate varying standards across regions. For instance, Europe’s Farm to Fork Strategy mandates reduced chemical inputs and stricter sustainability reporting, while the U.S. Food Safety Modernization Act (FSMA) emphasizes preventive controls.

- Sustainability and environmental pressures: The food processing market faces mounting pressure to reduce its environmental footprint, particularly in packaging, energy use, and chemical waste. Governments and NGOs are pushing for circular economy models, recyclable packaging, and reduced greenhouse gas emissions. For instance, the Europe Green Deal sets ambitious targets for carbon neutrality, while the EPA from the U.S. enforces stringent waste disposal and emissions standards. Meeting these goals requires costly upgrades in equipment, adoption of biodegradable materials, and investment in renewable energy. However, transitioning to sustainable practices is complex: recyclable packaging often raises costs, renewable energy integration requires infrastructure, and waste reduction demands new chemical formulations.

Food Processing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.3% |

|

Base Year Market Size (2025) |

USD 183.5 billion |

|

Forecast Year Market Size (2035) |

USD 521.2 billion |

|

Regional Scope |

|

Food Processing Market Segmentation:

Food and Beverage Processing Segment Analysis

The dairy products sub-segment, which is part of the food and beverage processing segment, is anticipated to garner the highest share of 35.8% in the food processing market by the end of 2035. The sub-segment’s upliftment is highly attributed to its rich nutrient inclusion, such as vitamins, calcium, and protein. In addition, this enables product diversification, enhances texture, and offers functional ingredients. According to official statistics published by the USDA in December 2025, the aspect of milk production by the majority of dairy product exporters is forecasted to be 0.4% higher by the end of 2026. Based on this, the milk production in the U.S. is projected to be higher by 1.2% in the same year, since dairy farmers are continuing to enhance their herds to significantly supply development in processing capacity, thus denoting a huge growth opportunity for the sub-segment.

Fruits and Vegetables Processing Segment Analysis

Based on the fruits and vegetables processing segment, part of the frozen fruits and vegetables sub-segment in the food processing market is projected to hold the second-highest share by the end of the forecast period. The sub-segment’s growth is highly driven by its importance for expanding shelf life, ensuring year-round availability, diminishing food waste, and preserving peak nutritional flavor and value. As stated in an article published by MOFPI in 2025, the global fruit production witnessed a generous growth of 63% as of 2022, and successfully reached an overall production volume of 933 million tons. Simultaneously, there has been an increase in international vegetable production by 71% and reached 1.1 billion tons in the same year. Besides, different fruits are readily produced in different volumes, which also positively caters to the sub-segment’s development.

Top 10 Fruits Global Volume Analysis (2024-2025)

|

Fruit Type |

Production Volume (Million Tons) |

|

Bananas |

135,112.3 |

|

Watermelons |

99,957.6 |

|

Apples |

95,835.9 |

|

Oranges |

7,641.0 |

|

Grapes |

74,942.5 |

|

Coconuts, in shell |

62,409.4 |

|

Mangoes, Guavas, and Mangosteens |

59,151.8 |

|

Pineapples |

29,361.1 |

|

Peaches and Nectarines |

26,354.5 |

|

Pears |

26,324.8 |

Source: MOFPI

Processing Equipment and Automation Segment Analysis

By the end of the stipulated timeline, the thermal equipment sub-segment, part of the processing equipment and automation segment, is expected to account for the third-largest share in the food processing market. The sub-segment’s development is highly propelled by its pivotal role in the food processing industry, enabling safe, efficient, and large-scale production of packaged foods. This sub-segment includes pasteurizers, sterilizers, ovens, dryers, and heat exchangers, all designed to apply controlled heat for cooking, preservation, and microbial safety. The demand for thermal equipment is driven by rising consumption of dairy, bakery, ready-to-eat meals, and beverages, where heat treatment ensures extended shelf life and compliance with food safety standards. Automation has transformed thermal processing, with modern systems integrating sensors, IoT, and AI to optimize temperature control, reduce energy consumption, and maintain consistent product quality.

Our in-depth analysis of the food processing market includes the following segments:

|

Segment |

Subsegments |

|

Food and Beverage Processing |

|

|

Fruits and Vegetables Processing |

|

|

Processing Equipment and Automation |

|

|

Ingredients and Functional Additives |

|

|

Packaging and Cold Chain |

|

|

Food Biotechnology and Alternative Proteins |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Processing Market - Regional Analysis

APAC Market Insights

The Asia Pacific food processing market is anticipated to garner the largest share of 37.8% by the end of 2035. The market’s upliftment in the region is highly attributed to modernization in the retail sector, urbanization, and a rise in private consumption. According to official statistics published by the OECD in July 2023, the region contributed nearly 40% of international fish production, and 90% is deliberately sourced in China. In addition, this country is regarded as one of the major drivers for fish production, which is expected to grow by 1.3% every year. This particular growth is rapid in aquaculture at 1.5% per annum in the upcoming decade, in comparison to only 0.6% in captured fisheries. Meanwhile, aquaculture is projected to account for nearly 78% of the overall production in the overall region by the end of 2032, thereby making it suitable for boosting the food processing market’s exposure.

The food processing market in China is growing significantly due to rapid e-commerce and retail penetration, along with upscaling of cold-chain, beverages, and food expansion. As per an article published by the ITA in September 2025, there has been an increase in the country’s e-commerce industry by 11.9% as of 2023, significantly reaching CNY 15.4 trillion (USD 2.2 trillion). The industry is further expected to continue extending at a 9.9% growth rate by the end of 2028, and successfully reach CNY 25.4 trillion (USD 3.6 trillion). This particular growth is readily fueled by the continuous shift in customer preferences from offline to online shopping, which positively impacts the overall market in the country. Besides, the Ministry of Ecology and Environment (MEE), along with the National Development and Reform Commission (NDRC)prioritized pollution control, thus reducing emissions in food facilities.

The food processing market in India is also growing, owing to robust growth in frozen, RTD beverages, bakery, and dairy categories, a rise in disposable incomes, organized retail, and increased urbanization. As per an article published by the IBEF in October 2025, the food processing industry in the country accounted for nearly 8.8% and 8.3% of the gross value added (GVA), especially in agriculture and manufacturing, while readily contributing 13% of domestic exports, along with 6% of total industrial investment. In addition, the aspect of GVA from food processing has increased from Rs. 1.6 lakh crore (USD 24.6 billion) to Rs. 1.9 lakh crore (USD 24.4 billion) as of 2023. Besides, the country has successfully established itself as the international leader in milk production, accounting for almost 25% of the worldwide output between 2023 and 2024, thus denoting an optimistic outlook for the food processing market’s exposure.

Food Processing Industry’s Annual Growth Analysis in India (2023-2047)

|

Year |

Growth (USD Billion) |

|

2023 |

307 |

|

2030 |

700 |

|

2035 |

1,100 |

|

2040 |

1,900 |

|

2045 |

1,900 |

|

2047 |

2,150 |

Source: IBEF Organization

Europe Market Insights

Europe food processing market is expected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly propelled by digitalized traceability, hygienic processing, generous investment in sustainable packaging, robust retail penetration, and the presence of stringent environmental and safety regulations. According to official statistics published by Food Drink Europe in 2023, the industry’s turnover amounted to € 1,112 billion, along with 2% value addition, and 21.4% of consumption of household spending on food and drink products. Additionally, 4.6 million people are employed across 291,000 organizations, with €2.1 billion in research and development spending. Besides, the aspect of the ongoing industrial food preparation machinery supply chain is also creating a positive impact on the food processing market.

2023 Industrial Food Preparation Machinery Export and Import in Europe

|

Countries |

Export (USD) |

Import (USD) |

|

Germany |

2.7 billion |

638 million |

|

Italy |

2.4 billion |

338 million |

|

Netherlands |

1.9 billion |

447 million |

|

France |

675 million |

576 million |

|

Denmark |

649 million |

178 million |

|

Spain |

391 million |

384 million |

|

Switzerland |

371 million |

- |

|

Poland |

303 million |

392 million |

Source: OEM

The food processing market in Germany is gaining increased traction due to digitalized quality assurance and checks for beverages, bakery, meat, and dairy, along with energy-efficient thermal processing, in-depth integration of hygienic design, and an increased export orientation. As stated in an article published by the USDA Foreign Agricultural Service in March 2024, the country produced USD 238.9 billion of processed food and drinks as of 2022, denoting an increase by 17%. Moreover, as per an article published by the CSCP Organization in 2026, a single domestic citizen readily generates more than 220 kilograms of waste packaging every year. Therefore, to keep a check on this, the country’s federal government unveiled the latest packaging act, wherein approaches are set for increasing the recycling rate of plastic packaging, thereby ensuring sustainability for the market.

The food processing market in Poland is also developing, owing to a rise in the domestic consumption of RTD beverages, bakery, and packaged dairy products, as well as modernizing processing lines and capacity additions. According to official statistics published by the Trade Government of Poland in September 2025, the dairy industry in the country significantly recorded a massive increase, with exports reaching almost EUR 2.1 billion, which is 14% more than the previous year. Additionally, in May 2025, the number of dairy cows in the country was 1.9 million head, and meanwhile, the largest herds are located in the Podlaskie Voivodeship and Mazowieckie, each accounting for 22% of the total share. This also comprises 15% of the share in Wielkopolskie, along with 8% for Warmińsko-Mazurskie, thereby denoting a positive outlook for the market’s growth.

North America Market Insights

North America food processing market is projected to witness considerable growth during the stipulated duration. The market’s growth in the region is highly driven by sustained investment for sustainability, safety, and automation, along with an increase in consumer demand for convenience, fortified, and packaged foods. According to government data published by the Congress Government in October 2024, fruit and vegetable growers in the U.S. readily contributed USD 62.4 billion to farm-based production as of 2022. In addition, contributions by other regional participants throughout the value chain led to overall consumer sales of fruit and vegetable products between USD 160 billion and USD 190 billion every year. Besides, fruits and vegetables demonstrate almost 1/5th of the overall food market value yearly, thus denoting a huge growth opportunity for the market.

The food processing market in the U.S. is gaining increased traction due to safety standards, regulatory compliance, industrial efficiency, government expenditure, customer demands, green chemistry, and sustainability. As per an article published by the Academy of Nutrition and Dietetics in March 2023, 60% of foods purchased by customers comprise technical food additives, such as sweeteners, preservatives, flavoring, or coloring agents. Besides, customers in the country purchase over 400,000 different types of packaged food and beverage products annually at grocery stores, with the latest products continuously being added to shelves. Besides, as per the March 2024 FTC Government data report, the country comprises an estimated 25,000 traditional supermarkets and approximately 15,000 additional grocery retail stores across different formats, employing 2.6 million people, which is extremely suitable for uplifting the market.

The food processing market in Canada is also growing, owing to circular economy policies, clean manufacturing, government incentives for sustainable packaging, customer trends, policy support, and trade and export orientation. According to an article published by the Investment Agriculture Foundation of BC in September 2025, the Food Processing Growth Fund is considered a 3-year and nearly USD 20 million program significantly funded by the government through the Ministry of Agriculture and Food (AF) and delivered by IAF. The purpose of this fund is to help fund recipients in optimizing their systems, capacity, operations, and facilities to enhance productivity and readily support the utilization of agricultural inputs. Besides, the food processing industry in the country comprises more than 3,200 registered establishments, along with USD 12.6 billion in sales, thus making it suitable for boosting the overall market.

Key Food Processing Market Players:

- Nestlé (Switzerland)

- Unilever (UK)

- Danone (France)

- Mondelez International (U.S.)

- PepsiCo (U.S.)

- The Hershey Company (U.S.)

- Mars, Incorporated (U.S.)

- General Mills (U.S.)

- Kellogg Company (U.S.)

- Lactalis (France)

- Ferrero (Italy)

- Dr. Oetker (Germany)

- Ajinomoto (Japan)

- Meiji Holdings (Japan)

- CJ CheilJedang (South Korea)

- Yili Group (China)

- China Mengniu Dairy (China)

- Fonterra (New Zealand)

- Britannia Industries (India)

- Arnott’s Group (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Nestlé is the world’s largest food and beverage company, with a diversified portfolio spanning dairy, coffee, infant nutrition, and packaged foods. Its scale and global distribution network give it a dominant share in processed food categories, while sustainability initiatives such as recyclable packaging and plant-based innovation strengthen its competitive edge.

- Unilever operates across food, beverages, and consumer goods, with strong brands in sauces, spreads, and ice cream. The company emphasizes sustainable sourcing and circular packaging, aligning with Europe and global consumer trends toward eco-friendly products, which enhances its position in the food processing market.

- Danone is a leader in dairy, plant-based foods, and bottled water, with a strong presence in health-focused consumer goods. Its strategy centers on functional nutrition and sustainability, supported by Europe-based regulatory frameworks, making it a key player in processed dairy and alternative protein segments.

- Mondelez International dominates global snacking, particularly in biscuits, chocolate, and confectionery. Its investment in digital traceability and premiumization of brands like Oreo and Cadbury positions it strongly in the food processing market, especially in emerging markets with rising disposable incomes.

- PepsiCo combines beverages and packaged foods, with iconic brands in snacks and soft drinks. Its strategy integrates healthier product reformulations, expansion into functional beverages, and sustainability commitments, ensuring resilience and growth in the global food processing landscape.

Here is a list of key players operating in the global food processing market:

The international food processing market’s competition is concentrated among diversified multinationals with strong brands, integrated supply chains, and scale advantages in procurement, manufacturing, and distribution. Leaders pursue premiumization, portfolio renovation, and disciplined pricing while investing in sustainability, lower-emission operations, recyclable packaging, and greener chemistries, aligned with regulatory and consumer expectations. Digital traceability and data-driven quality systems enhance safety and efficiency, while mergers and acquisitions and partnerships expand into high-growth categories, including functional nutrition, RTD, and plant-based. Besides, in February 2025, Adisseo demonstrated futuristic new MetaSmart production infrastructure, especially in the Middle East and Africa, and Europe, with an increase in the focus on dairy nutrition, thus bolstering the food processing industry globally.

Corporate Landscape of the Food Processing Market:

Recent Developments

- In October 2025, Hiperbaric announced its record growth with 30 HPP machine installations as of 2025 by adding 9,900 liters of processing capacity internationally. This particular milestone also comprises the latest tolling partnerships that have readily expanded the HPP accessibility.

- In August 2025, the Middleby Corporation declared its acquisition of Frigomeccanica S.p.A, with the objective of expanding its portfolio of Middleby Food Processing equipment innovations.

- In June 2025, Fortifi Food Processing Solutions notified that it has successfully completed the acquisition of Area 52 in Canada. The purpose of this acquisition is effectively focused on ensuring patented solutions for crab and lobster production.

- Report ID: 8348

- Published Date: Jan 15, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Processing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.