Air Care Aerosol Market Outlook:

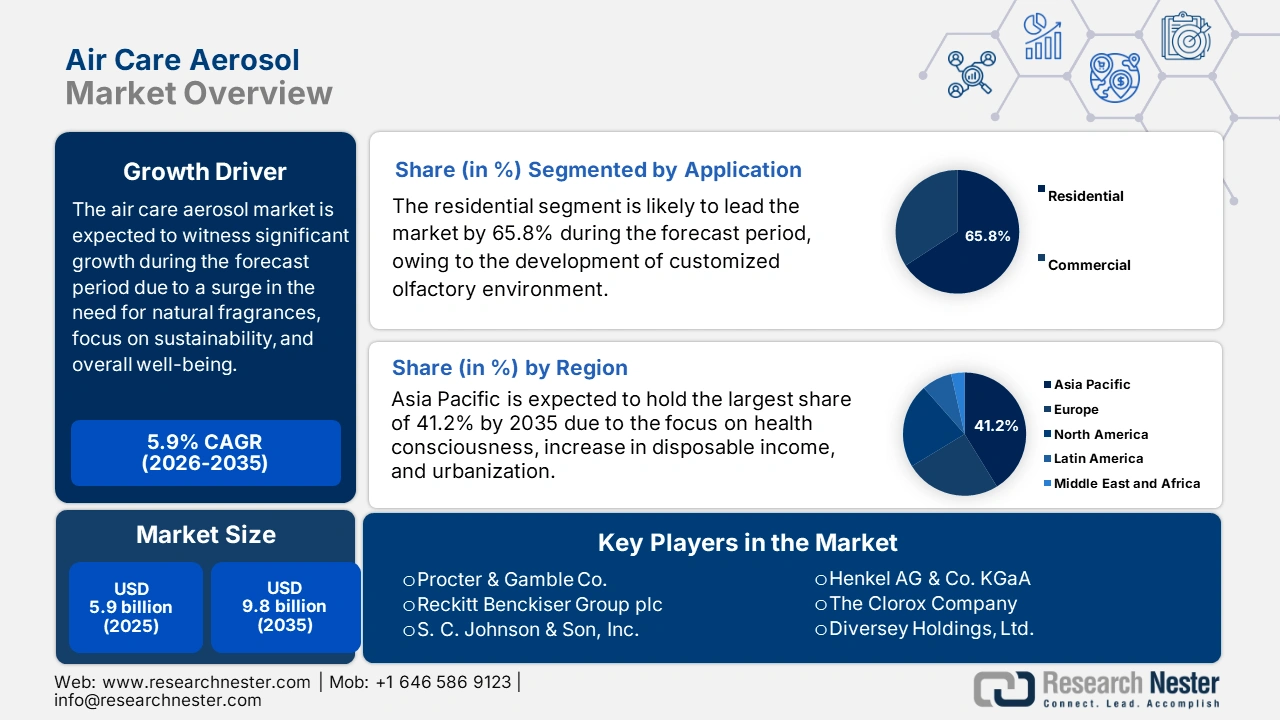

Air Care Aerosol Market size was USD 5.9 billion in 2025 and is anticipated to reach USD 9.8 billion by the end of 2035, increasing at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of air care aerosol is assessed at USD 6.2 billion.

The international market is presently being transformed by an effective confluence of robust growth factors and trends. These include a surge in the demand for plant-based fragrances and organic certifications, increased focus on sustainability, positioning products as suitable solutions for overall well-being, and the existence of digital-first discovery and commerce. According to an article published by NLM in March 2022, organic and natural skin care maintains the topmost billing in the worldwide organic beauty market and has emerged as the most effective segment with a 30.9% share by the end of 2024, thereby positively impacting the holistic market.

Moreover, the March 2022 NLM article indicated that Citrus bergamia Risso, which is a bergamot oil, is readily utilized in cosmetics, with only 0.1 ppm, particularly in Austria. In addition, the permissible concentration of the oil in baths and shower gels is 0.01%, while it is 0.001% in creams, massage oils, and body oils. Besides, the increased awareness of indoor air quality as well as hygiene, the availability of products with verified antiviral, antibacterial, and allergen-based properties, enhanced urbanization, and an upsurge in disposable incomes are also driving the market globally. Meanwhile, as per a report published by the MUC Women’s College in June 2022, the international fragrance and flavor sector is valued at USD 24.1 billion and India is readily contributing an estimated USD 500 million, suitable for the market’s growth.

Key Air Care Aerosol Market Insights Summary:

Regional Highlights:

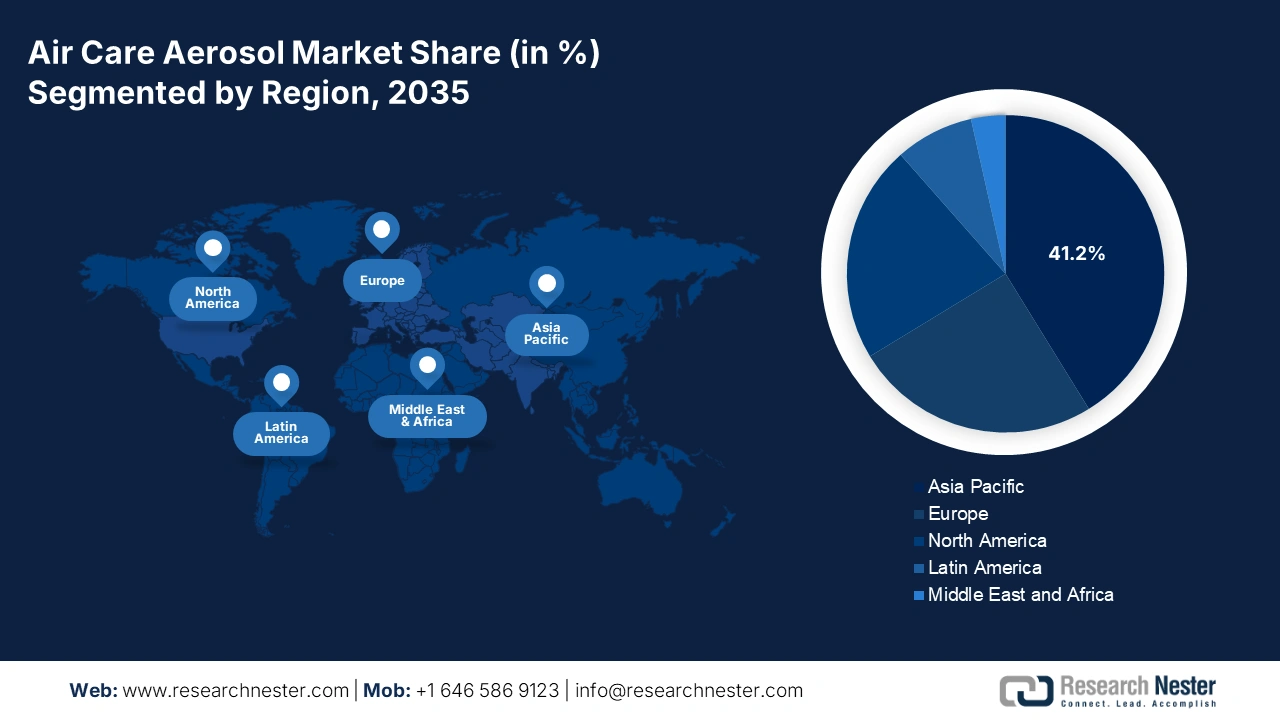

- The Asia Pacific region in the Air Care Aerosol Market is anticipated to command the largest share of 41.2% by 2035, fueled by rising health awareness, surging disposable incomes, and rapid urbanization.

- North America is projected to be the fastest-growing region during 2026–2035, impelled by consumers’ growing preference for multifunctional air care products offering wellness and odor-control benefits.

Segment Insights:

- The residential segment of the Air Care Aerosol Market is anticipated to hold a 65.8% share by 2035, propelled by the post-pandemic transformation of homes into multifunctional wellness, leisure, and workspaces emphasizing personalized olfactory experiences.

- The hydrocarbons (HC) segment is projected to secure the second-largest share by 2035, spurred by its extensive use as a fuel and raw material across transportation, energy, and industrial applications

Key Growth Trends:

- Increased focus on hygiene

- The presence of clean and natural formulations

Major Challenges:

- Slow growth and saturation in mature markets

- Competition between e-commerce and digital marketing

Key Players: Procter & Gamble Co., Reckitt Benckiser Group plc, S. C. Johnson & Son, Inc., Henkel AG & Co. KGaA, The Clorox Company, Diversey Holdings, Ltd., Godrej Consumer Products Ltd., Unilever PLC, Kao Corporation, Amway Corp., PZ Cussons, Nobel Hygiene Pvt. Ltd., CarrollClean, Spectrum Brands Holdings, Inc., Nice Group Co., Ltd., Earth Chemical Co., Ltd., LG Household & Health Care Ltd., JR Watkins Co., The Caldrea Company.

Global Air Care Aerosol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 9.8 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Mexico, South Korea, Australia

Last updated on : 9 October, 2025

Air Care Aerosol Market - Growth Drivers and Challenges

Growth Drivers

- Increased focus on hygiene: The aspect of practicing hand hygiene is extremely essential for infection control and prevention, which is positively impacting the market globally. According to an article published by NLM in March 2024, there has been an increase in the compliance rate of hand hygiene from 66.0% to 88.3%, along with a concurrent enhancement from 68.6% to 78.9%. Besides, healthcare-based infections are essential for patients, with an estimated 7% in high-income countries and 15% in low- to middle-income nations severely at risk for infection, which is driving the market demand.

- The presence of clean and natural formulations: These particular formulations are gaining increasing importance in the market, owing to an increase in consumer awareness regarding personal health and indoor air quality. According to an article published by NLM in July 2024, there has been a steady increase in natural products by 35% to 45% for clinical trials, particularly in phase I to phase III. However, synthetic-compound-based patent documents have also outnumbered natural products with a consistent proportion of 77% in comparison to 23%, thereby denoting the increased need for natural-based products.

- Environmental concerns reshaping product development: These concerns are significantly reshaping the aspect of product development by shifting it from a linear take-make-disposable model to a sustainable and circular process. As per an article published by the Journal of Retailing and Consumer Services in January 2024, customers are increasingly inclined towards sustainable products, and almost 64% of the global population is reported to purchase products that are labeled as socially responsible or environmentally sustainable. Therefore, this modification is positively impacting the market, which is readily fueled by a surge in the consumer demand for eco-friendly products.

Sleep Disorder Prevalence Driving the Air Care Aerosol Market (2023)

|

Disease Type/Components |

Men vs Women Prevalence |

Patient Percentage |

|

Insomnia |

10.1% vs 17.6% |

More than 40% |

|

Sleep-Disordered Breathing (SDB) |

- |

50% of the old population |

|

Central Disorders of Hypersomnia |

- |

142,600 (44.3 per 100,000) |

|

Circadian Rhythm Sleep-Wake Disorders (CRSD) |

- |

0.13% to 0.17% |

|

Parasomnia |

|

8.7 per 100,000 |

|

Sleep-Related Movement Disorders |

50 females |

40 per 100,000 |

Source: NIH

Challenges

- Slow growth and saturation in mature markets: In developed nations, such as West Europe and North America, the market is immensely saturated. Besides, the market’s upliftment is extremely slow and effectively attributed to replacement and premiumization purchases, in comparison to new user acquisition. This has created a highly competitive and price-sensitive environment, wherein market share benefits are frequently gained at the expense of profit margins. Therefore, organizations need to rely on line extensions and continuous advancements to secure shelf space and consumer attention.

- Competition between e-commerce and digital marketing: The sudden transition to e-commerce, while an opportunity, is considered a huge challenge in the market. This has drastically reduced gaps for market entry, permitting digitally-native vertical brands to capture and emerge niche segments, along with targeted social media marketing. Besides, being competitive in such a situation needs suitable investment, especially in SEM, SEO, as well as data analytics. Moreover, the algorithm nature of platforms, such as Google and Amazon Shopping, highly favors sophisticated digital operations, which has pressured conventional brands to rapidly get adapted to commercial capabilities.

Air Care Aerosol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 9.8 billion |

|

Regional Scope |

|

Air Care Aerosol Market Segmentation:

Application Segment Analysis

Based on the application, the residential segment is anticipated to garner the largest share of 65.8% by the end of 2035. The segment’s upliftment is highly attributed to the post-pandemic redefinition of home as one of the multi-functional sanctuaries for wellness, leisure, and work. This has eventually bolstered customers’ focus on developing a pleasing and personalized olfactory environment and ensuring air care mobility from a flexible purchase to an essential component of home management. Besides, the segment’s growth is primarily fueled by premiumization since customers are seeking multifunctional products that provide aromatherapy advantages, such as stress relief and enhanced focus, which is far beyond the usual odor masking.

Propellant Type Segment Analysis

Based on the propellant type, the hydrocarbons (HC) segment is projected to cater to the second-largest share during the forecast duration. The segment’s growth is highly driven by its importance and utilization as a fuel for transportation, cooking, and heating. In addition, it plays an essential role as a raw material for dyes, pharmaceuticals, and plastics, along with its function as a lubricant and solvent in different industries. As stated in the 2023 DGH India report, hydrocarbons in India’s energy mix have enhanced to nearly 33% of the overall energy basket. The import reliance of oil currently stands at 85.7%, while it is 48.2% for natural gas, thereby denoting a huge opportunity for the segment’s growth.

Function Segment Analysis

Based on the function, the scented/fragrance segment is expected to account for the third-largest share by the end of the projected year. The segment’s development is highly fueled by its aspect of influencing emotions, triggering memories, boosting cognitive function, improving confidence, and ensuring positive social impressions. As per an article published by NLM in March 2023, linalool and limonene are considered fragrance chemicals in almost 45% and 72% of common household product formulations. Additionally, these fragrances have reached concentrations ranging from 544 to 787 μg/m3 of linalool and 7 to 140 μg/m3 limonene, thereby suitable for the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Propellant Type |

|

|

Function |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Type of Consumers |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Care Aerosol Market - Regional Analysis

APAC Market Insights

Asia Pacific in the air care aerosol market is anticipated to be the dominating region, garnering the highest share of 41.2% by the end of 2035. The market’s growth in the region is highly attributed to a profound transition in health consciousness, a rise in disposable incomes, and unprecedented urbanization. In addition, megacities across India and China are readily raising the need for products that ensure improved indoor air quality, owing to associated pollution concerns. According to an article published by the UNEP Organization in November 2024, approximately 6.5 million people face death every year due to exposure to poor air quality, and 70% of air pollution is associated with death in the overall region, which drives the need for the market.

The air care aerosol market in China is growing significantly, owing to the presence of the burgeoning middle class, especially in tier-1 and tier-2 cities, along with an increase in health awareness. Besides, the National Medical Products Administration (NMPA) has classified specific disinfectant aerosols as medical devices that require strict acceptance. As per the August 2023 NMPA Government article, the health awareness level among the country’s people was 27.7% as of 2022, which is 2.3% higher than the previous year. Therefore, with the increase in health, there is a huge growth opportunity for the market in the country.

The air care aerosol market in India is also gaining increased traction due to the aspect of urbanization, public health campaign influence, the Swachh Bharat Mission’s focus on sanitation, and the rise in the incorporation of residential and commercial air care products. As stated in the 2025 Swachh Bharat Mission-Urban report, the sewage treatment plant accounts for 37,572 design capacity, while feacal sludge treatment plant constitutes 49,865, thereby making it suitable for increased sanitation. Additionally, 4,692 cities in the country comprise open defection-free systems, which also cater to the market’s development in the country.

2025 Worst and Best Air Quality Stations in Asia

|

Cities |

Worst Stations |

Cities |

Best Stations |

|

Mumbai (India) |

Malad West (999) |

Ngari Sanai |

Ngari Station (1) |

|

Panipat (India) |

Sector-18 (500) |

Okinawa (Japan) |

Maezato, Ishigaki (13) |

|

Shaoxing |

Shaoxing Shaoxing Technical School (174) |

Brajrajnagar (India) |

GM Office (15) |

|

Aksu |

Art Center (160) |

Qionghai |

City People’s Hospital (17) |

|

Amritsar (India) |

Golden Temple (152) |

Okinawa (Japan) |

Hirara, Miyakojima (17) |

|

Ulsan |

Bugok-dong, Nam-gu (144) |

Sabah (Malaysia) |

Keningau (22) |

|

Ulaanbaatar |

Mongol Gazar (131) |

Sabah (Malaysia) |

Kota Kinabalu (24) |

|

Hosur (India) |

SIPCOT Phase-1 (120) |

Sabah (Malaysia) |

Sandakan (30) |

Source: AQICN

North America Market Insights

North America in the air care aerosol market is expected to emerge as the fastest-growing region during the forecast period. The market’s exposure in the overall region is highly propelled by consumers’ demand for multifunctional products to provide wellness advantages, such as improved sleep and stress relief, as well as suitable odor elimination. As per an article published by NLM in August 2024, an estimated 50 to 70 million adults in the U.S. readily experience sleep disorders, of which insomnia is the most common disorder. However, the intake of valerian has proved to be useful to combat the disorder, with a standardized mean difference of -0.70, which denotes a 95% confidence interval.

The air care aerosol market in the U.S. is developing, owing to the major aspect of sustainability, robust focus on natural ingredients, propellants, and recyclable packaging. Additionally, notable brands are also making generous investments, particularly in D2C e-commerce channels, along with targeted digitalized marketing. As indicated in the October 2023 RMI Organization article, health risks are extremely higher in the country for the utilization of gas stoves, wherein nitrogen dioxide levels are usually around 50 to 400 times higher in comparison to homes with electric stoves. Therefore, indoor air quality (IAQ) guidelines are essential to provide climatic and health solutions, thus suitable for the market’s exposure in the country.

The air care aerosol market in Canada is also growing due to the strong preference for eco-friendly and clean products, which is readily influenced by the country’s strict environmental reforms. Meanwhile, the existence of Health Canada’s regulations for volatile organic compound (VOC) emissions, particularly in consumer products, is directly shaping product formulation. According to an article published by the Government of Canada in October 2024, the government will be readily investing USD 150 million for developing a national net-zero by the end of 2050. This is possible through the Canada Green Buildings Strategy that will uplift research, create regulatory standards, and develop an approach to gain EnerGuide labeling.

Europe Market Insights

Europe in the air care aerosol market is expected to grow steadily by the end of the predicted timeline. The market’s development in the region is highly driven by consumers’ unwavering focus on wellness, environmental sustainability, and health. Additionally, strict EU-based regulations, especially the Europe-based Chemical Agency’s (ECHA) VOC Limitations Directive, are gradually shaping product formulation, which has pushed advancement to low-VOC, bio-based, and natural propellants, along with fragrances. The market is also effectively characterized by the requirement for multifunctional and premium products that provide aromatherapy benefits and proven antibacterial efficiency.

The air care aerosol market in Germany is gaining increased exposure, owing to the presence of increased consumer trust in efficiency and quality. Besides, the German Environment Agency (UBA) tends to play a critical role by enforcing the national incorporation of the EU VOC Directive, providing products that effectively meet severe emission limitations. As indicated in the February 2025 Clean Energy Wire article, the country has aimed to reach net greenhouse gas neutrality by the end of 2045 by setting interim targets of reducing emissions by almost 65% by 2030 and 88% by 2040. This is positively impacting the overall market in the country.

The air care aerosol market in the UK is also growing due to the robust need for natural, premium, and designer air pump brands. In addition, the public health guidance on infection control has significantly influenced the commercial industry in the country, which is also driving the market’s upliftment. For instance, the UK Health Security Agency (UKHSA) tends to provide suitable guidelines for infection control and prevention in workplaces, which has recommended air cleaning and ventilation. This indirectly stimulated the requirement for disinfectant aerosols in public spaces and aerosols, thus suitable for bolstering the market in the country.

Air Pumps 2023 Export Import in Europe

|

Countries |

Export |

Import |

|

Germany |

USD 10.5 billion |

USD 5.9 billion |

|

Italy |

USD 4.5 billion |

USD 2.4 billion |

|

Belgium |

USD 2.3 billion |

USD 2.4 billion |

|

France |

USD 2.0 billion |

USD 2.6 billion |

|

Poland |

USD 1.6 billion |

USD 1.9 billion |

|

UK |

USD 1.6 billion |

USD 2.8 billion |

|

Switzerland |

USD 1.4 billion |

USD 702 million |

|

Czechia |

USD 1.3 billion |

USD 1.1 billion |

Source: OEC

Key Air Care Aerosol Market Players:

- Procter & Gamble Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Reckitt Benckiser Group plc

- S. C. Johnson & Son, Inc.

- Henkel AG & Co. KGaA

- The Clorox Company

- Diversey Holdings, Ltd.

- Godrej Consumer Products Ltd.

- Unilever PLC

- Kao Corporation

- Amway Corp.

- PZ Cussons

- Nobel Hygiene Pvt. Ltd.

- CarrollClean

- Spectrum Brands Holdings, Inc.

- Nice Group Co., Ltd.

- Earth Chemical Co., Ltd.

- LG Household & Health Care Ltd.

- JR Watkins Co.

- The Caldrea Company

The international market is a consolidated and fiercely competitive landscape, which is readily dominated by certain FMCG giants, such as S.C. Johnson, Reckitt, and P&G, which jointly account for a generous portion of the overall market share. Their tactical strategies are threefold since they are effectively investing in product advancement, which is centered on sustainability, introducing brands with 100% recyclable, HFP propellants, and natural fragrances to cater to strict regulations, along with customer demand. Secondly, these companies have pursued robust portfolio diversification and finally also leveraged e-commerce optimization and digital marketing to develop suitable customer relationships, thereby bolstering the air care aerosol market’s exposure globally.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Coty, Inc. unveiled Origen, which is the latest consumer beauty fragrance brand, effectively inspired by the spirit of scent stories and discovery from across different nations.

- In January 2025, the Estée Lauder Companies Inc. declared an outstanding deal with Exuud Inc. on an advanced fragrance expression hardware-based platform, with the intention to modify the upcoming olfactive innovation

- Report ID: 8180

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Care Aerosol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.