Plant Tissue Culture Market Outlook:

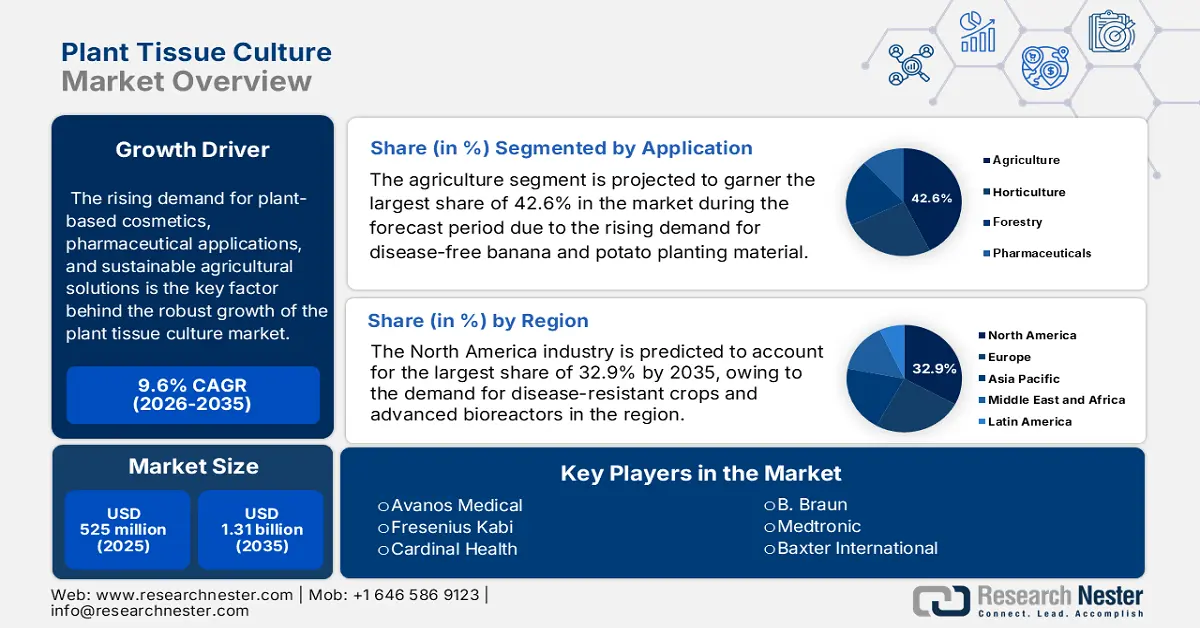

Plant Tissue Culture Market size was valued at USD 525 million in 2025 and is projected to reach USD 1.31 billion by the end of 2035, rising at a CAGR of 9.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plant tissue culture is evaluated at USD 552.8 billion.

The increasing demand for high-yield, disease-resistant crops and advancements in micropropagation technologies are the key factors behind the robust growth of the plant tissue culture market. The trade activities in the merchandise readily rely on the exports and imports of growth media, explants, and sterile equipment. As per a report published by OEC in 2023, the U.S is the key exporter of prepared culture media for developing micro-organisms, which accounted for USD 1.02 billion in exports, especially supplying agar, plant growth regulators, and pre-sterilized containers.

The patient population addressable for therapy based on APIs derived from plant tissue culture is large and increasing, especially in oncology and autoimmune diseases. The National Cancer Institute (NCI) estimates in May 2025 that more than 18.1 million cancer cases in the U.S. in 2022, and these patient population are highly dependent on taxanes and other plant-derived chemotherapeutics. These medicines have a worldwide, intricate supply chain involving the cultivation of source plants, extraction of raw material and advanced processing into GMP-compliant Active Pharmaceutical Ingredients (APIs).

Key Plant Tissue Culture Market Insights Summary:

Regional Highlights:

- North America is expected to secure the largest 32.9% revenue share in the plant tissue culture market by 2035, bolstered by the demand for disease-resistant crops and regulatory support for agricultural biotechnology advancements.

- Asia Pacific is projected to record the fastest growth from 2026 to 2035, owing to substantial R&D investments in smart farming and green biotechnology initiatives.

Segment Insights:

- The agriculture segment is projected to account for a 42.6% share of the plant tissue culture market by 2035, propelled by the rising demand for disease-free banana and potato planting material and supportive government subsidies.

- The plantlets segment is anticipated to capture a notable share by 2035, supported by the expansion of commercial horticulture dynamics and advancements in AI-based bioreactor systems enabling mass production.

Key Growth Trends:

- Growing incidences of diseases

- Sustainable agriculture and climate resilience

Major Challenges:

- Exacerbated compliance expenses

- Inadequate provinces in emerging economies

Key Players: Plant Cell Technology, DuPont, Phytoclone, Bayer AG, Syngenta, Murashige & Skoog, VitroTech, Lab Associates, Pioneer Agri-Tech, Krishidhan, Biotech Consortium, China Green, Shanghai Bio, Korea Plant Tech, AgriGenesis, Nissan Chemical, Japan Tissue Culture, Takii Seed, Otsuka AgriTechno, GreenBio.

Global Plant Tissue Culture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 525 million

- 2026 Market Size: USD 552.8 billion

- Projected Market Size: USD 1.31 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, India

- Emerging Countries: South Korea, Malaysia, Brazil, Mexico, Netherlands

Last updated on : 25 September, 2025

Plant Tissue Culture Market - Growth Drivers and Challenges

Growth Drivers

- Growing incidences of diseases: The increased global burden of cancer and autoimmune diseases is a major driver for demand. Such conditions are apt to require plant-derived chemotherapeutics and monoclonal antibodies, the manufacture of which can be done on a large scale through tissue culture. The National Cancer Institute (NCI) in May 2025 projects 2,041,910 new cases of cancer in the U.S., establishing a continuous demand for uninterrupted, high-quality API production that conventional plant harvesting is incapable of delivering, thus driving the use of advanced tissue culture methods for guaranteed drug production.

- Sustainable agriculture and climate resilience: Climate change causes various issues in traditional agriculture, such as flooding and disease transmission. Governments and agricultural agencies promote tissue culture as a technique to propagate climate-resilient, disease-free and high-yielding varieties of crops. The USDA's National Institute of Food and Agriculture (NIFA) offers sizeable grants for research in sustainable agricultural systems, including advanced propagation methods aimed at increasing crop resilience. Further, the NIFA in 2026 states that NIFA’s flagship program, outlined plans to invest approximately USD 300 million in research for food and agricultural sciences in fiscal year 2025-26, promoting initiatives that include climate-resilient crop development and sustainable propagation methods.

- Government and payer focus on cost-effective care: Government health agencies are prioritizing cost-saving interventions. The AHRQ has funded on research highlighting the early and effective treatment reducing long term hospitalization costs. For high-cost conditions treated with plant-derived drugs, ensuring a stable, affordable API supply through tissue culture is a key strategy to control drug prices and overall healthcare expenditure, making it a focus for public health policy and funding.

World’s Top 10 exporter of Vegetables Saps & Extracts (H.S Code-1302)

|

Rank |

Country |

2019 |

2020 |

2021 |

2022 |

||||

|

Value (Million USD) |

Share (%) |

Value (Million USD) |

Share (%) |

Value (Million USD) |

Share (%) |

Value (Million USD) |

Share (%) |

||

|

1 |

China |

1548.64 |

22.15 |

1627.87 |

23.90 |

2104.04 |

26.55 |

2752.78 |

30.41 |

|

2 |

India |

860.27 |

12.31 |

619.82 |

9.10 |

740.56 |

9.35 |

954.84 |

10.55 |

|

3 |

Spain |

506.77 |

7.25 |

570.06 |

8.37 |

716.20 |

9.04 |

930.49 |

10.28 |

|

4 |

Germany |

737.79 |

10.55 |

738.68 |

10.84 |

779.53 |

9.84 |

733.00 |

8.10 |

|

5 |

USA |

635.61 |

9.09 |

572.04 |

8.40 |

604.90 |

7.63 |

660.99 |

7.30 |

|

6 |

France |

146.47 |

2.10 |

153.17 |

2.25 |

168.37 |

2.12 |

568.66 |

6.28 |

Source: Directorate General of Commercial Intelligence and Statistics, 2023

Challenges

- Exacerbated compliance expenses: The constraints related to the heightened regulatory compliance costs remain consistent in the plant tissue culture market. Testifying to the same USDA in 2023 revealed that the FDA & USDA clearances for tissue culture plants cost make it challenging for manufacturers from price-sensitive regions. On the other hand, in Europe, the existence of GMO regulations creates an ultimate delay in commercialization, hence limiting expansion in the plant tissue culture market.

- Inadequate provinces in emerging economies: The plant tissue culture market still faces cost pressures from volatilities related to funding in emerging nations. As evidence World Bank in 2023 stated that in Africa, the agri-biotech funding grants enable coverage for only tissue culture lab setup expenses, creating hesitation among small-scale firms. On the other hand, in India, the prolonged subsidy tenures resulted in project abandonments as of the DGFT 2024 report.

Plant Tissue Culture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 525 million |

|

Forecast Year Market Size (2035) |

USD 1.31 billion |

|

Regional Scope |

|

Plant Tissue Culture Market Segmentation:

Application Segment Analysis

Agriculture segment is projected to garner the largest share of 42.6% in the plant tissue culture market during the forecast period. The rising demand for disease-free banana and potato planting material makes this subtype the gold standard to generate revenue in this field. As evidence, the Food and Agriculture Organization study in 2023 observed that the developing economies such as India, Africa, and Latin America are increasingly preferring these plantlets to combat viral diseases such as the banana bunchy top virus causes yield loss up to 100% and, potato leaf roll virus, that can potentially cause 90% yield losses, based on NLM report in October 2022 and June 2025. Further, the government subsidies and export demand also propel growth in the segment.

Type Segment Analysis

Plantlets segment is anticipated to gain a significant share in the plant tissue culture market by the end of 2035. The growth in the segment is subject to the expansion of commercial horticulture dynamics, especially in roses and orchids. Therefore, the data from New Energy and Industrial Technology Development Organization (NEDO)in 2024 revealed that AI-based bioreactor deliberately reduces labor costs thereby enabling mass production. Further, the USDA February 2025 states that agricultural exports, including horticultural products (of which floriculture is a part) were forecasted at USD 41.7 billion for 2025, showing stable strong performance.

End user Segment Analysis

Biotechnology companies’ segment is anticipated to attain a considerable share in the plant tissue culture market during the discussed timeframe. The segment’s growth originates from the existence of CRISPR-edited crops requiring mass propagation measures. This can be testified by the study by NIH in 2023 that states that these CRISPR-edited crops, such as drought-resistant wheat, blight-proof potatoes, necessitate large-scale tissue culture propagation for commercialization, reflecting a wider segment scope. Furthermore, the regulatory push and corporate investments are providing an encouraging opportunity for players to capitalize on this sector.

Our in-depth analysis of the plant tissue culture market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

End user |

|

|

Crop Type |

|

|

Technique |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant Tissue Culture Market - Regional Analysis

North America Market Insights

North America in the plant tissue culture market is expected to attain the largest revenue share of 32.9% by the end of 2035. The region’s proprietorship in this field is attributed to the demand for disease-resistant crops and advanced bioreactors. In this context, the BreakThrough report in August 2022 states that AgARDA is authorized up to USD 40 million/year but initially funded at USD 1 million in 2022, awaiting scale-up. The 2023 Farm Bill has called for reauthorizing and increasing funding for agricultural biotechnology research, including AgARDA, to ramp up over time. Furthermore, the presence of regulatory support that includes fast-tracking of GMO-free protocols and Health Canada’s tissue culture mandates for cannabis positions North America as the critical leader in this landscape.

The U.S. is readily augmenting its leadership in the regional plant tissue culture market on account of huge public provinces and pharmaceutical demand. The U.S. is a leader in innovation, and the USDA report in 2025 states that the FY 2025 UAIP grant funding ranges from USD 100,000 to USD 250,000 per award, supporting efforts like automated plant propagation systems in urban and rural farming. Besides the pioneers, Syngenta and Bayer readily dedicated an amount to AI investments with a collective goal of enhancing scalability. Meanwhile, California’s drought-resistant grapes comprise domestic output, hence benefiting overall market growth.

With strong government financial support, Canada is leading the North America market for plant tissue culture. In May 2024, the Government of Canada announced that AAFC's AgriInnovate Program funds CAD 5 million per project to support crop preservation and sustainability initiatives, as well as the adoption of new agricultural technology in Canada. On the other hand, in Ontario, tissue culture is applied to strawberry cutting by the greenhouse industry, and pesticide use is indicative of having an available consumer base. Secondly, in the case of Quebec, frost-resistant blueberry varieties are effectively boosting yields, demonstrating efforts in climate adaptation.

Import Data on Micro-Organisms Culture, Plants, Human or Animal cells in 2023

|

Country |

Import Value |

|

U.S. |

USD 293 million |

|

Canada |

USD 71.2 million |

Source: OEC, 2023

APAC Market Insights

Asia Pacific in the plant tissue culture market is all set for the fastest growth during the forecast timeline from 2026 to 2035. The region’s market benefits from the presence of prominent countries such as Japan, China, India, South Korea, Malaysia, and their distinct growth approaches. As per the MAFRA report in 2025, the South Korea government plans an R&D investment worth approximately KRW 108.8 billion (around USD 90-95 million) in new high-growth industries such as smart farming and green biotechnology in 2025, hence a positive market outlook.

China is solidifying its dominance in the regional plant tissue culture market, facilitated by the Seed Industry Revitalization policy that extensively prioritizes disease-free crop propagation. The country is also a leader in medicinal plant applications, wherein commercial herbal production utilizes tissue-cultured starters, especially in terms of ginseng and astragalus. Besides, the provincial administrative programs, such as Yunnan's tea clone program, have increased yields and reduces pesticide use.

The plant tissue culture industry in India is experiencing rapid growth, fueled by mass propagation for domestic agriculture and export. The demand remains far ahead of production, and there are immense opportunities for commercial development. With the plant tissue culture market estimated to be worth USD 15 billion per year, India will be playing a leading role in world agri-biotech, based on Journal of Applied Biology & Biotechnology in April 2021. Keeping in view the biotechnology industry's value of USD 150 billion, out of which 50% to 60% is associated with agri-business, tissue culture product demand is growing by almost 10% every year, supporting India's growth story.

Europe Market Insights

Europe is expected to maintain its position as the second leading contributor to the plant tissue culture market during the discussed timeframe. The region’s growth in this field is subject to the domestic production capabilities and labor cost benefits. The European Commission states that its subsidy program for growth media production dedicated an amount, reinforcing the region’s captivity in this field. Germany is the leader of this landscape with major exports, whereas the U.K. closely follows with the existence of automated propagation.

Germany is the key growth engine for Europe’s plant tissue culture industry, which benefits from the internationally recognized ornamental plant industry. The BMBF dedicated an amount of €74 million specifically for enhanced tissue culture applications, particularly for developing disease-resistant rose varieties as per a BMBF 2024 report. Besides Fraunhofer Institute declared that it developed automated bioreactors that increased propagation efficiency thereby reducing labor costs, adopted by a remarkable commercial labs in the country, thus benefiting the overall market.

U.K. in the plant tissue culture market is demonstrating innovation-driven growth efficiently propelled by the automation advances and controlled environment agriculture. In this context, the country possesses Agri-Tech Strategy that focuses on robotic micropropagation, wherein commercial horticultural procedures currently utilize automated systems. This investment also reduced the lettuce propagation costs by enabling market penetration of tissue cultured salad crops, states the AHDB 2023 data. Furthermore, the country’s UK Energy-Saving Trust reports these systems use less water than conventional propagation, hence a wider market scope.

Key Plant Tissue Culture Market Players:

- Plant Cell Technology

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont

- Phytoclone

- Bayer AG

- Syngenta

- Murashige & Skoog

- VitroTech

- Lab Associates

- Pioneer Agri-Tech

- Krishidhan

- Biotech Consortium

- China Green

- Shanghai Bio

- Korea Plant Tech

- AgriGenesis

- Nissan Chemical

- Japan Tissue Culture

- Takii Seed

- Otsuka AgriTechno

- GreenBio

The international plant tissue market culture is extremely dominated by pioneers Bayer AG and Syngenta, emphasizing CRISPR and automation technologies. Meanwhile, the Japan-based players such as Nissan Chemical and Japan Tissue Culture specialize in terms of precision agriculture. On the other hand, players based in the U.S. are focusing on GMO applications, whereas companies from India lead the tropical crop propagation. Emerging competition arises from players in China, such as China Green, which grabs a significant market share through medicinal plant exports.

Here is a list of key players operating in the plant tissue culture market:

Recent Developments

- In January 2025, Sheel Biotech provides a high-tech lab setup service for plant tissue culture in the U.S. From initial infrastructure design to staff training and operational support, the lab meets global standards for efficiency, productivity, and sustainability.

- In March 2024, NXT Bioscience announces acquisition of Lowes TC and introduces the AX Technology Platform to transform plant propagation with systems capable of producing 2,000 to 5,000 PTC plants per hour.

- In April 2025, Kyowa Kirin, which is a leading stem cell gene therapy company, successfully constructed a biomanufacturing footprint with a USD 118m at Takasaki Plant

- In January 2024, AGC Biologics announced plans to construct a new manufacturing facility at AGC Inc.’s Yokohama Technical Center in Japan to meet the global demand for biologics and advanced therapy medicinal products.

- Report ID: 8127

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant Tissue Culture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.