Plant Stem Cell Market Outlook:

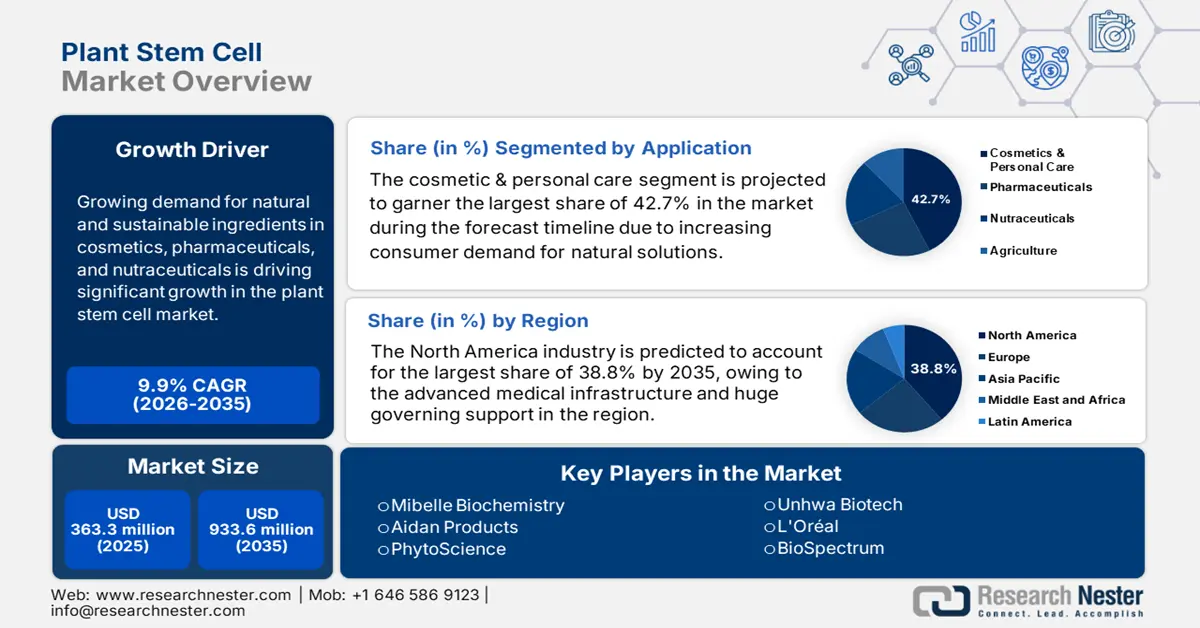

Plant Stem Cell Market size was valued at USD 363.3 million in 2025 and is projected to reach USD 933.6 million by the end of 2035, rising at a CAGR of 9.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plant stem cell is evaluated at USD 399.2 million.

The market is driven by the extensive patient pool, i.e., as per an article published by the National Institute of Health, an estimated 10.5 million individuals are receiving Medicare benefits for conditions such as chronic wounds and age-related degeneration, thus indicating the clear presence of a reliable consumer base. Meanwhile, the data from the U.S. International Trade Commission stated that the supply chain aspect of the merchandise heavily relies upon imported raw materials such as aloe vera and Ginkgo biloba, especially from India and China. Besides, the API production is concentrated in Europe due to the existence of EMA GMP-certified hubs.

Investment in research, development, and deployment (RDD) is mainly aimed towards refining bioprocessing methods to enhance the yield and purity of desired metabolites and thus providing solutions to scalability issues. Public and private grants, often channeled through academic and research institutions, fund much of the foundational science. Besides this, data from the Department of Agriculture (USDA) in June 2025 showed that India is presently exporting organic certified plant biomass, and India's market is increasing continuously at 6.76%, thereby contributing to market growth.

Key Plant Stem Cell Market Insights Summary:

Regional Highlights:

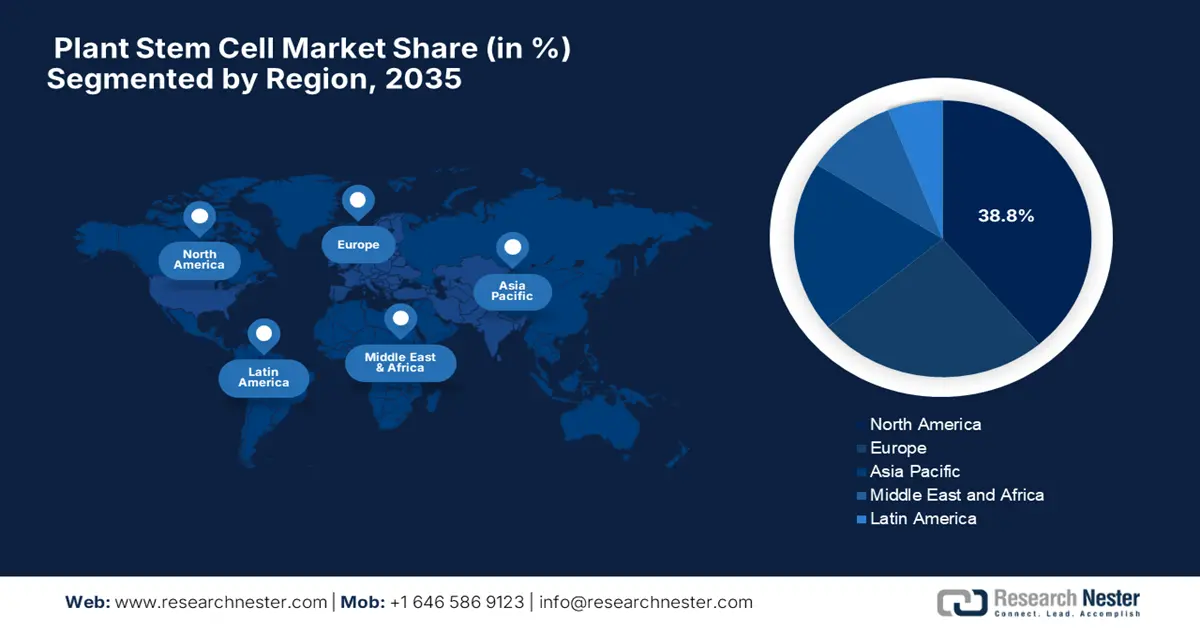

- North America Plant Stem Cell Market is anticipated to hold the dominant 38.8% share by 2035, primarily owing to advanced medical infrastructure and robust regulatory support for regenerative therapies.

- Asia Pacific is projected to witness the fastest expansion through 2026–2035, fueled by an aging population, active government R&D initiatives, and surging demand for natural therapeutics.

Segment Insights:

- The Cosmetic & Personal Care segment is projected to capture the largest 42.7% share of the Plant Stem Cell Market by 2035, propelled by rising consumer inclination toward natural, anti-aging, and skin-repair formulations.

- The Meristematic Stem Cell segment is anticipated to secure a notable share by 2035, underpinned by its strong proliferative capacity and regenerative potential driving its application in pharmaceuticals and nutraceuticals.

Key Growth Trends:

- Government and insurer investment in cost-effective care

- Increasing Incidence of Degenerative and Chronic Diseases

Major Challenges:

- Prolonged review times

- Limited payer acceptance

Key Players: Mibelle Biochemistry, Aidan Products, PhytoScience, Unhwa Biotech, L'Oréal, BioSpectrum, Biocon, Aneethun, JeNaCell, GreenTech, Marine Biotech, Amorepacific, Evonik, Himalaya Wellness, Nuvoderm, Shiseido, Rohto Pharmaceutical, Kaneka Corporation, Kao Corporation, Ajinomoto.

Global Plant Stem Cell Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 363.3 million

- 2026 Market Size: USD 399.2 million

- Projected Market Size: USD 933.6 million by 2035

- Growth Forecasts: 9.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 25 September, 2025

Plant Stem Cell Market - Growth Drivers and Challenges

Growth Drivers

- Government and insurer investment in cost-effective care: Government health programs are increasingly evaluating treatments based on long-term cost savings. Plant stem cell applications, particularly in preventative and early-intervention cosmeceuticals and nutraceuticals, can reduce the economic burden of age-related degeneration. NLM studies in April 2025 demonstrate that preventative skin care interventions among elderly patients can reduce hospital-acquired pressure injuries by up to 64%, lowering severe dermatological complications and thus substantially decreasing subsequent Medicare treatment costs. Specifically, incidence rates declined from 0.89 to 0.32 cases per 1,000 patient days between 2020-2021 and 2022-2023 due to effective preventive skin care regimens.

- Increasing Incidence of Degenerative and Chronic Diseases: The rising cases of chronic diseases are the key demand driver. Further, the growing aging population is increasing the patient pool seeking advanced therapeutic options. Plant stem cells are researched for their application in regenerative medicine and as a source of new bioactive compounds as potential treatments for these ailments. For example, in the U.S., 129 million individuals are affected with at least 1 chronic disease, highlighting a significant addressable market.

- Administrative support: The regulatory and reimbursement policies have been an asset for the plant stem cell market, fostering a profitable business environment. This can be testified by the report from the European Medicines Agency that states that the Advanced Therapy Medicinal Products (ATMP) Regulation has successfully streamlined approvals, boosting more clinical trials in 2024. In addition, the Centers for Medicare & Medicaid Services in 2024 expanded its coverage for outpatient plant stem cell treatments, thereby increasing accessibility in the sector.

Plant Extracts and Natural Products of Plant Origin on Skin Regeneration and Wound Healing

|

Plant (Family) |

Plant Material |

Cell/Animal |

Effect |

|

Agrimonia eupatoria |

WE |

in vitro, NIH 3T3, HDF and HaCaT; |

↑ ECM deposition, ↑ keratinocyte proliferation/differentiation; ↑ wound TS and contraction rates |

|

Angelica polymorpha |

flower absolute |

in vitro, HaCaT |

↑ cell migration, proliferation and collagen IV synthesis; ↑ phosphorylation of ERK1/2, JNK, MAPK p38 and Akt |

|

Annona reticulata |

leaf, EE |

in vitro, HaCaT |

↑ VEGF and Akt; ↑ cell migration and proliferation |

|

Astragalus floccosus |

root, ME |

in vitro, NHDF; |

↑ scratch wound healing, cell proliferation, fibrosis and epithelization |

|

Betula pendula |

bark, WE |

in vitro, HaCaT |

strong activities against S. aureus, C. acnes and S. epidermidis; |

|

Boesenbergia rotunda (Zingiberaceae) |

rhizome, EE |

in vitro, HaCaT |

↑ ERK1/2 and Akt; |

Source: NLM October 2023

Challenges

- Prolonged review times: The existence of long wait periods for product entry creates a major hurdle for the plant stem cell market. Therefore, the Pharmaceuticals and Medical Devices Agency (PMDA) stated that it requires additional months for approval when compared to the U.S. FDA. On the other hand, in Europe, ATMP regulations demand compliance costs, thereby causing hindrance to the market adoption. Besides, Takeda addressed this by emphasizing accelerated approval in Asia by aligning with the WHO’s regenerative medicine guidelines.

- Limited payer acceptance: Despite the presence of huge demand, the market faces various hurdles in terms of inadequate reimbursements. Both private and public insurers consider plant stem cell therapies as experimental, whereas Australia’s governing body, TGA, approved very few submissions in 2023 due to insufficient clinical data. On the other hand, Mesoblast deliberately secured U.S. Medicare coverage for its graft-versus-host disease therapy after a 5-year evidence review.

Plant Stem Cell Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.9% |

|

Base Year Market Size (2025) |

USD 363.3 million |

|

Forecast Year Market Size (2035) |

USD 933.6 million |

|

Regional Scope |

|

Plant Stem Cell Market Segmentation:

Application Segment Analysis

Cosmetic & personal care segment is projected to garner the largest share of 42.7% in the market during the forecast timeline. The dominance in this segment originates from the increasing consumer demand for natural, anti-aging, and skin-repair solutions. According to Our World in Data in November 2024, there are 830 million people aged 65 and older in the world. They are increasingly choosing non-invasive skincare, which is greatly increasing its uptake. According to an NIH 2022 study, apple stem cells, like Malus domestica, prolong the lifespan of fibroblasts. A broader segment scope is also a result of consumers' preference for plant-based bioactive ingredients over synthetic chemicals.

Type Segment Analysis

Meristematic stem cell segment is expected to gain a significant share in the plant stem cell market by the end of 2035. The subtype’s high proliferative and regenerative capacity is the key factor behind this leadership. The study by USDA in 2023 found that these cells have huge wound healing & tissue engineering capabilities, allowing them to differentiate into specialized cells that aid in regenerative medicine. For example, Omisirge in April 2023 received the approval particularly instructive for stem cell operators with hematologic malignancies undergoing cord blood transplantation. Also, they are extensively utilized in sustainable biomass production, which is pivotal in lab-grown plant tissues in pharmaceuticals and nutraceuticals, hence indicating a positive market outlook.

End user Segment Analysis

Pharmaceutical companies segment is anticipated to grab a considerable share in the market during the assessed timeframe. In this context, the World Health Organization’s 2023 report highlights that plant stem cells are efficacious in treating diabetes, cancer, and neurodegenerative disorders as well. Besides, these cells come with lower toxicity and higher biocompatibility when compared with synthetic compounds as per an NIH 2023 clinical study. Further, the U.S. FDA notes that firms utilize these cells to produce vaccines, monoclonal antibodies, and rare therapeutic proteins, thereby allowing a huge capital influx in the market.

Our in-depth analysis of the plant stem cell market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Type |

|

|

End user |

|

|

Source Plant |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plant Stem Cell Market - Regional Analysis

North America Market Insights

North America market is estimated to garner the largest revenue share of 38.8% by the end of 2035. The region’s leadership is effectively subject to its advanced medical infrastructure and huge governing support. The U.S. FDA approved 3 major stem cell drugs from 2023 to 2024 under its accelerated approval pathway for regenerative therapies, based on the REPROCELL report in September 2025. Further, the region also benefits in terms of cosmetic applications and chronic disease treatments, thus denoting a positive market outlook.

The FDA regulation and significant private R&D spending define the U.S. market. The federal government supports the development of climate-resilient crops and other agricultural uses. For instance, the April 2025 NASDA report shows that USDA has an annual budget of over USD 1.877 billion to support intramural research in plant biology, genomics, nutrition, and sustainability, which supports research in regenerative agriculture and plant stem cells. Standards for botanical extracts are being developed by the National Institute of Standards and Technology (NIST), which is crucial for supply chains in the industry.

The plant stem cell market in Canada is actively reshaping by focusing primarily on agricultural research and the Health Canada-regulated natural health products (NHP) industry. The key trend involves using plant cell culture technology, which is mainly used for the conservation of rare and endangered medicinal plant species, ensuring a sustainable supply of uniform raw materials for NHP manufacturers. In this regard, a significant trade and production category that supports both domestic NHP formulations and export potential is vegetable saps and extracts (HS Code 1302). Canada exports USD 62.4 million of vegetable saps in 2023 based on the OEC report, highlighting the market growth.

Trade Data on Vegetable Saps in 2023

|

Country |

Trade Flow |

Value 1000USD |

|

U.S. |

Import |

928,206.23 |

|

Canada |

Import |

99,748.84 |

|

U.S. |

Export |

253,502.41 |

|

Canada |

Export |

46,553.34 |

Source: WITS

APAC Market Insights

Asia Pacific market is considered to be the fastest-growing region during the discussed timeframe. The growth in the region is especially contributed by a rising aging population, government-backed R&D, and rising demand for natural therapeutics. Japan and China are the powerhouses of this landscape. Key regional drivers include the increasing integration of advanced bioprocessing technologies to enhance the yield of valuable phytochemicals and a growing export-oriented industry for high-value plant-derived raw materials.

China is the key growth engine for the Asia Pacific’s market, readily facilitated by the massive government investments and ample patient population. The State Key Laboratory of Crop Genetics & Germplasm Enhancement at Nanjing Agricultural University supported the Plant Stem Cell Informatics Database, which successfully identified and analyzed over 2,790,327 stem-cell-related genes from the genomes of 808 green plant species, according to the NLM report from January 2024. Additionally, the October 2023 NLM article depicts that China has invested more than RMB 3000 million in stem cell research, demonstrating the surging R&D and market expansion.

India is emerging in the regional plant stem cell market, where growth is fueled by agricultural scalability and cost-effective production. The rich biodiversity of the nation and the government's strong focus on biotechnology and Ayurveda are major factors driving the market. Growth is primarily driven by the cosmeceutical and nutraceutical sectors, where demand for natural and sustainable active ingredients is rising. As per the NBPGR report in 2023, 31,251 accessions of crops were characterized for agro-morphological, stress, and quality parameters, underpinning phenotyping and national plant stem cell research.

Europe Market Insights

Europe's plant stem cell market is continuously growing due to the presence of rapidly aging demographics, progressive regulatory frameworks, and strong R&D investments. The EMA report unveils the clearance of plant stem cell-based therapies since 2022, with heightened applications in dermatology and chronic disease treatments. Stringent regulatory oversight by the European Medicines Agency (EMA) and the European Food Safety Authority (EFSA) ensures product safety and efficacy, which in turn builds consumer trust and justifies premium product positioning.

Germany is the production powerhouse of the regional plant stem cell industry, possesses a huge capacity for digital health integration, and a research environment. Herein, according to the GTAI report in June 2025, German biotech investment recently came to an all-time high, with around €2 billion in new capital entering the sector in 2024, fueling expansion in pharmaceutical and biotech hotspots. It also highlighted that the biggest Leipzig site to be commissioned by 2025 will manufacture tons each year of standardized plant stem cell APIs, solving existing supply chain imbalances, thus appropriate for standard market development.

France is expected to be the second-largest plant stem cell market, and growth is being driven by its unmatched position in the cosmetics market. Major corporate players based in France drive significant private R&D investment into plant-derived actives for anti-aging and skincare applications. Government initiatives, such as investment plans like France 2030, fund resources to decarbonize industry and support innovation in green technologies, including the maximization of production of bio-based ingredients. A main trend is to focus on France's agricultural tradition and biodiversity to create distinctive, traceable, and high-performance ingredients for high-end product development.

Key Plant Stem Cell Market Players:

- Mibelle Biochemistry

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aidan Products

- PhytoScience

- Unhwa Biotech

- L'Oréal

- BioSpectrum

- Biocon

- Aneethun

- JeNaCell

- GreenTech

- Marine Biotech

- Amorepacific

- Evonik

- Himalaya Wellness

- Nuvoderm

- Shiseido

- Rohto Pharmaceutical

- Kaneka Corporation

- Kao Corporation

- Ajinomoto

The worldwide market of plant stem cells is extremely fragmented in nature, where the Europe-based firms such as Mibelle, PhytoScience lead in cosmetic-grade extracts. Meanwhile, the pioneers based in Japan, such as Shiseido, Rohto, dominate dermatological applications. Vertical integrations, regulatory partnerships, emerging market focus, and tech-driven cultivation are a few strategies undertaken by the players to elevate market growth internationally. In this regard, Kaneka’s AI-optimized bioreactors are productively boosting yield by a significant 30.8% whereas the small-scale companies such as Aneethun and Nuvoderm are focusing on region-specific botanicals.

Here is a list of key players operating in the market:

Recent Developments

- In August 2024, Green Bioactives awarded a £100,000 Scottish enterprise SMART grant to enhance biomanufacturing innovation in personal care, using plant vascular stem cells.

- In July 2024, Bioserve launches its advanced stem cell products from REPROCELL, aimed to support innovation in scientific drugs R&D, supporting advancements in regenerative medicine and therapeutic discovery.

- In July 2025, Gwo Xi Stem Cell, a Taiwan-based company that advances MSC therapies and exosomes, is seeking Japan partners for licensing and co-development in regenerative medicine and cosmetics.

- In April 2024, Mitsui Chemicals, Inc., announced that it had invested in FullStem Co. Ltd. to explore new opportunities in the cell culture sector. The company is relying on its own technologies and assets to develop materials for wide-ranging applications.

- Report ID: 8125

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plant Stem Cell Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.