Cell Harvesting System Market Outlook:

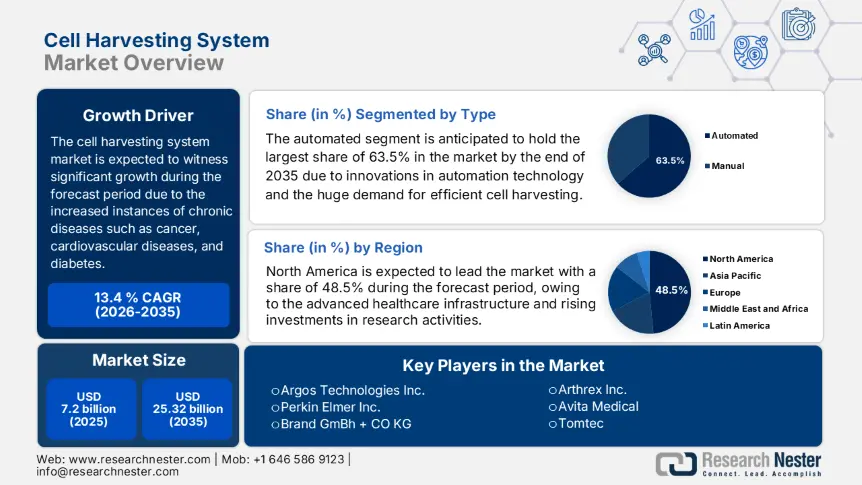

Cell Harvesting System Market size was valued at USD 7.2 billion in 2025 and is set to exceed USD 25.32 billion by 2035, registering over 13.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell harvesting system is estimated at USD 8.07 billion.

The market is witnessing tremendous growth attributable to the ongoing advancements in the field of stem cell therapy and the increasing investments in biotechnological and pharmaceutical research. The rising occurrences of cancer, neurodegenerative disorders, and autoimmune disorders require efficient cell therapy systems. As of August 2022, Blood Cancer UK reported that leukemia accounts for 250,000 cases in the U.K., and every 16 men and one in every 22 women are expected to be diagnosed with the disease. The mortality reached 16,000 cases each year, survival rate being 70% for blood cancer. Hence, the increased prevalence necessitates the cell harvesting systems and accelerates market growth.

Moreover, the immense awareness of stem cell benefits, coupled with innovation in automation, also contributes to the market expansion across the world, including developed and emerging regions. For instance, in May 2024, Cytiva Bioscience Holding Ltd launched a new Selfia cell therapy manufacturing system in collaboration with Kite Pharma, Inc. (a Gilead Company) to address challenges in autologous CAR-T cell therapy production. Therefore, this move enhances productivity and consistency in the process, thereby showcasing lucrative growth opportunities in the forecast period.

Key Cell Harvesting System Market Insights Summary:

Regional Highlights:

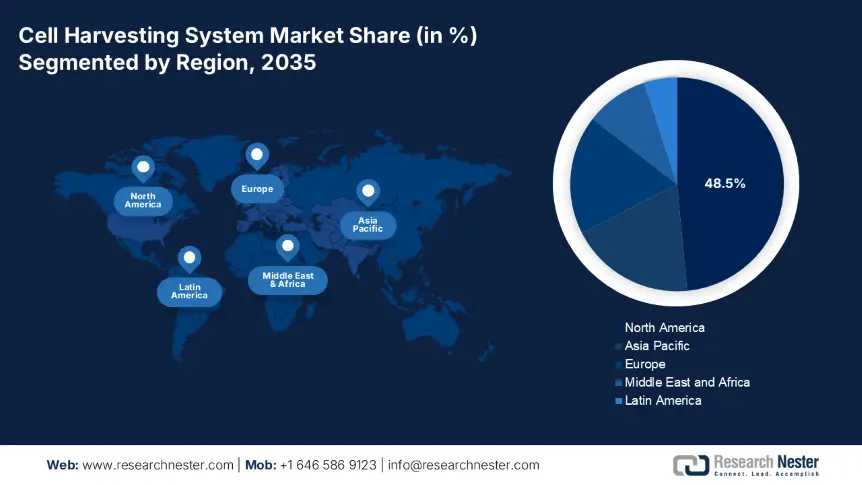

- North America commands a 48.5% share in the Cell Harvesting System Market, driven by high demand for cell-based therapies and research investments, ensuring sustained growth through 2035.

- Asia Pacific's Cell Harvesting System Market is forecasted to grow rapidly from 2026–2035, fueled by rising personalized medicine and adoption of automated harvesting.

Segment Insights:

- The Automated segment is projected to hold 63.5% market share by 2035, driven by lowered contamination risk and increasing demand for prompt procedures in research and clinical use.

Key Growth Trends:

- Increasing demand for cell-based therapies

- Chronic disease prevalence

Major Challenges:

- High-cost concerns

- Strict regulatory approvals

- Key Players: Argos Technologies Inc., Perkin Elmer Inc., Brand GmBh + CO KG, Arthrex Inc., Avita Medical.

Global Cell Harvesting System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 8.07 billion

- Projected Market Size: USD 25.32 billion by 2035

- Growth Forecasts: 13.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 12 August, 2025

Cell Harvesting System Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for cell-based therapies: The global shift toward regenerative medicine and stem cell therapies is another major driver for the market. Huge emphasis on research activities, along with the wider adoption of these therapies encourages the global leaders to develop more of such systems with collaborative efforts. In March 2025, AstraZeneca announced the acquisition of EsoBiotec by including an in vivo delivery platform, to advance in the field of cell therapy for oncology and immunity-associated disorders. This milestone marks a significant step in the market, demonstrating the huge demand for cell-based therapies.

- Chronic disease prevalence: The rapid occurrence of noncommunicable diseases such as diabetes, is an exceptional driver for the market. These diseases require advanced approaches to extract the cells, such as the cell harvesting systems, as a reliable solution. As per the May 2024 CDC report, around 38.4 million people in the U.S., which is 11.6% of the population, have diabetes in a year. It further reported that adults aged over 18 years, 38.1 million had diabetes, with 8.7 million unaware of their condition. This inflates the demand for efficient cell-based therapies, boosting the sector’s upliftment.

Challenges

- High-cost concerns: One of the biggest challenges in the global cell harvesting system market is the rising costs of cell harvesting systems. These involve intricate design and advanced functionality due to which the investment associated with the procedures increases. Moreover, the development and maintenance of automated and closed system technologies require significant investment, making them limited to developed regions. This hinders the wider market penetration despite the rising demand for automated cell-based treatments.

- Strict regulatory approvals: Another significant challenge in the cell harvesting systems market is the complex and stringent regulatory framework governing cell-based therapies. The governing bodies often demand higher evaluation, clinical trials, and data for approval, which makes the process even more lengthy, hindering the scalability. Additionally, the lack of skilled professionals limits the ability of industries to fully leverage the benefits of cell harvesting system technologies.

Cell Harvesting System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.4% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 25.32 billion |

|

Regional Scope |

|

Cell Harvesting System Market Segmentation:

Type (Automated, Manual)

Based on type, the automated segment is anticipated to register the largest share of 63.5% in the cell harvesting system market during the forecast period. The dominance is attributable to the lowered risk of contamination in the automated systems and an increasing need for a prompt procedure in research and clinical applications. For instance, in March 2021, Biosero, Inc. and Celltrio, Inc. declared a partnership to integrate Biosero’s Green Button Go Automation Software with Celltrio’s RoboCell Automation Platform. This move aims to hasten cell line culturing and harvesting, including cryogenic storage, into a modular automated system. Thus, this is the evidence for a wider scopethat is amplifying the segment’s growth.

Application (Peripheral Blood, Umbilical Cord, Bone Marrow, Adipose Tissue)

Based on application, the peripheral blood segment is projected to account for a lucrative share in the cell harvesting system market by 2035. The segment’s initial deployment for peripheral blood stem cell harvesting, ease of collection, and demand for minimally invasive procedures illustrates the dominance. As per a report in November 2024 by the Ash Publications Organization, adding Eltrombopag to stem cell mobilization significantly improved peripheral blood harvesting success in East-Asia lymphoma patients undergoing ESHAP chemo-mobilization. Owing to this, 92.3% of patients achieved the target CD34+ cell count on the first apheresis day. Hence, this denotes a positive outlook for the segment’s dominance.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Harvesting System Market Regional Analysis:

North America Market Analysis

North America is a key player in the cell harvesting system market, projected to register a significant share of 48.5% during the forecast period. The dominance of this region is mainly attributable to factors such as the advanced healthcare infrastructure, increasing investments in research activities, and the rising demand for cell-based treatments in various disease applications. In January 2024, Merck & Co., Inc. finalized the acquisition of Harpoon Therapeutics, Inc. for nearly USD 680 million, leveraging access to HPN328, a 3 (DLL3) targeting T-cell engager under evaluation for carcinoma. Hence, it underscores the demand for cell-based therapies, positively influencing the market growth.

U.S. dominates the North America market owing to the early adoption of regenerative medicine and cell therapy. Moreover, funding initiatives from both public and private sectors, and the presence of key market players dedicated to innovative cell harvesting technologies boost the market growth. For instance, in March 2022, Terumo Blood and Cell Technologies received FDA clearance for its next-gen plasma collection system known as Rika to reduce operational errors and collect plasma in under 35 minutes or less. Thus, such innovative approvals mark the U.S. as the global hub for cell harvesting systems.

The Canada market is growing steadily with substantial advancements in technologies, rising demand for personalized medicine, the rising occurrence of obesity and lifestyle disorders across its vast geography. For instance, in January 2024, STEMCELL Technologies finalized the acquisition of Propagenix Inc. to accelerate new approaches in regenerative medicine and inspire scientific research in clinical settings for various diseases. Thus, such acquisitions and collaborations strengthen the country’s ecosystem and position Canada as a key player in the global markets.

APAC Market Statistics

The Asia Pacific cell harvesting system market is anticipated to grow at the fastest rate during the forecast period. The market is primarily driven by higher instances of chronic disorders and the huge demand for personalized medicine. The region hosts a large consumer base due to the early adoption of automated and closed system cell harvesting processes, investments in stem cell research, and wider applications in the field of immunotherapy. Additionally, the requirement for an enhanced and contamination-free cell harvesting process is intended to help the region’s patient pool embrace the market progression.

China is a leader in the market, supported by the growing research on stem cell therapies due to a great focus on unmet medical needs. Governing bodies, along with private organizations in the country, are readily investing in research and development of exclusive products, which widens the market scope. For instance, in October 2024, Sino-Biocan Biotech Ltd. launched the WUKONG Automated, Closed, Integrated Cell Processing System, which offers a completely automated solution for cell preparation and bedside therapies. As a global hub for innovation, the country’s market continues to expand rapidly, shaping the region’s healthcare landscape.

The India cell harvesting system market is gaining momentum, fueled by the increasing healthcare spending and the ongoing research on cell-based therapies. Additionally, collaborations between the public and private firms and the launch of production facilities by the domestic players also intend to support the market expansion. In March 2025, Bharat Biotech International Limited launched the country’s only vertically integrated cell and gene therapy, an exclusive production facility at Genome Valley, to leverage its approaches in regenerative and personalized therapies. Thus, a positive outlook is expected to uplift the market growth, making India a rapidly emerging player in the global market.

Key Cell Harvesting System Market Players:

- Argos Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer Inc.

- Brand GmBh + CO KG

- Arthrex Inc.

- AVITA Medical, Inc.

- Tomtec

- Merck & Co., Inc.

- STEMCELL Technologies

- Thermo Fisher Scientific Inc.

- Terumo Corporation

- Teleflex Inc.

- Bertin

- Tasso, Inc.

- Propagenix Inc.

- Sino-Biocan Biotech Ltd.

- Cytiva Bioscience Holding Ltd

- AstraZeneca

- Biosero, Inc.

- Celltrio, Inc.

- Bharat Biotech International Limited

Companies involved in the cell harvesting system market are emphasizing customization and alliances to cater to diverse patient needs. Many focus on strategic partnerships, expansions, and training initiatives to accelerate adoption and expand market presence. For instance, in May 2023, Terumo Blood and Cell Technologies started a development programme aiming to help cell and gene therapy developers improve their cell harvesting processes and accelerate the commercialization of drugs. Hence, such strategies to educate the professionals will encourage the adoption of innovative technologies, thereby widening the market presence.

Some of the prominent players in the market are:

Recent Developments

- In April 2025, Thermo Fisher Scientific Inc. inaugurated the advanced therapies collaboration center 6,000-square-foot facility in Greater San Diego aiming to support the evolution and capitalization of cell therapies.

- In May 2024, AVITA Medical, Inc., notified that it received the premarket approval from the U.S. FDA for its RECELL GO System, a next-generation autologous cell harvesting device to treat thermal burn injuries and full-thickness skin conditions.

- Report ID: 7588

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Harvesting System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.