Transplant Monitoring Kits Market Outlook:

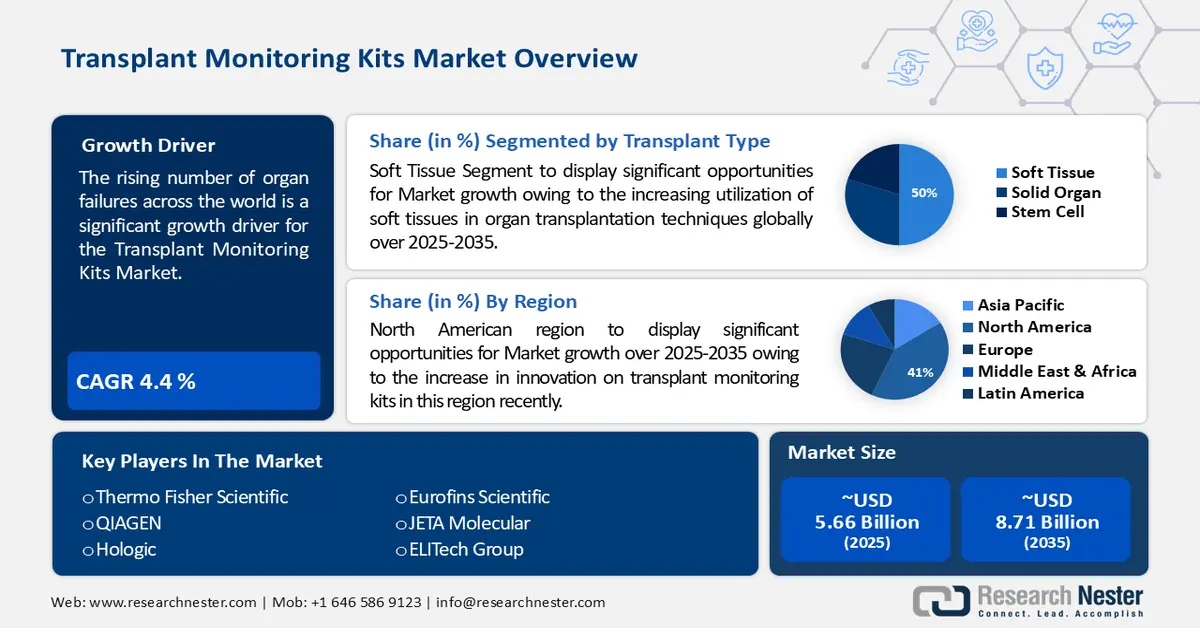

Transplant Monitoring Kits Market size was valued at USD 5.66 billion in 2025 and is likely to cross USD 8.71 billion by 2035, registering more than 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transplant monitoring kits is assessed at USD 5.88 billion.

The rising number of organ failures across the world will primarily drive the market growth of transplant monitoring kits. 16, 335 people, in total, gave one or more organs to the deceased. This is an increase of 9.6% over 2022 and the first year for donors who have had more than 15,000 passed away. The total of 6 953 people who became living organ donors is the third-highest and highest level since the record-breaking year of 2019. Although the number of living donors fluctuates annually, 2023 marks the thirteenth year in a row that there have been more organ donors than deceased.

Another reason that will propel the transplant monitoring kits market by the end of 2037 is the rising number of organ transplant surgeries executed internationally. The World Health Organization (WHO) estimates that annually, approximately 100 to 800 solid organ transplants are performed, the majority of which are liver and kidney transplants. The United States is a major destination for helping people who need organ donation because about 30% of these transplant procedures are performed there.

Key Transplant Monitoring Kits Market Insights Summary:

Regional Insights:

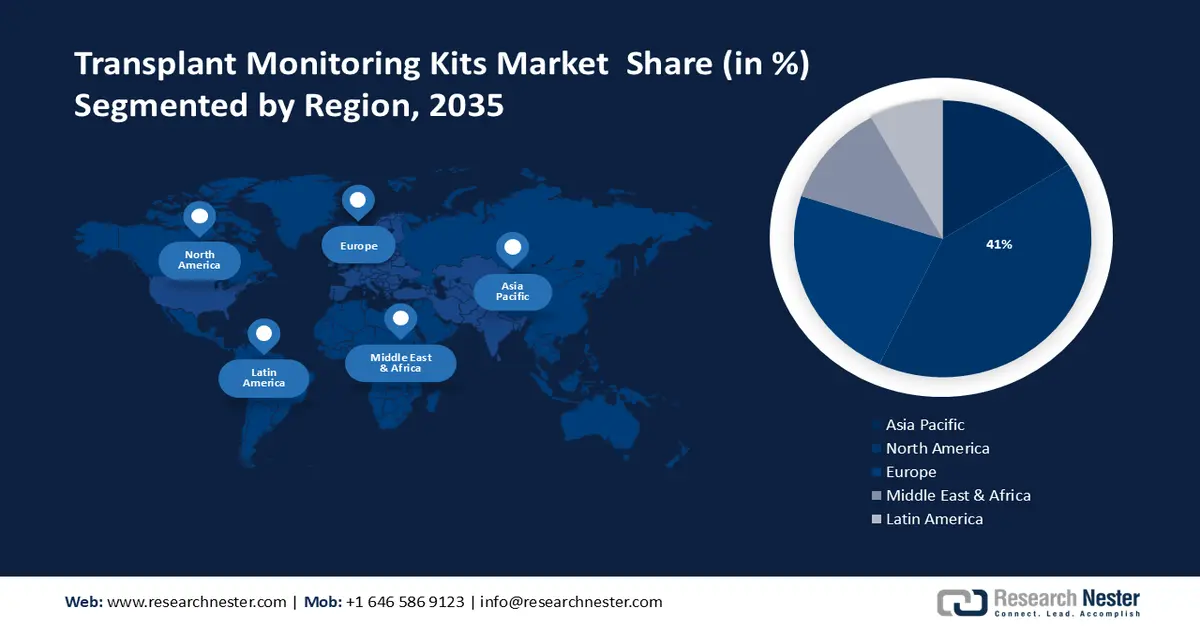

- North America is anticipated to secure nearly 41% share by 2035 in the transplant monitoring kits market, supported by rapid innovation in transplant monitoring technologies that is reshaping organ-delivery efficiency.

- Europe is projected to attain a substantial market position by 2035 as it experiences heightened demand for advanced healthcare capabilities, propelled by expanding expectations for personalized and accessible medical services.

Segment Insights:

- The reagents & consumables segment is expected to command around 43% share by 2035 in the transplant monitoring kits market, bolstered by its critical role in ensuring testing precision and regulatory-compliant laboratory workflows.

- The soft tissue segment is forecasted to hold approximately 50% share by 2035, supported by rising global utilization of soft tissues in organ transplantation procedures.

Key Growth Trends:

- Advancement in Technologies in Transplantation of Organs

- Rise in the Number of Organ Donors

Major Challenges:

- Lack of Organs to Donate Across the World

- Excessive Cost of Organ Transplantation

Key Players: CareDx Inc., Thermo Fisher Scientific, QIAGEN, Hologic, Eurofins Scientific, JETA Molecular, ELITech Group, Natera Inc., Roche Ltd., Biocare Health Resources Inc., Takeda Pharmaceutical Co Ltd., Astellas Pharma Inc., Otsuka Holdings Co Ltd., Eisai Co Ltd.

Global Transplant Monitoring Kits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.66 billion

- 2026 Market Size: USD 5.88 billion

- Projected Market Size: USD 8.71 billion by 2035

- Growth Forecasts: 4.4%

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, United Arab Emirates

Last updated on : 28 November, 2025

Transplant Monitoring Kits Market - Growth Drivers and Challenges

Growth Drivers

- Advancement in Technologies in Transplantation of Organs - In the United States, there are 104, 000 people on the transplant waiting list. In line with Donate Life America, 17 people are reportedly killed daily while waiting for a release. Organ donation has traditionally been a rite of passage for donors who pass away from brain death in a heartbeat. More donors who pass away after their hearts stop beating are receiving donated organs. Hearts and lungs from these deaths used to go unnecessarily in the past. These organs can now be used by transplant specialists thanks to modern medical advancements. To become a donor, transplant experts can resuscitate the heart using a heart-lung bypass device or an out-of-body perfusion device. These donors account for 20% to 30% of all organ donations. The heart attack diagnostics will also require most of the time transplantation.

- Rise in the Number of Organ Donors - According to preliminary information from the Organ Procurement and Transplantation Network, 42, 887 organ transplants were performed in the United States in 2022, an increase of 3.7 percent over 2021 and a new annual record. Several actions will be put in place today by the Region of the Americas 'health ministers to improve access to organ, tissue, and cell transplants. This initiative is based on voluntary donations to meet the growing need for these treatments, make these treatments more effective, save lives, and raise awareness of the need for them.

- Increasing Awareness Associating Transplantation - End-stage renal disease (ESRD) patients who receive living donor kidney transplantation (LDKT) have excellent and better graft survival than patients who have donor organs gone wrong. In many nations, healthy volunteers routinely donate organs to loved ones or family members, which represents a philosophical shift in clinical practice. It is recognized as morally acceptable and adheres to the agreed boundaries of best practice given that LDKT is becoming more prevalent worldwide and that healthcare professionals are committed to it by accepted standards and accepted best practices.

Challenges

- Lack of Organs to Donate Across the World - The liver transplant list currently addresses 12,240 Americans. Unfortunately, 25% of those patients will pass away while waiting. The American Liver Foundation (ALF) is working to raise awareness of living-donor liver transplants and reduce this statistic. The glaring reality of the world's organ shortage serves as a stark reminder of the difficulties that still exist in contemporary medicine in a world characterized by technological advancements and technological advancements. Organ donations have never been more necessary because millions of lives are in danger. The world's organ shortage is a sobering statistic. The demand for organ transplants far exceeds the supply, according to the World Health Organization (WHO), leading to a crisis that affects both patients and their families all over the world. Around 50,000 people pass away each year waiting for a suitable organ transplant.

- Excessive Cost of Organ Transplantation

- Sense of Fear in Patients Related to Organ Transplantation

Transplant Monitoring Kits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 5.66 billion |

|

Forecast Year Market Size (2035) |

USD 8.71 billion |

|

Regional Scope |

|

Transplant Monitoring Kits Market Segmentation:

Product Segment Analysis

The reagents & consumables segment is expected to hold around 43% share of the global transplant monitoring kits market by 2035.because of its necessary importance in organ transplantation. For instance, laboratories 'daily operations heavily rely on single-use plastics and laboratory testing consumables are typically not susceptible to substitution. To ensure the safety and efficacy of testing protocols as well as the accuracy and reliability of data, laboratories are subject to stringent scientific and regulatory regulations. Life sciences research requires high-quality laboratory consumables, reagents, and validated standard processes. The life science sector has seen an unprecedented need for laboratory supplies related to COVID-19 laboratory work since the pandemic. With suppliers unable to keep up with demand, lab plastic consumables were being used at a faster rate than they were to run RT-PCR tests (consumables like plates and pipette tips). Therefore, this segment will hold immense importance in the market.

Transplant Type Segment Analysis

The soft tissue is expected to hold around 50% share of the global transplant monitoring kits market by 2035 owing to the increasing utilization of soft tissues in organ transplantation techniques globally. One of the most frequently transplanted solid organs is the kidney, which is the result of a steady increase in demand for organ transplants. The kidney, liver, heart, lung, pancreas, small bowel, and heart were the most frequently transplanted solid organs in 2021, making up 153, 863 of the entire. Organ and tissue transplantation continues to be effective in ensuring the survival of some seriously ill patients. The current limited capacity of organ preservation techniques that are used in clinical settings is insufficient to meet the demand for organ transplantation. Ultra-low-temperature storage techniques have attracted a lot of attention because they enable long-term, high-quality tissue and organ preservation. Thus, this segment will have the highest revenue in the market.

Our in-depth analysis of the global transplant monitoring kits market includes the following segments:

|

Technology Type |

|

|

Product |

|

|

Application |

|

|

Transplant Type |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transplant Monitoring Kits Market - Regional Analysis

North American Market Insights

North America industry is anticipated to hold largest revenue share of 41% by 2035. This growth will be noticed owing to the increase in innovation on transplant monitoring kits in this region recently. In the US, there are roughly 100,000 people on the waiting list for kidney transplants. It is a race against the clock to deliver the donor organ as quickly as possible the moment an organ becomes available. The donor organ can begin to disintegrate once it has been outside of the body. More people are receiving the lifesaving organs they need thanks to innovations that are changing the way organ transplants are carried out. This will help this region to have the highest revenue share in the market.

European Market Insights

The transplant monitoring kits market in the Europe region will also encounter huge growth during the forecast period and will hold the second position owing to increasing demand for better healthcare scopes in this region. In 2024, European hospitals will garner a projected revenue share of USD 0.92tn. While the quantity and quality of providing attention have modified, the scale and intricacy of healthcare requirements have increased, with public expectations of more customized and handy services. Therefore, Europe will acquire a significant position in the transplant monitoring kits market.

Transplant Monitoring Kits Market Players:

- CareDx Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific

- QIAGEN

- Hologic

- Eurofins Scientific

- JETA Molecular

- ELITech Group

- Natera Inc.

- Roche Ltd.

- Biocare Health Resources Inc.

Recent Developments

- CareDx, Inc., the transplant organization, declared that it will be demonstrating the breadth of its personalized digital solutions and the newest modifications in its cellular treatment and transplant monitoring pipeline at the 2024 Tandem Meetings, Transplantation& Cellular Therapy Meetings of ASTCT™ and CIBMTR®, organized on February 21- 25 in San Antonio, Texas.

- CareDx, Inc., the transplant organization, declared a leading existence and the fifth successive year as the Distinguished Founder’s Circle Sponsor for the Annual American Society of Transplant Surgeons (ASTS) Winter Symposium organized on January 11 - 14, 2024 in Miami, Florida.

- Report ID: 5918

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transplant Monitoring Kits Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.