Cell and Tissue Culture Incubators Market Outlook:

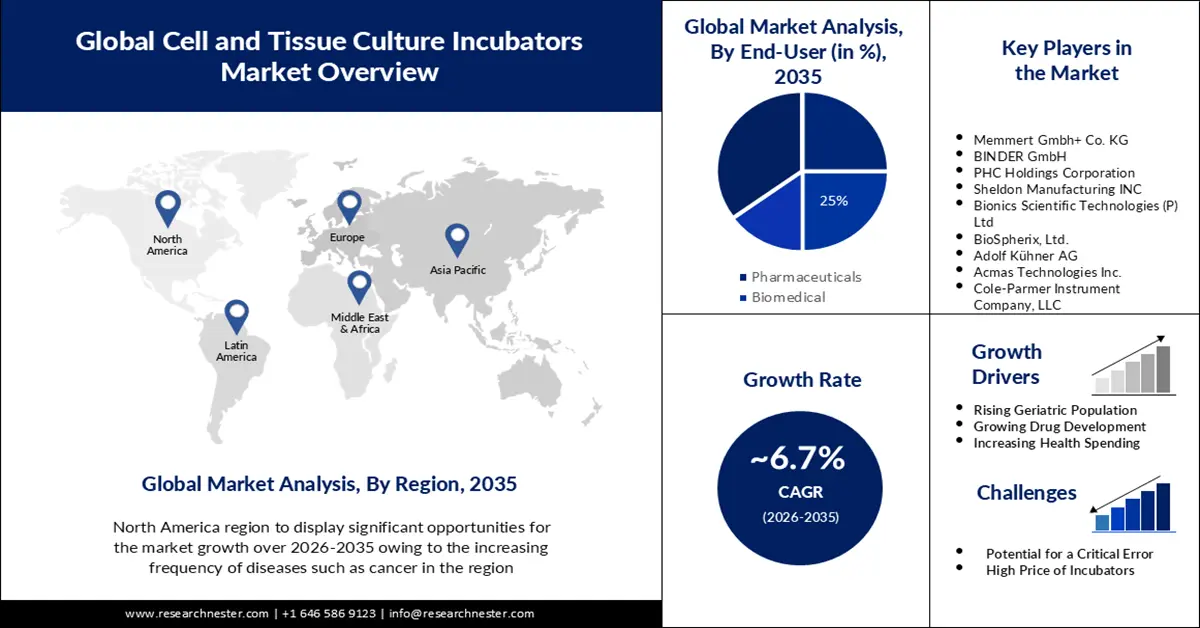

Cell and Tissue Culture Incubators Market size was valued at USD 3.79 billion in 2025 and is set to exceed USD 7.25 billion by 2035, registering over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell and tissue culture incubators is evaluated at USD 4.02 billion.

The growth of the market can be attributed to the increasing number of chronic diseases. The desire for novel medicines and treatments is being driven by the rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders. For instance, several of these therapies are based on cell and gene therapies, which call for the utilization of sophisticated cell culture methods and premium incubation equipment. By 2030, there will be over 40 million more Americans who suffer from chronic illnesses.

In addition to these, factors that are believed to fuel the market growth of cell and tissue culture incubators include the rise in technological advancements. Technology advancements have resulted in the creation of more advanced cell and tissue culture incubators. For instance, some incubators now come equipped with enhanced imaging capabilities, and remote monitoring, which are increasing the demand in industrial and research environments.

Key Cell and Tissue Culture Incubators Market Insights Summary:

Regional Highlights:

- By 2035, North America is projected to secure a 35% share in the cell and tissue culture incubators market, fueled by escalating cancer prevalence and the resulting surge in research demand.

- Europe is anticipated to hold the second-largest share by 2035, supported by more flexible research regulations that enable streamlined R&D activities.

Segment Insights:

- By 2035, the IVF centers segment is projected to capture the largest share in the cell and tissue culture incubators market, propelled by the increasing global volume of IVF treatments.

- The research segment is anticipated to attain a substantial share by 2035, owing to expanding research activities that rely on controlled cell and tissue culture environments.

Key Growth Trends:

- Growing Pharmaceutical Sector

- Rising Geriatric Population

Major Challenges:

- Potential for a Critical Error

- High Price of Incubators

Key Players: Thermo Fisher Scientific Inc., Memmert Gmbh+ Co. KG, BINDER GmbH, PHC Holdings Corporation, Sheldon Manufacturing INC, Bionics Scientific Technologies (P) Ltd, BioSpherix, Ltd., Adolf Kühner AG, Acmas Technologies Inc., Cole-Parmer Instrument Company, LLC.

Global Cell and Tissue Culture Incubators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.79 billion

- 2026 Market Size: USD 4.02 billion

- Projected Market Size: USD 7.25 billion by 2035

- Growth Forecasts: 6.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Majority Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 21 November, 2025

Cell and Tissue Culture Incubators Market - Growth Drivers and Challenges

Growth Drivers

- Growing Pharmaceutical Sector – On account of the expanding pharmaceutical industry, the need for cell and tissue culture incubators is expected to rise, as incubators are a necessary piece of equipment for pharmaceutical research and development. Globally, the pharmaceutical industry in India is valued at over USD 40 billion. The Indian pharmaceutical market expanded by 17% yearly in 2021.

- Rising Geriatric Population – Owing to the necessity for research and drug development in age-related disorders as well as the expanding interest in regenerative medicine, the need for cell and tissue culture incubators is projected to increase as the older population grows. Lately over 8 % of the world's population, is over the age of 65. This number is anticipated to increase to over 15% of the global population by 2050.

- Increasing Health Spending – Probably, the need for cell and tissue culture incubators to assist the research will increase owing to an increase in health spending across the globe. According to the most recent expenditure data, in 2021, health spending in the US increased by over 2%.

- Growing Drug Development – It is expected that more cell and tissue culture incubators might be required as new medications are created and made available, which is anticipated to drive market growth. According to statistics, the top 20 pharmaceutical corporations around the globe invest over USD 50 billion annually in medication development.

Challenges

- Potential for a Critical Error- The possibility of errors is one of the major factors predicted to slow down the market growth. For instance, the growth and viability of cell and tissue cultures can be impacted by changes in temperature, humidity, and other environmental conditions. In addition, critical errors can also affect the integrity of experimental findings and result in erroneous inferences, both of which can be detrimental to the research project.

- High Price of Incubators

- Standardization Issues in High-Volume Production

Cell and Tissue Culture Incubators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 3.79 billion |

|

Forecast Year Market Size (2035) |

USD 7.25 billion |

|

Regional Scope |

|

Cell and Tissue Culture Incubators Market Segmentation:

End-user Segment Analysis

The cell and tissue culture incubators market is segmented and analyzed for demand and supply by end-user into pharmaceuticals, biomedical, academics, and IVF centers. Out of the four end-users of cell and tissue culture incubators, the IVF centers segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the growing frequency of IVF treatments being carried out. The demand for premium cell culture incubators is growing along with the number of IVF treatments. For instance, in IVF centers, cell culture incubators are crucial equipment for growing and keeping embryos in a controlled environment. In addition, the embryos are often cultivated in a lab for a few days before being transferred to boost the chances of success. Cell culture incubators are necessary to maintain the best conditions possible for the embryos to develop and thrive during this process. According to statistics, approximately 2 million IVF procedures are carried out annually throughout the world.

Application Segment Analysis

The cell and tissue culture incubators market is also segmented and analyzed for demand and supply by application into research, bioproduction, and diagnostics. Amongst these three segments, the research pharmacies segment is expected to garner a significant share in the year 2035. Incubators for cell and tissue culture are necessary instruments for preserving and developing cells and tissues in a controlled environment, which is critical for a variety of research applications. For instance, scientists employ cell culture methods to examine the effects of various medications, evaluate the efficacy and safety of novel treatments, and look into the molecular causes of disease. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell and Tissue Culture Incubators Market - Regional Analysis

North American Market Insights

North America industry is predicted to account for largest revenue share of 35% by 2035. The growth of the market can be attributed majorly to the increasing frequency of diseases such as cancer. There will would be a greater need for cancer research and treatment development owing to rising cancer cases in the region. In consequence, it is anticipated that this would result in an increased demand for cell and tissue culture incubators. For instance, cell and tissue culture incubators are widely used in cancer research and medication development since they provide the ideal conditions for cell and tissue growth and preservation. Further, the growing technological advancements in the region, along with the availability of a large number of incubators manufacturers, are also anticipated to contribute to the market growth in the region. In addition, the growing demand at research institutes and centers for cutting-edge cell culture incubators in the region is also anticipated to boost market growth during the forecast period. In the United States, there were over 609,000 cancer deaths and an estimated 1 million newly diagnosed cancer cases in 2022.

Europe Market Insights

The European cell and tissue culture incubators market is estimated to hold the second-largest share by the end of 2035. The growth of the market can be attributed majorly to the enhanced flexibility in government rules and regulations for the region's research operations. Research institutions in the area can undertake research and development more effectively and with a less regulatory burden as government laws and regulations are more flexible. As a result, researchers are likely to have easier access to financing and resources for their further studies, which may increase the demand for cell and tissue culture incubators. Further, the favorable regulatory standards in the region, along with the growing biotech and pharmaceutical industry, are also anticipated to contribute to the market growth in the region.

APAC Market Insights

Further, the market in the Asia Pacific region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing focus on cell culture-based vaccine production. For instance, the demand for specialist equipment, including incubators, is projected to rise as more biotech and pharmaceutical firms in the area turn to cell culture-based approaches for vaccine production. Further, the growing awareness of cell and gene therapy in the region, along with the increasing popularity of scientific technologies, is also anticipated to contribute to the market growth in the region.

Cell and Tissue Culture Incubators Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Memmert Gmbh+ Co. KG

- BINDER GmbH

- PHC Holdings Corporation

- Sheldon Manufacturing INC

- Bionics Scientific Technologies (P) Ltd

- BioSpherix, Ltd.

- Adolf Kühner AG

- Acmas Technologies Inc.

- Cole-Parmer Instrument Company, LLC

Recent Developments

- Thermo Fisher Scientific Inc. introduced the Thermo Scientific DynaSpin Single-Use Centrifuge system to offer the best single-use answer for extensive cell culture collection. Further, by the use of fewer depth filtering cartridges, the DynaSpin technology enhances and streamlines harvesting for cell culture separation in single-use bioprocesses.

- PHC Holdings Corporation teamed up with Univercells Technologies to introduce scale-X for gene therapy and regenerative medicine development. Furthermore, the scale-X portfolio provides comparable fluid conditions across all scales, guaranteeing consistent cell and product activity.

- Report ID: 4050

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell and Tissue Culture Incubators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.