pH Adjuster Market Outlook:

pH Adjuster Market size was estimated at USD 11.5 billion in 2025 and is expected to surpass USD 18.9 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. By the end of 2026, the industry size will reach USD 12.1 billion.

The main growth driver of the market is increasing demand in municipal water treatment, especially for corrosion control and balancing pH levels in drinking and industrial water systems. Citing the U.S. EPA, the U.S. has approximately 19 manufacturing facilities for phosphoric acid, a commonly used pH-adjusting agent. Historically, most of the domestic consumption of phosphoric acid has been for water treatment applications. Moreover, sulfuric acid serves as a key component in pH adjusters, providing rapid and precise acidification for water treatment, mining, and chemical manufacturing processes. Its high acid strength and cost-effectiveness make it a preferred choice for large-volume applications. The trade of sulfuric acid ensures the consistent availability of this critical raw material, supporting the production and supply of pH adjusters globally. Regions with active sulfuric acid import and export see higher adoption of pH-adjusting chemicals. Overall, sulfuric acid trade directly influences market growth by stabilizing supply, pricing, and industrial accessibility.

Worldwide Trade - Sulfuric Acid (2021)

|

Top Exporters |

Top Importers |

||

|

China |

3,000 M kg |

U.S. |

3,252 M kg |

|

Canada |

1,094 M kg |

Chile |

2,451 M kg |

|

Germany |

1,136 M kg |

Morocco |

2,109 M kg |

|

Peru |

1,110 M kg |

India |

1,874 M kg |

|

Mexico |

970 M kg |

Philippines |

1,522 M kg |

Source: WITS

The raw material supply chain consists of phosphate rock and chlorine/caustic soda sectors, with domestic phosphate rock production requiring imports to supplement the shortfall for company-specific demands, underscoring limited capacity. The variety of manufacturing capacity in chloride acid and phosphoric acid is widely dispersed, 19 manufacturing sites for phosphoric acid and 94 for hydrochloric acid. Phosphoric acid imports primarily come from Canada, while phosphoric acid exports go to Mexico. Hydrochloric acid imports exhibited the U.S. as potentially the largest hydrochloric acid importer and roughly tenth in exports for 2021. Hydrochloric acid is tariff-free except for a 27% import charge associated with sources from China. R&D investment continues for defining viable purification methods for wet-process phosphoric acid and examining optimized chlor-alkali routes. It is not possible to assume investment or spending patterns, as recent expenditure reporting remains aggregated within reporting for EPA chemical policies.

Key ph Adjuster Market Insights Summary:

Regional Insights:

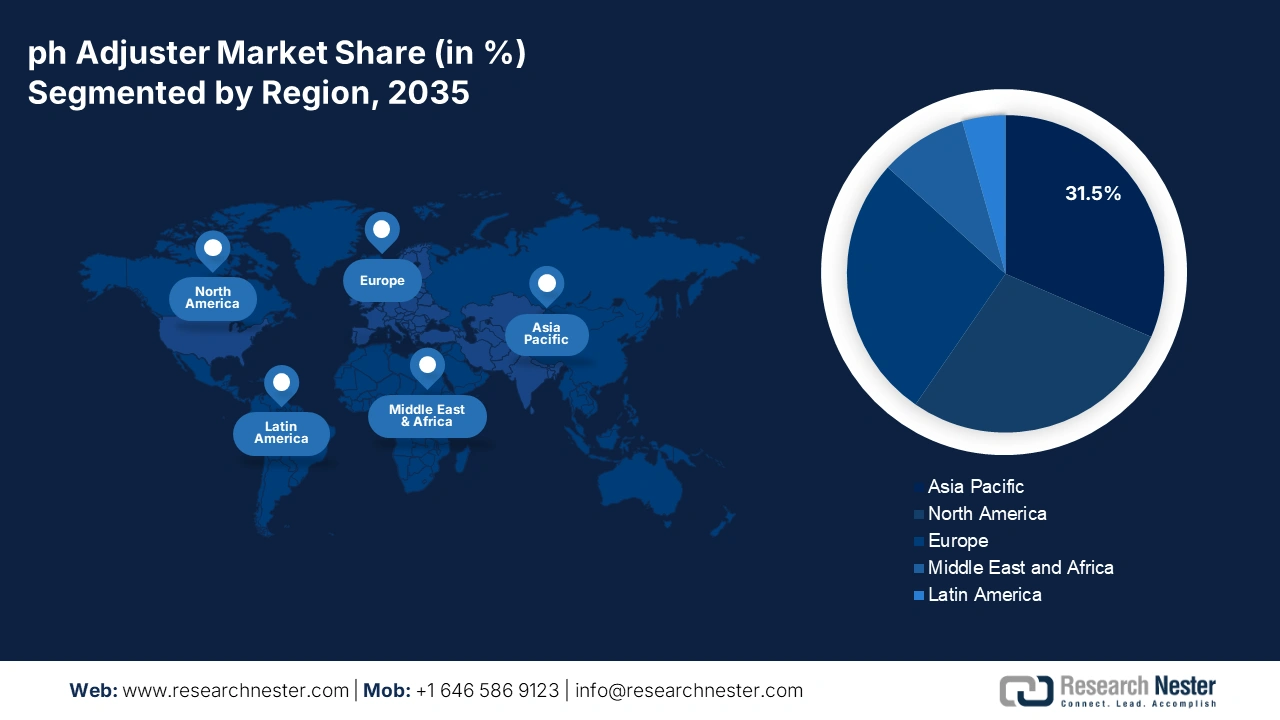

- By 2035, the Asia Pacific region is projected to command a 31.5% share of the pH Adjuster Market, supported by tightening wastewater regulations and rising industrial activity owing to stricter environmental compliance.

- The North America market is expected to secure a 28.1% share by 2035, sustained by expanding demand across water treatment, food processing, and specialty chemicals as regulatory pressure intensifies.

Segment Insights:

- The liquid segment is forecast to capture 51.6% share by 2035 in the pH Adjuster Market, supported by ease of dosing, rapid solubility, and reduced operational hazards.

- The water treatment segment is projected to achieve a 47.2% share by 2034, reinforced by rising freshwater scarcity and the growing need for pH control in treated water.

Key Growth Trends:

- Growth in water and wastewater treatment

- Sustainability and green chemicals initiatives

Major Challenges:

- Volatility in raw material prices

- Disposal and waste management issues

Key Players: BASF SE, Dow Chemical Company, Solvay SA, Eastman Chemical Company, Evonik Industries AG, Ashland Global Holdings Inc., Huntsman Corporation, Arkema Group, and Clariant AG.

Global ph Adjuster Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.5 billion

- 2026 Market Size: USD 12.1 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 3 October, 2025

pH Adjuster Market - Growth Drivers and Challenges

Growth Drivers

- Growth in water and wastewater treatment: Balanced pH levels are critical for efficient water and wastewater treatment as well as for meeting stringent environmental regulations, making this sector a key driver of the market. In municipal plants, pH adjusters help neutralize acidic or alkaline wastewater before discharge, ensuring safety for aquatic ecosystems. In industrial sectors, they optimize chemical reactions, enhance coagulation and flocculation, and protect pipelines from corrosion. As urbanization, industrialization, and stricter water quality standards expand globally, demand for reliable pH control chemicals continues to rise. This growing reliance directly fuels the market for both acidic and alkaline pH adjusters.

- Sustainability and green chemicals initiatives: The market is being propelled by the shift from traditional synthetic acids and alkalis toward eco-friendly and safer alternatives, a trend strongly influenced by global sustainability and green chemical initiatives. Companies are increasingly developing bio-based or less hazardous pH adjusters that minimize environmental impact while maintaining treatment efficiency in water, wastewater, and industrial processes. Regulatory frameworks supporting sustainable chemical use further accelerate adoption, especially in sensitive applications like food processing and municipal water treatment. Additionally, end-users are seeking solutions that lower carbon footprints and reduce harmful byproducts. This sustainability-driven transition is reshaping the pH adjuster market toward greener, more innovative offerings.

- Innovations in production technologies: Advancements in production technologies are fueling the market by enabling the creation of more efficient, cost-effective, and customized chemical formulations. These technologies improve product consistency, reduce impurities, and enhance neutralization performance, ensuring effective pH control across diverse industrial and municipal applications. They also lower energy consumption and production costs, making pH adjusters more accessible to a wider range of end-users. Furthermore, modern production methods support the development of specialty and blended pH adjusters tailored to specific treatment requirements, boosting adoption and expanding the market’s application scope.

Country-wise Production of Hydrochloric Acid (2023)

|

Country |

Trade Value (1000 USD) |

Quantity (Kg) |

|

Germany |

72,611.01 |

369,756,000 |

|

Canada |

56,122.71 |

303,082,000 |

|

European Union |

52,237.03 |

127,461,000 |

|

Japan |

29,539.66 |

9,164,960 |

|

U.S. |

27,949.09 |

127,924,000 |

|

China |

12,841.36 |

20,267,000 |

Source: trade.gov

Challenges

- Volatility in raw material prices: The fluctuations in raw material prices have a considerable effect on the market, leading to increased production costs and disruptions in supply chains. Price variations arise from geopolitical conflicts, resource shortages, and imbalances between supply and demand. This uncertainty compels manufacturers to explore alternative raw materials and adopt adaptable procurement strategies to maintain stable production and competitive pricing, all while ensuring product quality and adherence to regulatory standards.

- Disposal and waste management issues: Disposing of used pH adjusters and associated waste materials poses both environmental and regulatory challenges. Inadequate management can result in soil and water pollution, which escalates treatment expenses and compliance obligations for businesses. Stringent environmental regulations necessitate the adoption of advanced waste management techniques, encouraging manufacturers to create more biodegradable and environmentally friendly pH adjusters to alleviate disposal problems and lessen their ecological impact.

pH Adjuster Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 11.5 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

pH Adjuster Market Segmentation:

Form Segment Analysis

The liquid segment is predicted to gain the largest market share of 51.6% during the projected period by 2035, due to dosing convenience, speed at which the liquid is soluble, and lower hazards of operational hazards and exposure/protective equipment in both operations and warehouses. Sulfuric acid, hydrochloric acid, phosphoric acid, nitric acid, sulfurous acid, carbonic acid, and citric acid are preferred over powdered forms. The U.S. National Institute of Environmental Health Sciences has cited liquid pH-adjusting agents as critical for maintaining consistency within the waste treatment process and reducing worker exposure risk.

Application Segment Analysis

The water treatment segment is anticipated to constitute the most significant growth by 2034, with 47.2% market share, mainly due to increasing global shortages in freshwater resources. The U.S. Geological Survey cites nearly 47% of treated water from water facilities requires pH control to meet safe drinking standards. Industrial effluents and increasing environmental compliance through regulated discharge requirements are key drivers.

Type Segment Analysis

The acids segment is anticipated to constitute the most significant growth by 2034, with 42.2% market share, mainly due to their massive application as neutralizing agents in alkaline wastewater streams and are utilized in the municipal and industrial water treatment process. As an example, sulfuric acid and hydrochloric acid are recognized through the U.S. EPA as the major acidifier utilized in the adjustment of pH in wastewater treatment to achieve final discharge compliance standards.

Our in-depth analysis of the global pH adjuster market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

pH Adjuster Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific pH adjuster market is expected to hold 31.5% of the market share due to new and more stringent wastewater/environmental regulations, higher levels of industrial activity, and new applications associated with agriculture and food/personal care. The market is also seeing new market innovations like sustainable formulations and digital dosing technology to fulfill the demand in regions across the high-growth APAC economies. The market is also benefiting from water-quality policies that are implemented by governments to spur adoption within all economic sectors.

China is anticipated to play a significant role in the growth of the market within the APAC region, propelled by reforms in urban wastewater treatment, a rise in agrochemical and agricultural applications, and swift industrial growth—particularly in watershed development and environmental restoration. These elements are driving the need for efficient pH control solutions. Sinochem Group, a prominent Chinese chemical enterprise, provides a wide array of pH adjusters that serve the agriculture and industrial water treatment industries throughout China. India is expected to be a vital contributor to the expansion of the market in APAC, influenced by the increasing demand for municipal wastewater treatment, fertilizer and agrochemical production, pharmaceutical manufacturing, and more stringent environmental regulations. The rapid pace of industrialization and heightened investment in water infrastructure are additionally stimulating demand. Tata Chemicals Ltd., a leading chemical producer in India, offers pH adjusters utilized in agriculture, industrial water treatment, and effluent management, thereby promoting sustainable growth in essential sectors.

North America Market Insights

The North America market is expected to hold 28.1% of the pH adjuster market share due to the expansion of demand across water treatment, food processing, and specialty chemicals, which will drive growth in the market, which is estimated to be valued at approximately USD 3.6 billion by 2035 with a CAGR of 4.4% during the forecast period. The increased regulatory emphasis on compliance for wastewater will result in pH adjuster consumption, as will incentives to expand food-grade chemical production. In addition, as the demand for sustainable chemical processing continues to grow, coupled with regulatory pressure to comply with EPA water quality standards, long-term demands across the region will also grow.

The U.S. market is propelled by robust demand in industrial wastewater treatment, food and beverage manufacturing, and specialty chemicals. This growth is bolstered by EPA regulations, an increasing adoption of membrane-based water treatment technologies, and a heightened utilization of pharmaceuticals and personal care products. The Dow Chemical Company offers a comprehensive range of pH adjusters utilized across these industries, facilitating compliance and enhancing process efficiency.

U.S. Exports of Hydrogen Chloride in 2023

|

Country |

Trade Value 1000USD |

Quantity (Kg) |

|

Canada |

55,668.58 |

299,685,000 |

|

Japan |

4,337.78 |

1,449,000 |

|

Germany |

2,895.57 |

9,561,000 |

|

China |

1,476.16 |

2,736,000 |

|

United Kingdom |

208.39 |

716,000 |

|

India |

204.74 |

732,000 |

Source: WITS

The Canada market is expected to experience steady growth, driven by escalating investments in municipal and industrial wastewater treatment, more stringent environmental regulations, and a growing demand from the agricultural and food processing sectors. The focus on sustainable water management and clean-label products further fosters market growth. Kemira Chemicals Canada Inc. stands out as a significant contributor, providing innovative pH adjustment solutions specifically designed for Canadian industries, with an emphasis on environmental compliance and operational efficiency.

Europe Market Insights

The European pH adjuster market is witnessing consistent growth, propelled by strict environmental regulations and a rise in industrial activities. The need for pH adjusters is especially pronounced in industries such as water treatment, agriculture, and food processing. Nations like Germany, the UK, and France are significant contributors to this market, thanks to their sophisticated industrial infrastructure and dedication to environmental sustainability.

Germany is anticipated to dominate the European market by 2035, fueled by its robust industrial foundation in chemical manufacturing and water treatment. Stringent environmental regulations and governmental investments in sustainable technologies further enhance demand. The country’s compliance with the EU Water Framework Directive necessitates considerable upgrades in wastewater treatment, thereby increasing the usage of pH adjusters. BASF SE, a leading global chemical company headquartered in Germany, plays a pivotal role by offering innovative pH adjustment solutions for both industrial and municipal applications.

The UK is expected to emerge as a significant player in the European pH adjuster market by 2035, due to its advanced water treatment infrastructure and regulatory frameworks. Government initiatives, such as those specified in the UK's water industry regulations, aim to improve wastewater treatment processes, including dewatering, to comply with environmental standards. Despite facing challenges in overseas development assistance, the UK remains committed to enhancing domestic water infrastructure, which encompasses investments in dewatering technologies.

Key pH Adjuster Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Chemical Company

- Solvay SA

- Eastman Chemical Company

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Huntsman Corporation

- Arkema Group

- Clariant AG

- LG Chem Ltd.

- Tata Chemicals Limited

- Nufarm Limited

- Lotte Fine Chemical Co., Ltd.

- CCM Chemicals Sdn Bhd

- Stepan Company

The global market is moderately consolidated, with dominant players like BASF, Dow, Solvay, and Eastman Chemical jointly possessing a large market share, leveraging their wide-ranging product portfolio, well-acquired R&D, and distributor relationships. The companies have initiated several activities to improve their status in the market, including mergers (for example, Huntsman is in talks to buy Clariant), expansion of capacity, etc., and in addition, there is some innovation in terms of eco-friendly adjusters. Emerging companies from India, Malaysia, and South Korea are now entering global supply chains, using cost competitiveness and localization strategies. Continuously, sustainability and circular chemistry will strengthen strategic initiatives aimed at regulatory compliance and safer chemical formulations that meet consumer preferences.

Some of the key players operating in the market are listed below:

Recent Developments

- In May 2024, DuPont introduced Eco pH Master, a bio-based pH adjuster, in Europe to lessen acidic wastewater released to the area. By Q3 2024, DuPont, following the launch, saw an increase in its industrial water-treatment contract by 16% compared to the previous year. Interest in the EU industrial sites grew substantially as companies expressed strong interest in environmentally sustainable solutions for wastewater treatment, which continues to enhance DuPont’s competitive position in the industrial water-treatment market.

- In November 2024, BASF launched Neutralix, a phosphate-free neutralizing agent targeted at municipal wastewater treatment facilities across the U.S. Trials with municipal wastewater showed good performance, and by Q1 2025, BASF stated an increase in revenues in its Performance Chemicals segment of 12% that was attributed to Neutralix as compared to the previous year. A municipal client reported a 20% reduction in sludge with Neutralix since conventional lime dosing, which reduced their treatment volume, disposal costs, and sludge pH volumes, while increasing the operational efficiency.

- Report ID: 4231

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ph Adjuster Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.