Graphitic Cathode Block Market Outlook:

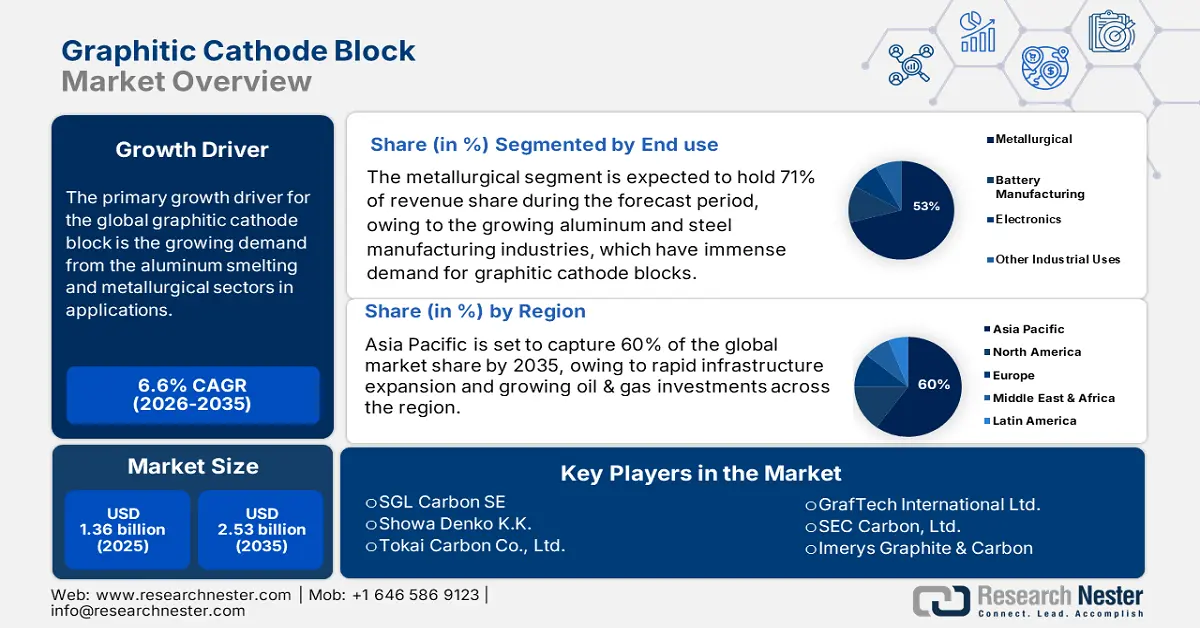

Graphitic Cathode Block Market size was valued at USD 1.36 billion in 2025 and is projected to reach USD 2.53 billion by the end of 2035, rising at a CAGR of approximately 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the graphitic cathode block is assessed at USD 1.45 billion.

The primary growth driver of the global graphitic cathode block markets is the growing demand from aluminum smelting and metallurgical sectors in applications such as electrolytic reduction cells, furnace linings, and high-temperature refractories. Against this background, the International Aluminum Institute recorded primary aluminum production at 293,456 thousand metric tons in 2024. Other factors that bring forth demand include rising industrial activities throughout the Asia-Pacific, especially in India. Primary aluminum output increased from 10.28 lakh tons (LT) in FY 2023-24 (April-June) to 10.43 lakh tons (LT) in FY 2024-25 (April-June), a 1.2% increase over the same period the previous year.

The supply chain for raw materials for producing graphitic cathode blocks is challenging, primarily because of its dependence on petroleum coke and needle coke, which are susceptible to supply interruption and fluctuations in price. Global needle coke prices rose from Q1 2023 to Q2 2024 due to constrained refinery production and increasing demand from lithium-ion batteries. Faced with these trends, the North American, EU, and East Asian governments are implementing strategic subsidies, tax incentives, and protectionism to enable domestic cathode block production.

Key Graphitic Cathode Block Market Insights Summary:

Regional Insights:

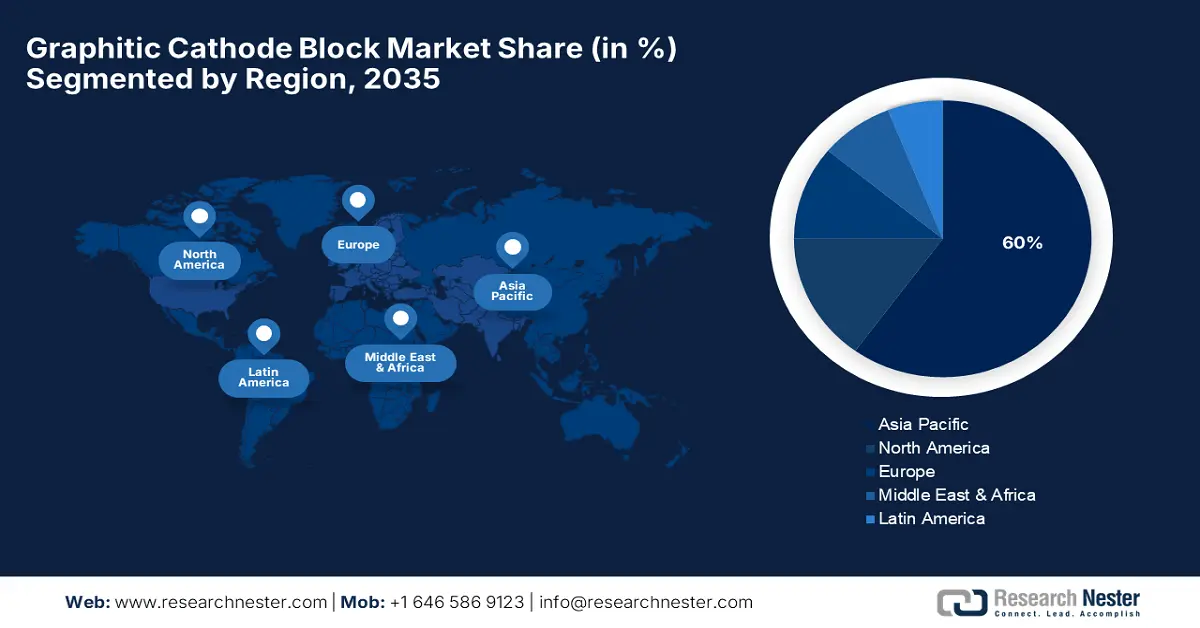

- The Asia Pacific region is expected to command nearly 60% share of the Graphitic Cathode Block Market by 2035, owing to rapid industrialization and surging steel and aluminum production across China, India, Japan, and South Korea.

- North America is predicted to secure about 15% share by 2035, impelled by modernization of metallurgical plants and policy-driven adoption of energy-efficient cathode materials under stringent emission norms.

Segment Insights:

- The metallurgical segment in the Graphitic Cathode Block Market is projected to account for around 71% revenue share by 2035, propelled by the rapid expansion of aluminum and steel production industries emphasizing energy-efficient and low-emission manufacturing.

- The aluminum smelting segment is anticipated to capture about 63% share by 2035, driven by surging global aluminum production and technological advancements enhancing cathode block durability and energy efficiency.

Key Growth Trends:

- Recycling & circular economy

- Application in renewable energy storage systems

Major Challenges:

- High capex & long lead times

- Raw material volatility

Key Players: SGL Carbon SE, Showa Denko K.K., Tokai Carbon Co., Ltd., GrafTech International Ltd., SEC Carbon, Ltd., Imerys Graphite & Carbon, HEG Limited, BHP Group Ltd., Mitsubishi Chemical Corporation, Tokai Carbon India Pvt Ltd, Graftech Malaysia Sdn Bhd, Asbury Carbons, Inc., H.C. Starck GmbH.

Global Graphitic Cathode Block Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.36 billion

- 2026 Market Size: USD 1.45 billion

- Projected Market Size: USD 2.53 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 11 September, 2025

Graphitic Cathode Block Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of the aluminum smelting industry: Aluminum production had reached about 6,373 thousand metric tons in July 2025. This hike came about due to increasing demands from the automotive, aerospace, and construction industries. Graphitic cathode blocks are essential components in aluminum electrolysis cells, offering high thermal conductivity, chemical resistance, and structural integrity under extreme conditions. As global demand for lightweight aluminum surges, especially in automotive, aerospace, and packaging sectors, smelters are scaling up production capacity, directly increasing the need for durable and efficient cathode materials. Technological upgrades in smelting operations further boost demand for advanced graphitic blocks with longer lifespans and lower energy losses. Additionally, regions like Asia-Pacific and the Middle East are investing heavily in new smelting facilities, reinforcing the market’s upward trajectory.

- Advancements in metallurgical processes: Modern smelting techniques are under constant development to enhance energy efficiency and reduce emissions. Because of the use of inert anodes and advanced electrolytic cell technologies, the cathode blocks are forced to have superior thermal conductivities and better mechanical strength. According to the World Economic Forum (citing IEA and IAI data), primary aluminum smelting consumes approximately 70 GJ per ton, making it one of the most energy-heavy industrial activities, significantly higher than steel or cement production. The process also represents around 4 % of global electricity consumption, with up to 70 % of that electricity derived from fossil-fuel sources, primarily coal. Innovations are expected to allow cathode blocks to last from 3 to 5 years, hence reducing the need for replacement and operational cost, which is expected to further encourage their adoption and the growth of the graphitic cathode block market.

- Rising demand for high-purity carbon materials: Aluminum smelting requires cathode blocks of carbon purity of above 99.6%, having the least sulfur, so as not to cause contamination. Such high-purity graphite cathode blocks, in turn, ensure perfect metal and few defects. With crude steel production increasing worldwide, the metallurgical sectors place emphasis on carbon materials having low impurities. This quality consciousness has diverted manufacturing setups toward the production of high-grade graphite cathode blocks, thereby supporting the market growth for these boxes that demand purer specifications and better performance.

Global Graphite Supply and Its Impact on the Graphitic Cathode Block Market

World mine production and reserves of graphite are fundamental to driving the graphitic cathode block market, as they determine the availability, pricing, and scalability of raw materials. Graphitic cathode blocks rely heavily on high-purity natural or synthetic graphite, sourced from major producers like China, Mozambique, and Brazil. As global mining output increases and new reserves are tapped, manufacturers gain access to more consistent and cost-effective graphite supplies, enabling expansion in aluminum smelting infrastructure. Conversely, supply constraints or geopolitical disruptions can tighten availability, pushing demand toward synthetic alternatives and advanced processing technologies. Thus, the dynamics of global graphite mining directly influence the growth, innovation, and competitiveness of the graphitic cathode block market.

World Mine Production and Reserves

|

Country |

2023 |

2024 |

Reserve |

|

Austria |

500 |

500 |

|

|

Brazil |

72,000 |

73,000 |

74,000,000 |

|

Canada |

13,000 |

3,500 |

5,700,000 |

|

China |

1,210,000 |

1,230,000 |

78,000,000 |

|

Germany |

170 |

150 |

|

|

India |

11,000 |

11,500 |

8,600,000 |

|

Korea, North |

8,100 |

8,100 |

2,000,000 |

|

Korea, Republic |

23,800 |

27,000 |

1,800,000 |

|

Madagascar |

130,000 |

100,000 |

24,000,000 |

|

Mexico |

2,000 |

2,000 |

3,100,000 |

|

Mozambique |

166,000 |

96,000 |

25,000,000 |

|

Norway |

10,380 |

7,200 |

600,000 |

|

Russia |

16,000 |

16,000 |

14,000,000 |

|

Sri Lanka |

2,600 |

2,200 |

1,500,000 |

|

Tanzania |

6,120 |

6,000 |

18,000,000 |

|

Turkey |

2,800 |

2,000 |

6,900,000 |

|

Ukraine |

Ukraine 1,000 |

2,000 |

|

|

Vietnam |

500 |

500 |

|

Source: USGS

Export and Import of Graphite in 2023

|

Top Exporter |

Value USD |

Top Importers |

Value USD |

|

China |

$402M |

United States |

$160M |

|

Mozambique |

$71M |

South Korea |

$109M |

|

Madagascar |

$48.3M |

Japan |

$95.4M |

Source: OEC

Challenges

- High energy consumption and production costs: To manufacture the cathode block, graphitic technology requires high temperatures continuing uninterrupted for hours, thereby consuming enormous quantities of electrical energy, which can cause an increase in costs because of the rise in energy prices globally, especially in those regions where the power supply is unpredictable. The cost pressure, while limiting the manufacturers' ability to scale up competitively, also lessens their profit margin, which forces them to put up prices at the end-user level, thus discouraging the market from growing and slowing down acceptance into the price-sensitive metallurgical industries.

- Technological barriers and quality standards: Producing graphitic cathode blocks with consistently high purity, thermal stability, and electrical conductivity is very technically challenging. Quality variations cause decreased efficiency in aluminum smelting, operational disturbances, and replacement costs. Such strict quality requirements restrict the number of capable manufacturers, increase production complexity, and hinder industry expansion. Thus, such barriers dissuade new entrants from meeting industry standards.

Graphitic Cathode Block Market Size and Forecast

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 1.36 billion |

|

Forecast Year Market Size (2035) |

USD 2.53 billion |

|

Regional Scope |

|

Graphitic Cathode Block Market Segmentation:

End use Segment Analysis

The metallurgical segment dominates the graphitic cathode block market and is expected to retain approximately 71% of the revenue share through the year 2035. This is primarily propelled by the growing aluminum and steel manufacturing industries, which have an immense demand for graphitic cathode blocks due to their excellent thermal and electrical conductivities. In FY 2023–2024, India produced 143.6 million tons of crude steel and 138.5 million tons of finished steel. There were 1,319 active mines and 95 minerals produced, totaling $13.4 billion in mineral output value. Increased adoption of electric arc furnace (EAF) steel production and electrolytic aluminum production processes, aimed at increasing energy efficiency and reducing carbon dioxide release, drives demand. The metals industry's growing shift toward cleaner, greener manufacturing also highlights graphitic cathode blocks' central role in the processes.

Application Segment Analysis

In the application segment, aluminum smelting is projected to hold the largest graphitic cathode block market share of about 63% in 2035. Growth of this sub-segment depends on the rapid growth of global aluminum production, particularly in the Asia-Pacific. Graphitic cathode blocks are fundamental electrodes of electrolytic reduction cells, enabling efficient aluminum extraction. The development of cathode block technology for enhanced lifespan and minimizing energy use while smelting results in growing adoption. Mounting need from the packaging, automotive, and construction sectors continues to drive this sub-segment's leadership in the market.

Type Segment Analysis

The petroleum needle coke sub-segment is expected to hold the highest graphitic cathode block market share of around 56% in 2035. This coke has a high structure and purity, and therefore is most suitable for the production of high-grade graphitic cathode blocks for application in the demanding metallurgical markets. Its technological superiority and readily available nature compared to coal-based graphite coke are also further consolidating its market position. However, supply droughts and volatility of prices are expected to test the mettle of producers, driving them to invest more in green procurement and process improvements to keep pace with the increasing demand.

Our in-depth analysis of the global graphitic cathode block market includes the following segments:

|

Segments |

Subsegments |

|

End use |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Graphitic Cathode Block Market - Regional Analysis

Asia Pacific Market Insight

The Asia Pacific is expected to lead the world graphitic cathode block market with a 60% market share in 2035, due to fast industrialization, where local crude steel production has increased. According to preliminary figures published by the World Steel Association, the global production of crude steel reached 1,884.6 million tons (MT) in 2024. After declining 0.9% year over year to 1750.9 MT in 2024, the October 2024 estimate predicts that steel demand will increase 1.2% year over year in 2025 to reach 1,771.5 MT. Demand is also driven by aluminum production, which exceeds 50.1 million tons in China alone. Asia Pacific's infrastructure spending was over USD 3.2 trillion in 2023, driving metallurgical progress. Japan, South Korea, and India enable extensive modernization of smelting processes, which creates demand for robust, energy-efficient cathode blocks.

China is expected to remain the largest graphitic cathode block market in the region, capturing around 40.2% of the global market by 2035. The country's metallurgical industry is shifting toward electric arc furnace (EAF) technologies, increasing demand for high-purity cathode blocks that reduce sulfur content and lower carbon emissions. As of 2023, China was the world's leading graphite producer, accounting for approximately 77% of global production. About 15% of the graphite produced in China was amorphous, while around 85% was flake. In October, China announced export restrictions set to take effect on December 1 for certain items, including flake graphite, spherical graphite (both natural and synthetic), expandable graphite, and several synthetic graphite products. China exported 58,000 tons of flake graphite concentrate, a decrease from 81,000 tons exported during the same period in 2022. The main destinations were the Republic of Korea (18%), Japan (17%), India (14%), and the United States (8%). During the same period in 2023, China exported 39,000 tons of natural spherical graphite, down from 45,000 tons in 2022. The primary recipients were the Republic of Korea (56%), the United States (23%), and Japan (19%).

India is expected to hold a 12% graphitic cathode block market share by 2035. A steelmaking capacity of 300.3 million tons with infrastructure investments worth USD 50.1 billion is on the agenda under the National Steel Policy of the Government. Upgradation has fostered very high demand for graphitic cathode blocks for smelters so as to improve efficiency and cut down on energy requirements, and thereby fill India's 15.2% energy intensity gap in metallurgy against world leaders. Besides that, the country's renewable energy integration journey (with a 151-GW installed capacity in 2024) optimization approves smelting to use clean electricity. Some impetus, worth USD 5.2 billion, has been well established by the 2023 Government to encourage high-quality carbon material production domestically, thus cutting down its dependency on imports.

North America Market Insight

North America is expected to hold a 15% share in the global graphitic cathode block market by 2035 due to steady growth witnessed in the aluminum and steel industries. The major level of demand for advanced blocks stems from the modernization of plants under stricter emission norms for energy efficiency. Resilience programs incentivize domestic sourcing of materials critical to the industry, including graphite cathode blocks, such as those under the Buy American Act.

The U.S. is expected to retain 14.3% of the global graphitic cathode block market by 2035. Aluminum smelting is a huge investor in low-carbon technologies. The U.S. synthetic graphite production rose to 319,000 metric tons (t), valued at $1.45 billion in 2022. This compares to 259,000 t, valued at $1.16 billion in 2021. The U.S. exports (limited to natural graphite) and imports of natural graphite were 9,500 and 89,200 t. This information represented an increase in exports of 10% and imports of 68% from those in 2021. U.S. exports and imports of synthetic graphite were 38,700 and 151,000 t, respectively. U.S. apparent consumption of synthetic graphite and natural graphite was 431,000 and 79,700 t, respectively. World production of natural graphite was estimated to be 1.68 million metric tons (Mt). Additionally, EAF production is growing rapidly, requiring high-quality graphitic cathode blocks to improve operational efficiency and emission reductions.

Canada is expected to grab a share of 7.8% of the worldwide graphitic cathode block market by 2035, due to the tremendous strategic implications since the country is a major producer of aluminum, producing more than 3.4 million tons annually, at 61% of the global total, with aluminum production from hydroelectric sources being the largest. An amount of USD 200.2 million is spent by the government on programs providing support for green manufacturing and innovation in metallurgy. The investment in improved cathode blocks should increase smelting energy efficiency by 11-17% to help Canada achieve the reduction in carbon emissions envisaged by the Pan-Canadian Framework on Clean Growth and Climate Change.

Europe Market Insight

Europe is expected to hold approximately 11% market share of the global graphite cathode block market by 2035, and this reflects the commitment to decarbonization and sustainable industrial processes. There were almost 140.2 million tons of steel estimated to be produced in Europe in 2023, with more than 61% coming from steelmaking processes involving the use of graphitic cathode blocks, chiefly an electric arc furnace. Aluminum production is also undergoing modernization to suit the EU Green Deal targets, estimated at USD 50.2 billion. Governments in the region fund programs worth over USD 5.1 billion every year in promoting circular economy principles and carbon emission reductions in metallurgy.

Trade of Natural Graphite in Powder or in Flakes in 2023

|

Country / Region |

Trade Value (1,000 USD) |

Quantity (Kg) |

|

United Kingdom |

2,415.57 |

1,168,280 |

|

Germany |

25,167.88 |

12,193,500 |

|

France |

161.77 |

90,965 |

|

Italy |

316.45 |

176,682 |

|

Spain |

204.94 |

143,504 |

Source: WITS

Germany is expected to hold the highest share of Europe’s graphitic cathode block market, almost 30.2% of the market share in the region. During 2023, Germany produced 40.2 million tons of crude steel. At the same time, low-carbon steel initiatives are being fast-tracked with USD 1.2 billion towards government grants for hydrogen steelmaking and modernization of cathode technology. The National Hydrogen Strategy of Germany sets out the target of reducing emissions from steel by 50.2% by 2030, which is expected to increase the commercialization of carbon additives that bolster furnace efficiency and durability.

France is expected to hold approximately 15.3% graphitic cathode block market share in Europe, the steel and chemical industries being the primary drivers behind this. The SNBC supports carbon mitigation production processes, with USD 810 million allocated to carbon materials R&D. The French metallurgical sector uses graphitic cathode blocks for energy savings in the order of 10 to 12.3% and for sulfur emission reductions of about 8%, both values being in line with stringent environmental norms imposed by the European Union. Public-private partnerships further accelerate the pace of innovation, which in turn makes France a very important center for sustainable cathode block demand.

Key Graphitic Cathode Block Market Players:

- SGL Carbon SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Showa Denko K.K.

- Tokai Carbon Co., Ltd.

- GrafTech International Ltd.

- SEC Carbon, Ltd.

- Imerys Graphite & Carbon

- HEG Limited

- BHP Group Ltd.

- Mitsubishi Chemical Corporation

- Tokai Carbon India Pvt Ltd

- Graftech Malaysia Sdn Bhd

- Asbury Carbons, Inc.

- H.C. Starck GmbH

The global graphitic cathode block market is highly competitive, with key players focusing on innovation, capacity expansion, and sustainable production. Leading manufacturers like SGL Carbon SE and Showa Denko K.K. invest heavily in R&D to develop high-performance cathode blocks with enhanced thermal conductivity and lower emissions. Strategic collaborations and acquisitions help companies expand their geographic footprint and product portfolios. In response to tightening environmental regulations, firms are adopting greener manufacturing processes and recycling initiatives. Additionally, government incentives in countries like the USA and Japan drive local production capacities, reducing supply chain risks and enhancing market stability. The last two market leaders from Japan are known for their cutting-edge technology and strong export presence, solidifying Japan’s pivotal role in the industry.

Top global manufacturers in the Graphitic Cathode Block market

Recent Developments

- In July 2024, POSCO‑Primetals HyREX Demonstration Plant MOU and Primetals Technologies signed a Memorandum of Understanding to jointly develop a full-scale HyREX demonstration facility, slated for completion by 2027 and aiming for commercial readiness by 2030. The project anticipates producing up to 2.5 million tons annually by 2040 using hydrogen-based reduction, stimulating demand for high-durability cathode materials.

- In April 2024, POSCO successfully produced its first molten iron using HyREX—a hydrogen-based steelmaking technology at its Pohang pilot facility, emitting only ~400 kg CO₂ per ton of iron, a major reduction compared to traditional blast furnaces. This breakthrough emphasizes carbon reduction and paves the way for eco-friendly steel production, enhancing demand for high-performance carbon materials such as graphitic cathode blocks in electric smelting furnaces.

- Report ID: 8084

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Graphitic Cathode Block Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.