Cobalt Free Cathode Market Outlook:

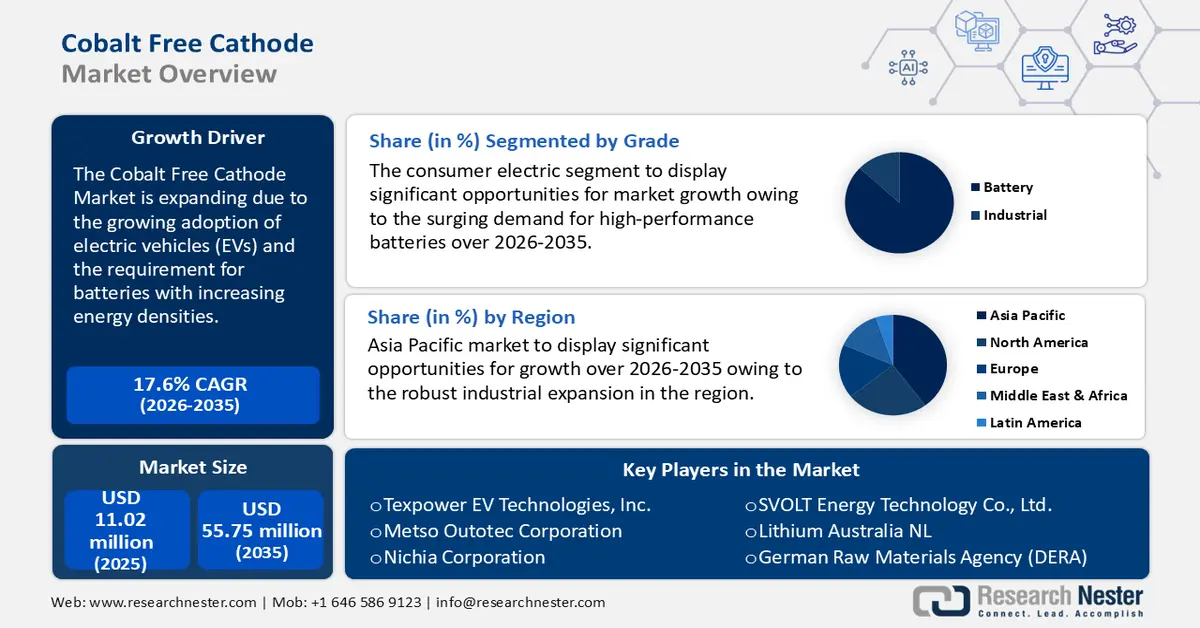

Cobalt Free Cathode Market size was valued at USD 11.02 million in 2025 and is expected to reach USD 55.75 million by 2035, registering around 17.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cobalt free cathode is assessed at USD 12.77 million.

The growth of the market can be attributed to the increasing use of cobalt-free cathode in electric vehicles. Cobalt is a costly and rare metal, which makes the production of lithium-ion batteries expensive. This, in turn, surges the cost of electric vehicles, which is why developers are focusing on mass production of the cobalt-free cathode to be used in batteries. The growing demand for electric vehicles is estimated to primarily drive the market growth. According to the data from the International Energy Agency (IEA), 2.1 million EVs were sold globally in 2019, registering a 6% growth from 2018. As of 2019, the total number of electric vehicles running across the world amounted to 7.2 million vehicles.

Moreover, the sales of battery-powered vehicles are also growing across the globe, including commercial and personal cars, backed by the surge in environmental awareness amongst people. As per the IEA report, the total sale of battery-powered electric vehicles (BEV) reached 2,008,024 units in 2020, up from 1,542,867 units in 2019 across the world. Additionally, the advancement in technology and growing R&D activities are estimated to boost the market growth. The increasing disposable income of people across the world and rising preference for eco-friendly vehicles such as electric vehicles is estimated to drive market growth in the coming years. The government initiatives to reduce pollution and the high cost of fossil fuels are anticipated to drive market growth during the forecast period.

Key Cobalt Free Cathode Market Insights Summary:

Regional Insights:

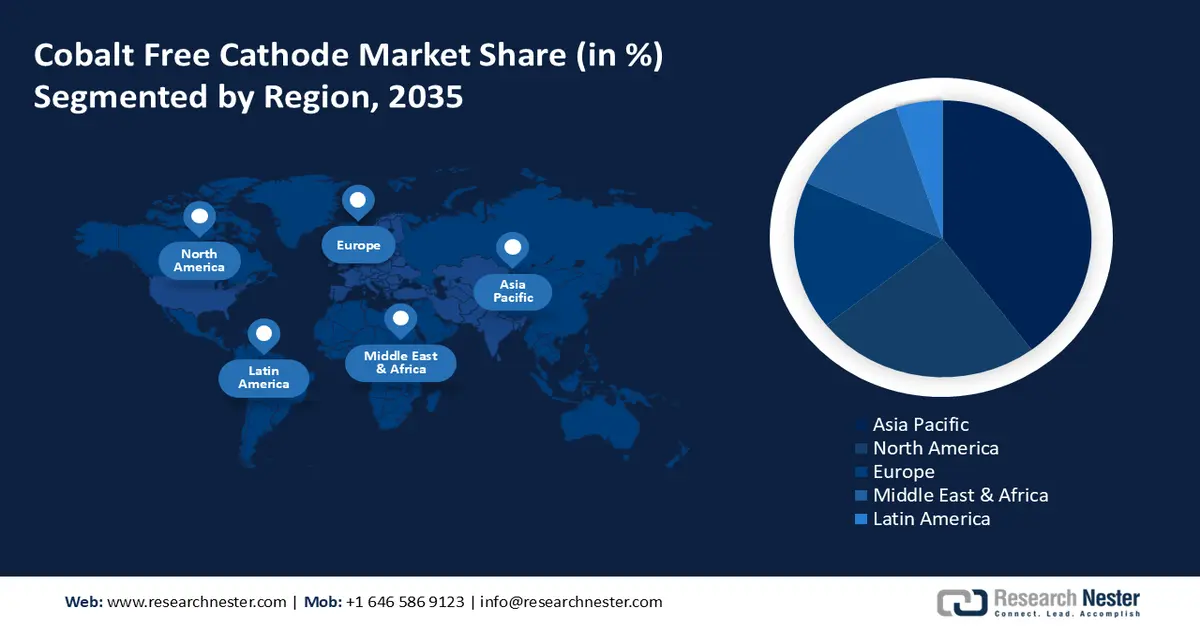

- The Asia Pacific region is expected to secure the largest revenue share by 2035 in the cobalt free cathode market, owing to the strong presence of leading automobile manufacturers and rising EV sales.

- Europe is projected to expand steadily by 2035, bolstered by the growing shift toward cobalt-free lithium-ion batteries alongside increasing digitalization and demand for consumer electronics.

Segment Insights:

- The consumer electronics segment is forecasted to attain the largest share by 2035 in the Cobalt Free Cathode Market, sustained by accelerating digitalization and growing use of devices such as televisions, smartphones, and laptops.

- The automotive segment is projected to hold a substantial share by 2035, stimulated by increasing demand for cobalt-free cathodes in EV batteries driven by heightened environmental awareness.

Key Growth Trends:

- Growing Sales of Electric Vehicles Across the World with Rising Disposable Income

- Rising Adoption of Technology across the Globe

Major Challenges:

- Lower Driving Range of Cobalt Free Batteries

- Lack of Public Awareness regarding the Product

Key Players: Targray Technology International Inc., Texpower EV Technologies, Inc., Metso Outotec Corporation, Nichia Corporation, SVOLT Energy Technology Co., Ltd., Lithium Australia NL, German Raw Materials Agency (DERA), Morrow Batteries GmbH, Umicore, TÜV Nord Group.

Global Cobalt Free Cathode Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.02 million

- 2026 Market Size: USD 12.77 million

- Projected Market Size: USD 55.75 million by 2035

- Growth Forecasts: 17.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (Largest Revenue Share by 2035)

- Fastest Growing Region:North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Thailand

Last updated on : 21 November, 2025

Cobalt Free Cathode Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Sales of Electric Vehicles Across the World with Rising Disposable Income – The increasing price of fossil fuels and rising consumption of petroleum products in the combustion is estimated to drive the market growth as per the market analysis. According to an IEA org report published in 2022, electric car sales attained an all-time high in 2021. Revenues roughly doubled to 6.6 million (a selling proportion of nearly 9%) in comparison to 2020, bringing the overall number of electric vehicles on the road to 16.5 million in the U.S. The growing number of electric vehicles across the world with rising disposable income of people as well as increasing economic standards is also estimated to propel the market growth in the coming years. The rising concern regarding environmental pollution caused by the combustion of fossil fuels is also anticipated to drive market growth during the forecast period.

-

Rising Adoption of Technology across the Globe – Customers all over the world are increasingly turning to high-performance, low-cost battery technologies in recent years. The battery market is expected to more than quadruple between 2021 and 2030. Thus, technological advancements are anticipated to further evolve battery development, which is projected to add to industry growth.

-

Rising Concern among People on Environmental Pollution created by Cobalt – Cobalt is estimated to cause global warming and eutrophication by emitting large amounts of carbon dioxide and nitrogen dioxide. The emissions from cobalt production were estimated to be over 1.5 Mt as of 2021 worldwide.

-

Increasing Utilization of Electronics and Electronic Goods by People Across the World – Worldwide electronic products are estimated to have a value of about USD 1,200 billion by the end of 2020.

Challenges

- Lower Driving Range of Cobalt Free Batteries

- Lack of Public Awareness regarding the Product

- Side Effects of Cobalt on the Environment - Cobalt may cause eye, skin, heart, and lung irritation and disorders when exposed for a longer time. Continuous exposure may also cause cancer in the people working in these situations. Cobalt causes hypersensitivity, and inflammation leading to respiratory disorders such as asthma and shortness of breath. These factors are estimated to hamper the market growth during the forecast period.

Cobalt Free Cathode Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.6% |

|

Base Year Market Size (2025) |

USD 11.02 million |

|

Forecast Year Market Size (2035) |

USD 55.75 million |

|

Regional Scope |

|

Cobalt Free Cathode Market Segmentation:

End-user Segment Analysis

The global cobalt free cathode market is segmented and analyzed for demand and supply by end-user into automotive, consumer electronics, and others. Out of these, the consumer electronics segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the rising adoption of digitalization across the world with the increasing living standards of people also estimated to drive the market growth. The growing number of e-commerce purchases with rising internet penetration is expected to have a positive impact on market growth in the coming years. The rising use of T.V., mobiles, computers, and laptops is also estimated to drive market growth in the coming years. More than 5 billion population around the world are using television as per the estimations of 2022.

Automotive Segment Analysis

The global cobalt free cathode market is also segmented and analyzed for demand and supply by end-user into automotive, consumer electronics, and others, out of which, the automotive segment is anticipated to hold a substantial share in the global cobalt-free cathode market over the forecast period on account of increasing demand for cobalt-free cathodes for batteries of EVs. Furthermore, the increasing demand for electric vehicles, backed by rising environmental awareness amongst the global population, is projected to fuel the segment’s growth. The rising purchase of automobile vehicles and an increasing number of vehicles on road is estimated to drive the market growth as per the market analysis. The increasing need for people to move from one place to another place is also driving the market growth during the forecast period. As per the reports, the total revenue of dealers of motor vehicles and parts in the United States was estimated to be over USD 1 trillion by the end of 2021.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cobalt Free Cathode Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share by 2035. The market’s growth can be attributed majorly to the presence of major automobile manufacturers in the region. Moreover, increasing sales of electric vehicle, backed by increasing disposable income in the region, and growing environmental awareness among the people are anticipated to encourage regional market growth. According to the data from the IEA, 47% of the total EVs running across the globe, were in China, in 2019. The rising adoption of people and concern of the government on eco-friendly products is estimated to drive market growth in this region.

Europe Market Insights

On the other hand, the increasing replacement of cobalt with lithium-ion batteries is also expected to propel the growth of the market in the coming years in Europe. The rising digitalization in the region with growing demand for software is driving the market growth as per the market analysis. The increasing economic standards and spending capacity of people to buy consumer electronics including smartphones and other electronic devices are also driving the market growth in this region.

North American Market Insights

The market in the North American region is anticipated to gain the largest market share throughout the forecast period owing to the increasing adoption of electric vehicles in developed countries, such as the U.S. and Canada. According to the report by IEA, over 231,088 battery-powered electric cars were sold in the US in 2020.

Cobalt Free Cathode Market Players:

- Targray Technology International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Texpower EV Technologies, Inc.

- Metso Outotec Corporation

- Nichia Corporation

- SVOLT Energy Technology Co., Ltd.

- Lithium Australia NL

- German Raw Materials Agency (DERA)

- Morrow Batteries GmbH

- Umicore

- TÜV Nord Group

Recent Developments

-

SVOLT Energy Technology Co., Ltd announced the onset of mass production of the cobalt-free cathode material for its NMX battery cells in Jintan, China.

-

Texpower EV Technologies, Inc.’s Cobalt-Free Battery received a special mention in the WIRE journal, as an environmental and human rights-friendly alternative to traditional lithium-ion batteries.

- Report ID: 4066

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cobalt Free Cathode Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.