3D Graphene Market Outlook:

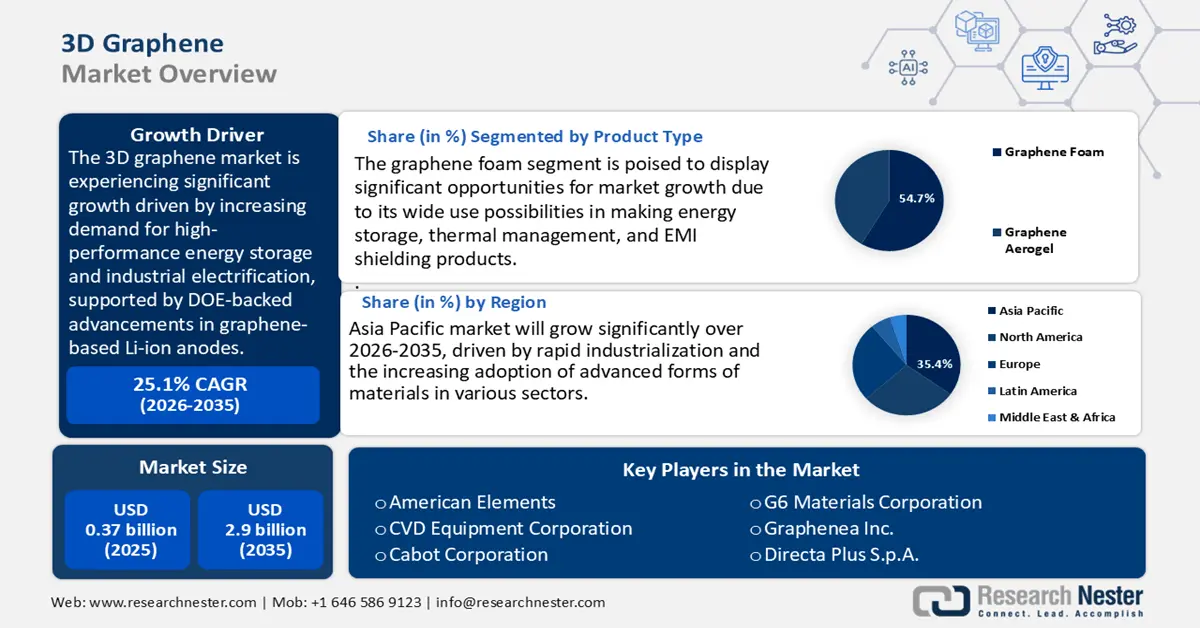

3D Graphene Market size was valued at USD 0.37 billion in 2025 and is projected to reach USD 2.9 billion by the end of 2035, rising at a CAGR of 25.1% during the forecast period, from 2026 to 2035. In 2026, the industry size of 3D graphene is estimated at USD 0.45 billion.

The global 3D graphene market is expected to grow significantly over the forecast period, primarily driven by industrial electrification and high-performance energy storage. The U.S. Department of Energy (DOE) research programs and technology transition papers show direct results in increased electrode power density and cycle life when graphene-based 3D architectures are integrated into Li-ion anodes and composite electrodes. Furthermore, DOE documentation highlights that even small concentrations of graphene significantly reduce charging time and enhance cycling stability. The demand is reflected in national minerals statistics, with the United States Geological Survey (USGS) reporting increasing graphite imports to serve battery anode manufacturing, 84,000 t in 2023, a trend that suggests ongoing demand for upstream carbon feed stocks whose manufacturing feeds downstream graphene and 3D-graphene goods fabrication.

The National Nanotechnology Initiative (NNI) 2025 Budget Supplement has increased its budgetary request to greater than the USD 2.2 billion on foundational nanoscale science, translation to applications, and added emphasis on commercialization and workforce development. The NNI also aligns R&D efforts among its 20 federal members, including NSF and NIST, to accelerate nanotechnology scale-up, manufacturing methods, and small business commercialization, decreasing industry technical uncertainty. The NNI has invested a total of over USD 45 billion to date, and in less than two decades, has developed the world-leading infrastructure to advance nanotechnology research, innovation, and deployment toward national priorities in areas such as clean energy, health, and economic security. The details of the carbon and graphite captured by the BLS PPI series may be a useful proxy for upstream cost pressure. The Producer Price Index (PPI) of carbon and graphite products is at 245.555 as of March 2025, and this value remained the same in the previous months of the index shown. It indicates a steady producer price environment on carbon and graphite products through November 2024 to March 2025.

The supply chain and the trade scenario are correlated with a technology that has moved beyond the laboratory to industrial lines. USITC working papers and USGS commodity briefs present non-binding countries holding concentrated mines to refining stages along the global chain of aging graphite and related carbon materials, with downstream processing and electrode production extending around the world; the USITC study refers to a dominant chain of refining and downstream processing in China of battery carbons. In addition, the country accounted for graphite production at an estimated 77% of total world production. Approximately 15% of graphite produced in China was amorphous, and about 85% was flake. The notification of graphene-based nanomaterials within the WTO reflects their growing global importance as a subject of trade policy and standardization, now being actively discussed in multilateral forums. Additionally, NIST and NSF publications detail systematic investment in measurement science, process validation, and pilot 3D-printing lines of gel-based and ink-based graphene constructs; those programs are aimed at fast-tracking assembly-line formats (direct ink writing, freeze-dry/hydrothermal workflows) beyond demonstration prototypes to pilot production. , thereby driving the supply chain of the market effectively.

Key 3D Graphene Market Insights Summary:

Regional Highlights:

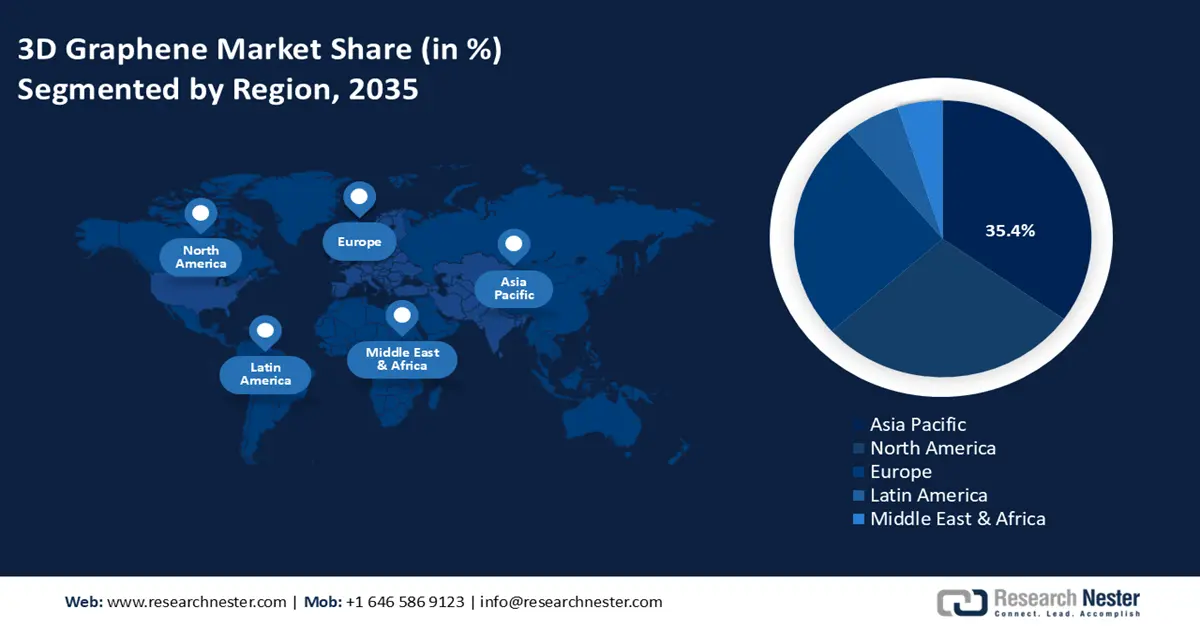

- The Asia Pacific region is forecasted to dominate the global 3D graphene market with a 35.4% share by 2035, attributed to rapid industrialization and increasing adoption of advanced materials across multiple industries.

- The North American market is anticipated to secure a 29% revenue share by 2035, supported by robust government initiatives and escalating investments in clean energy and sustainable chemical manufacturing.

Segment Insights:

- The graphene foam segment is anticipated to account for a dominant 54.7% share of the 3D graphene market by 2035, propelled by its extensive applications in energy storage, thermal management, and EMI shielding solutions.

- The chemical vapor deposition (CVD) segment is projected to capture a 32.8% revenue share by 2035, owing to its growing utilization in fabricating high-quality, scalable 3D graphene architectures for advanced electronics and energy storage applications.

Key Growth Trends:

- Manufacturing scale-up and process validation

- Growth in catalytic and process efficiency

Major Challenges:

- Cost pressure from international trade regulations

- Nanomaterials challenges and gaps in R&D investment

Key Players: American Elements (USA), CVD Equipment Corporation (USA), Cabot Corporation (USA), G6 Materials Corporation (USA), Graphenea Inc. (Spain), Directa Plus S.p.A. (Italy), Versarien PLC (UK), First Graphene Ltd. (Australia), Talga Group Ltd. (Australia), Samsung SDI (South Korea), INOVYN (INEOS Group) (UK).

Global 3D Graphene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 0.37 billion

- 2026 Market Size: USD 0.45 billion

- Projected Market Size: USD 2.9 billion by 2035

- Growth Forecasts: 25.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Canada, United Kingdom, Australia, France

Last updated on : 3 September, 2025

3D Graphene Market - Growth Drivers and Challenges

Growth Drivers

- Manufacturing scale-up and process validation: Development is being made with scaling up 3D graphene manufacturing, assisted through government incentives. The focus of NIST additive manufacturing is to develop measurement science, standards, and pilot-line validation to enable the growth of industrial adoption of 3D printing processes, which potentially 3D graphene constructs may apply. The high reproducibility and minimized technical uncertainty of this process create a viable path for scale-up. Furthermore, while NIST does not share production volumes, its core mission to promote innovative manufacturing and the efficient production of reliable goods in American industry implicitly supports the industrial preparedness and cost-reduction efforts critical to emerging materials.

- Growth in catalytic and process efficiency: The U.S. DOE has outlined an industrial decarbonization roadmap demonstrating that when applied to specific processes, catalytic and process efficiencies can deliver significant energy, economic, and financial benefits. An example here is retrofitting pumps, fans, and blowers with new, more-efficient technologies that have saved between 15% and 23% in energy use. Such efficiency gains, potentially applied to synthesis or functionalisation steps of 3D graphene, can be translated to significant operational cost and emissions savings, benefiting competitiveness in the chemicals industry. In spite of the fact that these numbers provided by the DOE are related to the nonspecific manufacturing equipment, the principle of process intensification and efficiency improvement would apply to the advanced chemical production.

- Standards, Safety testing & nanomaterials regulation: ECHA regulation of nanoforms under REACH now requires clear risk assessment and registration of substances that contain nanomaterials. The amendment obligates companies to detail information on nanoforms and safety evaluations in their dossiers, which is a requirement directly applicable to any chemical company producing or supplementing 3D graphene products. By 2020, of the approximately 37 registration dossiers that included nanoforms, ECHA had focused on grouping and read-across as strategies to avoid unnecessarily generating data. The increased costs in upfront testing and documentation of a product by manufacturers also increase buyer confidence in regulated markets in the downstream.

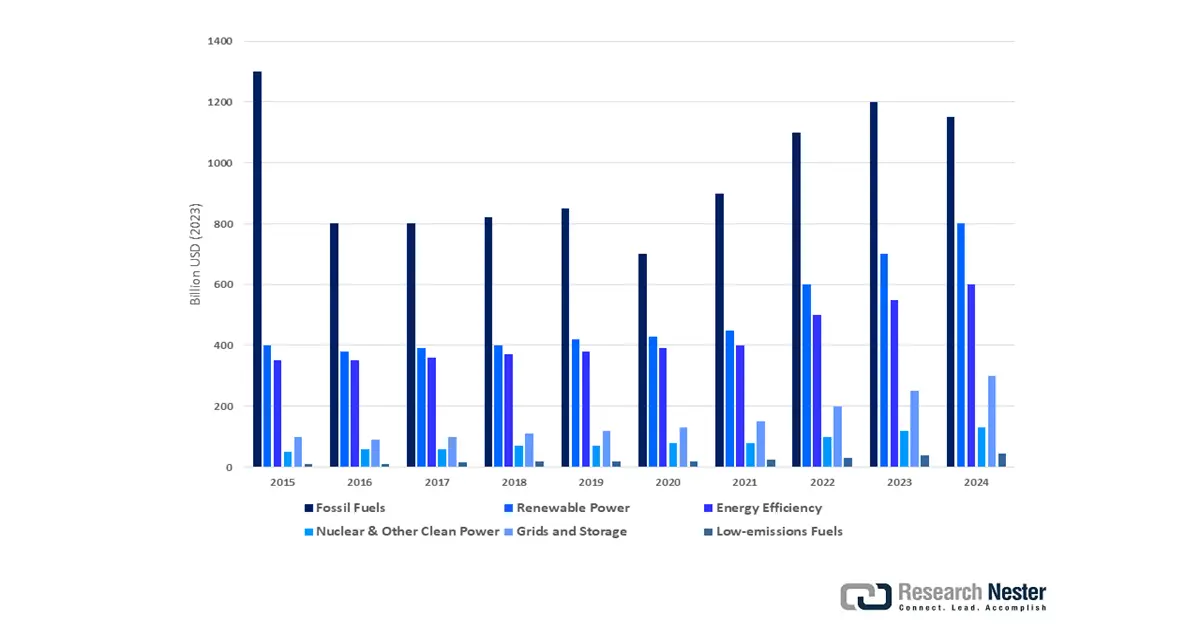

Global Investments in Clean Energy

Investment in clean energy creates direct demand for 3D graphene by driving innovation in high-performance batteries, hydrogen storage, and catalytic systems, where its properties significantly enhance efficiency and capacity. Simultaneously, fossil fuel investment, particularly from energy companies diversifying into advanced materials and carbon management technologies, funds the research and scale-up of 3D graphene production. This dual support accelerates both supply-side capabilities and application development. Together, these investments reduce technical and commercial risks, fostering broader adoption across energy sectors.

Global Investment in clean energy and fossil fuel, 2015 – 2024

Source: IEA

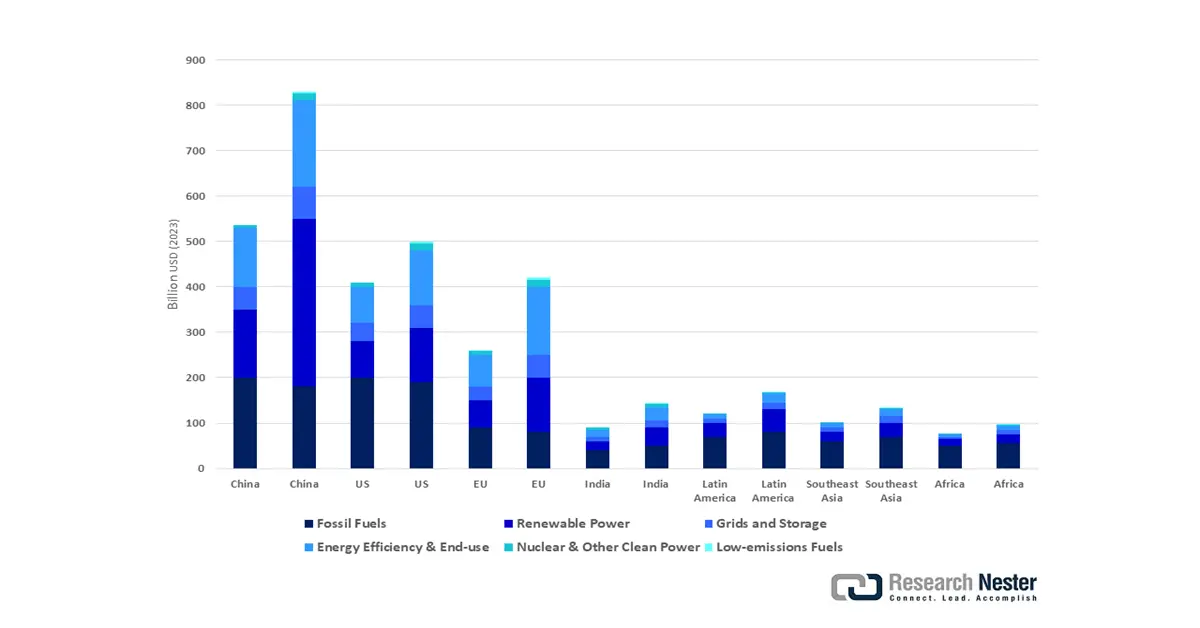

Annual Energy investment by selected country and region, 2019 and 2024

Source: IEA

Challenges

- Cost pressure from international trade regulations: As stated in the World Trade Organization (WTO) Report 2023, in developing economies, tariffs on chemical products may go up to a significant rate, resulting in high input prices and dislocated pricing systems. Different tariff regimes and inconsistent application of tariffs at various points complicate cost modeling of 3D graphene producers that depend on cross-border sourcing of materials and components, necessitating many players to accept margin compression to stay afloat or raise prices to reduce the elasticity of demand. This situation reflects broader issues of cost pressures, global trade uncertainties, and the need for strategic adaptations to maintain competitiveness in the advanced materials sector.

- Nanomaterials challenges and gaps in R&D investment: The OECD, Science, Technology and Innovation Outlook 2023 indicates that total public R&D investment in nanotechnology is less than 5% of the overall public expenditure in the chemical sector, even though nanomaterial-based industries are increasingly contributing to value addition. This underinvestment also acts as a hindrance to innovation pipelines, expansion of production procedures, and development of new applications, extending average time to commercialization by 18-24 months as firms find it challenging to attract upstream funding.

3D Graphene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.1% |

|

Base Year Market Size (2025) |

USD 0.37 billion |

|

Forecast Year Market Size (2035) |

USD 2.9 billion |

|

Regional Scope |

|

3D Graphene Market Segmentation:

Product Type Segment Analysis

The graphene foam segment is expected to grow at the largest 3D graphene market share of 54.7% over the forecast period from 2026 to 2035, attributed to its wide use possibilities in making energy storage, thermal management, and EMI shielding products. Graphene foam, especially open-cell, can facilitate the transport of ions to advance the performance of lithium-ion and supercapacitors. Its structural adaptability enables it into automotive, aerospace, and energy storage systems. The DOE report on low-cost long-duration energy storage highlights that the U.S. is experiencing rapid growth in grid-scale energy storage capacity, with deployments increasing substantially to support the integration of renewable energy sources. It notes that more than 4 gigawatts (GW) of new grid-scale battery storage projects were commissioned in recent years, and capacity additions are expected to accelerate further to meet increasing demand for grid flexibility and reliability. Manufacturers focused on developing scalable production processes for open-cell foam are positioned to capture the largest revenue share by 2035.

Open-cell foam adds a porous structure to the energy storage and offers high ion movement and a superior surface area, which is why it has been used to make batteries, mostly lithium-ion and supercapacitors, its thermal management capabilities, and also in EMI shielding. Its flex and its conductivity propel its use in automotive, aerospace, and grid-scale storage systems. In comparison, closed-cell foam is solid, giving it greater mechanical strength, which makes it usable in lighter-weight structural composites and shock absorption in automotive and aerospace products. Both sub-segments derive the benefit of the research and scaling being done to satisfy the increasing industry demand.

Technology & Manufacturing Process Segment Analysis

The chemical vapor deposition (CVD) segment is projected to grow at a significant revenue 3D graphene market share of 32.8% by 2035, driven by its increased usage in manufacturing high-quality, uniform, and scalable architectures of 3D graphene. CVD offers the capability to tune thickness, porosity, and the integrity of graphene layers accurately, which is necessary to achieve energy storage, electronics, and advanced composite applications. More importantly, 3D structured CVD enables manufacturers to produce complex geometries that are ideal for use in electrodes in lithium-ion and solid-state batteries by enhancing the conductivity and mechanical stability of the products. The National Institute of Standards and Technology (NIST) confirms that standardized pilot-line CVD manufacturing minimizes defects, improves yield, and enables viable production at an industrial scale. This makes CVD the largest-revenue sub-segment in the technology & manufacturing process category.

Foil-based CVD is an established process that enables high-quality graphene layers on metal substrates, with uniform layer thickness and exceptional electrical conductivity, and can be applied to electronics and sensor applications. 3D Structured CVD allows highly complex three-dimensional architectures to be grown, which enhance absorbency, mechanical properties, and surface area, which are critical to energy storage electrodes and high-performance composites. NIST states that 3D structured CVD pilot lines can enhance control of the defects and industrial scalability, hence suitable for developing batteries and other high-performing substances. These two methods are complementary to each other to meet a wide range of industrial needs and the technological advancements in the 3D graphene market.

Application Segment Analysis

The batteries segment is expected to constitute the largest application in the 3D graphene market, with a share of 28.3% during the projected years, driven by the crucial role of batteries in 3D graphene to boost conductivity, energy density, and cycle life. 3D graphene acts as an electrode additive and electrode scaffold, improving ion transport and decreasing internal resistance, which extends the battery life. The International Energy Agency (IEA) reports that the electric vehicle (EV) market is growing at significant levels, with a recorded increase of electric vehicle sales to just above 10 million in 2022. This increase has resulted in a cumulative amount of more than 35 million EVs globally. This growth is fueled by favorable policies, emerging battery technologies, and the increased demand of consumers for cleaner modes of transport. The recent increase is also driven by government plans to integrate renewable energy, and, as such, high-capacity, robust storage systems are needed. As a result, energy storage applications will continue to be the leading factor driving the 3D graphene market through the end of the forecast period in 2035.

Our in-depth analysis of the 3D graphene market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Technology & Manufacturing Process |

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Graphene Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is projected to dominate the global 3D graphene market with the largest share of 35.4% over the projected years from 2026 to 2035, owing to rapid industrialization and the increasing adoption of advanced forms of materials in various sectors. This development is enhanced by strong government investments and government programs to encourage the development of sustainable chemical technologies, and the state/industry alliances as an avenue of spurring innovation. The Asia-Pacific Economic Cooperation (APEC) Chemical Dialogue developed sustainable chemical management in the region, as together these economies account for about 7% of global GDP and over 45% of global chemical manufacturing.

The 2020-2023 Strategic Framework is compiled on the foundation of health, environmental, and sustainable development objectives, regulatory cooperation, and innovative approaches to sustainable development and chemical products stewardship. The Chemical Dialogue helps advance major efforts on regulatory harmonization, chemical safety, marine debris mitigation, and data exchange to enhance the national-industry collaborative efforts throughout the Asia-Pacific. Such initiatives establish the region as a leader regarding sustainable practices of chemical industries in the face of problems affecting the world. Ramping up of R&D expenditure coupled with favorable regulation further boosts the industry in the Asia Pacific, making the region one of the centers of the sustainable chemical industry in the world, as well as 3D graphene commercialization.

The 3D graphene market in China is expected to lead the region from 2026 to 2035, attributed to large governmental backing and scale. Most companies have embraced sustainable chemical processes, with the report released by the China Ministry of Ecology and Environment in 2023 on climate action indicating that China has lowered the carbon dioxide emissions per unit of gross domestic product by more than 51% relative to the 2005 level by 2022. By the year-end of 2022, 17.5 percent of the total energy use was accounted for by renewable energy, and a renewable capacity of 1.213 TW was installed. The covered percentage of forest was 24.02% in the year 2021, which revealed good effects on the process of environmental sustainability and trade in carbon markets.

The New Energy Vehicle Industrial Development Plan (20212035) presents environmental sustainability and advanced manufacturing to be prioritized by the National Development and Reform Commission (NDRC) in China. The plan aims at achieving 20 percent of new energy vehicle purchases in new vehicle sales by 2025, includes advanced technology in battery and intelligent systems, and facilitates integration of the energy, transportation, and communication sectors. It expects to develop a low-carbon and internationally competitive automotive industry along with the low-carbon objectives of China. China National Chemical Corporation (ChemChina) and China Petroleum and Chemical Industry Federation (CPCIF) also donate resources in the form of R&D and commercialization. This is an integrated policy and industrial ecosystem that makes China one of the rapidly growing and leading in the global 3D graphene market.

India’s 3D graphene market is predicted to grow with the fastest CAGR during the projected years by 2035. This is mainly driven by active governmental investments and industrial uses. The Government of India is also encouraging semiconductor manufacturing, including gallium arsenide wafer technologies, by undertaking the Semicon India Program with a total outlay of Rs 76000 (approximately USD 9-10 billion). It also funds developments in compound semiconductors and has been giving financial incentives to firms establishing manufacturing and research and development centres, e.g., the Gallium Arsenide Enabling Technology Centre (GAETEC) in Hyderabad. The aim is to develop a powerful ecosystem of design, fabrication, and advanced manufacturing, which is aligned with the wishes of India to be at the forefront in the realm of technology. The Department of Science & Technology funds several graphene-related research and development projects so as to make faster progress towards commercialization, in areas of energy, electronics, and chemicals.

In addition, the Federation of Indian Chambers of Commerce and Industry (FICCI) estimates that the Indian chemical industry is likely to expand further at 7.5% to 9.5% CAGR based on domestic demand and incentives plans like the PLI scheme. The industry is oriented on green production, circular economy, and generating chemical centers like PCPIRs to lower the reliance on imports and increase investments. The suggested chemical market in India is expected 2030 at USD 300 billion and USD 1 trillion by 2040. Initiatives undertaken by the government to promote sustainable growth and clean fabrication activities increase the popularity of 3D graphene, and this further makes India an important growth region in the Asia Pacific region.

North America Market Insights

The North American 3D graphene market is expected to grow at a significant revenue share of 29% during the projected years by 2035, attributed to robust government support and a growing demand among industry players in the chemical landscape. The World Energy Investment 2024 report by the IEA suggests that global investment in clean energy was USD 2 trillion in 2023 and is projected to grow in the years to come, with the clean energy investing increasing by over 50% since 2020. In particular, an increase is observed in the investment in renewable energy generation sources, grids, and battery storage, and solar photovoltaic (PV) investment is expected to exceed USD 500 billion in 2024. Sustainable chemical production and industrial transformation investments will surpass USD 50 billion in 2024 and are part of an overall trend in growing battery storage investments. The Environmental Protection Agency already implemented a Green Chemistry Program, according to which more than 50 green processes in chemistry were introduced, resulting in a more significant reduction of 20% of the hazardous waste generation since 2021.

In 2020, the U.S. government launched programs to support private investments in semiconductor supply chains and production, with over USD 600 billion invested in 28 states since that time through the programs, including the Advanced Manufacturing Investment Credit and manufacturing grants. This has cost them USD 32.5 billion in grant awards and almost USD 6 billion in loans to back 48 projects, to increase local production of advanced semiconductors like gallium arsenide wafers. The efforts will bolster clean and efficient production, supply chain resiliency, and result in more than 500,000 new American jobs. All these efforts combine to lead to strong growth in the 3D graphene chemical market in North America to strengthen its leadership in sustainable materials innovation and the competitive industry.

The U.S. 3D graphene market is estimated to rise quite strongly in the region over the forecast period, primarily due to the elevated assimilation of graphene in energy storage, flexible electronics, and improved chemical processes. Graphite is considered a critical energy material by the U.S. Department of Energy (DOE), with it possessing 100 percent reliance on imports in the year 2023 and mostly imported by China (42%), Mexico (16%), as well as Canada (15%). It estimates that the demand for domestic graphite will increase greatly as a result of EV adoption targets (713,000 tons of graphite by 2030 compared to 84,000 metric tons imported in 2023). To serve this growing demand, and to ensure national resilience in the supply chain, DOE is supporting cleaner, low-temperature technologies to produce synthetic graphite. The combination of these efforts with the active support of OSHA regarding the regulations on chemical safety promotes the market growth and commercialization of technologies in the U.S.

The 3D graphene market in Canada is experiencing robust development due to federal investments and collaboration with the industry with respect to making chemicals in a sustainable way. Canada has invested about 450 million US dollars in clean energy research and material innovation, although the figure represents a considerable boost in expenditure when compared to the previous year, as reported by Indigenous Industries and Innovations. This funding is used to achieve initiatives that promote clean technology, advance sustainable development, and innovation in materials that are essential to the clean energy transformation. This investment increases investment in graphene-enabled chemical processes, mainly energy storage and green technology. The national government implements regulations, facilitating a safer production process and reduction of wastes, which is also accompanied by financial incentives related to green technology adoption. The development of public-private partnership programs has been used to reduce the angle at which commercialization of graphene-related products is achieved.

Europe Market Insights

The European 3D graphene market is likely to grow at a steady pace over the forecast years, driven by influential government policies, strict regulations, and investment in innovation. The regulatory frameworks implemented by the European Chemicals Agency (ECHA), such as REACH, stimulate greener chemical processes and the safe utilization of 3D graphene in order to achieve sustainable production. According to the European Chemical Industry Council, the European chemical industry spends on average 9 billion Euros a year in research and innovation, with a very strong focus on Green Chemistry. This investment helps to implement the move to safe and sustainable chemicals through incorporating the Safe and Sustainable-by-Design (SSbD) approach in line with the EU Green Deal aspirations. The driving force of SbD ensures competitiveness and sustainable growth due to innovation in climate-neutral, circular, and environmentally friendly production of chemicals. The UK government has committed to taking a leading role in the global semiconductor industry through research, development, and innovation of compound semiconductors, wide design, and intellectual property.

The UK pursues an ambitious plan to expand the national semiconductor industry, develop resilience in the supply chain, and defend national security by investing up to 200 million pounds by 2023-2025 and 1 billion in the next 10 years. This strategy aims at the development of technologies to be used in AI, quantum computing, telecommunications, and the green transition. With a turnover of 225.5 billion euros and exporting 60% of its sales in 2023, the chemical industry is the third-largest industry in Germany. The industry spent approximately 14 billion on R&D in 2023, and within the scope of technologies, there are sustainability-focused technologies, technologies in the field of climate change, and digitalization. High energy prices, regulatory constraints, and the interdependent nature of the supply chain are some of the challenges it has been facing as it undergoes change initiatives.

Key 3D Graphene Market Players:

- American Elements (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CVD Equipment Corporation (USA)

- Cabot Corporation (USA)

- G6 Materials Corporation (USA)

- Graphenea Inc. (Spain)

- Directa Plus S.p.A. (Italy)

- Versarien PLC (UK)

- First Graphene Ltd. (Australia)

- Talga Group Ltd. (Australia)

- Samsung SDI (South Korea)

- INOVYN (INEOS Group) (UK)

The global 3D graphene market is highly competitive as industry players are oriented to follow technological advancement and scale-up of manufacturing, and sustainability. Top companies make scale-up factory investments and increase applications to incorporate everything, such as energy storage, electronics, and composites. Whereas the added value of Japanese firms is the innovative applications of nanomaterials, the US firms mainly focus on innovations concerning the manufacturing processes, including chemical vapor deposition. European manufacturers have entered into priority environmentally friendly graphene solutions consistent with regulatory requirements. Firms have negotiated business alliances with research centres as a way of speeding up commercialization and product penetration in the international market. Australian and South Korean companies target efficient and cost-effective production and supply chains.

Top Global 3D Graphene Manufacturers:

Recent Developments

- In May 2025, Lyten expanded into a new venture called Lyten Motorsports, which makes ultra-lightweight and high-strength 3D Graphene supermaterials as racing parts in automotive. The program is one example of Lyten expanding into motorsports to improve speed, safety, and sustainability through 3D printing intrinsic to Lyten, via filaments and adhesives. Lyten Motorsports is currently a LEADER in the development of three-dimensional parts/ components in sanctioned racing, having spent two years of research and development along with iterative parts testing at the track.

- In October 2024, BeDimensional, a deeptech Italian startup focusing on graphene and two-dimensional crystals, was granted a debt funding round of Euro 20 million by the European Investment Bank (EIB). This capital financing expands the production capacity plan of the company to increase its production capacity to over 30 tonnes by 2028, as opposed to its current capacity of over three tonnes annually. Founded in Genova, becoming a spin-off of the Italian Institute of Technology, the firm works with Few-Layer Graphene (FLG) and Few-Layer Hexagonal Boron Nitride (FLhBN) to be used in energy storage, smart textiles, and coatings. The company also took in new investment of an additional 5 million euros, along with funds promised by existing shareholders, such as Eni venture capital sister fund and Italian state lender CDP.

- Report ID: 8049

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Graphene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.