3D Printing Filament Market Outlook:

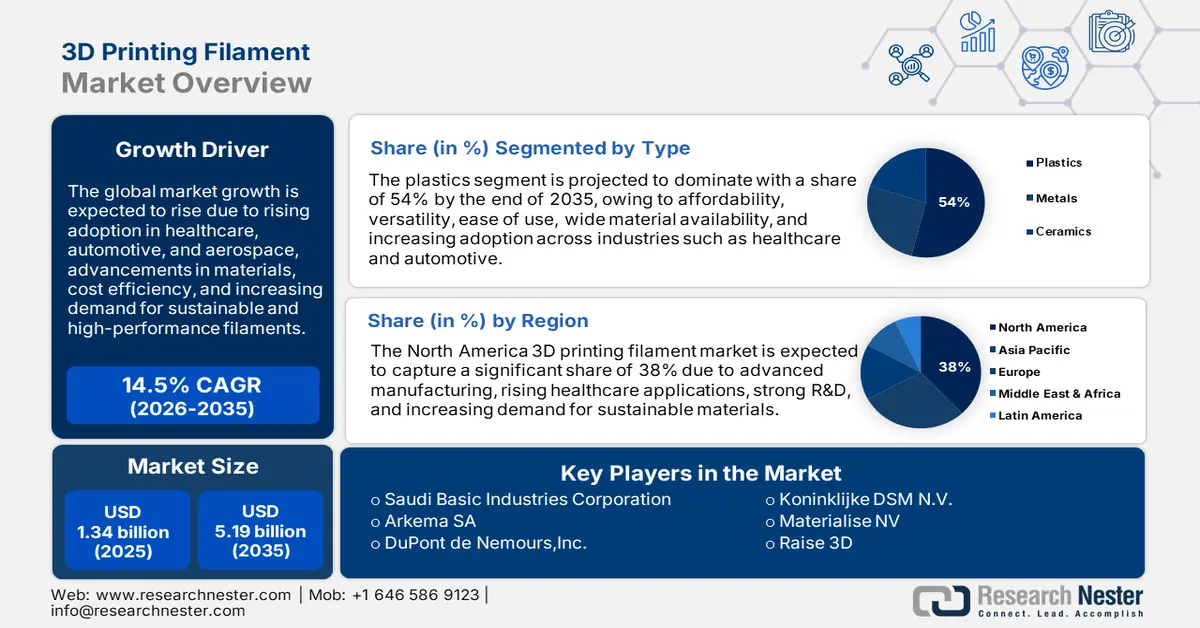

3D Printing Filament Market size was valued at USD 1.34 billion in 2025 and is likely to cross USD 5.19 billion by 2035, registering more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 3D printing filament is assessed at USD 1.51 billion.

The reason behind the growth is due to the growing production of automobiles across the globe driven by the increasing need for personal transportation, technology breakthroughs, and the expanding usage of artificial intelligence (AI), machine learning, and automation. For instance, more than 85 million motor vehicles were produced globally in 2022, a 5% increase from 2021.

The growing advancements in 3D printing are believed to fuel the market growth. For instance, virtual and augmented reality are being integrated with 3D printing technology to allow users to see how an item will seem once it has been manufactured, and enable designers to try out several color schemes and styles before settling on a certain design.

Key 3D Printing Filament Market Insights Summary:

Regional Highlights:

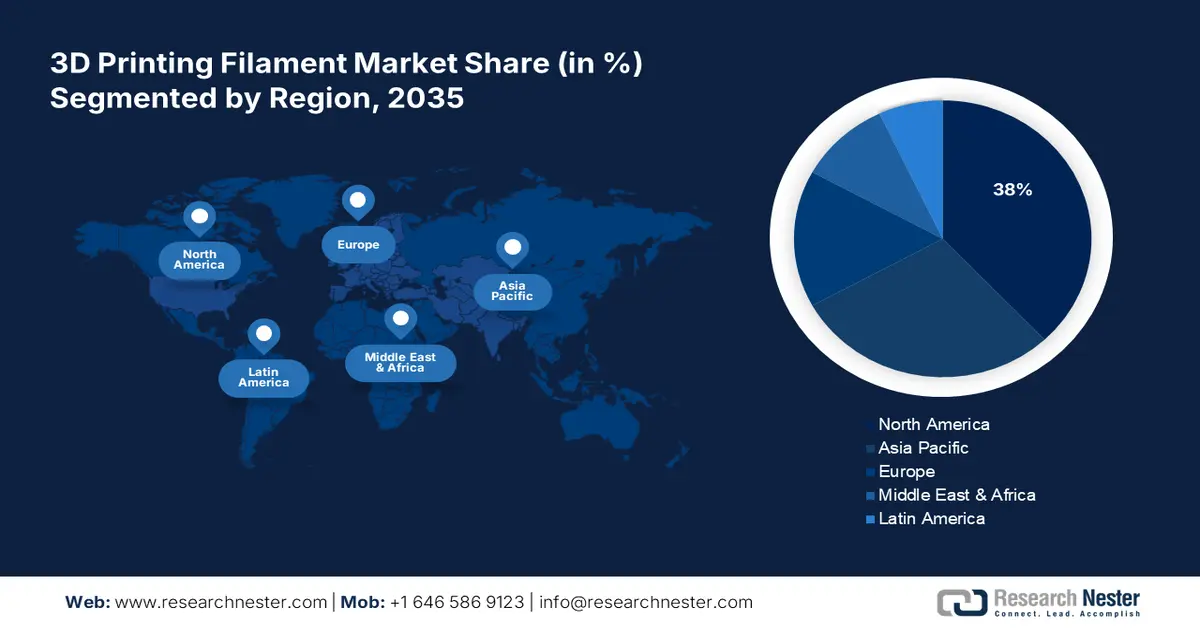

- North America 3D printing filament market will hold around 38% share by 2035, attributed to increased demands for defense and security and rising investments by aerospace and military businesses in engineering and R&D.

- Asia Pacific market will capture the second largest share by 2035, fueled by increasing production of electronics impelled by technology adoption, affordability, and sustainability.

Segment Insights:

- The plastics segment in the 3d printing filament market is expected to capture a 54% share by 2035, fueled by rising demand for lightweight and eco-friendly thermoplastics across industries.

- The aerospace & defense segment in the 3d printing filament market anticipates remarkable share by 2035, fueled by increased use of 3d printing filaments in manufacturing aerospace parts.

Key Growth Trends:

- Increasing Demand for Mass Customization of Objects with Complex Structures from End-Use Industries

- Growing Burden of Orthopaedics Conditions

Major Challenges:

- Increasing Demand for Mass Customization of Objects with Complex Structures from End-Use Industries

- Growing Burden of Orthopaedics Conditions

Key Players: Saudi Basic Industries Corporation, Arkema SA, DuPont de Nemours, Inc., Oxford Performance Materials, Inc., MG Chemicals, Shenzhen Esun Industrial Co., Ltd., CRP Technology S.r.l., Koninklijke DSM N.V., Materialise NV.

Global 3D Printing Filament Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.34 billion

- 2026 Market Size: USD 1.51 billion

- Projected Market Size: USD 5.19 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Netherlands, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

3D Printing Filament Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Mass Customization of Objects with Complex Structures from End-Use Industries - Rapid advancements in 3D printing are transforming it from a maker's hobby to an industrial production technique that offers mass customization and may create parts that are not able to be made using some conventional production techniques.

- Growing Burden of Orthopaedics Conditions- The use of metal implants in various orthopedic treatments has been made easier by 3D printing technology since it uses artificial intelligence, which is nearly entirely and precisely non-invasive. The custom production aspect of 3D printing technology makes it suitable for widespread application in personalized medicine, especially for patients suffering from knee arthritic pain who wish to replace their damaged natural knee joint with a new artificial one. For instance, more than 5% of individuals worldwide suffer from osteoarthritis (OA), a very common and debilitating ailment.

- Increasing Focus on Sustainability- With biodegradable filaments, 3D printing can be a sustainable procedure that can be altered in the same manner as regular fiber which can lessen the impact of the environment on the world and is less harmful to the environment since it produces no waste or harmful emissions.

Challenges

- Environmental Impact Caused by the Production of 3D Products - The creation and utilization of 3D printed items made of plastic may exacerbate environmental issues including waste production, resource depletion, and the delivery of water-soluble support filament may also hurt the environment. Many 3D printers use plastics and other non-biodegradable materials, the improper disposal of which could lead to pollution and other environmental problems. 3D printers need a substantial amount of power to operate and may be more difficult to recycle owing to their complex shapes and variety of components.

- Health Implications for Workers Involved in the Production of 3D Filament- Employees who use 3D printing technology run the risk of developing respiratory diseases as a result of work exposure since powdered metal or polymer is used in certain 3D printing techniques which produces a remarkably high concentration of hazardous nanoparticle emissions.

- Need for Standardization to Ensure Compatibility Across Several 3D Printers

3D Printing Filament Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 1.34 billion |

|

Forecast Year Market Size (2035) |

USD 5.19 billion |

|

Regional Scope |

|

3D Printing Filament Market Segmentation:

Type Segment Analysis

plastics segment in 3D printing filament market is poised to capture around 54% revenue share by the end of 2035. The increased need for lightweight and environmentally sustainable composite materials from the end-use industries has led to a rise in demand for thermoplastic from a variety of end-use industries, including aerospace, automotive, construction, and electrical and electronics. For instance, polypropylene (PP) had the largest demand share of thermoplastics in India in 2022, accounting for more than 30% of the total.

Thermoplastics are specialized plastics that are used in 3D printing such as nylon, also referred to as a synthetic thermoplastic linear polyamide that offers flexibility, resilience to corrosion, minimal friction, and durability making it a popular filament for 3D printing. It is extremely hygroscopic, which means that it should not be left out in the open. The primary benefits of 3D printing nylon include its superior abrasion resistance, good resistance against organic compounds such as fuel and oil, and toughness which makes it capable of being used to make tools, working prototypes, or mechanical parts such as buckles, gears, or hinges.

In addition, a range of materials, including titanium alloys, nickel, cobalt-chrome, aluminum, and stainless steel, are available as metal-filled filaments that are filled with metal powder to give it a shiny sheen and extra weight which aids in improving the quality of prints, and is often employed in the aerospace industry to print fuel nozzles and other vital engine components that demand extreme precision and accuracy. Metal powders such as bronze, copper, and magnetic iron are mixed with plastic materials such as PLA to create metal composite filaments which is quite popular as it's the simplest material to use for 3D printing.

End-user Segment Analysis

In 3D printing filament market, aerospace & defense segment is expected to account for remarkable revenue share by the end of 2035. The aerospace and defense industries' 3D printing filament exhibits a positive growth trend as it is extensively being utilized in additive manufacturing methods to create parts and components such as jet engine models, drone housing, and more for the defense and aerospace industries. In the past, 3D printing was mostly utilized in the aerospace industry for testing and prototyping however, today, it is applied across the whole lifetime of an aerospace component, including tools, end-use parts in jet engines, aircraft interiors, jigs for maintenance, and designs. Achieving weight savings of more than 45% is possible with 3D printing by creating parts with incredibly strong and lightweight constructions that are said to enhance the performance of airplanes and decrease fuel consumption.

In addition, for the additive production of medical components, 3D printing filaments are the best option which have also become significant in the fields of pharmaceutical and medical applications owing to the ability to quickly manufacture custom items that can be used in individualized treatment or medicine. Medical devices such as surgical guides, reference models, and patient-specific prostheses are printed using 3D printing technology, which makes the everyday job performed by medical experts much easier, enables them to save an increasing number of lives, and perform complex surgeries using precise, personalized bone structures of their patients. Moreover, dentistry could benefit from 3D printing as it is appropriate for use in dental implant surgery and is capable of producing stunning, high-precision, temporary 3D-printed crowns and bridges.

Furthermore, fused Filament Fabrication, or FFF, is one of the most widely utilized and well-liked 3D printing technologies in the automotive industry right now that uses filament to create pieces, and is one of the most widely used thermoplastic polymer additive manufacturing (AM) techniques.

Our in-depth analysis of the global 3D printing filament market includes the following segments:

|

Type |

|

|

Plastic Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

3D Printing Filament Market Regional Analysis:

North American Market Insights

North America region is estimated to hold 3D printing filament market share of over 38% by the end of 2035, owing to the increased demands for defense and security around the world, and an increase in global passenger traffic U.S. Department of Defense modernization spending in 2024 is probably going to stay at or above current high levels. Moreover, leading aerospace and military businesses are expanding their spending in engineering and R&D as a result of the industry's strong development in recent years.

For instance, US military spending increased by more than 2% to USD 800 billion from around USD 778 billion the previous year.

APAC Market Insights

The Asia Pacific 3D printing filament market is estimated to be the second largest, during the forecast timeframe led by the increasing production of electronics impelled by technology adoption, increasing affordability, and sustainability. India's electronics sector has enormous growth potential, which may fuel the demand for 3D printing filament.

According to estimates, the Indian electronics sector produced around USD 101 billion worth of electronics in 2022–2023 compared to USD 25 billion in 2014–15.

3D Printing Filament Market Players:

- BASF 3D Printing Solutions GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Saudi Basic Industries Corporation

- Arkema SA

- DuPont de Nemours, Inc.

- Oxford Performance Materials, Inc.

- MG Chemicals

- Shenzhen Esun Industrial Co., Ltd.

- CRP Technology S.r.l.

- Koninklijke DSM N.V.

- Materialise NV

- Raise 3D

Recent Developments

- Raise 3D jointly announced the launch of a metal 3D printing solution with BASF, featuring Ultrafuse 316L and 17-4 PH metal filaments, enabling faster and more cost-effective 3D printing of metal parts.

- Saudi Basic Industries Corporation introduced a new, flame-retardant 3D printing material compliant with the rail industry’s latest global fire-safety regulations, and to be commonly used for producing and repairing rail parts, as well as for on-demand printing of huge, complex exterior and interior parts in relatively modest build numbers.

- Report ID: 3504

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

3D Printing Filament Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.