Additive Manufacturing Market Outlook:

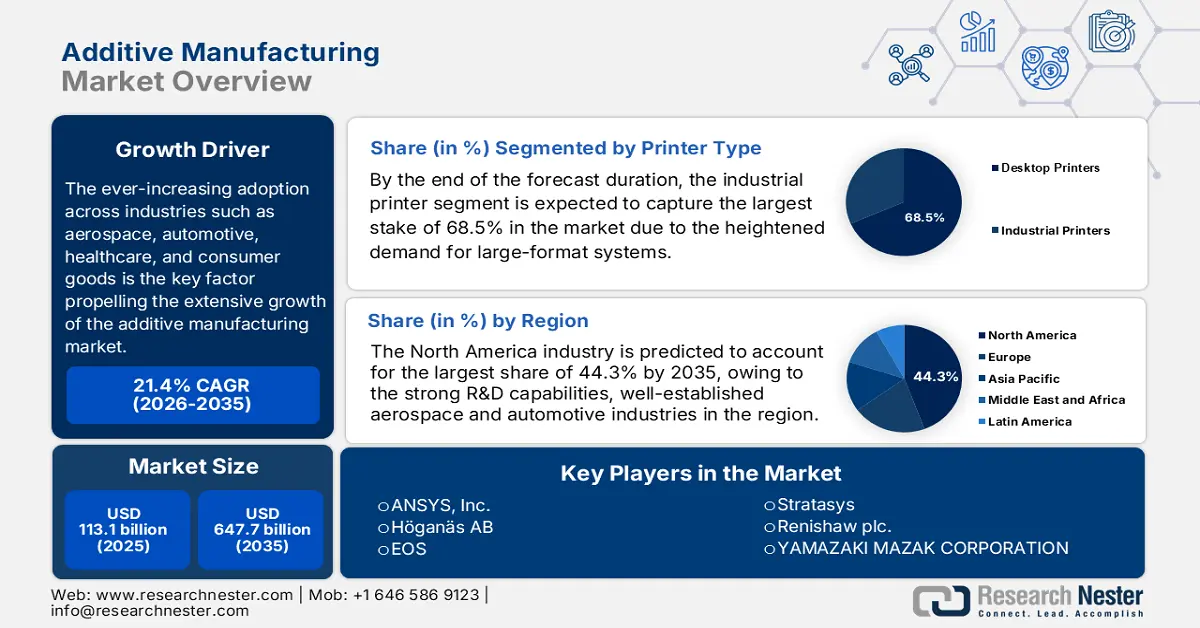

Additive Manufacturing Market size was valued at USD 113.1 billion in 2025 and is projected to reach USD 647.7 billion by the end of 2035, growing at a CAGR of 21.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of additive manufacturing is evaluated at USD 137.3 billion.

The adoption across industries has been increasing, with industries such as aerospace, automotive, healthcare, and consumer goods, which is the key factor propelling the extensive growth of the additive manufacturing market. Meanwhile, on the supply chain aspect, companies in this field are leveraging 3D printing to reduce lead times, minimize inventory, and enable domestic production, which mitigates disruptions caused by worldwide logistics. In this regard Ministry of Electronics & IT India, in February 2022, reported that it has released the national strategy on additive manufacturing, which mainly focuses on digital manufacturing and strengthening domestic production under the Make in India as well as Atmanirbhar Bharat initiatives. The report also highlighted that it aims for increased innovation through a National Centre, sector-specific hubs, and PPP-driven R&D to develop AM machines, materials, and products across various industries such as electronics, medical devices, and food processing, thus positively influencing market upliftment.

Furthermore, the trade dynamics in the market are shifting as the regions with extensive manufacturing are making investments in 3D printing infrastructure, whereas the emerging economies are seeking partnerships and technology transfers to accelerate adoption. In November 2024, the U.S. Defense Logistics Agency stated that it awarded its first competitive contract for an additively manufactured pylon bumper for F-15 aircraft, which marks a major shift from sole-source to open-source procurement and fostering vendor competition. It also noted that the initiative was supported by DLA’s additive manufacturing integrated product team, which integrates 3D printing into the military supply chain, enabling faster, on-demand production of critical parts by reducing storage and transportation needs, hence enhancing logistics agility and collaboration between the DoD and industry vendors.

Global Trade Statistics for Machine Parts for Additive Manufacturing - 2023

|

Metric |

Value |

Details |

|

Global Trade Value |

USD 9.94 Billion |

Total exports + imports in 2023 |

|

Share of World Trade |

0.044% |

Rank 367 out of 4644 products |

|

Product Complexity Index (PCI) |

1.16 |

Rank 279 out of 2913 products |

|

Export Growth (2022-2023) |

0.35% |

Nominal increase from USD 9.91 B in 2022 |

|

Leading Exporter |

Germany (USD 2.04 Billion) |

Followed by the USA (USD 1.28 B) and China (USD 1.24 B) |

|

Leading Importer |

Germany (USD 987 Million) |

Followed by the USA (USD 870 M) and China (USD 734 M) |

|

Top 5 Exporting Countries |

1. Germany - USD 2.04 Billion |

Data for 2023 |

|

Top 5 Importing Countries |

1. Germany - USD 987 Million |

Data for 2023 |

|

Countries with the Largest Trade Surpluses |

Germany (USD 1.06 Billion), China (USD 507 Million), U.S. (USD 411 Million) |

Exports > Imports |

|

Trade Growth (5-year annualized) |

1.38% |

Average annual growth rate over the past five years |

Source: OEC

Key Additive Manufacturing Market Insights Summary:

Regional Highlights:

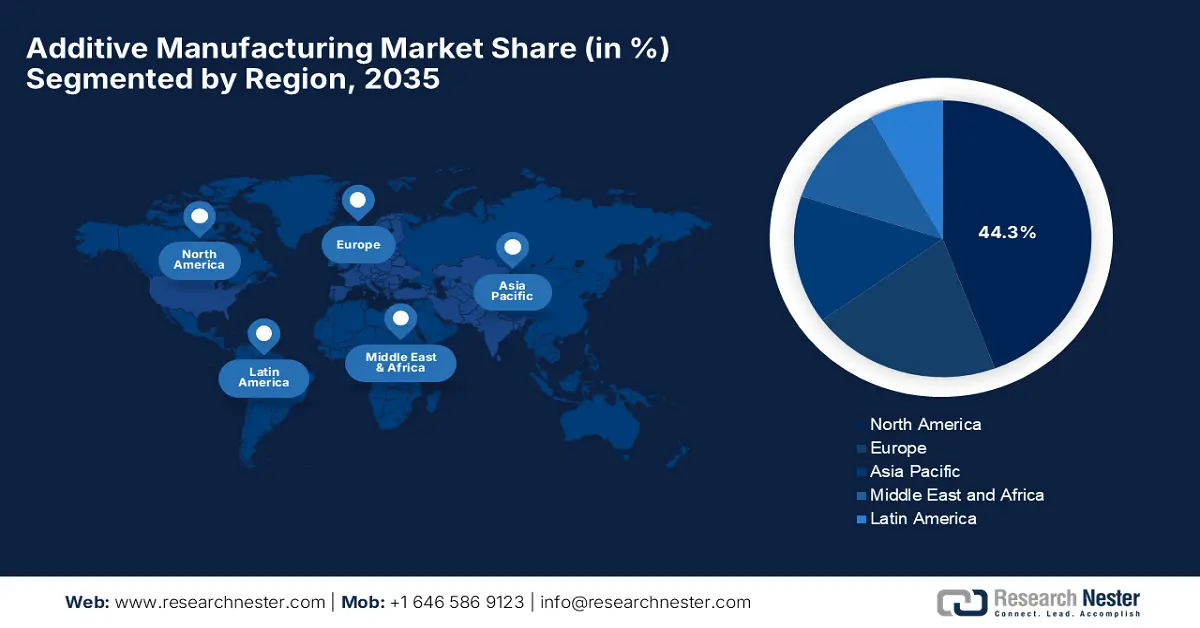

- North America in the additive manufacturing market is forecast to secure a 44.3% share by 2035, underpinned by strong R&D capabilities and robust federal funding.

- Asia Pacific is projected to expand at the fastest pace through 2026-2035, supported by rapid industrialization, smart manufacturing initiatives, and substantial government backing.

Segment Insights:

- By 2035, the industrial printer segment in the additive manufacturing market is anticipated to account for 68.5% of the overall share, propelled by surging demand for reliable, large-format systems suited for serial production.

- The metals subtype within the material segment is expected to command a significant share by 2035, owing to the rising adoption of functional, high-performance parts in advanced manufacturing.

Key Growth Trends:

- Material advancements

- Cost and time efficiencies

Major Challenges:

- Higher equipment costs

- Material limitations

Key Players: ANSYS, Inc. (U.S.), Höganäs AB (Sweden), EOS (Germany), Stratasys (U.S.), Renishaw plc. (U.K.), YAMAZAKI MAZAK CORPORATION (Japan), Materialise (Belgium), Markforged (U.S.), Titomic Limited (Australia), SLM Solutions (Germany), Proto Labs (U.S.), ENVISIONTEC US LLC (U.S.), Ultimaker BV (Netherlands), American Additive Manufacturing LLC (U.S.), Optomec, Inc. (U.S.), 3D Systems Inc. (U.S.), ExOne (U.S.).

Global Additive Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 113.1 billion

- 2026 Market Size: USD 137.3 billion

- Projected Market Size: USD 647.7 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, France, Canada

Last updated on : 3 December, 2025

Additive Manufacturing Market - Growth Drivers and Challenges

Growth Drivers

- Material advancements: This, coupled with improved metal AM technologies, is the primary growth driver for the additive manufacturing market. There have been continuous improvements in terms of metal powders, polymers, composites, and high-performance alloys, which are broadening AM’s application range. In November 2024, Stratasys reported that it had expanded beyond polymers by making substantial investments and partnering with Tritone Technologies, adding production-grade metal and ceramic additive manufacturing to its product portfolio. Also, this collaboration brings Tritone’s MoldJet technology, an industrial, powder-free, high-throughput metal AM process, into Stratasys’ ecosystem, thereby enabling scalable, end-use metal part production. Hence, the move significantly enhances the company’s total addressable market and strengthens its position as a leading provider of end-to-end additive manufacturing solutions.

- Cost and time efficiencies: These gains from reduced waste and rapid prototyping AM significantly reduces material waste compared to subtractive manufacturing, especially for expensive metals such as titanium. In this context, manufacturers can move from digital models to physical parts quickly, accelerating decision-making, thereby prompting a profitable business environment for the market. In November 2025, GE Aerospace’s Propulsion & Additive Technologies reported that its team is applying its FLIGHT DECK lean operating model to streamline the metal powder handling process used in producing TiAl turbine blades for the GE9X engine. It also noted that by simplifying workflows, reducing contamination risks, teams across Avio Aero, Colibrium Additive, and AP&C are already achieving productivity gains and lowering manufacturing costs. Thus, these improvements are helping make metal additive manufacturing more competitive with traditional casting.

- Increasing industry 4.0 adoption: The integration of simulation, AI, data analytics, and automation is efficiently transforming workflows in the additive manufacturing market. The aspects, such as digital twins and build-simulation tools, improve accuracy and reduce errors before printing starts. For instance, in November 2022, Siemens and GENERA announced that they had entered into a partnership to accelerate the industrialization of digital light processing additive manufacturing for large-scale production. Besides, through Siemens’ IoT-enabled hardware, software, automation, and Digital Twin simulation tools, GENERA’s fully automated G2 and F2 systems can now be modeled, optimized, and integrated into full factory layouts. Hence, this collaboration enhances production planning, safety, and efficiency, helping manufacturers adopt scalable resin-based AM for industrial applications.

Key Additive Manufacturing Initiatives and Market Opportunities

|

Year |

Company / Project |

Market Opportunity |

|

2025 |

PioCreat at Additive Manufacturing Expo Tokyo |

Industrial and desktop 3D printing for prototyping, small-batch production, and digital workflow optimization across automotive, aerospace, and healthcare |

|

2025 |

Jacksonville State University & EOS Additive Minds Ignite Program |

Education and workforce development in metal AM, enabling skilled talent for industrial adoption |

|

2023 |

3D Systems NextDent LCD1 & Materials |

Dental 3D printing for dentures, crowns, bridges, and orthodontic models, improving efficiency and precision in clinics and labs |

Source: Company Official Press Releases

Challenges

- Higher equipment costs: This is one of the primary challenges hindering adoption in the additive manufacturing market. The upfront costs associated with the 3D printing equipment, advanced materials, and supporting infrastructure are high, making it challenging for the small-scale players. Simultaneously, industrial-grade AM machines, particularly for metals and high-performance polymers, necessitate substantial capital investment, which can again be prohibitive for small and medium-sized enterprises. In addition, integrating these systems into existing production lines also necessitates particular facilities, environmental controls, and skilled technicians. Hence, this high initial cost slows widespread adoption despite prototyping and inventory reduction. Therefore, businesses must carefully balance capital expenditure against projected efficiency gains.

- Material limitations: This, coupled with standardization issues, is also posing a major drawback for the market to capture desired success. The challenges related to the range, performance, and consistency of materials are creating hesitation among companies to make investments in this field. The polymers, metals, ceramics, and composites are available, but not all meet industrial requirements for mechanical strength or temperature resistance. Hence, this variability between material batches and differences in machine calibration can lead to inconsistent product quality, thereby complicating large-scale production. Therefore, the lack of globally accepted material standards and testing protocols further hampers trust in AM components, particularly in regulated sectors such as aerospace, medical devices, and automotive.

Additive Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 113.1 billion |

|

Forecast Year Market Size (2035) |

USD 647.7 billion |

|

Regional Scope |

|

Additive Manufacturing Market Segmentation:

Printer Type Segment Analysis

By the end of the forecast duration, the industrial printer segment is expected to capture the largest stake of 68.5% in the additive manufacturing market. The heightened demand for robust, reliable, and large-format systems that are capable of serial production is driving the subsegments' dominance in this field. These industrial printers also offer repeatability, superior part quality, and advanced material compatibility, which are highly essential for final part manufacturing. In July 2025, Phillips Additive announced that it had partnered with InssTek to bring advanced directed energy deposition metal 3D printing solutions to India, which also includes systems for industrial, R&D, medical, and large-format applications. The collaboration provides end-to-end support, including system integration, applications engineering, training, and service, hence denoting a wider segment scope.

Material Segment Analysis

In the material segment metals subtype is expected to lead the market with a lucrative share value by the end of 2035. The shift from prototyping to manufacturing functional, high-performance parts directly fuels the demand for metal materials. Also, metals such as titanium, nickel alloys, and aluminum are highly essential for critical applications in aerospace, automotive, and medical implants. On the other hand, their high strength-to-weight ratio and durability under extreme conditions make them indispensable. In November 2025, Fabric8Labs raised USD 50 million to scale its electrochemical additive manufacturing production in the U.S., increasing capacity from 5 million to 22 million components annually for thermal management, wireless communications, and power electronics. The funding was led by NEA and Intel Capital, will expand engineering and production teams and accelerate programs in AI/HPC, RF, and EV systems.

Industry Vertical Segment Analysis

The aerospace & defense category is anticipated to lead the additive manufacturing market, capturing significant revenue over the analyzed timeframe. The sector is emerging as a pioneer in adopting AM for end-use parts. The growth in the segment is highly subject to the weight reduction for improved fuel efficiency and the ability to produce complex, consolidated components, which are generally not possible with traditional manufacturing. As per an article published by National Defense in July 2023, additive manufacturing is transforming defense manufacturing by enabling rapid, on-site production of metal and concrete components, from tooling and jigs to shipboard parts and construction-scale structures. It further notes that the U.S. military has integrated AM across almost all branches, with milestones such as the Navy’s first permanent metal 3D printer aboard a ship and the Jointless Hull Project, which is producing combat vehicle hulls.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Printer Type |

|

|

Material |

|

|

Industry Vertical |

|

|

Technology |

|

|

Software |

|

|

Application |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Additive Manufacturing Market - Regional Analysis

North America Market Insights

North America market is predicted to hold the highest share of 44.3% throughout the discussed tenure. The region’s leadership in this field is attributable to the strong R&D capabilities, well-established aerospace and automotive industries, and robust federal funding. In June 2025, the U.S. National Science Foundation announced that it made an investment of USD 25.5 million to advance research and workforce development in future manufacturing through its NSF Future Manufacturing Program. Besides, the funding supports multidisciplinary projects in areas such as biomanufacturing, cyber and eco-manufacturing, and additive manufacturing, including innovations such as AI-based recyclofacturing and multi-material 3D printing. Furthermore, by fostering new manufacturing capabilities and preparing a skilled workforce, the program aims to strengthen U.S. leadership in manufacturing and emerging technologies.

The U.S. has gained a dominating position in the regional additive manufacturing market, backed by an increased adoption across aerospace, healthcare, and industrial sectors, with extensive support from policies that are promoting Industry 4.0 manufacturing. In November 2025, Future Foundries, developed by Oak Ridge National Laboratory, reported that it integrates wire-arc additive manufacturing, machining, heat treatment, and inspection into a single, flexible platform, which efficiently reduces production cycles and lead times. In addition, its modular, adaptive design allows manufacturers to customize workflows, leverage existing equipment, and scale operations more efficiently, which benefits both small and large enterprises. Furthermore, by unifying processes, the company is readily enhancing automation and enabling continuous optimization, hence making it suitable for overall market growth.

Canada is continuously growing in the North America additive manufacturing market, readily propelled by material research and manufacturing solutions that are suitable for clean energy, aerospace, and medical applications. Its growth is also backed by supportive innovation funding and a growing base of AM-focused enterprises. For instance, in November 2024, Renishaw announced a partnership with Canada Makes to promote additive manufacturing across the nation, combining Renishaw’s AM expertise with Canada Makes, which is an extensive network of organizations and knowledge-sharing initiatives. In this context, the collaboration aims to advance innovation, scale production, and expand AM applications in sectors such as healthcare, aerospace, and automotive. Furthermore, it supports the transition from prototyping to mass manufacturing while driving standards and accessibility in the country’s market.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the global additive manufacturing market owing to the rapid industrialization, smart manufacturing initiatives, and strong government support. Prominent countries such as Japan, China, and India are leveraging AM for consumer electronics, automotive, and medical parts, whereas regional digitalization is making AM more accessible. In June 2025, Shimadzu Corporation stated that it was selected by Japan’s NEDO for a five-year R&D program to develop an integrated metal additive manufacturing system, in collaboration with universities and industry partners. It also reported that the project aims to enable high-value, complex parts with improved functionality and shorter delivery times using Shimadzu’s BLUE IMPACT 6 kW blue laser DED technology. Furthermore, the program also focuses on establishing quality assurance standards and optimal production workflows to advance the country’s manufacturing capabilities.

China is recognized as the central player in the additive manufacturing market, which is expanding rapidly due to strategic investments in smart cities, rising domestic production, and high-value manufacturing. Domestic firms are constantly putting efforts into scaling up in both polymer and metal printing, capitalizing on a large manufacturing base and increasing demand for innovative, on-demand production. Simultaneously, manufacturers in the country are also making investments in research and development to enhance material capabilities, printing speed, and precision. The country’s market also benefits from collaboration between universities, research institutes, and private entities, which is fostering innovation, thereby accelerating the commercialization of additive technologies. Furthermore, the country is focused on establishing standardized processes, ensuring both quality and reliability for industrial-scale applications.

The government initiatives, such as Make in India and digital manufacturing goals, are helping to increase adoption, especially in sectors like aerospace, automotive, and defense, positioning India as the key growth engine in the additive manufacturing market. The country also hosts a startup ecosystem that is active in developing numerous AM solutions for both prototyping and low-volume production. In April 2025, EOS and Godrej Enterprises Group announced that they had formed a strategic partnership to advance additive manufacturing in India’s aviation and space sectors, focusing on large-scale, multi-laser AM technology for production. The collaboration aims to simplify complex assemblies and build a robust AM supply chain to serve both domestic as well as global OEMs. In addition, this initiative supports the country’s space ambitions and aligns with the government’s Make in India program, as stated by EOS.

Europe Market Insights

Europe is growing exponentially in the market, supported by the presence of a large industrial base, sustainability goals, and cross-border R&D programs. Prominent countries in this region are utilizing AM to reduce waste, improve lightweight designs, and digitize production, especially in terms of aerospace and automotive sectors. In November 2025, Renishaw announced that its RenAM 500 series and TEMPUS technology were fully integrated into Dassault Systèmes’ 3DEXPERIENCE virtual machine, which allows users to set up, program, and analyze additive manufacturing processes virtually. It also stated that this TEMPUS technology optimizes laser operation during recoater movement, cutting build times by around 50% while maintaining part quality. Hence, this, coupled with France’s potential, which has a growing additive manufacturing sector with strong industrial, research, and innovation capabilities, is prompting a profitable business environment for the players in this region.

France: Additive Manufacturing Sector - Key Metrics & Insights

|

Metric |

Value |

Details |

|

Global Market Share |

3% |

France ranks 4th in AM after Germany, Italy, and the UK |

|

Projected Market Size (2030) |

~USD 700 million |

Assuming a 17% growth rate |

|

Number of AM Companies |

~200 |

Includes private sector firms in AM |

|

R&D Centers |

60 |

Includes universities, labs, and research institutes |

|

Clusters & Innovation Centers |

40 |

Part of initiatives like Additive Factory Hub |

|

Tool Parts Produced via AM |

65% |

Molds, inserts, and pliers are produced additively |

|

Distribution Entities |

~100 |

Includes wholesalers, resellers, direct sales, and hybrid approaches |

Source: ITA

Germany is maintaining its strong leadership in the regional additive manufacturing market, highly attributed to its engineering capabilities, industrial precision, and high-value manufacturing culture. The country’s market also benefits since it is heavily integrated with its broader Industry 4.0 framework, wherein companies support in-house AM production for complex and high-performance parts. In November 2025, Brose introduced a high-performance metal 3D printer, which was developed with Farsoon Technologies, enabling larger, complex components and higher-volume additive series production in the country. The printer uses fully recycled metal powder from the firm’s press shops, thereby promoting sustainability and circular economy practices. Furthermore, by integrating additive processes from prototyping to series production, Brose enhances flexibility, productivity, attracting more players to operate in this field.

The U.K. has also acquired a leading position in the regional additive manufacturing market, primarily fueled by the aerospace, medical use cases, and is bolstered by solid digital infrastructure and R&D investment. National strategies and innovation hubs are also helping firms in the country to scale additive adoption. In August 2025, Honeywell announced that it had led a UK government-funded consortium under the ATI Program to advance additive manufacturing for aerospace, with a prime focus on Environmental Control and Cabin Pressure Systems. The report also highlights that the STRATA project leverages AI, simulation, and additive manufacturing to optimize component design and consolidate complex assemblies into single parts, enhancing efficiency and sustainability. Furthermore, partners including 3T Additive Manufacturing, BeyondMath, Qdot Technology, and Oxford Thermofluids Institute will collaborate to strengthen the country’s aerospace supply chain.

Key Additive Manufacturing Market Players:

- ANSYS, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Höganäs AB (Sweden)

- EOS (Germany)

- Stratasys (U.S.)

- Renishaw plc. (U.K.)

- YAMAZAKI MAZAK CORPORATION (Japan)

- Materialise (Belgium)

- Markforged (U.S.)

- Titomic Limited (Australia)

- SLM Solutions (Germany)

- Proto Labs (U.S.)

- ENVISIONTEC US LLC (U.S.)

- Ultimaker BV (Netherlands)

- American Additive Manufacturing LLC (U.S.)

- Optomec, Inc. (U.S.)

- 3D Systems Inc. (U.S.)

- ExOne (U.S.)

- Ansys is leading the entire global dynamics of engineering‑simulation software and playing a pivotal role in additive manufacturing by offering its Additive Suite, which simulates metal AM processes such as powder bed fusion and directed energy deposition. The company has efficiently strengthened its additive manufacturing simulation capability to predict residual stress, distortion, and build failures, thereby enabling increased adoption.

- Höganäs is well recognized across the globe as one of the largest producers of powdered metals, which is supplying high-performance metal powders optimized for AM applications. Also, their PowderFinder tool helps customers, including those in automotive, electric motors, and industrial sectors, select the ideal powder for their AM processes. Simultaneously, the company is focusing on tailor-made powder solutions wherein it also supports industries in deploying lightweight, durable, and efficient AM-produced parts.

- EOS is considered to be a pioneer in industrial 3D printing, particularly known for its laser-based metal and polymer systems. The company provides a full stack of AM solutions, machines, certified materials, and process parameters efficiently backed by consulting, training, and service. The company has a strong focus on responsible manufacturing, emphasizing sustainability, quality, and scalability in its production-grade AM offerings.

- Stratasys is one of the most popular names in the field of 3D printing, and the company is leveraging a broad portfolio that spans polymer extrusion, SAF, PolyJet, and others. The company has pushed into production-scale additive manufacturing, utilizing its P3 technology for high-precision, high-throughput applications, gaining the largest consumer base. Furthermore, the firm also emphasizes sustainability, promoting powder recycling in its SAF systems.

- Renishaw plc is a prominent engineering and technology firm that is best known for its expertise in precision measurement, metrology, and additive manufacturing solutions. The company specializes in developing advanced metal 3D printing systems, which include the RenAM 500 series, as well as software, probes, and sensors. Furthermore, the company focuses on innovation and automation, allowing manufacturers to improve productivity, achieve high-quality production.

Below is the list of some prominent players operating in the global market:

The additive manufacturing market is extremely competitive, in which the established players such as Stratasys, 3D Systems, EOS, HP, and GE Additive are constantly putting efforts into dominance. These major pioneers are pursuing distinct strategies such as introducing new FDM, SAF printers, acquisitions, extensive R&D, introducing specialized materials and platforms, hence serving the growing metal AM demand. In June 2023, Hexagon AB announced that it had acquired CADS Additive GmbH to strengthen its end-to-end metal additive manufacturing workflow. Also, the deal integrates CADS Additive’s build-preparation software with Hexagon’s simulation, CAD/CAM, and Nexus digital reality platform to improve efficiency and streamline metal 3D-printing processes. Hence, such strategic moves will accelerate market growth by offering a more integrated, efficient, and reliable metal 3D-printing workflow that helps manufacturers scale from prototyping to full production.

Corporate Landscape of the Additive Manufacturing Market:

Recent Developments

- In November 2025, Renishaw joined the £38 million (USD 46.5 million) DECSAM programme, which was led by Airbus, to industrialize laser powder bed fusion (L-PBF) for sustainable aerospace additive manufacturing. The initiative is running from July 2024 to June 2028, involves 11 partners across OEMs, Tier‑1s, SMEs, RTOs, and academia.

- In September 2025, Oerlikon declared that it had established a strategic partnership with TRUMPF Additive Manufacturing, strengthening its AM capabilities through the addition of three new TRUMPF TruPrint 5000 3D printing systems at its Huntersville, NC site.

- Report ID: 5009

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Additive Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.