Artificial Intelligence in Manufacturing Market Outlook:

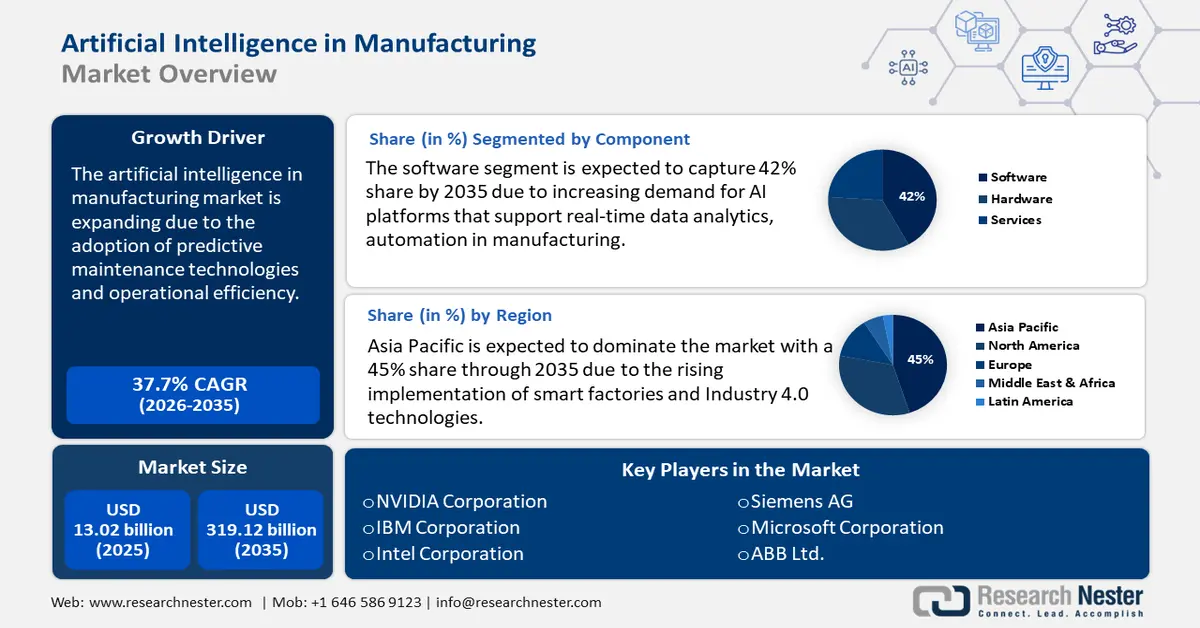

Artificial Intelligence in Manufacturing Market size was over USD 13.02 billion in 2025 and is poised to exceed USD 319.12 billion by 2035, witnessing over 37.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of artificial intelligence in manufacturing is estimated at USD 17.44 billion.

The integration of artificial intelligence (AI) into the manufacturing supply chain is reshaping global trade patterns. The U.S. and China lead the AI manufacturing supply chain, importing substantial quantities of electronic components, specialized hardware, and essential raw materials, including rare earth metals, predominantly obtained from areas including Southeast Asia, Africa, and Latin America. According to the U.S. Census Bureau, U.S. imports of electronic components exceeded USD 330 billion in 2023, highlighting the importance of global trade within the AI industry. Additionally, the U.S. International Trade Commission (USITC) noticed a consistent rise in the trade of industrial machinery and automation equipment, critical for AI system production, with U.S. exports touching USD 64.7 billion in 2022. This substantial trade volume reflects the growing dependence of nations on each other within the AI manufacturing sector and underscores the necessity for efficient supply chain operations to sustain production cycles.

The adoption of AI in manufacturing is influencing key economic indicators, including the Producer Price Index (PPI) and Consumer Price Index (CPI). Regarding economic indicators, both the PPI and CPI provide valuable insights into the pricing trends within the manufacturing sector. According to the U.S. Bureau of Labor Statistics, the PPI for industrial machinery recorded a year-over-year rise of 6.5% in 2023, indicating increased expenses for raw materials and component inputs in AI-driven manufacturing systems. Additionally, the U.S. Bureau of Economic Analysis (BEA) report states a 3.1% rise in the CPI for durable goods in 2023, suggesting increasing costs for final products in the AI domain, including robotics and automation tools. Moreover, the rising investment in technological innovation is evident in the significant increase in federal funding for AI research. In 2023, the National Science Foundation (NSF) allocated over USD 1.5 billion towards AI-related initiatives, emphasizing the strategic significance of AI in contemporary manufacturing practices. These economic indicators illustrate a complex and changing environment where both the manufacturing costs of AI systems and the global trade of materials are crucial in influencing market dynamics

Key AI in Manufacturing Market Insights Summary:

Regional Highlights:

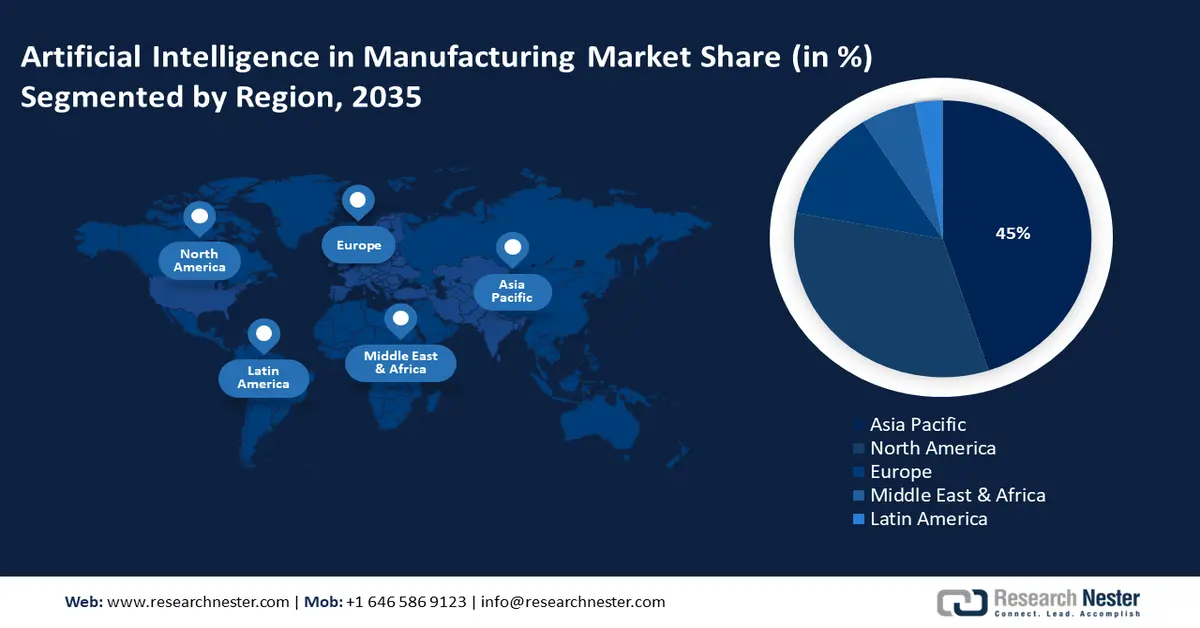

- Asia Pacific artificial intelligence in manufacturing market will dominate over 45% share by 2035, fueled by rising implementation of smart factories and Industry 4.0 technologies.

- North America market will account for substantial share by 2035, driven by demand for resilient automated supply chains, AI-driven robotics, and regulatory emphasis on energy efficiency.

Segment Insights:

- The machine learning segment in the artificial intelligence in manufacturing market is anticipated to capture a 46% share by 2035, driven by its ability to analyze complex data and enable predictive decision-making.

- The software segment in the artificial intelligence in manufacturing market is expected to capture a 42% share by 2035, driven by rising demand for AI platforms supporting real-time data analytics.

Key Growth Trends:

- Adoption of predictive maintenance technologies and operational efficiency

- Technological advancements and AI integration

Major Challenges:

- Adoption of predictive maintenance technologies and operational efficiency

- Technological advancements and AI integration

Key Players: Nvidia Corporation, IBM Corporation, Intel Corporation, Microsoft Corporation, General Electric (GE), Siemens AG, ABB Ltd, Schneider Electric, KUKA AG, Samsung Electronics, Civalue, Tata Consultancy Services (TCS).

Global AI in Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.02 billion

- 2026 Market Size: USD 17.44 billion

- Projected Market Size: USD 319.12 billion by 2035

- Growth Forecasts: 37.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Artificial Intelligence in Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of predictive maintenance technologies and operational efficiency: The use of predictive maintenance technologies is driving AI adoption in the manufacturing sector. A report from the National Institute of Standards and Technology (NIST) states that AI-driven predictive maintenance allows manufacturers to observe equipment conditions in real time, forecast failures, and optimize maintenance routines. This approach minimizes downtime and lowers maintenance expenses while prolonging equipment lifespan. For instance, GE Aviation has successfully utilized AI and machine learning for predictive maintenance, resulting in a 25% decrease in maintenance expenses and a 20% boost in engine uptime.

- Technological advancements and AI integration: AI technologies such as machine learning, natural language processing, and computer vision are progressively being incorporated into manufacturing systems to foster innovation in quality management, production scheduling, and process automation. A report from McKinsey in April 2022 indicates that using machine learning in manufacturing can improve efficiency by 10-30%. These innovations are important for minimizing waste, enhancing product quality, and boosting throughput. This implementation has led to better defect identification and a decrease in production expenses by 12-15%.

Major Technological Innovations in Artificial Intelligence in Manufacturing Market

The integration of AI in manufacturing is changing how industries operate by improving efficiency and precision throughout essential processes. Predictive maintenance allows for continuous monitoring of equipment. AI-enhanced robotics and automation, especially collaborative robots, are facilitating labor-intensive activities while increasing accuracy. In the realm of quality control, AI technologies such as computer vision enable the early identification of defects, enhancing output consistency, as shown by semiconductor companies utilizing SAP solutions. AI is also revolutionizing supply chains by allowing for smarter inventory management and demand predictions, assisting electronics companies in minimizing stock shortages and surpluses. These developments are not only improving current operations but also altering the strategic trajectory of manufacturing on a global scale.

|

Technology |

Industry |

Impact |

Company |

|

Predictive Maintenance |

Aerospace, Manufacturing |

23% maintenance cost reduction |

GE Aviation |

|

Robotic Process Automation (RPA) |

Automotive, Electronics |

65.4% AI use in assembly lines |

Tesla |

|

Supply Chain Optimization |

Retail, Manufacturing |

23.8% CAGR in AI-based logistics |

Amazon |

|

Computer Vision |

Electronics, Automotive |

28% defect reduction |

Toyota |

|

Generative Design |

Automotive, Aerospace |

15–20% material cost savings |

BMW |

Challenges

- High initial costs and uncertainty in ROI: Implementing AI technologies requires a significant upfront cost in infrastructure, skilled workers, and system integration. This presents a challenge to adoption for numerous small and medium-sized manufacturers due to these costs. Moreover, the return on investment (ROI) from AI initiatives is not always certain, leading companies to be reluctant to allocate resources without clear financial justification. A report from the International Trade Administration (ITA) indicates that more than 40% of manufacturers view budget limitations as a major obstacle to embracing smart manufacturing technologies.

- Challenges with data quality and integration: AI systems depend significantly on large amounts of precise and consistent data. However, in manufacturing settings, data is frequently isolated within legacy systems, varies in format, or is deficient in quality. This poses substantial challenges for both AI training and its effectiveness. According to the National Institute of Standards and Technology (NIST), inadequate data quality and the absence of interoperability rank among the primary technical challenges hindering AI implementation in U.S. manufacturing industries.

Artificial Intelligence in Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

37.7% |

|

Base Year Market Size (2025) |

USD 13.02 billion |

|

Forecast Year Market Size (2035) |

USD 319.12 billion |

|

Regional Scope |

|

Artificial Intelligence in Manufacturing Market Segmentation:

Component Segment Analysis

The software segment in artificial intelligence in manufacturing market is expected to capture 42% share by 2035 due to increasing demand for AI platforms that support real-time data analytics, automation in manufacturing. These solutions are increasingly opted by manufacturers to optimize work processes and enhance better decision-making. Further, the rise of cloud-based AI solutions has made implementation more scalable and economical. Additionally, the capability of AI-driven software to lower operational expenses and enhance equipment performance is accelerating its adoption across various industries. A significant instance of AI software implementation in the manufacturing sector is the collaboration between Siemens and Microsoft in February 2024. This alliance intends to create AI co-pilots that support human workers in improving productivity and safety on the production floor.

Technology Segment Analysis

The machine learning (ML) segment in artificial intelligence in manufacturing market is predicted to hold a notable share of around 46% through 2035 due to its ability to ability to analyze complex data and enable predictive decision-making. The use of ML algorithms enhances process automation, predicts equipment failure, defect detection, and helps in equipment maintenance. As industries move towards more advanced automated manufacturing, the need for machine learning in AI applications is rising. This integration is adopted by top tech companies to make the manufacturing process easy and convenient. For instance, in June 2021, Bosch integrated ML in its global manufacturing operations at its Dresden wafer fabrication plant and Charleston, South Carolina plant. The company utilized machine learning in its internal AI system to identify potential faults early and speed up the manufacturing schedules.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Technology |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Intelligence in Manufacturing Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is expected to dominate the market with a 45% share through 2035 due to the rising implementation of smart factories and Industry 4.0 technologies. Governments worldwide are investing heavily in AI-driven automation to enhance productivity. Thus, initiatives such as the Digital India and Society 5.0 are promoting the adoption of smart factory technologies, which is fueling the integration of AI into supply chain and production processes. For instance, in 2024, Hitachi introduced an AI-driven industrial platform in Southeast Asia aimed at enhancing factory operations by utilizing real-time data. Numerous manufacturing industries, ranging from electronics to automotive, use predictive maintenance and automation of processes to work at ease. Moreover, the increasing number of skilled professionals in AI and data analytics is further propelling this growth.

The artificial intelligence in manufacturing market in China is driven by its national objective to establish itself as a global leader in intelligent manufacturing, supported by substantial investments from both government and private entities. The Made in China 2025 initiative highlights the importance of automation, robotics, and AI-enhanced quality control to boost international competitiveness. In contrast to other countries, China possesses unrivaled access to extensive datasets, which utilize ML algorithms for detecting defects and optimizing processes. Major domestic technology companies like Baidu and Huawei are partnering with factories to create proprietary AI models specifically designed for local production.

The artificial intelligence in manufacturing market in South Korea is expanding due to emphasis on hyper-automation, semiconductors, and consumer electronics. The growth also depends on the government's AI National Strategy, which is focused on integrating AI to enhance precision and minimize downtime in production industries. The presence of robust small and medium enterprises such as Samsung and LG influences innovation and implementation.

North America Market Insights

North America is anticipated to capture a substantial share from 2026 to 2035. In North America, the market is expanding due to the demand for resilient, automated supply chains. The development of AI-driven robotics and digital twins is fueled by advanced research and development facilities and access to venture capital. Manufacturers are encouraged to embrace AI for smart energy management due to the regulatory emphasis on energy efficiency and sustainability.

The U.S. artificial intelligence in manufacturing market is expanding due to rising need for innovation in the automotive, aerospace, and electronics industries. U.S. manufacturers are adopting AI technologies to streamline intricate processes, improve accuracy, and prevent human mistakes. The U.S. tech landscape encourages partnerships between startups and established companies to facilitate progress. For instance, in June 2023, Lockheed Martin collaborated with Xaba to incorporate AI-powered cognitive robotics into airframe manufacturing that improved robotic accuracy tenfold and improved efficiency in drilling operations on aluminum test plates. This resulted in lower production costs in the aerospace sector.

In Canada, the artificial intelligence in manufacturing market is rapidly rising as the nation prioritizes sustainable manufacturing and green technology initiatives. With governmental backing for clean-tech projects, AI is being utilized to enhance energy efficiency and reduce waste in industrial processes. Additionally, the robust academic research infrastructure in Canada encourages the development of AI-driven innovation. A recent innovation is the launch of Husky A300 by Clearpath Robotics in October 2024. This autonomous mobile robot, built for agriculture and mining operations, increases material handling productivity by 25%, showcasing how AI can improve operational effectiveness across various sectors.

Artificial Intelligence in Manufacturing Market Players:

- Nvidia Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- General Electric (GE)

- Siemens AG

- ABB Ltd.

- Schneider Electric

- KUKA AG

- Samsung Electronics

- Civalue

- Tata Consultancy Services (TCS)

The artificial intelligence in manufacturing market is extremely competitive, with key players such as Nvidia, IBM, and Siemens leading the AI hardware, software, and industrial automation solutions. Key strategic moves involve substantial investments in research and development, creating AI-integrated product lines, and forming partnerships to boost growth and fulfill the rising demand for smart manufacturing and automation on a global scale. Here are some leading players in the artificial intelligence in manufacturing market:

Recent Developments

- In March 2024, Xiaomi introduced a completely automated manufacturing facility in Changping, China, driven by AI. This plant operates continuously without any human involvement, producing one smartphone every second and optimizing its performance through real-time communication and proprietary AI systems.

- In March 2024, NVIDIA launched a platform for researching 6G, equipping researchers with the tools necessary to push forward the next generation of wireless technology. This platform integrates AI to support cloud radio access network (RAN) technology, and the development of 6G by connecting trillions of devices to cloud infrastructure.

- Report ID: 3767

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI in Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.