Telecom Electronic Manufacturing Services Market Outlook:

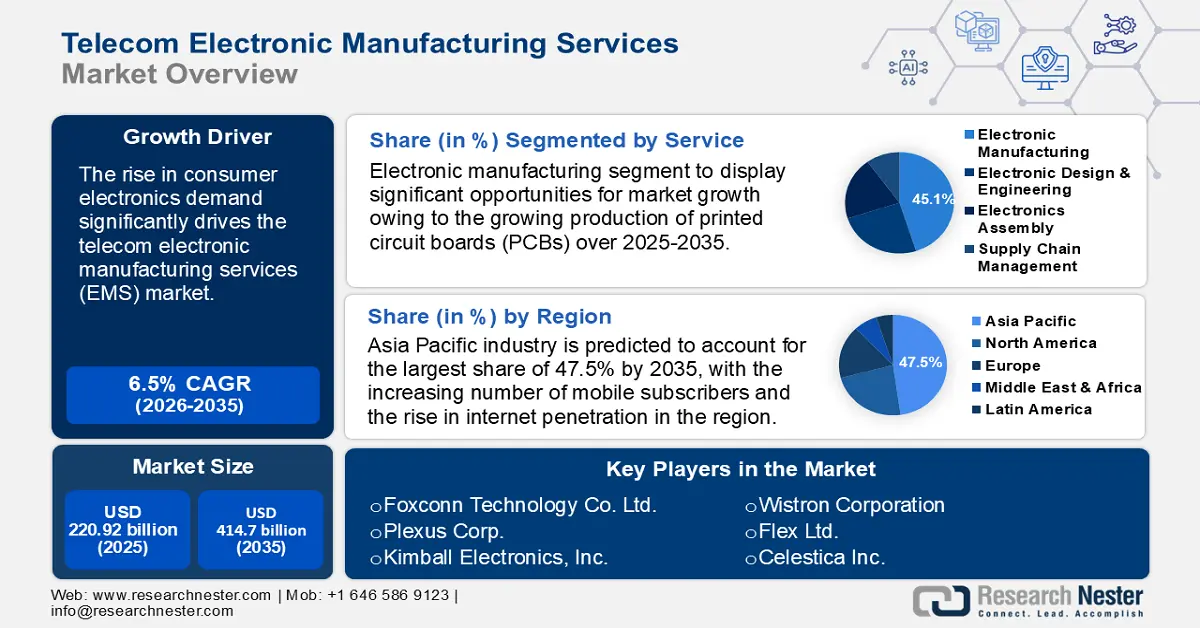

Telecom Electronic Manufacturing Services Market size was valued at USD 220.92 billion in 2025 and is likely to cross USD 414.7 billion by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of telecom electronic manufacturing services is assessed at USD 233.84 billion.

The rise in consumer electronics demand significantly drives the telecom electronic manufacturing services (EMS) market. The consumer electronic industry worldwide will amount to a staggering USD 956.0 billion by the end of 2024. The growing number of connected devices requires enhanced telecom infrastructure and components to support seamless communication. Also, the demand for high-speed and reliable internet connections drives the need for advanced telecom equipment and electronics.

The deployment of advanced technologies like 5G networks and the growing need for network densification require specialized manufacturing and assembly services for telecom equipment. EMS providers play a crucial role in offering cost-effective, high-quality manufacturing solutions, including the production of complex components, assembly, and testing services, to meet the evolving needs of the telecom sector.

Key Telecom Electronic Manufacturing Services Market Insights Summary:

Regional Highlights:

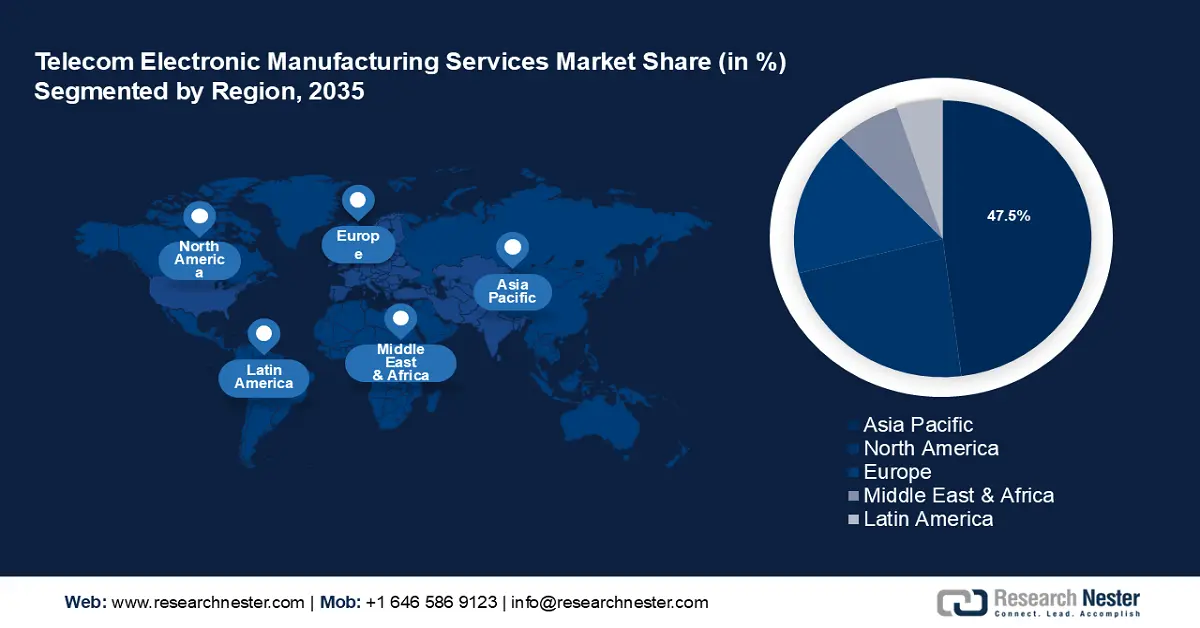

- The Asia Pacific telecom electronic manufacturing services market will dominate around 47% share by 2035, driven by the increasing number of mobile subscribers and the rise in internet penetration across the region.

Segment Insights:

- The electronic manufacturing segment in the telecom electronic manufacturing services market is forecasted to see substantial growth till 2035, fueled by growing production of printed circuit boards (PCBs) essential for telecom equipment.

- The transceivers and transmitters segment in the telecom electronic manufacturing services market is poised for significant growth over 2026-2035, attributed to innovations in transceiver and transmitter technologies driven by 5G and emerging telecom tech.

Key Growth Trends:

- Increasing installation of 5G networks

- Rising popularity of IoT (Internet of Things)

Major Challenges:

- Exorbitant capital needs

- Substantial labor expenses

Key Players: Foxconn Technology Co. Ltd., Plexus Corp., Kimball Electronics, Inc., Wistron Corporation, Flex Ltd., Celestica Inc., Reliance Strategic Business Ventures Limited, Benchmark Electronics, Inc., Sanmina Corporation.

Global Telecom Electronic Manufacturing Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 220.92 billion

- 2026 Market Size: USD 233.84 billion

- Projected Market Size: USD 414.7 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 18 September, 2025

Telecom Electronic Manufacturing Services Market Growth Drivers and Challenges:

Growth Drivers

- Increasing installation of 5G networks: As telecom operators expand and upgrade their networks to support 5G technology, they require advanced electronic components, complex assemblies, and high-precision manufacturing services. This creates a strong demand for EMS providers who offer expertise in producing and assembling the necessary equipment, including base stations, antennas, and other critical infrastructure components. The rapid rollout of 5G networks accelerates the need for these services, fueling telecom electronic manufacturing services market growth. By 2025, 5G will account for up to 1.2 billion connections, covering one-third of the global population.

- Rising popularity of IoT (Internet of Things): The proliferation of IoT devices requires a wide range of specialized electronic components and systems for connectivity, data processing, and communication. EMS providers are crucial in delivering the necessary hardware and manufacturing solutions to support this growing ecosystem. As more IoT applications emerge across various industries such as industrial automation, and connected vehicles the demand for tailored electronic solutions and efficient manufacturing processes increases, thereby boosting the telecom electronic manufacturing services market.

Challenges

- Exorbitant capital needs: The industry requires high expenditures for personnel training, state-of-the-art machinery, and technology which may operate as a deterrent to entry and expansion for new entrants and some small businesses that may find it difficult to navigate these stringent capital requirements.

- Substantial labor expenses: High labor costs may hamper the telecom electronic manufacturing services market as it has a major impact on the total cost of producing electronic goods. These costs are influenced by several factors, including design decisions, regional variations in labor prices, and shortages of skilled labor, and are likely to increase the overall cost of manufacturing.

Telecom Electronic Manufacturing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 220.92 billion |

|

Forecast Year Market Size (2035) |

USD 414.7 billion |

|

Regional Scope |

|

Telecom Electronic Manufacturing Services Market Segmentation:

Service Segment Analysis

Electronic manufacturing segment is poised to dominate over 45.1% telecom electronic manufacturing services market share by 2035 owing to the growing production of printed circuit boards (PCBs). The development of high-performance and complex PCBs is essential for advanced telecom equipment, including 5G infrastructure and network devices. Innovations in PCB technology enable better signal integrity, higher speed, and increased functionality, driving demand in the telecom EMS market. Moreover, the trend towards smaller, more compact telecom devices requires miniaturized PCBs with higher-density interconnects.

The rise of IoT and smart devices in telecom, such as smart meters and connected sensors, drives demand for specialized electronics and PCBs. EMS providers are essential in manufacturing these devices. The Internet of Things is rapidly growing, and its impact on the telecom business is becoming more substantial. It is anticipated that there will be over 75 billion Internet-connected devices by 2025.

Product Type Segment Analysis

The transceivers and transmitters segment in the telecom electronic manufacturing services market is projected to register significant CAGR during the projected timeframe on account of the flourishing telecommunications sector. For many years, the telecommunication sector has been one of the world's fastest-growing industries and is set to grow rapidly as 5G and other emerging technologies become more widely used. Innovations in transceiver and transmitter technologies, such as improved signal processing and higher frequency ranges, are pushing the envelope for performance and efficiency in telecom networks.

Our in-depth analysis of the telecom electronic manufacturing services market includes the following segments:

|

Service |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Telecom Electronic Manufacturing Services Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 47% by 2035. The increasing number of mobile subscribers and the rise in internet penetration across Asia Pacific countries boost the need for advanced telecom equipment and services. In 2023, the region's unique mobile subscriber penetration rate was 63%, excluding Greater China. This value is expected to reach 70% by 2030.

Japan's telecommunications industry is expected to grow rapidly by 2030 propelled by an increasing number of 5G subscriptions and higher government investments in the development standardization of 6G networks.

The Asia Pacific telecom electronic manufacturing services market is foreseen to be controlled by the market in China, since the country is a global center for foreign electronic manufacturers and commands a leading position in the market for electronic manufacturing services worldwide.

Moreover, the presence of prominent electronic manufacturers in South Korea such as SK Hynix, Hanwha Techwin, LG Electronics, Samsung Electronics, Partron Corporation, and Simmtech, which consistently introduce cutting-edge products to the market and place a high priority on research and development may boost market demand for telecom electronic manufacturing services.

North American Market Insights

The North America telecom electronic manufacturing services market is projected to experience a significant rise in revenue encouraged by the surging investments by the government. The government has designated future telecommunications as one of its five essential priority technologies, which will help the market for telecom electronic manufacturing services to expand in the region. EMS providers discover a favorable climate for growth in areas where governments support investment and development which is essential for both economic expansion and competitiveness.

Companies in the U.S. may invest significantly in digital transformation, which will raise the demand for robust telecom infrastructure to support reliable connectivity. Moreover, leading EMS providers in the U.S. include companies such as Flex Ltd., Jabil Inc., and Sanmina Corporation. These companies offer a range f services from design and prototyping to full-scale manufacturing and logistics.

Furthermore, Canada boasts a strong and varied manufacturing industry that includes automobiles, telecommunications, and healthcare, which may create a greater need for telecom electronic manufacturing services (EMS). Investment in 5G infrastructure is a significant driver for the telecom electronic manufacturing services market , with increasing demand for high-speed network equipment.

Telecom Electronic Manufacturing Services Market Players:

- Jabil Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Foxconn Technology Co. Ltd.

- Plexus Corp.

- Kimball Electronics, Inc.

- Wistron Corporation

- Flex Ltd.

- Celestica Inc.

- Reliance Strategic Business Ventures Limited

- Benchmark Electronics, Inc.

- Sanmina Corporation

- Tata Electronics Private Limited

- Universal Scientific Industrial Co., Ltd.

The telecom electronic manufacturing services market is set to rise owing to the growth of key players in this market. These key players are focusing on advancing their services and adopting novel methods for telecom electronic manufacturing services to sustain themselves in the market. Some of these key players include:

Recent Developments

- In March 2022, Reliance Strategic Business Ventures Limited announced a partnership with Sanmina Corporation to establish a manufacturing powerhouse of international repute and will build a cutting-edge "Manufacturing Technology Center of Excellence" that will work as an incubator to boost India's hardware start-up scene and product development.

- In March 2020, Universal Scientific Industrial Co., Ltd. acquired Asteelflash Group to seize business opportunities from its major customers, helping USI expand its overseas manufacturing sites and operational systems faster to meet market demand which will ultimately boost its business growth to become an emerging regional champion.

- Report ID: 6347

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telecom Electronic Manufacturing Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.