Electronic Manufacturing Services Market Outlook:

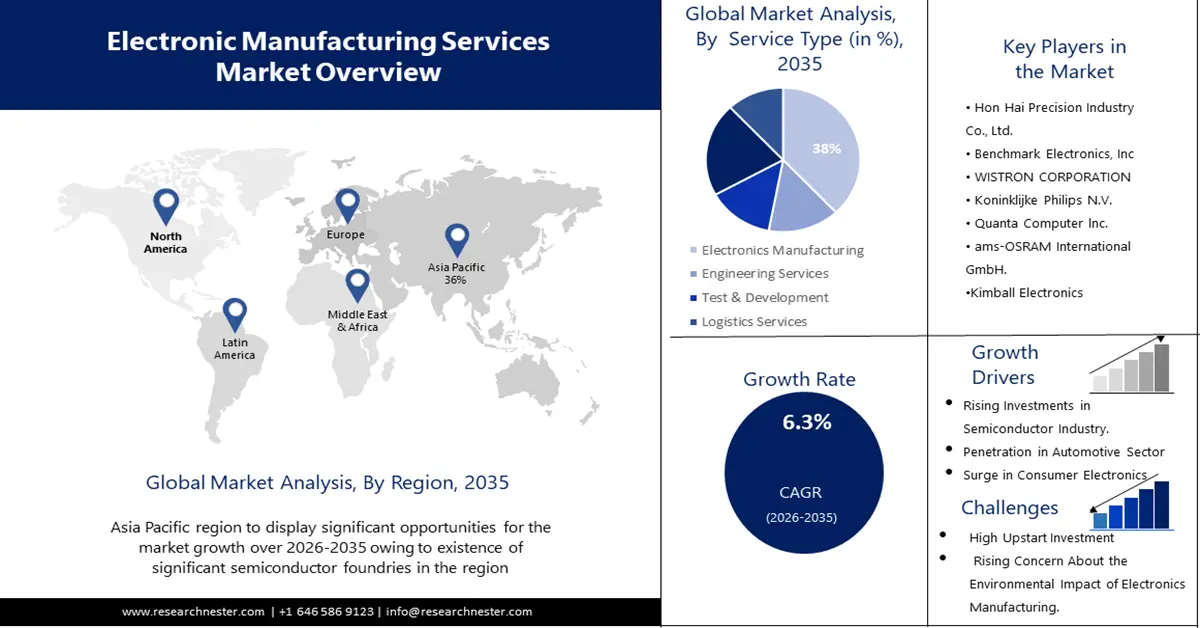

Electronic Manufacturing Services Market size was over USD 635.49 billion in 2025 and is projected to reach USD 1.17 trillion by 2035, growing at around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electronic manufacturing services is evaluated at USD 671.52 billion.

The global electric vehicle transition is driving a surge in electronic components, as devices including electronic control units (ECUs), battery management systems (BMS), and electric drivetrains are required for EVs and their operational efficiency. According to a report from the World Economic Forum published in May 2023, global EV sales reached approximately 10.5 million units in 2022, marking a substantial 55% increase from the previous year. The fast adoption of electric vehicles is encouraging automotive manufacturers to rely more on electronic manufacturing services (EMS) providers to handle exact production operations, high-volume assembly, and reduced time-to-market for electronic vehicle systems.

The EMS providers are collaborating with automotive manufacturers to support high-tech electrification components. For instance, in July 2023, ZF's Commercial Vehicle Solutions division unveiled its next-generation electric driveline systems, AxTrax 2 and CeTrax 2 dual, designed for light to heavy-duty commercial vehicles. These integrated e-mobility solutions emphasize modularity, quiet operation, and zero emissions. The EMS companies are implementing advancements in powertrain and control unit design alongside mass production, enabling them to enhance their position in the modern automotive electronics supply chain.

Key Electronic Manufacturing Services (EMS) Market Insights Summary:

Regional Highlights:

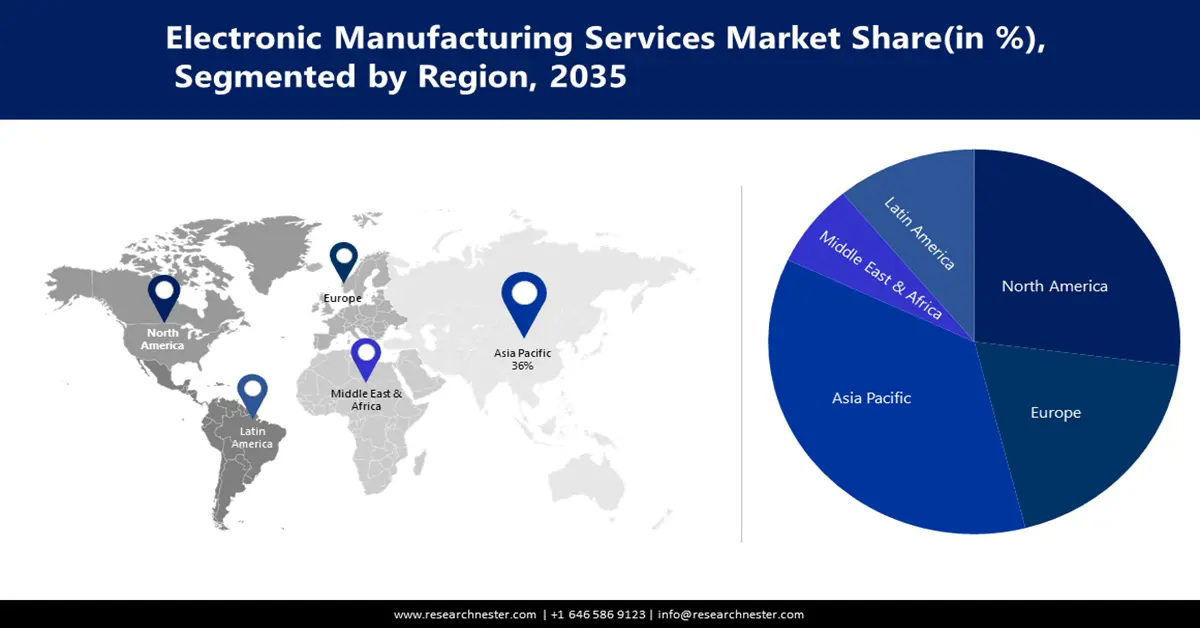

- Asia Pacific electronic manufacturing services market will hold over 36% share by 2035, rapid expansion of local consumer electronics including smartphones.

Segment Insights:

- The electronics manufacturing segment in the electronic manufacturing services market is forecasted to achieve a 38% share by 2035, propelled by the growing complexity of next-gen electronic devices requiring end-to-end EMS providers.

- The industrial segment in the electronic manufacturing services market is expected to hold the highest market share by 2035, driven by leveraging smart technologies and demand for high-precision electronics.

Key Growth Trends:

- Rising adoption of consumer electronics

- Advancements in industrial automation

Major Challenges:

- Rising adoption of consumer electronics

- Advancements in industrial automation

Key Players: General Electric Company, Hon Hai Precision Industry Co., Ltd., Benchmark Electronics, Inc., WISTRON CORPORATION, Koninklijke Philips N.V., Quanta Computer Inc. and other.

Global Electronic Manufacturing Services (EMS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 635.49 billion

- 2026 Market Size: USD 671.52 billion

- Projected Market Size: USD 1.17 trillion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Thailand, Indonesia, Mexico

Last updated on : 10 September, 2025

Electronic Manufacturing Services Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of consumer electronics: The rising popularity of consumer electronics such as smartphones, tablets, and wearable devices is resulting in a surge in demand for EMS. This demand is largely driven by the need for high-speed production and cost-effective manufacturing to meet ever-evolving consumer expectations. As the market for personal electronics becomes more competitive and innovation cycles shorten, consumer electronics brands increasingly rely on EMS providers to deliver rapid prototyping, scalable production, and integrated supply chain support. This outsourcing model allows OEMs to focus on design and branding while EMS companies handle complex assembly and logistics requirements, thereby accelerating product launches and improving EMS market responsiveness.

- Advancements in industrial automation: The rapid advancements in industrial automation are resulting in an increased reliance on sophisticated electronic components, driving demand for EMS. As per the 2024 report of the International Federation of Robotics, in 2024, there were nearly 4 million robots operating in factories around the globe. The annual installations were also increased by half a million units, with Asia Pacific recording 70% of all newly deployed robots. This milestone underscores that industries are significantly integrating automation and control systems to enhance efficiency and productivity, necessitating complex electronic assemblies.

The EMS providers are expanding their capabilities through strategic acquisitions and partnerships. In April 2023, Emerson Electric acquired National Instruments in a USD 8.2 billion all-cash deal, aiming to enhance its automation technology offerings with advanced testing and measurement solutions. This acquisition positions Emerson to better serve the evolving requirements of industrial automation clients. Such developments highlight the critical role EMS companies play in supporting the global shift towards automated industrial processes.

Challenges

- Component shortages and supply chain disruptions: Component shortages and persistent supply chain disruptions have emerged as critical challenges for the electronic manufacturing services (EMS) market. The global shortage of semiconductors and key components such as microcontrollers and integrated circuits is impacting production timelines, leading to delays, order backlogs, and cost inflation. EMS providers are struggling to meet client demands, especially in high-growth sectors like automotive and consumer electronics. Logistics constraints, such as port congestion, container shortages, and geopolitical transport issues, further compound the problem.

Electronic Manufacturing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 635.49 billion |

|

Forecast Year Market Size (2035) |

USD 1.17 trillion |

|

Regional Scope |

|

Electronic Manufacturing Services Market Segmentation:

Service Type

The electronics manufacturing segment is estimated to hold a EMS market share of 38% during the analysis timeframe. The growing complexity of next-generation electronic devices is fueling demand for vertically integrated EMS providers capable of managing end-to-end manufacturing, from prototyping to final assembly. As industries like automotive and industrial automation evolve, there is an increasing need for custom high-performance electronic modules that require deep expertise across the manufacturing value chain. In response to this, major players are strengthening their capabilities through strategic collaborations. In May 2023, Hon Hai Precision Industry Co., Ltd (Foxconn) partnered with Infineon Technologies AG to co-develop silicon carbide and power semiconductors to improve EV manufacturing efficiency and reliability.

Application

The industrial segment is expected to account for the highest electronic manufacturing services (EMS) market share during the forecast period, as the industrial sector is leveraging smart technologies. This is driving EMS providers to deliver high-precision and custom-built electronics for applications such as industrial IoT, robotics, and advanced control systems. The growing demand for intelligent automation solutions across manufacturing plants and processing units is necessitating the development of rugged and reliable electronic assemblies, which EMS firms are well-positioned to provide.

Our in-depth analysis of the global electronic manufacturing services market includes the following segments:

|

Service Type |

|

|

Application |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electronic Manufacturing Services Market Regional Analysis:

APAC Market Insights

The Asia Pacific electronic manufacturing services market is expected to account for a share of 36% during 2026-2035, owing to the rapid expansion of local consumer electronics including smartphones. According to the January 2025 report of the India Brand Equity Fund, the mobile phone manufacturing in India reached USD 49.27 in 2024. As domestic demand for smartphones rises, regional EMS firms are increasingly involved in end-to-end manufacturing solutions. This growing ecosystem is strengthening the supply chain resilience and driving long-term partnerships with both regional and international brands.

The Electronic manufacturing services market in China is projected to grow at a significant pace due to the country’s advanced infrastructure and government-backed industrial zones. Specialized manufacturing hubs equipped with high-speed logistics networks, power supply systems, and localized supplier ecosystems make it easier for EMS providers to streamline production and reduce turnaround times. These purpose-built zones attract both domestic and international clients seeking efficiency and scale.

North America Insights

The electronic manufacturing services market in North America is expected to account for a substantial share during the forecast period. The market is benefiting from increased reshoring initiatives, as companies seek to reduce reliance on overseas production and mitigate geopolitical risks. Supply chain vulnerabilities highlighted by recent global disruptions have encouraged the U.S.-based firms to bring manufacturing operations closer to end markets. This strategic shift is allowing EMS providers to offer improved supply chain control, faster delivery times, and enhanced responsiveness to customer needs.

The U.S. electronic manufacturing services market is projected to witness rapid growth due to the rapid advancement of smart technologies and the increasing integration of electronics in industrial automation systems. According to the International Federation of Robotics 2024 report, the U.S. accounted for nearly 37,587 robot installations in 2023. As factories and infrastructure evolve toward Industry 4.0 standards, there is a rising need for custom-built electronic components such as sensors, controllers, and embedded systems. EMS providers are well-positioned to meet these demands through precision manufacturing and engineering services.

Electronic Manufacturing Services Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hon Hai Precision Industry Co., Ltd.

- Benchmark Electronics, Inc.

- WISTRON CORPORATION

- Koninklijke Philips N.V.

- Quanta Computer Inc.

- ams-OSRAM International GmbH

- Kimball Electronics

- Jabil Inc.

- Plexus Corp.

The electronic manufacturing services (EMS) market is highly competitive, characterized by the presence of global players such as Foxconn, Jabil Inc., Flex Ltd., and Pegatron Corporation. These companies compete based on service breadth, pricing, scalability, and geographic presence. Strategic partnerships, acquisitions, and investments in advanced manufacturing technologies, such as robotics and AI, are common to maintain a competitive edge. Here are some key players operating in the global EMS market:

Recent Developments

- In February 2024, Neotech launched a New Product Introduction (NPI) and Electronics Manufacturing Center of Excellence in Silicon Valley, focusing on advanced electronics for aerospace, defense, and medical devices.

- In January 2023, FIT Hong Teng announced that it entered into an SPA to acquire PRETTL SWH group, horizontally expanding its core capabilities in EV components and extending its mobility solutions. PRETTL SWH group's product portfolio focuses on niche segments as it offers high-margin and high-precision manufacturing products in the industry.

- Report ID: 4833

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electronic Manufacturing Services (EMS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.