Personal Training Software Market Outlook:

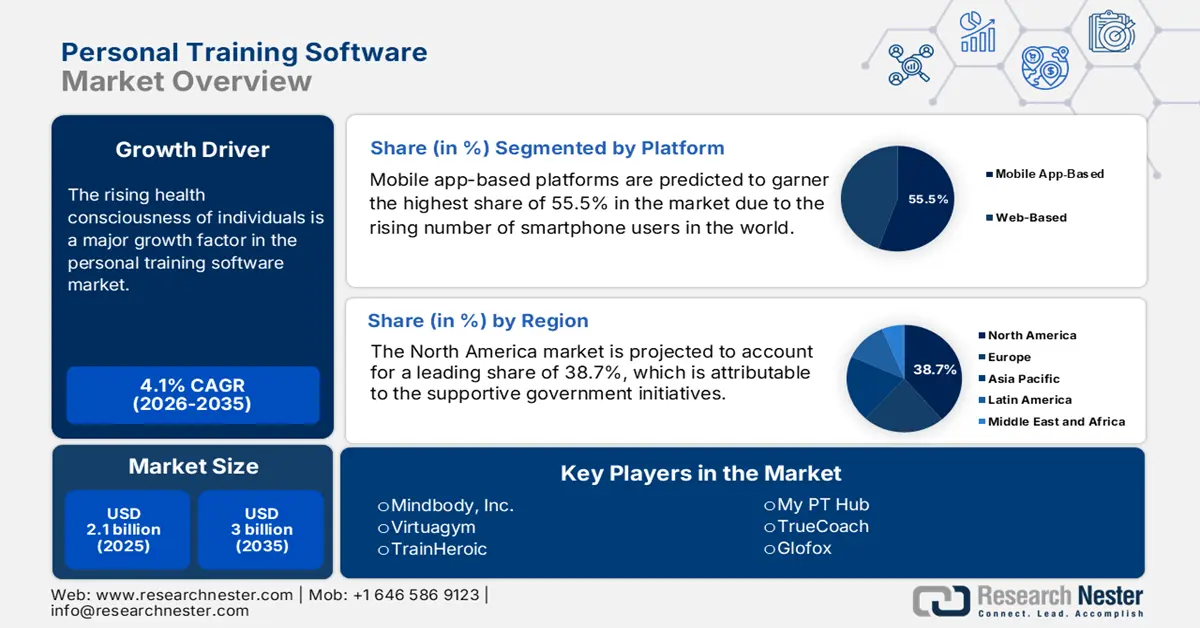

Personal Training Software Market size was over USD 2.1 billion in 2025 and is estimated to reach USD 3 billion by the end of 2035, expanding at a CAGR of 4.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of personal training software is evaluated at USD 2.1 billion.

The rising health consciousness of individuals and the shifting trend towards digital health solutions are the major growth factors in the personal training software market. The increasing incidence of lifestyle-related disorders, such as diabetes and obesity, is making associated chronic diseases more severe. This is pushing medical authorities to promote weight management and fitness maintenance, inspiring individuals to invest in this sector. Such a substantial demography can be testified by the 2024 findings by the NCD Risk Factor Collaboration (NCD-RisC), which revealed that over 1.0 billion people living worldwide were obese, where 880 million and 159 million were adults and children & adolescents aged 5-19 years.

The supply chain of the market is principally distributed across software developers and service providers. The traditional indicators of payers’ pricing dynamics, including the producer price index (PPI) and the consumer price index (CPI), of the global fitness industry showcase a persistent rise in values, particularly due to the cost inflation in the equipment, workforce, and infrastructure. In this regard, in a 2024 article, the National Academy of Sports Medicine (NASM) suggested a balanced and comprehensive pricing strategy for fitness centers, setting private training sessions at USD 85 per hour and coaching pay at USD 30 per hour to secure a 65% profit margin. Thus, tech-based pioneers are focusing on the development of more scalable and affordable options to attract a larger consumer base.

Key Personal Training Software Market Insights Summary:

Regional Highlights:

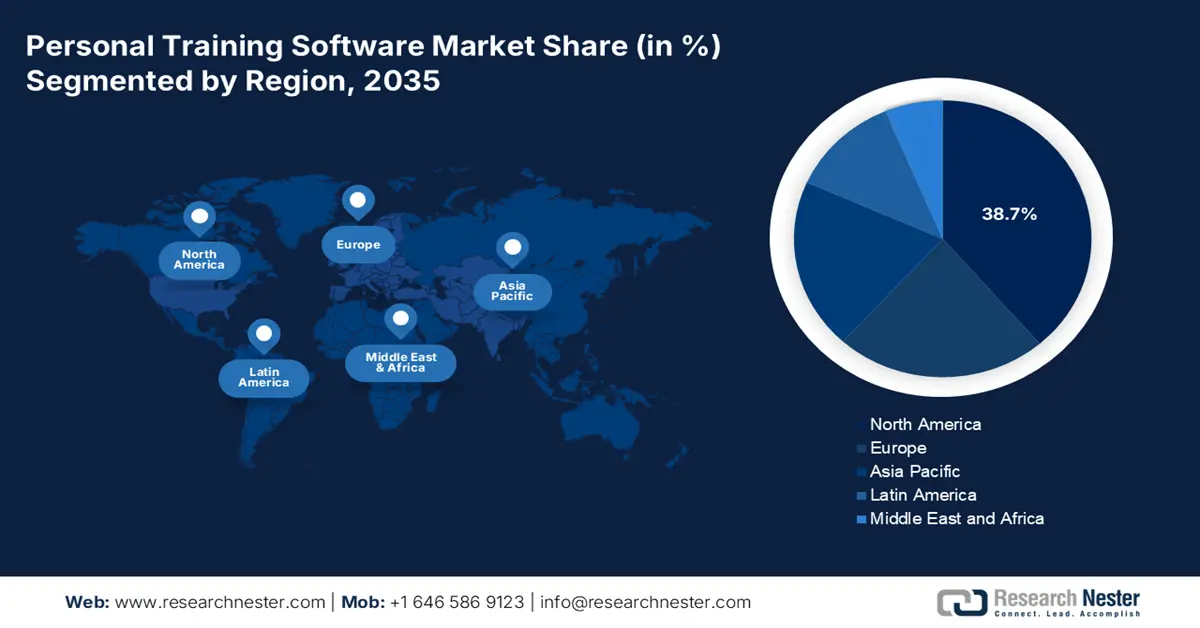

- North America is anticipated to capture a 38.7% share by 2037 in the personal training software market, underpinned by a robust healthcare ecosystem and supportive governmental initiatives promoting wellness technology adoption.

- Asia Pacific region is expected to witness the fastest growth from 2026 to 2035, impelled by rising health consciousness, rapid urbanization, and the proliferation of digital fitness platforms in developing economies.

Segment Insights:

- The mobile app-based platforms segment of the personal training software market is projected to hold a 55.5% share by 2035, propelled by the widespread smartphone adoption and the growing preference for on-the-go fitness engagement.

- The nutrition management software segment is anticipated to secure a substantial share through 2035, driven by the rising prevalence of lifestyle-related diseases and the increasing focus on preventive health and personalized nutrition tracking.

Key Growth Trends:

- Growing popularity of preventive healthcare

- Rising demand for remote wellness solution

Major Challenges:

- Exorbitant economic barriers

Key Players: Mindbody, Inc., Virtuagym, TrainHeroic, My PT Hub, TrueCoach, Glofox, Exercise.com, WellnessLiving, PushPress, GymMaster, Jack City Fitness, FitSW, TeamBuildr, Acuity Scheduling, The PT Distinction, Zen Planner, FitnessForce, Gymini, Sportbit, Heiaheia, FITR

Global Personal Training Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.1 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2037)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Australia

- Emerging Countries: India, China, South Korea, Singapore, Brazil

Last updated on : 25 September, 2025

Personal Training Software Market - Growth Drivers and Challenges

Growth Drivers

- Growing popularity of preventive healthcare: Worldwide health agencies are increasingly recognizing the cost-effectiveness of lifestyle interventions for managing chronic conditions, such as obesity, diabetes, and cardiovascular disease (CVD). The personal training software market aligns perfectly with this cohort, which is becoming a key driver. For instance, in May 2024, the Centers for Disease Control and Prevention (CDC) released grants and started programs, such as the National DPP Lifestyle Change Program, focused on diabetes prevention, which follows a yearlong evidence-based curriculum and lifestyle coaching via digital platforms.

- Rising demand for remote wellness solutions: With the global shift toward virtual healthcare delivery, more individuals are opting for solutions available in the market to maintain overall wellness remotely. The advanced features offered by these commodities include real-time progress tracking and communication with clients from anywhere, appealing to both trainers and clients, which increases engagement and cash inflow in this sector. This can be displayed by the post-pandemic picture of the industry value of healthy eating, nutrition, and weight loss in 2023, surpassing USD 1096 billion, as per the figures from the Global Wellness Economy Monitor.

- Tech-based advances and personalized approach: The emergence of wearable devices is making people around the globe more aware of the importance of maintaining personal health. Specifically, smartwatches and fitness bands are becoming pivotal growth tools for the personal training software market by adding valuable health and activity data. Besides, the pipelines of the sector are evolving with the integration of IoT and AI, enriching the overall process of exercise with the required instructions and insights. For instance, in September 2025, ABC Fitness and MyFitnessPal extended their partnership into the next phase to bring fitness and nutrition in a single platform for more personalized coaching and revenue opportunities.

Statistical Overview of the Key Patient Pools of the Personal Training Software Market

Global Overweight and Obesity Statistics (1990-2024)

|

Category |

Timeline |

Statistic |

Notes / Trends |

|

Adults (18+ years) |

2022 |

2.5 billion overweight (including 890 million obese) |

43% of adults are overweight (43% men, 44% women) |

|

1990 |

25% of adults are overweight |

Significant increase from 25% in 1990 to 43% in 2022 |

|

|

Regional Adult Overweight Prevalence |

2022 |

31% (South-East Asia, Africa), 67% (Americas) |

Varies significantly by region |

|

Adult Obesity Prevalence |

2022 |

16% of adults are obese |

More than doubled since 1990 |

|

Children under 5 years |

2024 |

35 million overweight |

Increasing trend, especially in low/middle-income countries |

|

2000-2024 |

12.1% increase in overweight children under 5 in Africa |

Reflects a growing issue outside high-income countries |

|

|

2024 |

~50% of overweight children under 5 lived in Asia |

Asia bears a significant burden |

|

|

Children & Adolescents (5–19 years) |

1990 |

8% overweight |

Approx. 124 million |

|

2022 |

20% overweight (390 million) |

Nearly tripled since 1990 |

|

|

2022 |

8% obese (160 million) |

A fourfold increase in obesity in the 5-19 age group |

|

|

2022 |

19% of girls and 21% of boys are overweight |

Similar rising trends in both sexes |

Challenges

- Exorbitant economic barriers: For the development and deployment of personal training software (PTS), the upfront capital is quite steep. Besides, the continuously evolving consumer demands created a burden of hefty financial commitment toward R&D for manufacturers. On the other hand, the heightening costs related to the employment of training staff and buying hardware add up to the overall budget overflow for end users, which often deters small-sized organizations from investing in the personal training software market.

Personal Training Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 2.1 billion |

|

Forecast Year Market Size (2035) |

USD 3 billion |

|

Regional Scope |

|

Personal Training Software Market Segmentation:

Platform Segment Analysis

Mobile app-based platforms are predicted to garner the highest share of 55.5% in the personal training software by the end of 2035. The rising number of users for smartphones that seamlessly fit into daily lifestyles is remarkably fueling the segment’s leadership in this sector. Testifying to such a large potential consumer base, in a 2022 article, the NLM unveiled that the count of smartphone users worldwide crossed 3.8 billion in 2021 alone, doubling from 2015. Thus, as more people are turning to the ubiquity and on-the-go accessibility of these devices, this subtype continues to gain a predominant captivity over revenue generation.

Type Segment Analysis

The nutrition management software segment is poised to account for a major share in the personal training software market over the assessed period. Given the wide recognition in portraying how crucial diet is to overall health, this technology is becoming the primary asset for global medical agencies to promote and deploy preventive measures against the growing epidemic of chronic metabolic disorders. Nutrition management software provides tailored meal plans, tracks calories, and analyzes nutrients, all designed for those who are mindful of their health. Additionally, the rise in diseases linked to lifestyle choices has highlighted the necessity for effective nutrition management solutions.

End user Segment Analysis

Fitness enthusiasts are expected to dominate the personal training software market throughout the discussed timeline. Being proactively engaged with regular health and fitness goals, these users often seek structured, data-driven programs to track their progress and performance, assisting them in staying motivated. Besides, they are one of the biggest consumers of personalized workout plans, nutrition tracking, and wearables, which secures a stable cash inflow from the segment in this sector. Besides, due to being digitally savvy consumers, fitness enthusiasts are quick to adopt advanced tools that offer flexibility, real-time feedback, and a tailored experience, making them a target audience for suppliers.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segment |

|

Platform |

|

|

Type |

|

|

Features/Functionality |

|

|

Device |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Personal Training Software Market - Regional Analysis

North America Market Insights

The North America personal training software market is projected to account for a leading share of 38.7% by the end of 2037. The region’s dominance in this sector is primarily empowered by the strong healthcare framework and supportive government initiatives. Particularly, dedicated agencies operating across the U.S. and Canada are prompting greater investment in these wellness technologies and services. Evidencing the same, the Health & Fitness Association reported that the number of overall fitness facility users rose by 8.1% in 2023 from 2022, totaling 82.7 million. On the other hand, the inclusion of PTS into standard health care plans and insurance coverage has further allowed the landscape to continue expanding.

With a strong emphasis on preventative healthcare maintenance and awareness, the U.S. has become the prominent contributor to the regional expansion in the market. As obesity and diabetes are a few of the most concerning nationwide clinical problems, the demand for real-time PTS solutions is earning financial advantages from the government. In this regard, a 2025 report from the Health Action Council revealed that more than 20% adults in 50 states of the country were living with obesity, whose monthly costs grew 2.3 times higher than those without this condition.

Recent Commercial Milestones in Key Landscapes

(August 2025)

|

Country |

Company Name |

Key Notes |

|

U.S. |

ABC Fitness |

Launched a powerful member retention tool for fitness operators, Click2Save, powered by DXFactor |

|

Canada |

TRAINERIZE |

Inaugurated ABC Trainerize Business to commercialize smarter ways to scale coaching businesses |

Source: Company Presss Relase

APAC Market Insights

Asia Pacific is emerging to become the fastest-growing region in the market over the timeline between 2026 and 2035. The rising personal health awareness, rapid urbanization, and disposable incomes are collectively fostering a lucrative business environment for the merchandise in the region. Developing economies, such as China and India, are seeing a robust surge in fitness app adoption and digital training platforms, fueled by growing smartphone penetration and internet access. Furthermore, the continuous enlargement of tech-savvy populations, combined with the amplifying demography of lifestyle-related ailments, is increasing demand for these personalized fitness and wellness solutions.

The rapid expansion of gyms, wellness centers, and corporate wellness initiatives across India is accelerating the uptake of tools and services available in the market. This attractive environment is further complemented by the 85.5% and 86.3% of households across the country possessing at least one smartphone and internet access, respectively, as unveiled by the 2025 PIB report. Besides, the growing digital economy of India is also propelling adoption rates in this sector, where it earned the second-largest position in the world in terms of smartphone unit volume in 2024, according to the IBEF findings.

Feasible Opportunities Present in Key Landscapes

|

Country |

Key Notes |

Timeline |

|

India |

690 million smartphone users within a total population of 1.4 billion |

2024 |

|

China |

Dominated both the global smartphone shipments and industry value with 22% and 31% shares, respectively |

2024 |

|

Australia |

The proportion of young people meeting the national physical activity guidelines doubled to 5.6% from 1.9% |

2018-2022 |

Source: IBEF and ABS Australia

Europe Market Insights

Europe is poised to hold the second-largest revenue share in the market by the end of 2035. The region’s consistency in growth is highly attributable to its robust healthcare digitalization and government initiatives that promote preventive measures. These organizations are also investing heavily in integrating software-based solutions for managing fitness, rehabilitation, and chronic disease into public health systems. Besides, the regulatory frameworks in Europe not only allow innovation but also assure safety and efficacy, building a strong foundation for this sector with greater consumer trust.

Cross-border collaboration and public funding, ramp up research and deployment of cutting-edge PTS systems in the mainstream medical practices, securing future progress in the UK market. Moreover, demographic changes, including an aging population, add to the demand for these technologies that promote remote health management and preventive care through lifestyle changes. Currently, being home to several pharma and tech pioneers, the country strongly expedites market expansion. Further, in August 2023, the government of the UK empowered this cohort by implementing a new strategy, Get Ready, for the future of sport and physical activity.

Key Personal Training Software Market Players:

- Mindbody, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Virtuagym

- TrainHeroic

- My PT Hub

- TrueCoach

- Glofox

- Exercise.com

- WellnessLiving

- PushPress

- GymMaster

- Jack City Fitness

- FitSW

- TeamBuildr

- Acuity Scheduling

- The PT Distinction

- Zen Planner

- FitnessForce

- Gymini

- Sportbit

- Heiaheia

- FITR

The personal training software market is expanding with many fitness market leaders competing for attention and market share. US companies like Mindbody and Trainerize are leading the charge with cloud-based solutions that support remote and interactive training with clients. In Europe, companies like Virtuagym and My PT Hub are focused on fully integrated wellness platforms for a more streamlined approach to onboarding and client management. The market has numerous strategic initiatives that share the goal of achieving rapid market expansion. The landscape of market players is increasingly focusing on providing a seamless consumer experience, providing robust, data-driven user insights, and bringing hybrid service models to capitalize on increasing demand worldwide.

Here is a list of key players operating in the market:

Recent Developments

- In August 2025, ABC Fitness announced the expansion of its ABC Glofox × ABC Trainerize integration, enabling studios to scale digital coaching and boost member engagement. This helps gyms and studios to unify in-person & digital offerings, streamline coaching delivery, and grow revenue through personalized member experiences.

- In May 2025, FITR launched new fitness calculators for coaches as an extended feature of its FITR coaching platform, which is designed to streamline their training planning and give them data-driven insights in seconds. The tool helps monitor progress through the rep converter, percentage table, and pace estimator precisely.

- Report ID: 3779

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Personal Training Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.