Clinical Trials Matching Software Market Outlook:

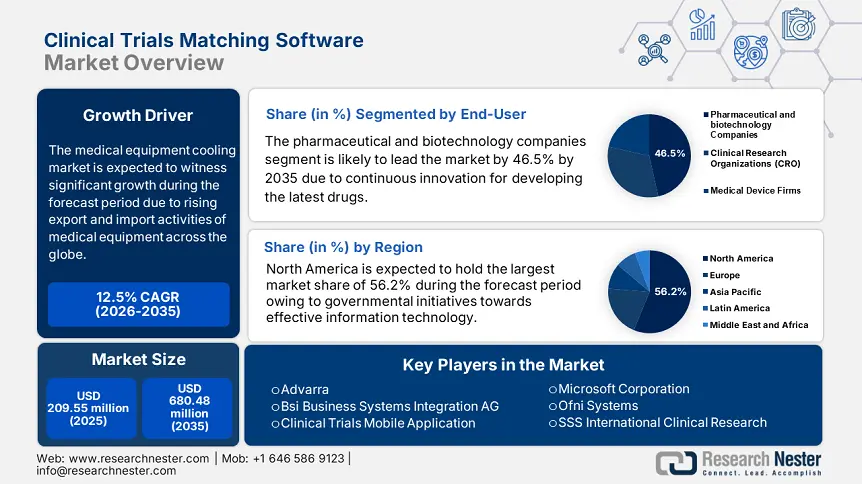

Clinical Trials Matching Software Market size was valued at USD 209.55 million in 2025 and is expected to reach USD 680.48 million by 2035, expanding at around 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of clinical trials matching software is evaluated at USD 233.12 million.

The implementation of automated software tools in clinical trials ensures an efficient method for rapid identification of potentially eligible patients in clinical research, which is highly driving the upliftment of the clinical trials matching software market. As per an article published by NLM in February 2023, there are different phases of a clinical trial, including Phase 0 which is exploratory, Phase Ia, Phase Ib, and Phase Ic as a non-therapeutical trial, Phase II, Phase IIa, and Phase IIb denoting exploratory trial, Phase III as a therapeutic confirmatory trial, and Phase IV as post-approval study. Thereby, the combination of all these phases and the inclusion of innovative software tools are effective enough for the market to expand.

The clinical trials matching software market is subjected to boost with the use of technologies and processing machines to evaluate study probability, simplify participant recruitment and maintenance, permit entry to varied populations, rationalize data collection, and ease data management. Based on this, the implementation of computers and toolsets in clinical trials is exclusively common, thus driving their demand increasingly. According to the 2023 OEC report, the global trade value of computers was USD 323 billion with China being the top exporter at USD 158 billion and the United States being the top importer at USD 93.2 billion.

Moreover, the use of toolsets in clinical trials is useful for the effective management of study operations, data, and communication across the trial lifecycle, which caters to the development of the clinical trials matching software market. Additionally, these help in facilitating practice changes, and can include strategies for guideline implementation, informing policy, and providing quality audit materials. As per the 2023 OEC report, the international trade of toolsets is valued at USD 1.29 billion with China as the top exporter at USD 606 million and Germany as the top importer at USD 114 million, thus positively impacting the market growth.

Computers and Toolsets Export/Import Comparison

|

Countries |

Computers |

Toolsets |

||

|

Export |

Import |

Export |

Import |

|

|

Mexico |

USD 29.5 billion |

- |

- |

- |

|

Taipei |

USD 27.1 billion |

- |

USD 158.0 million |

- |

|

Vietnam |

USD 15.9 billion |

- |

- |

- |

|

United States |

USD 15.3 billion |

USD 93.2 billion |

USD 59.6 million |

USD 82.4 million |

|

Germany |

- |

USD 20.4 billion |

USD 147.0 million |

USD 114.0 million |

|

Hong Kong |

- |

USD 15.5 billion |

- |

- |

|

Netherlands |

- |

USD 14.3 billion |

USD 29.3 million |

USD 68.4 million |

|

United Kingdoms |

- |

USD 13.0 billion |

- |

- |

|

Russia |

- |

- |

- |

USD 114.0 million |

|

France |

- |

- |

- |

USD 93.7 million |

Source: OEC 2023

Key Clinical Trials Matching Software Market Insights Summary:

Regional Highlights:

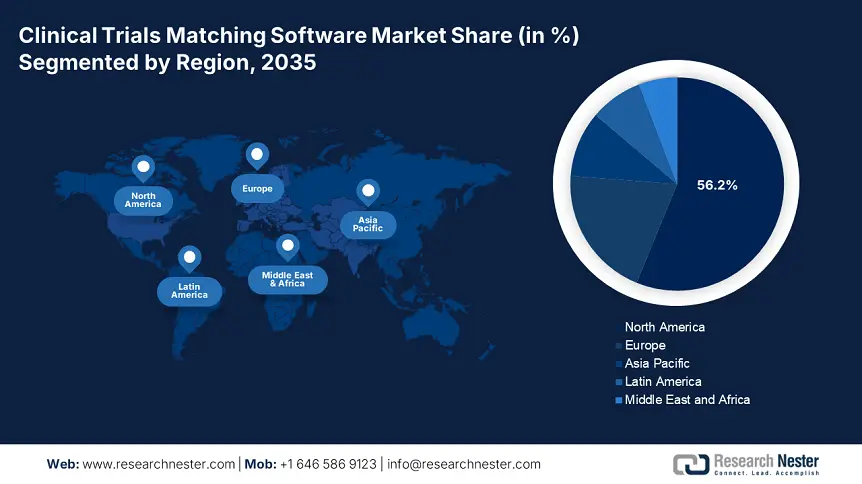

- North America commands a 56.20% share in the Clinical Trials Matching Software Market, driven by acceptance of drug trial matching systems, governmental strategies, and NIH initiatives, ensuring strong growth by 2035.

- The Asia Pacific Clinical Trials Matching Software Market is expected to grow fastest by 2035, attributed to the availability of a large number of patients and rising healthcare IT projects.

Segment Insights:

- The pharmaceutical and biotechnology companies segment is predicted to hold over 46.5% market share by 2035 driven by the large number of drug trials required to launch the product.

- The software segment is projected for substantial growth from 2026-2035, attributed to the increased usage and adoption of drug trials, implementation of research and development, and generous contributions by medical organizations.

Key Growth Trends:

- Increased clinical trial activities

- Digitalization in research

Major Challenges:

- Expensive software

- Insufficient training and adaptation

- Key Players: Advarra, Antidote Technologies, Inc., IBM Clinical Development, Clinical Trials Mobile Application.

Global Clinical Trials Matching Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 209.55 million

- 2026 Market Size: USD 233.12 million

- Projected Market Size: USD 680.48 million by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (56.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Clinical Trials Matching Software Market Growth Drivers and Challenges:

Growth Drivers

- Increased clinical trial activities: The clinical trials matching software market is expected to boost depending upon the enhancement of clinical trials internationally. According to the December 2024 WHO report, the United States is subjected to increased trials by 186,497, followed by 135,747 in China, 74,031 in India, 65,167 in Japan, 54,902 in Germany, and many more. This is due to the augmented infiltration of advanced healthcare technologies coupled with the rising demand for innovative drugs with superior effectiveness, readily amplifying the market development and evolution.

- Digitalization in research: The incorporation of sophisticated technology such as Electronic Data Capture (EDC) and clinical trials management systems is increasing the demand for the clinical trials matching software market globally. As per an article published by Mayo Clinic Proceedings in October 2023, 94% of hospitals in the U.S. readily utilized an electronic health record (EHR) to provide clinical care, and this constituted 45% of the overall regional population to comprise a medical record in the EHR. The EHR was primarily envisioned as a tool for patient-focused care, but clinical investigators have used its near-universal adoption in various aspects of studies.

Challenges

- Expensive software: The high price of matching software systems is effectively hindering the growth of the clinical trials matching software market. A few aspects of software such as initiation, per user, contractual term commitment, per the study, maintenance, training, support, and system integration fees cumulatively raise the overall cost required for the implementation of clinical trial matching software solutions. In addition, customization and configuration costs are charged to organizations based on specific organizational and research requirements.

- Insufficient training and adaptation: Healthcare professionals may lack the essential training to utilize advanced clinical trial matching tools effectively, restricting their probable benefits. Moreover, complex trials often comprise multiple variables and strict eligibility criteria, making it problematic for professionals to provide software solutions to match patients accurately and efficiently. This creates a gap in the overall conduction of trials that leads to incomplete results, thus restraining the clinical trials matching software market globally.

Clinical Trials Matching Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 209.55 million |

|

Forecast Year Market Size (2035) |

USD 680.48 million |

|

Regional Scope |

|

Clinical Trials Matching Software Market Segmentation:

End user (Pharmaceutical and biotechnology Companies, Clinical Research Organizations (CRO), Medical Device Firms)

Pharmaceutical and biotechnology companies segment is expected to capture clinical trials matching software market share of over 46.5% by 2035. The evolution of this segment is ascribed to the large number of drug trials required to launch the product. For instance, as per the April 2024 U.S. FDA report, CDER successfully launched a center for clinical trial innovation (C3T1) to foster revolution-based efforts and operate as a central point for coordinating, sharing knowledge, and communicating with both internal and external parties. Thus, this development in association with the FDA is a huge contribution towards the upliftment of the market globally.

Components (Software, Services)

The software segment is expected to influence the clinical trials matching software market at a considerable rate during the forecast timeline. This growth is attributed to the increased usage and adoption of drug trials, implementation of research and development, and generous contributions by medical organizations to promote and conduct complex drug trials. For instance, as stated in the February 2025 article published by Drug Discovery Today, the average probability of first approval rate accounts for 14.3% across foremost research-based pharmaceutical companies, broadly ranging between 8% to 23%. Therefore, this ensures an overall success rate of clinical development ranging from 7% to 25%.

Our in-depth analysis of the global clinical trials matching software market includes the following segments:

|

End user |

|

|

Components |

|

|

Deployment Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clinical Trials Matching Software Market Regional Analysis:

North America Market Analysis

By the end of 2035, North America clinical trials matching software market is set to dominate around 56.2% revenue share. Factors including the acceptance of drug trial matching systems by biotechnology and pharmaceutical organizations, governmental strategies, and the adoption of patient matching software as well as clinical trial matching software are highly bolstering the market expansion in the region. For instance, the National Institute of Health (NIH) in September 2024 launched a series of initiatives including Basic Experimental Studies Involving Humans (BESH), clinical trial-based review, funding, and practices, human information forms, protocol templates, and training and resources suitable for market upliftment.

The U.S. clinical trials matching software market has been gaining traction due to the provision of suitable guidelines by administrative bodies. For instance, the U.S. FDA in its September 2022 report has put forward section 201(h) of the Federal Food, Drug, and Cosmetic Act (FD&C Act) to include software that is envisioned to deliver decision support for the diagnosis, treatment, prevention, cure, or mitigation of diseases or other health conditions. Additionally, under section 520(o)(1)(E), medical imaging systems such as X-rays, computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound are suitable for medical purposes. Therefore, the implementation of guidelines ensures a positive impact on the market growth.

The clinical trials matching software market in Canada is witnessing significant growth owing to governmental investments and contributions made by researchers. As per the July 2023 Canada Institutes of Health Research report, the Government of Canada invested USD 250 million to support clinical trial funds, an initiative to enhance Canada’s Biomanufacturing and Life Sciences Strategy. Besides, researchers from the Ontario Institute of Cancer Research in February 2024 developed PMATCH, an automated system to match precision medicine clinical trials with suitable cancer patients. Therefore, with all such developments and funds, there is more exposure for the market to boost and expand.

APAC Market Statistics

The clinical trials matching software market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline owing to the availability of a large number of patients. In addition, various organizations are targeting to place their research and development activities in the region to support the expansion of the market. This can be accredited to a rise in the number of healthcare IT projects, a developing economy, and a complete upgradation in healthcare infrastructures, especially in developing countries including India and China, denoting the upliftment of the market.

The clinical trials matching software market in India is expecting substantial growth since these trials are readily implemented for the evaluation of therapies to aid cancer patients. For instance, as per an article published by NLM in February 2024, NexCAR19 is the country’s first CAR-T cell therapy approved by the U.S. FDA based on two clinical trials on 64 patients with advanced leukemia. As per the trials, 67% of patients comprised a prominent decrease in the level of their cancer (objective response), with the cancer disappearing altogether in about half (complete response). Therefore, with such development of innovative therapies, the market is expected to successfully flourish in the country.

The clinical trials matching software market in China is gaining exposure owing to the presence of innovation and advancement to evaluate the clinical aspect of patients suffering from rare disorders. According to the February 2024 NLM article, a retrospective study was conducted on 1,053 inpatients diagnosed with hepatocellular carcinoma regarding the evaluation of artificial intelligence in the clinical trial matching system (CTMS). The study revealed acceptable interrater reliability ranging between 0.65 to 0.88 with an accuracy rate between 92.9% to 98.0%. Additionally, the sensitivity ranged between 51.9% to 83.5%, 99.0% to 99.1% of specificity, 75.7% to 85.1% of positive predictive value, and 97.4% to 98.9% of negative predictive value.

Key Clinical Trials Matching Software Market Players:

- Advarra

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Antidote Technologies, Inc.

- Accenture

- IBM Clinical Development

- Clinical Trials Mobile Application

- SSS International Clinical Research

- Aris Global

- Clario

- Bsi Business Systems Integration AG

- Microsoft Corporation

- Ofni Systems

- Oracle

- IQVIA

- Syneos Health

Companies dominating the clinical trials matching software market are gaining rapid exposure due to the increasing demand for real-time data analytics by researchers. Additionally, advances in artificial intelligence (AI) are reforming key steps of clinical trial design towards cumulative trial success rates. Based on this, in January 2024, Accenture declared a tactical investment, through Accenture Ventures in QuantHealth to allow pharmaceutical and biotech organizations to rapidly and cost-effectively develop treatments for patients. This denotes an optimistic approach for the market to expand effectively and efficiently.

Moreover, with exclusive AI technology trained on a massive dataset of 350 million patients, huge biomedical knowledge-based graphs, and clinical trial data, QuantHealth’s simulation platform can forecast trial upshots with substantial accuracy. This further can evaluate protocol variations and determine the ideal trial design for success, assisting research and development (R&D) teams more precisely and swiftly predict clinical trial results, and deciding whether a trial should progress, optimize cohorts, whether drugs can be repurposed, and other crucial factors. All these factors cater to the upliftment of the market in the global arena.

Here's the list of some key players:

Recent Developments

- In January 2025, Syneos Health signed an agreement with ACTIVATO to expand clinical trial competencies across a broad range of therapeutic areas in Japan. The purpose of this is to fast-track its clinical development impact in this rapidly growing and changing market.

- In June 2024, IQVIA notified the launch of One Home for Sites, the latest technology platform that operates as a single sign-on and a single dashboard for the key systems and tasks that a clinical research site requires to execute across all of the clinical trials it is conducting.

- In May 2024, Oracle made advancements in its global Clinical One Randomization and Trial Supply Management (RTSM) by enhancing regionalization, access, and assisting users with country-specific regulations along with reliability and transparency of trials from commencement to closeout.

- Report ID: 7333

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.