Optical Fiber Raw Material Market Outlook:

Optical Fiber Raw Material Market size was valued at USD 1.6 billion in 2025 and is projected to reach approximately USD 4.8 billion by the end of 2035, rising at a CAGR of 11.6% during the forecast period, from 2026 to 2035. In 2026, the industry size of optical fiber raw material is evaluated at USD 1.8 billion.

The global optical fiber raw material market is expected to witness an upward trend over the projected years, primarily driven by the expansion of broadband infrastructure, especially in U.S. federal programs. In the Federal Register remarks, industry stakeholders cited that more than 100 domestic companies are already in the production of fiber optic cables, which has generated an annual revenue of about USD 4 billion and employment of about 7,000 employees. Since 2020, domestic production has increased by approximately 22% and is indicative of significant capacity build-out to keep up with Federal programs such as the Broadband Equity, Access, and Deployment (BEAD) program. Additionally, exports of optical fiber cables from the U.S. were 1.66 billion dollars in 2022, with Germany, Canada, and Mexico being the major optical fiber raw material market leaders. In the meantime, the imports into the U.S. amounted to USD 2.26 billion in 2023, and Japan and Germany are among the largest importers, which highlights the current internationalization and the possibility of the domestic industry to gain in the world optical fiber raw material market. The strength of public support to drive demand through strong public expenditure, and a complete upstream supply of raw materials in the domestic optical fiber raw material market, scale, and strategic sourcing changes in the raw material markets continue to occur, which further drives the optical fiber raw material market growth.

The supply chain of the optical fiber raw material includes the manufacture of fused silica cylinders and preforms, glass fiber drawing, and cable assembly lines. Even with the growth in domestic cable production, upstream production of preforms and core material is still internationally diffused, leading to the need to import these items. In June 2025, the PPI of Fiber Optic Cable Manufacturing (using purchased strands) was at 87.006 (Dec 2003 = 100). This reflects an increasing demand and investment in the optical fiber raw materials, whereby the global capacity has grown, compelling upstream growth. Additionally, the information provided by the Bureau of Labor Statistics on the category of electronic components and accessories shows that there is a slight change in the PPI index in October 2021, with 64.7, implying that raw materials might be low to moderate in terms of price volatility. Research investments are being pursued in national laboratories, including the work of NIST on metrology methods and optical sensors used on fiber networks. Local assembly lines are dependent on U.S.-produced and imported preforms on the trade front; companies note sourcing of cable components in Mexico and Korea; optical fiber preforms in Japan and Denmark. These varied trade flows highlight globally integrated manufacturing and national deployment capacity.

Key Optical Fiber Raw Material Market Insights Summary:

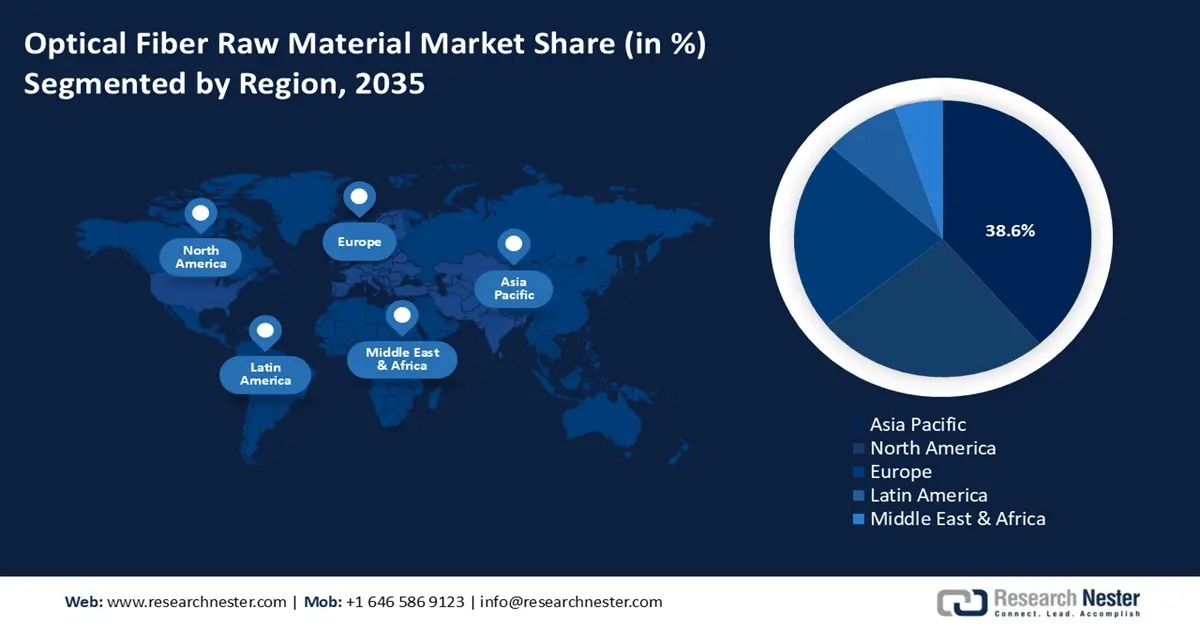

Regional Highlights:

- North America is projected to secure a 25.4% share by 2035 in the optical fiber raw material market across 2026–2035, attributed to the rapid expansion of telecommunication infrastructure and the rising need to transmit data at high rates.

- Europe is anticipated to advance steadily with a notable share by 2035, supported by the region’s accelerating digitalization and stringent environmental regulations.

Segment Insights:

- The single-mode fiber segment is expected to attain a 59.8% share by 2035 in the optical fiber raw material market, propelled by its high bandwidth and long-distance transmission capabilities required in telecommunications and data centers.

- Silicon tetrachloride is forecasted to represent a 44.6% share by 2035, reinforced by its essential role in producing high-purity optical fibers.

Key Growth Trends:

- Data center expansion and hyperscale computing

- Smart grid and energy infrastructure modernization

Major Challenges:

- Supply chain impact of export controls

- Low domestic production capacity within major markets

Key Players: Corning Incorporated (U.S.), Prysmian Group (Italy), FiberHome Telecommunication Technologies Co. (China), Yangtze Optical Fibre and Cable Co., Ltd. (China), Sterlite Technologies Limited (STL) (India), Nexans S.A. (France), CommScope Holding Company, Inc. (U.S.), Hengtong Group (China), LEONI AG (Germany), YOFC (Yangtze Optical Fibre and Cable Co.) (China), SGL Carbon (Germany), Toyobo Co., Ltd. (Japan), Sumitomo Electric Industries, Ltd. (Japan), Fujikura Ltd. (Japan).

Global Optical Fiber Raw Material Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 4.8 billion by 2035

- Growth Forecasts: 11.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (25.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 8 December, 2025

Optical Fiber Raw Material Market - Growth Drivers and Challenges

Growth Drivers

- Data center expansion and hyperscale computing: The fast growth of data centers all over the world has a big influence on the demand for optical fiber raw materials. In 2023, data centers are estimated to consume approximately 4.4% of such electricity used in the country, and it is expected to increase to a range of between 6.7% and 12% by 2028. The fuel behind this growth is the use of hyperscale facilities to serve cloud computing and AI workloads, which demand high-bandwidth interconnects served by advanced optical fiber. According to the Lawrence Berkeley National Laboratory, data center electricity consumption went up by a factor of quadrupled between 58 TWh in 2014 and 176 TWh in 2023. This demand boom reflects a similar boom in raw material demand, like silicon tetrachloride and germanium tetrachloride, which are needed to manufacture optical fiber components.

- Smart grid and energy infrastructure modernization: The modernization of energy infrastructure using smart grid technologies increases the demand for optical fiber raw materials. In 2022-2026, the U.S. Department of Energy provided about USD 3 billion of Smart Grants program support to enhance the flexibility of grid and sensor integration. The DOE under the Bipartisan Infrastructure Law has deployed USD 3.46 billion in 58 grid resilience and innovation partnerships projects to increase grid reliability, many of which include fiber-optic communication to enable real-time monitoring. Such undertakings demand large quantities of optical fiber raw materials to use in cable production, and as such, there is a high effect on the optical fiber raw material market demand.

- Railway and transportation fiber connectivity: The fiber optic systems upgrade of the transportation infrastructure is the catalyst for the consumption of optical fiber raw materials. The Strategic Plan of the U.S. Department of Transportation 2022 2026 focuses on the implementation of advanced technologies and infrastructure to make transportation safer, more efficient, and resilient. It promotes the development of the communications infrastructure- such as broadband and new digital technologies - to enhance traffic control and meet future mobility requirements on highways and railways. Similarly, the US Department of Transportation has also granted USD8.2 billion of new grants to ten passenger railroads, as well as introduced planning of 69 corridors in 44 states to increase railroads. This is in addition to almost USD 30 billion of investment in the U.S. rail system that has been undertaken so far, which has been spurring growth in the optical fiber raw material market.

Optical Fibre Cables, Made Up of Individual Exports by Country, 2022

|

Reporter |

Trade Flow |

Partner |

Trade Value 1000 USD |

Quantity (Kg) |

|

China |

Exports |

World |

2,745,899.10 |

409,634,000 |

|

U.S. |

World |

1,660,097.43 |

_ |

|

|

EU |

World |

1,319,918.77 |

86,680,600 |

|

|

France |

World |

490,403.27 |

46,338,100 |

|

|

Japan |

World |

352,043.79 |

22,339,400 |

|

|

Germany |

World |

315,430.29 |

15,567,400 |

|

|

UK |

World |

170,888.71 |

6,225,190 |

|

|

India |

World |

62,471.97 |

_ |

(Source: worldbank.org)

Challenges

- Supply chain impact of export controls: The exportations of key raw materials like germanium tetrachloride have also significantly affected the optical fiber raw material market in the supply chain of optical fiber raw materials. In 2024, China, which is a leading exporter of germanium, introduced an export licensing scheme, and the reduction in germanium metal exports reached 55% in August, compared to 2023. This grossly hampered the international chain of supply, and germanium metal prices in Europe rose to 1550/kg in January and to 2,950/kg in September, and germanium dioxide to 940/kg to 2125/kg. In addition, the WTO restrictions on exports resulted in optical fiber raw material market access restrictions and instability in the availability of raw materials. These challenges compel firms to seek expensive alternative sourcing and production options or delay, which impacts the stability and development of the optical fiber raw material optical fiber raw material market.

- Low domestic production capacity within major markets: Some major markets, especially North America and Europe, have been facing a significant challenge due to a high dependency on imported optical fiber raw materials because of a lack of local production capacity. Such reliance places the supply chains in geopolitical risks and logistical delays that are compounded by customs and regulatory complexities. The 2023 report by the WTO observes that insufficient domestic production also makes a country susceptible to external shocks in trade, adding to the fluctuation in prices. For example, according to the official Fiber Broadband Association white paper, supply chain issues in 2022-2023 led to a significant increase in lead time of North American fiber manufacturers, often increasing to more than 52-60 weeks in critical fiber optic cable products, largely due to raw material shortages, import limitations and limited local inventory, resulting in schedule production and responsiveness to the optical fiber raw material market.

Optical Fiber Raw Material Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 4.8 billion |

|

Regional Scope |

|

Optical Fiber Raw Material Market Segmentation:

Fiber Type Segment Analysis

The single-mode fiber segment is projected to grow with the largest optical fiber raw material market share of 59.8% by 2035, owing to the high bandwidth and long-distance transmission abilities required in telecommunications and data centers. The increasing application of 5G networks and hyperscale data centers has become a worldwide demand. As of 2023, fiber broadband comprised 42 percent of fixed broadband subscriptions in OECD countries, and 5G coverage increased to 28% of mobile broadband subscriptions, a 9%-point increase over the prior year. Meanwhile, the U.S. DOE estimates that data center electricity consumption may increase more than 3x by 2028, driven by the high rates of AI and hyperscale infrastructure. The development of single-mode fiber technology, such as dispersion-shifted variants, is ongoing to augment performance and marketability. Amplified investments in fiber optic infrastructure to handle the growing data traffic confirm a significant role of single-mode fiber in global communications.

Raw Material Segment Analysis

Silicon tetrachloride in the optical fiber raw material market is expected to dominate the raw material segment with a revenue share of 44.6% by 2035, attributed to its involvement in the manufacture of high-purity optical fibers. It is the choice precursor in silica glass production because of its cost-effectiveness and availability. Germanium Tetrachloride and Phosphorus Oxychloride have a considerable distribution because of their doping qualities and ability to enhance the performance of fibers, and to modulate the refractive index in fiber cores, respectively. The expansion of industries worldwide in terms of fiber optic networks and heavier environmental regulations mandating more environmentally clean manufacturing processes is helping the industry develop. Emission controls are required by the U.S. EPA and provide an incentive to use newer methods of production that are efficient and less damaging to the environment. This is the dynamic that helps keep Silicon Tetrachloride on top of the supply chain of raw materials in optical fiber manufacturing.

End user Industry Segment Analysis

By 2035, the IT & Telecom segment is expected to grow steadily with optical fiber raw material market share of 41.3%, due to the worldwide growth in broadband, 5G networks, and cloud data centers. The industry requires the use of large amounts of optical fiber to ensure high-speed, reliable infrastructure. For example, the U.S. Department of Transportation strategic plans and the Ministry of Internal Affairs and Communications (MIC) in Japan also note fiber optic implementations as essential to growing 5G networks and broadband access, which directly top-up raw material usage to produce optical fibers. U.S. Federal Communications Commission (FCC) highlights the critical role of fiber optics in next-generation connectivity and infrastructure development that maintains the leading optical fiber raw material market share of IT & Telecom.

Our in-depth analysis of the optical fiber raw material market includes the following segments:

|

Segment |

Subsegment |

|

Raw Material |

|

|

Fiber Type |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Fiber Raw Material Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific optical fiber raw material market is anticipated to dominate with the largest revenue share of 38.6% during the projected years from 2026 to 2035, due to the massive development of digital infrastructure and growing telecommunications networks in the region. For example, 5G is expected to have a positive impact on the Indian economy valued at ₹36.4 trillion between 2023 and 2040. GSMA projects that telecom operators will spend approximately ₹1.6 trillion (USD 19.5 billion) on their networks in the period between 2022 and 2025. It is estimated that manufacturing will constitute 20% of the 5G adoption total benefit. In addition, the International Telecommunication Union (ITU) states that in the year 2024, there are about 5.5 billion individuals, 68% of the global population, utilizing the Internet. This is a rise of 53% in 2019 alone, and approximately 1.3 billion individuals have gone online in the same year. The growth of the optical fiber raw material market is further supported by government policies favoring technological advancement and greener production meant to be environmentally compliant, and regional policies in support of production that is energy efficient and environmentally compliant. In addition, regional trade agreements also support resilience in the supply chain of raw materials that can guarantee a stable supply of essential chemicals like silicon tetrachloride and germanium tetrachloride. This combination of technology and a conducive policy environment makes the Asia Pacific the most important growth centre for optical fibers' raw materials.

China’s optical fiber raw material market is expected to lead the Asia Pacific region with a substantial revenue share by 2035, mainly driven by the strong investment in 5G infrastructures and smart cities. The 14th Five-Year Plan (20212025) of China, which will see state-owned enterprises (SOE) invest in excess of 10 trillion yuan (about USD 1.49 trillion) in more than 1,300 new-infrastructure projects, such as telecommunications and digital infrastructure, is expected to further stimulate optical fiber components demand substantially. Furthermore, self-reliance policies have led to the domestic manufacturing of silicon tetrachloride and germanium tetrachloride of high purity and lessened reliance on imports. For example, companies such as New Silicon Technology in Qianjiang have become the dominant domestic manufacturer of high-purity silicon tetrachloride with 11N purity (99.999999999%) and are beginning global exports. Such a transition to self-reliance not only decreases dependence on imports, but it also expands global supply chains- establishing new opportunities and competition standards in new optical fiber raw material markets such as high-performance optical fiber raw materials.

The optical fiber raw material market in India is predicted to grow with the fastest CAGR over the forecast years, owing to high-speed digitization and government-driven policies such as the National Optical Fibre Network (NOFN), aimed at increasing rural network connectivity. The rapid infrastructure growth is evident in India, which has rolled out 3,726,574 km of optical fiber in June 2023, compared to 2,812,627 km of rolled out fiber at the end of September 2022. Fiber laying increased six times after the rollout of 5G, with an average of 101,550 km laid every month, which was half of the 16,712 km that was laid before the rollout. This infrastructure speedup highlights increased pressure on optical fiber raw materials, including glass preforms and specialty chemicals, and this puts the manufacturing industry in India in a position to respond with scaling up. India is steadily increasing its local capacity of major chemicals like phosphorus oxychloride to decrease its dependency on imports. By rigorously enforcing environmental clearances and regulations through the Ministry of Environment, Forest and Climate Change (MoEFCC), sustainable manufacturing is enforced by the encouragement to implement cleaner chemical processes. Further, the government subsidies on modernization of the chemical industry are also drawing in investments in research and development and infrastructure improvement to help India enhance supply chain resilience and serve the increasing requirements of the telecom sector.

North America Market Insights

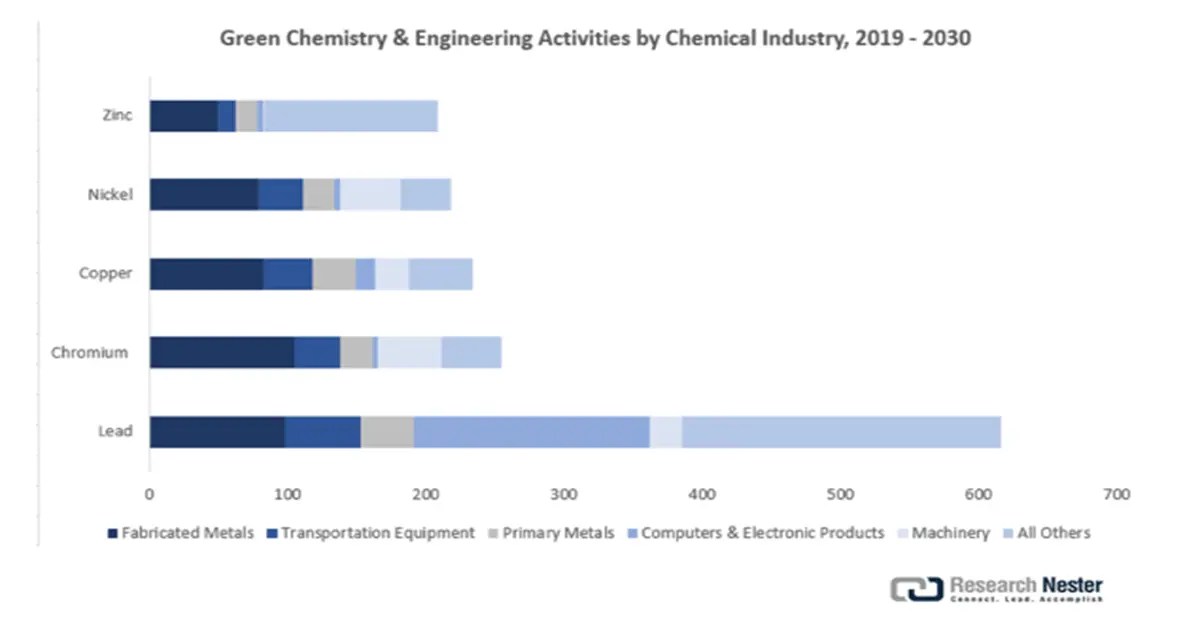

The North America optical fiber raw material market is projected to grow significantly during the forecast years, with a revenue share of 25.4%, driven by the increasing telecommunication infrastructure and the increasing demand to transmit data at high rates. In October 2023, the U.S. Department of Energy released USD 7 billion in its Regional Clean Hydrogen Hubs (H2Hubs) initiative, an element of an 8-billion-dollar federal authorization in the Bipartisan Infrastructure Law. It chose several hubs, e.g., the Gulf Coast Hydrogen Hub and California Hydrogen Hub, to fund between USD 750 million and USD 1.2 billion, and produce between 50 and 9,000 metric tons of hydrogen per day, depending upon the project. In addition, maintaining sustainable chemical design is encouraged by the U.S Environmental Protection Agency, through the Green Chemistry Program, and since 2018, thousands of reported green chemistry and engineering activities have been aimed at minimizing the number of hazardous materials. This trend of safer, more efficient chemical processes augments the increasing need of North America for high-purity optical fiber raw materials, primarily silica and dopants, in growing broadband and 5G networks, where the sustainability of the processes and minimization of waste are rapidly becoming of paramount importance to achieve regulatory and environmental goals. Agency regulations, including OSHA and NIST, can also help increase the safety and efficiency of manufacturing, which supports the competitive advantage of North America in the manufacture of optical fiber raw materials and success in the supply chain.

(Source: epa.gov)

The U.S. optical fiber raw material market is predicted to dominate the North American region with a substantial revenue share during the projected years, owing to heavy federal investments in next-generation communication infrastructure. The National Telecommunications and Information Administration (NTIA) provided USD 277 million in the Broadband Infrastructure Program in February 2022. The grants are to reach out to more than 133,000 unserved households in 13 states and a territory, which includes Georgia, Kentucky, Louisiana, Maine, Mississippi, Missouri, Nevada, North Carolina, Pennsylvania, Texas, Washington, and West Virginia. The funding facilitates the broadband implementation in rural and underserved communities and promotes access to high-speed internet services. Strict regulations set by the Environmental Protection Agency (EPA) to minimize emissions in the production of silicon tetrachloride are designed to assist manufacturers in using cleaner technologies. Further, the guidelines offered by OSHA guarantee safety in the workplace during the operation of a chemical plant, ensuring compliance and minimizing the risks of the operations. This collection of initiatives provides a strong culture of innovation to help the U.S. remain a major player in the world supply chain.

U.S. Trade: Optical Fibre Cables Imports vs Exports by Partner (1000 USD) (2022)

|

Partners |

Imports |

Exports |

|

Mexico |

1,672,519.20 |

738,565.86 |

|

India |

273,968.63 |

16,041.19 |

|

China |

191,623.46 |

24,554.66 |

|

Japan |

123,687.46 |

13,756.43 |

|

Germany |

45,107.12 |

39,169.13 |

|

United Kingdom |

32,868.05 |

24,645.03 |

|

Canada |

17,124.56 |

498,838.45 |

Source: worldbank.org

The optical fiber raw material market in Canada is expected to witness a steady growth rate in the North American region, backed by the government programs focused on sustainability and high-tech manufacturing. In 2023, Natural Resources Canada announced it would invest more than CAD 1.2 billion in clean chemical technologies, which is encouraging to produce key raw materials such as silicon tetrachloride in an energy-efficient way. Additionally, the Canadian Environmental Protection Act imposes strict environmental requirements on the manufacturing of chemicals, which promotes the utilization of greener processes. Innovation, Science and Economic Development Canada (ISED) also aids in advancing R&D activities in optical materials by providing grants and collaborations, and contributing to competitiveness. For example, ISED works with organizations as Mitacs that promote R&D. ISED is a co-founding partner, through this partnership, which assists in supporting industry R&D and innovation in Canada, especially among small to medium-sized enterprises (SMEs). The Canadian government's agenda of lowering carbon footprints in its manufacturing sector is in line with world sustainability, and this has led to the need to use more sophisticated raw materials in the telecommunication and data industries.

Europe Market Insights

The optical fiber raw material market in Europe is likely to grow steadily over the projected years, driven by an increased pace of digitalization in the region and strict environmental regulations. According to the European Commission Digital Economy and Society Index (DESI), 93.09% of households in Europe are connected to the internet, with coverage ranging from 99.06% in Luxembourg to 86.9% in Greece, which increases the pressure on optical fiber infrastructure and raw materials to be manufactured. The EU Green Deal is actively encouraging sustainable manufacturing, that is, the necessity to reduce carbon emissions and use energy-efficient chemical manufacturing processes. Such a regulatory climate encourages manufacturers to innovate in the manufacturing of major raw materials like silicon tetrachloride and germanium tetrachloride, which are vital in high-performance optical fibers. Moreover, Europe enjoys an established supply chain, which is aided by the cross-border trade agreements that guarantee consistency in the supply of raw materials despite global shocks. The combination of technological advancement, the ability to comply with regulations, and sustainable practices will ensure that Europe continues to have a competitive advantage in the optical fiber raw material market during the forecast period.

Meanwhile, in its National Infrastructure Strategy, the UK government has also given a priority to the fiber-optic network growth, which is accompanied by tax breaks and grants to encourage manufacturing and innovation domestically and to source the raw material. For example, as part of the National Infrastructure Strategy in the UK, Its Project Gigafast is projected to use public funding to the tune of £5 billion to extend gigafast broadband connections to the country, with grants and incentives to spur domestic innovation and manufacturing of products such as fiber-optic preforms and equipment used in deployment, including the sourcing of raw materials to produce the fiber-optic products.

Germany is a chemical industry hub, leading Europe, and is making major strides with federal funds towards research and development on the optical fiber raw materials. The Federal Ministry of Economic Affairs and Climate Action (BMWK) facilitates programs aimed at clean production and the resilience of supply chains of chemicals.

Key Optical Fiber Raw Material Market Players:

- Corning Incorporated (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Prysmian Group (Italy)

- FiberHome Telecommunication Technologies Co. (China)

- Yangtze Optical Fibre and Cable Co., Ltd. (China)

- Sterlite Technologies Limited (STL) (India)

- Nexans S.A. (France)

- CommScope Holding Company, Inc. (U.S.)

- Hengtong Group (China)

- LEONI AG (Germany)

- YOFC (Yangtze Optical Fibre and Cable Co.) (China)

- SGL Carbon (Germany)

- Toyobo Co., Ltd. (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Fujikura Ltd. (Japan)

- Corning Incorporated has become one of the world’s foremost suppliers of optical fiber and raw glass materials used to produce fiber-optic cable. Strategically, Corning invests heavily in R&D and manufacturing capacity expansion, such as new optical-fiber manufacturing facilities outside the U.S. to meet global demand. heir product portfolio spans high-performance optical fibers (single-mode, multi-mode, specialty fibers), preforms and glass cores, and cabled fiber solutions for networks - including long-haul, metro, data-center and FTTH (fiber-to-the-home) applications.

- Prysmian Group offers a comprehensive suite of fiber-optic products and cables: from bend-insensitive fibers to high-density multi-fiber ribbon cables, microduct cables, submarine cables, and terrestrial telecom cables for long-haul, metro, enterprise, and data-center use. The company’s strength also draws from its end-to-end expertise in cabling- from raw materials to submarine cable systems, which helps it secure large infrastructure contracts and maintain a competitive advantage.

- FiberHome Telecommunication Technologies Co. is officially recognized as a national-level industrialization base under China’s 863 Plan and has been involved in over 200 national/industry standards. The company has also pushed for innovation in fiber-optics, for instance, developing multi-core fiber, dispersion-compensating fiber, high-temperature and radiation-resistant fibers, and undertaking high-density / high-core-count cable production to meet growing demand from 5G, data centers, and large-scale network deployment.

- Yangtze Optical Fibre and Cable Co., Ltd. (YOFC) is one of the world’s largest suppliers of optical fiber, fiber-optic preforms, and cable products.Strategically, YOFC continues to expand manufacturing capacity across China and internationally, while investing in R&D to advance low-loss and specialty fiber technologies. Growth is driven by China’s aggressive 5G and fiber-broadband rollout, global telecom expansion, and YOFC’s vertically integrated operations, which enhance cost efficiency and product reliability.

- Sterlite Technologies Limited (STL) is a major global provider of optical fiber, preforms, specialty fibers, optical cables, and integrated digital-network solutions. STL’s product suite covers optical fiber, high-density cable designs, fiber deployment services, and network software, enabling end-to-end telecom infrastructure delivery. STL’s growth stems from its robust presence in emerging optical fiber raw material markets, strong innovation pipeline, and ability to deliver both raw fiber materials and turnkey network solutions.

Below is the list of some prominent players operating in the global optical fiber raw material market:

The global optical fiber raw material market is marked by substantial competition among the major players. Corning Incorporated holds a strong standing with the optical fiber raw material market share of about 45-48% due to its complicated production schemes and intensive innovations. Prysmian Group comes in with a optical fiber raw material market share of 12-15% which is reinforced by the strategic acquisitions such as Draka Communications and the presence of the European submarine cable market. In addition, the Japanese firms to be included are Sumitomo Electric Industries, Fujikura, and OFS Fitel, with considerable shares that add up to a good share of the optical fiber raw material market. Moreover, Yangtze Optical Fiber and Cable Co., Ltd. and Hengtong Group are among the companies in Asia that are expanding their presence with emphasis on the high-capacity transoceanic communication system and space communication usage. Strategic moves that have been undertaken in these companies are technological developments, capacity building, and focused acquisitions in a bid to improve their optical fiber raw material market presence and supply to meet the increasing demand for optical fiber materials.

Recent Developments

- In July 2025, STL (Sterlite Technologies Ltd.) commissioned the first green hydrogen and green oxygen plant in Maharashtra, in partnership with Hygenco, and specifically aligned with its production of glass preforms in Chhatrapati Nagar. The project has also rendered STL one of the first manufacturers of optical fiber in the world to adopt 100% green hydrogen in its production, which also supports its Net Zero by 2030 ambition. The proposed Industry 4.0-enabled plant is expected to have autonomous control over energy, control in real time, and automated systems to achieve a reduction in carbon emissions of approximately 30% a year. The project establishes a new sustainability standard within an optical fiber raw material supply chain.

- In March 2025, Sumitomo Electric Industries, Ltd. entered into an assembly deal with 3M to manufacture optical fiber connectivity products by using 3M Expanded Beam Optical (EBO) interconnect technology. This scalable, high-performance solution, which can be deployed in single-mode or multi-mode, offers nonphysical contact optical coupling to minimize wear, risk of contamination, and maintenance requirements, but increases deployment speed. Sumitomo integrated its fusion splicing experience to design termination equipment with 12- and 16-fiber EBO cable assemblies, and with companion patch panels, interconnect panels, cassettes, and 12 to 16-fiber count pre-connectorized cables.

- In July 2025, Fujikura Ltd. presented two innovative high-density optical cable solutions commercially. First, the company launched a 16-fiber SWR/WTC cable line, which is specifically designed to address data centers in response to increasing AI-driven demand. Second, Fujikura introduced the first 13,824-fiber SWR 13,824/WTC cable in the world, which is commercially available today with matching termination elements. These technologies bring important advances in fiber density, splicing efficiency, and flexibility of installation- ideal in hyperscale data centers. The introduction brings Fujikura into the lead of ultra-capacity fiber infrastructure needed in next-generation cloud and artificial intelligence computing settings.

- Report ID: 8287

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Fiber Raw Material Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.