Carbon Fiber Reinforced Plastic Market Outlook:

Carbon Fiber Reinforced Plastic Market size was valued at USD 23.53 Billion in 2025 and is set to exceed USD 54.19 Billion by 2035, expanding at over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon fiber reinforced plastic is estimated at USD 25.37 Billion.

The growth of the market can be attributed to the increasing expansion of the automotive industry in recent years. The high demand for vehicles from the population is expected to increase the utilization rate of carbon fiber reinforced plastic in automobiles over the forecast period. According to recent statistics, the Indian automotive industry is projected to rise by up to USD 282 billion by 2026. Further, the global automotive industry is expected to reach approximately USD 9 trillion by 2030.

Carbon fiber reinforced plastic market trends, such as, the burgeoning population propelling the demand for lightweight vehicles with fuel-efficient properties backed by government regulations to curb vehicular pollution, are expected to increase the sales of carbon fiber reinforced plastic during the forecast period. Furthermore, the high number of vehicles on the road is expected to increase the use of carbon fiber reinforced plastic, propelling the market’s size during the forecast period. By the end of the first quarter of 2022, it was estimated that there were approximately 1.45 billion vehicles on the roads across the globe. Out of these, around 1 billion are estimated to be passenger cars.

Key Carbon Fiber Reinforced Plastic Market Insights Summary:

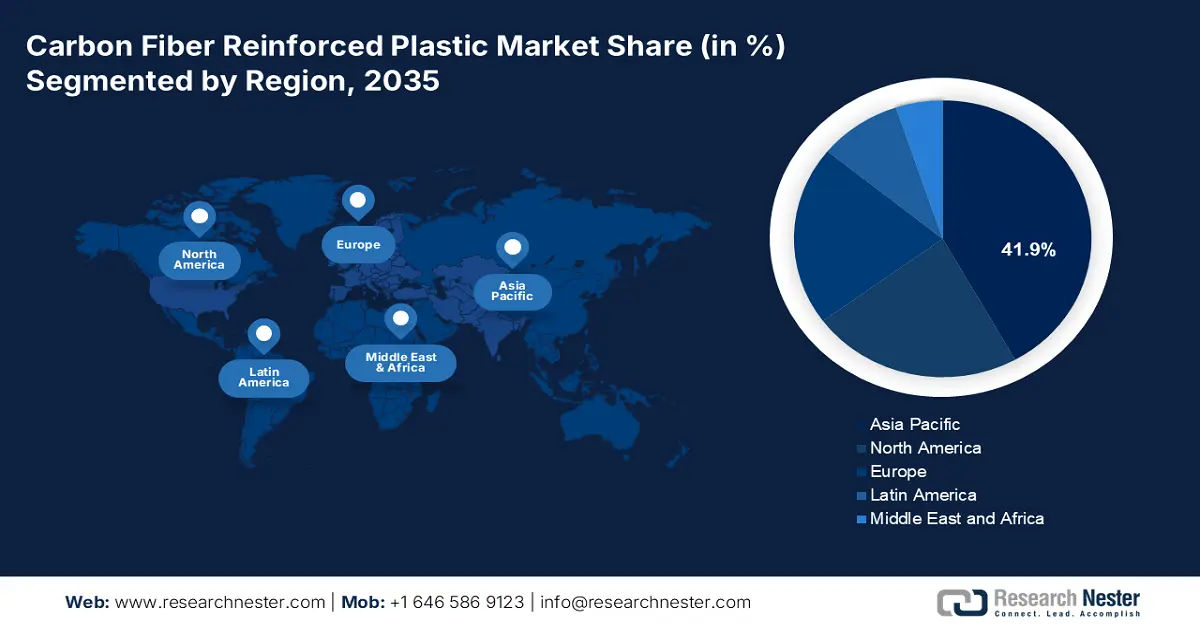

Regional Highlights:

- The Asia Pacific carbon fiber reinforced plastic market will hold around 41.9% share by 2035, fueled by rising vehicle demand and rapid automotive growth.

Segment Insights:

- The automotive segment in the carbon fiber reinforced plastic market is expected to hold the largest share by 2035, driven by rising global automobile demand and manufacturing across both electric and combustion engine vehicles.

- The thermosetting segment in the carbon fiber reinforced plastic market is expected to achieve a significant share by 2035, attributed to the extensive use of thermosetting resins with high strength, adhesion, and adaptability across multiple industries.

Key Growth Trends:

- Surge in the Production Volume of Vehicles

- Growth in the Aerospace and Defense Industry

Major Challenges:

- Presence of Prolonged Production Cycles

- Easy Availability of Steel Counterparts

Key Players: SGL Carbon SE, Toray Industries, Inc., Röchling SE & Co. KG, Nikkiso Co., Ltd., Formosa Plastics Corporation, U.S.A., Teijin Limited, Hexcel Corporation, PHC Holdings Corporation, Solvay SA, Nippon Graphite Fiber Co., Ltd.

Global Carbon Fiber Reinforced Plastic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.53 Billion

- 2026 Market Size: USD 25.37 Billion

- Projected Market Size: USD 54.19 Billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 9 September, 2025

Carbon Fiber Reinforced Plastic Market Growth - Drivers and Challenges

Growth Drivers

- Surge in the Production Volume of Vehicles – As per the Organization of Motor Vehicle Manufacturers, the global production of vehicles was 80,145,988 units in 2021. This is a rise from 77,711,725 units in 2020.In the automotive industry, carbon fiber reinforced plastics are being highly utilized owing to their considerable weight savings, enhanced tensile strength, fatigue resistance, and durability. Thus, the increase in demand for and production of vehicles is expected to create lucrative opportunities in the market.

- Growth in the Aerospace and Defense Industry – Recently, the revenue generation by the global aerospace and defense industry was approximately USD 700 billion in 2021, an increment of 4% from 2020, and there was a profit generation of almost USD 6o billion in the same time period.

- Burgeoning of Population with Middle Income - According to the World Bank, the total population with a middle income in the world rose from USD 5.51 billion in 2015 to USD 5.86 billion in 2021.

- Higher Utilization of Carbon Fiber Reinforced Plastic in Construction Sector – for instance, the rise in construction was observed to be around 11% in 2021 than the previous year globally, while total construction output is projected to hit approximately USD 15 trillion by 2030 across the globe.

Challenges

- Presence of Prolonged Production Cycles

- Easy Availability of Steel Counterparts

- High Costs Associated with Carbon Fiber Reinforced Plastics

- Carbon fiber reinforced plastic is expensive since its cost is directly associated with the cost of the precursor from which it is acquired. The manufacturing process of carbon fiber reinforced plastic is also highly-specialized and it also requires advanced machinery for production. Moreover, the machinery to produce carbon fiber reinforced plastic can cost thousands of dollars that increases the price of the end product. Hence, it is expected to hamper the market’s growth.

Carbon Fiber Reinforced Plastic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 23.53 Billion |

|

Forecast Year Market Size (2035) |

USD 54.19 Billion |

|

Regional Scope |

|

Carbon Fiber Reinforced Plastic Market Segmentation:

Application Segment Analysis

The global carbon fiber reinforced plastic market is segmented and analyzed for demand and supply by application into aerospace & defense, wind turbine, automotive, sports equipment, building & construction, and others. Out of these segments, the automotive segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for and manufacturing of automobiles, whether they are electric or powered by combustion engines, across the globe. This factor is projected to hike the utilization of carbon fiber reinforced plastic, and it is predicted to drive the segment’s growth in the market. As per the Organization of Motor Vehicle Manufacturers, the sales of vehicles rose from 78, 774,320 units in 2020 to 82, 684, 788 in 2021 worldwide.

Type Segment Analysis

The global carbon fiber reinforced plastic market is also segmented and analyzed for demand and supply by type into thermosetting, thermoplastic, and others. Amongst these segments, the thermosetting segment is expected to garner a significant share. The growth of the segment is ascribed to the escalated utilization of thermosetting resin such as, vinyl, epoxy, polyester, and others in the formation of carbon fiber reinforced plastics since it comprises of the significant properties that are high strength, adhesion, low shrinkage, adaptability, and others. It is observed that thermosetting resins shrinks only by 2 to 8 % during polymerization. Additionally, thermosetting resins are heavily used in multiple industries, such as, automotive, aerospace, marine, oil & gas, wind energy, electrical & electronics, and others.

Our in-depth analysis of the global carbon fiber reinforced plastic market includes the following segments:

|

By Raw Material |

|

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Fiber Reinforced Plastic Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is projected to account for more than 41.9% market share by 2035. The growth of the market can be attributed majorly to the increasing demand for vehicles and expansion of rapid growth in automotive industry. The International Organization of Motor Vehicles stated that the total production of vehicles in China rose from 44,276,549 units in 2020 to 46,732,785 units in 2021. Similarly, the total sales in the region rose from 40,322,544 in 2020 to 42,663,736 units in 2021. In addition, the presence of major key players and leading exporters and importers of vehicles in the region is expected to offer growth opportunities for the market in the forecast period. In 2021, China exported around 400,000 commercial vehicles and around 2 million passenger vehicles. India and Japan are also projected to obtain the notable share in the global automotive industry, backed by the higher manufacturing of commercial vehicles. For instance, in 2021, nearly 75,0000 units of commercial cars were produced in India while Japan manufactured approximately 12,000,00 units of commercial cars in the similar year. Furthermore, the growing population and rapid migration of people from rural to urban areas has triggered the demand for higher construction of building that requires the heavy utilization of carbon fiber reinforced plastic. Hence, it is anticipated to boost the market’s growth in the region.

Carbon Fiber Reinforced Plastic Market Players:

- SGL Carbon SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toray Industries, Inc.

- Röchling SE & Co. KG

- Nikkiso Co., Ltd.

- Formosa Plastics Corporation, U.S.A.

- Teijin Limited

- Hexcel Corporation

- PHC Holdings Corporation

- Solvay SA

- Nippon Graphite Fiber Co., Ltd.

Recent Developments

-

Solvay SA and SGL Carbon SE has entered into a partnership to develop composite materials based on large-tow intermediate modulus (IM) carbon fiber. These materials are expected to reduce costs and CO2 emissions, and improve the production process and fuel efficiency of next-generation commercial aircraft.

-

Teijin Limited and Mitsui Chemicals, Inc. has joined hands to develop and market biomass-derived bisphenol A (BPA) and polycarbonate (PC) resins, that will support efforts to achieve carbon neutrality by reducing greenhouse gas (GHG) emissions. Furthermore, Tenjin Limited is also planning to start the production and development of biomass PC resin utilizing the similar BPA.

- Report ID: 4402

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.