Agrifiber Products Market Outlook:

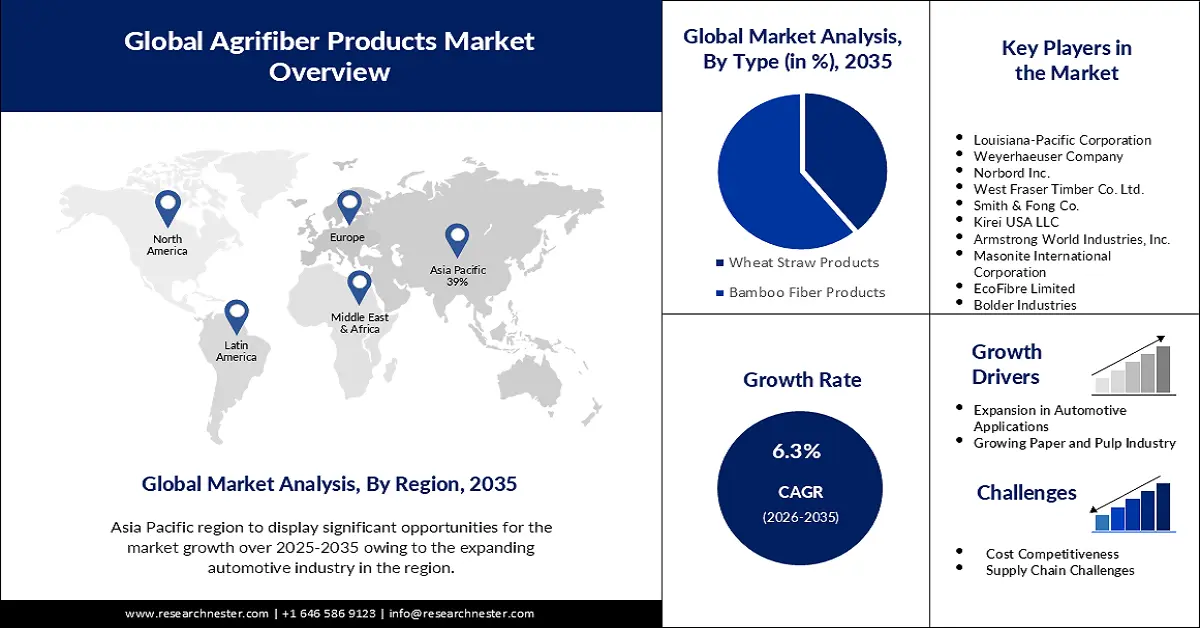

Agrifiber Products Market size was valued at USD 2 billion in 2025 and is set to exceed USD 3.68 billion by 2035, registering over 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agrifiber products is estimated at USD 2.11 billion.

In recent years, the global marketplace has witnessed a notable surge in the demand for sustainable and eco-friendly materials, and this trend is significantly propelling the growth of the market. The escalating awareness of environmental issues and the pressing need for more sustainable consumption patterns have led both consumers and industries to seek alternatives to conventional materials, with a keen focus on reducing the ecological footprint. Governments and regulatory bodies worldwide are actively promoting sustainable practices, further fostering the adoption of agrifiber products. Regulations and standards that encourage the use of environmentally friendly materials in various industries create a conducive environment for the growth of the agrifiber market. A report revealed that 73% of global consumers are willing to pay more for products that come from sustainable sources.

The growing concern over environmental degradation and climate change has driven a paradigm shift in consumer behavior. Individuals are increasingly prioritizing products that align with their eco-conscious values, seeking alternatives that contribute to a more sustainable future. Agrifiber products, derived from agricultural residues and fibers, present an attractive solution as they utilize by-products, reducing waste and mitigating the environmental impact associated with traditional materials.

Key Agrifiber Products Market Insights Summary:

Regional Highlights:

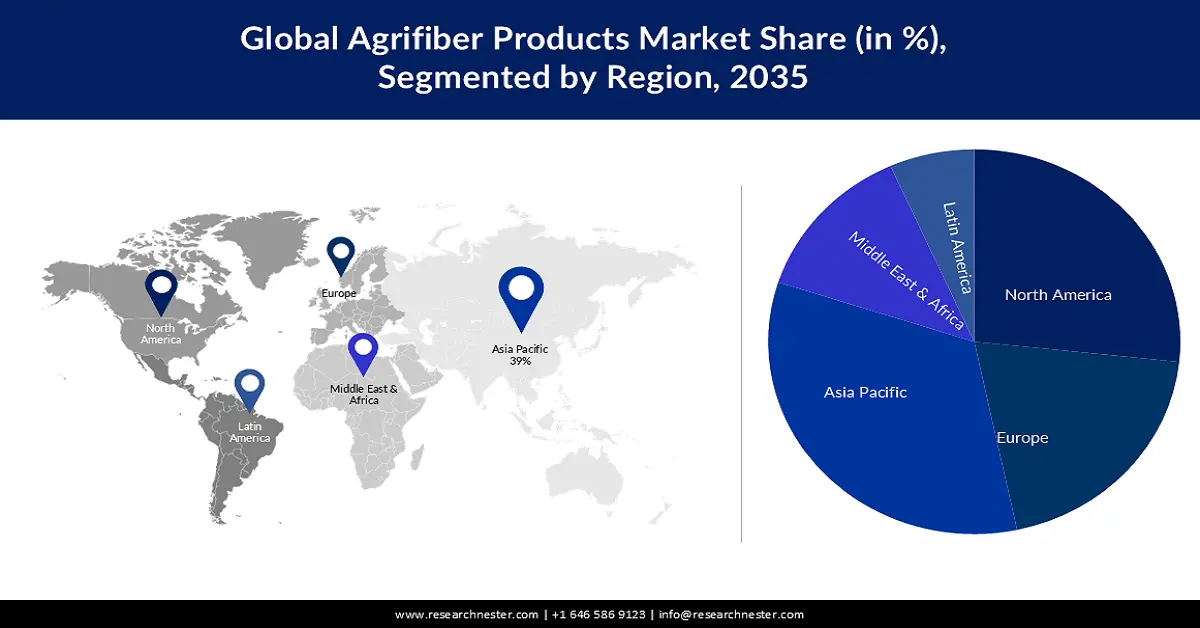

- Asia Pacific agrifiber products market achieves a 39% share by 2035, fueled by rapid economic growth, government initiatives, changing consumer preferences, expansion in construction and real estate, and a focus on sustainability.

- North America market will exhibit significant CAGR during 2026-2035, attributed to green building practices in the construction sector and the increasing demand for environmentally friendly materials.

Segment Insights:

- The bamboo fiber products segment in the agrifiber products market is forecasted to capture a 61% share by 2035, fueled by government support and policies promoting sustainable practices.

Key Growth Trends:

- Rising Preference for Biodegradable Packaging

- Expansion in Automotive Applications

Major Challenges:

- Rising Preference for Biodegradable Packaging

- Expansion in Automotive Applications

Key Players: Louisiana-Pacific Corporation, Weyerhaeuser Company, Norbord Inc., West Fraser Timber Co. Ltd., Smith & Fong Co., Kirei USA LLC.

Global Agrifiber Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.11 billion

- Projected Market Size: USD 3.68 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Brazil, Germany, India

- Emerging Countries: China, India, Thailand, Indonesia, Malaysia

Last updated on : 16 September, 2025

Agrifiber Products Market Growth Drivers and Challenges:

Growth Drivers

- Rising Preference for Biodegradable Packaging: The global push towards sustainability has significantly increased the demand for biodegradable packaging solutions, and agrifiber products are emerging as a key player in this arena. Consumers and businesses alike are seeking alternatives to traditional plastic packaging due to its detrimental impact on the environment. Agrifiber-based packaging offers a sustainable option, as it is not only biodegradable but also often compostable, addressing concerns related to plastic pollution. According to a report, the global biodegradable packaging sales are expected to reach USD 21.15 billion by 2025.

- Expansion in Automotive Applications: Agrifiber products are finding applications in the automotive industry as a sustainable alternative to traditional materials. For instance, natural fibers derived from plants like kenaf or flax are being used to reinforce plastic components in car interiors. This trend is driven by the automotive sector's growing emphasis on lightweight and eco-friendly materials to enhance fuel efficiency and reduce environmental impact.

- Integration in Paper and Pulp Industry: Agrifiber products, such as those derived from sugarcane bagasse or wheat straw, are being utilized as alternatives to traditional wood pulp in the paper and pulp industry. The shift towards using agricultural residues for paper production reduces the dependence on forest resources and promotes sustainable paper manufacturing practices. This integration aligns with the global movement towards responsible forestry management and conservation. This growth indicates the increasing importance of non-wood pulp sources, including agrifiber, in the paper and pulp industry as a sustainable and environmentally friendly alternative to traditional wood-based pulp.

Challenges

- Limited Awareness and Education: One of the primary challenges is the limited awareness and understanding of agrifiber products among consumers and businesses. Many are unfamiliar with the benefits and applications of these materials, which hinders their widespread acceptance. The lack of awareness can result in a slower adoption rate, as potential users may opt for traditional materials due to familiarity. Industry stakeholders need to invest in educational campaigns to increase awareness about the environmental benefits, performance characteristics, and diverse applications of agrifiber products. Agrifiber products may face challenges in achieving cost competitiveness compared to traditional materials. The production processes and raw materials involved in creating agrifiber products can sometimes be more expensive.

- Cost Competitiveness

- Supply Chain Challenges

Agrifiber Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 3.68 billion |

|

Regional Scope |

|

Agrifiber Products Market Segmentation:

Type Segment Analysis

The bamboo fiber products segment in the agrifiber products market is estimated to gain the largest revenue share of 61% in the year 2035. Government support and policies promoting sustainable practices have played a significant role in the growth of bamboo fiber products. Subsidies, incentives, and regulations favoring eco-friendly materials contribute to the overall market development and encourage businesses to invest in bamboo-based solutions. In countries like China, where bamboo is abundantly available, government initiatives supporting bamboo cultivation for industrial purposes have been notable. These initiatives aim to enhance bamboo's economic value and contribute to sustainable development. For instance, China's 13th Five-Year Plan includes provisions for expanding the bamboo industry, emphasizing its strategic importance. The growth of the bamboo fiber products segment is driven by a combination of eco-friendly consumer preferences, sustainable and renewable sourcing, biodegradability, versatile applications, increasing demand in the textile industry, and supportive government policies.

End User Segment Analysis

Agrifiber products market from the automotive segment is expected to garner a significant share in the year 2035. The economic viability of agrifiber products is a critical factor influencing their adoption in the automotive sector. As technology and manufacturing processes evolve, agrifiber solutions are becoming more cost-competitive, providing automakers with sustainable alternatives without compromising on economic feasibility. A study estimates that the cost of batteries, a significant component in electric vehicles, could decline by 50% by 2030. This cost reduction, coupled with advancements in agrifiber technology, positions sustainable materials as economically competitive solutions in the automotive manufacturing landscape. The automotive segment in the market is witnessing substantial growth driven by the imperative for weight reduction, consumer preferences for sustainable materials, circular economy considerations, regulatory initiatives, technological advancements, and the increasing economic viability of agrifiber solutions. Ongoing technological advancements and material innovations in the automotive sector are opening new possibilities for the integration of agrifiber products. Research and development initiatives are exploring ways to enhance the performance, durability, and aesthetic qualities of agrifiber-based materials, expanding their applications in vehicle manufacturing.

Our in-depth analysis of the global agrifiber products market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agrifiber Products Market Regional Analysis:

APAC Market Insights

The agrifiber products market in the Asia Pacific region is projected to hold the largest revenue share of 39% by the end of 2035. The Asia Pacific region is placing increased emphasis on renewable energy and circular economy practices. Agrifiber products align with these goals, offering a sustainable alternative to traditional materials and contributing to the region's commitment to resource efficiency and environmental stewardship. As an example, China, a key player in the Asia Pacific region, is investing heavily in circular economy practices. The Chinese government's Circular Economy Promotion Law aims to encourage sustainable production and consumption, creating a conducive environment for the adoption of agrifiber materials. The market in the Asia Pacific region is further flourishing, driven by rapid economic growth, government initiatives, changing consumer preferences, expansion in construction and real estate, innovations in raw material sourcing, and a regional focus on sustainability.

North American Market Insights

North America region is set to witness significant growth till 2035. North America has witnessed a surge in sustainability initiatives, particularly in the construction sector. Green building practices, which emphasize the use of environmentally friendly materials, are driving the demand for agrifiber products in applications such as panels, boards, and insulation materials. The U.S. Green Building Council reports that the green building market in the United States is expected to grow by 20% annually, reaching USD 81 billion by 2022. This growth underscores the increasing adoption of sustainable materials like agrifiber in construction, positioning them as integral components of green building practices. Consumer awareness and demand for sustainable products have gained considerable momentum in North America. As eco-conscious consumers seek alternatives to traditional materials, the agrifiber products market is benefiting from a heightened focus on renewable and environmentally friendly options. Government regulations and certification programs are playing a pivotal role in driving the adoption of agrifiber products.

Agrifiber Products Market Players:

- Louisiana-Pacific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Weyerhaeuser Company

- Norbord Inc.

- West Fraser Timber Co. Ltd.

- Smith & Fong Co.

- Kirei USA LLC

- Armstrong World Industries, Inc.

- Masonite International Corporation

- EcoFibre Limited

- Bolder Industries

Recent Developments

- Strategic Focus on Timberland Assets and Sustainable Forestry: Weyerhaeuser remains focused on managing its vast timberland holdings sustainably and responsibly. They actively participate in reforestation programs, invest in innovative silvicultural practices, and collaborate with conservation organizations to protect vital ecosystems.

- Ongoing Investments in Wood Products Manufacturing: Weyerhaeuser continues to invest in modernization and expansion of their wood products manufacturing facilities across the US and Canada. This focus on operational efficiency and product quality enhances their competitiveness in the lumber and other wood product markets.

- Report ID: 5549

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agrifiber Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.