Optical Coating Equipment Market Outlook:

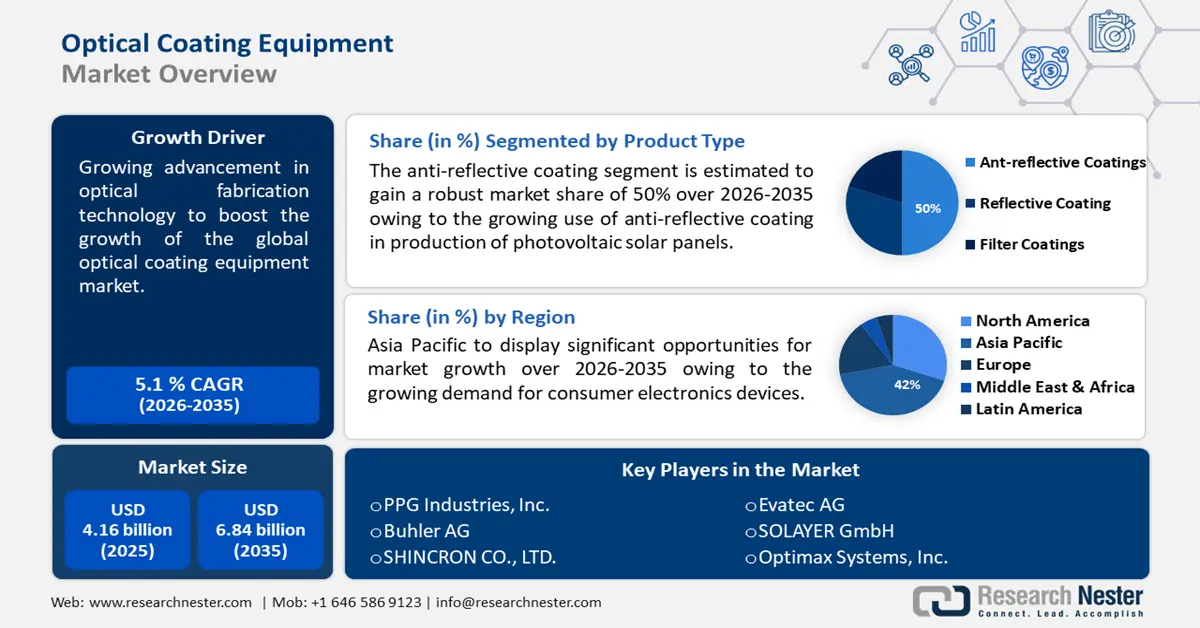

Optical Coating Equipment Market size was over USD 4.16 billion in 2025 and is projected to reach USD 6.84 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of optical coating equipment is assessed at USD 4.35 billion.

The growth of the market can be attributed to the expanding advancements in optical fabrication technology and the rising installation of such equipment, backed by enhancements in optical coating capabilities for providing high-quality coatings. For instance, Precision Glass and Optics officially confirmed the installation of a new optical monitoring system, the SL-2012A SpectraLock from Eddy Company, in March 2019. The cutting-edge technique utilizes in-situ optical monitoring and rate control to generate single and multi-layered thin films with an extreme level of accuracy and precision. Moreover, the surging use of optical coatings in numerous applications comprising automotive, agriculture, telecommunication, and so on is another significant factor that is projected to propel the growth of the global optical coating equipment market in the forecast period.

In addition to these, factors that are believed to fuel the market growth of optical coating equipment include their outstanding properties to enhance the visual appeal of glass. For instance, the application of optical coatings in architectural glass enhances the dichroic properties which help to improve the visual appeal of the glass when applied in buildings. Additionally, the surging use of optical coating equipment in fiber optics, along with the rise in the adoption of optically coated materials across various end-user industry verticals are some of the further factors anticipated to drive the growth of the market during the forecast period.

Key Optical Coating Equipment Market Insights Summary:

Regional Highlights:

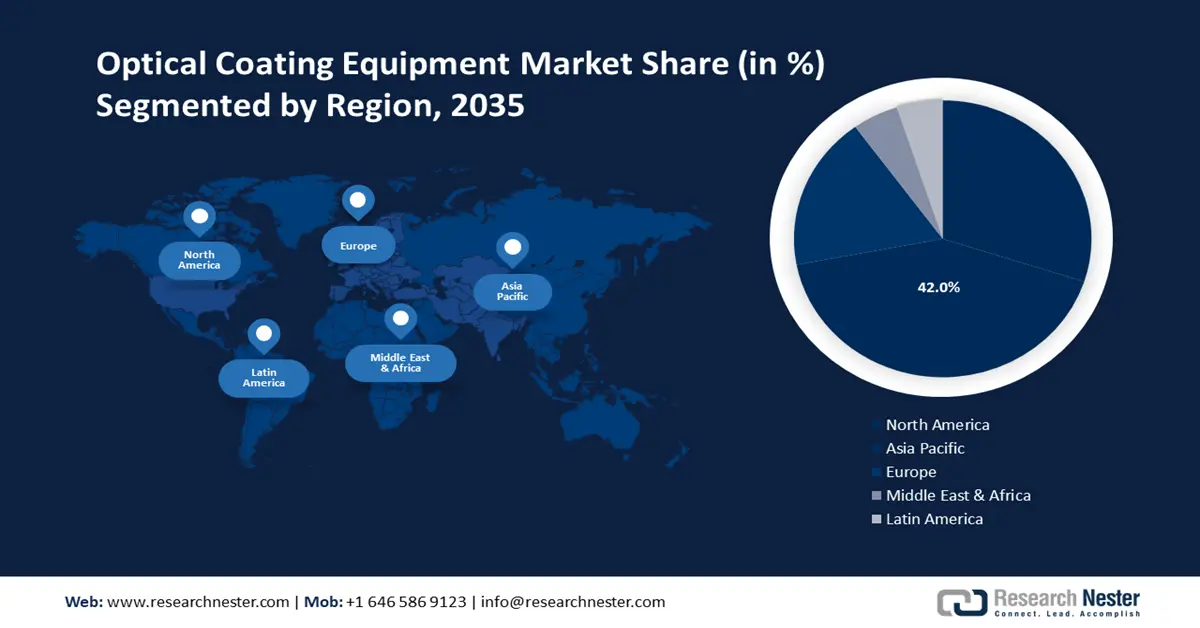

- Asia Pacific optical coating equipment market will dominate over 42% share by 2035, driven by increasing demand for consumer electronics, growth in the automotive industry, and demand from aerospace and military sectors.

- North America market will capture a 30% share by 2035, driven by demand for optical coating in aerospace, military, eco-friendly applications, and solar industry adoption.

Segment Insights:

- The anti-reflective coatings segment in the optical coating equipment market is projected to secure a 50% share by 2035, driven by increasing demand in solar PV and optoelectronics due to its anti-glare properties.

- The vacuum deposition segment in the optical coating equipment market is projected to achieve a 48% share by 2035, fueled by wide usage in optics, automotive, and semiconductor coating applications.

Key Growth Trends:

- Worldwide Surge in the Production of Smartphones

- Worldwide Escalation in Fiber Optics Industry

Major Challenges:

- High Cost of Optical Coatings Equipment

- Fluctuating Price of Raw Metals and Oxides

Key Players: Coburn Technologies, Inc., Mustang Vacuum Systems, SOLAYER GmbH, Bühler AG, SHINCRON CO., LTD., Optorun Co., Ltd., Evatec AG, Optimax Systems, Inc., Cascade Optical Corporation, PPG Industries, Inc.

Global Optical Coating Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.16 billion

- 2026 Market Size: USD 4.35 billion

- Projected Market Size: USD 6.84 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, Taiwan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Optical Coating Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Worldwide Surge in the Production of Smartphones – With time, the global demand for smartphones and tablets has been surging as these telecommunication devices have become an integral part of our day-to-day life. Currently, several optical sensors are now included in smartphones to monitor light and color. Moreover, anti-reflective coatings are a necessary tool for optical developers to decrease undesirable reflections and ghost images in camera optics and produce the highest imaging quality possible. Thus, the increasing demand and production of smartphones and tablets are deriving the massive demand for optical coating equipment. For instance, the cumulative number of smartphone shipments worldwide reached around 1.25 billion units in 2022.

-

Global Upsurge in the Adoption of Smart TVs - Smart TVs are engineered to be adaptable with a wide range of gadgets, allowing consumers to watch their favorite content on any gadget. The possibility to watch content other than standard TV channels is the most valuable feature of a Smart TV. A Smart TV provides access to favorite video-on-demand services such as Netflix, YouTube, and Amazon as well as music streaming services including Spotify, and a variety of games and sports content. These smart TVs also have specific optical coatings applied on their screen which can enhance the viewing experience. Thus the surge in the adoption of smart TVs is estimated to further drive market growth in the coming years. For instance, more than 250 million smart TV units were sold in 2019 across the globe. Further, this yearly total is estimated to potentially increase to around 290 million units by 2025.

-

Worldwide Escalation in Fiber Optics Industry – Based on a report, by 2027, the global fiber optics industry is projected to have a worth of around USD 9 billion.

-

Growing Investment in Telecommunication Sector – For instance, in the United States, the IT sector investment in telecommunication services augmented by around USD 1.40 trillion in 2022.

-

Worldwide Surging Adoption of Household and Smart Kitchen Appliances – The deployment of cutting-edge technology in home appliances has been increasing day by day. Currently, a larger pool of technologically advanced appliances is available to make life simple. Additionally, technology-driven smart kitchen appliances are gaining more traction among people as of their energy efficiency, convenience, expert cooking features, and simplified cooking. Thus, the surge in the household, as well as smart kitchen appliances is also estimated to spur the market growth of optical coating equipment in the coming years. For instance, by 2026, worldwide demand for home appliances is estimated to rise by nearly USD 28 billion. Whereas, the household appliances retail sale surged by around 450 billion in 2021 throughout the world.

Challenges

- High Cost of Optical Coatings Equipment - The cost of optical coating equipment is usually very high and hence it is not possible for many small and medium-sized enterprises to purchase and install such costlier equipment. Such a factor is anticipated to hamper the market growth during the forecast period.

- Fluctuating Price of Raw Metals and Oxides

- Requirement of High Initial Investment

Optical Coating Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 4.16 billion |

|

Forecast Year Market Size (2035) |

USD 6.84 billion |

|

Regional Scope |

|

Optical Coating Equipment Market Segmentation:

Product Type

The global optical coating equipment market is segmented and analyzed for demand and supply by product type into filter coatings, reflective coatings, anti-reflective coatings, and others. Out of these four types of segments, the anti-reflective coatings segment is estimated to gain the largest market share of about 50% in the year 2035. The growth of the segment can be attributed to the increasing demand and usage of anti-reflective coatings in the production of photovoltaic solar panels owing to the upsurge in solar PV installation throughout the world. For instance, till December 2022, Australia had over 3.38 million PV installations with an installed output of more than 29.7 gigawatts. In addition to this, its rising usage in optoelectronics applications and consumer electronics is also estimated to propel the growth of the segment as these coatings are efficient in eliminating reflection and glare from lenses. This coating in lenses also allows more amount of light to pass through the lens. As a result, these all factors are projected to drive the growth of the segment in the projected time frame.

Technology Type

The global optical coating equipment market is also segmented and analyzed for demand and supply by technology type into ion beam sputtering, evaporation deposition, vacuum deposition, and advanced plasma reactive sputtering. Amongst these segments, the vacuum deposition segment is expected to garner a significant share of around 48% in the year 2035. Vacuum coating is performed usually in two methods, namely, physical vapor deposition (PVD) or chemical vapor deposition (CVD). Vacuum deposition technology is used widely in ophthalmic optics applications, architectural glass, and metallization of headlights in the automotive industry and others. Moreover, the surging use of vacuum deposition technology for coating semiconductor devices, magnetic films, and so on is another crucial factor that is projected to drive segmental growth in during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Technology Type |

|

|

By Substrate Type |

|

|

By End-User Industries |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Coating Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 42% by 2035. The growth of the market can be attributed majorly to the increasing demand for consumer electronic devices such as smartphones, smart TVs, tablets, gaming consoles, and digital radios, along with the massive growth in the automotive industry. For instance, the revenue of consumer electronics in Southern Asia extended to approximately USD 92 billion in 2021. In addition, the growing demand for optical coating equipment from the aerospace and military sectors is also projected to boost the market growth in the APAC region during the forecast period.

North American Market Insights

The North American optical coating equipment market, amongst the market in all the other regions, is projected to hold the second largest share of about 30% during the forecast period. The growth of the market can be attributed majorly to the surge in demand for optical coating applications in the aerospace and military industries. Additionally, the rising demand for eco-friendly coating applications for sensing applications and laser systems in the region is also anticipated to drive market growth over the forecast period. In addition to this, the significantly increased adoption of solar panels backed by the rise in the solar industry is also estimated to push the market growth further during the forecast period in the region. For instance, by 2020, roughly 5% of homes in the United States had installed solar panels. Hence, these all factors are anticipated to radically accelerate the market growth in the region during the forecast period.

Europe Market Insights

Further, the optical coating equipment market in the European region, amongst the market in all the other regions, is projected to hold a considerable share of about 18% by the end of 2035. The growth of the market can be attributed majorly to the increasing growth in the telecommunication sector, followed by the surging usage of these coatings in automobile displays, car windows, and so on. In addition to this, the strong presence of the automobile sector in the region, coupled with the rising demand for low-cost vehicles is also estimated to spike the market growth further throughout the forecast period in the region.

Optical Coating Equipment Market Players:

- Coburn Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mustang Vacuum Systems

- SOLAYER GmbH

- Bühler AG

- SHINCRON CO., LTD.

- Optorun Co., Ltd.

- Evatec AG

- Optimax Systems, Inc.

- Cascade Optical Corporation

- PPG Industries, Inc.

Recent Developments

-

Coburn Technologies, Inc. announced that it has launched the spin lens coater, Velocity LTE Spin Coating System, under its portfolio of Velocity coating platforms. The semi-automated lens coater is designed specifically for use in small to mid-sized labs and allows its user to optimize the coating process for different lens parameters.

- PPG Industries, Inc. announced that it has acquired Arsonsisi, an industrial coatings company in Milan, Italy, for powder coatings. With this acquisition, PPG is all set to expand its powder coatings offering across Europe, the Middle East, and Africa.

- Report ID: 2864

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Coating Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.