Music Streaming Market Outlook:

Music Streaming Market size was valued at USD 56.3 billion in 2025 and is projected to reach USD 205.9 billion by the end of 2035, rising at a CAGR of 15.5% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of music streaming is estimated at USD 65.0 billion.

The international music streaming market is all set to witness tremendous growth in the upcoming years, owing to the increasing internet penetration, rising smartphone adoption, and a shift from ownership to on-demand consumption. In this regard, a report from IFPI in 2025 disclosed that in 2024, streaming continued to be the dominant force in the global recorded music industry, which accounted for 69.0% of all revenues. This format experienced significant growth, wherein the global subscription streaming revenue increased by 9.5%. The study also found that for the first time, total streaming revenues exceeded a substantial USD 20 billion. In addition, subscription audio streaming alone was responsible for over half of all global recorded music revenues, representing a 51.2% share, hence providing encouraging opportunities for worldwide pioneers in this field.

Revenue Distribution in the Global Music Streaming Market (2022)

|

Category |

Statistic |

|

Streaming share of global recorded music revenue |

67% |

|

Premium streaming services revenue share |

48.3% |

|

Revenue share to label/distributor (average) |

50-55% |

|

Revenue share to publisher/society (average) |

10-15% |

Source: CMM.org

Furthermore, in the emerging economies, the expansions into podcasts, gaming, and social media are opening new avenues for the music streaming market with a proper balance of ad-supported and subscription models. As per an article published by CMA in November 2022, the UK music streaming industry generated a total of £1.115 billion (USD 1.4 billion) in recorded music revenues in 2021, whereas streaming accounted for around three-quarters of that total. It also underscored that there were 39 million monthly active users of music streaming services in the country, who streamed tracks more than 138 billion times in 2021. In addition, Spotify recorded the largest share of UK streaming revenues, which was at 50% to 60%, followed by Apple, Amazon, and YouTube Music, hence contributing to overall market expansion.

Key Music Streaming Market Insights Summary:

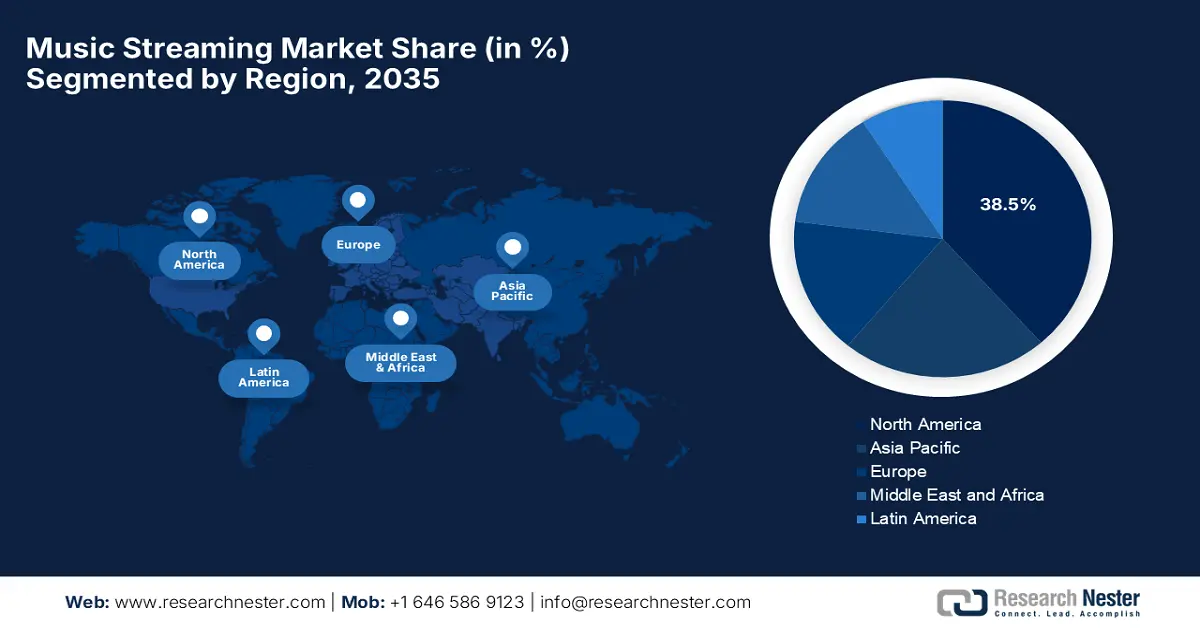

Regional Highlights:

- North America is anticipated to secure a 38.5% share in the music streaming market by 2035, owing to extensive digital adoption and a strong base of leading streaming platforms.

- Asia Pacific is expected to grow rapidly from 2026-2035, propelled by rising mobile connectivity and an increasingly active young listener base.

Segment Insights:

- The app segment in the music streaming market is projected to command an 89.5% share during 2026-2035, supported by the accelerating shift toward smartphone usage and mobile-first convenience.

- The subscription-based segment is expected to secure a notable revenue share by 2035, underpinned by rising demand for high-quality listening experiences that enable superior monetization.

Key Growth Trends:

- Smartphone& internet penetration

- Subscription model adoption

Major Challenges:

- Intense competition

- Licensing and royalty complexities

Key Players: Spotify (Sweden), Apple Inc. (U.S.), Amazon.com, Inc. (U.S.), Tencent Music Entertainment (China), YouTube Music (U.S.), Deezer (France), SoundCloud (Germany), SiriusXM (U.S.), NetEase Cloud Music (China), Tidal (U.S.), JioSaavn (India), Gaana (India), Yandex (Russia), Anghami (UAE), KKBOX (Taiwan).

Global Music Streaming Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.3 billion

- 2026 Market Size: USD 65.0 billion

- Projected Market Size: USD 205.9 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, Indonesia, South Korea, Mexico

Last updated on : 26 November, 2025

Music Streaming Market - Growth Drivers and Challenges

Growth Drivers

- Smartphone& internet penetration: The increasing adoption of smartphones around the world, coupled with increasing broadband and mobile‑internet access, is enabling more users to stream music consistently, driving growth in the music streaming market. In this regard, IBEF in January 2025 reported that India has risen to become the second-largest smartphone manufacturer, wherein the government programs such as Make in India and the PLI scheme have pushed mobile production from reaching just 25% of domestic needs a decade back to 97% in 2024. The report also mentioned that smartphone exports have also expanded sharply, growing 42% in the year 2023-24, making them India’s fourth-largest export item. Further, with more than 200 manufacturing units and continued policy support, India will help the stronger adoption of music streaming in the upcoming years.

- Subscription model adoption: Most listeners are readily moving from ad-supported or free tiers to paid subscriptions, which is driven by better audio quality, offline downloads, and driving business in the music streaming market. Testifying at the World Economic Forum in March 2023 revealed that music streaming has reshaped the worldwide music industry, driving a sustained recovery after years of declining physical and digital download sales. Similarly, industry revenues surpassed USD 26.2 billion in 2022, which marks an eighth consecutive year of growth, wherein streaming alone contributed 67% of total earnings. It also mentioned that as consumers shifted towards digital access over ownership and the widespread adoption of streaming platforms reversed the industry’s 20-year downturn trajectory, thereby establishing subscription-based streaming as the most dominant force in today’s music economy.

- Personalization through technology: Most of the platforms are utilizing AI to recommend playlists and songs that are suitable to individual tastes, by improving user engagement and retention, which is also a major growth contributor for the music streaming market. In June 2025, Deezer introduced the world’s first-ever AI-tagging system for music streaming, marking all albums that contain fully AI-generated tracks to ensure complete transparency for listeners. The company’s AI-music detection tool reveals that about 18% of newly uploaded daily tracks, which is over 20,000 songs, are entirely AI-generated, with roughly 70% of their streams identified as fraudulent and removed from royalty calculations. To protect artists’ earnings and maintain platform integrity, the company is excluding fully AI-generated content from algorithmic and editorial recommendations.

Challenges

- Intense competition: The music streaming market is extremely competitive, wherein the established players such as Spotify, Apple Music, and Amazon Music, along with emerging regional platforms, are all vying for user attention. The existence of this intense rivalry pressures companies to make investments heavily in marketing campaigns, content creation, and innovative advanced features to attract and retain subscribers. On the other hand, differentiating themselves through personalization, social engagement, and device integration becomes necessary but more expensive. Hence, this competition creates price wars, limiting profitability, and making growth under such conditions a persistent strategic challenge in this field.

- Licensing and royalty complexities: This is yet another restraining factor in the music streaming market. In this regard, licensing music and managing royalties represent significant challenges for streaming services, especially while operating across multiple countries with different copyright laws. In this regard, platforms must negotiate agreements with record labels, publishers, and artists, which can be both time-consuming and complex. In addition, disputes in terms of royalty rates or delayed payments can harm relationships with artists and result in potential litigation. Moreover, streaming services need to ensure proper attribution and reporting for millions of tracks, thereby necessitating a robust system for tracking usage and payments makes widespread adoption even more complex.

Music Streaming Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 56.3 billion |

|

Forecast Year Market Size (2035) |

USD 205.9 billion |

|

Regional Scope |

|

Music Streaming Market Segmentation:

Platform Segment Analysis

The music streaming market is witnessing the strong dominance of the app sub-segment based on platform, capturing the largest revenue share of 89.5% during the forecast period. The booming adoption of smartphones and the convenience enabled by the mobile-first platforms are the key factors behind this dominance. In June 2022, Spotify announced its strong evolution from just a music-streaming service into a broad audio and creator platform, influenced by ubiquity, personalization, and a strong freemium model. In this investor day, executives emphasized expanding content verticals such as podcasts, video, Live, and now audiobooks within a unified, personalized user experience that fuels massive discovery and audience growth. Furthermore, the company reinforced its long-term vision to empower over 50 million creators to reach more than a billion users through the Spotify machine, a platform of integrated tools.

Service Type Segment Analysis

By the conclusion of 2035, the subscription-based subtype based on service type is expected to attain a significant revenue share in the music streaming market. The increasing consumer demand for high quality listening experience, wherein the platforms can monetize more effectively when compared to ad-supported models, is propelling this growth. As per an article published by UNESCO in December 2022, the music streaming sector has grown at an extensive rate in the 21st century, owing to the emergence of digital platforms that are offering vast catalogues. The report also highlighted that by the end of 2021, the subscribers were 523 million, and streaming represented 65% of global recorded music revenues, which reflects its dominance in the industrial growth. Its expansion accelerated during the COVID-19 pandemic, as restrictions on live performances pushed audiences toward digital cultural consumption, hence denoting a wider segment scope.

Content Type Segment Analysis

In terms of content type audio streaming segment is expected to garner a lucrative share in the music streaming market by the end of the forecast duration. This leading share is effectively propelled by its integration into daily life through smartphones, connected cars, and smart speakers. On the other hand, its utility for background listening during activities such as commuting or work makes it indispensable. In addition, the continuous improvements in terms of audio recommendations and personalization are readily enhancing the user engagement in this sector. Also, the ever-increasing availability of exclusive audio content along with artist releases is amplifying the market outlook, wherein streaming continues to be dominant in the digital music ecosystem.

Our in-depth analysis of the music streaming market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Service Type |

|

|

Content Type |

|

|

End user |

|

|

Service |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Music Streaming Market - Regional Analysis

North America Market Insights

North America is expected to lead the entire global dynamics of the music streaming market, capturing the largest revenue share of 38.5% during the forecasted duration. The region’s dominance in this field is effectively subject to high digital adoption, widespread smartphone usage, and the presence of leading streaming platforms. In November 2025, Stingray Group Inc. announced that it had entered into a definitive agreement to acquire TuneIn, which marks a major expansion of its digital audio presence and advertising capabilities. This alliance will combine the firm’s extensive content distribution with TuneIn’s large listener base and strong device partnerships, thereby positioning the company as a leading force in connected audio experiences across home, automotive, and mobile environments. Furthermore, with this acquisition, Stingray aims to create a unified audio ecosystem that boosts audience reach, strengthens advertiser offerings, and accelerates market growth in the upcoming years.

The U.S. has gained a leading position in the regional music streaming market, backed by the presence tech-forward consumer base and the prominence of major record labels and streaming companies. The country’s market also benefits from strong cultural diversity, which fuels demand for varied genres and artists. In November 2025, KLAY Vision Inc. announced that it had secured AI licensing agreements with major industry leaders, which include UMG, SME, and WMG, enabling it to develop interactive, AI-powered music experiences built entirely on licensed content. Besides, KLAY positions itself as an artist-centered platform that readily enhances creativity, protects copyright, and ensures fair recognition for creators. Furthermore, with support from key music companies and a leadership team experienced in AI, digital business, and music innovation, the company aims to establish trusted frameworks.

Canada is also representing strong progress in the music streaming market, propelled by the presence of both domestic and international platforms, which are offering listeners a mix of global and homegrown music. In June 2025, Spotify reported that artists in the country are witnessing unprecedented success with its platform, wherein creators are earning about USD 460 million in 2024, which marks almost double their earnings when compared to 5 years earlier. It also stated that the vast majority of this income now comes from international listeners, underscoring Canada’s role as a major exporter of music across languages, genres, and cultures. Hence, this global success of the country’s artists demonstrates the strongest market’s potential for international audience growth, boosting streaming revenues and subscriber engagement in the music streaming industry.

Key Statistics on Canadian Artists’ Global Success on Spotify (2024)

|

Category |

Statistic |

|

Canadian artist royalties on Spotify (2024) |

Nearly 460 million CAD |

|

Year-over-year royalty growth (2023-2024) |

5% increase |

|

Share of royalties from outside Canada (2024) |

92% |

|

Daily global listening of Canadian artists |

15 million hours |

|

Number of global playlists featuring Canadian music |

2.4 billion |

|

Recorded music revenue growth in Canada (2014-2024) |

129% increase |

|

Recorded music revenue in 2024 |

909 million CAD |

|

Share of recorded music revenue from audio streaming |

Nearly 79% |

|

Share of royalties earned by indie artists/labels |

~40% |

|

Growth in global streams for Canadian women (since 2020) |

Nearly doubled |

|

Share of artists earning over CAD 1 million who are women or mixed-gender groups (2024) |

Over 40% |

Source: Spotify

APAC Market Insights

Asia Pacific is expected to expand at a rapid pace in the music streaming market from 2026 to 2035. The region’s pace of progress in this field effectively catered to the rising mobile connectivity and a young and active listener base. Local platforms in the region are proactively competing with the global pioneers attributable to the different linguistic as well as cultural preferences. On the other hand, the growing investments in terms of digital entertainment are pushing streaming deeper into everyday media consumption. In addition, the proliferation of data plans is making streaming more accessible across both urban and rural areas. Strategic partnerships with telecom providers and device manufacturers are readily accelerating user adoption. Furthermore, presence of this dynamic ecosystem is fostering innovation in terms of content formats and monetization models across the region.

China continues to elevate its potential in the regional music streaming market, leveraging the consumer base who prefer social-integrated features, enabling sharing, fan engagement, and community-building. The country also benefits from rising interest in original and independent music content since it shapes the market’s unique direction. In March 2025, Tencent Music Entertainment Group reported strong 2025 for the first quarter results, with total revenues of RMB 7.36 billion (USD 1.01 billion), up 8.7% YoY, highly influenced by 16.6% growth in music subscription revenue to RMB 4.22 billion and 122.9 million paying users. It also mentioned that the company’s net profit surged 201.8% YoY to RMB 4.29 billion (USD 591 million), supported by gains from strategic investments reflecting the presence of strong demand for music offerings in the country.

India hosts a very rich, culturally active music streaming market, which is primarily fueled by the heightened demand for multilingual content and a mobile-first listener base. Local and global platforms compete by offering extensive regional catalogues and affordable digital access in the country. In addition, the popularity of film music and rapidly shifting digital habits make streaming a central part of media consumption in the country, hence attracting more players to make investments in this field. For instance, in March 2022, Warner Music India and JioSaavn announced that they had launched Spotted, which is an artist discovery program in partnership with Rolling Stone India, aimed at uncovering and promoting new musical talent across the country. The program allows aspiring artists to submit original tracks, with one artist selected each month by industry veterans and featured on JioSaavn playlists and Rolling Stone India stories.

Europe Market Insights

Europe has a strong scope to revolutionize the music streaming market, which is characterized by a blend of different cultural traditions and strong regulatory frameworks that extensively support digital services. On the other hand, continuous advancements in terms of platform usability and discovery tools help maintain steady market growth. As per an article published by ECSA in November 2023 European Parliament’s CULT Committee adopted a report on music streaming, which emphasizes fair remuneration for music creators in the region. The report encourages accurate metadata, transparency, ethical AI use, and alternative revenue models to address current imbalances for authors and performers. It also stated that ECSA supports these measures and looks forward to collaborating with the European Commission, Member States, and the industry to implement a strategy, including a European Music Observatory, to ensure a more equitable streaming ecosystem.

The preference for high-quality audio experiences and strong music culture has positioned Germany as the key growth contributor in the regional music streaming market. The industry represents a blend of international hits with support for domestic artists, thereby enriching platform catalogues. In December 2022, Believe reported that it achieved a landmark performance in Germany in 2022, becoming the third-largest company in the local streaming sector by supporting artists and labels across diverse genres, from urban to metal. The company leverages its digital expertise, local teams, and tailored services, which range from TuneCore for emerging artists to Premium Artist Services for established acts, to drive growth and chart success for talent like Theo Junior, KAFFKIEZ, and Milky Chance. Hence, with consistent revenue growth, the company’s support for diverse local artists and digital services drives streaming adoption, audience expansion, and overall growth in the market.

The U.K. also represents a dynamic landscape of the music streaming market, which is supported by its influential tracks and tech-savvy consumers. In this context, streaming plays a crucial role in shaping listening trends, particularly among younger audiences. On the other hand, strong integration with smart home devices and evolving content formats enables the country to remain competitive as well as innovative. In September 2025, ERALTD reported that in the UK, music streaming services are actively supporting the domestic music industry through more than 60 initiatives, with a third specifically targeting new and emerging British talent. It also mentioned that these programs encompass artist development, education, diversity, and inclusion, providing encouraging opportunities for funding, exposure, and training, hence contributing to market expansion.

Key Music Streaming Market Players:

- Spotify (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc. (U.S.)

- Amazon.com, Inc. (U.S.)

- Tencent Music Entertainment (China)

- YouTube Music (U.S.)

- Deezer (France)

- SoundCloud (Germany)

- SiriusXM (U.S.)

- NetEase Cloud Music (China)

- Tidal (U.S.)

- JioSaavn (India)

- Gaana (India)

- Yandex (Russia)

- Anghami (UAE)

- KKBOX (Taiwan)

- Spotify continues to lead the entire global music‑streaming space by doubling down in terms of personalization, making investments in its recommendation algorithms, and expanding into podcasts, along with audiobooks. The company is building out its audiobook business, diversifying its expertise beyond the music field. Further, Spotify is also forging partnerships with telecom companies and pushing into emerging markets, thereby optimizing margins regardless of the rising content licensing costs.

- Apple Music's strength lies in its deep integration with its own hardware ecosystem, such as iPhones, Macs, HomePods, and services. The company deeply emphasizes exclusive content, spatial audio, as well as high-fidelity streaming. On the other hand, the company also leverages cross-selling opportunities within its ecosystem and pursues regional expansion through partnerships with telecom operators and labels.

- Amazon Music is recognized as one of the prominent players in this field, which leverages the Prime subscriber base and integrates tightly with Alexa-enabled devices to offer voice-controlled experiences. Consumers are also preferring its bundled offerings and flexible subscription tiers, including HD audio, which makes it a compelling value proposition for users. Furthermore, the expansion globally through device partnerships and localized content is allowing it to gain the interest of a wider audience group.

- Tencent Music Entertainment is the dominating player in China with services such as QQ Music, KuGou, and Kuwo, combining streaming with social features, live performances, and virtual gifting. Also, the company’s monetization model blends subscription, ad-supported streaming, and value-added services, making it extremely preferable. Tencent is also expanding through content acquisitions and partnerships with international labels.

- YouTube Music leverages YouTube’s massive user base and video content to engage listeners across the globe. It has also introduced taste match playlists and integrated concert alert features through a partnership with Bandsintown. The company’s strategic focus lies on community and discovery, tapping into user-generated content, cross-platform engagement between video and audio, and concert discovery to deepen listener interaction as well as retention.

Below is the list of some prominent players operating in the global market:

The music streaming market is dominated by the most prominent global players, such as Spotify, Apple Music, Amazon Music, Tencent, YouTube Music, whereas the regional specialists, such as JioSaavn, Gaana, Anghami, and KKBOX, deepen domestic penetration. Leveraging device ecosystems, bundling with larger platforms, social features, and live engagement, and high-fidelity or artist-first models are a few strategies implemented by these pioneers to uplift market growth internationally. In September 2025, Spotify reported that it had rolled out Lossless audio for premium subscribers in select markets by delivering the highest-quality listening experience with up to 24-bit/44.1 kHz FLAC streaming. Further, this feature allows users to customize playback settings across Wi-Fi, cellular, and downloads, which ensures maximum flexibility and is compatible with multiple devices supporting Spotify Connect.

Corporate Landscape of the Music Streaming Market:

Recent Developments

- In October 2025, Universal Music Group and AI music platform Udio announced that they had settled copyright litigation and declared strategic agreements to launch a licensed AI music creation platform, which will allow users to create, stream, and share music in a protected environment using generative AI trained on authorized content.

- In June 2025, Apple Music introduced AutoMix for seamless DJ-style playback, along with lyrics translation and pronunciation to help users enjoy songs across various languages. Apple Maps, Wallet, and Podcasts also gain intelligent updates, including preferred routes, Visited Places, order tracking, Digital ID, and enhanced dialogue isolation.

- In April 2024, Amazon Music announced that it had launched Maestro, which is a new AI-powered playlist generator, now in beta for a subset of U.S. users on both iOS and Android. The feature allows users to create personalized playlists using simple prompts, emojis, emotions, activities, or sounds, making playlist creation even faster.

- Report ID: 4383

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Music Streaming Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.