Nickel-Metal Hydride (Ni-MH) Battery Market Outlook:

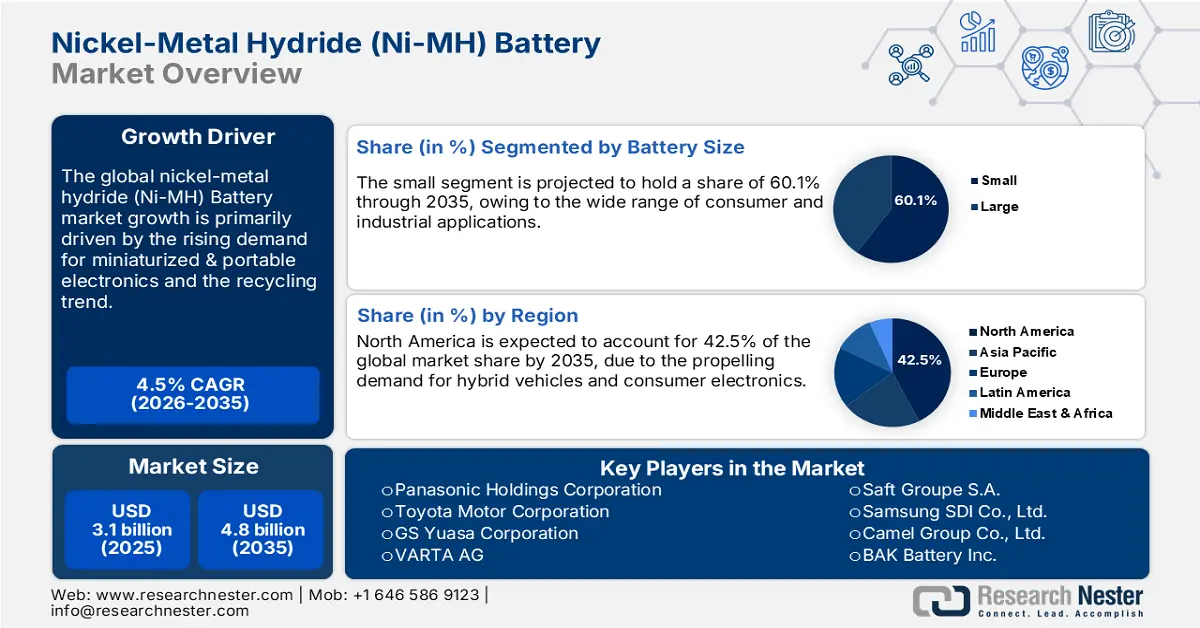

Nickel-Metal Hydride (Ni-MH) Battery Market size was USD 3.1 billion in 2025 and is estimated to reach USD 4.8 billion by the end of 2035, expanding at a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nickel-metal hydride battery is assessed at USD 3.2 billion.

The electric vehicle trend is estimated to propel the sales of nickel-metal hydride batteries in the years ahead. The expanding demand for hybrid vehicles, especially in developing countries, is spurring the application of nickel-metal hydride batteries. According to the International Energy Agency (IEA) in China, plug-in hybrid electric cars are in high demand. The share of plug-in hybrid electric vehicle (PHEV) sales, not counting extended-range EVs, has increased from about 15% of total electric car sales in 2020 to nearly 30% in 2024. This indicates that the hybrid electric car trade is poised to double the revenues of key players in the years ahead.

Key Nickel-Metal Hydride (Ni-MH) Battery Market Insights Summary:

Regional Highlights:

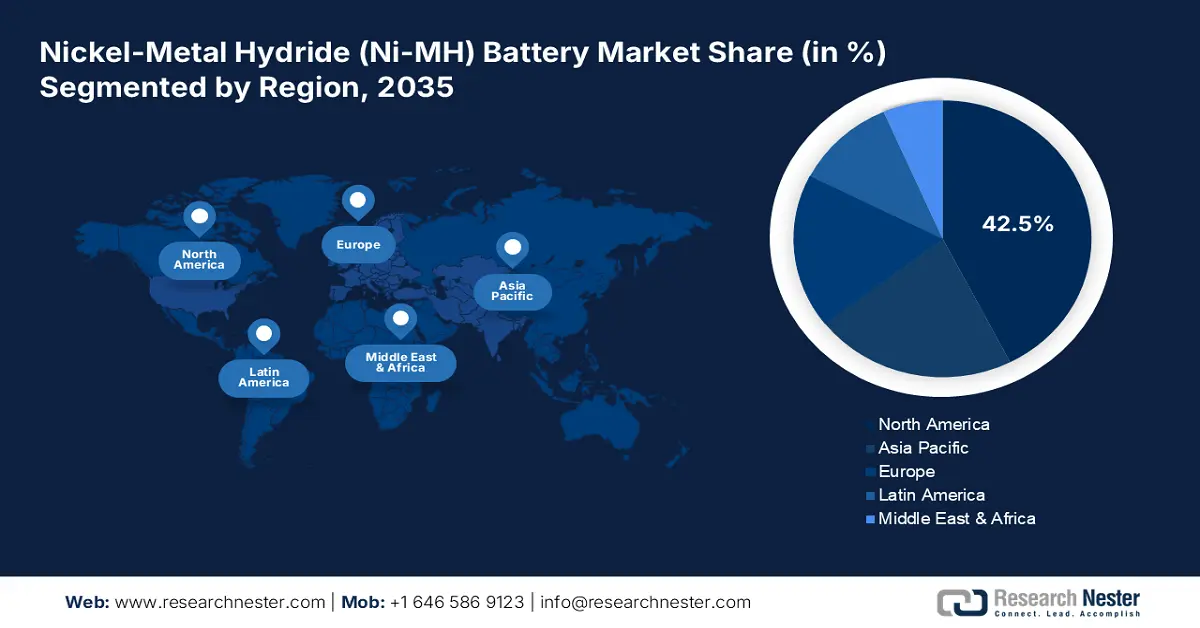

- The North America nickel-metal hydride (Ni-MH) battery market is projected to secure 42.5% of the global share by 2035, attributed to rising demand for hybrid vehicles and advanced consumer electronics.

- Europe is anticipated to maintain the second-largest share by 2035, sustained by growing emphasis on electric mobility and battery recyclability trends.

Segment Insights:

- The electrode segment is anticipated to hold 48.5% share of the global nickel-metal hydride (Ni-MH) battery market by 2035, propelled by continuous technological advancements enhancing efficiency and recyclability.

- The small battery size segment is projected to capture 60.1% share by 2035, supported by expanding electronics demand and diverse consumer applications.

Key Growth Trends:

- Miniaturization and portable electronics

- Military and aerospace uses

Major Challenges:

- Competition from Li-ion batteries

- Environmental concerns with rare earth mining

Key Players: Panasonic Holdings Corporation, Toyota Motor Corporation (Battery & Pack Division / Toyota Industries), GS Yuasa Corporation, VARTA AG, GP Batteries / Gold Peak Industries, Energizer Holdings, Inc., Duracell (Berkshire Hathaway), Saft Groupe S.A., Samsung SDI Co., Ltd., Camel Group Co., Ltd., BAK Battery Inc., Exide Industries / Exide Technologies, Amara Raja Batteries Ltd., HBL Power Systems Ltd., Johnson Controls (Legacy Ni Products / Aftermarket), Hitachi Chemical / Showa Denko Materials, Furukawa Battery Co., Ltd., Toshiba Battery (Industrial & Energy Systems), Maxell Holdings, Ltd., FDK Corporation (subsidiary of Fujitsu).

Global Nickel-Metal Hydride (Ni-MH) Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 4.8 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, United States, China, Germany, South Korea

- Emerging Countries: India, Indonesia, Brazil, Mexico, Thailand

Last updated on : 8 October, 2025

Nickel-Metal Hydride (Ni-MH) Battery Market - Growth Drivers and Challenges

Growth Drivers

- Miniaturization and portable electronics: The miniaturized and portable devices are the top consumers of Ni-MH batteries, owing to their cost-effectiveness and easy availability. Digital cameras, lighting, handheld gaming devices, and remote controls that often rely on Ni-MH cells are directly fueling the sales of AA and AAA-sized batteries. The Observatory of Economic Complexity (OEC) reports that the global trade in portable lighting was worth USD 3.5 billion in 2023. This shows that while lithium-ion batteries are common in high-end devices such as smartphones and laptops, nickel-metal hydride (Ni-MH) batteries are still used in everyday gadgets.

- Military and aerospace uses: The nickel-metal hydride batteries are expected to report high applications in the military and aerospace sectors in the years ahead. The safety, reliability, and durability offered by these batteries make them most sought-after in various military and aerospace solutions. The aircraft systems, submarines, and battlefield equipment are expected to be the prime end users of nickel-metal hydride batteries. The hefty public-private investments in this domain are poised to double the revenues of key players.

- Recycling and secondary materials market: The recycling and secondary materials market is anticipated to create a profitable environment for nickel-metal hydride (Ni-MH) batteries. The geopolitical concerns and supply chain risks associated with rare earth mining are also increasing the importance of recycling. The U.S. Geological Survey (USGS) disclosed that in 2024, 54% of the nickel consumed was recovered from recycled scrap. Further, the strict government regulations in the EU, Japan, and North America are also accelerating the need for robust recycling infrastructure. Overall, the recycling trend is expected to offer long-term benefits.

Challenges

- Competition from Li-ion batteries: The NI-MH battery manufacturers are witnessing a major challenge from the strong presence of alternatives. The lithium-ion batteries are prime competitors for the nickel-metal hydride batteries. Lithium-ion’s higher energy is challenging NI-MH batteries in smartphones, laptops, and electric vehicles to some extent. However, continuous technological advancements are anticipated to boost the sales of nickel-metal hydride batteries in the years ahead.

- Environmental concerns with rare earth mining: The long-term scalability of nickel-metal hydride batteries is expected to be hampered by the environmental concerns with rare earth mining. Strict regulations and limitations on excessive mining are likely to create supply chain disruptions, increasing the price of nickel-metal hydride batteries. Thus, strict regulations and supply chain disruptions leading to raw material volatility are expected to lower the profit margins of nickel-metal hydride battery producers.

Nickel-Metal Hydride (Ni-MH) Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 4.8 billion |

|

Regional Scope |

|

Nickel-Metal Hydride (Ni-MH) Battery Market Segmentation:

Component Segment Analysis

The electrode segment is anticipated to account for 48.5% of the global Ni-MH battery market share by 2035, owing to its performance and high demand. Electrodes determine the energy density, cycle life, and thermal stability of the battery, which makes them a vital element in the manufacturing process. Continuous technological advancements are set to boost the overall efficiency and effectiveness of the electrode and amplify their sales growth. Also, the recycling efforts are set to push the sales of electrodes, as they are the main source of reusable nickel and rare earth materials.

Size Segment Analysis

The small battery size segment is projected to capture 60.1% of the global Ni-MH battery market share throughout the forecast period. The wide range of consumer and industrial applications is contributing to the increasing demand for small Ni-MH batteries. Cost-effectiveness, convenience, and versatility are also propelling the sales of small-sized nickel-metal hydride batteries. These battery types are widely used in digital cameras, handheld tools, remote controls, toys, medical devices, and emergency lighting. Thus, the expanding electronics demand is directly pushing the adoption of small-sized Ni-MH batteries.

Vertical Segment Analysis

The consumer electronics segment is expected to hold the leading Ni-MH battery market share throughout the study period. The sheer breadth of applications and consistent replacement demand is accelerating the use of Ni-MH batteries in consumer electronics. The Federal Reserve Bank of St. Louis states that the producer price index for electrical equipment and appliance manufacturing stood at 213.337 in July 2025. The expanding demand and continuous technological advancements in cameras, smartphones, gaming consoles, toys, and other electronic products directly influence the trade of Ni-MH batteries.

Our in-depth analysis of the nickel-metal hydride battery market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Battery Type |

|

|

Battery Size |

|

|

Sales Channel |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nickel-Metal Hydride (Ni-MH) Battery Market - Regional Analysis

North America Market Insights

The North America nickel-metal hydride battery market is projected to hold 42.5% of the global revenue share through 2035. The propelling demand for hybrid vehicles and consumer electronics is boosting the sales of nickel-metal hydride batteries. The Ni-MH batteries hold ground in hybrid electric vehicles (HEVs), particularly through Japanese automakers with a strong North American presence, such as Toyota and Honda. The U.S. and Canada are both the most lucrative marketplaces for nickel-metal hydride battery manufacturers.

The nickel-metal hydride battery sales in the U.S. are expected to be driven by the strong presence of automotive, defense, and consumer electronics sectors. The hefty public-private investments and infrastructure upgrades are accelerating the trade of nickel-metal hydride batteries. Technological advancements are further set to boost the revenues of key players in the years ahead.

The strong presence of early adopters and industry giants is estimated to fuel the trade of nickel-metal hydride batteries in Canada. The smart home trends and IoT device demand are opening lucrative doors for nickel-metal hydride battery manufacturers. The EV trend is another factor contributing to the increasing application of nickel-metal hydride battery technologies.

Europe Market Insights

The Europe nickel-metal hydride battery market is expected to account for the second-largest revenue share throughout the study period. The electric mobility and high-performance consumer electronics sectors are dominating the sales of nickel-metal hydride batteries. The sustainability and recyclability trends are estimated to further expand the application of nickel-metal hydride batteries manufactured through recycled materials. The U.K., Germany, and France are some of the leading markets in the region.

The sales of nickel-metal hydride batteries in Germany are set to be driven by the strong presence of premium and EV automakers. The industrial automation trend is also contributing to the high demand for nickel-metal hydride batteries. The country’s broader strategy to reduce dependency on imported critical minerals is poised to lead to the expansion of recycling facilities. Further, innovations in consumer electronics are attracting hefty market investments.

The U.K. nickel-metal hydride battery market is anticipated to increase at the fastest pace from 2026 to 2035. The regulatory-driven recycling initiatives and robust consumer electronics trade are contributing to the market growth. The strict environmental regulations coupled with the sustainability trend are increasing the demand for zero-emission vehicles, which is subsequently fueling the application of nickel-metal hydride batteries. The increasing investments in smart homes are also creating a profitable environment for key players.

APAC Market Insights

The Asia Pacific nickel-metal hydride battery market is estimated to increase at a robust CAGR between 2026 and 2035. The swift rise in industrialization and urbanization is poised to fuel the sales of nickel-metal hydride batteries. The EV and consumer electronics industries are key rivers of the nickel-metal hydride battery trade in the region. China, India, Japan, and South Korea are some of the leading markets in APAC. The hefty public-private investments are set to fuel the nickel-metal hydride battery sales in the years ahead.

China leads the sales of nickel-metal hydride batteries through its strong consumer electronics and EV manufacturing facilities. The battery recycling initiatives are also expected to support the nickel-metal hydride battery trade. The robust domestic and international demand for toys, tools, cameras, and small electronics is expanding the production cycles in the country, which is directly attracting big investors.

The massive investments in renewable energy storage and early-stage hybrid vehicle adoption are foreseen to fuel the demand for nickel-metal hydride batteries in India. The India Brand Equity Foundation (IBEF) estimates that the country's USD 109.50 billion plan is set to expand power infrastructure to meet 458 GW demand by 2032. These developments are expected to propel the application of nickel-metal hydride batteries in the coming years.

Key Nickel-Metal Hydride (Ni-MH) Battery Market Players:

- Panasonic Holdings Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toyota Motor Corporation (Battery & Pack Division / Toyota Industries)

- GS Yuasa Corporation

- VARTA AG

- GP Batteries / Gold Peak Industries

- Energizer Holdings, Inc.

- Duracell (Berkshire Hathaway)

- Saft Groupe S.A.

- Samsung SDI Co., Ltd.

- Camel Group Co., Ltd.

- BAK Battery Inc.

- Exide Industries / Exide Technologies

- Amara Raja Batteries Ltd.

- HBL Power Systems Ltd.

- Johnson Controls (Legacy Ni Products / Aftermarket)

- Hitachi Chemical / Showa Denko Materials

- Furukawa Battery Co., Ltd.

- Toshiba Battery (Industrial & Energy Systems)

- Maxell Holdings, Ltd.

- FDK Corporation (subsidiary of Fujitsu)

The Ni-MH battery market is characterized by the strong presence of key players and the increasing emergence of start-ups. Leading companies are focusing on sustainability initiatives to earn lucrative gains through recycling trends. Large companies are employing both organic and inorganic marketing strategies to expand their reach and increase profits. They are also entering into strategic partnerships with other players to innovate their product offerings. Further, some top players are expanding their operations into developing markets to double their profit shares.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, Panasonic Energy showcased its new nickel-metal hydride battery system for trains at InnoTrans 2024 in Berlin, held from September 24 to 27. This aided the company in introducing its products to various investors and consumers.

- In December 2023, Lexus announced the launch of the new Lexus LBX. This powertrain uses a self-charging 1.5-liter hybrid electric system powered by a bipolar nickel-metal hydride battery.

- In March 2025, Panasonic Energy Co., Ltd. started a program to recycle nickel used in lithium-ion battery materials, working with Sumitomo Metal Mining Co., Ltd., a major Japanese company that processes metals and makes battery parts. This is the first project to fully recycle nickel in a closed-loop system.

- In September 2023, Toyota announced plans for a new factory to build battery electric vehicles, starting production in 2026. These cars are set to be designed and built in a new way and use various advanced batteries, including nickel-metal hydride (Ni-MH) batteries.

- Report ID: 8175

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nickel-Metal Hydride (Ni-MH) Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.