Electric Vehicle Battery Market Outlook:

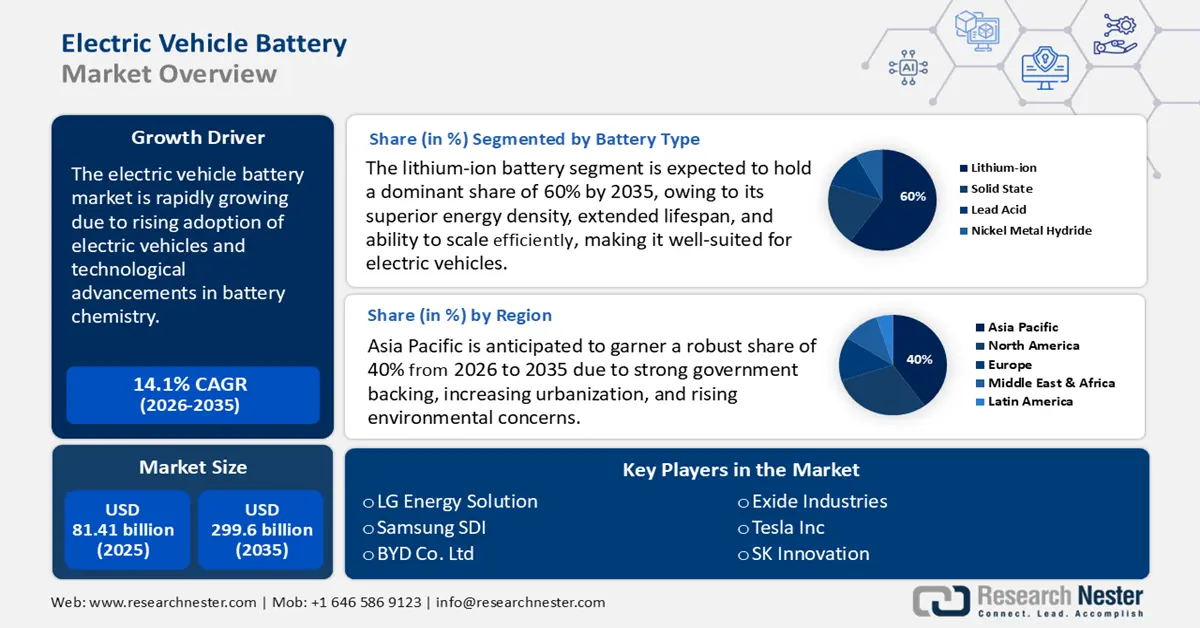

Electric Vehicle Battery Market size was valued at USD 81.41 billion in 2025 and is projected to reach USD 299.6 billion by the end of 2035, rising at a CAGR of 14.1% during the forecast period, i.e., 2026-2035. In 2026, the electric vehicle battery is assessed at USD 91.74 billion.

The rising adoption of electric vehicles globally is driving the need for more efficient and higher-capacity batteries. The increasing demand for EVs is a key driver of the electric vehicle battery market, as each new EV sold requires a high-capacity battery, making batteries essential to the expansion of the sector. According to a report by the International Energy Agency (IEA), EV sales reached over 17 million units in 2024 globally, reflecting the accelerating responsibility towards sustainable means of transport. This surge in electric vehicle adoption directly increases demand for EV batteries, compelling battery manufacturers to scale production, invest in modern advanced technologies, and expand global supply chains to support the surging global demand. The demand for EV batteries is predicted to increase from over 1 TWh in 2024 to over 3 TWh in 2030 in the STEPS.

Environmental concerns, government incentives, and advancements in vehicle performance are some key pointers driving the global demand for EVs. This surge encourages battery manufacturers to expand capacity, develop batteries for longer range and faster charging, and build new gigafactories to meet rising supply demands. Additionally, the electrification of two-wheelers, buses, and delivery vans is a huge factor in broadening the market reach. For instance, Tesla sold over 1,789,226 EVs in 2024, highlighting the rapid growth of the electric vehicle market. As a result, the demand for lithium-ion batteries is also rising, pushing battery makers to increase their production.

Key Electric Vehicle Battery Market Insights Summary:

Regional Highlights:

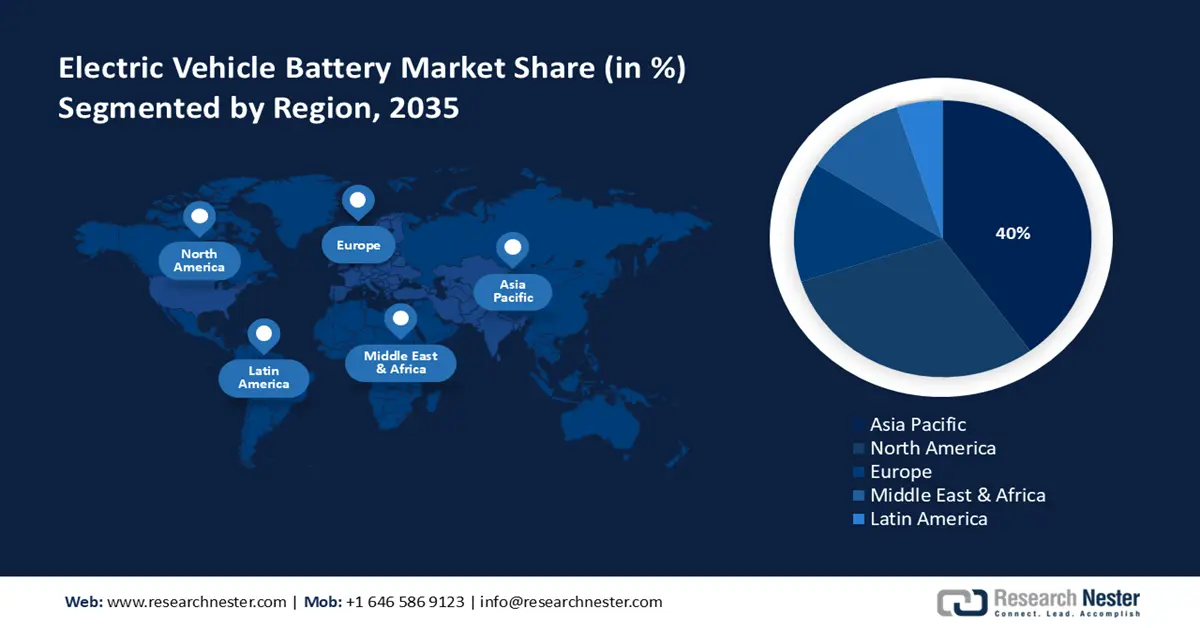

- Asia Pacific is anticipated to garner a 40% share from 2026 to 2035, propelled by strong government support, urbanization, and rising environmental concerns.

- The North American market is projected to hold 30% by 2035, driven by growing environmental awareness, supportive policies, and increased EV adoption.

Segment Insights:

- The lithium-ion battery segment is projected to hold a 60% share by 2035, driven by its superior energy density, extended lifespan, and scalability.

- The passenger cars segment is expected to account for 50% of the market by 2035, owing to rising consumer demand for eco-friendly transportation and government incentives.

Key Growth Trends:

- Government policies and subsidies

- The surge in venture capital (VC) investments

Major Challenges:

- Raw material supply constraint

- Battery recycling and sustainability issue

Key Players: CATL (Contemporary Amperex Technology Co. Ltd), LG Energy Solution, Samsung SDI, BYD Co. Ltd, Tesla Inc., SK Innovation, Exide Industries, Johnson Matthey, Redflow Limited, MIDA Battery Tech, Gotion High-Tech, Farasis Energy, Sunwoda, SVOLT, Northvolt

Global Electric Vehicle Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 81.41 billion

- 2026 Market Size: USD 91.74 billion

- Projected Market Size: USD 299.6 billion by 2035

- Growth Forecasts: 14.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share from 2026 to 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, France, United Kingdom, Canada, Brazil

Last updated on : 18 August, 2025

Electric Vehicle Battery Market - Growth Drivers and Challenges

Growth Drivers

- Government policies and subsidies: Through a combination of legislative mandates, subsidies, and strategic investments, government support is significantly contributing to the acceleration of the EV battery market. With a budgetary investment of USD 1.43 billion, the FAME II program is specifically designed to encourage the use of electric vehicles and boost production. In addition, the Ministry of Heavy Industries introduced the PM E-DRIVE Scheme in September 2024 with a budget of USD 1.28 billion to strengthen India's EV ecosystem, encourage electric mobility, and lessen dependency on fossil fuels. The demand for batteries is rising as a result of manufacturers being forced to prioritize EV production due to stricter emissions regulations and ICE phase-out timelines being implemented in several countries. In order to lessen dependency on foreign supply chains, direct financial incentives such as the EU Green Deal Industrial Plan and the U.S. Inflation Reduction Act (IRA) subsidize local battery manufacture, research and development, and the sourcing of essential minerals.

In order to maintain sustainability, governments are also supporting battery recycling initiatives and gigafactories, such as Tesla's Berlin facility, which is supported by German subsidies. Domestic manufacturing is further strengthened via public-private partnerships, such as India's PLI initiative for advanced chemical cells and China's CATL cooperation. Government regulations are actively influencing the future of the EV battery sector by lowering investment risk and maintaining market stability.

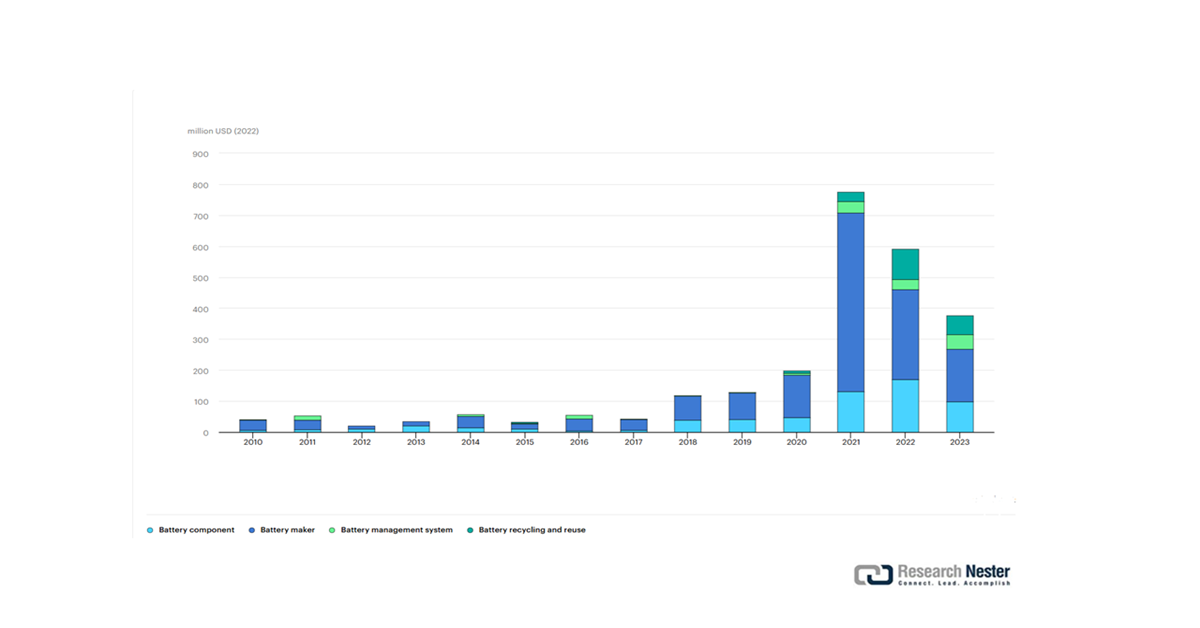

- The surge in venture capital (VC) investments: By allowing entrepreneurs to quickly develop in battery technology, charging infrastructure, and car design, venture capital (VC) funding is propelling the EV battery and vehicle market. These initiatives help lower costs and enhance performance by supporting innovations in solid-state batteries, higher energy density cells, and faster charging solutions. Additionally, traditional automakers are pushed to hasten their own EV roadmaps by VC-backed startups, which increases competitiveness. Funding also promotes developments in environmentally friendly supply chains, like the extraction and recycling of lithium. VCs are essential to increasing production and commercializing cutting-edge technology because they de-risk early-stage R&D. This capital inflow is strengthening the shift to electric transportation, increasing customer choice, and speeding up adoption.

Early-stage venture capital investments in batteries by technology, 2010-2023

(Source: IEC)

- Expansion of charging infrastructure: The rapid build-out of EV charging networks reduces range anxiety and supports higher EV adoption, thereby increasing battery demand. In the US, President Biden’s Bipartisan Infrastructure Law invests $7.5 billion in EV charging, $10 billion in clean transportation, and over $7 billion in EV battery components, essential minerals, and materials. This accelerates EV adoption, consequently increasing the demand for high-capacity EV batteries from companies like CATL and Samsung SDI.

Electric vehicle (EV) charging infrastructure in the U.S. (2024)

|

Metric |

Q1 (% increase) |

Q2 (% increase) |

|

Total Charging Ports |

4.6% |

6.3% |

|

Public Ports |

4.8% |

6.5% |

|

Private Ports |

3.2% |

4.4% |

|

DC Fast Charging Ports |

8.2% |

7.4% |

(Source: U.S. Department of Energy)

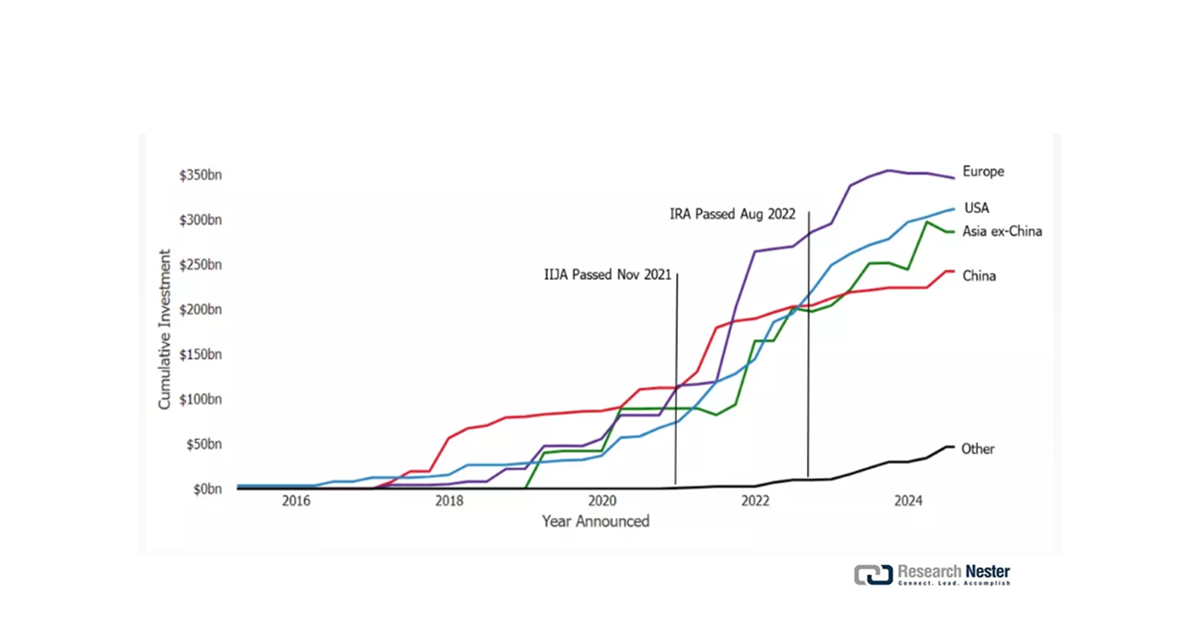

Electric Vehicle Battery Investment Trends

The U.S. is the leading country for attracting investments in electric vehicle (EV) and battery manufacturing, outpacing China and other countries worldwide. Companies have announced $312 billion worth of investments in the U.S, up from approximately $75 billion in 2021. Of the $312 billion of investments for the United States, $223 billion is dedicated to specific facilities or initiatives, an increase of roughly $66 billion since January 2023, suggesting that firms are putting their prior commitments into action. More than half of that investment ($133 billion) is designated for battery manufacturing and recycling; 32%, or approximately $70 billion, for EV manufacturing; and $21 billion is allocated to facilities producing components further down the supply chain, such as EV parts and critical minerals.

Total Investments by EV and EV Battery Manufacturers, by Region

(Source: NRDC)

Challenges

- Raw material supply constraints: The production of EV batteries heavily depends on rare minerals such as lithium, cobalt, and nickel. The global supply chain for these materials is limited and only concentrated in a few countries. This creates vulnerability to geopolitical risks, trade restrictions, and market volatility. As EV demand grows, securing a consistent and ethical supply of raw materials becomes tough, potentially leading to higher costs and production delays. Further, the growth of the EV battery market is hampered by the lack of adequate charging infrastructure in several regions, as the absence of sufficient charging stations discourages consumers from transitioning to electric vehicles, affecting battery demand.

- Battery recycling and sustainability issues: With millions of electric vehicles anticipated to be on the road in the coming years, handling end-of-life batteries is a rising concern. As recycling infrastructure is still underdeveloped in many regions, extracting valuable materials from used batteries becomes expensive and inefficient. Thus, without scalable recycling solutions, the industry may cause environmental damage and resource depletion, which can undermine the sustainability goals of electric mobility.

Electric Vehicle Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 81.41 billion |

|

Forecast Year Market Size (2035) |

USD 299.6 billion |

|

Regional Scope |

|

Electric Vehicle Battery Market - Regional Analysis

Battery Type Segment Analysis

The lithium-ion battery segment is expected to hold a dominant share of 60% by 2035, owing to its superior energy density, extended lifespan, and ability to scale efficiently. It is lighter in weight in comparison to other battery types, which helps in improving the vehicle's efficiency and range. Moreover, technological advancements in battery types have decreased cost, making EVs an economical choice. The boost in customer demand for sustainable transportation is further propelled by supportive government policies. Government policies, including the U.S. DOE, reported over $2 billion in investments aimed at modernizing lithium-ion technology, which is important for transitioning to electric mobility.

Vehicle Type Segment Analysis

The passenger cars segment is anticipated to hold a 50% share by 2035, due to the rising consumer demand for eco-friendly transportation. The increased availability of electric car models with improved battery technology is making EVs more reliable and affordable. The demand also depends on government incentives and stricter emission regulations. Further, urbanization and awareness of environmental impacts are influencing buying behavior. As a result, the passenger car segment continues to grow rapidly in the EV battery market.

Application Segment Analysis

The automotive segment is anticipated to hold 38% share by 2035, due to rapid passenger-vehicle electrification, falling cell costs, and government targets/incentives are driving the biggest battery demand from cars and light-duty fleets. Higher EV model availability and R&D goals (lower $/kWh, faster charging) increase pack adoption and battery capacity per vehicle, keeping automotive the largest revenue source for batteries through 2035. Regulatory push for zero-emission vehicle uptake and heavy investments in domestic battery manufacturing amplify demand

Our in-depth analysis of the global electric vehicle battery market includes the following segments:

|

Segment |

Subsegments |

|

Battery Type |

|

|

Vehicle Type |

|

|

Application |

|

|

Battery Chemistry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Battery Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to garner a robust share of 40% from 2026 to 2035 due to strong government backing, increasing urbanization, and rising environmental concerns. Countries such as China, Japan, South Korea, and India are investing heavily in EV infrastructure and battery manufacturing. Consumer demand for affordable, low-emission transport is encouraging battery innovation and production. Additionally, regional supply chain integration and access to raw materials are accelerating market growth.

China is projected to lead the Asia Pacific EV battery market with a significant revenue share by 2035, driven by strong government backing and targeted industrial strategies promoting electric vehicle adoption. In comparison to the same period of the previous year, the Chinese market grew by 33% between January and May 2025, supported by initiatives that merge EV production with upgrades in ICT infrastructure. Additionally, government incentives and regulations about battery recycling and next-gen technologies are reinforcing its dominant position.

EV Sales in China (2014-2030)

|

Year |

Total EV Unit Sales |

EV Sales Ratio (%) |

Total EVs in Use |

Total EVs as % of All Vehicles |

|

2014 |

6K |

0.32% |

12K |

0.13% |

|

2024 |

11M |

50%-60% |

25M |

7% |

|

2030 (Predicted) |

35M |

80% |

100M |

30% |

(Source: climatescorecard.org)

North America Market Insights

The electric vehicle battery market in North America is projected to hold 30% by 2035 due to growing environmental awareness and supportive government policies. Rising investments in clean energy infrastructure and stricter emissions standards are encouraging EV adoption across the region. Automakers in the region are also scaling up EV production, directly fueling the demand for EV batteries. Additionally, strong collaborations between tech-oriented companies and manufacturers boost innovation in battery technologies.

The U.S. EV battery market is rapidly growing due to rising federal funding, tax incentives, and increasing consumer interest in electric mobility. Major battery manufacturing facilities, such as gigafactories, are being built to fulfill the surging demand. With tax incentives still available for qualified vehicles through the end of 2025, the US market is still expanding moderately at a rate of 4% year to date, which could support continued growth in EV sales. The U.S. also benefits from a stable research ecosystem that backs advancements in battery performance and safety. Growing support for domestic supply chains is helping reduce dependence on imports.

Europe Market Insights

The electric vehicle battery market in Europe is projected to hold 14% by 2035 due to the EU battery value-chain strategy and Europe's mandate for zero-emission autos are driving rapid industrialization and demand for batteries. Through the first 5 months of the year, the European EV market grew 27%, with 1.6 million units sold. For many of the major European countries, growth in the electric vehicle battery market continues to accelerate. As national member-states are developing gigafactory projects and implementing the EU batteries law, there's a forecast for massive growth in cell manufacturing, recycling capacity, and materials processing across the union from the period of 2026-2035.

The UK has accelerated its support for electric vehicles, culminating on July 15, 2025, in the launch of the £650 million Electric Car Grant. This would provide tiered subsidies of £3,750 to car makers, which could be used at the point of sale on new electric cars priced at or below £37,000, provided they satisfy several rigorous sustainability conditions. This builds on other recent initiatives to expand low-cost home charging and reduce the cost of electrification, as the UK continues to increase its support for cleaner transport infrastructure.

Key Electric Vehicle Battery Market Players:

- CATL (Contemporary Amperex Technology Co. Ltd)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Energy Solution

- Samsung SDI

- BYD Co. Ltd

- Tesla Inc.

- SK Innovation

- Exide Industries

- Johnson Matthey

- Redflow Limited

- MIDA Battery Tech

- Gotion High-Tech

- Farasis Energy

- Sunwoda

- SVOLT

- Northvolt

The EV battery market is highly competitive, led by major players from China and South Korea, with growing input from the U.S. and Europe. CATL leads in innovation, while LG Energy and Samsung SDI focus on scale. Panasonic and AESC prioritize reliability and solid-state research, and Tesla integrates batteries across its ecosystem. Global companies are investing in R&D, partnerships, and localized production to strengthen their market presence. Given below is a list of top global firms leading the electric vehicle battery market.

Recent Developments

- In April 2025, CATL introduced groundbreaking battery innovations at its Super Technology Day. Notably, the second-generation Shenxing Super Charging Battery offers a 520 km range with just a 5-minute charge. Additionally, CATL launched the Naxtra sodium-ion battery, a cost-effective alternative to lithium-ion batteries, and the Xiaoyao Dual-Core Battery, combining two chemistries for enhanced performance.

- In May 2025, General Motors and LG Energy Solution announced plans to produce new lithium manganese-rich (LMR) battery cells at their Ultium Cells facilities in Ohio and Tennessee, starting in 2028. These prismatic LMR cells aim to reduce battery pack costs by over 50% and offer over 400 miles of range per charge, moving closer to cost parity between EVs and internal combustion engine vehicles.

- Report ID: 4770

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.