Industrial Lead Acid Battery Market Outlook:

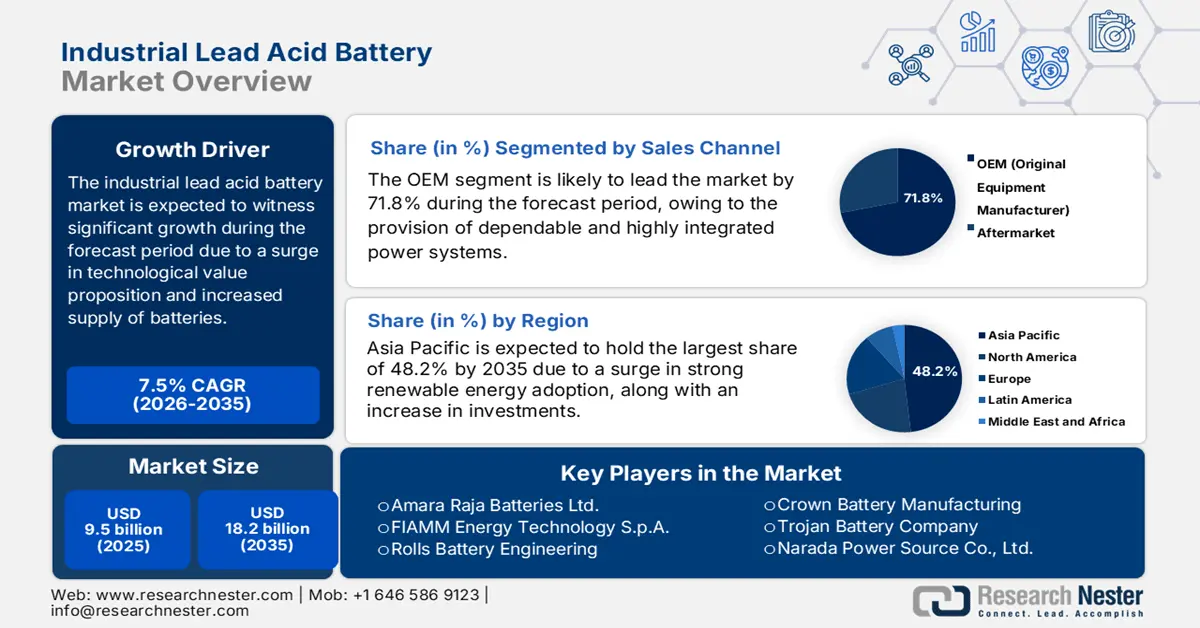

Industrial Lead Acid Battery Market size was over USD 9.5 billion in 2025 and is estimated to reach USD 18.2 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of industrial lead acid battery is assessed at USD 10.2 billion.

The international market is effectively reshaped by different key trends, which are enhancing the technology’s value proposition by opening the latest avenues for application and ensuring competitiveness. The aspect of advanced hybrid technologies is immensely fueling the market’s demand across different nations. According to an article published by the Battery Council International Organization in 2025, the battery sector in the U.S. readily powers USD 10 trillion of regional industrial economic output every year, denoting 21% of the country’s economy. Moreover, the lead battery sector yearly contributes more than USD 34 billion to the global economy, which is suitable for bolstering the market’s exposure.

Furthermore, the tactical focus on circular economy credentials, as well as a rise in battery-as-a-service models, are also fueling the market development globally. Besides, as per an article published by the CAS Organization in February 2025, lithium-ion battery production accounts for an estimated 40% to 60% of the overall emissions, which are produced during an electric vehicle’s manufacturing process. Besides, Volkswagen’s team has been deliberately committed to diminish carbon emissions by almost 30%. This has been possible by introducing a pilot infrastructure for successfully recycling vehicle batteries through specific circular economy KPI for upstreaming battery suppliers, which is positively impacting the market.

Key Industrial Lead Acid Battery Market Insights Summary:

Regional Highlights:

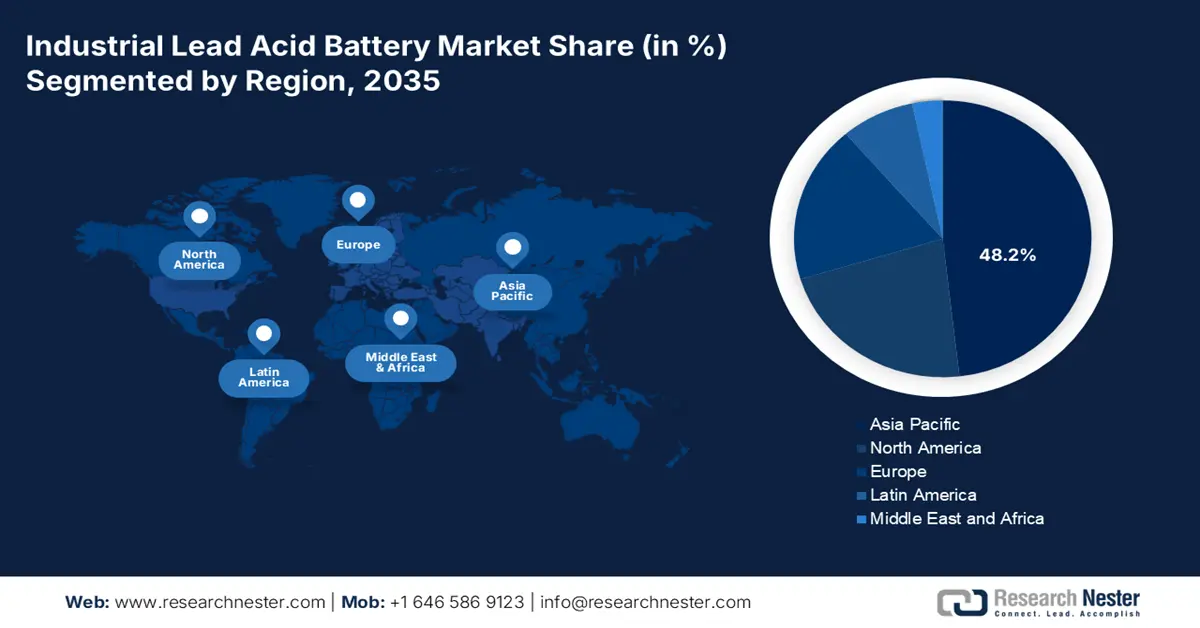

- Asia Pacific in the industrial lead acid battery market is anticipated to command a 48.2% share by 2035, supported by escalating renewable energy adoption, substantial data-telecom infrastructure investments, and rapid industrialization.

- By 2035, Europe is expected to emerge as the fastest-growing region as its expansion is encouraged by stronger industrial reliability mandates, environmental sustainability focus, rising backup-power requirements, and increased renewable-energy integration.

Segment Insights:

- By 2035, the OEM segment in the industrial lead acid battery market is forecast to secure a 71.8% share, reinforced by intensifying demand for warranty-backed, reliable, and integrated power systems across industrial equipment.

- By 2035, the VRLA segment is projected to capture the second-largest share as its advancement is stimulated by the industry’s transition toward versatile, sealed, and maintenance-free battery technologies.

Key Growth Trends:

- Proliferation of 5G facilities and data centers

- Expansion of renewable energy storage

Major Challenges:

- Alternative chemistries and intense competition

- Strict occupational and environmental regulations

Key Players: Clarios (U.S.), EnerSys (U.S.), East Penn Manufacturing Co. (U.S.), Exide Industries Ltd. (India), GS Yuasa International Ltd. (Japan), C&D Technologies, Inc. (U.S.), Leoch International Technology Ltd. (China), CSB Energy Technology Co., Ltd. (Taiwan), HBL Power Systems Limited (India), Amara Raja Batteries Ltd. (India), FIAMM Energy Technology S.p.A. (Italy), Rolls Battery Engineering (Canada), Crown Battery Manufacturing (U.S.), Trojan Battery Company (U.S.), Narada Power Source Co., Ltd. (China), B.B. Battery Co., Ltd. (China), First National Battery (South Africa), Mutlu Battery (Turkey), Hankook Atlas BX Co., Ltd. (South Korea), Banner Batteries (Austria).

Global Industrial Lead Acid Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.5 billion

- 2026 Market Size: USD 10.2 billion

- Projected Market Size: USD 18.2 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 4 November, 2025

Industrial Lead Acid Battery Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of 5G facilities and data centers: The international push for decarbonization is readily driving massive investments in the market. For instance, according to a data report published by Invest India Government in October 2025, India’s renewable energy capacity accounts for 18.4 GW, which has successfully generated a USD 19.9 billion valuation between 2020 and 2024, along with a 40% cumulative electric power capacity installation. Besides, the international renewable capacity is projected to triple by the end of 2030, leading to an increase in the need for battery systems through generous investments.

International Investment in Fossil Fuels and Clean Energy (2020-2024)

|

Years |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Fossil Fuels |

USD 897 billion |

USD 963 billion |

USD 1,036 billion |

USD 1,090 billion |

USD 1,116 billion |

|

Renewable Power |

USD 446 billion |

USD 470 billion |

USD 605 billion |

USD 735 billion |

USD 771 billion |

|

Grids and Storage |

USD 313 billion |

USD 330 billion |

USD 365 billion |

USD 416 billion |

USD 452 billion |

|

Energy Efficiency and End use |

USD 436 billion |

USD 562 billion |

USD 655 billion |

USD 646 billion |

USD 669 billion |

|

Nuclear and Other Clean Power |

USD 46 billion |

USD 58 billion |

USD 65 billion |

USD 67 billion |

USD 80 billion |

|

Low-emissions Fuel |

USD 9 billion |

USD 11 billion |

USD 17 billion |

USD 20 billion |

USD 31 billion |

Source: IEA Organization

- Expansion of renewable energy storage: The expansion in the digital economy, which is uplifting artificial intelligence (AI), Internet of Things (IoT), and cloud computing, has readily necessitated the build-out of hyperscale data facilities as well as 5G networks. In this regard, the April 2025 5G Americas Organization article indicated that the 5G adoption has been accelerated with over 2.2 billion connections across different nations. This acceleration is rapidly increasing four times faster than the 4G technology, which is upscaling the international commitment for cutting-edge mobile facilities, thus driving the market’s demand globally.

- Increased battery supply: The sudden expansion in the demand for data center sectors, as well as renewable energy, has readily upsurged the supply chain of batteries, which is also positively impacting the market globally. The majority of manufacturers, such as Exide and EnerSys, have declared capital extensions by ensuring a dependable supply chain for severe infrastructure projects. Besides, as per the 2023 OEC data report, China, Indonesia, and Singapore accounted for the countries with the highest battery trade surplus, with a valuation of USD 2.8 billion, USD 497 million, and USD 413 million.

Batteries 2023 Export and Import Fueling the Industrial Lead Acid Battery Market

|

Countries/Components |

Export |

Import |

|

China |

USD 3.1 billion |

- |

|

U.S. |

USD 849 million |

USD 1.2 billion |

|

Germany |

USD 782 million |

USD 662 million |

|

Mexico |

- |

USD 413 million |

|

Global Trade Valuation |

USD 9.4 billion |

|

|

Global Trade Share |

0.04% |

|

|

Product Complexity |

1.0 |

|

Source: OEC

Challenges

- Alternative chemistries and intense competition: The most pressing challenge in the market is the presence of relentless competitive pressure from other progressive battery options. While the market maintains a cost benefit upfront, lithium-ion’s superior energy density, decreased cost per cycle, and long-lasting cycle life are gradually eroding the market share. Besides, corporate sustainability goals and government incentives frequently favor the newest technologies, which have pressured manufacturers to aggressively communicate and continuously innovate the overall ownership expense and reliability benefits.

- Strict occupational and environmental regulations: The market currently operates under stringent international policies, catering to lead recycling, emissions, and handling. Compliance with standards readily set by agencies, such as the REACH in Europe and the EPA in the U.S., has significantly mandated generous capital investment in closed-loop logistics, worker safety systems, and manufacturing pollution controls. These administrative regulations complicate the overall supply chain and increase operational expenses, thereby causing a hindrance in the market.

Industrial Lead Acid Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 9.5 billion |

|

Forecast Year Market Size (2035) |

USD 18.2 billion |

|

Regional Scope |

|

Industrial Lead Acid Battery Market Segmentation:

Sales Channel Segment Analysis

Based on the sales channel, the OEM segment is anticipated to garner the largest share of 71.8% by the end of 2035. The segment’s upliftment is highly attributed to the pivotal demand for warranty-backed, reliable, and integrated power systems in industrial equipment. Manufacturers of renewable energy inverters, telecommunications facilities, UPS systems, and forklifts directly source batteries to ensure smooth compatibility, wide-ranging service warranties, and optimal performance. Besides, this particular channel offers end users with single-point and streamlined solution for essential power source and primary equipment, thus diminishing technical risk.

Construction Method Segment Analysis

Based on the construction method, the VRLA segment is projected to account for the second-largest share during the predicted period. The segment’s growth is driven by the aspect of a decisive market transition towards versatile, safe, and maintenance-free battery solutions. Unlike flooded batteries, these are usually non-spillable and sealed, and do not need regular watering, which makes them the most ideal for utilization in telecom sites, data centers, and offices. Meanwhile, this particular construction method has encompassed both GEL and AGM technologies, providing a small footprint and superior resistance to vibration, thereby bolstering the segment’s exposure in the market.

Type Segment Analysis

Based on type, the stationary segment is predicted to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly fueled by its importance for offering dependable backup power, renewable energy integration, and is essential for grid stability. Besides, according to an article published by the Battery Tech Association Organization in October 2024, battery energy storage is emerging to be essential, with the UK installing 4.7 GW to 5.8 GWh battery systems, while the need for UK-based batteries for stationary storage applications can rise to 10 GWh per year, thus suitable for the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Sales Channel |

|

|

Construction |

|

|

Type |

|

|

Voltage Range |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Lead Acid Battery Market - Regional Analysis

APAC Market Insights

Asia Pacific in the industrial lead acid battery market is anticipated to garner the highest share of 48.2% by the end of 2035. The market’s upliftment is highly driven by robust renewable energy adoption, huge investments in data and telecom centers, and unprecedented industrialization. According to an article published by the IBA Asia Correspondent in September 2025, the International Energy Agency (IEA)’s 2025 energy investment report indicated an increase in the capital flow for the energy sector in the region, amounting to USD 3.3 trillion on a year-on-year (YoY) basis. Of this, an estimated USD 2.2 trillion caters to electrification, efficiency, low-emission fuels, storage, grids, nuclear, and renewables, which is positively impacting the market’s growth.

The industrial lead acid battery market in China is growing significantly, owing to its pivotal role in huge domestic investments and international manufacturing, along with the existence of Dual Carbon objectives directed by the National Development and Reform Commission (NDRC). Besides, as per the December 2024 SCIO Government article, the country’s 5G mobile phone subscriptions have reached 1.002 billion by the end of 2024, leading 56% of total mobile phone subscriptions, which marked a 9.4% increase. This has resulted in an increase in lead-acid battery manufacturing in the country, which is rapidly skyrocketing the market’s growth.

The industrial lead acid battery market in India is also growing due to governmental strategies, readily targeting digitalization, renewable energy, and industrial modernization. Simultaneously, the presence of the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage, along with the rapid growth of the 5G technology, are also driving the market’s demand in the country. According to an article published by the PIB Government in November 2024, the country has set the renewable energy target of gaining 500 GW from non-fossil sources by the end of 2030. Meanwhile, an increase in lead-acid electric accumulators supply aspect in the country and the overall region is also fueling the market’s upliftment.

Lead-Acid Electric Accumulators (Vehicle) 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

South Korea |

USD 1.6 billion |

USD 47.5 million |

|

China |

USD 1.0 billion |

- |

|

Vietnam |

USD 182 million |

USD 18.1 million |

|

India |

USD 213 million |

USD 73.9 million |

|

Malaysia |

USD 128 million |

USD 218 million |

|

Japan |

USD 66.4 million |

USD 286 million |

|

Indonesia |

USD 93.2 million |

USD 80.2 million |

|

Thailand |

USD 163 million |

USD 87.8 million |

Source: OEC

Europe Market Insights

Europe in the industrial lead acid battery market is predicted to emerge as the fastest-growing region during the forecast period. The market’s development in the region is propelled by increased focus on industrial dependability, strict environmental sustainability, the demand for backup power in the digitalizing economy, renewable energy source integration, and the electrification of material handling equipment in both logistics and manufacturing. According to an article published by the Eurobat Organization in February 2022, it has been estimated that an overall €1.4 billion of lead acid batteries are imported into the region, with more than 61.0% of them readily utilized for non-piston engines. Additionally, the import facility for the market in the region is extremely concentrated, with the majority of countries covering more than 95% of imports.

The industrial lead acid battery market in Germany is gaining increased traction, owing to the presence of its strong Industry 4.0 strategy for accelerating automation in logistics and manufacturing, which is further driving continuous demand for motive power batteries in both automated guided vehicles and electric forklifts. As per the 2025 Federal Ministry for Economic Affairs and Energy data report, Industry 4.0 in the country has executed €40 billion investments, along with 20% of the share catering to automotive organizations. In addition, €153 billion constitutes additional growth, with 83% of the share accounting for companies to adopt value chains for digitalization.

The industrial lead acid battery market in Poland is also developing due to huge regional funds and investments in modernization, which is readily driving the parallel need for backup power in the latest data facilities and ensuring energy storage for supporting the growing solar capacity. As per the April 2025 EIB Organization article, PLN 2.2 billion has been successfully granted to the country’s top utility, Polska Grupa Energetyczna (PGE), for supporting renewable energy production. This resulted in planned investments for photovoltaic installations with a share capacity of almost 730 MW, thus suitable for the market’s upliftment.

North America Market Insights

North America in the industrial lead acid battery market is projected to witness steady growth by the end of the forecast duration. The market’s development in the region is fueled by the expansion of renewable energy projects, robust demand from data facilities, and aging grid infrastructure modernization. According to an article published by the World Resources Institute in February 2025, battery storage capacity almost doubled in the U.S. in 2024, reaching nearly 29 GW, and is projected to grow by 47% by the end of 2025. In addition, Amazon announced a USD 500 million investment in small modular nuclear reactors (SMRs), which is also boosting the market in the region.

Overall Electricity Production Among Different Renewable Power (2022)

|

Renewable Power Type |

Shares |

|

Wind |

10.3% |

|

Hydropower |

6.0% |

|

Solar |

3.4% |

|

Biomass |

1.2% |

|

Geothermal |

0.4% |

Source: U.S. Department of Energy

The industrial lead acid battery market in the U.S. is gaining increased exposure, owing to the governmental support for ensuring the chemical sector’s advancement, programs for innovative manufacturing technologies benefiting the industrial battery supply chain directly, and the existence of the Environmental Protection Agency (EPA). As per a data report published by the OSTI Government in February 2024, the Advanced Materials and Manufacturing Technologies Office (AMMTO) introduced a funding opportunity to provide USD 15 to USD 30 million to projects that readily advance net shape manufacturing techniques in the country, based on which there is a huge growth of the market in the country.

The industrial lead acid battery market in Canada is also growing due to generous investments in critical infrastructure and remote communities, rapid electrification in the natural resources sector, and effective support for renewable energy integration. As stated in the August 2025 Government of Canada article, the country’s clean energy gross domestic product is predicted to reach USD 107.0 billion, which is readily fueled by USD 58.0 billion in yearly investments by the end of 2030, and is expected to provide over 600,000 employment opportunities. Besides, the $1.5 billion Critical Minerals Infrastructure Fund (CMIF) has declared USD 200 million in funding for clean energy projects, which is also driving the market’s exposure.

Key Industrial Lead Acid Battery Market Players:

- Clarios (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EnerSys (U.S.)

- East Penn Manufacturing Co. (U.S.)

- Exide Industries Ltd. (India)

- GS Yuasa International Ltd. (Japan)

- C&D Technologies, Inc. (U.S.)

- Leoch International Technology Ltd. (China)

- CSB Energy Technology Co., Ltd. (Taiwan)

- HBL Power Systems Limited (India)

- Amara Raja Batteries Ltd. (India)

- FIAMM Energy Technology S.p.A. (Italy)

- Rolls Battery Engineering (Canada)

- Crown Battery Manufacturing (U.S.)

- Trojan Battery Company (U.S.)

- Narada Power Source Co., Ltd. (China)

- B.B. Battery Co., Ltd. (China)

- First National Battery (South Africa)

- Mutlu Battery (Turkey)

- Hankook Atlas BX Co., Ltd. (South Korea)

- Banner Batteries (Austria)

- Clarios is considered the global leader, well-known for its extended portfolio of innovative lead-acid batteries that readily power backup systems in telecommunications and data centers. The organization has heavily invested in AGM and VRLA technologies, thus reinforcing market dominance. Owing to this, the company has successfully generated approximately USD 10.6 billion in revenue, sold more than 154 million batteries, and accounted for over 80% revenue from aftermarket sales.

- EnerSys is one of the premier providers, recognized for its advanced reserve power and motive power, such as the acclaimed NexSys line of thin plate pure lead batteries. The organization has strengthened its position through tactical acquisitions and a focus on industrial-grade and high-value energy storage applications.

- East Penn Manufacturing Co. is considered a dominant and privately held manufacturer with a completely integrated operational model that has encompassed lead recycling to finished battery production. Besides, the organization’s commitment to its extended and sustainable Deka brand product line has made it a notable automotive supplier. Based on all these, its 2025 sustainability report states that the company has generated more than USD 3.6 billion in net sales and USD 21.7 million as investment for research and development.

- Exide Industries Ltd. is considered a suitable market leader in India, offering a comprehensive range of industrial batteries for sectors such as power, railways, and telecommunications. The firm readily continues to extend its manufacturing capabilities and focus on technological advancement to maintain a stronghold in the regional market.

- GS Yuasa International Ltd. is a Japan-based powerhouse, well-known for its reliable and high-quality stationary batteries, utilized in emergency power supplies and UPS systems across Europe and Asia. The organization’s robust R&D drives the creation of long-lasting and maintenance-free batteries, thus solidifying its reputation for excellence in the industrial sector.

Here is a list of key players operating in the global market:

The international market is extremely consolidated, with the majority of players accounting for a significant share. East Penn, EnerSys, and Clarios have successfully formed a dominant core, especially in Europe and North America, due to which competition is intense, which is fueled by distribution networks, technology, and price. Notable strategies, such as generous investments in research to boost lead carbon and TPPL technologies, are also driving the market’s demand. Besides, in November 2024, Exide Technologies declared the unveiling of the newest addition to its Absorbed Glass Mat (AGM) battery range by extending coverage for almost 1 million additional vehicles in Europe, thus suitable for uplifting the industrial lead acid battery market growth.

Corporate Landscape of the Industrial Lead Acid Battery Market:

Recent Developments

- In December 2024, Stellantis and CATL notified their joint agreement to invest almost €4.1 billion in building a large-scale Europe-based lithium-ion phosphate battery plant in Zaragoza, Spain, which will be carbon neutral and will be implemented in different phases through investment plans.

- In October 2023, Toyota Motor Corporation and Idemitsu Kosan Co., Ltd. announced their entry into a strategic agreement to operate together in creating mass production technology for solid electrolytes to gain all-solid-state batteries for battery electric vehicles (BEVs).

- Report ID: 8209

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Lead Acid Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.