Forklift Battery Market Outlook:

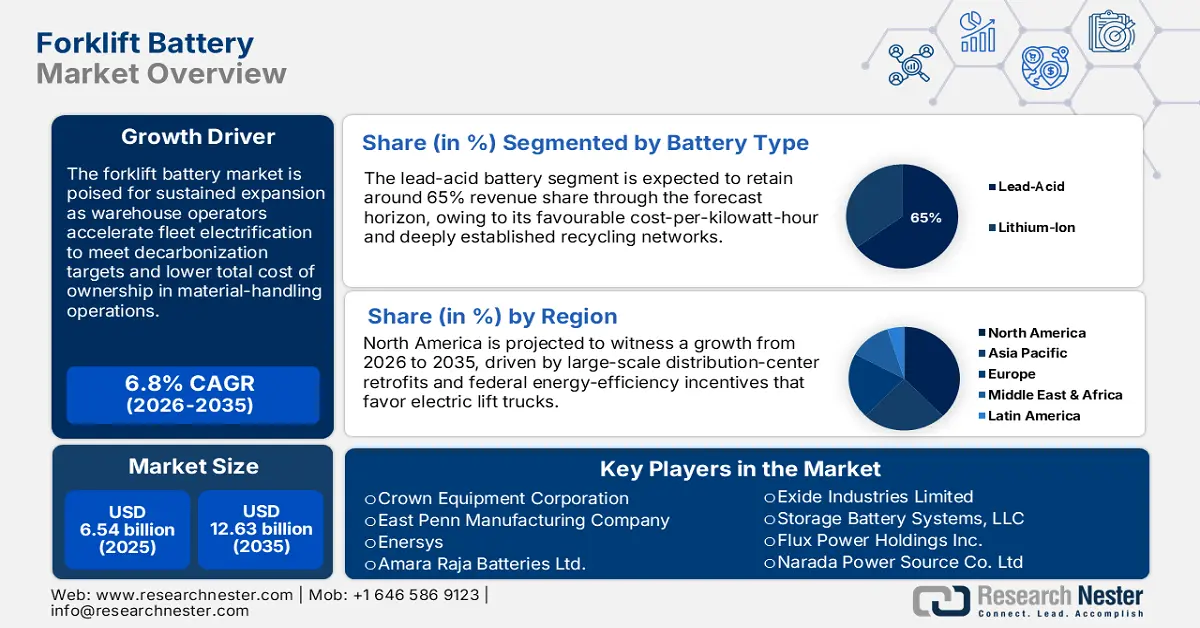

Forklift Battery Market size was over USD 6.54 billion in 2025 and is projected to reach USD 12.63 billion by 2035, growing at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of forklift battery is assessed at USD 6.94 billion.

The forklift battery market is witnessing a significant adoption of electric and eco-friendly material handling alternatives. This is triggered by the growing demand for clean energy alternatives and the cost advantage of lowered operational expenses. A notable event in February 2025 was the launch by Godrej & Boyce of the country's first locally manufactured lithium-ion forklift, marking a significant leap in energy efficiency and reduced dependency on fossil fuels in the Indian market. Such breakthroughs are creating room for increased acceptance of electric forklifts in various industries.

Government incentives for green energy and increased enforcement of emission norms are further fueling demand for electric forklifts, thereby driving the forklift battery market. Furthermore, advanced battery technology in the form of lithium-ion batteries is a major driver of such growth. These batteries deliver higher energy density, longer lifespan, and faster charging compared to traditional lead-acid batteries. These technologies are making electric forklifts a viable and competitive option in various applications. Ongoing technology innovation in batteries is likely to support further forklift battery market growth. Additionally, the decreasing cost of lithium-ion batteries is increasing their accessibility to a wider range of users.

Key Forklift Battery Market Insights Summary:

Regional Highlights:

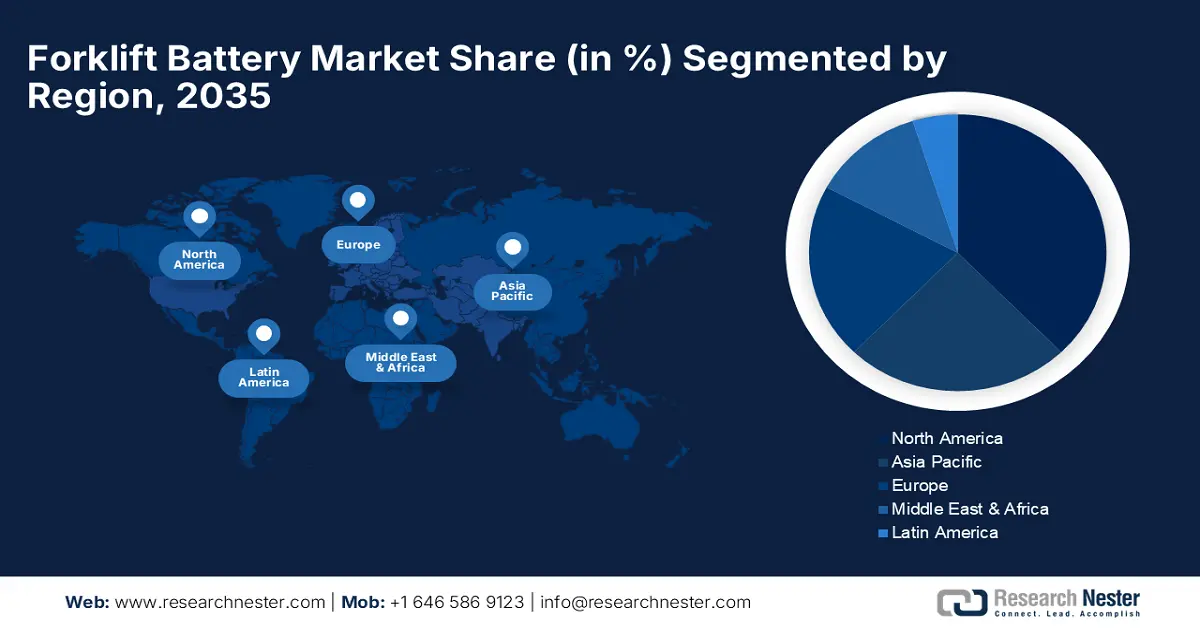

- Asia Pacific forklift battery market is poised to capture 47% share by 2035, driven by rapid industrialization and demand for efficient material handling equipment.

- North America market projects substantial growth during the forecast timeline, driven by electrification of logistics and state/federal clean energy incentives.

Segment Insights:

- The lead-acid battery segment in the forklift battery market is expected to secure a 65% share by 2035, influenced by cost advantages, ease of maintenance, and proven reliability across applications.

- The manufacturing segment in the forklift battery market is projected to secure a 35% share by 2035, driven by high demand for material handling and logistics operations in manufacturing facilities.

Key Growth Trends:

- Development of next-generation battery technologies

- Strategic partnerships and collaborations

Major Challenges:

- Recycling and environmental concerns

Key Players: Exide Industries Limited, Storage Battery Systems, LLC, Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH, Crown Equipment Corporation, East Penn Manufacturing Company, Enersys, Amara Raja Batteries Ltd., Flux Power Holdings Inc., Narada Power Source Co. Ltd., Trojan Battery Co. LLC.

Global Forklift Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.54 billion

- 2026 Market Size: USD 6.94 billion

- Projected Market Size: USD 12.63 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Forklift Battery Market Growth Drivers and Challenges:

Growth Drivers

- Development of next-generation battery technologies: The innovation of advanced battery technologies, including lithium-ion batteries, is a major growth driver. These batteries have higher energy density, longer life cycles, and faster charging times than traditional lead-acid batteries. In February 2025, BSLBATT Battery emphasized its role in supplying the material handling industry with lithium-ion batteries with a focus on improving efficiency and maintaining environmentally friendly warehouse operations. All these innovations are making electric forklifts more feasible and appealing to multiple applications. Ongoing innovation in battery technology will continue to fuel forklift battery market growth. Furthermore, with declining costs for lithium-ion batteries, these batteries are becoming accessible to a wider range of users.

- Strategic partnerships and collaborations: Partnerships between OEMs of forklifts and manufacturers of batteries allow advanced battery solutions to be integrated into the design of the forklift. In September 2024, Flux Power launched a joint venture with a prominent OEM of forklifts to introduce a private label battery program so that the OEM can sell Flux's UL Type EE-certified lithium-ion batteries with its own branding. Such joint ventures are promoting the use of advanced battery technology in the case of forklifts. These joint ventures also simplify the supply chain and promote higher compatibility of batteries with forklifts. In addition to that, joint ventures promote innovation and speed up the process involving customized battery solutions.

- Government support and incentives: Government incentives and policies play a significant role in the promotion of the use of electric forklifts and, subsequently, the demand for batteries in them. In March 2025, the BlueOval SK joint venture between Ford Motor and SK On from South Korea received a USD 9.63 billion loan from the U.S. Department of Energy to fund the establishment of three new battery production facilities in Tennessee and Kentucky. These kinds of large investments reflect the government's determination to encourage the battery sector. These policies not only enhance domestic production of batteries but also generate employment and stimulate growth in the economy. Other policies to curb carbon emissions are also pushing companies to use electric forklifts.

Challenges

- Supply chain restraints: Supply chain challenges arise from the sudden growth in demand for lithium-ion batteries, with shortages in raw materials and manufacturing capacity. Although such investment tries to ease supply restraints, the industry continues to contend with challenges in fulfilling growing demand. Such restraints may result in longer lead times and costs, compromising the general use of electric forklifts. Further, geopolitical tensions and trade policies may also affect the supply chain stability.

- Recycling and environmental concerns: Disposal and recycling of forklift batteries, especially of the lead-acid variety, present environmental-related problems. Even with such efforts, the industry requires more comprehensive recycling facilities to meet the growing number of used batteries. Improper disposal also contributes to contamination of the environment and poses health risks. Thus, improving recycling methods and promoting sound disposal become critical to achieving growth in a sustainable manner.

Forklift Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 6.54 billion |

|

Forecast Year Market Size (2035) |

USD 12.63 billion |

|

Regional Scope |

|

Forklift Battery Market Segmentation:

Battery Type Segment Analysis

The lead-acid battery segment in forklift battery market is predicted to retain over 65% share during the forecast period. This is owing to their cost advantage and proven market presence. Lead-acid batteries are widely used in various applications due to their ease of maintenance and reliability. In April 2025, OnPoint Group's subsidiary, Concentric LLC, acquired Industrial Battery Solutions to enhance its forklift battery market presence in providing comprehensive energy solutions to forklift fleets. This acquisition points to the long-term demand for lead-acid batteries in the industry. Nonetheless, the segment is threatened by upcoming battery technologies that deliver improved performance and offerings with reduced impact on the environment.

Application Segment Analysis

The manufacturing sector is expected to dominate the forklift battery market, accounting for a 35% share through 2035. High demand in manufacturing centers for use in material handling and logistic operations in manufacturing facilities is the primary driver of this dominance. In March of 2025, Hyster launched a broad lineup of configurable high-capacity electric forklifts to cater to increased demand in industrial markets for efficient and sustainable material handling solutions. These products specifically address the manufacturing industry's unique end-users' demands to boost productivity and operational efficiency. Advanced battery technologies' implementation in manufacturing operations is also driving growth in this segment.

Our in-depth analysis of the global forklift battery market includes the following segments:

|

Battery Type |

|

|

Application Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Forklift Battery Market Regional Analysis:

North America Market Insights

North America region is poised to witness substantial growth through 2035. Growth is supported by the broad-based electrification of warehouse and logistics operations in industry segments such as retail, manufacturing, and e-commerce. Organizations are upgrading from diesel and lead-acid forklifts to lithium-ion alternatives with improved performance and eco-friendly gains. Automating and electrifying the fleet is now the norm in large-scale logistics centers of distribution. Stringent climate regulation and carbon-emissions reduction obligations also encourage industry to turn towards zero-emission solutions, and that aligns with financial offerings to upgrade batteries. Being based in regions with a highly developed industry base helps the region to dominate long term.

The U.S. forklift battery market is picking up speed with incentives at the state and federal levels in the direction of clean energy and vehicle electrification. Under Section 45W Commercial Clean Vehicle Credit by the IRS, businesses can claim incentives of up to USD 40,000 per electric industrial vehicle, which includes forklifts. This has been stimulating the acquisition of lithium-ion-powered forklifts in manufacturing and logistics facilities. In March of 2025, Grid On Demand initiated a pilot mobile battery storage product focused on electrified fleets of forklifts. The system provides scalable energy assistance to high-load operations. American companies are also investing in the local production of batteries to de-risk the supply chain. Collectively, these measures are stimulating steady demand in the market.

Canada forklift battery market is being driven by corporate electrification and a supportive regulatory landscape. In March 2025, Walmart Canada ordered the purchase of CAD 7 million in battery systems from Electrovaya to be supplied to two of its distribution centers. This project reveals increasing corporate demand for low-emission warehouse equipment that is reliable. Canada’s policy to become Net-Zero Emissions by 2050 has encouraged industries to shift to carbon-cutting technologies. Industrial electric vehicle adoption is supported by provincial rebate schemes. Logistics operators are adopting lithium-ion forklifts to achieve internal ESG commitments. All those efforts and policies combined place Canada firmly in North America market.

APAC Market Insights

Asia Pacific is set to dominate the forklift battery market with a share of 47% by 2035. Industrialization and the construction of infrastructure in emerging economies are generating tremendous demand for efficient material handling equipment. Asia Pacific's huge warehousing demand and growth driven by e-commerce and city growth is promoting the use of electric forklifts. Lithium-ion batteries are garnering forklift battery market share due to their charging speed advantage and long-term cost savings. Southeast Asia and India are placing great emphasis on upgrading fleets in order to meet the growth in manufacturing. Incentives from the government to support clean energy use by corporate players in the private sector are further pushing the implementation of high volumes of batteries in the region.

China forklift battery market is witnessing growth driven by large-scale production and government-initiated electrification. In March 2025, a USD 67 million investment was reported in South Carolina to produce critical components of lithium-ion batteries shipped to China. Locally, domestic authorities are implementing tighter emission regulations on industrial trucks in urban areas. This is hastening internal combustion forklift replacement. While major industry players such as BYD are increasing their production of lithium-ion forklifts, the nation is both a major producer and consumer. Scale and policy incentives in China put it at the forefront of the global demand for batteries.

India forklift battery market is gaining traction with the improvement of the country's logistics and warehousing network. Demand is increasing in pharmaceuticals, e-commerce, and manufacturing sectors, where downtime and maintenance costs arise as major areas of concern. Policies of the government, such as the National Electric Mobility Mission, pave the way towards a favorable environment. Import duty cuts on the components of batteries also decreased entry barriers. Local production and growing demand in India together indicate good prospects of growth.

Forklift Battery Market Players:

- Crown Equipment Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- East Penn Manufacturing Company

- Enersys

- Amara Raja Batteries Ltd.

- Exide Industries Limited

- Storage Battery Systems, LLC

- Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH

- Flux Power Holdings Inc.

- Narada Power Source Co. Ltd.

- Trojan Battery Co. LLC

The forklift battery market is highly competitive with major players following innovation, strategic alliances, and expansion to consolidate their market share. Key market players in the market are Exide Industries Limited, Storage Battery Systems, LLC, Accumulatorenwerke HOPPECKE Carl Zoellner & Sohn GmbH, Crown Equipment Corporation, East Penn Manufacturing Company, Enersys, Amara Raja Batteries Ltd., Flux Power Holdings Inc., Narada Power Source Co. Ltd., and Trojan Battery Co. LLC.

The players in the industry are investing in research and development to launch next-generation battery technologies and meet the changing demands of other industries. In September 2025, EnerSys was awarded a USD 199 million contract to build a state-of-the-art gigafactory of lithium-ion cells to supply batteries to electric forklifts and other industrial users. Such massive investments reflect the competitive forklift battery market scenario and the focus on technological upgrades. Organizations also aim to expand their footprint in the global market through mergers and acquisitions and alliances to gain market leverage.

Here are some leading players in the forklift battery market:

Recent Developments

- In February 2025, Hyster implemented a new solution for electric vehicles, focusing on enhancing the performance and efficiency of electric forklifts, which will likely lead to wider adoption of these environmentally friendly machines. This innovation included a more energy-efficient motor and an improved regenerative braking system.

- In June 2025, TDK announced advancements in solid-state battery technology. These developments have potential applications in electric forklifts, offering higher energy density and safety. This advancement could lead to longer operating times and safer warehouse environments.

- Report ID: 2749

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Forklift Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.