Secondary Battery Market Outlook:

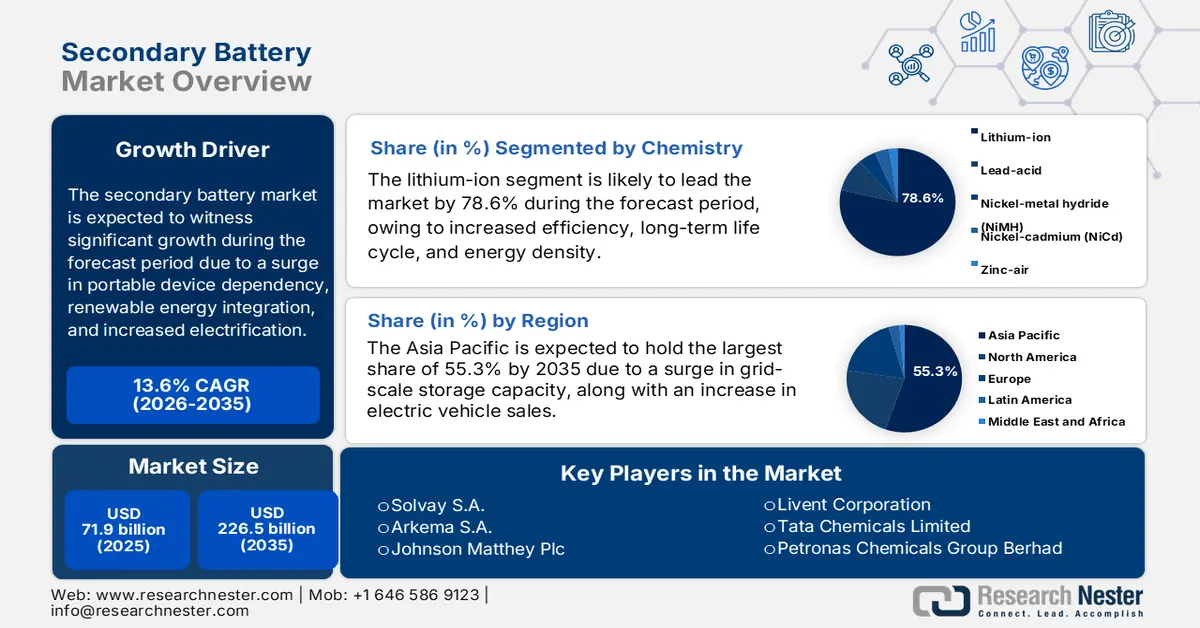

Secondary Battery Market size was over USD 71.9 billion in 2025 and is estimated to reach USD 226.5 billion by the end of 2035, expanding at a CAGR of 13.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of secondary battery is assessed at USD 81.6 billion.

The international secondary battery market is effectively fueled by an increase in the reliance on portable devices, a rise in renewable energy integration, and the electrification of transport. In addition, the market is also highly competitive, with the Asia Pacific is readily leading in innovation and production, while Europe and North America are focusing on advanced chemistries, recycling, and sustainability. Besides, according to a data report published by the IEA Organization in 2025, copper plays a vital role in overall electrical applications, with a secondary share of 33% as of 2023. Likewise, the overall demand for recycled nickel accounts for 31% in the same year. Besides, the main exception is aluminum, with the recycled share increasing from 24% to 26%, which is proliferating the overall market’s growth and expansion across different nations in the upcoming years.

Furthermore, the shift towards lithium-ion dominance, the solid-state battery development, the circular economy, battery recycling, artificial intelligence (AI) integration, digitalized manufacturing, along with expansion in regional gigafactory, are other factors driving the secondary battery market globally. As per an article published by NLM in December 2024, Toyota has readily claimed to commence providing cars with solid-state batteries, as well as a range of 750 miles. In addition, two China-based car organizations, such as IM Motors and Nio, ensured production models within a year. Besides, QuantumScape, within 5 years, and USD 100 million to select the standard material for the solid electrolyte in its battery. Additionally, within another 5 years, the company utilized USD 200 million to develop prototypes for car companies with over 2 million tests, thus making it suitable for the secondary battery market’s growth.

Key Secondary Battery Market Insights Summary:

Regional Insights:

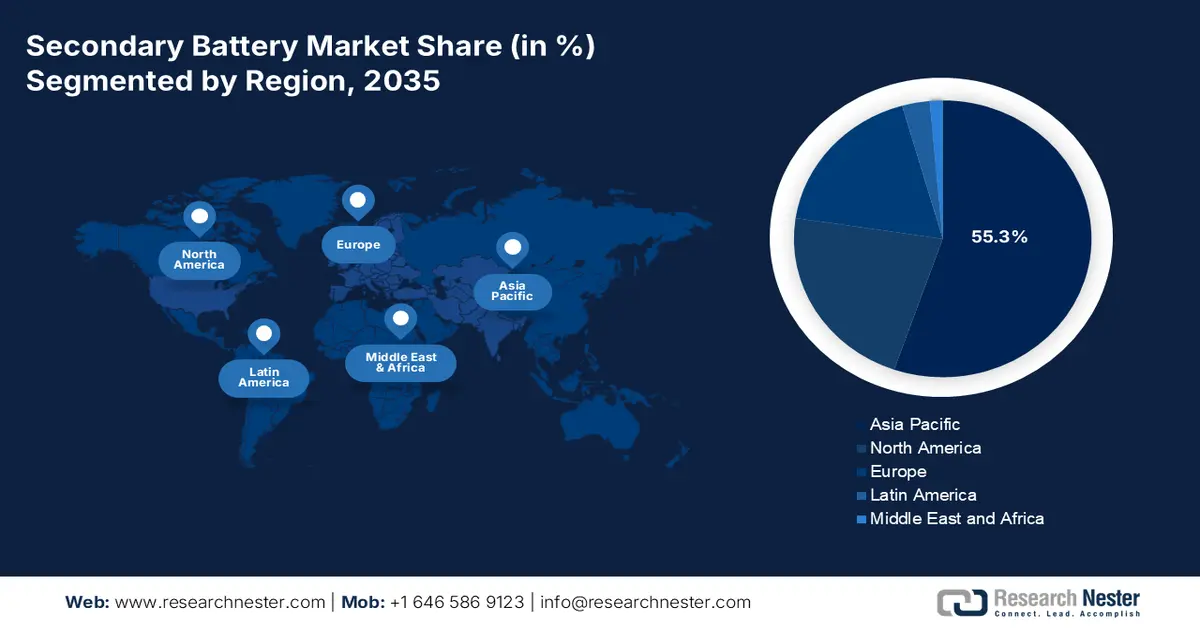

- By 2035, Asia Pacific is projected to command a dominant 55.3% share in the secondary battery market, strengthened by rising grid-scale energy storage deployments, widespread electric vehicle penetration, and strong consumer electronics manufacturing across major Asian economies.

- Europe is expected to register the fastest growth trajectory by 2035, as the region’s expansion is catalyzed by rapid industrial electrification, accelerating battery energy storage system installations, and surging electric vehicle adoption.

Segment Insights:

- By 2035, the lithium-ion segment within the chemistry category is forecast to capture a substantial 78.6% share of the secondary battery market, underpinned by its high efficiency, extended lifecycle, and superior energy density enabling compact and lightweight energy storage solutions.

- By the end of 2035, the automotive segment is anticipated to hold the second-largest share in the market, bolstered by automakers’ swift transition toward electrification supported by regulatory mandates, government incentives, and rising demand for sustainable mobility.

Key Growth Trends:

- Increase in electric vehicle adoption

- Renewable energy storage

Major Challenges:

- Volatility in raw material supply chain system

- Increased manufacturing expenses and capital intensity

Key Players: Samsung SDI Co., Ltd. (South Korea), SK On Co., Ltd. (South Korea), Contemporary Amperex Technology Co., Limited – CATL (China), BYD Company Limited (China), Panasonic Holdings Corporation (Japan), GS Yuasa Corporation (Japan), Hitachi Chemical Co., Ltd. (Japan), Mitsubishi Chemical Group Corporation (Japan), UBE Corporation (Japan), BASF SE (Germany), Solvay S.A. (Belgium), Arkema S.A. (France), Johnson Matthey Plc (United Kingdom), Umicore N.V. (Belgium), Dow Inc. (U.S.), Albemarle Corporation (U.S.), Livent Corporation (U.S.), Tata Chemicals Limited (India), Petronas Chemicals Group Berhad (Malaysia).

Global Secondary Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 71.9 billion

- 2026 Market Size: USD 81.6 billion.

- Projected Market Size: USD 226.5 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.3% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Mexico

Last updated on : 16 December, 2025

Secondary Battery Market - Growth Drivers and Challenges

Growth Drivers

-

Increase in electric vehicle adoption: The increase in electric vehicle sales has created an unprecedented need for the secondary battery market globally. Besides, zero-emission mandates and governmental subsidies have equally escalated the adoption. Based on this, the 2025 IEA Organization data report indicated that electric car sales upsurged 17 million as of 2024, denoting a sales share of over 20%. Moreover, the electric car sales are projected to surpass 20 million, which accounts for more than a quarter of cars purchased internationally. Additionally, within three months of 2025, the international electric car sales rose to almost 35% year-on-year (YoY). Therefore, the continuous rise in electric car sales across different regions is a huge driving factor for the market’s demand.

Yearly International Electric Car Sales (2014-2024)

|

Year |

China BEV |

China PHEV |

Europe BEV |

Europe PHEV |

U.S. BEV |

U.S. PHEV |

Rest of the World BEV |

Rest of the World PEHV |

|

2014 |

- |

- |

0.1 million |

- |

0.1 million |

0.1 million |

- |

- |

|

2015 |

0.1 million |

0.1 million |

0.1 million |

0.1 million |

0.1 million |

- |

- |

- |

|

2016 |

0.3 million |

0.1 million |

0.1 million |

0.1 million |

0.1 million |

0.1 million |

- |

- |

|

2017 |

0.5 million |

0.1 million |

0.1 million |

0.2 million |

0.1 million |

0.1 million |

0.1 million |

- |

|

2018 |

0.8 million |

0.3 million |

0.2 million |

0.2 million |

0.2 million |

0.1 million |

0.1 million |

0.1 million |

|

2019 |

0.8 million |

0.2 million |

0.4 million |

0.2 million |

0.2 million |

- |

- |

0.1 million |

|

2020 |

0.9 million |

0.2 million |

0.8 million |

0.6 million |

0.2 million |

0.1 million |

- |

0.1 million |

|

2021 |

2.7 million |

0.5 million |

1.2 million |

1.1 million |

0.5 million |

0.2 million |

0.2 million |

0.1 million |

|

2022 |

4.4 million |

1.5 million |

1.6 million |

1.0 million |

0.8 million |

0.2 million |

0.5 million |

0.1 million |

|

2023 |

5.4 million |

2.7 million |

2.2 million |

1.0 million |

1.1 million |

0.3 million |

0.8 million |

0.2 million |

|

2024 |

6.4 million |

4.9 million |

2.2 million |

1.0 million |

1.2 million |

0.2 million |

1.0 million |

0.3 million |

Source: IEA Organization

- Renewable energy storage: The aspect of grid-scale storage is extremely severe for stabilizing renewable supply, which is rapidly uplifting the secondary battery market internationally. Besides, by the end of 2030, the worldwide energy storage capacity is projected to triple, which is gradually driving the demand for ESS batteries. As per an article published by the IEEFA Organization in August 2025, India has rapidly increased its hybrid tenders, which are a combination of renewable energy and battery storage, from almost 12% to more than 49% as of 2024. Moreover, between 2022 and 2025, the country is projected to significantly auction an estimated 12.8 GWh of battery energy storage system capacity for both standalone and hybrid applications. Out of this, 219 MWh of the capacity is effectively operational, denoting a growing opportunity for remaining capacities in the country.

- Surge in consumer electronics demand: The availability of wearables, laptops, and smartphones continues to drive the portable battery demand. Besides, the rise of Internet of Things (IoT) devices has further added pressure on small-format batteries, all of which create a positive impact on the secondary battery market. As stated in a data report published by the PIB Government in October 2025, the electronics production has upsurged almost 6-fold from ₹1.9 lakh crore to ₹11.3 lakh crore. Based on this growth, the mobile phone export increased 127 times from ₹1,500 crore in to ₹2 lakh crore as of 2025. Moreover, this continuous growth resulted in electronics manufacturing paving the way for 25 lakh employment opportunities over the past 10 years, thereby gradually enhancing the market’s demand.

Challenges

- Volatility in raw material supply chain system: The secondary battery market is readily dependent on critical minerals such as lithium, cobalt, nickel, and manganese. Therefore, the supply chain volatility, fueled by geopolitical tensions, concentrated mining in limited regions, along with fluctuating commodity prices, is posing a significant risk. For instance, cobalt prices have historically surged, owing to political instability and labor concerns, directly impacting battery costs. In addition, environmental regulations on mining and refining processes in countries such as Chile and Indonesia have limited supply expansion. This particular volatility creates uncertainty for manufacturers, constituting the intention of balancing long-term contracts with spot market purchases.

- Increased manufacturing expenses and capital intensity: The production process in the secondary battery market demands innovative manufacturing facilities, precise chemical processing, and stringent quality control, all of which are capital-intensive. Besides, gigafactories are expensive to build, and upscaling production comprises significant upfront investment in equipment, workforce training, and safety compliance. For instance, lithium-ion battery pack costs have reduced over the past decade but remain high in comparison to internal combustion engine alternatives, restricting cost-effectiveness in mass-market electric vehicles, thereby causing a hindrance in the secondary battery market’s growth.

Secondary Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 71.9 billion |

|

Forecast Year Market Size (2035) |

USD 226.5 billion |

|

Regional Scope |

|

Secondary Battery Market Segmentation:

Chemistry Segment Analysis

The lithium-ion segment, which is part of the chemistry category, is anticipated to account for the largest share of 78.6% in the secondary battery market by the end of 2035. The segment’s upliftment is primarily attributed to its superior high efficiency, long-lasting life cycle, and increased energy density. This eventually enables powerful, compact, and lightweight energy storage solutions for modernized technology. According to a data report published by the IEA Organization in May 2023, the lithium-ion battery manufacturing capacity was 1.2 TWh in China as of 2022, which further increased to 2.9 TWh in 2025 and is projected to be 4.6 TWh by the end of 2030. Simultaneously, in the U.S., the capacity was 0.1 TWh in 2022, followed by 0.4 TWh in 2025, and is expected to reach 0.7 TWh by the end of 2030. Therefore, this denotes a huge exposure of the battery type, thus driving the segment’s growth internationally.

End user Segment Analysis

The automotive segment in the secondary battery market is expected to cater to the second-largest share by the end of the forecast period. The segment’s growth is highly propelled by the aspect of automakers rapidly shifting toward electrification, which is driven by strict emission regulations, government incentives, and consumer demand for sustainable mobility. Besides, secondary batteries, especially lithium-ion chemistries, are considered the backbone of this transformation, deliberately powering electric cars, buses, and commercial vehicles. Moreover, the automotive sector’s dependency on secondary batteries expands beyond propulsion, and they are readily utilized in auxiliary systems such as start-stop technology, hybrid drivetrains, and onboard electronics, thereby creating an optimistic outlook for the segment’s upliftment.

Application Segment Analysis

By the end of the stipulated timeline, the electric vehicles sub-segment, part of the application segment, is projected to account for the third-largest share in the secondary battery market. The sub-segment’s development is extremely fueled by the aspect of depending on high-capacity lithium-ion batteries for propulsion, with chemistries such as nickel manganese cobalt, along with lithium iron phosphate dominating the secondary battery market. Besides, electric vehicle battery packs demand innovative chemical formulations to deliver high energy density, safety, and long cycle life, making the chemical industry central to EV growth. Moreover, government policies are accelerating EV adoption worldwide, with Europe’s Fit for 55 package, the U.S. Inflation Reduction Act, and China’s New Energy Vehicle (NEV) mandate.

Our in-depth analysis of the secondary battery market includes the following segments:

|

Segment |

Subsegments |

|

Chemistry |

|

|

End user |

|

|

Application |

|

|

Voltage |

|

|

Form Factor |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Secondary Battery Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the secondary battery market is anticipated to garner the highest share of 55.3% by the end of 2035. The market’s upliftment in the region is highly attributed to an increase in grid-scale storage, electric vehicle availability, and the presence of consumer electronics across Southeast Asia, India, South Korea, Japan, and China. According to an article published by the EIA Government in May 2025, China plays a major role in the international battery supply chain, importing nearly 12 million short tons of processed and raw battery minerals. This readily accounts for 44% of interregional trade and exports nearly 11 million short tons of battery components, packs, and materials. In addition, this effectively caters to 58% of global trade as of 2023, thus making it suitable for bolstering the market’s growth as well as expansion in the overall region.

2023 Battery Export and Import in Asia

|

Countries |

Export (USD) |

Import (USD) |

|

China |

3.0 billion |

240 million |

|

Singapore |

709 million |

322 million |

|

Indonesia |

567 million |

145 million |

|

Japan |

427 million |

204 million |

|

South Korea |

169 million |

132 million |

|

Hong Kong |

152 million |

291 million |

|

Malaysia |

126 million |

309 million |

|

India |

21.4 million |

102 million |

Source: OEC

China in the secondary battery market is growing significantly, owing to a surge in storage exports and demand, along with an end-to-end battery ecosystem spanning critical minerals, packs, cells, and active materials, which are supported by massive domestic electric vehicles. As per an article published by the ITIF Organization in July 2024, domestic automakers readily produce 21% of the world’s passenger vehicles, which is predicted to reach 33% by the end of 2030. In addition, these automakers produced 62% of the world’s electric vehicles as of 2022, along with 77% of electric vehicle batteries. Moreover, between 2020 and 2023, the country’s international electric vehicle exports increased by 851%, with the highest share, almost 40%, going to Europe, thereby making it suitable for uplifting the secondary battery market in the country.

Secondary Battery Market in India is also growing due to industrial electrification, grid modernization, and an acceleration in electric vehicles. Besides, as per an article published by the IBEF Organization in August 2025, the country is regarded as the third-largest consumer and producer of electricity, with an installation capacity of 476 GW as of 2025. In addition, the country has successfully generated 1,821 BU of power, denoting a 5% year-over-year (YoY) increase in 2024. Moreover, the peak demand reached 2,29,715 MW in 2025, along with 1,50,472 million units supplied. Besides, the overall battery industry outlook significantly indicates a rise in the demand for chemical inputs, such as binders, electrolytes, and cathode or anode batteries, which are readily fueled by renewable integration and mobility programs, thus denoting an optimistic outlook for the market’s growth in the country.

Europe Market Insights

Europe is expected to emerge as the fastest-growing region by the end of the forecast period. The secondary battery market’s development in the region is highly propelled by industrial electrification, acceleration in battery energy storage systems, and an increase in electric vehicle adoption. According to a report published by the Solar Power Europe Organization in May 2025, a 5-year outlook approach has forecast a significant BESS expansion in the overall region, denoting a 6-fold increase to almost 120 GWh by the end of 2029. This is readily driving the overall capacity to 400 GWh, which is creating an optimistic outlook for the overall market’s development. Besides, a 15% yearly growth to 22 GWh of newly deployed BESS as of 2024 has made expansion in the region’s battery fleet to 61 GWh. This caters to 1/3rd of the region’s total installed batteries, thus suitable for bolstering the secondary battery market.

Germany in the secondary battery market is gaining increased traction, owing to machinery and deep materials supply chain, Gigafactory investments, and the presence of a massive automotive base. As per a report published by the GTAI in 2025, 1.3 million passenger electric vehicles have been readily produced as of 2024, catering to 24% of the overall domestic industrial revenue. In addition, there has been more than 60% research and development growth in the overall region by domestic automotive sectors, with 158,000 high-skilled personnel. Besides, 1/3rd of international research and development expenditure is readily made by the country’s OEMs, and meanwhile, all these account for 23.8% share of total country’s total exports as of 2024. Moreover, the nation’s light commercial and passenger car vehicle OEMS have generated EUR 372.2 billion as foreign market revenue in the same year, which is also uplifting the market.

Spain in the secondary battery market is also developing due to the BESS expansion to successfully integrate wind and solar, grid flexibility demands, and aggressive renewables deployment. As per an article published by the Open Access Government Organization in May 2023, under the Temporary Crisis and Transition Framework, the overall region has funded EUR 837 million to significantly produce electric car batteries and optimize the industrial chain of connection and electric vehicles, which caters to the country’s growth. Besides, based on the Spanish scheme for electric car batteries, the maximum aid amount per beneficiary ranges between €100 million and €300 million as an investment for batteries. Furthermore, trends for localized manufacturing partnerships, industrial microgrids for resilience, and utility-scale storage procurement are other factors positively impacting the market’s development.

North America Market Insights

North America’s secondary battery market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by industrial electrification, grid-scale storage, and electric vehicle adoption. In addition, policy-based demand signals, which are anchored by federal investments in the U.S. into innovative battery manufacturing and supply chains, are also fueling the market’s growth. For instance, in December 2024, the U.S. Department of Energy (DOE) announced its generous contribution of nearly USD 33 billion to support the onshoring of advanced capabilities and the commercialization of cutting-edge battery technologies. Besides, the U.S. has also invested USD 85 billion in reinvigorating refining, processing, and manufacturing of critical minerals, along with optimizing the productive capacity for U.S.-based energy products, thus boosting the market’s exposure.

The secondary battery market in the U.S. is gaining increased exposure due to policy support, federal investment, electric vehicle facilities and adoption, standard and safety policies, as well as a tactical focus on solid-state battery research and development. For instance, in 2022, the DOE initiated the Battery Manufacturing and Recycling Grants Program and effectively allocated USD 3 billion. The objective is to provide generous grants to ensure that the country has a standard recycling and domestic manufacturing capability to readily support the regional battery supply chain. Besides, as of September 2023, the DOE Office of Energy Efficiency and Renewable Energy (EERE) has successfully notified the careful selection of 5 projects, amounting to USD 16 billion to ensure advancement in domestic capabilities in flow and solid-state battery manufacturing, thereby creating a growing opportunity for the market.

The secondary battery market in Canada is also growing, owing to governmental innovation and funding, electric vehicle supply chain localization, expansion in energy storage, and the existence of safety and sustainable programs. According to an article published by the Government of Canada in October 2025, the Minister of Energy and Natural Resources notified a significant investment of more than USD 22 million to support 8 projects to escalate battery production and innovation capacity across the country. Additionally, to remain on track and achieve net-zero emissions by the end of 2050, the international cumulative battery requirement between 2022 to 2050 is projected to surge by nearly 150-fold. Besides, by making investments in organizations, such as NanoXplore, the country’s government is ensuring innovation by allocating almost USD 2.8 million for developing lithium-ion battery cells. Besides, the ongoing solid-state storage semiconductor device supply chain is also proliferating the market’s exposure in the country and the overall region.

2023 Solid-State Storage Semiconductor Devices Export and Import in the U.S., Canada, and Other North America Locations

|

Countries |

Export (USD) |

Import (USD) |

|

U.S. |

3.5 billion |

8.3 billion |

|

Mexico |

1.1 billion |

3.9 billion |

|

Canada |

88.7 million |

351 million |

|

Guatemala |

- |

14.1 million |

|

Costa Rica |

- |

4.8 million |

|

Panama |

- |

3.6 million |

Source: OEC

Key Secondary Battery Market Players:

- LG Energy Solution (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung SDI Co., Ltd. (South Korea)

- SK On Co., Ltd. (South Korea)

- Contemporary Amperex Technology Co., Limited – CATL (China)

- BYD Company Limited (China)

- Panasonic Holdings Corporation (Japan)

- GS Yuasa Corporation (Japan)

- Hitachi Chemical Co., Ltd. (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- UBE Corporation (Japan)

- BASF SE (Germany)

- Solvay S.A. (Belgium)

- Arkema S.A. (France)

- Johnson Matthey Plc (United Kingdom)

- Umicore N.V. (Belgium)

- Dow Inc. (U.S.)

- Albemarle Corporation (U.S.)

- Livent Corporation (U.S.)

- Tata Chemicals Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- LG Energy Solution is regarded as one of the world’s largest lithium-ion battery manufacturers, supplying electric vehicles, energy storage systems (ESS), and consumer electronics. The organization is extending production of lithium iron phosphate (LFP) batteries to gain ESS demand, while maintaining a robust presence in nickel-manganese-cobalt (NMC) chemistries for premium EVs.

- Samsung SDI Co., Ltd. has focused on high-performance secondary batteries, especially for premium EVs and IT devices. The company is generously investing heavily in solid-state battery research and development and upscaling LFP production for ESS, thereby positioning itself as a technology leader amid rising competition from China-based firms.

- SK On Co., Ltd. has rapidly extended its international footprint through joint ventures with automakers such as Ford and Hyundai. The organization has diversified into LFP batteries for ESS while continuing to upscale NMC chemistries for EVs, intending to significantly recover market share lost to China-specific competitors.

- Contemporary Amperex Technology Co., Limited is one of the international market leaders in secondary batteries, holding the highest share of electric battery supply worldwide. It effectively dominates in LFP production, cutting down expenses and achieving contracts with Tesla and other automakers, while also investing in next-gen sodium-ion batteries.

- BYD Company Limited is both a notable electric vehicle manufacturer and a major secondary battery producer, vertically integrating its supply chain. Its proprietary Blade Battery (LFP) has emerged as the benchmark for safety and cost efficiency, giving BYD a competitive edge in mass-market EVs and stationary storage.

Here is a list of key players operating in the global secondary battery market:

The worldwide secondary battery market is extremely competitive and readily dominated by Asia-based giants, including Panasonic, LG Energy Solution, and CATL, along with Europe-specific players, such as Umicore and BASF, as well as U.S. leaders, including Dow and Albemarle. Notable strategies, such as capacity extension through heavy research and development investments, vertical integration of raw materials, and gigafactories expansion, are proliferating the market’s growth internationally. Organizations are also significantly pursuing tactical alliances with recycling technologies, government-based subsidies, and automakers to achieve supply chains and reduce expenses. Besides, in November 2023, Toyota Motor Corporation continued to promote activities that tend to focus on developing a circular economy. This includes a standard circular ecosystem for batteries utilized in its vehicles, based on the comprehensive objective of gaining carbon neutrality, thus suitable for propelling the secondary battery market globally.

Corporate Landscape of the Secondary Battery Market:

Recent Developments

- In July 2025, General Motors has effectively signed a non-binding memorandum of understanding with Redwood Materials to escalate the deployment of energy storage systems by utilizing both secondary-life battery packs, along with the newest U.S.-based manufacturing batteries from its own electric vehicles.

- In December 2024, Stellantis and Zeta Energy declared an agreement to effectively develop lithium-sulfur electric batteries, intended to create a significantly lighter battery pack with the same usable energy, thus enabling improved and greater range, as well as enhanced performance.

- In November 2024, Honda Motor Co., Ltd. introduced the overall demonstration production line for all-solid-state batteries, which is being created independently by the company to ensure mass production.

- Report ID: 8318

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Secondary Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.