Battery Contract Manufacturing Market Outlook:

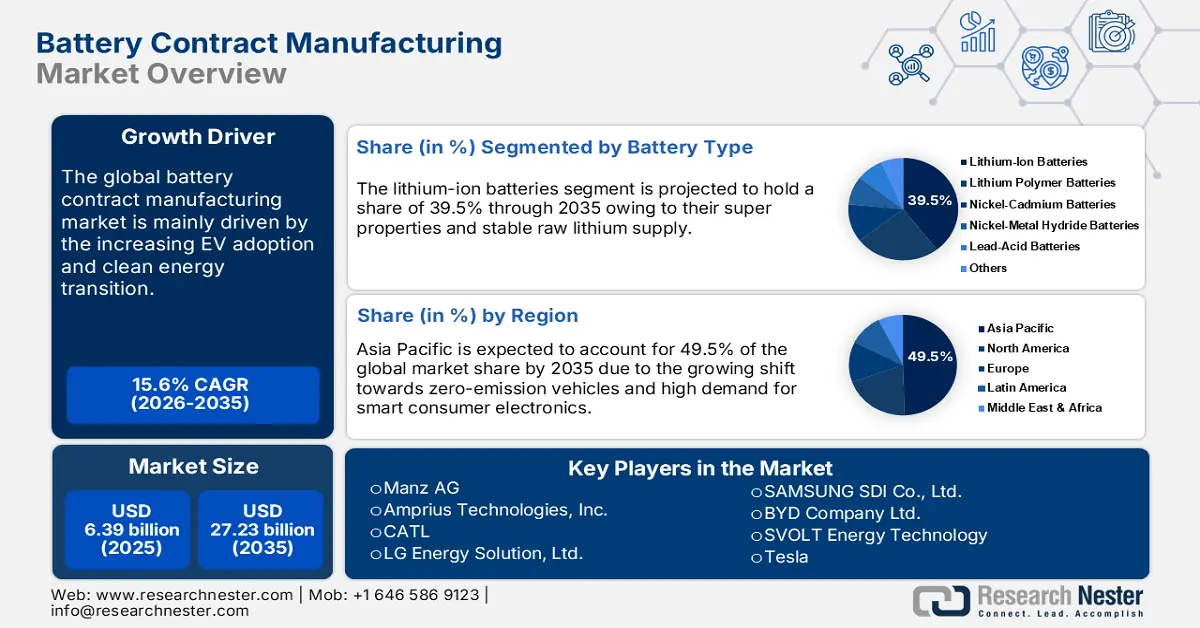

Battery Contract Manufacturing Market size was valued at USD 6.39 billion in 2025 and is likely to cross USD 27.23 billion by 2035, registering more than 15.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of battery contract manufacturing is assessed at USD 7.29 billion.

The rise in commercial and domestic use of batteries through several modes, such as vehicles, energy storage solutions, consumer electronics, medical devices, and aerospace or defense equipment, is significantly driving the manufacturing activities. The domino effect of adoption, influencing from region to region and industry to industry, is exponentially fueling the battery demand. Further, the battery domino effect, where the battery cost drops and energy density enhances, is set to reduce the reliance on fossil fuel power and offer a positive S-curve sales growth. The integration of new technologies and the emerging popularity of sustainable energy solutions are uplifting the demand for battery solutions. The Rocky Mountain Institute (RMI) estimates that battery sales double every 2 or 3 years, offering a robust growth rate.

|

Batteries |

|||

|

Country |

Export Value in USD Million |

Country |

Import Value in USD Million |

|

China |

3110 |

U.S. |

1240 |

|

U.S. |

849 |

Germany |

662 |

|

Germany |

782 |

Mexico |

413 |

|

Singapore |

726 |

U.K. |

384 |

|

Indonesia |

627 |

Malaysia |

376 |

Source: OEC

The Observatory of Economic Complexity (OEC) study explains that the total trade of batteries stood at USD 9.4 billion globally in 2023. China and the U.S. held the leading positions as exporters and importers during the same year. The battery export registered the fastest growth in Germany, the U.S., France, Belgium, and Hong Kong between 2022 to 2023. The market concentration amounted to 3.85 using Shannon Entropy, explaining export dominance by 14 countries. The high battery export potential is observed in India with an export gap of USD 41.4 million, while Indonesia has an import potential gap of USD 12.6 million.

Key Battery Contract Manufacturing Market Insights Summary:

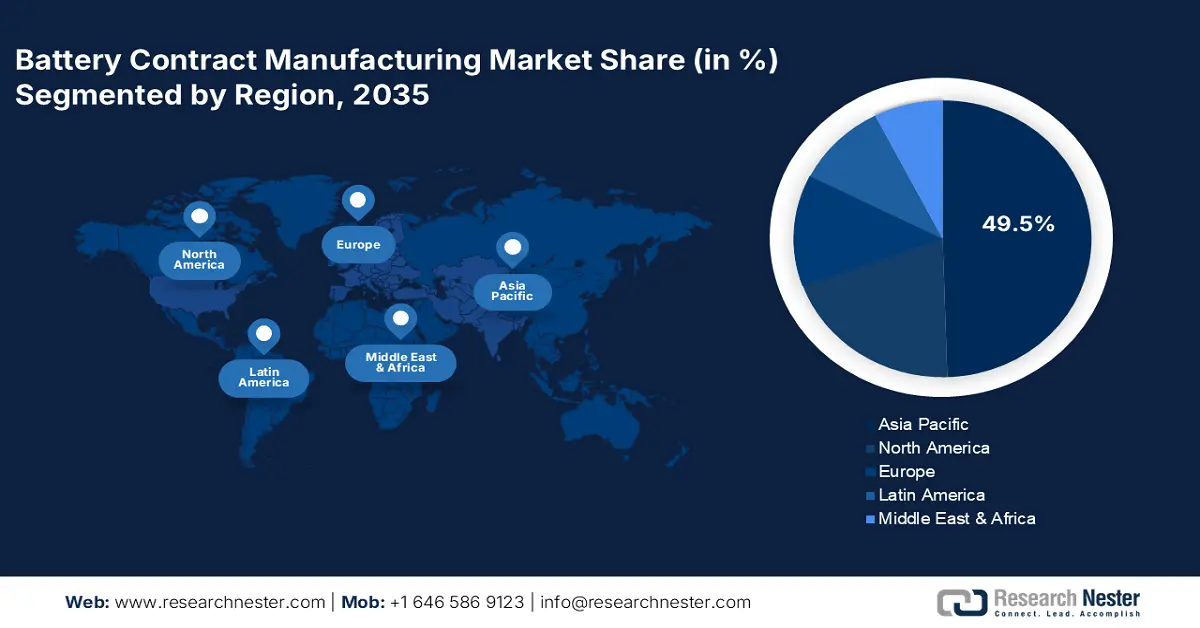

Regional Highlights:

- Asia Pacific dominates the Battery Contract Manufacturing Market with a 49.5% share, driven by the swiftly expanding automotive sector, particularly the EV trend, alongside the strong presence of industry giants in China and India, ensuring robust growth through 2026–2035.

- North America's Battery Contract Manufacturing Market is set for rapid growth by 2035, driven by supportive government policies for renewable energy adoption, the increasing adoption of zero-emission vehicles, and innovations in energy storage solutions.

Segment Insights:

- The Cell Manufacturing segment is expected to achieve 31.9% market share by 2035, propelled by innovations in energy storage technology and strategic partnerships with end users.

- Lithium-Ion Batteries segment are projected to achieve a 39.5% market share by 2035, driven by their superior properties and expanding use in electric vehicles.

Key Growth Trends:

- Rise in EV popularity

- Clean energy transition

Major Challenges:

- Raw material shortages limit production cycles

- High CAPEX for advanced manufacturing technologies

Key Players: CATL, LG Energy Solution, Ltd., SAMSUNG SDI Co., Ltd., BYD Company Ltd., SVOLT Energy Technology, and Tesla.

Global Battery Contract Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.39 billion

- 2026 Market Size: USD 7.29 billion

- Projected Market Size: USD 27.23 billion by 2035

- Growth Forecasts: 15.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Battery Contract Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Rise in EV popularity: The swift shift towards the adoption of electric vehicles is showcasing a drastic effect on the sales of batteries. The original equipment manufacturers are majorly outsourcing battery production to meet the increasing demand. The boom in EV registrations represents a profitable environment for battery producers. According to the analysis by the International Energy Agency (IEA), the total EV battery demand surpassed 750 GWh in 2023, with electric cars accounting for nearly 95.0% of this growth. The U.S. and Europe together are potentially propelling the EV battery market by achieving around 40% year-on-year growth, followed by China with 35.0%. Due to increasing EV sales, the battery demand increased to 70.0% in 2023, and the market stood at 100 GWh in the U.S, Europe (185 GWh), and China (415 GWh).

- Clean energy transition: The zero-emission goals, coupled with the increasing importance of a clean energy mix, are driving high demand for grid-scale storage solutions. The growing installations of energy storage solutions in residential, commercial, and industrial structures are necessitating manufacturers to outsource production to meet high battery demands. The IEA states that the total installed grid-scale battery storage capacity amounted to 28 GW in 2022. The net-zero scenario is likely to increase this capacity by 35X between 2022 and 2030 and reach 970 GW. Nearly 170 GW of capacity is expected to be added in 2030. The U.S. and China lead the installations of grid-scale battery storage, owing to positive government policies.

Challenges

- Raw material shortages limit production cycles: The raw material shortages potentially hinder battery production and ultimately the revenues of key players. The delay in entry for new products is likely due to the supply chain disruption, particularly in raw materials such as lithium, cobalt, nickel, and lead, which are vital for battery manufacturing. High taxes and mining challenges are also factors liable for instability in production for contract manufacturers.

- High CAPEX for advanced manufacturing technologies: Technological complexity hampers battery production to some extent, owing to the struggle of some manufacturers to keep up with advanced technologies. The production of innovative battery technologies, including solid states and lithium-sulfur, requires expertise, next-gen equipment, and high CAPEX. The unavailability of these technologies, owing to budgetary issues, often limits the growth of small-scale manufacturers, leaving them behind in earning high profits.

Battery Contract Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.6% |

|

Base Year Market Size (2025) |

USD 6.39 billion |

|

Forecast Year Market Size (2035) |

USD 27.23 billion |

|

Regional Scope |

|

Battery Contract Manufacturing Market Segmentation:

Battery Type (Lithium-Ion Batteries, Lithium Polymer Batteries, Nickel-Cadmium Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, Others)

Lithium-ion batteries segment is poised to capture over 39.5% battery contract manufacturing market share by 2035. The lithium-ion battery sales are primarily driven due to their superior properties, such as fast charging rates, high energy density, and durability. The stable supply of lithium is also contributing to the Li-ion battery sales globally. For instance, the study of the Indian Council of World Affairs (ICWA) suggests that the worldwide supply of lithium stood at 634,000 metric tons in 2022 and is expected to surpass 2.14 million metric tons by 2030. The increasing EV registrations across the world are amplifying the sales of lithium-ion batteries. The IEA analysis estimates that the trade of lithium-ion batteries was led by China with 417.97 GWh capacity in 2023. Europe, North America, and Japan also held dominant positions in the trade with 99.16 GWh, 57.94 GWh, and 12.54 GWh lithium-ion battery capacities, respectively.

Service Type (Cell Manufacturing, Pack Assembly, Prototype Development, Testing and Quality Control, Supply Chain Management, Others)

By 2035, cell manufacturing segment is anticipated to hold more than 31.9% battery contract manufacturing market share. Being the foundation of any battery, cell manufacturing is expected to drive innovations in energy storage technology. The integration of complex and specialized materials uplifts the importance of cell manufacturing in the overall battery market. The growth in electric vehicles, energy storage systems, and consumer electronics is likely to increase customization needs in cell manufacturing. Furthermore, the strategic partnerships with end users are set to fuel the revenues of market players in the coming years.

Our in-depth analysis of the global battery contract manufacturing market includes the following segments:

|

Battery Type |

|

|

Service Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Contract Manufacturing Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in battery contract manufacturing market is projected to capture over 49.5% revenue share by 2035. The swiftly expanding automotive sector, driven by the EV trend, is fueling the demand for batteries. The strong presence of industry giants, owing to supportive manufacturing policies and initiatives, is likely to uplift the position of Asia Pacific in the global landscape. China and India are offering lucrative earning opportunities owing to rapidly expanding industrial and urban activities. Japan and South Korea are advancing in battery technologies, attracting tech-savvy consumers.

China’s advancements in electronics are set to open profitable doors to battery contractors in the coming years. Innovations in consumer electronics are directly fueling high demand for advanced batteries, leading to third-party production contracts to meet the demands. The Semiconductor Industry Association (SIA) states that China accounts for 36.0% of the global consumer electronics share. Smartphones, computers, cloud servers, and telecom infrastructure are poised to drive the electronics sector and subsequently the battery consumption in the country.

The increasing adoption of electric vehicles in India is likely to fuel battery sales in the years ahead. The India Brand Equity Foundation (IBEF) study highlights that the country registered 49.2% growth in EV sales in 2023. Further, the EV battery market is foreseen to reach USD 27.7 billion by 2028. The ICWA analysis highlights that India is a major importer of lithium-ion batteries. Around 617 million units of lithium-ion batteries worth USD 1.8 billion were imported into the country in 2022. Several initiatives, such as cross-border partnerships and foreign investments, are employed by the government to cut the import costs.

North America Market Statistics

The North America battery contract manufacturing market is foreseen to increase at the fastest pace from 2025 to 2035. The supportive government policies for renewable energy technology adoption are offering lucrative opportunities for battery contractors. The increasing adoption of zero-emission vehicles and innovations in energy storage solution technologies are propelling the sales of advanced batteries. The integration of 4.0 manufacturing technologies is also contributing to the overall battery contract manufacturing market growth.

The green transformation trend is likely to augment battery sales in the U.S. in the years ahead. The shift towards clean energy and high public-private investments is propelling the sales of batteries. For instance, the American Clean Power study highlights that the battery storage capacity of the country increased to 17380 MW in 2023, up from 47 MW in 2010. The increasing EV registrations and the declining costs of lithium-ion batteries are likely to drive the battery contract manufacturing sector in the country.

Canada’s smart home market is likely to offer high-earning opportunities to battery manufacturers in the coming years. The growing demand for smart electronics, renewable energy storage solutions such as solar panels, and home ecosystems is pushing a high demand for advanced battery solutions. To meet these high demands, many original equipment manufacturers are collaborating with third-party companies.

Key Battery Contract Manufacturing Market Players:

- Manz AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amprius Technologies, Inc.

- CATL

- LG Energy Solution, Ltd.

- SAMSUNG SDI Co., Ltd.

- BYD Company Ltd.

- SVOLT Energy Technology

- Tesla

- EVE Energy Co., Ltd.

- SK On Jiangsu Co., Ltd

- CALB Group., Ltd

- Gotion High-Tech Co., Ltd

- Sunwoda Electronic Co., Ltd.

- Farasis Energy

- EnerDel

Leading companies in the battery contract manufacturing market are adopting various tactics to maximize their reach and revenues. Industry giants are forming strategic partnerships with end users and are collaborating with original equipment manufacturers to boost their dominance in the competitive landscape. To earn high profits from the emerging markets, the companies are expanding their production units. The swift rise in industrial and urban activities is also aiding the contract manufacturers to increase their sales. The integration of advanced manufacturing technologies is likely to increase the production cycle of contract manufacturers and help them earn high profits by meeting increasing demands.

Some of the key players include in battery contract manufacturing market:

Recent Developments

- In November 2024, Manz AG’s management board decided to sell its battery cell production equipment business. The planned transaction is estimated to be completed by the first half of 2025.

- In October 2024, Amprius Technologies, Inc. announced that one of its contract manufacturing partners opened new lines to meet the increasing silicon anode batteries. The newly installed production lines are set to expand the company’s manufacturing capacity of up to 800 MWh for its SiCore pouch cells.

- Report ID: 7489

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.