Battery Market Outlook:

Battery Market size was valued at USD 157.4 billion in 2025 and is projected to reach USD 631.8 billion by the end of 2035, rising at a CAGR of 16.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of battery is estimated at USD 183.6 billion.

The battery market is representing continued expansion owing to the rising demand for energy storage across sectors such as transportation, grid, and industrial applications. Also, supply chains in this market are increasingly focused on domestic sourcing and vertical integration to address geopolitical and logistical risks, whereas manufacturers are investing in advanced production techniques and materials processing to enhance both efficiency and performance. The article published by the U.S. Department of Energy in February 2022 disclosed that the global grid energy storage sector was projected to expand rapidly, with lithium-ion batteries identified as the dominant technology, comprising over 95% of short-duration storage deployments. It also stated that China held a commanding position with nearly 80% of the world's lithium-ion cell manufacturing capacity, positively contributing to the sector’s expansion.

Furthermore, the Congress article published in July 2025 reported that there has been a significant growth in the U.S. battery sector, wherein the domestic exports of lithium-ion energy storage batteries increased from negligible levels in 2012 to nearly USD 8 billion in 2024, whereas the imports of such batteries grew even more substantially, reaching over USD 25 billion in the same year. Simultaneously, China is dominating this import sector, supplying 69% of finished lithium-ion batteries and 33% of non-lead-acid battery parts. The report also underscored that domestically, the shipment value of U.S.-produced non-lead-acid batteries surpassed USD 16.6 billion in 2022, and employment in battery manufacturing reached 54,400 in 2024, indicating a strong battery market potential in the upcoming years.

U.S. Battery Supply Chain: Data and Trends

|

Category |

Key Fact |

Figure / Trend |

|

Imports |

Lithium-ion Battery Imports (Share) |

Increased from 17% (2009) to 84% (2024) of all battery imports. |

|

Top Import Source (China) |

Supplied 69% of finished lithium-ion batteries in 2024. |

|

|

Domestic Production |

U.S. Factory Output (2020-2023) |

Grew by 57.6%. |

|

U.S. Battery Jobs (2024) |

54,400 (a record high). |

|

|

Supply Chain |

Projected U.S. Battery Cell Supply |

Expected to meet future demand. |

|

Projected U.S. Component Supply (e.g., separators, foil) |

Projected to be insufficient for future cell production. |

|

|

Prices |

U.S. vs. China Battery Cost (2024) |

U.S. cells were ~90% more expensive before subsidies/tariffs. |

Source: Congress.gov

Key Battery Market Insights Summary:

Regional Highlights:

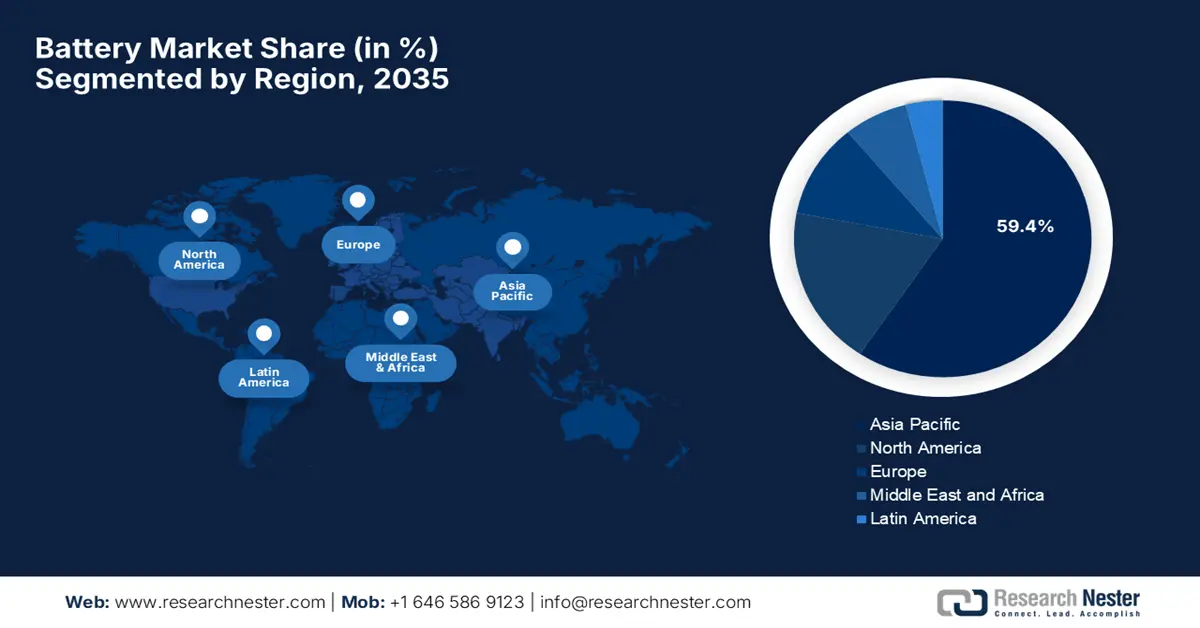

- By 2035, the Asia Pacific region is set to command a 59.4% share of the battery market, strengthened by large-scale electrification programs and expanding renewable deployments owing to rising renewable energy growth.

- North America is projected to maintain a robust position through 2035 with its substantial investments in domestic manufacturing and critical mineral processing spurred by advancements in next-generation battery technologies.

Segment Insights:

- The lithium-ion segment is projected to secure a 90.5% share by 2035 in the battery market, underpinned by superior energy density and established global supply chains impelled by relentless innovation.

- The automotive segment is anticipated to capture a 75.4% share by 2035, supported by rising EV adoption and stringent emissions regulations fostered by consumer incentives.

Key Growth Trends:

- Rapid electrification of transportation

- Expansion of renewable energy

Major Challenges:

- Raw material supply

- Manufacturing and production bottlenecks

Key Players: Contemporary Amperex Technology Co., Limited (CATL), BYD Co. Ltd., LG Energy Solution, Ltd., Panasonic Corporation (Panasonic Energy), Samsung SDI Co., Ltd., SK On, Gotion High-Tech (Guoxuan), EVE Energy Co., Ltd., Sunwoda Electronic Co., Ltd., CALB (China Aviation Lithium Battery Co.), Farasis Energy, Northvolt AB, SVOLT Energy Technology Co., Ltd., AESC Group Ltd., Leclanché S.A.

Global Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 157.4 billion

- 2026 Market Size: USD 183.6 billion

- Projected Market Size: USD 631.8 billion by 2035

- Growth Forecasts: 16.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Mexico, Brazil

Last updated on : 26 November, 2025

Battery Market - Growth Drivers and Challenges

Growth Drivers

- Rapid electrification of transportation: The ever-increasing adoption of electric vehicles across passenger, commercial has been the strongest catalyst for the battery market. Also, the government incentives, coupled with OEM commitments to phase out internal combustion engines, continue to expand EV production volumes. In December 2024, Stellantis reported that with Zeta Energy have entered a joint development agreement to advance lithium-sulfur battery technology for future electric vehicles, targeting lighter packs with comparable energy output to lithium-ion systems and the potential for 50% faster charging. It also stated that the partnership aims to cut battery costs to less than half of today’s levels while using sulfur-based materials that eliminate reliance on cobalt, nickel, manganese, and graphite, significantly improving supply-chain resilience.

- Expansion of renewable energy: This, coupled with grid modernization, is providing encouraging opportunities for pioneers in the battery market. The shift toward solar and wind power requires large-scale stationary battery storage to stabilize grids, support peak-load management, and ensure round-the-clock renewable availability. Therefore, utilities and grid operators are increasingly investing in battery-based energy storage systems to reduce curtailment. In this regard, IBEF in August 2025 reported that India is accelerating renewable energy expansion, which is creating strong downstream demand in the battery sector due to higher solar and wind integration and the growing need for grid-scale storage to stabilize variable generation, thereby positively impacting market growth.

- Increasing public and private sector investments: In November 2022, the U.S. Department of Energy announced a major investment to accelerate lithium production in the U.S. by funding advanced research into extracting battery-grade lithium from geothermal brines, particularly from California’s Salton Sea region. It also stated that this USD 12 million initiative aims to strengthen the nation’s supply chain for lithium batteries, which are extensively utilized in EVs, consumer electronics, and grid-scale storage by reducing dependence on foreign sources. Furthermore, through continued support from AMMTO, the Geothermal Technologies Office, and critical materials programs under the Bipartisan Infrastructure Law, DOE is positioning geothermal brine extraction as both a viable lithium source and a catalyst for expanding clean-energy manufacturing, hence suitable for overall battery market growth.

Challenges

- Raw material supply: The constraints associated with raw material supply are the major obstacle hindering growth in the worldwide battery market. Securing access to critical raw materials such as lithium, cobalt, nickel, and graphite is a persistent challenge that has become a major burden in the sector. On the other hand, mining and refining these materials are highly concentrated in specific regions, making the supply chain vulnerable to geopolitical tensions, trade restrictions, as well as environmental regulations. Also, the existence of fluctuating commodity prices and export controls is exacerbating the risks for manufacturers who are relying on imports. Furthermore, limited domestic production capacity in most countries is compelling reliance on foreign suppliers, thereby increasing both logistical complexity and expenses.

- Manufacturing and production bottlenecks: This is also a considerable challenge in the battery market since to meet the surging the operational challenges arise wherein manufacturers need to efficiently scale the entire process. Also, advanced battery cell production requires high precision, specialized equipment, and stringent quality control, which limits the speed at which new capacity can be deployed. On the other hand, assembly lines are extremely capital-intensive, and establishing new gigafactories demands extensive lead times, skilled work professionals, and reliable energy inputs. Therefore, bottlenecks in electrode coating, cell formation, and testing stages can delay overall output. Furthermore, recycling and second-life battery integration are still in early stages, thereby limiting raw material recovery, marking a critical obstacle for industry growth.

Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.7% |

|

Base Year Market Size (2025) |

USD 157.4 billion |

|

Forecast Year Market Size (2035) |

USD 631.8 billion |

|

Regional Scope |

|

Battery Market Segmentation:

Product Type Segment Analysis

In the battery market lithium-ion segment of product type is expected to attain the largest revenue share of 90.5% during the forecast duration. The superior energy density, established global supply chains, and relentless innovation are the key factors propelling the dominance of this subsegment. Also, its numerous applications in EVs and stationary storage are supporting continuous growth across the subtype. In September 2025, the Ministry of Electronics & IT announced that it had inaugurated TDK Corporation’s advanced lithium-ion battery manufacturing plant in Sohna, Haryana, marking a major milestone in India’s push toward electronics self-reliance. It also mentioned that the facility will produce 20 crore battery packs on a yearly basis, meeting 40% of national demand while strengthening the domestic supply chain for mobile devices and wearables.

Application Segment Analysis

The automotive segment is likely to attain a significant share of 75.4% in the battery market by the end of 2035. The electric vehicles are the key growth engine for this, wherein the market is efficiently augmented by stringent government emissions regulations and consumer incentives. In September 2025, Ashok Leyland announced that it had invested in next-generation battery development and manufacturing for both automotive and energy storage applications. The company also stated that it has entered a long-term exclusive partnership with CALB Group of China to localize battery production, supporting its own EV lineup as well as demand across the broader mobility and storage sectors. Furthermore, investments were planned for over ₹5,000 crore (USD 600 million) and the creation of a global centre of excellence, wherein the company aims to advance innovation in battery materials, recycling, and manufacturing.

End Use Segment Analysis

In terms of end use stationary energy storage segment is predicted to gain a lucrative share in the battery market during the analyzed timeframe. The global transition to renewable energy is the key factor behind this leadership. Utilities and grid operators are integrating higher levels of variable wind and solar power, where large-scale battery storage is highly essential for grid stability, frequency regulation, and shifting energy to peak demand hours. Also, the subtype plays a pivotal role in enhancing grid resilience and reliability, encouraging significant investment in battery storage projects to support a decarbonized power sector. Furthermore, the growing policy support and declining battery costs accelerate deployment, positioning stationary storage as a central pillar of future energy infrastructure.

Our in-depth analysis of the battery market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End use |

|

|

Material |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Market - Regional Analysis

APAC Market Insights

The battery market in the Asia Pacific is likely to emerge as the dominant force by the end of 2035, with the largest share of 59.4%. This dominance is efficiently propelled by rising electrification programs, accelerating renewable energy deployments, and the continuous growth of renewable energy. In October 2025, Saft announced that it had expanded its footprint in the Asia Pacific with a new contract to supply a 356 MWh lithium-ion battery energy storage system for Foxwell Power Co in Taichung, supporting Taiwan’s 2050 net-zero roadmap. The company also stated that the project will enhance grid stability by enabling frequency regulation and peak-shifting as renewable penetration increases across the island. Furthermore, it leverages advanced, AI-enabled control architecture and high-level cybersecurity capabilities, marking their fifth and largest collaboration, hence continuing to shape the region’s growth trajectory.

China is the global hub in the entire battery market, which is the most dominant, large as well and influential. The country is supported by mature manufacturing capabilities, which have extensive mineral processing capacity and strong policy incentives. The article published by the U.S. Energy Information Administration in May 2025 the country plays a dominant role in the global battery supply chain, controlling all of the major stages from mineral production to battery cell manufacturing. It also mentioned that the country produces lithium, graphite, and cobalt, and leads in processing and exporting battery materials, components, and packs. Furthermore, China’s global influence ensures it remains central to the trade of battery minerals and materials, shaping supply chains for electric vehicles as well as energy storage worldwide.

China’s Dominance in Global Battery Minerals and Materials Trade

|

Battery Supply Stage |

China’s Share |

Notes |

|

Lithium production |

18% of the global mined lithium |

Controls 25% of global mining capacity, with investments in Argentina |

|

Graphite production |

79% of the global natural graphite |

Major domestic production; the U.S. produces none |

|

Cobalt production |

80% in Congo-Kinshasa |

China controls a significant global cobalt supply |

|

Raw battery mineral imports |

46% of world trade |

Mainly lithium from Australia |

|

Processed battery mineral exports |

58% of world trade |

Includes synthetic graphite |

|

Battery material exports |

53% of world trade |

Key materials for electrodes, cathodes, and electrolytes |

|

Battery component & pack exports |

74% of world trade |

Includes anodes, cathodes, electrolytes, and separators |

|

Battery cell production capacity (monetary) |

85% of world capacity |

Largest global share by monetary value |

Source: EIA

India is readily exploring opportunities in the battery market, efficiently backed by the push for energy independence, renewable energy integration, and rapid electrification in multiple sectors. The country’s market also benefits from government support for domestic manufacturing and large-scale commitments in cell production and battery recycling. For instance, in June 2025, Cummins India Limited announced the launch of its battery energy storage systems, which support the country’s clean energy transition and enhance grid reliability, aligning with net-zero and renewable energy goals. It also stated that the modular and scalable BESS solutions integrate solar and wind power with existing infrastructure, enabling peak shaving, energy shifting, as well as renewable energy utilization across industries.

North America Market Insights

North America is predicted to hold a strong position in the global battery market throughout the discussed tenure. The leadership of the region in this field is primarily fueled by significant investments in domestic manufacturing, critical mineral processing, and next-generation technologies. In December 2024, the U.S. DOE announced a major investment of USD 25 million across 11 projects to advance domestic manufacturing of next-generation batteries, focusing on scalable, flexible, and cost-effective production processes. It also stated that these projects target platform technologies, which include sodium-ion battery manufacturing, flow battery system scale-up, and nanolayered film production, as well as smart manufacturing platforms applicable across battery types. Furthermore, the initiative aims to build on more than USD 140 billion in private investments in battery and critical mineral supply chains.

The U.S. is undergoing significant transformations in the regional battery market, wherein the large-scale gigafactory projects, recycling facilities, and mineral extraction facilities are gaining momentum. The country’s market also benefits from federal incentives as well as partnerships across automotive, energy, and technology sectors, which are accelerating the adoption of advanced battery chemistries. As per an article by the U.S. DOE in December 2024, its four-year review, the country’s battery industry is catalyzed by federal policies like the Bipartisan Infrastructure Law and the Inflation Reduction Act. The report also mentioned that these policies have spurred over USD 150 billion in private investment and built a pipeline of over 1,100 GWh of annual domestic battery cell manufacturing capacity, hence denoting a positive market outlook.

Canada has gained immense exposure in the regional battery market since it’s the hub of battery materials, cell manufacturing, and clean storage deployment. The country leverages abundant natural resources, a supportive policy landscape, and growing collaboration with automotive OEMs. In this regard, the country’s government reported that it is investing over USD 22 million through its Energy Innovation Program to accelerate domestic battery innovation and production capacity. This funding supports eight projects across the country focused on developing next-generation technologies, including more efficient and environmentally friendly production of cathode materials, advanced anode materials such as silicon and tin, and the creation of ultra-high-power and high-energy-density battery cells. Furthermore, these initiatives aim to enhance the safety, performance, and competitiveness of Canada's battery value chain.

Energy Innovation Program: Battery Industry Acceleration Projects

|

Recipient |

Project Focus |

Funding Amount |

|

NOVONIX Battery Technology Solutions Inc. |

Dry, zero-waste cathode production |

USD 5,000,000 |

|

Calumix Technologies Inc. |

Coated current collectors |

USD 4,545,000 |

|

Flex-Ion Battery Innovation Center |

Ultrahigh-capacity cylindrical cells |

USD 3,319,640 |

|

HPQ Silicon Inc. |

Silicon oxide anode material |

USD 3,000,000 |

|

NanoXplore Inc. |

Ultra high-power cylindrical cells |

USD 2,750,000 |

|

E-One Moli Energy (Canada) Ltd |

Power capability enhancement |

USD 1,620,314 |

|

Nanode Battery Technologies |

Tin-based anode materials |

USD 1,500,000 |

|

E-One Moli Energy (Canada) Ltd |

Low-temperature performance |

USD 1,067,499 |

|

Total Investment |

|

USD 22,802,453 |

Source: Government of Canada

Europe Market Insights

Europe is readily blistering growth in the international battery market owing to the decarbonization targets, automotive electrification commitments, and the drive to localize battery production. The collaborative industry initiatives, stringent environmental standards, and strong demand across various sectors are solidifying the long-term growth. The European Commission in November 2025 announced that five innovative EV battery cell projects have secured €643 million (USD 707 million) under the innovation fund 2024 battery call, aiming to reduce 88 million tonnes of CO₂ over their first decade and enter operation between 2027 and 2029. It is located across four EU countries, and the projects will advance the battery value chain through material production, cell manufacturing, recycling, and second-life applications, thereby reducing dependence on external suppliers. It also underscored that this project is aligned with the EU climate, industrial, and circular economy support net-zero objectives and contributes to a sustainable battery industry.

Germany has a strong position in the regional battery market, supported by the automotive sector’s transition towards electrified platforms, a strong manufacturing and industrial base. The presence of key market players and their strategic steps is also driving business in the market. For instance, in November 2025, Canadian Solar announced that its subsidiary e-STORAGE had secured a 20.7 MW / 56 MWh battery energy storage project in Lower Saxony, Germany, including a 20-year long-term service agreement, supporting grid flexibility and renewable integration. The project, developed by Kyon Energy, will use e-STORAGE’s proprietary SolBank technology, and this expansion strengthens the firm’s presence in Europe. Furthermore, the move leveraging its expertise in utility-scale solar and battery storage solutions will advance the energy transition.

France is exponentially growing in the regional battery market on account of strategic investments in battery gigafactories, domestic mineral processing, and clean mobility initiatives. The collaborations between government and industry are strengthening domestic innovation, whereas increasing EV adoption and energy storage requirements are reshaping the growth dynamics in this field. In September 2025, Connected Energy announced that it is expanding into France with a 100 MWh second-life battery energy storage project in Région Centre-Val de Loire, marking one of Europe’s largest such deployments. The company has inaugurated a Bordeaux office and aims to deploy around 1 GWh of second-life BESS across multiple sites by the end of 2030, leveraging the country’s renewable growth and grid stability needs. Furthermore, the firm plans to optimize site selection, secure land, and accelerate the adoption of second-life battery systems in the country’s market.

Key Battery Market Players:

- Contemporary Amperex Technology Co., Limited (CATL) - China

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Co. Ltd. - China

- LG Energy Solution, Ltd. - South Korea

- Panasonic Corporation (Panasonic Energy) - Japan

- Samsung SDI Co., Ltd. - South Korea

- SK On (formerly SK Innovation) - South Korea

- Gotion High-Tech (Guoxuan) - China

- EVE Energy Co., Ltd. - China

- Sunwoda Electronic Co., Ltd. - China

- CALB (China Aviation Lithium Battery Co.) - China

- Farasis Energy - China

- Northvolt AB - Sweden

- SVOLT Energy Technology Co., Ltd. - China

- AESC Group Ltd. - Japan

- Leclanché S.A. - Switzerland

- CATL is the global leader in terms of lithium-ion battery manufacturing, which also has a strong foothold in the electric vehicle and energy storage fields. The company is extensively focused on large-scale production facilities, vertical integration, and advanced R&D in next-generation chemistries, which positions the company as a predominant leader in this field. Further partnerships with leading OEMs are enabling it to secure long-term supply agreements in this field.

- BYD is emerging as a dominant force in this field by integrating battery production with its EV and renewable energy businesses. The company also produces lithium-ion batteries for various sectors, such as EVs, buses, as well as energy storage systems. On the other hand, strategic expansion into international markets, investment in solid-state and LFP battery technologies, and strong government backing have positioned BYD as a critical player in both domestic and global landscapes.

- LG Energy Solution is recognized as one of the most prominent suppliers of lithium-ion batteries for EVs, consumer electronics, as well as energy storage systems. The company has extensive partnerships with automakers, and it emphasizes innovation in terms of high-energy-density cells and advanced battery management systems. Furthermore, the company has been investing heavily in manufacturing expansion, particularly in established economies with a prime focus on meeting rising EV demand and addressing supply chain risks.

- Panasonic is one of the most popular brand names in the worldwide marketplaces, which emphasizes a long-standing presence in the battery sector, and is primarily supplying lithium-ion cells to the automotive and consumer electronics sectors. It also has a strong focus on improving energy density, safety, and cost-efficiency through innovations in t cell chemistry as well as manufacturing processes, hence solidifying its position in the battery industry.

- Samsung SDI is based in South Korea and is one of the leading providers of lithium-ion batteries for EVs, energy storage systems, and consumer electronics. Also, the company emphasizes high-performance, long-life batteries with advanced safety features, allowing it to capture the interest of a wider audience group. It has pursued international expansion strategies by establishing production facilities and joint ventures to meet the growing global EV and renewable energy demand.

Below is the list of some prominent players operating in the global market:

The international battery market is dominated by several large, vertically integrated players, particularly the firms based in China, South Korea, and Japan. CATL maintains a critical lead in global battery cell production, whereas BYD’s deep integration across battery manufacturing, EV production, and raw-material sourcing is allowing it to gain a strategic edge. Simultaneously, the Korea-based players such as LG Energy Solution, SK On, and Samsung SDI are scaling aggressively in established economies through joint ventures with auto OEMs. In December 2023, Komatsu announced that it had completed its acquisition of American Battery Solutions, enabling the company to integrate advanced lithium-ion battery technology into its construction and mining equipment. The company will be operating as a stand-alone entity within Komatsu and will continue to serve commercial vehicle segments while gaining new opportunities to scale its battery systems for heavy-duty and off-highway applications.

Corporate Landscape of the Battery Market:

Recent Developments

- In November 2025, Adani Group announced its entry into the Battery Energy Storage Systems sector with a 1126 MW / 3530 MWh project at Khavda, which marks one of the world’s largest single-location BESS deployments. The project comprises over 700 lithium-ion battery containers integrated with advanced energy management systems, which will enhance grid reliability, support peak load management.

- In November 2025, Elements Green announced plans to invest €2 billion (US$2.3 billion) in eight German battery storage projects totaling around 3.2 GW, all with secured grid connections.

- In September 2025, American Battery Technology Company announced that entered into a partnership with Call2Recycle have partnered to expand consumer lithium-ion battery recycling across the U.S., creating a direct-to-consumer channel that strengthens the domestic supply of critical minerals.

- Report ID: 3474

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.