IoT Battery Market Outlook:

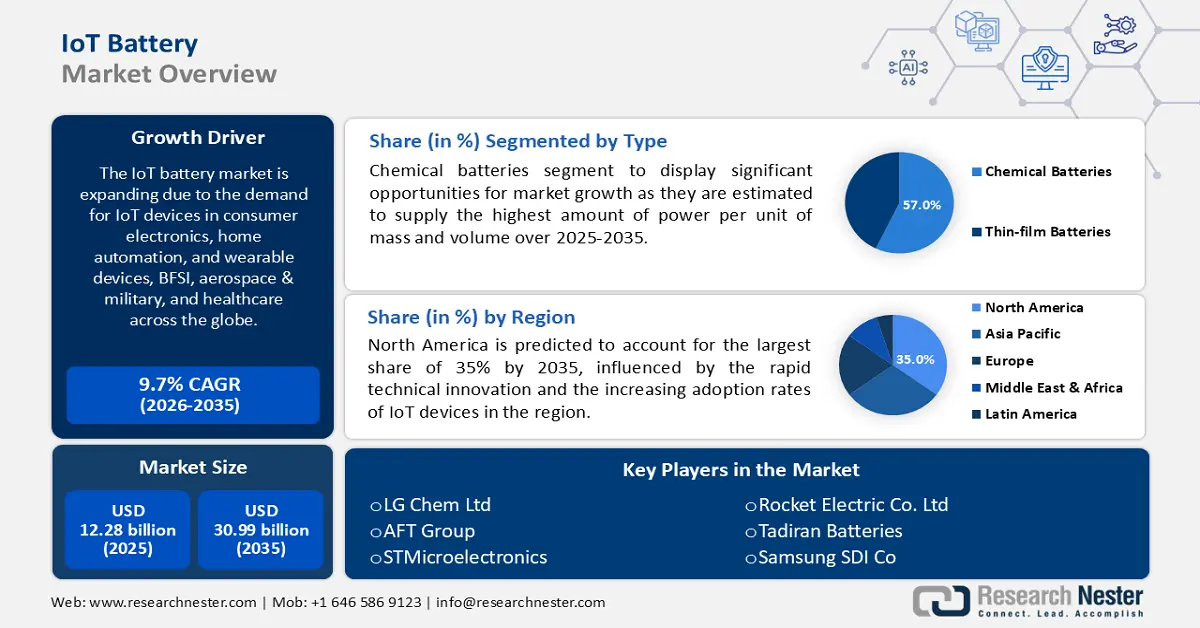

IoT Battery Market size was over USD 12.28 billion in 2025 and is anticipated to cross USD 30.99 billion by 2035, witnessing more than 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IoT battery is assessed at USD 13.35 billion.

The demand for IoT devices in consumer electronics, home automation, and wearable devices, BFSI, aerospace & military, and healthcare is driving IoT battery market. Industry players are accelerating their product innovation to tap into opportunities in robotics, automotive solutions, manufacturing, and edge AI. Printed Energy collaborated with the IoT M2M Council (IMC) in March 2024 to launch integrated batteries for smart labels, RFID tags, wearable biosensors, and medical devices.

Key IoT Battery Market Insights Summary:

Regional Highlights:

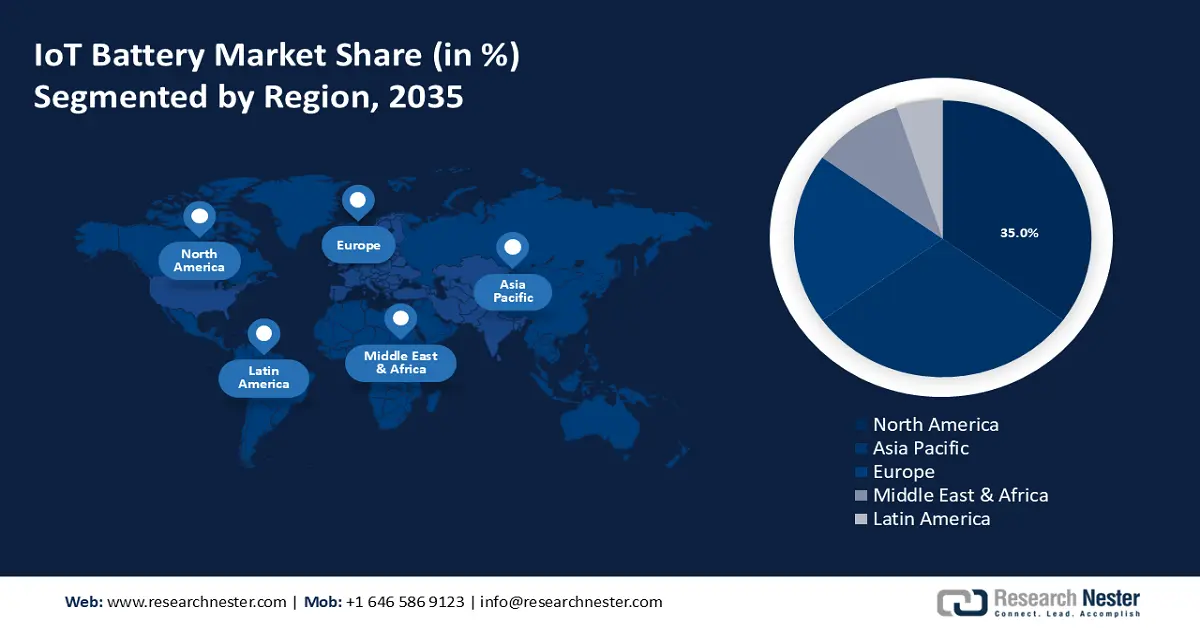

- The North America IoT battery market is anticipated to capture 35% share by 2035, driven by technical innovation and the increasing adoption of IoT devices.

- The Asia Pacific market will achieve a 30% share by 2035, driven by extensive industrialization, rising consumer electronics demand, and rapid technical breakthroughs.

Segment Insights:

- The primary batteries segment in the iot battery market is projected to exhibit the highest CAGR through 2035, driven by demand in low-power IoT applications like smart packaging.

- The healthcare segment in the iot battery market is forecasted to secure a staggering revenue share by 2035, driven by the rising use of wearable health devices and telemedicine.

Key Growth Trends:

- Emergence of Ambient IoT

- Rising adoption of disruptive technologies

Major Challenges:

- Volatility in the cost of raw materials

- Limited battery energy density and durability

Key Players: LG Chem Ltd, AFT Group, STMicroelectronics, Ultralife corporation, Cymbet Corporation, Enfucell, Rocket Electric Co. Ltd, Tadiran Batteries, Samsung SDI Co.

Global IoT Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.28 billion

- 2026 Market Size: USD 13.35 billion

- Projected Market Size: USD 30.99 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 17 September, 2025

IoT Battery Market Growth Drivers and Challenges:

Growth Drivers

-

Emergence of Ambient IoT- Ambient IoT is an innovative category that exclusively relies on harvested environmental energy, ensuring both sustainability and affordability. These devices are designed to eliminate the need for battery replacements, alleviating the maintenance burden. It optimizes device battery life by using radio waves, light, heat, or any other viable energy source while maintaining low latency in XR services. This employs power-saving schemes such as Connected mode Discontinuous Reception (CDRX) to balance latency and device battery lifetime., and high throughput.

Balancing the quality of experience with efficient codecs addresses the trade-off between latency, throughput, reliability, and power consumption. Ambient IoT batteries are the most budget-friendly, power-efficient, and uncomplicated, tier of batteries available in the market. The Institute of Electrical and Electronics Engineers (IEEE), oversees Wi-Fi and network standards, the 3rd Generation Partnership Project (3GPP) is responsible for cellular standards, and the Bluetooth Special Interest Group (SIG) catering to Bluetooth technology standards, is engaged in the development of Ambient IoT devices and batteries.

This partnership effort underscores the cross-industry support to support innovation of ambient IoT. These self-sustaining batteries lower the bill-of-materials (BOM) cost and is a key step toward achieving sustainability. Its affordability facilitates a multitude of applications, including inventory management, logistics and object tracking, actuators and remote command, and smart agriculture sensors. The market opportunity for this new class of IoT devices is extensive. -

Rising adoption of disruptive technologies- The growing popularity of IoT devices is a primary catalyst for the growth of the IoT battery market. Internet of Things gadgets are significantly dependent on batteries for their power supply, which makes it essential to have battery solutions that are dependable, efficient, and have a long shelf life. In order to facilitate real-time monitoring and automation, IoT applications depend on sensors and actuators.

The rising focus on the development of smart cities, which utilize the Internet of Things to enhance urban administration, further intensifies the need for such technology. The advancement of such technology, including edge computing and AI, increases the need for high-performance batteries that can support these functionalities. This demand drives market expansion. -

Technological advancements - The IoT battery market has experienced notable technological progress, with a specific emphasis on the creation and manufacturing of inventive battery solutions for diverse industries. The market is propelled by advancements in novel materials, chemistries, manufacturing processes, and production equipment. This specifically pertains to emerging applications across diverse industries including electronics, medical devices, home and building automation, smart cities, wearables, e-textiles, and the Internet of Things (IoT).

Ligna Energy introduced an eco-friendly supercapacitor, named "S-Power 1," in September 2022. Subsequently, the company has been actively partnering with customers to develop more environmentally friendly Internet of Things (IoT) devices. Based on input from their partners, the S-Power 2S has been developed to offer the market a small, environmentally friendly, and highly efficient energy storage solution.

Challenges

-

Volatility in the cost of raw materials - This has led to dissatisfaction across the battery and energy storage system industries due to the unstable pricing dynamics. This situation is attributed to a significant surge in the cost of battery production, coupled with a rise in the prices of minerals and raw materials.

-

Limited battery energy density and durability- Despite battery advancements, energy density and longevity limit the IoT battery industry. Current battery technologies struggle to produce long-lasting batteries for IoT applications. Traditional lithium-ion batteries are popular but suffer from capacity loss, leakage, overheating, and fire dangers. These restrictions are crucial in remote sensors and medical implants, where battery replacement is impractical or expensive. The environmental implications of battery disposal and regular replacements compound the issues. These reasons may slow down the global IoT battery market growth.

IoT Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 12.28 billion |

|

Forecast Year Market Size (2035) |

USD 30.99 billion |

|

Regional Scope |

|

IoT Battery Market Segmentation:

Type Segment Analysis

The chemical battery segment is expected to dominate the IoT battery market during the forecast period. Lithium-ion batteries are used in most applications as they supply the highest amount of power per unit of mass and volume. Li-ion power units have excellent energy density and minimal self-discharge. The most common cathode materials for lithium-ion batteries are LiCoO2, LiMn2O4, LiFePO4, and LiNiMnCoO2. This battery family meets various energy density and load capacity needs. Most reliable rechargeable batteries can be used repeatedly without losing power making them ideal for IoT devices. These batteries are prevalent in IoT devices like smartphones and smartwatches.

Umicore and Automotive Cells Company (ACC, a joint venture comprising Stellantis, Mercedes-Benz, TotalEnergies, and Saft) announced a long-term strategic supply agreement for European EV cathode materials in April 2022. Umicore provides ACC's future large-scale European battery plants with next-generation high nickel cathode materials from its Nysa, Poland greenfield project.

Rechargeability Segment Analysis

The primary battery segment in IoT battery market is expected to grow at the highest CAGR throughout the projected period. Products with limited lifespans and low power opt for primary batteries and are extensively popular in smart packaging, smart cards, home automation, retail, and cosmetic and medicinal patches. This is due to their shorter self-discharge durations than rechargeable thin-film batteries.

In October 2022, Alameda, CA Sila received USD 100 million from the U.S. Department of Energy (DOE) to build out its 600,000-square-foot Moses Lake, Washington plant and scale manufacturing of their revolutionary silicon anode materials. Sila's 160-acre campus rollout plan forecasts 20 GWh of capacity by 2026, enough to power (recharge) 200,000 electric vehicles. Mercedes-Benz, the facility's first commercial customer, will use Sila's anode materials to power its electric G-Class cars.

Application Segment Analysis

The healthcare application segment is projected to contribute a staggering revenue share to the IoT battery market. Wearable health monitors, remote patient monitoring systems, and smart medical implants depend on efficient and reliable batteries. For patient safety and convenience, these devices need long-lasting batteries to operate without regular recharges or replacements. The great energy density and endurance of lithium-ion and solid-state batteries are making them more popular in these applications.

Telemedicine and the use of IoT for real-time health tracking and diagnostics are driving demand for durable batteries to ensure ongoing performance and better patient outcomes. Additionally, better patient monitoring with sensor systems reduces tests, unneeded appointments, and expenditures. Hence, IoT technology is crucial to early disease identification and treatment.

Our in-depth analysis of the IoT battery market includes the following segments:

|

Type |

|

|

Rechargeability |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Battery Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share of 35% by 2035. The market in this region is propelled by technical innovation and the increasing adoption rates of IoT devices. North America is advantaged by the substantial presence of influential industry leaders and superior research and development centers, which contribute to the commercialization of battery technology.

The rising adoption of IoT technologies across many industries, such as healthcare, smart homes, and industrial automation, is driving the United States IoT battery market. Customers are eagerly embracing home automation technology to improve convenience and energy efficiency. In the year 2021, around 41.9% of houses in the U.S. possessed an IoT device. It is anticipated that this percentage will increase by 2035, resulting in a surge in demand for Internet of Things (IoT) batteries in the country.

In Canada, the IoT battery industry is experiencing an increased demand owing to the emphasis on technological innovation and smart city initiatives. Cities such as Toronto and Vancouver allocate significant resources to develop IoT infrastructure to enhance municipal management and public services. The country's focus on sustainability and environmental preservation fuels the use of eco-friendly battery technology. Canada's extensive industrial sector is progressively incorporating IoT to improve operational efficiency, which requires durable and resilient battery solutions. Furthermore, the government's endorsement of R&D in cutting-edge battery technology & applications serves as a further catalyst for market expansion.

APAC Market Insights

In IoT battery market, Asia Pacific segment is set to hold revenue share of more than 30% by 2035. The region's extensive industrialization, rising consumer electronics demand, rapid technical breakthroughs, and vast consumer base offer substantial opportunities for market expansion. China, Japan, South Korea, and India are the main countries driving this expansion.

The China IoT battery market holds a dominating position owing to its extensive production capabilities and strong technological infrastructure. Moreover, the government has been aggressively pushing to improve the country's global manufacturing capabilities with advanced technologies. The widespread adoption of smart city initiatives, leading to the massive utilization of smart home devices, hence fueling the need for effective battery solutions. Additionally, China's rapid electronics manufacturing sector provides significant support for the production of diverse IoT devices, hence strengthening the market for IoT batteries.

The IoT battery market in India is experiencing substantial growth due to fast urbanization, digital transformation initiatives, and the increasing number of technologically proficient individuals. Here, the government's endeavor to promote smart cities, enhance urban management, and elevate the overall quality of life is aiding to technological innovation. This generates significant demand for Internet of Things (IoT) devices and, as a result, IoT batteries.

The increasing availability of affordable smartphones and wearable gadgets in India further drives the need for sophisticated battery technologies. Due to continuous enhancements in infrastructure and growing investments in IoT, India is set to emerge as a pivotal IoT battery market in the near future.

The Japan IoT battery market is impacted by the rising need for battery energy storage systems and its effort to regain its position in the global IoT battery market. The rising adoption of IoT applications and the growing emphasis on electric vehicles and renewable energy are propelling the substantial expansion of the market. The decreasing cost of Li batteries and the government's objective to achieve complete electrification of vehicles by 2050 is anticipated to have a favorable influence on the growth of the industry.

IoT Battery Market Players:

- Duracell Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Chem Ltd

- AFT Group

- STMicroelectronics

- Ultralife corporation

- Cymbet Corporation

- Enfucell OY

- Rocket Electric Co. Ltd

- Tadiran Batteries

- Samsung SDI Co

The market dynamics for IoT batteries is characterized by the presence of multiple players striving to develop contemporary battery solutions. These firms that are involved are leading the way in offering dependable, effective, and environmentally friendly power sources for the interconnected world, influencing the future of batteries for the Internet of Things. The prominent participants in IoT battery market comprise:

Recent Developments

- In June 2024, OnePlus launched “Glacier Battery” together with Contemporary Amperex Technology Limited. The latter stated on Weibo that the technology will improve smartphone battery capacity while reducing battery size. OnePlus claims it used this breakthrough technology to include a 6,100 mAh battery in its OnePlus Ace 3 Pro smartphone.

- In January 2023, LG Energy Solution signed a MoU with Hanwha Solutions to form a collaborative partnership in the battery industry. Through this Memorandum, LGES and partners will invest in the development of energy storage systems (ESS) battery production lines in the U.S. This strategic move aims to solidify LGES's position as a market leader in the rapidly expanding ESS industry, which is a crucial component of the U.S. green energy policies. The companies will collaborate to optimize the combined effects and broaden the use of batteries in upcoming areas of transportation, which includes Urban Air Mobility (UAM).

- In 2022, Duracell introduced POWER BOOST Ingredients in its Optimum and Coppertop AA/AAA batteries. Duracell has introduced a significant enhancement to its safety system for lithium coin batteries. Additionally, incorporating child-resistant packaging and safety warnings on the packaging and batteries, a bitter coating has been applied to prevent unintentional consumption. The 2032, 2025, and 2016 lithium coin batteries are loaded with a non-toxic bitter chemical that is specifically developed to deter ingestion and ensure the safety of minors.

- Report ID: 6308

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.