Biosensors Market Outlook:

Biosensors Market size was valued at USD 32.21 billion in 2025 and is set to exceed USD 77.66 billion by 2035, registering over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biosensors is estimated at USD 34.88 billion.

The rising demand for point-of-care diagnostics and continuous monitoring solutions for patients with diabetes, cardiovascular disease (CVD), and cancer is fuelling the market. Thus, the enlarging worldwide patient pool is directly proportionated to the sector’s expansion. On this note, NLM projected the global diabetes prevalence to reach 578.0 million and 700.0 million by 2030 and 2045, respectively. Similarly, the crude occurrence and mortality of CVD around the globe are expected to increase by 90.0% and 73.4% from 2025 to 2050. The number of deaths due to this condition is further poised to surpass 35.6 million by the end of 2050 (NLM). On the other hand, the annual number of new diagnoses and deaths from cancer is predicted to cross 26.0 million and 17.0 million by 2030 (NLM)

This magnifying demography indicates the continuous flow of business in the market throughout the upcoming years. As the economic burden on patients with such chronic conditions rises, the need for a treatment approach with reduced expenses is increasing. To establish this fact, an NLM study calculated the net global expenditure on these residents to attain USD 47.0 trillion by 2030. This is pushing companies to develop solutions that offer faster and more accurate detection and surveillance, where biosensors are clinically proven to establish affordable payers’ pricing for advanced healthcare. Moreover, associated medical devices are eliminating the need for long-term hospitalization and a workforce for monitoring disease progression or drug efficacy to serve this purpose.

Key Biosensor Market Insights Summary:

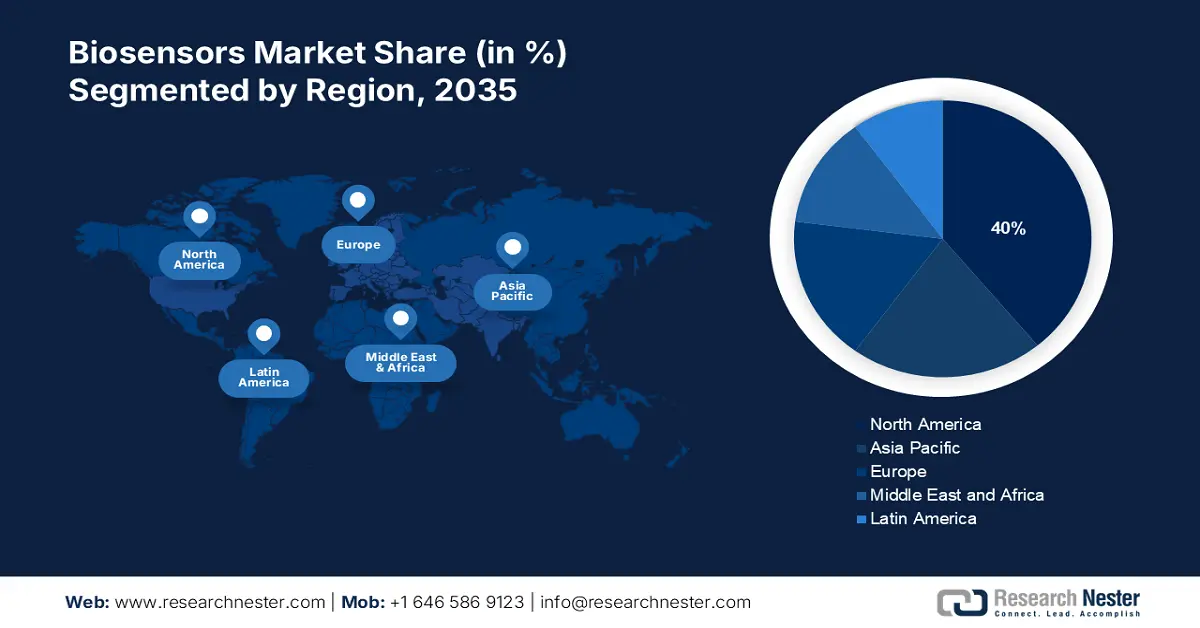

Regional Highlights:

- North America biosensors market will secure over 40% share, driven by the rising patient pool and innovations in biowearable devices, forecast period 2026–2035.

- Asia Pacific market will hold the second largest share, fueled by growing health awareness and production capabilities in countries like India and China, forecast period 2026–2035.

Segment Insights:

- The electrochemical segment in the biosensors market is forecasted to hold a 73% share by 2035, driven by its use in point-of-care diagnostics and health indicator monitoring.

- The medical segment in the biosensors market is expected to secure notable revenue share by 2035, attributed to the growing use of biosensors in disease detection and monitoring medical devices.

Key Growth Trends:

- Ongoing funding for developing tech-based solutions

- Public & private efforts to enable greater accessibility

Major Challenges:

- Cost barriers in product development and implementation

Key Players: Biosensors International Group, Ltd., Pinnacle Technologies Inc., Ercon, Inc., Nova Biomedical, Molex LLC, TDK Corp., Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Zimmer & Peacock AS, Siemens Healthcare.

Global Biosensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.21 billion

- 2026 Market Size: USD 34.88 billion

- Projected Market Size: USD 77.66 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Biosensors Market Growth Drivers and Challenges:

Growth Drivers

-

Ongoing funding for developing tech-based solutions: Considering the success of AI and machine learning (ML) in making clinical products more efficient, the biosensors market is increasingly adopting these advancements. Both government and private investors are encouraging dedicated companies to engage in these R&D cohorts by providing significant financial support. For instance, in October 2024, a team of researchers at the Pennsylvania State University was awarded a 3-year grant of USD 1.5 million by the U.S. National Science Foundation. This investment was intended to empower the commencement of an AI-designed biosensor research project. Such a secure capital influx is further inspiring others to invest in this field.

-

Public & private efforts to enable greater accessibility: Besides the technological advancements, the pipeline in the market is being explored deeper to expand its field of application. In addition, several public healthcare authorities are proactively forming strategic alliances and affiliating tech-based pioneers to realize worldwide implementation and adoption. For instance, in January 2024, WHO, in collaboration with the Medicines Patent Pool (MPP), signed a licensing agreement with SD Biosensor, offering the company the right, method, and components to manufacture rapid diagnostic testing (RDT) technology. This transfer of the COVID-19 Technology Access Pool (C-TAP) aimed to improve public access to multiple disease detection tools.

Challenges

-

Cost barriers in product development and implementation: Owing to specific equipment and technological needs, participating in the R&D culture of the market may become expensive for several MedTech companies. A few of these main factors are anticipated to be the high initial investment and elongated process of regulatory compliance. However, the recently introduced cost-effective materials and chemical bindings are mitigating this issue. For instance, in August 2023, a study from ScienceDirect produced bacterial cellulose-based and low-cost electrochemical biosensors for just USD 3.5 for ultrasensitive detection of SARS-CoV-2.

Biosensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 32.21 billion |

|

Forecast Year Market Size (2035) |

USD 77.66 billion |

|

Regional Scope |

|

Biosensors Market Segmentation:

Technology Segment Analysis

The electrochemical segment is predicted to account for a majority share of 73% in the global biosensors market by 2035. This leadership is attributable to its growing usage in point-of-care diagnosis as one of the most promising and emerging areas in identifying and measuring health indicators. This, as a result, magnifies the importance of electrochemical biosensors in developing systems for faster identification of analytes such as glucose, lactic acid, cholesterol, uric acid, blood ketones, hemoglobin, neurotransmitters, amino acids, soluble gases, and immunoglobulin. For instance, in October 2024, STMicroelectronics launched a new bio-sensing chip, ST1VAFE3BX, for healthcare wearables, including smartwatches, sports bands, connected rings, and smart glasses, backed by inertial sensing and AI core.

Application Segment Analysis

The medical segment in the biosensors market is set to garner a notable share throughout the assessed timeframe. This predominant captivity on revenue generation is driven by its utilization in a wide range of disease detection and management electronics. This can also be testified by the projected expansion of the smart diagnostic and monitoring medical device industry, exhibiting a remarkable CAGR till 2035. In addition, the heightened awareness about early diagnosis, personalized treatment, and accurate prognosis in cancer is contributing significantly to the segment’s proprietorship. Furthermore, the worldwide use of these devices in identifying pathogens such as viruses, bacteria, and parasites to facilitate timely intervention and infection control measures is fueling its augmentation.

Our in-depth analysis of the global biosensors market includes the following segments:

|

Application |

|

|

End-User |

|

|

Technology |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biosensors Market Regional Analysis:

North American Market Insights

The biosensors market in North America is predicted to account for the largest share of 40% over the discussed timeline, i.e. between 2026 and 2035. The magnifying patient pool is highly responsible for the rapid growth in this landscape, making it an attractive destination for doing business for both domestic and international leaders. On this note, in June 2024, Abbott announced its debut in the U.S. consumer biowearables industry by gaining FDA approval for its two new over-the-counter continuous glucose monitoring systems, Lingo and Libre Rio. The company further shared its plans to create a multi-functional sensor to detect both glucose and ketone, fostering a possibility of garnering USD 10.0 billion in revenue from its Libre portfolio by 2028.

According to the American Journal of Preventive Medicine, the overall age-standardized diabetes prevalence in the U.S. increased by 18.6% in 2022 from 2012. It also estimated the national financial exhaustion to surpass USD 412.9 billion by 2024. Another NLM study reported that the numbers of new and death cases of cancer across the country were 2,041,910 and 618,120 in 2025, respectively, where they were 2,001,140 and 611,720 in 2024. This multiplying demography, coupled with the increasing pharmaceutical advances, is propelling the augmentation of the U.S. in the market. In this regard, in September 2024, Monod Bio unveiled a rapid biosensor assay platform, NovoLISA, for life sciences research and diagnostics. This de Novo protein-linked instantaneous solution-based assay can deliver results in just 15 minutes.

APAC Market Insights

The Asia Pacific biosensors market is estimated to be the second largest revenue generator, with a significant pace of growth by the end of 2035. Its propagation is led by the growing health awareness in emerging healthcare landscapes such as India, China, and Japan. Moreover, as these health-conscious consumers become more eager to spend money on exercise programs & activities, natural food intake, health supplements, and specialized diets, the surge for smart monitoring electronics grows. The region is also becoming the production hub for this field with the increased need for quality management in the food & beverages industry. On this note, in January 2023, Universal Biosensors extended its Sentia wine testing platform by launching a new Fructose biosensor test.

India is augmenting the market with several innovations and its extended manufacturing capabilities. With support from the government on the domestic production of medical devices and academic excellence, the country is securing its position at the top of the list of global manufacturers. For instance, in July 2023, China and India were the 1st and 3rd largest exporters of wearables in the world, where India alone shipped over 100.0 million units (IBEF). The growing awareness about the integration of advanced technologies to enhance the accuracy of diagnosis is also contributing to the country’s progress. In this regard, in April 2025, a multi-institute research team, led by the Indian Institute of Technology Madras developed a new biosensor platform for detecting Pre-eclampsia in pregnant women.

Biosensors Market Players:

- Bio-Rad Laboratories Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Medtronic

- LifeScan, Inc.

- QTL Biodetection LLC

- Molecular Devices Corp.

- Nova Biomedical

- Molex LLC

- Biosensors International Group, Ltd.

- Pinnacle Technologies Inc.

- DuPont Biosensor Materials

- Johnson & Johnson

- Zimmer & Peacock AS

- The Cultivated B. GmbH

- Versarien Plc

- DexCom, Inc.

The market is witnessing a boost in technological development and worldwide adoption with the integration of AI and increasing availability of over-the-counter (OTC) products. Thus, key players are upgrading their pipeline with new features to cope and align with the transition. For instance, in August 2024, DexCom made its OTC glucose biosensor, Stelo, available for general consumers through its e-commerce site, Stelo.com. The company’s strategic expansion in the U.S. is expected to generate greater revenue by captivating one of the largest diabetic populations in the world. Simultaneously, during the same timeline, Monod Bio secured a USD 25.0 million fund to accelerate the development of molecular biosensors for both health and industrial applications. This cohort of innovators include:

Recent Developments

- In February 2025, The Cultivated B introduced AI-enabled multi-channel biosensors to deliver enhanced monitoring of the growth and metabolism of cell culture and fermentation processes. This next-generation tool is designed to empower bioprocess engineers to achieve unmatched accuracy, helping them make faster and more informed decisions.

- In December 2024, Versarien announced the commercial launch of a new biosensor chip, built with a novel graphene barristor sensor platform technology. This is further utilized to fabricate A Barristor Company’s products, including infrared detection, gas/chemical detection, temperature detection, and multiple sensor-on-a-chip technologies, as per their distribution agreement with the company.

- In November 2024, DexCom partnered with ŌURA to offer its customers a seamless metabolic health management experience by forming a connected ecosystem, offering a complete overview of vital signs, sleep, stress, heart health, and activity. This, coupled with a USD 75.0 million investment in ŌURA Series D funding, enabled two-way data flow between Dexcom glucose biosensors & apps and Oura Ring & the Oura App.

- Report ID: 5832

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biosensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.