Next Generation Batteries Market Outlook:

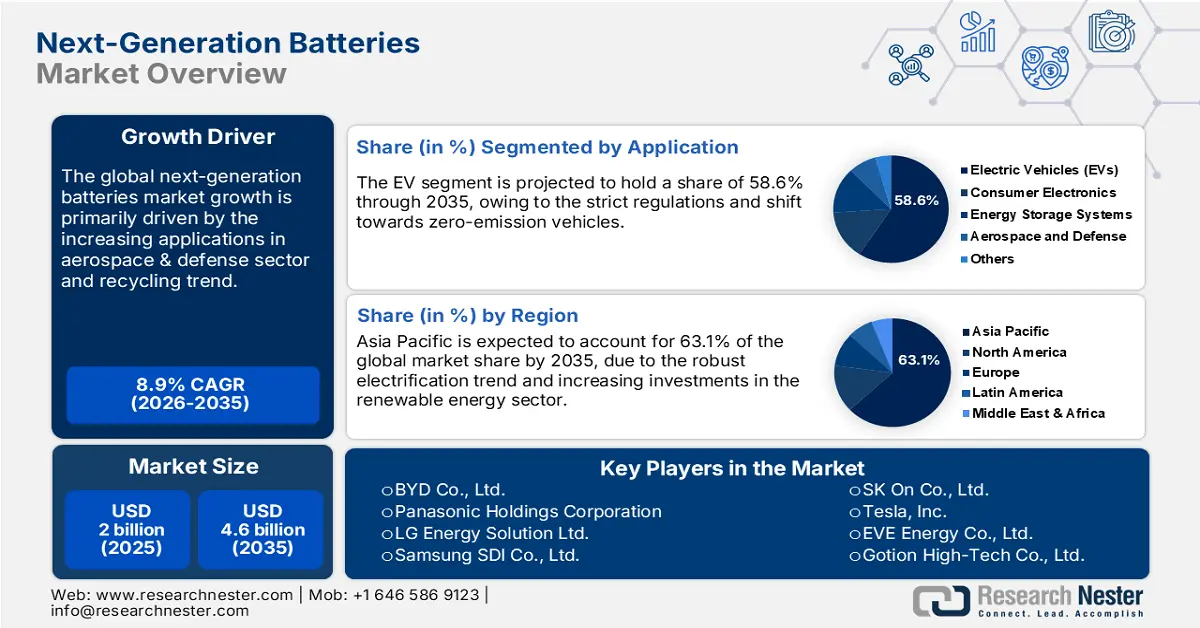

Next Generation Batteries Market size was USD 2 billion in 2025 and is estimated to reach USD 4.6 billion by the end of 2035, expanding at a CAGR of 8.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of next generation batteries is assessed at USD 2.1 billion.

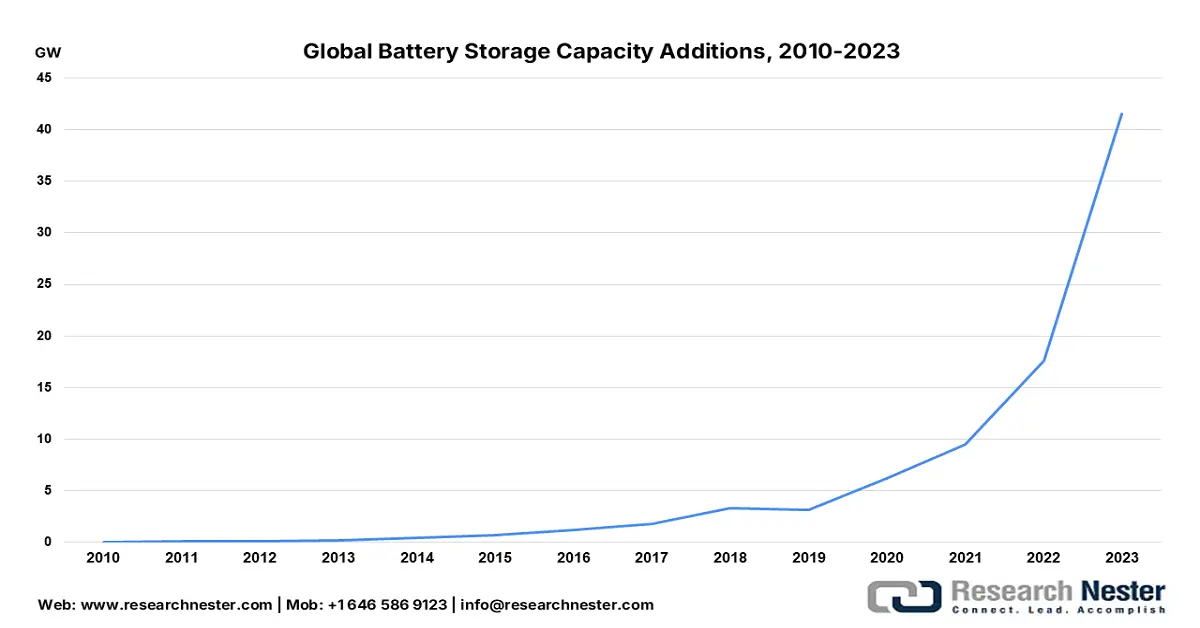

The integration of next-generation batteries with renewable energy systems is estimated to bring a critical market shift in the years ahead. The strong demand for grid-scale storage solutions is fueling the application of next-gen batteries. The massive public-private investments in clean energy infrastructure expansion are poised to amplify the production and commercialization of next-generation batteries in the years ahead. According to the International Energy Agency (IEA), battery storage for power was the fastest-growing energy technology available in 2023, with more than twice as much added compared to the previous year. A total of 42 gigawatts of battery storage was added worldwide through large-scale battery projects, home and business batteries, small power grids, and solar home systems for electricity access.

Source: IEA

Even though billions of personal devices still use lithium-ion batteries, over 90% of the demand for these batteries is currently led by the energy sector, compared to 50% in 2016 when the market was ten times smaller. With lower costs and better performance, lithium-ion batteries are becoming a key part of economies. Flow batteries, including vanadium redox, are also being widely adopted for large installations due to their unlimited scalability and longer operational lifespans with minimal degradation.

Key Next-Generation Batteries Market Insights Summary:

Regional Highlights:

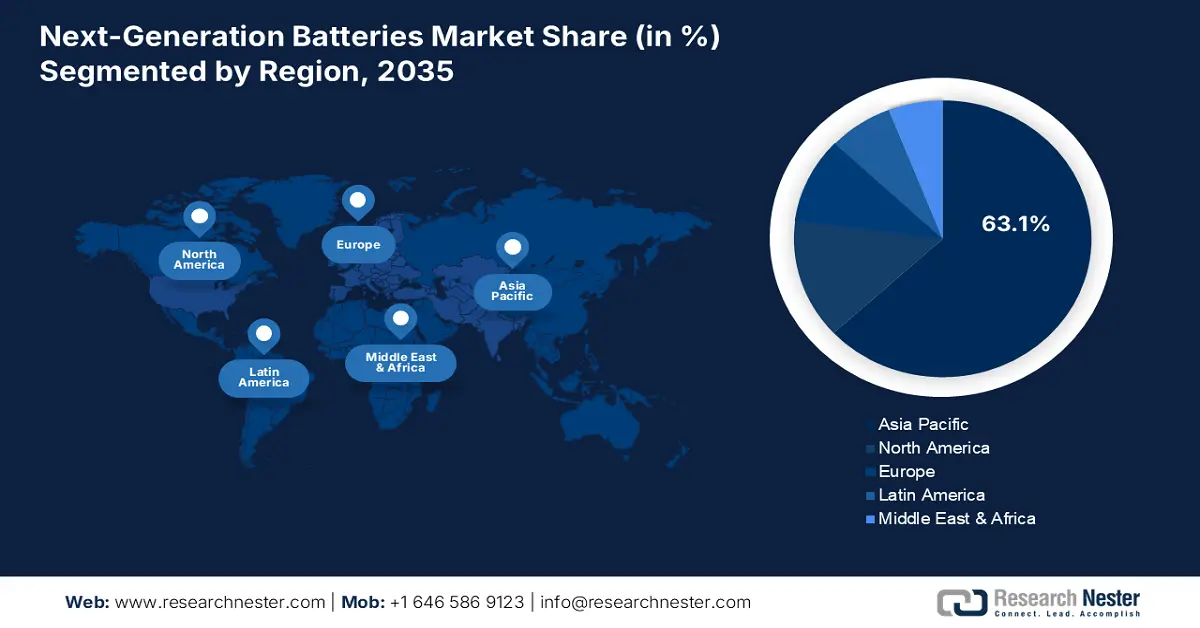

- The Asia Pacific next generation batteries market is estimated to secure 63.1% of the global revenue share through 2035, owing to robust electrification trends and rising investments in the renewable energy sector.

- North America is projected to capture the second-largest share by 2035, impelled by strong policy backing and a mature automotive industry.

Segment Insights:

- The solid-state segment is projected to account for 50.5% revenue share by 2035 in the Next Generation Batteries Market, propelled by their high performance and scalability.

- The electric vehicles (EVs) segment is expected to capture 58.6% share by 2035, driven by the booming trend of zero-emission vehicles.

Key Growth Trends:

- Recycling & circular economy focus

- Increasing aerospace & defense applications

Major Challenges:

- High production costs

- Infrastructure gaps

Key Players: Contemporary Amperex Technology Co., Ltd. (CATL), BYD Co., Ltd., Panasonic Holdings Corporation, LG Energy Solution Ltd., Samsung SDI Co., Ltd., SK On Co., Ltd., Tesla, Inc., EVE Energy Co., Ltd., Gotion High-Tech Co., Ltd., Northvolt AB, QuantumScape Corporation, Solid Power, Inc., Saft Groupe S.A. (TotalEnergies), VARTA AG, Panasonic Holdings Corporation, GS Yuasa Corporation, Toshiba Corporation (SCiB), Sony Group Corporation (Sony Energy Devices), Subaru Corporation.

Global Next-Generation Batteries Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (63.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: India, France, Canada, United Kingdom, Australia

Last updated on : 8 October, 2025

Next Generation Batteries Market - Growth Drivers and Challenges

Growth Drivers

- Recycling & circular economy focus: The evolving environmental rules and the push for a circular economy are creating big opportunities for companies making advanced batteries. In Europe, the EU Battery Regulation (2023) requires that by 2030, all new batteries must include a certain amount of recycled lithium, cobalt, and nickel. The strict recycling rules are driving carmakers and battery companies to invest in systems that collect and reuse materials. This is making recycling a key focus for growing the next-generation batteries market.

- Increasing aerospace & defense applications: The next-generation batteries are being widely used in the aerospace and defense sectors, owing to the increasing demand for lightweight, high-capacity energy storage solutions. The hefty investments in defense system modernization across the world are poised to propel the profits of next-generation battery manufacturers. In May 2025, Lyten launched a new project to meet the growing need for long-lasting, far-reaching drones used in defense. This project is using the company's super-light lithium-sulfur (Li-S) batteries to power an advanced drone energy storage solution. Thus, technological innovations and massive R&D investments are likely to propel the A&D application of next-generation batteries.

- Hydrogen-battery hybrids: The hydrogen-battery hybrids are expected to gain momentum owing to the shift towards flexible energy storage solutions that combine the strengths of both technologies. Lithium-ion and new types of batteries are great for quick energy responses and short-term storage, while hydrogen fuel cells are better for long-term, high-energy needs. Combining both creates a mixed solution that works better for transportation, heavy industry, and power grids than either one alone. The industrial and transport sector is expected to be the prime end user of hydrogen hybrids in the years ahead.

Challenges

- High production costs: The production of next-generation batteries is a capital-intensive process, owing to the high installation of advanced manufacturing technologies. The requirements of skilled experts and technicians again add to the production costs. Thus, high capex needs hamper the expansion opportunities of small and medium companies in next generation batteries market.

- Infrastructure gaps: The unavailability of advanced infrastructure is a major drawback for the large-scale adoption of next-generation batteries. The small and medium-sized players are often hampered by this factor in the price-sensitive markets. Most public charging stations for electric vehicles (EVs) are designed for standard lithium-ion batteries. Newer battery types need different voltages, charging speeds, or cooling systems, which don’t work with current stations, making their market entry challenging due to infrastructure gaps.

Next Generation Batteries Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Next Generation Batteries Market Segmentation:

Technology Segment Analysis

The solid-state next generation batteries market is projected to account for 50.5% revenue share by 2035, due to their high performance and scalability. The EV and energy storage solutions are major users of solid-state batteries as they reduce the risk of thermal runaway and fire. Continuous technological advancements are likely to propel the sales of solid-state batteries in the years ahead. The International Energy Agency (IEA) also discloses that beyond 2030, the price of batteries is expected to decline and accelerate the commercial adoption of solid-state batteries due to enhanced performance.

Application Segment Analysis

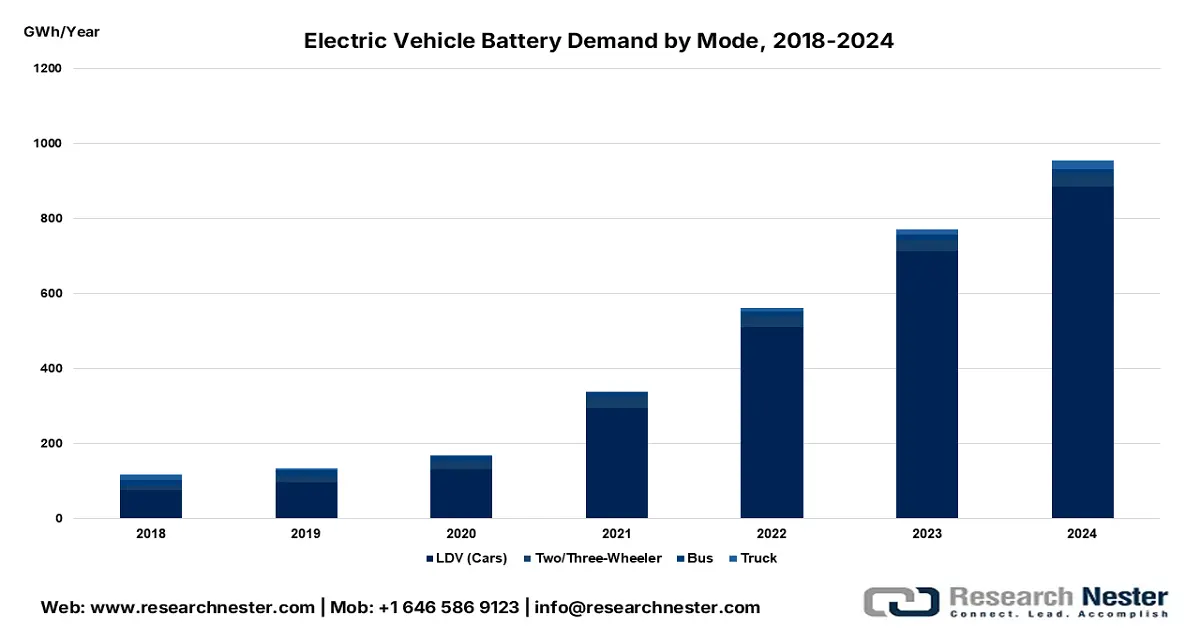

The electric vehicles (EVs) segment is expected to capture 58.6% of the next-generation batteries market share throughout the study period. The booming trend of zero-emission vehicles is driving the sales of next-generation batteries. IEA reveals that the electric car sales in 2024 surpassed 17 million. The vehicle-to-energy technology is also contributing to the robust adoption of next-generation batteries. In 2024, the demand for batteries in the energy sector, including electric vehicle (EV) batteries and energy storage, hit a record 1 terawatt-hour. The battery demand for just one week in 2024 was more than the total demand for an entire year ten years ago. Thus, this highlights that the EV sector is poised to double the revenues of next-generation batteries in the years ahead.

Source: IEA

Our in-depth analysis of the next generation batteries market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next Generation Batteries Market - Regional Analysis

APAC Market Insights

The Asia Pacific next generation batteries market is estimated to hold 63.1% of the global revenue share through 2035. The robust electrification trend and increasing investments in the renewable energy sector are poised to fuel the demand for next-generation batteries. The strong government support for decarbonization and clean energy transition is propelling the application of next-generation batteries. China, Japan, South Korea, and India are the most profitable marketplaces in the region. The continuous technological advancements in consumer electronics are also contributing to the increasing sales of next-generation batteries.

China leads the trade of next-generation batteries owing to the supportive government policies and its massive manufacturing capacity. The expanding investments in EV charging infrastructure and booming electric vehicle registrations are also fueling the adoption of next-generation batteries. The government’s 14th Five-Year Plan, focusing on energy security and innovations, is poised to drive the sales of next-generation batteries.

The India next generation batteries market is set to increase at a robust pace from 2026 to 2035. The continuous government support in the form of subsidies, funding, and policies aimed at the expansion of the EV sector is anticipated to substantially propel the demand for next-generation batteries. According to the India Brand Equity Foundation (IBEF), the Ministry of Heavy Industries inaugurated the PM E-DRIVE Scheme with around USD 1.28 billion to support the country’s electric vehicle (EV) industry. The plan aims to encourage electric transportation and reduce the use of fossil fuels. Thus, the foreign direct investments are poised to offer hefty long-term benefits in the years ahead.

North America Market Insights

The North America next generation batteries market is projected to capture the second-largest revenue share throughout the study period. The strong policy backing and a mature automotive sector are boosting the sales of next-generation batteries. The large-scale renewable integration is also contributing to the increasing installation of next-generation batteries. The U.S. Inflation Reduction Act (IRA) and Canada’s Critical Minerals Strategy are further expected to fuel the trade of next-generation batteries in the region.

The U.S. next generation batteries market growth is expected to be driven by the aggressive federal initiatives and the increasing emergence of leading-edge startups. The supportive government policies and funding are also poised to double the revenues of key players in the years ahead. The defense and military sectors are also set to fuel the demand for lightweight, high-capacity batteries for drones and advanced combat systems.

The increasing registration of zero-emission vehicles in Canada is expected to push the demand for next-generation batteries. The report by Statistics Canada reveals that around 46,366 all-zero-emission vehicles were registered in the country in the second quarter of 2025. The federal government’s Critical Minerals Strategy is expected to position the country as a reliable raw material supplier for battery production. The clean energy trend is also set to increase the adoption of next-generation batteries in the years ahead.

Europe Market Insights

The Europe next-generation batteries market is foreseen to expand at the fastest CAGR from 2026 to 2035. The stringent climate policies and increasing investments in renewables are propelling the demand for next-generation batteries. The strong presence of automakers and increasing adoption of electric vehicles is creating a profitable environment for next-generation battery manufacturers. The U.K., Germany, France, and the Nordic countries are set to lead the EU market owing to robust investments in research and development activities.

The U.K. next generation batteries market is estimated to be driven by the EV transition targets and the increasing investments in advanced battery R&D. The strict regulations aimed at reducing the use of fuel-based vehicles are opening lucrative doors for key players. The expansion of clean energy grid infrastructure is also supporting the growth of the market in the country.

The sales of next-generation batteries in Germany are set to be influenced by the country’s mature automotive sector and strong industrial base. The strong presence of automobile leaders is also driving innovation trends in the market. The accelerated renewable transition is pushing the adoption of long-duration storage solutions, including next-generation batteries. The continuous innovations in consumer electronics are likely to double the revenues of industry giants in the years ahead.

Key Next Generation Batteries Market Players:

- Contemporary Amperex Technology Co., Ltd. (CATL)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Co., Ltd.

- Panasonic Holdings Corporation

- LG Energy Solution Ltd.

- Samsung SDI Co., Ltd.

- SK On Co., Ltd.

- Tesla, Inc.

- EVE Energy Co., Ltd.

- Gotion High-Tech Co., Ltd.

- Northvolt AB

- QuantumScape Corporation

- Solid Power, Inc.

- Saft Groupe S.A. (TotalEnergies)

- VARTA AG

- Panasonic Holdings Corporation

- GS Yuasa Corporation

- Toshiba Corporation (SCiB)

- Sony Group Corporation (Sony Energy Devices)

- Subaru Corporation

The next generation batteries market is dominated by the mature companies owing to their leadership in R&D. The market is also expected to witness the increasing emergence of start-ups in the years ahead. The leading companies are entering into strategic partnerships with other players to increase their reach and product offerings. They are also collaborating with raw material suppliers for a smooth supply chain. Some of the industry giants are exploring emerging markets to earn lucrative gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2024, the U.S. company NanoGraf announced large-scale orders for its new silicon battery, which was created for military purposes. The battery will first power portable electronics for soldiers, but there are also signs it could be used in electric vehicles.

- In June 2025, magniX, a company leading the electric aviation movement, announced that its new Samson battery is set to use a powerful 400 Wh/kg cell. This advanced battery was developed with the help of a partner company to power the next generation of its Samson battery product.

- In September 2024, Subaru Corporation and Panasonic Energy Co., Ltd. shared plans to start preparing to supply automotive lithium-ion batteries and build a new battery factory together in Japan. This partnership is set to create a 20-gigawatt-hour production capacity, boosting Japan’s battery manufacturing and helping increase electric vehicle use.

- In July 2024, Toyota Motor Corporation announced its plans to develop and produce next-generation batteries, including high-performance and all-solid-state batteries, which are approved by Japan’s Ministry of Economy, Trade and Industry (METI). This approval is part of the Japanese government’s Supply Assurance Plan for Batteries.

- Report ID: 8179

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Next-Generation Batteries Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.