Disposable Batteries Market Outlook:

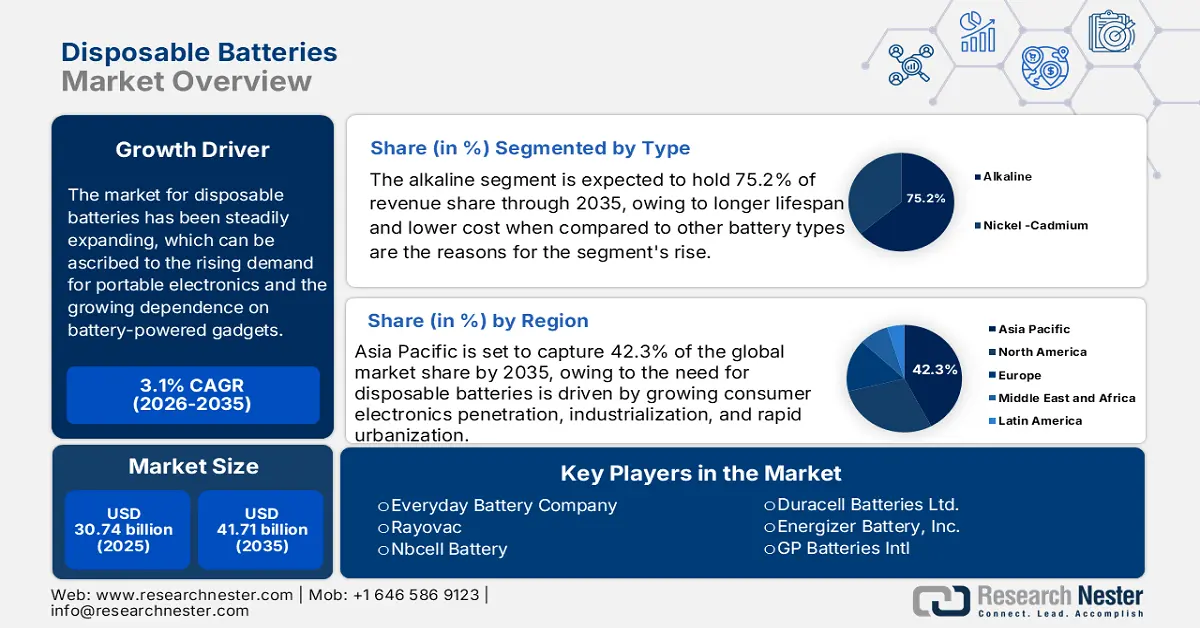

Disposable Batteries Market size was valued at USD 30.74 billion in 2025 and is expected to reach USD 41.71 billion by 2035, registering around 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of disposable batteries is evaluated at USD 31.6 billion.

The disposable batteries market has been steadily expanding, which can be ascribed to the rising demand for portable electronics and the growing dependence on battery-powered gadgets. Convenience and technological improvements are major factors driving the need for disposable batteries in a variety of industries. According to recent investment trends, Form Energy received a USD 12 million grant from the New York Governor in August 2023. Although the location of the system has not yet been determined, the company revealed plans to design, develop, and build a 10 MW/1000 MWh iron-air battery system. In addition to just starting construction on a commercial battery factory in West Virginia, Form Energy has contracts for battery installations with utilities such as Xcel Energy, Southern Company, and Great River Energy.

The growing demand for consumer electronics is one of the main drivers of the disposable batteries market's expansion. Disposable batteries are essential to the functioning of many gadgets, including portable music players, torches, remote controls, and toys. The continued demand for these batteries has been fueled in part by the growth of electronic devices and the increase in disposable income. In addition, users choose disposable batteries for low-draw and intermittent-use applications due to their availability and ease.

Key Disposable Batteries Market Insights Summary:

Regional Highlights:

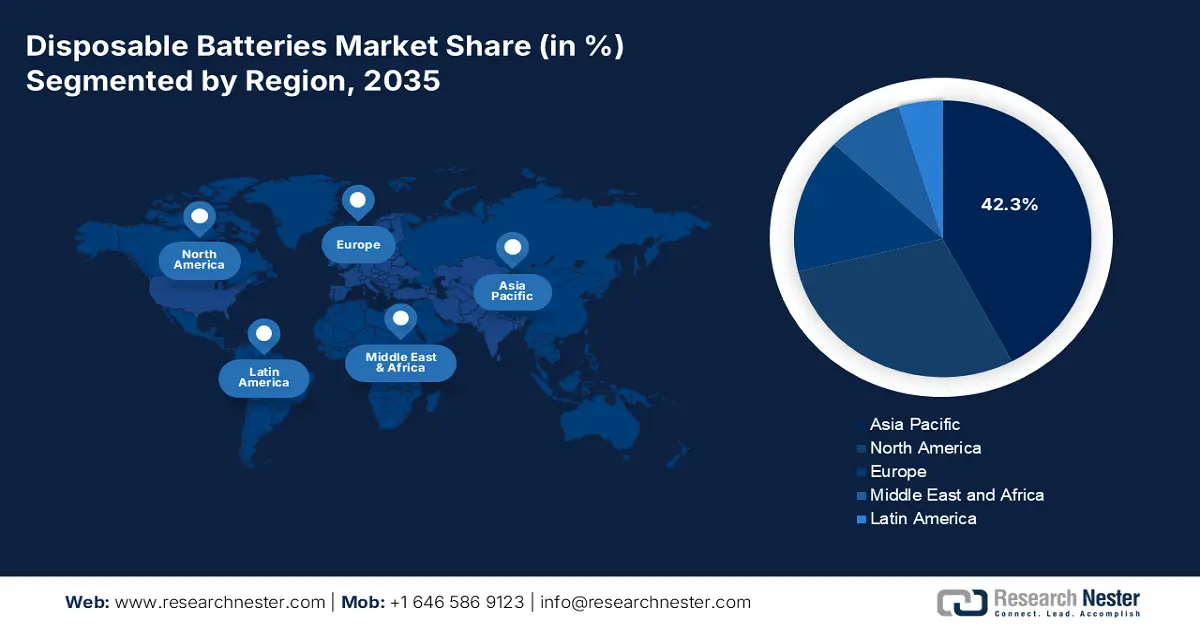

- Asia Pacific leads the Disposable Batteries Market with a 42.3% share, driven by growing consumer electronics penetration, industrialization, and urbanization, ensuring significant expansion through 2035.

- The Disposable Batteries Market in North America is expected to maintain stable growth through 2026–2035, fueled by strong industrial sector, advanced healthcare infrastructure, and high adoption of consumer electronics.

Segment Insights:

- The Alkaline segment is expected to achieve a 75.20% share by 2035, driven by its longer lifespan, low cost, and high energy density.

- The Consumer Electronics segment of the Disposable Batteries Market is poised for noteworthy growth from 2026 to 2035, driven by the increasing demand for disposable batteries in electronic devices.

Key Growth Trends:

- Rising adoption in medical devices

- Increasing usage in industrial applications

Major Challenges:

- Competition from rechargeable batteries

- Increased environmental awareness

- Key Players: GP Batteries Intl, Everyday Battery Company, Rayovac, Nbcell Battery, Battco, Southwest Electronic Energy Group, Liebherr Group, Eveready Industries India Ltd., GPB International Limited, and Camelion Batterien GmbH.

Global Disposable Batteries Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.74 billion

- 2026 Market Size: USD 31.6 billion

- Projected Market Size: USD 41.71 billion by 2035

- Growth Forecasts: 3.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 12 August, 2025

Disposable Batteries Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption in medical devices: The widespread usage of medical equipment that requires disposable batteries is another important element supporting disposable batteries market expansion. The use of portable medical devices, such as digital thermometers, hearing aids, and blood glucose meters, has increased due to the aging of the world's population and the rise in chronic illnesses. Disposable batteries are used in most of these gadgets because they are dependable, affordable, and simple to replace. The market is therefore significantly driven by the healthcare sector's growing dependence on portable diagnosis and monitoring equipment.

- Increasing usage in industrial applications: Another important factor driving the disposable batteries market expansion is industrial applications. Industries frequently need dependable and durable power sources for a range of uses, such as emergency lighting, sensors, and meters. Due to their reliability, simplicity of use, and low maintenance needs, disposable batteries are preferred in industrial applications. Disposable batteries are anticipated to become more and more necessary in industrial applications as industrial automation and the use of IoT (Internet of Things) devices grow.

Challenges

- Competition from rechargeable batteries: The disposable batteries market is negatively impacted by rechargeable batteries because they are more cost-effective, have a higher power density, a high discharge rate, good low-temperature performance, and are energy-efficient. Rechargeable batteries are becoming more and more popular among consumers and businesses due to their long-term cost-effectiveness and less environmental impact. The disposable batteries market for disposable batteries is seriously threatened by technological developments in rechargeable battery performance and the falling cost of rechargeable alternatives.

- Increased environmental awareness: Increasing environmental awareness is projected to limit the disposable batteries market throughout the forecast period. After a single usage, these batteries are disposed of in landfills. Due to the presence of powerful acids and heavy metals, disposable batteries present a waste danger. Governments everywhere are enforcing more stringent laws on the disposal of hazardous garbage. As a result, during the forecast period, rising environmental consciousness is anticipated to limit the global disposable batteries market.

Disposable Batteries Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 30.74 billion |

|

Forecast Year Market Size (2035) |

USD 41.71 billion |

|

Regional Scope |

|

Disposable Batteries Market Segmentation:

Type (Alkaline and Nickel-Cadmium)

The alkaline segment in disposable batteries market is projected to gain a 75.2% share through 2035. Alkaline disposable batteries' longer lifespan and lower cost when compared to other battery types are the reasons for the segment's rise. Alkaline batteries dominate the market because of their high energy density, extended shelf life, and capacity to function effectively throughout a broad temperature range. Due to these qualities, alkaline batteries can be used in a wide range of devices, including industrial machinery and home electronics. Alkaline batteries' ubiquitous availability and comparatively low cost support their market domination.

Despite competition from more recent technologies, nickel-cadmium is still useful in some industrial applications because of its durability. The data from the market shows a variety of trends and growth factors, including consumers' growing reliance on battery-operated products and continuous advancements in battery technology that seek to reduce costs while enhancing capacity and sustainability.

End use (Consumer Electronics, Industrial, Automotive, Medical, Military and Defense)

Based on the end use, the consumer electronics segment in disposable batteries market is likely to hold a noteworthy share by the end of 2035. The growing demand for disposable batteries for usage in a variety of electronic products, including computers, laptops, TVs, and air conditioners, is propelling the market expansion for this sector. Many consumer electronic devices rely on disposable batteries for power because of their affordability, accessibility, and ease of use. There is a consistent need for disposable batteries in this disposable batteries market due to the rapid pace of innovation in consumer devices. Disposable batteries have an important use in the industrial sector as well. Sensors, meters, control systems, and emergency lighting are just a few of the industrial applications for disposable batteries. Disposable batteries are appropriate for demanding industrial settings due to their dependability and minimal maintenance needs.

As the use of wearable and portable medical devices grows, the medical application segment is expanding rapidly. Disposable batteries are essential to the functioning of many devices, including blood glucose meters, digital thermometers, hearing aids, and portable diagnostic instruments. Disposable batteries find extensive use in the military and defense industry, such as in portable lighting systems, night vision equipment, and communication devices. High-quality disposable batteries are required for military applications due to the strict reliability and performance requirements.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Batteries Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific is expected to lead the disposable batteries market with a share of 42.3% during the forecast period. The need for disposable batteries is driven by growing consumer electronics penetration, industrialization, and rapid urbanization. The growing healthcare industry, rising disposable incomes, and growing use of portable electronics all contribute to the market's expansion in the region. Additionally, the region's established industrial base provides cost advantages and efficient supply chains, both of which support disposable batteries market growth. In this dynamic market, the need for disposable batteries is increasing across a variety of applications.

China's strong focus on innovation and technology adoption is further fueling this trend. Additionally, the rising popularity of smart homes and connected devices, which often use disposable batteries, is contributing substantially to regional disposable batteries market expansion. Chinese company Changhong New Energy Tech will begin construction of an alkaline battery plant in Thailand in December 2024. It further stated that five production lines with an annual output of more than 700 million cells will be part of the first phase. At its two production facilities in China, Changhong New Energy Tech can produce over 3 billion alkaline batteries annually. Changhong New Energy Tech declared its intention to construct the Thai facility with an investment of USD33.9 million. According to figures from the International Energy Agency, China manufactured over 650 gigawatt-hours of batteries last year, accounting for over 80% of global production.

In India, the disposable batteries are in high demand, especially for home and medical applications, which defines the market. The market's expansion is further supported by the existence of robust battery producers and a robust distribution system. Eveready Industries India (EIIL) is increasing its production capacity with a new alkaline battery manufacturing facility in Jammu. For this greenfield project, the corporation purchased land as part of the "Make in India" campaign. It is anticipated that activities will begin in the second half of FY26, increasing EIIL's market presence. In Q3 FY25, Eveready Industries reported a 9.4% year-over-year increase in revenue to USD 350334 billion. This revenue increase was primarily driven by strong sales in the flashlight and battery areas. Alkaline batteries are still operating well, although carbon zinc batteries are currently recovering.

North America Market Analysis

North America is expected to experience a stable CAGR during the forecast period. The disposable batteries market is being driven by a strong industrial sector, advanced healthcare infrastructure, and high adoption rates of consumer electronics. The consistent need for disposable batteries, especially in home and medical applications, is what defines the mature market in the region. The market's expansion is further supported by the existence of significant battery producers and a robust distribution system. The market for disposable batteries in North America is anticipated to expand at a moderate rate, emphasizing environmental sustainability and technological developments.

In the U.S., the market is being driven by the widespread use of consumer gadgets and the expanding healthcare industry. The market for environmentally friendly disposable batteries is driven by the strict laws governing battery recycling and disposal. Millions of single-use and rechargeable batteries are purchased, used, recycled, or thrown in the trash each year in the United States. Batteries are available in many sizes, kinds, and chemistries depending on their intended function. When single-use batteries are no longer needed to power the device, they may usually be taken out. The rapid rise in the usage of power tools, tiny portable gadgets, and other commonplace items, as well as the rise in "smart" products such as cars and small and large appliances, are the main causes of the growing need for batteries.

Canada's consumer electronics' explosive rise and the purchase of medical supplies have been the main drivers of the expansion. Due to the region's high amount of medical and electronic device use, the industry is anticipated to be significantly impacted during the projection period. The market is anticipated to expand considerably throughout the projected period. EVSX and Call2Recycle Canada have agreed to open EVSX's new battery processing facility in Thorold, Ontario, in July 2024. The facility will recycle the growing amounts of carbon zinc and alkaline batteries that Call2Recycle's battery recycling program collects. 87.7 percent of battery components are successfully recycled (RER, or recycling efficiency rate) at this new factory, which can process 4,200 tons of alkaline batteries annually.

Key Disposable Batteries Market Players:

- Duracell Batteries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Energizer Battery, Inc.

- GP Batteries Intl

- Everyday Battery Company

- Rayovac

- Nbcell Battery

- Battco

- Southwest Electronic Energy Group

- Liebherr Group

- Eveready Industries India Ltd.

- GPB International Limited

- Camelion Batterien GmbH

The disposable batteries market is very competitive, with businesses constantly looking to innovate, broaden their customer base, and satisfy changing needs. Prominent companies are increasing their market share through partnerships and acquisitions. In addition, manufacturers are integrating recycled components into their products and creating high-performance, environmentally friendly batteries as a result of the increased emphasis on environmental responsibility. This strategy appeals to customers who care about the environment in addition to meeting legal requirements.

Here are some leading players in the disposable batteries market:

Recent Developments

- In September 2023, Ultima Alkaline batteries were upgraded and introduced by Eveready Industries India Ltd. While the D/AA/AAA Eveready Ultima Pro promised an extended lifespan of up to 800%, the AAA/AA Eveready Ultima batteries claimed to last about 400% longer. These batteries were made to function reliably in a wide range of contemporary gadgets and high-drain uses, including as medical equipment, wireless keyboards and mice, video games, trimmers, smart remote controls, and toys.

- In July 2022, the new Power Boost components from Duracell are now included in Coppertop AA/AAA batteries, which the company has said will be available soon. For all of this summer's outdoor activities, from moderate to intense, Duracell Optimum, the brand's best alkaline batteries, are now manufactured with four times the proprietary Power Booster Ingredients vs. Copper top with AA/AAA batteries. In many products, new Duracell batteries with Power Boost chemicals may offer greater power or a longer lifespan than older Coppertop cells.

- Report ID: 7678

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Batteries Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.