Nano Fertilizer Market Outlook:

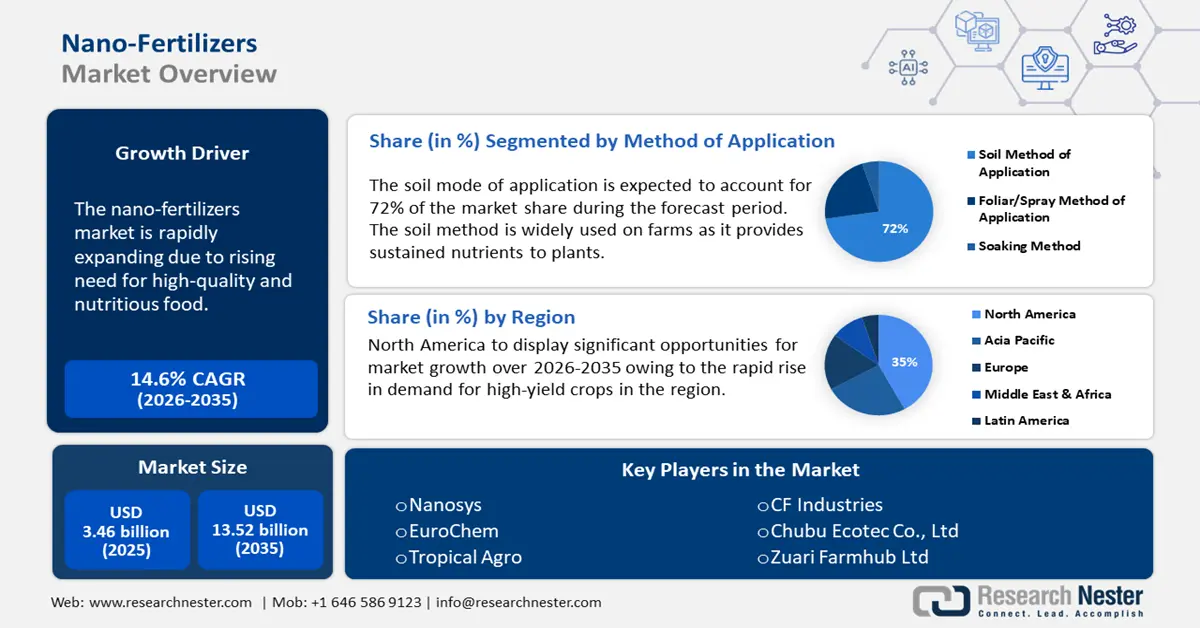

Nano Fertilizer Market size was over USD 3.46 billion in 2025 and is anticipated to cross USD 13.52 billion by 2035, growing at more than 14.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nano fertilizer is assessed at USD 3.91 billion.

The growth of the market is attributed to the rising need for high-quality and nutritious food to cater to the rapidly expanding global population. Nano fertilizer improve the nutritional value of agricultural products and are widely used in farms due to their cost-effectiveness, easy usage, and low requirement compared to conventional chemical fertilizer. These nano fertilizer are rapidly gaining traction as there has been a steady inclination toward sustainable agriculture.

Several governments across the globe are launching new programs and campaigns to promote nanofertilizer with higher efficiencies and lower drawbacks, compared to conventional fertilizer. For instance, in July 2024, Nano Fertilizer Usage Promotion Mahaabhiyan was launched by IFFCO India to promote the use of nano fertilizer. Under this, farmers from 800 villages will be given a subsidy of 25% on the market price of Nano Urea Plus, Nano DAP, and Sagarika to improve crop yields.

Key Nano Fertilizer Market Insights Summary:

Regional Highlights:

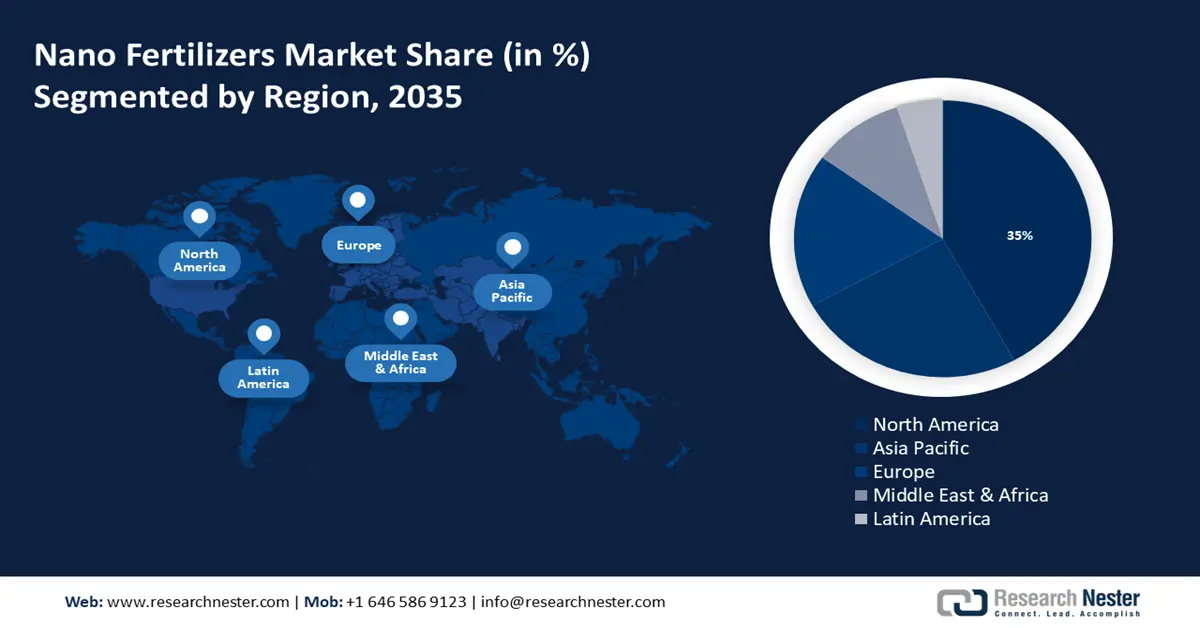

- The North America nano fertilizer market achieves a 35% share by 2035, driven by rapid adoption of high-quality nano fertilizers to improve crop productivity in response to rising demand.

- The Asia Pacific market will register significant growth during the forecast timeline, driven by increasing food demand, rising population, and high adoption of sustainable agricultural practices.

Segment Insights:

- The soil mode of application segment in the nano fertilizer market is projected to achieve significant growth till 2035, driven by extensive use in agriculture, providing sustained nutrient availability to plants.

- The cereals and grains segment in the nano fertilizer market is expected to secure a 45% share by 2035, driven by growing demand for grains and cereals to feed the rising population.

Key Growth Trends:

- High usage of nano fertilizer to enhance crop productivity

- Increasing public awareness

Major Challenges:

- Concerns associated with high production cost

- Competition from conventional fertilizer

Key Players: AG CHEMI GROUP s.r.o., Indian Farmers Fertiliser Cooperative, JU Agri Sciences Pvt. Ltd., Tropical Agro, Chemat Technology Inc, EuroChem, Nanosys, NanoScientifica Scandinavia AB, Zuari Farmhub Ltd., CF Industries, Chubu Ecotec Co., Ltd., Bionet Co., Ltd., Taki Chemical. CO., LTD.

Global Nano Fertilizer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.46 billion

- 2026 Market Size: USD 3.91 billion

- Projected Market Size: USD 13.52 billion by 2035

- Growth Forecasts: 14.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Nano Fertilizer Market Growth Drivers and Challenges:

Growth Drivers

-

High usage of nano fertilizer to enhance crop productivity: Nano fertilizer also exhibit distinctive characteristics that improve plant performance by facilitating ultrahigh absorption, increasing production, enhancing photosynthesis, and significantly expanding the surface area of leaves. According to a publication of Scholarly Community Encyclopedia 2022, nano fertilizer play a crucial role in plant nutrition and human health and are about 50-70% highly efficient compared to traditional fertilizer.

- Increasing public awareness: Nano fertilizer, including nano pesticides and nano sensors, are designed to enhance solubility, increase nutrient absorption in plants, and improve agricultural productivity. These advancements have the potential to bring about efficient dosage of fertilizer, improved vector and pest management, reduced chemical pollution, and ultimately increased agricultural productivity.

Rising awareness of the harmful effects of chemical fertilizer led to increasing use of bio-fertilizer, nano fertilizer, microbiomes, and various other alternative solutions. According to the International Journal of Botany Studies (2024), around 64% of farmers agreed that using N-Nano fertilizer leads to higher production levels as compared to traditional methods.

Challenges

-

Concerns associated with high production cost: The manufacturing of nano fertilizer involves the use of advanced technology and materials that are costly. This in turn increases the overall cost of the product, leading to its low adoption, especially, among small-scale farm owners.

- Competition from conventional fertilizer: Many conventional fertilizer low cost and widely available as compared to these nano fertilizer. Thus, convincing farmers to switch to expensive alternatives can be difficult without clear benefits and results. This is a key factor expected to hamper overall market growth in the coming years.

Nano Fertilizer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.6% |

|

Base Year Market Size (2025) |

USD 3.46 billion |

|

Forecast Year Market Size (2035) |

USD 13.52 billion |

|

Regional Scope |

|

Nano Fertilizer Market Segmentation:

Method of Application

It is anticipated that the soil mode of application will dominate the nano fertilizer market and account for the largest revenue share of 72% during the forecast period owing to the extensive use of soil method of application in agricultural practices, the ability to provide sustained nutrient availability to plants, and the ease of application over large areas of cultivated land. Additionally, the soil application of fertilizer enables the gradual release of nutrients, providing a consistent supply to crops over an extended period, which is particularly beneficial for the growth and development of agricultural produce.

Raw Material

The carbon segment is projected to dominate the nano fertilizer market in terms of revenue, primarily due to its exceptional absorption capability. Carbon nanomaterials (CNMs) serve as fertilizer and play a key role in promoting crop growth and health. Graphene oxide film, for instance, is a carbon-based nanomaterial, that can prolong the process of potassium nitrate release, and time of function and minimizes losses by leaching. These raw materials have been infused with particles that possess antibacterial properties against different plant illnesses, as well as the capacity to enhance plants' ability to absorb essential nutrients from the soil.

In April 2022, Zhu et al. disclosed that novel fungicides could be made using carbon-based nanomaterials that have antifungal properties. SWCNTs or single-walled carbon nanotubes, have the highest antifungal effect compared to several other carbon nanomaterials (CNMs) tested against two plant pathogenic fungi.

Application

The cereals and grains segment in the nano fertilizer market is projected to hold a revenue share of 45% throughout the projected period owing to the growing demand for grains and cereals, particularly maize, wheat, rice, and oats to provide food to the rapidly rising population. The nutritional value and protein content of cereals & grains, compared to other vegetables and fruits, further contribute to the growth of this segment.

Farmers are transitioning towards nano fertilizer to fulfill the growing need for production. According to Food and Agriculture’s (FAO) latest prediction for global cereal production in 2024 has been raised by 7.9 million tons and is now valued at 2,854 million tons. The capacity of nano fertilizer to enhance crop productivity and effectiveness in delivering vital nutrients continues to be highly profitable in boosting segment revenue growth.

Our in-depth analysis of the nano fertilizer market includes the following segments:

|

Raw Material |

|

|

Method of Application |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nano Fertilizer Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 35% by 2035. There has been rapid adoption of high-quality nano fertilizer in the U.S., Canada, and Mexico to improve crop quality and cater to rising demand for crops such as maize, wheat, rice, and oats.

The market for nano fertilizer in the U.S. is rapidly expanding as farmers are transitioning from traditional fertilizer to nano fertilizer to enhance crop productivity and agricultural companies are launching advanced, innovative products. For instance, in November 2023, Nano Yield introduced the NanoCote brand, a groundbreaking nanotechnology-based granular fertilizer coating designed for fertilizer, adjuvants, and crop chemistries.

The nan0-fertilizer market in Canada is propelled by strong growth in the agriculture and food business, together with the consequent technological development in the nano fertilizer sector. This growth aligns with growing investments and the rising awareness about the benefits of using nano fertilizer to improve crop productivity and address the need for enhanced agricultural technologies.

APAC Market Insights

Asia Pacific is expected to register significant growth in the nano fertilizer market owing to increasing food demand, rising population in the region, and high adoption of sustainable agricultural practices. Countries such as India, China, Japan, South Korea, and Indonesia play diverse and influential roles in shaping the agriculture industry landscape.

In India, the development and adoption of nano fertilizer, particularly nano urea, has received significant attention and are poised to revolutionize agricultural practices to enhance crop productivity while reducing environmental pollution and input costs. In June 2024, Coromandel International Limited, introduced an advanced nano fertilizer plant at the Kakinada complex in Andhra Pradesh. This unit produces a huge range of NPK grades with an annual capacity of 2 million metric ton of fertilizer and serves to the needs of farming communities across India.

In China, nano fertilizer are gaining attention as a potential solution to enhance agricultural practices and crop production. The efficient use of engineered nanomaterials (ENMs) in place of conventional fertilizer and pesticides is seen as a way to minimize the environmental impact of agricultural approaches. Key players such as Neufarm Chemical, Qingdao Develop Chemistry Co., Ltd, and Xingtai Ruijin Import and Export Co., Ltd. are adopting several strategies and advancements to enhance crop nutrition, improve soil quality, and promote sustainable agricultural practices.

Japan’s nano fertilizer market is rapidly expanding due to the presence of strong financial initiatives and policy structures. The continuing process of research and development in Japan within this field demonstrates the potential for nano fertilizer to contribute to the advancement of agricultural practices.

Nano Fertilizer Market Players:

- Nanotechnology Products Database

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AG CHEMI GROUP

- Indian Farmers Fertiliser Cooperative

- JU Agri Sciences Pvt. Ltd.

- Tropical Agro

- Chemat Technology Inc

- EuroChem

- Nanosys

- NanoScientifica Scandinavia AB

- Zuari Farmhub Ltd.

- CF Industries

Nano fertilizer offer benefits such as enhanced nutrient absorption within the plants, high crop yield, and reduced environmental impacts. To deliver maximized output, key players in the agricultural sector are actively exploring the potential of nano fertilizer to enhance sustainable agriculture and address complex challenges in farming practices. These key players are adopting several strategies such as mergers and acquisitions, partnerships, product launches, and license agreements to retain their market position and enhance their product base. Here is a list of key players in the market.

Recent Developments

- In Jan 2024, Zuari FarmHub Ltd., announced the launch of two nano fertilizer ‘Nano Shakti Nano Urea’, and ‘Nano Shakti Nano DAP’. The government of India approved ZFHL to manufacture these nano fertilizer in a Gazette notification in November 2023, to increase crop production and soil health.

- In April 2023, IFFCO launched the world's first Nano DAP Liquid Fertilizer in an effort to provide farmers to enhance productivity and help reduce their financial burden. IFFCO has set up manufacturing facilities for the production of Nano DAP Fertilisers in Gujarat and Odisha.

- Report ID: 6370

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nano Fertilizer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.