Nanocellulose Materials Market Outlook:

Nanocellulose Materials Market size was valued at USD 608.7 million in 2025 and is projected to reach USD 4.7 billion by the end of 2035, rising at a CAGR of approximately 19.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nanocellulose materials is assessed at USD 714.9 million.

The global nanocellulose materials market is projected to rise significantly over the forecast years, primarily driven by the growing need for sustainable packaging materials. Governments across the world are enacting stringent laws to curb plastic pollution and promote biodegradable products. For example, the Circular Economy Action Plan of the European Union proposes to transform sustainable products into norms by 2030, which will affect the packaging industry directly. Nanocellulose is a renewable wood pulp-based natural material that can serve as an alternative to conventional plastics, as it is biodegradable and renewable. Its use in packaging supports the environmental objectives and complies with the increase in consumer demand for environmentally friendly products. Additionally, the Sustainable Nanomanufacturing Signature Initiative of the National Nanotechnology Initiative explicitly focuses on making cellulosic nanomaterials available in scalable and sustainable quantities, making them high-performance cellulosic materials that are lightweight and eco-friendly, with wide effects in the industry, including their possible use in sustainable packaging technologies. Design of scalable, sustainable nanomaterials and processes is brought into focus through the initiative.

The supply chain of the nanocellulose materials is backed up by a growing chain of production plants that are mainly in nations such as the United States, Canada, and Finland, where governments promote innovation and commercialization. Investments into new technologies of processing, like high-pressure homogenization and enzymatic hydrolysis, which enhance the efficiency and scalability of the manufacturing process, have increased manufacturing capacity and enlarged the production scale. For instance, a 2023 open-access study presents that rice husk, an agricultural by-product, has been effectively converted to nanocellulose by high-pressure homogenization (HPH)-either alone or in combination with acid hydrolysis. The size of the nanocellulose particles, the index of crystallinity, and thermal stability were all directly dependent on the number of HPH cycles performed (at 120 MPa) and showed that parameters of HPH can be adjusted for large-scale production. All these innovations are necessary to satisfy the increasing needs in other areas such as packaging, biomedical, and electronics.

Moreover, the U.S. Forest Service underscores that an increase in nanocellulose production will result in economic gains, such as the creation of employment and the utilization of forests in a sustainable manner. Trade relations indicate that the global nanocellulose materials market is witnessing a high movement of nanocellulose materials between the major producers and consumption zones to facilitate a consistent demand-supply situation. In June 2025, the Producer Price Index (PPI) of Wood Pulp, which is one of the main raw materials of nanocellulose production, is 155.766. Nanocellulose materials are based on wood pulp as a feedstock, and as such, the price of wood pulp has a direct effect on the cost and profitability of manufacturing nanocellulose materials. When the price of pulp rises, the price of nanocellulose is generally higher, thus influencing the development of the nanocellulose materials market or leading to an increase in the cost of the products.

Key Nanocellulose Materials Market Insights Summary:

Regional Highlights:

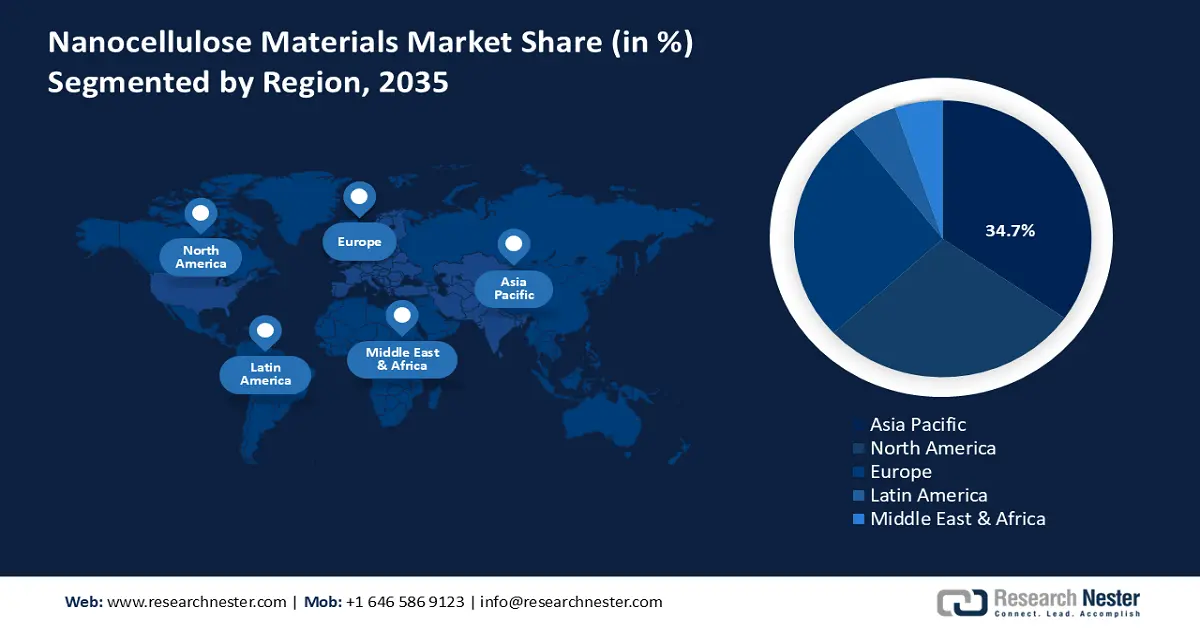

- From 2026-2035, Asia Pacific is anticipated to secure a 34.7% revenue share in the nanocellulose materials market, spurred by rising demand for sustainable and biodegradable materials across packaging, automotive, electronics, and construction industries.

- North America is projected to account for a 28.4% share during 2026-2035, underpinned by increasing adoption of green materials and government-backed advancements in sustainable chemical manufacturing.

Segment Insights:

- By 2035, the wood pulp segment is forecast to command a 58.5% share of the nanocellulose materials market, supported by extensive forestry supply chains and long-term sustainable forest management policies.

- From 2026-2035, the cellulose nanofibrils (CNF) segment is expected to attain a 40.2% share, reinforced by its high mechanical strength, flexibility, and wide applicability in packaging, composites, and biomedical fields.

Key Growth Trends:

- Green catalysis and chemical recycling (EPA green chemistry impact)

- Circular economy mandates and regulatory push in the EU

Major Challenges:

- Lack of harmonized global standards (Technical Barriers to Trade)

- Delayed entry in market owing to chemical registration

Key Players: Cellulose Lab Inc. (U.S.), American Process Inc. (U.S.), Borregaard ASA (Norway), CelluForce Inc. (Canada), Stora Enso Oyj (Finland), Blue Goose Biorefineries Inc. (Canada), ANOMER Technologies Inc. (Canada), Bluepha Biotech Co., Ltd. (South Korea), Papertech Co., Ltd. (Malaysia), ITC Limited (India), Borregaard LignoTech AS (Norway), JNC Corporation (Japan), Nippon Paper Industries Co., Ltd (Japan).

Global Nanocellulose Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 608.7 million

- 2026 Market Size: USD 714.9 million

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 19.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 8 December, 2025

Nanocellulose Materials Market - Growth Drivers and Challenges

Growth Drivers

- Green catalysis and chemical recycling (EPA green chemistry impact): The Green Chemistry Challenge Awards provided by the U.S Environmental Protection Agency have provided significant environmental and economic returns. By 2022, winning technologies have removed 830 million pounds of toxic chemicals every year, conserved 21 billion gallons of water, and avoided almost 7.8 billion pounds of CO2 equivalent emissions each year. These numbers show the real benefits of green chemical innovations and the benefits of nanocellulose-based processes that can be shared when these processes align with the greener inputs, waste reduction, and closed loops. A shift in the conventional chemical avenues to the more environmentally-friendly nanocellulose systems, therefore, increases the regulatory congruence, reduces the disposal and compliance expenses, and benefits the marketability in the most sustainable-focused procurement strategies.

- Circular economy mandates and regulatory push in the EU: The European Chemicals Agency (ECHA) and EU policymaking processes give preference to materials that close the resource loop. For example, the Circular Economy Action Plan by the EU requires an increase in the proportions of recycled materials, biodegradable packaging, and composites. Nanocellulose is bio-based, renewable, and can be used in recycling systems, which will benefit it. Such a regulatory trend invites manufacturers in the chemical industry to incorporate nanocellulose and cut down on the use of non-renewable sources, and enhance adherence to longer producer responsibility goals.

- Production efficiency improves through enzymatic and mechanical means: Nanocellulose-based improvements in production efficiency have been achieved using a mixture of enzymatic hydrolysis, as well as mechanical treatment. Recent research indicated that nanocellulose up to 83% could be obtained via tailored cocktails of enzymes that were used after mechanical pretreatment with significant enhancement of extraction efficacy. This is because such high-yield processes lower energy, enzyme, and raw material costs per unit produced. This clearly reflects a large efficiency improvement, enabling lower production costs, better throughput, and making nanocellulose more competitive with its traditional chemical-based equivalents.

Challenges

- Lack of harmonized global standards (Technical Barriers to Trade): The problem of non-tariff barriers to the manufacture of nanocellulose materials is a severe situation with unequal technical rules in different countries. The Agreement on Technical Barriers to Trade (TBT) by the WTO aims at minimizing these impediments, although countries tend to create divergent standards, testing procedures, and certification methods, especially of new nanomaterials, which in effect postpones nanocellulose materials market entry and increases costs. Such inconsistencies compel firms to undergo several cycles of conformity tests that increase the time to market and costs significantly. Consequently, manufacturers need to operate in a maze of regulatory requirements, discredit competitive price structures, and restrict wider use of nanocellulose formulations, particularly where local nanocellulose materials market requirements are strict.

- Delayed entry in market owing to chemical registration: Nanocellulose materials, as a product of nanomaterials, are under strict pre-market registration and evaluation measures in a majority of jurisdictions. Delays in regulations are usually caused by the absence of toxicological data, ambiguous classification grounds, and multi-agency regulations. Such requirements can very easily increase time-to-market and increase compliance costs to producers. For example, South Korean regulation K REACH requires registration of new chemical substances. Even though a 2024 revision increased the registration threshold of 0.1 t/year to 1 t/year, unresolved data contention by the consortium is still holding approvals up. The revision of the National Assembly of 2025 permits up to two years' extension of the registration resolution.

Nanocellulose Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.3% |

|

Base Year Market Size (2025) |

USD 608.7 million |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Nanocellulose Materials Market Segmentation:

Source Segment Analysis

The wood pulp segment is expected to grow the largest nanocellulose materials market share of 58.5% over the forecast years, attributed to the extensive global forestry supply chains and uniform quality of cellulose, which is critical in manufacturing high-grade nanocellulose. Nanocellulose made of wood pulp can be scaled, unlike other feedstocks, such as agricultural residues or microbial feedstocks. The availability and developed processing infrastructure have been steady and have reduced the costs, making it more widely used in industry. In addition, policies of sustainable forest management established by the governments will guarantee pulp availability in the long term and will make it easy to expand the nanocellulose materials market steadily.

Product Type Segment Analysis

The cellulose nanofibrils (CNF) are projected to grow at a substantial nanocellulose materials market share of 40.2% from 2026 to 2035, owing to their high mechanical strength, flexibility, and wide range of applications in packaging, composites, and biomedical. These nanofibrils increase the strength of paper; hence, they cannot be avoided in the reinforcement of materials. They are sustainable (renewable and biodegradable), which is closer to worldwide sustainability requirements, which will increase their adoption rates. The adaptability of CNF is favored by the increasing need for green technologies, which leads to a steady nanocellulose materials market rise. Under the projections of the industry, the CNF is being favored when compared to other types of nanocellulose because of the cost-effectiveness and scalability.

Form Segment Analysis

The gel form segment is likely to grow steadily with a revenue share of 38.6% by 2035, owing to its convenience in handling and incorporating into industrial operations. Gels help in mixing nanocellulose in composites, coatings, and packaging uniformly, boosting the performance of the products. The gel type used is aqueous, which is a safer form of processing in line with laws on the environment. Furthermore, as gel is compatible with current slurry handling machinery in the paper and packaging industries, it minimizes capital spending, which promotes its use over suspensions or dry powders. This is a practical advantage that helps gel dominate the world in the nanocellulose materials market.

Our in-depth analysis of the nanocellulose materials market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Source |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nanocellulose Materials Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is projected to dominate the global nanocellulose materials market with the largest revenue share of 34.7% from 2026 to 2035. This growth is primarily driven by the increase in demand for sustainable and biodegradable materials in the packaging, automotive, electronics, and construction industries. Expanding manufacturing bases and highly coordinated global supply chains increase the availability of raw materials and the effective distribution of products, which improves regional competitiveness. Enhanced regulations and waste management systems in the Asia Pacific will push the growth of nanocellulose materials, as they promote a cleaner manufacturing process and sustainable alternatives in the packaging and industrial sectors. Regulatory assistance, along with sustainability programs on a national scale, is a major factor in the accelerated growth of the industry using nanocellulose technologies. There is a lot of R&D that is leading to innovation aimed at enhancing the efficiency of production and reducing costs. In addition, export-related incentives and free trade agreements, which are sponsored by the government, contribute to the expansion of cross-border trading activities, which, in turn, boost the development of the nanocellulose materials market. These variables make Asia Pacific the most dynamic regional market and improve the strategic value of the region in the global nanocellulose materials market.

The nanocellulose materials market in China is projected to lead the Asia Pacific with a substantial share by 2035, due to a high level of governmental support for green manufacturing and sustainable materials. The national emphasis on carbon emission reduction has increased investments in chemical production that are environmentally friendly, and investment is growing significantly. In addition, there has been an active process of nanotechnology research and development in the Ministry of Science and Technology (MOST) with emphasis on nanomaterials and their applications, helping in the development of new industries like the nanocellulose materials market in the country. Furthermore, high-volume production, which is facilitated by the large-scale manufacturing infrastructure, can help to gain the benefits of lower costs and wide domestic distribution in China. The regulatory requirement of chemical safety and waste minimization has also made the use of nanocellulose to gain traction, especially in the packaging and automobile industries. The Made in China 2025 program by the government focuses on the use of advanced materials, which promotes an upgrade of nanocellulose production in terms of technology and innovation, depicting the dominant position of the country in the international nanocellulose materials market.

India nanocellulose materials market is anticipated to expand with the fastest CAGR within the Asia Pacific region over the forecast years, owing to growing industrial needs to use green options that provide sustainable solutions in textiles, packaging, and construction. The bioeconomy of India has experienced an impressive surge, increasing from USD 10 billion in 2014 to USD 165.7 billion in 2024, with a CAGR of 17.9%, resulting in 4.25% GDP growth through the efforts of the government in biotechnology, agriculture, health, and circular bioeconomy frameworks like BioE3, setting a promising stage for accelerated development and scale‑up in emerging nanomaterials such as nanocellulose in India. The high agricultural residues in India offer a competitive edge in that they are a raw material in the production of nanocellulose. There is an increase in investments in innovation and capacity expansion, with specific emphasis on green chemical technologies startups. For instance, Chennai cleantech startup Proklean Technologies raised a 4-million-dollar (almost 33 crore) funding round seeded by the Raintree Family Office to develop green chemistry solutions in the pulp and paper sector, which are the major downstream applications of nanocellulose-based products. These aspects are making India one of the leading growth nanocellulose materials markets in the international setting.

North America Market Insights

North America nanocellulose materials market is expected to grow significantly, with a revenue share of 28.4% from 2026 to 2035, attributed to the increased demand for green materials in various applications in the chemical industry. Sustainable chemical manufacturing was given a substantial government funding boost throughout 2020-2023, making strides in nanocellulose production technologies. For example, in 2020, the U.S. Department of Energy provided a USD 1.7-million grant to North Dakota State University to research thermochemical cellulose nanocrystals (CNC), with a particular objective of achieving new energy storage materials and pilot-scale production infrastructure. The project partners had several national laboratories as well, which demonstrated the high level of government participation in the sustainable development of chemicals. Emphasis on regulatory controls on hazardous waste and carbon emissions has increased the pace of greener processes. In the U. S. (within TSCA and FDA regulations), increasing regulation on nanomaterials, including nanocellulose, has further boosted the growth of the nanocellulose materials market. Such regulations require intensive safety data, toxicological studies, and environmental impact analysis, especially when the materials are renewable and biodegradable, such as nanocellulose composites. The region enjoys a strong manufacturing base and public-private collaborations to encourage research and commercialization. Tax credits and grants are other incentives that help companies expand production in compliance with environmental rules. These factors together make North America one of the innovators and drivers of the nanocellulose materials market in the chemical industry.

The nanocellulose materials market in the U.S. is predicted to dominate the North American region with a notable share by 2035, driven by federal investments in clean energy and manufacturing sustainability. In 2022, the U.S. Department of energy awarded open funding of USD 150 million, to support basic chemical and materials research to help enhance efficiency and minimize carbon emissions through energy technologies and manufacturing, including solar, next-gen batteries, carbon capture and new manufacturing approaches inspired by photosynthesis, which supports major Energy Earthshots projects such as the Hydrogen Shot, the Long Duration Storage Shot, and the Carbon Negative Shot. Moreover, the OSHA laws provide workplace safety in chemical manufacturing, which also contributes to stability in industries. The rich research base and interest in high-technological materials make the country a leader in nanocellulose innovation and commercialization on a global scale. For instance, the product laboratories of the U.S. Forest Service have the first-of-its-kind Nanocellulose Pilot Plant in the country, making it the leading producer of nanocellulose materials in the country. The facility allows mass access to wood-based nanomaterials, which are stronger than Kevlar but lightweight, that could be utilized in lightweight armor, automotive, aerospace, electronics, and medical devices, and this indicates the ability of the U.S. to innovate in high-tech nanocellulose.

Canada nanocellulose materials market is likely to grow at a steady rate, owing to a high level of governmental support that focuses on clean technologies and the use of resources in a sustainable manner. In March 2025, Natural Resources Canada funded CAD 309,000 to scale nanofibrillated cellulose (NFC) production by pilot-scale testing the refining and drying process. The project generated more than 100 pre-dispersed samples to sustain a bigger NFC facility design. In May 2023, an NFC commercial plant in Quebec at Domtar became the largest in the world, further supporting the Canadian leadership in nanocellulose innovation. The governments’ focus on bio-based materials and circular economy models promotes the increase in nanocellulose applications, especially in the packaging and automobile industries. The institutes of research in Canada are engaged in active cooperative work with industry to enhance the efficiency of nanocellulose production and environmental impact. For example, the Waterloo University’s Waterloo Institute of Nanotechnology (WIN) is collaborating with other industries to establish sustainable nanomaterials such as nanocellulose to be used in energy systems, therapeutics, and smart materials. The collaborative strategy of WIN consists of more than 100 faculty members engaged in projects, which unite nanotechnology with industrial requirements with the purpose of commercializing the innovations and solving the real problems, contributing to the competitiveness of investment, and making Canada a prospective emerging sustainable production centre in North America.

Europe Market Insights

Europe nanocellulose materials market is expected to witness an upward trend during the projected years, mainly due to the strict environmental policies and the presence of a strong focus on sustainable chemical production. The EU Green Deal favors bio-based products that come from renewable sources so that they can cut up to 2.5 billion tonnes of CO2 equivalent per year by 2030. This cultivates a green economy, employment, and the shift towards a climate-neutral circular economy by 2050 by maintaining funding in research and innovation implementation. Additional investments in clean technologies have allowed the emergence of new nanocellulose manufacturing processes, as well as the expansion of the scope of commercial use, particularly in packaging, automotive, and medical industries. For instance, the European Investment Bank (EIB) has loaned Stora Enso €435 million to finance its renewable packaging manufacturing plant in Oulu, Finland. This investment is in line with the European Union goals to minimize plastics and implement a circular bioeconomy through the development of sustainable, fiber-based packaging materials to substitute plastics based on petroleum.

The UK nanocellulose materials market is developing with the support of governmental initiatives in the field of zero-carbon production and the introduction of a circular economy. Bio-based materials are encouraged by the UK Bioeconomy Strategy through greater research funding. Meanwhile,

Germany, one of the important manufacturing centres, enjoys a developed R&D environment in the chemical industry and a high degree of export orientation. The National Bioeconomy Strategy in Germany promotes sustainable chemical manufacturing that helps in the stable market growth.

Key Nanocellulose Materials Market Players:

- Cellulose Lab Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Process Inc. (U.S.)

- Borregaard ASA (Norway)

- CelluForce Inc. (Canada)

- Stora Enso Oyj (Finland)

- Blue Goose Biorefineries Inc. (Canada)

- ANOMER Technologies Inc. (Canada)

- Bluepha Biotech Co., Ltd. (South Korea)

- Papertech Co., Ltd. (Malaysia)

- ITC Limited (India)

- Borregaard LignoTech AS (Norway)

- JNC Corporation (Japan)

- Nippon Paper Industries Co., Ltd (Japan)

- Cellulose Lab Inc. markets a diversified portfolio of nanocellulose materials and positions itself as a full-spectrum nanocellulose supplier - covering all major nanocellulose types (CNC, CNF, BC). Their emphasis on customization and flexibility makes them useful for early-stage development, specialty applications, or pilots - a segment that larger, heavy-scale producers might not target.

- American Process Inc. produces nanocellulose under the brand name BioPlus®, using its proprietary AVAP® biorefinery technology. They have pursued partnerships and joint development agreements with users in industry — for example, collaborating with a major carbon-black supplier to integrate nanocell cellulose and carbon black in tires. As the global nanocellulose materials market grows, API’s integrated, low-cost production model gives them an edge among commercial-scale producers.

- Borregaard ASA’s nanocellulose is offered for applications such as coatings, adhesives, personal-care formulations, composites, specialty chemicals, and other industrial uses. The company has been scaling up its nanocellulose capacity, reportedly doubling Sarpsborg capacity, and securing funding to expand and even launch a pharma-grade production line. Their integrated biorefinery model, with access to wood-based raw materials, lignin co-products, and specialty cellulose infrastructure, gives them resource advantage, cost stability, sustainability credentials and ability to produce at scale.

The global nanocellulose materials market is fiercely competitive with a combination of established chemical and pulp companies and biotech firms. The Japanese major players (JNC Corporation, Daicel Corporation, Nippon Paper Industries, and Oji Holdings) are the leaders in innovation with intense R&D spending aimed at improving the material qualities and production volume. U.S. firms focus on environmentally friendly production and strategic alliances to advance nanocellulose materials market penetration. Additionally, European companies enjoy the benefits provided by environmental policies that promote the use of green chemicals. In South Korea, India, and Malaysia, emerging market participants are catching up with low-cost production and government subsidies. Technology licensing, expansion of capacity, and vertical integration are some of the strategic efforts that will enhance positions in the global markets.

Corporate Landscape of the Nanocellulose Materials Market:

Recent Developments

- In February 2025, Arkema announced innovations to resolve the industrial and environmental transition issues, such as battery recycling, and an eco-designed vertical wind turbine blade manufactured using Elium resins that reinforce the principles of the circular economy. Arkema introduced Rilsan Polyamide 11, a 100% bio-based composite solution, and UDX carbon fiber tapes consisting of bio-based thermoplastics that could be used in transportation and aerospace. The HAICoPAS aerospace demonstrator featured industry and academic-developed next-generation thermoplastic composites. Arkema also underlined the high-performance material development in the field of Smart devices and electric vehicles with the help of advanced polyimide films supplied by PI Advanced Materials.

- In October 2024, UPM Biomedicals announced the industry's first injectable permanent implantable medical device nanocellulose hydrogel, FibGel. FibGel is a renewable birch wood cellulose and water-based alternative suitable for soft tissue repair, orthopedics, and regenerative medicine, and is safe and animal-free. It is manufactured as per ISO 13485 standards, giving it longevity in stability and in biocompatibility without undue reaction by the immune system. Its tunable rigidity and injectable quality allow tailor-made clinical use. Future clinical research partners will definitely begin clinical studies in 2025 and place FibGel as a disruptive material in the development of medical devices.

- In June 2025, Toyo Seikan Group Holdings launched the New ECOCRYSTAL Cup at Expo 2025 Osaka and made a tremendous breakthrough in the field of sustainable packaging. This new paper container applies the first cellulose nanocrystals (CNCs) in Japan, which offer unparalleled oxygen barrier properties, allowing the container to reduce or eliminate the use of traditional plastic coating on the paper. Combining CNCs, the ECOCRYSTAL Cup provides more efficient food and beverage preservation and contributes to the development of the environment. This innovation is in line with macro-sustainability efforts of Japan, which is a bright move towards environmentally and socially friendly, biodegradable packaging materials in the chemical and materials industry.

- In March 2025, Nippon Paper Industries unveiled a prototype of a supercapacitor made with cellulose nanofiber (CNF) at Expo 2025 Osaka. This innovative prototype suggests the prospects of CNFs in the state-of-the-art energy storage methods, as it was demonstrated that they could be used as a durable substitute to traditional materials in electronics components. This innovation is indicative of a new paradigm shift in incorporating nanocellulose into the future of electronics, given the potential of CNFs due to their high surface area and mechanical integrity, and has potential implications in the future of chemistry in the development of energy efficiency and green technology.

- Report ID: 8277

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nanocellulose Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.