Battery Materials Market Outlook:

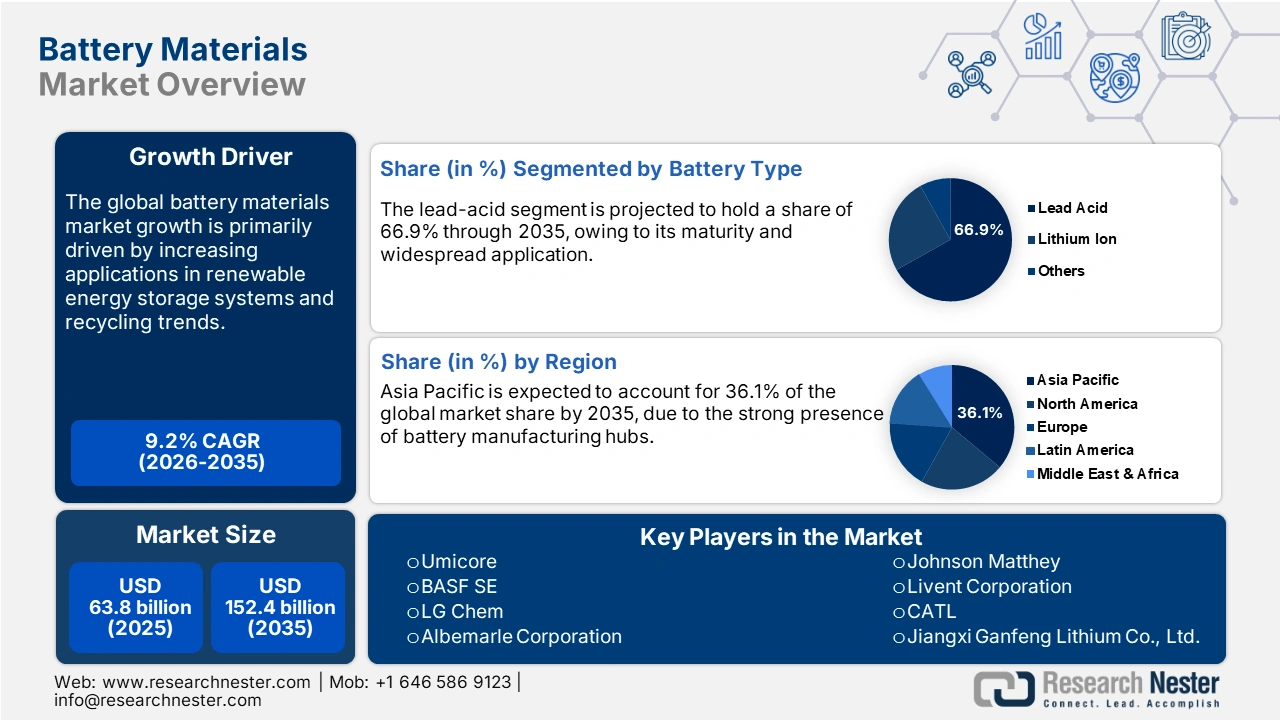

Battery Materials Market size was USD 63.8 billion in 2025 and is estimated to reach USD 152.4 billion by the end of 2035, expanding at a CAGR of 9.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of battery materials is projected to be valued at USD 69.6 billion.

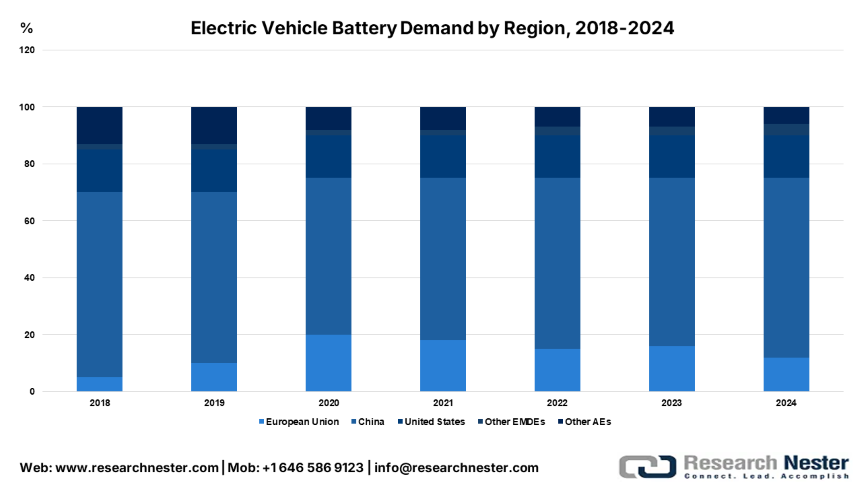

The swift rise in electric vehicle production and registration is estimated to fuel the trade of battery materials in the years ahead. Governments worldwide are implementing aggressive electrification targets and offering subsidies, which is fueling a high demand for battery materials. According to the International Energy Agency (IEA), in 2024, the demand for batteries in the energy sector, including electric vehicle (EV) batteries and energy storage, hit a record 1 terawatt-hour. EV battery demand grew by over 30% in China and 20% in the United States, where demand was nearly equal to the European Union’s, partly because U.S. EVs use about 25% larger batteries, while emerging markets and developing countries (excluding China) made up only about 5% of global battery demand.

Source: IEA

Key Battery Materials Market Insights Summary:

Regional Insights:

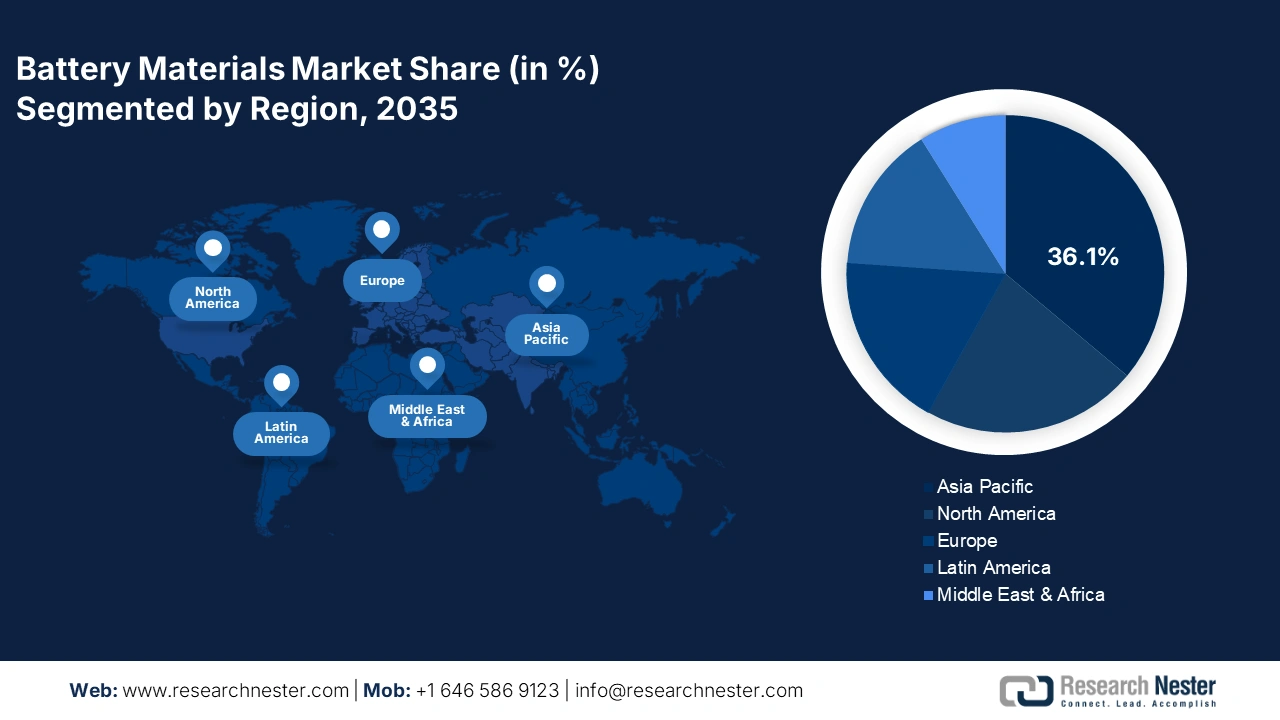

- The APAC region is anticipated to hold 36.1% of the global Battery Materials Market revenue share by 2035, fueled by extensive investments in mineral and metal exploration projects.

- North America is projected to secure the second-largest market share by 2035, stimulated by favorable government policies and rapid EV adoption.

Segment Insights:

- The lead-acid segment is expected to capture 66.9% of the global Battery Materials Market share by 2035, supported by its maturity, cost efficiency, and recyclability.

- The electrodes segment is projected to account for 80.1% of the global market share by 2035, propelled by their crucial role in enhancing battery performance and efficiency.

Key Growth Trends:

- Recycling & circular economy

- Application in renewable energy storage systems

Major Challenges:

- High capex & long lead times

- Raw material volatility

Key Players: Umicore, BASF SE, LG Chem / LG Energy Solution, Albemarle Corporation, Johnson Matthey, Livent Corporation, CATL, Jiangxi Ganfeng Lithium Co., Ltd., SQM, Tesla, Inc., EcoPro BM, Targray, Talga Resources, Godrej Industries Ltd., Vena Energy, Sumitomo Metal Mining Co., Ltd., Panasonic Corporation, Mitsubishi Chemical Corporation, Mitsubishi Corporation.

Global Battery Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.8 billion

- 2026 Market Size: USD 69.6 billion

- Projected Market Size: USD 152.4 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (36.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Canada, Indonesia, Australia, Mexico

Last updated on : 3 October, 2025

Battery Materials Market - Growth Drivers and Challenges

Growth Drivers

- Recycling & circular economy: The recycling and circular economy initiatives are creating a lucrative environment for recyclable battery material producers. In Europe, a 2023 battery Regulation estimates that by 2030, all new batteries must contain some recycled lithium, cobalt, and nickel. These strict recycling requirements are pushing car and battery companies to invest in recycled materials. Thus, the recycling trend is set to reform the market growth in the years ahead.

- Application in renewable energy storage systems: The clean energy trend is accelerating the use of battery materials in the production of advanced energy storage systems. The International Energy Agency (IEA) disclosed that in 2023, battery storage was the fastest-growing energy technology, with more than twice as much added compared to the previous year. A total of 42 gigawatts of battery storage was added worldwide through large-scale battery projects, home and business batteries, small power grids, and solar home systems for electricity access. The rising public-private partnerships in clean energy are likely to double the revenues of key players.

- Consumer electronics & power tools: Consumer electronics products, a major consumer of lithium-ion batteries, are key drivers for the battery material sales. Smartphones, laptops, tablets, wearables, and wireless earbuds that rely on compact and advanced batteries are significantly fueling the sales of critical materials. The World Economic Forum (WEF) states that there are more mobile phones than people globally. This directly reflects that consumer electronics are set to ensure consistent consumption of specialized battery materials.

Challenges

- High capex & long lead times: The high capital expenditure (capex) and long lead times hinder the trade of battery materials. Unlike mining, where materials are extracted once a site is approved, manufacturing refined products and cathode active materials (CAM) requires complex facilities, advanced technologies, and strict environmental rules, which cost billions of dollars and take many years to plan and start fully operating. This high capex mainly limits the expansion opportunities for SMEs and new companies eager to enter the market.

- Raw material volatility: The fluctuations in the raw material supply often lead to price volatility, which is a major concern for small and medium-sized players. Some key minerals, including lithium, nickel, and cobalt, have prices that change a lot in the supply chain. This price instability makes it difficult to get funding as investors are unsure about projects with unpredictable profits.

Battery Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 63.8 billion |

|

Forecast Year Market Size (2035) |

USD 152.4 billion |

|

Regional Scope |

|

Battery Materials Market Segmentation:

Battery Type Segment Analysis

The lead-acid segment is expected to capture 66.9% of the global battery materials market share by 2035, owing to its maturity and widespread application. The low upfront cost and recyclability are also propelling the sales of lead-acid batteries. According to the UN Environment Programme, approximately 86% of the world’s lead is used to manufacture lead-acid batteries, owing to their high demand in electric vehicles, to store energy from solar panels and wind turbines, and for backup power. As more countries develop economically and use more cars and renewable energy, the need for lead-acid batteries is set to boom in the years ahead.

Material Type Segment Analysis

The electrodes segment is projected to account for 80.1% of the global market share throughout the study period. The vitality and high performance in battery operation drive the sales of electrodes. The Observatory of Economic Complexity (OEC) reports that in 2023, the global trade of electrodes, coated, of base metal, for arc welding was calculated at USD 1.43 billion, an 8.37% increase compared to 2022. The segment’s dominance is also represented by the high consumption of critical materials such as nickel, lithium, cobalt, manganese, iron phosphate, and graphite.

Application Segment Analysis

The automotive segment is anticipated to hold 57.1% of the global battery materials market share by 2035. The prime factor boosting the consumption of battery materials is the robust rise in EV manufacturing and registrations. High consumer demand, coupled with increasing awareness of environmental protection is accelerating the use of battery materials in zero-emission vehicles. According to the analysis by the International Energy Agency (IEA), the demand for batteries is expected to increase at a high pace and is set to be four and a half times higher by 2030 and over seven times higher by 2035, based on current policy settings. Emerging markets (other than China) are estimated to play a bigger role, making up 10% of global battery demand by 2030, up from 3% in 2023, while battery production is forecast to spread out more, especially with investments in Europe and North America, and is likely to grow further in other developing countries if climate promises are followed.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Battery Type |

|

|

Material Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Materials Market - Regional Analysis

APAC Market Insights

The APAC battery materials market is poised to hold 36.1% of the global revenue share through 2035, owing to the massive investments in mineral & metal exploration projects. The region’s leadership is anchored by China, South Korea, India, and Japan, owing to the strong presence of battery manufacturing hubs. The expanding production and commercialization of consumer electronics and EVs is creating a profitable environment for battery material manufacturers.

China is set to lead the sales of battery materials in the years ahead, owing to supportive government policies for mining. The country’s rules requiring more New Energy Vehicles (NEVs) and generous financial support are increasing the demand for battery materials. The continuous technological innovations are set to increase the consumption of critical metals and minerals.

The India market is foreseen to increase at a high pace from 2026 to 2035, owing to a rise in electric vehicle demand and investments in renewable energy storage solutions. The government’s FAME II scheme, the Production Linked Incentive (PLI) program for Advanced Chemistry Cell (ACC) manufacturing, and state-level EV policies are anticipated to significantly boost the trade of battery materials. The India Brand Equity Foundation (IBEF) reports that mineral production in India reached USD 16.4 billion in the financial year 2025. This suggests that investing in the country is likely to offer big profits.

North America Market Insights

The North America battery materials market is estimated to account for the second-largest revenue share throughout the forecast period. The lucrative government policies and rapid EV adoption are accelerating the demand for specialized battery materials. The large-scale renewable integration is also contributing to the increasing application of battery materials. The U.S. Inflation Reduction Act (IRA) and Canada’s Critical Minerals Strategy are the key policy drivers supporting the overall market growth.

The U.S. market is estimated to be driven by domestic EV adoption and strategic public-private investments. The Inflation Reduction Act (IRA) and the Department of Energy’s loan programs are channeling billions into domestic mining, refining, and recycling, which is expected to boost the battery material trade in the country. Tesla, Ford, and GM are top premium automakers creating a lucrative environment for cathode and anode manufacturers.

Canada’s abundant natural resources and favorable regulatory environment are set to boost its position in the global landscape. The hefty investments in mining & refining, and expanding exploration of lithium, nickel, cobalt, and graphite are likely to fuel the revenues of key players. The Natural Resources of Canada reveals that the country explored more than 60 minerals and metals worth CAD 72 billion in 2023. The growing advancements in clean energy technologies are driving the overall market growth.

Europe Market Insights

The Europe battery materials market is forecast to increase at a high CAGR from 2026 to 2035. The EU’s ambitious electrification and climate policies are estimated to increase the consumption of battery materials. The EU Battery Regulation (2023) requires sustainable practices, recycling, and tracking of materials in the battery supply chain. The strict aims to cut CO₂ emissions and a ban on traditional gas-powered engines are contributing to the region with the fastest-growing demand for battery materials.

The Germany market is estimated to be driven by the aggressive shift towards clean energy and electric vehicles. Major car companies, including Volkswagen, BMW, and Mercedes-Benz, are increasing the need for high-quality battery parts such as cathodes, anodes, and electrolytes. The country’s plans to build large battery factories are also driving demand for local supplies of cathode active materials (CAM) and the chemicals used to make them.

France is expected to gain a top position in Europe’s battery materials supply chain in the years ahead, owing to the supportive government policies and subsidies. The country’s 2030 plan focused on hefty funding for electric vehicles and energy storage system production, which is estimated to fuel the revenues of key players in the years ahead. The continuous technological advancements in consumer electronics are further accelerating the trade of battery materials.

Key Battery Materials Market Players:

- Umicore

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- LG Chem / LG Energy Solution

- Albemarle Corporation

- Johnson Matthey

- Livent Corporation

- CATL

- Jiangxi Ganfeng Lithium Co., Ltd.

- SQM

- Tesla, Inc.

- EcoPro BM

- Targray

- Talga Resources

- Godrej Industries Ltd.

- Vena Energy

- Sumitomo Metal Mining Co., Ltd.

- Panasonic Corporation

- Mitsubishi Chemical Corporation

- Mitsubishi Corporation

The global market is dominated by industry giants with hefty CAPEX and innovation leadership. These big companies are employing both organic and inorganic marketing strategies to earn hefty gains. They are entering strategic partnerships with other players to maximize their offerings and reach. Further, some leading companies are also expanding their operations in the developing regions to maximize their revenue shares through untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2025, ExxonMobil agreed to buy the technology and assets of Superior Graphite, as well as some of its international offices. Superior Graphite has over 100 years of experience as a leader in making graphite and related materials.

- In August 2025, MIT researchers created a new electrolyte that can break down when a battery's life ends, making it easier to recycle its parts. This recycled material is expected to be widely used in electric vehicle batteries.

- Report ID: 8168

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.